Annual Report 2012 - Finance Uncovered

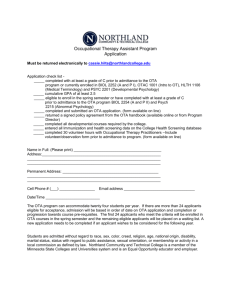

advertisement