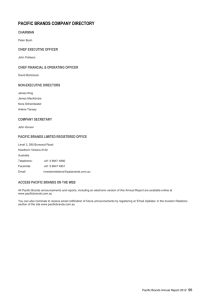

Pacific Brands - Johann Peter Murmann

advertisement