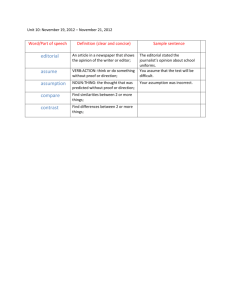

Macroeconomic Assumptions, 2008-2012

advertisement

Table A.1 MACROECONOMIC PARAMETERS, 2008-2012 Particulars Nominal Gross National Product (GNP) (in PhP Million) Budget Assumption Real GNP Growth (%) Budget Assumption 2/ 2010 9,776,185 10,652,466 11,996,077 low high 2/ Nominal Gross Domestic Product (GDP) (in PhP Million) Budget Assumption 2008 Actual Levels 2009 5.0 2/ 7,720,903 6.1 8,026,143 Projections/Targets 1/ 2011 2012 13,316,414 13,436,098 14,861,917 15,125,729 5.4-6.3 5.8-6.8 9,932,508 10,023,164 11,011,181 11,207,831 5.0-6.0 7.0-8.0 5.5-6.5 7.0-8.0 8.2 9,003,480 low high Real GDP Growth (%) 2/ Budget Assumption Target 4.2 Inflation Rate, CPI (2000=100) 9.3 3.2 3.8 3.0-5.0 3.0-5.0 Population (in Millions) 3/ Growth Rate (%) 90.5 2.0 92.2 2.0 94.0 1.9 95.8 1.9 97.6 1.9 364-Day Treasury Bill Rate (%)4/ 6.5 4.6 4.3 3.0-5.0 3.0-5.0 Foreign Exchange Rate (PhP/US$) 44.47 47.64 45.11 42.0-45.0 42.0-45.0 London Interbank Offered Rate (LIBOR), 6-Months, (%) 3.04 1.12 0.52 0.5-1.5 0.5-1.5 Dubai Crude Oil Price (US$/barrel) 93.56 61.69 78.04 90.0-115.0 90.0-110.0 Exports of Goods 5/ Level (in US$ Million) Growth Rate (%) 48,253 /r (2.5) /r 37,610 /r (22.1) /r 50,684 34.8 55,300-55,800 9.0-10.0 62,500 12.0 Imports of Goods 5/ Level (in US$ Million) Growth Rate (%) 61,138 /r 5.6 /r 46,452 /r (24.0) /r 61,068 31.5 71,500-72,100 17.0-18.0 85,100 18.0 Current Account Balance 5/ Level (in US$ Billion) Percent of GDP 3.63 2.2 9.36 /r 5.8 8.47 4.5 5.6 2.6 n/a n/a Gross International Reserves (Year-End) Level (in US$ Billion) Equivalent Months of Imports 37.6 6.0 44.2 8.7 62.4 9.6 70.0 9.3 n/a n/a 1.1 7.6 Sources: NEDA, Bangko Sentral ng Pilipinas (BSP) Note: Rates for inflation, 364-day Treasury Bill, foreign exchange, LIBOR, as well as Dubai Oil Price refer to annual averages. 1/ Assumptions adopted by the Development Budget Coordination Committee (DBCC) on July 4, 2011 2/ Actual levels and growth rates were adjusted due to the change in base year from 1985 to 2000. 3/ Population figures are projections based on the 2000 Population Census, medium assumptions. 4/ The DBCC, in its decision dated February 11, 2011, approved the shift from the 91-day T-bill rate to the 364-day T-bill rate. 5/ Levels adopt the IMF's Balance of Payments (BOP) Manual 5 (BPM5) concept. /r Revised as of September 2010