[2015] AATA 253 Division GENERAL ADMINISTRATIVE DIVISION

advertisement

![[2015] AATA 253 Division GENERAL ADMINISTRATIVE DIVISION](http://s3.studylib.net/store/data/008176575_1-fa914ef5db4cff94352fe89c1196dafc-768x994.png)

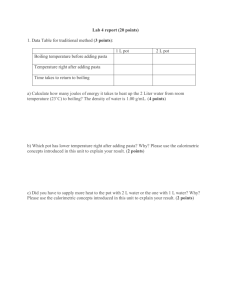

[2015] AATA 253 Division GENERAL ADMINISTRATIVE DIVISION File Number(s) 2014/4541 Re Pacific Worldwide Pty Ltd APPLICANT And Chief Executive Officer of Customs RESPONDENT DECISION Tribunal John Handley, Senior Member Date 24 April 2015 Place Melbourne The decision under review is set aside and in substitution it is decided that the imported goods should be classified to tariff heading 1605. ......[sgd].................................................................. John Handley, Senior Member © Commonwealth of Australia 2015 CUSTOMS – good entered as wontons, dumplings, parcels and hargows – classified as Pasta – whether or not cooked or stuffed – duty paid under protest – skins of the imported goods are not pasta nor are they stuffed pasta goods – decision set aside Legislation Customs Tariff Act 1995, Schedule 3 Cases Tridon Pty Ltd v Collector of Customs (1982) 4 ALD 615 Herbert Adams Pty Ltd v Federal Commissioner of Taxation (1932) 47 CLR 222 Collector of Customs v Agfa-Gevaert Pty Ltd (1996) 186 CLR 389 Atlas Copco Australia Pty Ltd and Collector of Customs (NSW) (1984) 7 ALD 204 Times Consultants Pty Ltd v Collector of Customs (Queensland) (1987) 16 FCR 449 Chinese Food and Wine Supplies Pty Ltd v Collector of Customs (Victoria) (1987) 72 ALR 591 Gissing and Collector of Customs (1978) 1 ALD 144 Secondary Materials Macquarie Dictionary (5th ed) Macquarie (6th ed, 2013) Collins Thesaurus of the English Language (2nd ed, 2002) The Concise Oxford Dictionary Macquarie On Line Oxford Dictionary of Food and Nutrition Cook’s Thesaurus The Complete Asian Cook Book (Charmaine Solomon, 1976, revised and updated in 2011) Encyclopedia of Pasta (Oretta Zanini De Vita; translated by Maureen B. Fant; with a foreword by Carol Field, 2009) PAGE 2 OF 14 REASONS FOR DECISION John Handley, Senior Member 24 April 2015 1. The applicant is an importer of frozen foods, broadly described as dumplings and wontons with a seafood filling. The goods are imported from Vietnam under the brandname Chan’s Yum Cha at Home. 2. An officer of the respondent decided on 17 July 2014 that the goods should be identified as stuffed pasta. The applicant has applied to review that decision. 3. At the time of entry, the applicant contends that the goods should be classified to tariff sub-heading 1605.29.00 or 1605.54.00 in Schedule 3 to the Customs Tariff Act 1995 (the Act) which state as follows: 1605 CRUSTACEANS, MOLLUSCS AND OTHER INVERTEBRATES, PREPARED OR PRESERVED: AQUATIC … 1605.29 .00 --Other; or … 1605.54 .00 4. --Cuttlefish and squid A note to Chapter 16 in Schedule 3 to the Act is in the following terms: 2.- Food preparations fall in this Chapter provided that they contain more than 20% by weight of sausage, meat, meat offal, blood, fish or crustaceans, molluscs or other aquatic invertebrates, or any combination thereof. In cases where the preparation contains two more of the products mentioned above, it is classified in the heading of Chapter 16 corresponding to the component or components which predominate by weight. Those provisions do not apply to the stuffed products of 1902…. 5. The respondent contends that the goods should be classified to tariff sub-heading 1902.20.00 in Schedule 3 to the Act which states as follows: 1902 PAGE 3 OF 14 PASTA, WHETHER OR NOT COOKED OR STUFFED (WITH MEAT OR OTHER SUBSTANCES) OR OTHERWISE PREPARED, SUCH AS SPAGHETTI, MACARONI, NOODLES, LASAGNE, GNOCCHI, RAVIOLI, CANNELLONI, PREPARED: COUSCOUS, WHETHER OR NOT … 1902.20 .00 6. -Stuffed pasta, whether or not cooked or otherwise prepared A note to Chapter 19 in Schedule 3 to the Act is in the following terms: 1.- This Chapter does not cover: (a) Except in the case of stuffed products of 1902, food preparations containing more than 20% by weight of sausage, meat, meat offal, blood, fish or crustaceans, molluscs or other courting vertebrates, or any combination thereof (Chapter 16); … 7. The parties agree that the imported goods contain more than 20 per cent by weight of fish, crustaceans or other aquatic invertebrates. The notes to each of the above chapters indicate that if the goods are classified as stuffed pasta, they will be classified to tariff heading 1902 and not fall within Chapter 16. 8. One of the frozen foods imported by the applicant during the relevant entry was packaged as Shiitake (Mushroom Vegetable) Dumpling. The parties agreed those goods should be classified to tariff sub-heading 2106.90.90 and are not relevant to this review. 9. The respondent called Gary Kennedy, a Food Technologist and Food Safety Auditor to give evidence. 10. In a statement completed by Mr Kennedy dated 24 February 2015 (Exhibit R1), he records that he is a food safety auditor with 20 years of auditing experience. He had been engaged as a food safety consultant and had audited pasta, noodle and prepared food plants in Australia. He has also worked in Australia with manufacturers of pasta, pasta products and Asian style foods which are sold internationally and domestically. 11. He was provided with copies of the packaging of the imported goods in issue by this review and recorded that they are identified as dumplings, wontons, parcels or hargows. He reached that conclusion because each of the products had similar characteristics, PAGE 4 OF 14 namely, they were of East Asian style and flavour, the fillings were covered by a noodle or pasta covering, the filling had set and required reheating only and each were of single portion. (In evidence, he said descriptions such as dumplings or wontons would be used in supermarkets and restaurants). 12. Mr Kennedy was satisfied that the wrapping or skin of the imported goods was pasta by regard to the method of manufacture and their ingredients. Additionally, he said there was no distinction between noodles and pasta. Any distinction, he said, would have regard to Western and East Asian cultures. He said the wrapping or skin would be regarded as pasta by Western manufacturers and would be regarded as noodles by East Asian manufacturers. 13. He recorded (and relied the Macquarie dictionary definitions) that pasta is used more for the Italian style products … [made from a combination of] flour, salt, water and sometimes egg… and noodle is used more for East Asian cuisine … [and is] a type of long, narrow pasta, usually made of wheat flour … (at paragraph 11). He added that ravioli, lasagne and cannelloni are forms of pasta made into a dough, kneaded and cut into shapes. When filling is added to these products, they continue to be referred to as pasta. 14. The Macquarie definitions adopted by him of dumpling (a rounded mass of steamed dough (often served with stewed meat…)) and wonton (…a ball of noodle dough filled with spicy minced pork, usually boiled and served in soup), reflect the descriptions of those goods used by manufacturers in the Australian food industry. 15. Mr Kennedy recorded (at paragraph 12) that although the imported goods would not be described by the general populations (sic) as pasta who would know them generally by their East Asian names as Hargows, he relied on the Food Standards Code (Standard 1.3.1) which did not distinguish between products labelled as pasta and noodles. Additionally, there was no difference in the ingredients used in the manufacture of the skins of the imported goods and of pasta. PAGE 5 OF 14 16. In cross-examination, Mr Kennedy said he was not employed in the sale and marketing of food items nor did he advise retailers of the locations that food items should be placed on shelves. He said that he did give advice on occasions concerning the labelling on packages (to ensure legislative compliance) and did consult with restaurant owners in the composition of their menus. 17. Mr Kennedy was asked to acknowledge a menu from Pacific Seafood B.B.Q. House (described on the menu as a Hong Kong Style restaurant) (Exhibit A16) listing 197 items, none containing the word pasta. Whilst he gave that acknowledgement, he noted that on some occasions the word vermicelli was recorded which he said was a pasta. 18. He was asked to consider a book of 639 pages entitled The Complete Asian Cook Book (by Charmaine Solomon), which does not contain the word pasta in any of its recipes. He said it was more likely that the word noodle was used. (The index to the book has a number of dishes containing noodles. A glossary of noodles, at page 14, lists four types – egg, rice (including rice vermicelli) and cellophane. Only the egg noodles are made from wheat flour. The others are made from rice flour and bean starch, respectively. Some of the recipes in the Chinese section of the book (at page 483) record the use of the words won ton wrappers, defined at page 626 as small squares of fresh noodle dough…). 19. It was suggested to Mr Kennedy, on the basis that the Australian population would not generally describe the imported goods as pasta, that it was likely that a customs officer, undertaking a wharf-side inspection would be likely to describe the goods by their Asian descriptions. Mr Kennedy said customs officers had a higher training of food standards than the population and they would identify the products as pasta. Applicant’s Submissions 20. Mr Gross, who appeared on behalf of the applicant, submitted that tariff heading 1902 referred to types of stuffed pasta products described as lasagne, ravioli and cannelloni. Although the product must have a component of pasta to be classified to tariff heading 1902, he submitted that in this instance the respondent had urged a finding that the whole of the imported goods was a pasta by reason of the outer skin or wrapping being made PAGE 6 OF 14 out of similar ingredients, thereby attempting to classify the goods by one component only. The description of the goods urged by the respondent was therefore alien to the goods themselves when looked at as a whole product. 21. As an example, he submitted that a pastry casing filled with meat or fruit would be identified and understood as a pie. A beef wellington, being a dish of a beef fillet wrapped in puff pastry would be identified and understood as a meat dish. He contended that consumers, manufacturers and retailers of these products would not describe them as pastry, stuffed or filled. 22. Mr Gross also drew comfort from the menus tendered from Pacific Seafood B.B.Q. House and the Sorrento Trattoria (Italian) restaurants (Exhibit A16). The word pasta does not appear in the Asian restaurant menu because the skin or wrapping of wontons and dumplings are not regarded or understood by the restaurant owner or patrons as pasta. Conversely, a similar explanation can be given to the absence of mention of the words dumpling and wonton from the Italian restaurant menu because the owners and patrons understood that they were serving and consuming a pasta-type product. Additionally, patrons attending those types of restaurants do so with the expectation that they will consume foods consistent with a commonly understood name and meaning of the food they intend and expect will be offered and consumed. 23. Attention was drawn to a number of dictionary definitions (Collins Thesaurus of the English Language (2nd ed, 2002); The Concise Oxford Dictionary and Macquarie (6th ed, 2013)) of the word pasta which identified many types of pasta such as cannelloni, fettuccine, lasagne, macaroni, ravioli, spaghetti, tagliatelle and tortellini. Additionally, the definitions, described pasta being made from the dough or paste of flour, salt water (and sometimes, from egg) and usually cooked by boiling. 24. Macquarie definitions of the words wonton, dumpling and dim sim described those products as a rounded mass or ball of steamed or noodle or thin dough, served either as boiled in soup (wonton), steamed or fried. The terms dim sum and yum cha are defined as descriptors of the cultural practice of individual servings of wontons, dumplings and dim sim selected by patrons from trolleys adjacent to their tables. PAGE 7 OF 14 25. Although the skins of the imported goods are also made from flour and water, a clear distinction exists between pasta products and the imported goods by the method of cooking, assembly, shape and size and the manner of serving. 26. It follows, having regard to the above, that the imported goods should be identified by regard to the knowledge of how those goods are described by those who trade in them (Tridon Pty Ltd v Collector of Customs (1982) 4 ALD 615 at 620); the words describing them in speech should be given the ordinary common meaning (Herbert Adams Pty Ltd v Federal Commissioner of Taxation (1932) 47 CLR 222 at 225); the character of the goods should be determined by common sense (Collector of Customs v Agfa-Gevaert Pty Ltd (1996) 186 CLR 389 at 400) and commercial and practical reality (Atlas Copco Australia Pty Ltd and Collector of Customs (NSW) (1984) 7 ALD 204 at 208). Respondent’s Submissions 27. Mr Millea, on behalf of the respondent, submitted that identification of the goods, as opposed to classification, was a wharf-side task made by reference to the characteristics of the goods, not by the intention of the importer (Tridon at 620-622; Times Consultants Pty Ltd v Collector of Customs (Queensland) (1987) 16 FCR 449 at 462). Identification may involve features of design or suitability for purpose. On occasions, tests may be carried out and other enquiries made (Chinese Food and Wine Supplies Pty Ltd v Collector of Customs (Victoria) (1987) 72 ALR 591 at 599). 28. Reference was made to dictionary definitions (Macquarie On Line; Oxford Dictionary of Food and Nutrition and Cook’s Thesaurus) of the words dumpling, dim sim and wontons which were consistent with the dictionary references made by Mr Gross. Additionally, the packaging of the imported goods described the ingredients for the skins, that is, a mixture of wheat flour, water and salt, to be similar if not the equivalent of the dictionary definitions of pasta (refer to above), consistent also with the evidence of Mr Kennedy. 29. It was contended that the focus of this review should be on whether the imported goods were stuffed pasta. It was not intended that the focus of the respondent was upon pasta only. If followed that the imported goods, when considered as a whole, being products PAGE 8 OF 14 encased or wrapped in a skin of dough, made from similar ingredients as pasta, should be identified as pasta, whether or not cooked or stuffed (with meat or other substances)… (tariff heading 1902) 30. The language of tariff heading 1902 was examined and it was submitted that the words such as do not confine the meaning of the word pasta to the examples recorded. By regard to Mr Kennedy’s evidence, manufacturers of the imported goods in East Asian countries regard themselves as noodle manufacturers and manufacturers in Australia of products similar to the imported goods consider themselves to be pasta manufacturers. It follows that the skins of the imported goods are in the same food family as pasta. 31. It was also submitted that it was not appropriate to interpret the chapter headings in Schedule 3 to the Act by regard to the origin of the imported goods. This contention was supported by the World Customs Organisation administration of the chapter headings not distinguishing goods by their country of origin. Conclusion and Reasons for Decision 32. Before the imported goods can be classified, there must be an identification of them, in their imported state. Identification must be objective, have regard to the characteristics of the goods and are remote, at that stage, from the language of a tariff. Identification is concerned with goods, not with the description of goods (Gissing and Collector of Customs (1978) 1 ALD 144 at 146; Tridon at 620). Classification involves the practical wharf-side task of looking at [the goods] and … considering their nature and function which they were designed to serve (Times Consultants at 463). 33. The imported goods were not physically produced at the hearing. Samples of packaging were produced and received as exhibits. Identification for the purposes of this review can be undertaken only by the goods as portrayed on the packaging. The contents of them cannot be identified but there is no issue in this application that the contents as recorded on the packaging are consistent with the types of seafood recorded under tariff heading 1605. PAGE 9 OF 14 34. Identification of the goods may also extend to characterisation of them by regard to their design features and suitability for a particular purpose (Tridon at 621). The character of the imported goods, again determined by the depiction from the packaging, may be described as small, delicate, single items of varying shapes, predominantly rounded or half-moon in shape with ridges and fluting. The skins appear to be very thin and frequently translucent. They are items well-known and consumed as food having an Asian origin. 35. By regard to their size, they are goods consistent with the definition of dim sum offered during yum cha (Macquarie Dictionary, 5th ed). Put another way, they are characterised as goods which are selected by multiple pieces and served from a trolley. 36. A description of goods by persons who trade in them will be relevant for the purpose of identification, but not conclusive (Tridon at 620). In this application, evidence was not heard from manufacturers of these goods. Mr Kennedy, confirmed that the imported goods reflect the descriptions used by manufacturers in the food industry in Australia, being dumpling, parcel, wonton and hargow (Exhibit R1, at paragraph 3). 37. I am satisfied and find as a fact that the goods as imported are properly identified by those names. 38. The principal issue in this application is classification of those goods to a tariff heading. The respondent contends they should be classified to tariff heading 1902 because they are stuffed pasta. There is no dispute that the goods are stuffed, in this case with seafood. The relevant question remaining is whether the skins are pasta. 39. In Herbert Adams, the High Court heard an appeal involving interpretation of a schedule item (now repealed) within the Sales Tax legislation. A relevant schedule entry – Pastry, but not including cakes or biscuits – was advocated by the appellant to exclude sales tax on sponges because they were not cakes. PAGE 10 OF 14 41. Starke J, who was satisfied that sponge was not a pastry but was in fact a cake, decided: Words of common speech are, or are supposed to be, within the judicial knowledge, and should be interpreted according to their common and ordinary meaning, namely, that which they bear in ordinary colloquial speech (Falkiner v. Whitton…) [(1917) A.C. 106, at p. 110]. 42. Dixon J, who considered interpretation by regard to trade meaning or practice decided: it has been considered permissible in applying a customs tariff to resort to evidence to ascertain what according to mercantile understanding are the characteristics connoted by the descriptive names used in the items as well as to identify the articles of commerce which possess them. He ultimately concluded that there was no sufficient reason for attaching to the word cakes in the Schedule a special sense which would exclude sponge. 43. The word pasta, does not require legal analysis or interpretation to comprehend its common or ordinary meaning. 44. It is a word describing food items of (historically) Italian origin (refer Exhibit A14 – Encyclopedia of Pasta (by Oretta Zanini De Vita)). It is readily identifiable and understood as being used in various forms of Italian cuisine. It is sold in a fresh or dried form in a myriad of shapes and sizes – the Encyclopedia of Pasta records 310 types of pasta (all having Italian names). It is prepared by cooking it in boiling water and accompanying it with a sauce when served or by stuffing it, before boiling or baking, in the case of ravioli or cannelloni. It may also be a component of soups (for example, minestrone). It can be consumed cold, after being boiled, in salad and other vegetable dishes. 45. Pasta is a firm, durable product capable of withstanding boiling and baking. It has an appearance both raw and when cooked, which is distinctly different from the skins of the imported goods (both raw and cooked). It is a staple of Italian cuisine. The success of Italian restaurants is based on the variety of pasta dishes appearing on menus by the preference of patrons who by their knowledge of the product, consume it. Pasta is consumed by using either a fork, spoon, knife or a combination. PAGE 11 OF 14 46. The skin or wrapping of the imported goods, although made from flour and water, are distinctly different from pasta, as it is well understood. The similarity with pasta, ends there. Unleavened bread of the same ingredient but no one would classify it as a pasta product. 47. The respondent relied on food items such as samosa, crispy, spring roll, oriental, and bon-bon and food items wonton (in wonton soup) and Chinese bun in Belgium and the United Kingdom, respectively which were classified as stuffed pasta to tariff heading 1902, but without reasons (T27, pages 303 – 304). Mr Gross drew attention to a Ruling and reasons issued by the United States Customs and Border Protection agency concerning food items such as shomai, wonton and hargrow in the context of classification to either Chapters 16 or 19. The respondent’s delegate also identified the US Ruling in the decision under review (T27, pages 302 – 303). Part of the Ruling of the US officer, relevantly, is as follows: Although the products classified as pasta are similar in construction to stuffed pasta, these Oriental speciality items are best described as filled dumplings. In trade, such products are never referred to or marketed as pasta products. In addition, these products are not commercially interchangeable with pasta products. Like pasta, these dumplings have their own, distinct, commercial identity. 48. Consumers and retailers readily identify the imported goods being food of Asian origin. The appearance is distinctly different from meals served having a pasta component. For example, wontons and dumplings are served either alone (or as multiple items during yum cha) or in soups. They are small delicate items having varying shapes and are cooked predominantly by steaming or frying and served with a dipping sauce. They are often consumed using chopsticks. 49. The absence of the imported goods from the menus of Italian restaurants and pasta dishes from the menus of Chinese restaurants are not surprising because of the ethnic and cultural origins of those food items. 50. Mr Kennedy recorded in his statement (Exhibit R1, at paragraph 4) and reaffirmed in evidence that the wrapping or skin of the imported goods was pasta having regard to the manufacturing method and ingredients. He qualified that opinion on the basis of his PAGE 12 OF 14 perspective as a Food Scientist or Food Technologist. That qualification, with respect, is confined to a scientific or manufacturing basis. Consumers, retailers and restaurant proprietors would not be influenced by food industry practice or manufacturing science. Equally, those persons would not be influenced by the nomenclature of the Food Standards Code. 51. I am not satisfied that consumers or retailers would regard the skins of the imported goods as pasta. I am satisfied that pasta is a word commonly understood as being confined to Italian cuisine, unlike the imported goods which belong to Asian cuisine. It is consistent also with the examples of pasta recorded at tariff heading 1902, all being Italian types or style of commonly understood pasta products. 52. The focus of this review is whether the imported goods are stuffed pasta, as the respondent advocated. However, attention must be given to the meaning of pasta as used in ordinary colloquial speech (Herbert Adams, per Starke J). The skin or wrapping of the imported goods are not understood as pasta nor is the assembled product, as a whole, understood or identified as a stuffed pasta product, unlike pasta products which have stuffing, for example, ravioli and cannelloni. I am satisfied that the imported goods cannot be properly classified as stuffed pasta to tariff heading 1902. 53. I think it is unlikely that a person shopping for sheets of pasta (with the intention of making lasagne) would not purchase dumpling or wonton skins. Equally, a person shopping for wontons or dumplings would not purchase ravioli. Decision 54. The decision under review is set aside and in substitution it is decided that the imported goods should be classified to tariff heading 1605. PAGE 13 OF 14 I certify that the preceding 54 (fiftyfour) paragraphs are a true copy of the reasons for the decision herein of John Handley, Senior Member ....[sgd].................................................................... Associate Dated 24 April 2015 PAGE 14 OF 14 Date(s) of hearing 1 April 2015 Solicitors for the Applicant Louis Gross, Gross & Becroft Lawyers Solicitors for the Respondent James Millea, Customs Law and Prosecutions Legal Advice and Operational Support Branch Legal Services Division