GLOBALIZATION 2001: CONTROLLING IT

Another Failure of the

Washington Consensus

on Transition Countries

Inequality and UndergroundEconomies

J. Barkley Rosser, Jr., and Marina Vcherashnaya Rosser

Western policymakers have long worried about

undergroundeconomies in transition nations and less

about income inequality. But the authors argue that

growing income inequality is an important cause of the

growth of an undergroundeconomy.

New Russian in Mercedes-Benz store: "I would like to see your most

expensive car."

Mercedes-Benz store manager: "Didn't you just buy one in here

yesterday?"

New Russian: "Yes, but the ashtray is already full."

J. BARKLEY ROSSER, JR., and MARINA VCHERASHNAYA ROSSER are, respectively, pro-

fessor and associate professor of economics at James Madison University. The authors wish to acknowledge useful inputfrom Ehsan Ahmed, John Bonin, Simon Commander, Branko Milanovic, and

the late Lynn Turgeon. None of them are responsibleforany errors, omissions, or misinterpretations

in this article.

Challenge,

vol.44,no.2,March/April

2001,

pp.39-50.

© 2001

M.E.

Sharpe,

Inc.Allrights

reserved.

ISSN

0577-5132/2001 $9.50

+0.00.

Challenge/AMrch-April 2001

39

Rosser and Rosser

IT

IS well known that income distribution in many of the tran-

sition economies has become sharply more unequal during

the transition process that began at the end of the 1980s.1 By

and large, the attitude of most policymakers in Washington and

in many international institutions has been that, although this

phenomenon is somewhat unfortunate, it is a necessary outcome,

to be expected and, within bounds, to be desired. The centrally

planned economies were viewed as having too much equality

and not offering sufficient incentives for growth opportunities.

It has been considered inevitable that, in moving to market capitalism, there would be increases in inequality as these incentives became available according to this Washington consensus.

The main concern has been that if this increase became too great,

a political backlash would halt or reverse the transition process

and bring back the former system. That some transition economies such as Russia now have unequal distributions of income

that exceed even that of the United States2 is viewed more as an

annoyance than as a problem that must be resolved.

On the other hand, the especially rapid growth of the underground economy in the transition economies is viewed somewhat more seriously,3 although perhaps as a more extreme case

of a more general global problem.4 This underground economy

is seen as undermining state finances, as those participating in

the underground economy avoid paying taxes. Nonreporting of

income is perhaps the most widely agreed-upon way to identify

underground economy activity. The budget deficits that can arise

if large proportions of economic activity are not reported, and

therefore not taxed, can become a problem, at least in the eyes of

any international lending institutions that have demanded that

the nations in question agree to reduce their budget deficits as a

condition of lending them money. It is also understood that the

crime and corruption that often accompany such underground

activities can corrode the political legitimacy of the system, and

40

Challenge/March-April2001

Failureof the Washington Consensus on Transition Countries

may even spill over into the high-income, nontransition economies as they become havens for money laundering and related

scams and scandals, some of which may even potentially affect

the solvency of Western financial institutions.

It has only dimly begun to be recognized that there may be a

link between these two problems. It is clear that a decline in the

fiscal health of a transition economy may lead it to cutbacks in

social safety net spending, especially when international lending institutions are demanding such cutbacks as part of the

economy's getting its budgetary house in order. It has been less

clearly understood that this relationship may well be a two-way

street, with causation possibly working in the opposite direction as well. Increasing income inequality itself may well contribute to the growth of the underground economy in the

transition economies.

The role of the underground economy in the transition economies is a matter of considerable controversy. Although widespread publicity connects it with outright criminal activity and

associated money laundering in Western banks, it may well perform a socially beneficial function in economies that are overly

regulated, or in which rent-seeking bureaucrats, who may be

officially enforcing the overly strict regulations, engage in bribery

and corruption. 5 In such situations, the only way entrepreneurs can

form what would be viewed as legitimate enterprises is to hide them

from the "grabbing hand" of the corrupt authorities. 6 Efforts to bring

the underground economy aboveground would lead to "throwing

out the baby with the bathwater."7 The hope of this view is that

current underground economy participants will provide a foundation for a functioning aboveground economy in the future, much as

the notorious "robber barons" of the nineteenth-century United

States became the fathers of respected corporations and philanthropic institutions. Even if they do not, their activities may stimulate the aboveground economy through multiplier effects.8

Challenge/March-April2001

41

Rosser and Rosser

Although it is recognized that in some transition economies

there may still be such levels of excessive regulation and associated bureaucratic corruption (Russia and Ukraine standing out

as examples), the apparently rapid growth of the underground

sector has come to be viewed with concern by most policymakers,

both within the countries in question and internationally, if only

because of the fiscal implications. Some observers have suggested

that countries may face two very distinct alternatives: a "good

equilibrium" of not much underground economy and a functioning and honest public sector or a "bad equilibrium" of a large

underground economy and a poorly functioning public sector

unsupported by tax revenues. Some have suggested that this

contrast between outcomes relates to ideas regarding the behavior of mafias and social capital, where there are increasing returns to people who obey the law and involve themselves in

socially worthwhile activities. However, if such behaviors fall

below certain critical levels, then the opposite phenomenon can

emerge-a breakdown of law enforcement and the emergence

of socially damaging behaviors. 9

This theory suggests that if the underground economy reaches

some critical threshold level, it can simply overwhelm the

aboveground economy and come to dominate it. Such an argument fits in well with the idea of sharply diverging possible outcomes with regard to the underground economy. Furthermore,

it becomes clear in the context of transition economies that the

enormous changes these economies have experienced may push

them over such thresholds and toward patterns of extensive underground economic activity that remains underground and becomes a self-reinforcing phenomenon.

What factors might push an economy beyond such a critical

threshold? The original literature on underground economies,

dating from the late 1970s and early 1980s, focuses upon their

emergence in advanced market capitalist economies. This early

42

Challenge/March-April2001

Failureof the Washington Consensus on Transition Countries

literature argues that higher taxes and higher social transfers

lead to larger underground economies as people face incentives

to avoid taxes and be unemployed so as to receive social transfers.' 0 The implication of such arguments is that if high taxes and

large social transfer payment programs are associated with greater

income equality, then one should expect to see income equality

associated with a larger underground economy. Never in this traditional literature is it suggested that the relationship might run

in the opposite direction, that an increase in inequality might

lead to increases in the size of the underground economy.

Such a possibility for the transition economies has now been

suggested, with a finding that there is a strong correlation between the size of the underground economy and the degree of

income inequality, as measured by the Gini coefficient in 1994.11

Of course, these economies have experienced profoundly unusual and disruptive circumstances, with large-scale institutional

transformations and upheavals of many sorts. Many of them

had massive declines in output and hyperinflationary outbreaks,

as well as wars, political instability, and various other extreme

events. That such events could lead to breakdowns of social solidarity and increases in alienation and general disillusionment is

not at all surprising.

Some of these elements appear also to be connected to the rise

of the underground economy.12 However, the only one that appears to be connected to the size of the underground economy

more strongly than the size of the Gini coefficient, at least as of

1994, is the cumulative decline in output from 1989 to 1994. The

maximum rate of inflation also plays a role, but not as great as

the Gini coefficient. Other variables that might be predicted to

have an influence either are much weaker or do not even have

the expected effect. Thus, democratic rights appear to be insignificantly negatively correlated with the size of the underground

economy, while economic freedom has a negative bivariate corCh;Xllenge/March-April 2001

43

Rosser and Rosser

relation but a significant positive correlation with the size of the

underground economy in a full multiple regression. Although

maximum tax rates on capital appear to be significantly positively correlated, maximum tax rates on labor actually appear

to be negatively correlated with the size of the underground

economy, in contrast with most of the existing literature. 13

These findings coincide with a broader reevaluation of transition policy that has been taking place. Whereas at one point most

international officials advocated "shock therapy" approachesin which all transition problems, ranging from macroeconomic

stabilization through institutional restructuring to privatization,

were to be attacked simultaneously and with equal vigor-it is

now clear that for some of these problems, especially privatization,

a more gradual and careful approach may well be called for. The

relatively successful case of Poland, which stabilized the

macroeconomy quickly but has been slow to carry out

privatization, is an important example. The speed of privatization

has been especially linked with the rise of the underground

economy and corruption. Many economies that implemented

rapid privatizations, such as Russia's, discovered that these policies resulted in insider takeovers, corrupt asset stripping, and

other dysfunctional outcomes.14

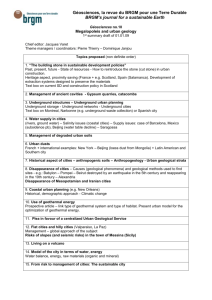

Table 1 presents a summary of data relevant for this discussion. There are very serious problems in measuring the relative

sizes of underground economies in any economy, much less in a

transition economy where previously stable relationships are

breaking down or otherwise changing. Thus, it may be that the

most widely accepted estimates of the size of the underground

economy in advanced market capitalist economies rely upon estimates of the use of currency compared to GDP.15 But for transition economies, such estimates are not very meaningful given

the enormous restructurings the financial sectors of these economies have experienced. Rather, examining patterns of electricity

44

ChaJlenge/March-April2001

Failure of the Washington Consensus on Transition Countries

IN hN C! O~ (Xs ° ID rl

c' r(ON '

f

N

-

N

oC

N

Lf

w.

a

'-

Un

C

O rm

c N

00 U

cD Lt

N

rN

M

Lf

O 'N 0D ID <q Ci OD

CNO

NfO

P

N

L?m (f

N

Ln 00

M

L('

Lr) %

n

r

D

O

-I-

C-

0

C

N0n U) L

LI 00

N n

f U) 00 LNf

(

CS

N 00

O re) oD

CqLL1Cr

Lr

UN m

m r,M

00 L

'4 r

UiU.'

CD

<0O C1

Lf)

-r

Co-

on

m

rn

a)

M('

MC

) N

u

:i N

r)

a)

CM CN 'D 0 0C-

ur C

. N

oN

(7

(N M

C'4

-

rI

o"I

C~)O'

-q-

'T

Lt) -n

('4~

N M

O0-.--

U

cc

('4

T 0

s.

"T

10

N

hO "T C"

0

co

n~OO

U

Co

a0

In

f'

rs

'IT

(N

o0

CN

L

'

OD

-0

N

a)

o CD

0').

.-

-.

~to

'ITCo

-

'.0Co

N

U)-

o0

'q

CD

tD

'(N

C"

n

oo

-

m

'0

-

if -

'.0 oo Co

oo

r0. na)re

O)00

0

0

.C. o O 0

0

'T

. -.

oc(>

unr-

)n

Co) 'IT if) ('

a

r

0)-

-L

('4o

0.0.

-n-(D '-

a

00

1

10

CD

CD

C

C:o

M O m

U)

(N CN r)

re) (N

C)

(A

0

E

U.'

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

U.'

0

Oq ["

.N

rm

I

.4-

r-

.

D

M

CY)

oo

=o

oo

ro

oI

U,

4'

-

I

.

1(

Ln 1

(N

I

I

u)

0

eU

c

- (TN un; 0n r-

N

-

(N 'O

4

(N

C")0 CS

()

O

D

0

Cn 'IT

cN oo

O

cO C- O %6 Ur x6 c0

qD rI

rn

r

N

r)

re

r)

-

-,

M

Um

-

( 0O

ur _:

0

t'

0

rU

0

.L

U

LU

CZ

0C

;D

E

2

U=

CZ

CD~~~~

-~

Q)

u

O a)

- N

C

C0 0

-

r-U

CU

N aO0

CU= >.. CU~.'

.C_

o -0 .coo:

b0CC

-3 °

E

(U

2

0)

a')

0 -'

-0

N

D

Chullenge/March-April2001

45

Rosser and Rosser

usage has been the most commonly used method for the transition economies, although any method has its limitations in any

economy, and it must be recognized that such measures ultimately involve attempting to measure the unmeasurable.

Table 1 presents data for eighteen countries on the size of the

underground economy in 1994 (UE) as a percent of GDP and

the change from 1989 to 1994 in the size of the underground

economy (dUE); the Gini coefficient in 1994 (GC) and its change

from 1989 to 1994 (dGC); the cumulative percentage decline in

output from 1989 to 1994 (CD); the maximum annual rate of

inflation after 1989 (IR); an economic freedom index in 1994 (EF)

and a democratic rights index in 1994 (DR), both 0-100, with a

higher number indicating more economic freedom or democratic

rights; and the effective marginal tax rates on labor income (LT)

and capital income (CT), respectively."6

Much of what one sees from this table fits the conventional wisdom of the Washington consensus. Thus, we find the more reformed and democratic countries in Central Europe, such as

Poland, Hungary, the Czech Republic, Slovakia, and Slovenia, to

have somewhat smaller underground economies and greater

macroeconomic stability. They also generally have more income

equality and tend to have higher tax rates on labor income but

not on capital income. Russia, Ukraine, Moldova, and Georgia all

have larger underground economies and considerable macroeconomic instability. They generally have higher income inequality

and higher capital income tax rates (Georgia's is unknown).

But there are a number of apparent anomalies. The Baltic

countries are somewhat mixed in their patterns, not even resembling each other on some of these variables. The Central

Asian countries are mixed, with Uzbekistan showing a pattern

that makes it look more like one of the Central European countries, at least on the economic variables.' 7 And notoriously undemocratic and unreformed Belarus shows up with both a

46

Challenge/March-April2001

Failureof the Washington Consensus on Transition Countries

relatively small underground economy and a relatively equal

distribution of income.

Furthermore, there is good reason to believe that income distribution policies, especially in the form of social transfers, vary

greatly among these countries. Thus, the very low reported Gini

coefficients in Slovakia and the Czech Republic may not be accidents or mere artifacts of high tax collections due to small underground economies. Studies suggest that their transfer policies

have been much more effectively targeted toward the poor and

those impacted negatively by the transition, policies such as generous unemployment benefits and family assistance.' 8 The programs in somewhat less equal Poland and Hungary are reported

to target the middle class, especially their generous pensions,

whereas the transfer programs in Russia are reportedly regressive in effect, making even more unequal a distribution of income that has become sharply unequal during the transition.' 9

All these findings suggest that the original Washington consensus may have been mistaken to ignore income distribution

policies or even to applaud increases in inequality, as appears to

have been the case. It is clear that quite a few people in some of

the institutions that developed that consensus have been documenting the large increases in income inequality in many of the

transition economies, even as their superiors so far seem to have

largely ignored these findings. Likewise, these people have documented that social safety net policies, by their nature, have in

fact influenced the outcomes regarding income distribution. We

also now see that income inequality itself may help to increase

the size of the underground economy through social alienation

and general dislocation, especially in conjunction with macroeconomic instability. Given that a large underground economy

makes it hard to raise tax revenues to pay for a social safety net,

there is a potential negative feedback effect that it would be wise

to avoid. Thus, there appears to be a case for a serious reconsidChAllenge/March-April 2001

47

Rosser and Rosser

eration of policies with regard to income distribution in the transition economies in light of this apparent interaction with the

underground economy. Not only political legitimacy, but economic stability, may call for more vigorous efforts to maintain

income equality in the transition economies.

Notes

1. For example, see Frances Stewart and Albert Berry, "Globalization, Liberalization, and Inequality: The Real Causes," Challenge 43, no. 1 (January-February

2000): 44-92; Branko Milanovic, Income, Inequality, and Poverty in the Transitionfrom

Planned to Market Economies (Washington, DC: World Bank, 1998); and Simon Commander, "The Impact of Transition on Inequality," Economics of Transition5 (1997):

499-504.

2. See Timothy Smeeding, "America's Income Inequality: Where Do We Stand?"

Challenge 39, no. 5 (September-October 1996): 45-53.

3. See Simon Johnson, Daniel Kaufmann, and Andrei Shleifer, "The Unofficial

Economy in Transition," Brookings Papers on Economic Activity 2 (1997): 159-221.

Other terms for this sector include "unofficial, informal, shadow, irregular, subterranean, black, hidden, and occult."

4. See Friedrich Schneider and Dominik H. Enste, "Shadow Economies: Size,

Causes, and Consequences," Journalof Economic Literature38 (March 2000): 77-114.

5. A study showing that in Russia, Ukraine, Poland, Slovakia, and Romania

bureaucratic corruption is strongly associated with firms hiding output from the

authorities is Simon Johnson, Daniel Kaufmann, John McMillan, and Christopher

Woodruff, "Why Do Firms Hide? Bribes and Unofficial Activity After Communism,"

Journalof Public Economics 76 (June 2000): 495-520.

6. See also in this regard Andrei Shleifer and Robert W. Vishny, The Grabbing

Hand: Government Pathologiesand Their Cures (Cambridge: Harvard University Press,

1998); and Eric Friedman, Simon Johnson, Daniel Kaufmann, and Pablo ZoidoLobat6n, "Dodging the Grabbing Hand: The Determinants of Unofficial Activity in

69 Countries," Journalof Public Economics 76 (June 2000): 459-493.

7. This position is presented in Patrick K. Asea, "The Informal Sector: Baby or

Bath Water? A Comment," Carnegie-Rochester Conference Series on Public Policy 45

(December 1996): 163-171.

8. This argument appears in Dilip K. Bhattacharya, "On the Economic Rationale

of Estimating the Hidden Economy," Economic Journal 109 (June 1999): 348-359.

9. Such arguments have been made in comparing northern Italy and southern

Italy, as by Robert D. Putnam, Making Democracy Work: Civic Traditions in Modern

Italy (Princeton: Princeton University Press, 1993); and also in a more abstract form,

using increasing returns and path dependency arguments from complexity theory,

by Maria Minniti, "Membership Has Its Privileges: Old and New Mafia Organizations," ComparativeEconomic Studies 37 (winter 1995): 31-47. In the sociology literature, such arguments have long been made regarding threshold levels in mass

48

Challenge/March-April2001

Failure of the Washington Consensus on Transition Countries

behavior, with Mark Granovetter providing a classic example in "Threshold Models of Collective Behavior," American Journalof Sociology 58 (1978): 1420-1443.

10. Examples of this early literature include Edgar L. Feige, "How Big Is the

Irregular Economy?" Challenge 22, no. 1 (January 1979): 5-13; and Bruno S. Frey

and Werner Pommerehne, "The Hidden Economy: State and Prospect for Measurement," Review of Income and Wealth 30 (March 1984): 1-23. This view led to arguments that welfare states were simply in a hopelessly frustrating situation whereby

their efforts to redistribute income would backfire as tax revenues fell; e.g.,

Manfred E. Streit, "The Shadow Economy: A Challenge to the Welfare State?"

Ordo Yearbook 35 (1984): 109-119.

11. A correlation coefficient of .76 between the size of the underground economy

and the Gini coefficient in 1994 for sixteen transition economies was found by J.

Barkley Rosser, Jr., Marina V.Rosser, and Ehsan Ahmed, "Income Inequality and

the Informal Economy in Transition Economies," Journalof Comparative Economics

28 (March 2000): 156-171. They also found a correlation coefficient of .705 between

changes in the size of the underground economy and changes in Gini coefficients,

with both of these correlations being significant in bivariate regressions. The Gini

coefficient varies between 0 and 1 with higher values indicating greater inequality.

12. Details of these relationships can be found in J. Barkley Rosser, Jr., Marina V.

Rosser, and Ehsan Ahmed, "Multiple Unofficial Economy Equilibria and Income

Distribution Dynamics in Systemic Transition," mimeo (Harrisonburg, VA: Department of Economics, James Madison University, 2000), available at http://

cob.jmu.edu/rosserjb. One important caveat to the relationships reported in the

text is that there is a problem with using the cumulative decline in output as such

because it is already distorted by changes in the relative size of the underground

economy, larger such changes automatically increasing the size of that reported

cumulative decline. As reported in this article, if one replaces the cumulative decline variable with an adjusted cumulative decline that accounts for the changes

due directly to increases in underground economy, that variable ceases to be significant, with the maximum rate of inflation becoming more significant than the

Gini coefficient, which remains very significant.

13. Despite the early literature, some studies have found that even in the

nontransition economies, tax rates on labor income may not be positively correlated with the size of the underground economy, with such factors as the complexity of the tax code possibly playing offsetting roles, as found by Friedrich Schneider

and Reinhard Neck, "The Development of the Shadow Economy Under Changing

Tax Systems and Structures," FinanzarchivN.F. 50 (1993): 344-369.

14. A compelling discussion of this problem with a discussion of the positive

example of Poland is provided by Marshall I. Goldman, "Reprivatizing Russia,"

Challenge43, no. 3 (May-June 2000): 28-43.

15. A classic example of using the currency demand approach to estimate the

size of the underground economy in the United States is Vito Tanzi, "The Underground Economy in the United States: Estimates and Implications," Banca Nazionale

Lavoro Quarterly Review 135 (December 1980): 427-453. Schneider and Enste,

"Shadow Economies," provide a thorough overview of various methods of estimating the size of the underground economy.

16. For all countries except for Kyrgyzstan and Slovenia, the size of the under-

Challenge/March-April2001

49

Rosser and Rosser

ground economy as a percent of GDP is from Johnson, Kaufmann, and Shleifer,

"The Unofficial Economy in Transition," who model electricity use as a function of

GDP. The estimates for Kyrgyzstan and Slovenia come from a study of household

consumption of electricity by Maria Lack6, "Hidden Economy-An Unknown Quantity? Comparative Analysis of Hidden Economies in Transition Countries, 198995," Economics of Transition8 (2000): 117-149. The Gini coefficients and changes of

these are from Rosser, Rosser, and Ahmed, "Income Inequality," which represent

combinations of estimates from a variety of studies. The cumulative decline in output and maximum annual inflation rates are both from Stanley Fischer, Ratna Sahay,

and Carlos Vegh, "Stabilization and Growth in Transition Economies: The Early

Experience," Journal of Economic Perspectives 10 (spring 1996): 67-86, although the

cumulative decline in output number has been adjusted to account for misreporting

due to changes in the size of the underground economy. The economic freedom and

democratic rights indexes for 1994 are both from Peter Murrell, "How Far Has the

Transition Progressed?" Journalof Economic Perspectives10 (spring 1996): 25-44. The

effective marginal tax rates on labor and capital incomes are both from Lack6, ""Hidden Economy." In some cases, the beginning or ending years are not exactly 1989 or

1994, but the nearest available, given the data sources.

17. Considerable doubts have been raised about the underground economy estimates for Uzbekistan in particular, a nation with a long history of reported corruption. See Marshall I. Goldman, "Comment on Johnson, Kaufmann, and Shleifer,"

Brookings Papers on Economic Activity 2 (1997): 222-230. Romania's numbers may

also be suspect due to structural changes in its electricity sector, as may be

Kyrgyzstan's for the same reason.

18. See Michael Forster and Istvan Gy6rgy T6th, "Poverty, Inequality and Social

Policies in the Visegrad Economies," Economics of Transition5 (1997): 505-510.

19. See Commander, "The Impact of Transition on Economy."

To order reprints, call 1-800-352-2210; outside the United States, call 717-632-3535.

50

Challenge/March-April2001

COPYRIGHT INFORMATION

TITLE: Another failure of the Washington consensus on

transition countries: inequality and underground

economies

SOURCE: Challenge (Armonk, N.Y.) 44 no2 Mr/Ap 2001

WN: 0106003937004

The magazine publisher is the copyright holder of this article and it

is reproduced with permission. Further reproduction of this article in

violation of the copyright is prohibited.

Copyright 1982-2001 The H.W. Wilson Company.

All rights reserved.