Annual Report - Fundsupermart.com

advertisement

Affin Hwang

Select Dividend Fund

Annual Report

30 September 2015

MANAGER

Affin Hwang Asset Management Berhad (429786-T)

TRUSTEE

CIMB Islamic Trustees Berhad (167913-M)

AFFIN HWANG SELECT DIVIDEND FUND

Annual Report and Audited Financial Statements

For the Financial Year Ended 30 September 2015

Content

Page

MANAGER’S REPORT ...............................................................................................................2

FUND PERFORMANCE DATA ...................................................................................................8

TRUSTEE’S REPORT ...............................................................................................................9

STATEMENT OF COMPREHENSIVE INCOME ....................................................................... 10

STATEMENT OF FINANCIAL POSITION ................................................................................. 11

STATEMENT OF CHANGES IN EQUITY ................................................................................. 12

STATEMENT OF CASH FLOWS .............................................................................................. 13

SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES ........................................................ 14

NOTES TO THE FINANCIAL STATEMENTS ........................................................................... 20

STATEMENT BY THE MANAGER ........................................................................................... 46

AUDITORS’ REPORT ...............................................................................................................47

DIRECTORY OF SALES OFFICE ............................................................................................ 49

1

MANAGER’S REPORT

(1)

MANAGER’S VIEW ON PORTFOLIO AND MARKET

Fund Type, Category, Objective and Distribution Policy

Affin Hwang Select Dividend Fund (the “Fund”) is an equity fund that provides a combination of regular

income and capital growth over the medium to long term period.

The Fund will distribute income (subject to income availability), on a semi-annual basis after the end of its

first financial year.

Benchmark

The benchmark used by the Manager in measuring the performance of the Fund will be 70% of the

benchmark is derived from the FTSE Bursa Malaysia Top 100 Index, which is in line with the Fund’s

expected long-term asset allocation of 70% of the Fund’s NAV invested domestically. The remaining 30% of

the benchmark is derived from the Dow Jones/Asia Pacific Select Dividend 30 Index as the Manager expects

over the long-term to invest 30% of the Fund’s NAV in foreign equities listed within the Asia-Pacific region.

(the “Benchmark”)

(70% FTSE Bursa Malaysia Top 100 Index) + (30% Dow Jones/Asia Pacific Select Dividend 30 Index)

(Obtainable: FTSE Bursa Malaysia 100 Index at http://www.klse.com.my + Dow Jones/Asia Pacific Select

Dividend 30 Index at http://www.djindexes.com/selectdividend/)

Performance of the Fund (1 October 2014 to 30 September 2015)

For the period under review from 1 October 2014 to 30 September 2015, the Fund registered a -0.99%

return compared to the benchmark return of -10.04%. The Fund thus outperformed the Benchmark by

9.05%. The Net Asset Value (“NAV”) per unit of the Fund as at 30 September 2015 was RM0.5941

compared to its NAV per unit as at 30 September 2014 of RM0.6445. During the same period under review,

the Fund has declared a total income distribution of RM0.045 per unit by way of reinvestment in the form of

additional units.

Given the performance during the period under review, we believe the Fund’s objective is being met to

provide investors with a regular income stream and high level of liquidity to meet cash flow requirement while

maintaining capital preservation.

Table 1: Performance of the Fund

1 Year

(1/10/14 - 30/9/15)

3 Years

(1/10/12 - 30/9/15)

Since Commencement

(16/4/11 - 30/9/15)

Fund

(0.99%)

23.58%

50.00%

Benchmark

(10.04%)

1.19%

8.49%

9.05%

22.39%

41.51%

Outperformance

Source of Benchmark: Bloomberg

Table 2: Average Total Return

1 Year

(1/10/14 - 30/9/15)

3 Years

(1/10/12 - 30/9/15)

Since

Commencement

(16/4/11 - 30/9/15)

Fund

(0.99%)

7.31%

9.52%

Benchmark

(10.04%)

0.39%

1.84%

9.05%

6.92%

7.68%

Outperformance

Source of Benchmark: Bloomberg

2

Table 3: Annual Total Return

FYE 2015

(01/10/14 30/9/15)

FYE 2014

(01/10/13 30/9/14)

FYE 2013

(01/10/12 30/9/13)

FYE 2012

(01/10/11 30/9/12)

Fund

(0.99%)

11.95%

11.48%

30.97%

Benchmark

(10.04%)

1.90%

10.38%

16.48%

9.05%

10.05%

1.10%

14.49%

Outperformance

Source of Benchmark: Bloomberg

Figure 1: Movement of the Fund versus the Benchmark since commencement.

“This information is prepared by Affin Hwang Asset Management Berhad for information purposes only. Past earnings or the Fund’s

distribution record is not a guarantee or reflection of the Fund’s future earnings/future distributions. Investors are advised that Unit

prices, distributions payable and investment returns may go down as well as up. Source of Benchmark is from Bloomberg.”

Benchmark: (70% FTSE Bursa Malaysia Top 100 Index) + (30% Dow Jones/Asia Pacific Select Dividend 30 Index)

(Obtainable: FTSE Bursa Malaysia 100 Index at http://www.klse.com.my + Dow Jones/Asia Pacific Select Dividend 30 Index at

http://www.djindexes.com/selectdividend/)

Strategies Employed (1 October 2014 to 30 September 2015)

The period under review was challenging for equity markets. Global political uncertainties, a weak Ringgit,

and the low oil price environment coupled with headwinds of a slowing global growth scenario have kept

financial markets in a limbo.

The Manager has kept a relatively high cash level for the Fund towards the end of the period under review

believing that the risk/reward environment was less than attractive and as the Manager took on a more

cautious view on the markets. The Manager continues to maintain its strategy of overlaying a top down

macro overview to determine the Fund’s equity and cash exposure, after which the country exposure is

determined based on our country analysis. Once the equity exposure and country exposure is determined,

the classic bottom-up approach is employed where stocks with good management, strong cash flow

generation and promising attractive dividend yields are selected.

3

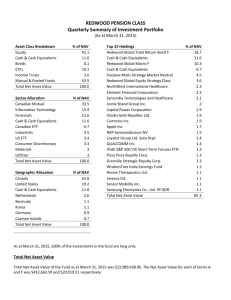

Asset Allocation

As at 30 September 2015, the asset allocation of the Fund stood at 80.41% in equities, and balance of

19.59% in cash. For a snapshot of the Fund’s equity sector allocation as at 30 September 2015, refer to

Figure 2.

Figure 2: Equity Sector Allocation

Sector Allocation

Local Investment

Consumer Goods

Consumer Services

Financial Services

Healthcare

Industrials

Oil & Gas

Properties

Telecommunications

Technology

Utilities

REITs

Basic Materials

Constructions

Industrial Products

Trading & Services

ICPS

Foreign Investment

Financials

Consumer Goods

Consumer Services

Healthcare

Industrials

Technology

Telecommunications

Utilities

REITs

Financial Services

Oil & Gas

Equity

Cash

Total

30 Sept 2015

30 Sept 2014

30 Sept 2013

9.18%

1.90%

20.88%

1.84%

1.23%

6.64%

2.82%

5.71%

0.74%

1.50%

6.22%

-

6.90%

4.54%

17.72%

4.34%

7.23%

1.09%

4.68%

1.12%

0.65%

-

12.17%

9.24%

0.49%

6.51%

3.37%

1.78%

0.80%

8.31%

5.75%

6.22%

2.78%

0.30%

3.34%

3.37%

1.52%

3.47%

0.16%

0.59

80.41%

19.59%

100.00%

6.93%

1.36%

2.93%

2.58%

3.86%

0.97%

2.89%

0.92%

0.52%

1.01%

2.36%

74.63%

25.37%

100.00%

9.92%

5.04%

3.05%

0.42%

4.99%

1.55%

1.72%

1.80%

2.49%

79.40%

20.60%

100.00%

rd

The Manager reduced slightly foreign investment exposure towards the end of the 3 quarter of the year as

the foreign markets became more volatile due to the key event in the US. The Fund’s domestic equities

exposure on the other hand, is slightly increased from previous period under review.

Review of Market (1 October 2014 to 30 September 2015)

Global financial markets remained volatile over the course of the period under review. Investors remained

concerned over the health of the global economy as deflationary risk and low commodity prices put pressure

on global growth. The European Central Bank (“ECB”) maneuvered to meet market expectations with a fullscaled quantitative easing (QE) program. Lower crude oil prices helped to lift economic activity within the

region – especially the net importers as the reduced inflationary pressure provided more room to provide

accommodative monetary policies. Monetary easing measures were seen being taken by many central

banks in a bid to address the slowing environment e.g. Australia, China, Singapore, India, and Thailand.

The domestic equity market took lead from crude oil prices and rebounded in mid-January. To the dismay of

local investors, the rebound was unsustainable, and the index continued to trade range-bound. Comments of

a possible sovereign rating downgrade by rating agency, Fitch, dragged down market sentiment.

4

Political tensions continued to heighten within Malaysia as senior political personalities started to bicker in

th

the open. The announcement of the 11 Malaysia Plan in May failed to excite the market due to limited

initiatives being announced. This highlighted the funding constrained faced by the Government.

The Federal Open Market Committee (“FOMC”) meeting in June refocused investors’ expectation that the

US Federal Reserves may be back on track to raise its interest rates in the second half of 2015. Investors

remained cautious, taking into consideration the possibility of Greece being forced out of the Eurozone. The

domestic equity market gauged by the FBM KLCI slumped 2.9% in the first half of the year, making it the

second worst-performing market in ASEAN behind Indonesia, which slid 5.2% over the same period.

The Ringgit has continued to depreciate against the USD on the back of the highly anticipated rate hike,

which generally pressures most Asian currencies lower. The severe depreciation of the local currency was

mainly attributed to the plunging oil prices, as well as the intensifying political struggle in the nation. This was

on the back of revived concerns over the reversal of fund flows caused by the impending rate hike,

weakening growth environment, plunging commodity prices coupled with a very poor corporate earnings.

Volatility heightened towards the end of the period under review after the People’s Bank of China made a

surprise move to devalue the Renminbi. The move intensified concerns surrounding the rate of China’s

economic growth. The devaluation of the RMB drove down most Asian currencies.

Investment Outlook

Equity markets are expected to remain volatile in the near term, given the challenging environment globally.

The slow pace of global growth and the increasing concerns surrounding China’s ailing economy will likely

influence the performance of the domestic, as well as the global financial market. In a low global growth

environment and where interest rates are expected to remain low, dividend stocks will be an area for

investors to seek returns. Companies that can deliver growing earnings and dividend will be sought after

especially now and likely outperform the general market. On a medium to long term basis, stocks which

deliver dividends which grow over time have been shown to outperform and these are the companies that

the Manager continues to look out for.

(2)

SOFT COMMISSIONS RECEIVED FROM BROKERS

As per the requirements of the Securities Commission’s Guidelines on Unit Trust Funds and Guidelines on

Compliance Function for Fund Management Companies., soft commissions received from brokers/dealers

may be retained by the management company only if the –

(i)

(ii)

goods and services provided are of demonstrable benefit to Unit holders of the Fund; and

goods and services are in the form of research and advisory services that assists in the decisionmaking process.

During the financial period under review, the management company had received on behalf of the Fund, soft

commissions in the form of research materials, data and quotation services, investment-related publications,

market data feed and industry benchmarking agencies which are of demonstrable benefit to Unitholders of

the Fund.

5

(3)

BREAKDOWN OF UNITHOLDERS BY SIZE AS AT 30 SEPTEMBER 2015

Size of holdings

(Units)

No. of Unitholders

No. of Units held *

(‘000)

5,000 and below

379

1,139

5,001 to 10,000

367

2,739

10,001 to 50,000

891

21,228

50,001 to 500,000

308

38,042

500,001 and above

44

272,018

Total

610

335,166

* Note : Excluding Manager’s Stock

There is neither any significant change to the state affairs of the Fund nor any circumstances that materially

affect any interests of the unit holders during the period under review.

6

INCOME DISTRIBUTION

Affin Hwang Asset Management Berhad has distributed a total of gross distribution of RM0.045 per Unit to

investors of the Affin Hwang Select Dividend Fund over the period under review.

The Net Asset Value per Unit prior and subsequent to the distribution is as follows:CumDistribution Date

Ex-Distribution

Date

Cum-distribution

(RM)

20 Jun 2012

7 Dec 2012

10 Jun 2013

9 Dec 2013

11 Jun 2014

8 Dec 2014

22 Jun 2015

21 Jun 2012

10 Dec 2012

11 Jun 2013

10 Dec 2013

12 Jun 2014

9 Dec 2014

23 Jun 2015

0.5586

0.6068

0.6580

0.6423

0.6686

0.6360

0.6437

7

Distribution per

Unit

(RM)

0.0105

0.0200

0.0100

0.0300

0.0300

0.0200

0.0250

Ex-distribution

(RM)

0.5484

0.5906

0.6427

0.6127

0.6374

0.6137

0.6213

FUND PERFORMANCE DATA

Source: CIMB Trustee

As at

30 Sept 2015

As at

30 Sept 2014

As at

30 Sept 2013

Total NAV (RM’million)

199.460

210.826

120.556

NAV per Unit (RM)

0.5941

0.6445

0.6323

Units in Circulation (million)

335.710

327.091

190.669

Highest NAV

0.6722

0.6690

0.6713

Lowest NAV

0.5733

0.6036

0.5906

-0.99

11.95

11.48

-7.82

7.41

4.50

4.50

1.67

1.38

1.93

9.83

6.00

6.00

1.63

1.44

6.18

4.99

3.00

3.00

1.63

1.33

Return of the Fund (%)

iii

i

- Capital Growth (%)

ii

- Total Income Return (%)

Gross Distribution per Unit (sen)

Net Distribution per Unit (sen)

1

Management Expense Ratio (%)

2

Portfolio Turnover Ratio (times)

Basis of calculation and assumption made in calculating the returns:The performance figures are a comparison of the growth/decline in NAV for the stipulated period taking into

account all the distribution payable (if any) during the stipulated period.

An illustration of the above would be as follow:Capital return

Income return

Total return

= NAV per Unit end / NAV per Unit begin – 1

= Income distribution per Unit / NAV per Unit ex-date

= (1+Capital return) x (1+Income return) - 1

i

Capital Growth

= {NAV per Unit @ 30/09/15 ÷ NAV per Unit @ 30/09/14* - 1} x 100

= {0.5941 ÷ 0.6445 – 1} x 100

= -7.82%

Income Return @ ex-date

= {Income distribution per Unit ÷ NAV per Unit on ex-date} + 1

= {0.020 ÷ 0.6137 @ 09/12/14} + 1 = 1.03258

= {0.025 ÷ 0.6213 @ 23/06/15} + 1 = 1.04023

ii

Total Income

Return

= {Income Return @ex-date x Income Return @ex-date}-1x100

= {(1.03258 x 1.04023) -1} x 100

= 7.41%

iii

= [{(1 + Capital Growth) x (1 + Total Income Return)} – 1] x 100

= [{(1+ (7.82%)) x (1+ 7.41%)} – 1] x 100

= -0.99%

Return of the

Fund

* Source – CIMB Trustee

Past performance is not necessarily indicative of future performance and that Unit prices and

investment returns may go down, as well as up.

1

The MER was consistent over the period under review compared to the previous periods

The PTR reduced slightly over the period under review after the Manager reduced its transactions given the volatile market conditions.

2

8

TRUSTEE’S REPORT TO THE UNITHOLDERS OF

AFFIN HWANG SELECT DIVIDEND FUND

We, CIMB Islamic Trustee Berhad (the “Trustee”), being the Trustee of Affin Hwang Select Dividend Fund

(the “Fund”), are of the opinion that Affin Hwang Asset Management Berhad (“the Manager”), acting in the

capacity of Manager of the Fund, has fulfilled its duties in the following manner for the financial year ended

30 September 2015.

In our opinion:

a)

The Fund has been managed in accordance with the limitations imposed on the investment powers

of the Manager and the Trustee under the Deeds, other provisions of the Deeds, the Securities

Commission Malaysia’s Guidelines on Unit Trust Funds, the Capital Markets and Services Act, 2007

(as amended from time to time) and other applicable laws during the financial year ended 30

September 2015;

b)

Valuation/pricing of units of the Fund has been carried out in accordance with the Deed and relevant

regulatory requirements;

c)

The creation and cancellation of units have been carried out in accordance with the Deed and the

relevant regulatory requirements; and

d)

The distributions for the financial year are relevant and reflected the objective of the Fund.

For and on behalf of

CIMB Islamic Trustee Berhad (167913-M)

LEE KOOI YOKE

Chief Operating Officer

Kuala Lumpur, Malaysia

20 November 2015

9

STATEMENT OF COMPREHENSIVE INCOME

FOR THE FINANCIAL YEAR ENDED 30 SEPTEMBER 2015

Note

2015

RM

2014

RM

INVESTMENT INCOME

Dividend income

Interest income from short term deposits

Net gain/(loss) on foreign currency exchange

Net (loss)/gain on financial assets at fair

value through profit or loss

4,317,351

1,382,288

3,032,179

2,764,736

404,168

(247,178)

8

(3,505,871)

16,643,591

───────── ─────────

5,225,947

19,565,317

───────── ─────────

4

5

(3,338,553)

(2,194,338)

(178,056)

(117,031)

(7,500)

(7,500)

(3,500)

(3,550)

(2,016,318)

(1,458,814)

(196,162)

(64,165)

───────── ─────────

(5,740,089)

(3,845,398)

───────── ─────────

EXPENSES

Management fee

Trustee fee

Auditors’ remuneration

Tax agent’s fee

Transaction costs

Other expenses

(514,142)

NET (LOSS)/PROFIT BEFORE TAXATION

6

TAXATION

NET (LOSS)/PROFIT AFTER TAXATION AND TOTAL

COMPREHENSIVE (LOSS)/INCOME FOR THE

FINANCIAL YEAR

15,719,919

(144,705)

(144,609)

───────── ─────────

(658,847)

15,575,310

═════════ ═════════

Net (loss)/profit after taxation is made up of the following:

Realised amount

Unrealised amount

16,432,683

6,814,809

(17,091,530)

8,760,501

───────── ─────────

(658,847)

15,575,310

═════════ ═════════

The accompanying summary of significant accounting policies and notes to the financial statements form an

integral part of these financial statements.

10

STATEMENT OF FINANCIAL POSITION

AS AT 30 SEPTEMBER 2015

Note

2015

RM

2014

RM

8

9

160,381,848

35,347,638

102,336

157,301,380

52,259,942

89,337

ASSETS

Financial assets at fair value through

profit or loss

Cash and cash equivalents

Dividend receivable

Amount due from Manager

- creation of units

Amount due from brokers

84,121

2,126,798

6,780,463

671,667

───────── ─────────

202,696,406

212,449,124

───────── ─────────

TOTAL ASSETS

LIABILITIES

Amount due to Manager

- management fee

- cancellation of units

Amount due to Trustee

Amount due to brokers

Auditors’ remuneration

Tax agent’s fee

Other payables and accruals

246,737

249,713

607,206

118,551

13,159

13,318

2,333,053

1,180,776

7,500

7,500

6,450

6,450

22,594

6,160

───────── ─────────

3,236,699

1,582,468

───────── ─────────

TOTAL LIABILITIES

199,459,707

210,866,656

═════════ ═════════

NET ASSET VALUE OF THE FUND

EQUITY

Unitholders’ capital

Retained earnings

188,481,897

183,729,409

10,977,810

27,137,247

───────── ─────────

199,459,707

210,866,656

═════════ ═════════

NET ASSETS ATTRIBUTABLE TO UNITHOLDERS

10

NUMBER OF UNITS IN CIRCULATION

335,710,000

327,091,000

═════════ ═════════

0.5941

0.6447

═════════ ═════════

NET ASSET VALUE PER UNIT (RM)

The accompanying summary of significant accounting policies and notes to the financial statements form an

integral part of these financial statements.

11

STATEMENT OF CHANGES IN EQUITY

FOR THE FINANCIAL YEAR ENDED 30 SEPTEMBER 2015

Balance as at 1 October 2014

Unitholders’

capital

RM

Retained

earnings

RM

Total

RM

183,729,409

27,137,247

210,866,656

Total comprehensive loss for

the financial year

-

(658,847)

(658,847)

Distributions (Note 7)

-

(15,500,590)

(15,500,590)

Movement in unitholders’ capital:

Creation of units arising from applications

58,095,542

-

58,095,542

Creation of units arising from distribution

15,333,594

-

15,333,594

Cancellation of units

Balance as at 30 September 2015

Balance as at 1 October 2013

(68,676,648)

(68,676,648)

───────── ───────── ─────────

188,481,897

10,977,810

199,459,707

═════════ ═════════ ═════════

96,508,826

24,046,977

120,555,803

Total comprehensive income for

the financial year

-

15,575,310

15,575,310

Distributions (Note 7)

-

(12,485,040)

(12,485,040)

Movement in unitholders’ capital:

Creation of units arising from applications

99,724,946

-

99,724,946

Creation of units arising from distribution

12,340,879

-

12,340,879

Cancellation of units

Balance as at 30 September 2014

(24,845,242)

(24,845,242)

───────── ───────── ─────────

183,729,409

27,137,247

210,866,656

═════════ ═════════ ═════════

The accompanying summary of significant accounting policies and notes to the financial statements form an

integral part of these financial statements.

12

STATEMENT OF CASH FLOWS

FOR THE FINANCIAL YEAR ENDED 30 SEPTEMBER 2015

Note

2015

RM

2014

RM

CASH FLOWS FROM OPERATING ACTIVITIES

Proceeds from sale of investments

Purchase of investments

Capital repayment

Dividends received

Interest received

Management fee paid

Trustee fee paid

Payment for other fees and expenses

Net realised foreign currency exchange gain/(loss)

Tax refund

297,758,202

192,905,380

(317,629,542) (237,920,937)

680,185

47,769

4,159,647

2,825,718

1,382,288

404,168

(3,341,529)

(2,091,447)

(178,215)

(111,543)

(190,728)

(77,076)

8,387,784

(1,434,417)

106,986

───────── ─────────

(8,971,908)

(45,345,399)

───────── ─────────

Net cash used in operating activities

CASH FLOWS FROM FINANCING ACTIVITIES

Proceeds from creation of units

Payments for cancellation of units

Payment for distributions

60,138,219

97,598,148

(68,187,993)

(25,077,379)

(166,996)

(144,161)

───────── ─────────

(8,216,770)

72,376,608

───────── ─────────

Net cash (used in)/generated from financing activities

NET (DECREASE)/INCREASE IN

CASH AND CASH EQUIVALENTS

(17,188,678)

276,374

EFFECTS OF FOREIGN CURRENCY EXCHANGE

CASH AND CASH EQUIVALENTS AT THE

BEGINNING OF THE FINANCIAL YEAR

27,031,209

12,357

52,259,942

25,216,376

───────── ─────────

CASH AND CASH EQUIVALENTS AT THE

END OF THE FINANCIAL YEAR

9

35,347,638

52,259,942

═════════ ═════════

The accompanying summary of significant accounting policies and notes to the financial statements form an

integral part of these financial statements.

13

SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

FOR THE FINANCIAL YEAR ENDED 30 SEPTEMBER 2015

The following accounting policies have been used in dealing with items which are considered material in

relation to the financial statements.

A

BASIS OF PREPARATION OF THE FINANCIAL STATEMENTS

The financial statements have been prepared under the historical cost convention in accordance with the

provisions of the Malaysian Financial Reporting Standards (“MFRS”) and International Financial Reporting

Standards (“IFRS”), as modified by financial assets at fair value through profit or loss.

The preparation of financial statements in conformity with MFRS requires the use of certain critical

accounting estimates and assumptions that affect the reported amounts of assets and liabilities and

disclosure of contingent assets and liabilities at the date of the financial statements, and the reported

amounts of revenue and expenses during the reported financial year. It also requires the Manager to

exercise their judgment in the process of applying the Fund’s accounting policies. Although these estimates

and judgment are based on the Manager’s best knowledge of current events and actions, actual results may

differ.

The areas involving a higher degree of judgment or complexity, or areas where assumptions and estimates

are significant to the financial statements are disclosed in Note N.

(a)

The new standards and amendments to published standards that are applicable to the Fund but not

yet effective and have not been early adopted are as follows:

(i)

Financial year beginning on/after 1 October 2018

•

MFRS 15 ‘Revenue from Contracts with Customers’ (effective from 1 January 2018)

deals with revenue recognition and establishes principles for reporting useful

information to users of financial statements about the nature, amount, timing and

uncertainty of revenue and cash flows arising from an entity’s contracts with

customers. Revenue is recognised when a customer obtains control of a good or

service and thus has the ability to direct the use and obtain the benefits from the good

or service. The standard replaces MFRS 118 ‘Revenue’ and MFRS 111 ‘Construction

Contracts’ and related interpretations.

This standard is not expected to have a significant impact on the Fund’s financial

statements.

(ii)

Financial year beginning on/after 1 October 2018

•

MFRS 9 "Financial Instruments" (effective from 1 January 2018) will replace MFRS

139 "Financial Instruments: Recognition and Measurement". The complete version of

MFRS 9 was issued in November 2014.

MFRS 9 retains but simplifies the mixed measurement model in MFRS 139 and

establishes three primary measurement categories for financial assets: amortised

cost, fair value through profit or loss and fair value through other comprehensive

income (“OCI”). The basis of classification depends on the entity's business model and

the contractual cash flow characteristics of the financial asset. Investments in equity

instruments are always measured at fair value through profit or loss with an

irrevocable option at inception to present changes in fair value in OCI (provided the

instrument is not held for trading).

14

SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

FOR THE FINANCIAL YEAR ENDED 30 SEPTEMBER 2015 (CONTINUED)

A

BASIS OF PREPARATION OF THE FINANCIAL STATEMENTS (CONTINUED)

(a)

The new standards and amendments to published standards that are applicable to the Fund but not

yet effective and have not been early adopted are as follows: (continued)

(ii)

Financial year beginning on/after 1 October 2018 (continued)

A debt instrument is measured at amortised cost only if the entity is holding it to collect

contractual cash flows and the cash flows represent principal and interest.

For liabilities, the standard retains most of the MFRS 139 requirements. These include

amortised cost accounting for most financial liabilities, with bifurcation of embedded

derivatives. The main change is that, in cases where the fair value option is taken for

financial liabilities, the part of a fair value change due to an entity’s own credit risk is

recorded in other comprehensive income rather than the income statement, unless

this creates an accounting mismatch.

There is now a new expected credit losses model on impairment for all financial

assets that replaces the incurred loss impairment model used in MFRS 139. The

expected credit losses model is forward-looking and eliminates the need for a trigger

event to have occurred before credit losses are recognised.

This standard is not expected to have a significant impact on the Fund’s financial

statements.

B

INCOME RECOGNITION

Interest income from short term deposits with licensed financial institutions is recognised based on effective

interest rate method on an accrual basis.

Dividend income is recognised on the ex-dividend date, when the right to receive the dividend has been

established.

For quoted investments, realised gains and losses on sale of investments are accounted for as the difference

between the net disposal proceeds and the carrying amount of investments, determined on a weighted

average cost basis.

C

DIVIDEND DISTRIBUTION

A distribution to the Fund’s unitholders is accounted for as a deduction from realised reserve. A proposed

distribution is recognised as a liability in the period in which it is approved by the Trustee of the Fund.

D

TRANSACTION COSTS

Transaction costs are costs incurred to acquire financial assets or liabilities at fair value through profit or loss.

They include the bid-ask spread, fees and commissions paid to agents, advisors, brokers. Transaction costs,

when incurred, are immediately recognised in the statement of comprehensive income as expenses.

15

SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

FOR THE FINANCIAL YEAR ENDED 30 SEPTEMBER 2015 (CONTINUED)

E

TAXATION

Current tax expense is determined according to the Malaysian tax laws at the current rate based upon the

taxable profits earned during the financial year.

Tax on investment income from foreign investments is based on the tax regime of the respective countries

that the Fund invests in.

F

FUNCTIONAL AND PRESENTATION CURRENCY

Items included in the financial statements of the Fund are measured using the currency of the primary

economic environment in which the Fund operates (the “functional currency”). The financial statements are

presented in Ringgit Malaysia, which is the Fund’s functional and presentation currency.

G

FOREIGN CURRENCY TRANSLATION

Foreign currency transactions are translated into the functional currency using the exchange rates prevailing

at the dates of the transactions or valuation where items are re-measured. Foreign exchange gains and

losses resulting from the settlement of such transactions and from the translation at period-end exchange

rates of monetary assets and liabilities denominated in foreign currencies are recognised in statement of

comprehensive income, except when deferred in other comprehensive income as qualifying cash flow

hedges.

H

FINANCIAL ASSETS AND FINANCIAL LIABILITIES

(i)

Classification

The Fund designates its investment in quoted securities as financial assets at fair value through

profit or loss at inception.

Financial assets are designated at fair value through profit or loss when they are managed and their

performance evaluated on a fair value basis.

Loans and receivables are non-derivative financial assets with fixed or determinable payments that

are not quoted in an active market and have been included in current assets. The Fund’s loans and

receivables comprise cash and cash equivalents, dividend receivable, amount due from Manager

and amount due from brokers.

Financial liabilities are classified according to the substance of the contractual arrangements entered

into and the definitions of a financial liability.

The Fund classifies amount due to Manager, amount due to Trustee, amount due to brokers,

auditors’ remuneration, tax agent’s fee and other payables and accruals as other financial liabilities.

Regular purchases and sales of financial assets are recognised on the trade-date – the date on

which the Fund commits to purchase or sell the asset. Investments are initially recognised at fair

value. Transaction costs are expensed in the statement of comprehensive income.

16

SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

FOR THE FINANCIAL YEAR ENDED 30 SEPTEMBER 2015 (CONTINUED)

H

FINANCIAL ASSETS AND FINANCIAL LIABILITIES (CONTINUED)

(ii)

Recognition and measurement

Financial liabilities, within the scope of MFRS 139, are recognised in the statement of financial

position when, and only when, the Fund becomes a party to the contractual provisions of the

financial instrument.

Financial assets are derecognised when the rights to receive cash flows from the investments have

expired or have been transferred and the Fund has transferred substantially all risks and rewards of

ownership.

Financial liabilities are derecognised when it is extinguished, i.e. when the obligation specified in the

contract is discharged or cancelled or expired.

Gains or losses arising from changes in the fair value of the ‘financial assets at fair value through

profit or loss’ category including the effects of currency transactions are presented in the statement

of comprehensive income within ‘net gain/(loss) on financial assets at fair value through profit or loss

’ in the period which they arise.

Dividend income from financial assets at fair value through profit or loss is recognised in the

statement of comprehensive income as part of gross dividend income when the Fund’s right to

receive payments is established.

If a valuation based on the market price does not represent the fair value of the securities, for

example during abnormal market conditions or when no market price is available, including in the

event of a suspension in the quotation of the securities for a period exceeding 14 days, or such

shorter period as agreed by the Trustee, then the securities are valued as determined in good faith

by the Manager, based on the methods or basis approved by the Trustee after appropriate technical

consultation.

Deposits with a licensed financial institution are stated at cost plus accrued interest calculated on the

effective interest method over the period from the date of placement to the date of maturity of the

deposit.

Loans and receivables and other financial liabilities are subsequently carried at amortised cost using

the effective interest method.

For assets carried at amortised cost, the Fund assesses at the end of the reporting period whether

there is objective evidence that a financial asset or group of financial assets is impaired. A financial

asset or a group of financial assets is impaired and impairment losses are incurred only if there is

objective evidence of impairment as a result of one or more events that occurred after the initial

recognition of the asset (a ‘loss event’) and that loss event (or events) has an impact on the

estimated future cash flows of the financial asset or group of financial assets that can be reliably

estimated.

The amount of the loss is measured as the difference between the asset’s carrying amount and the

present value of estimated future cash flows (excluding future credit losses that have not been

incurred) discounted at the financial asset’s original effective interest rate. The asset’s carrying

amount of the asset is reduced and the amount of the loss is recognised in profit or loss. If ‘loans and

receivables’ or a ‘held-to-maturity investment’ has a variable interest rate, the discount rate for

measuring any impairment loss is the current effective interest rate determined under the contract.

17

SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

FOR THE FINANCIAL YEAR ENDED 30 SEPTEMBER 2015 (CONTINUED)

H

FINANCIAL ASSETS AND FINANCIAL LIABILITIES (CONTINUED)

(ii)

Recognition and measurement (continued)

As a practical expedient, the Fund may measure impairment on the basis of an instrument’s fair

value using an observable market price.

If, in a subsequent financial year, the amount of the impairment loss decreases and the decrease

can be related objectively to an event occurring after the impairment was recognised (such as an

improvement in the debtor’s credit rating), the reversal of the previously recognised impairment loss

is recognised in statement of comprehensive income.

When an asset is uncollectible, it is written off against the related allowance account. Such assets

are written off after all the necessary procedures have been completed and the amount of the loss

has been determined.

I

CASH AND CASH EQUIVALENTS

For the purpose of statement of cash flows, cash and cash equivalents comprise cash and bank balances

and deposits held in highly liquid investments that are readily convertible to known amounts of cash and

which are subject to an insignificant risk of change in value.

J

AMOUNT DUE FROM/(TO) BROKERS

Amounts due from and to brokers represent receivables for securities sold and payables for securities

purchased that have been contracted for but not yet settled or delivered on the statement of financial position

date respectively.

These amounts are recognised initially at fair value and subsequently measured at amortised cost using the

effective interest method, less provision for impairment for amounts due from brokers. A provision for

impairment of amounts due from brokers is established when there is objective evidence that the Fund will

not be able to collect all amounts due from the relevant broker.

Significant financial difficulties of the broker, probability that the broker will enter bankruptcy or financial

reorganisation, and default in payments are considered indicators that the amount due from brokers is

impaired. Once a financial asset or a group of similar financial assets has been written down as a result of an

impairment loss, interest income is recognised using the rate of interest used to discount the future cash

flows for the purpose of measuring the impairment loss.

The effective interest method is a method of calculating the amortised cost of a financial asset or financial

liability and of allocating the interest income or loans expense over the relevant period. The effective interest

rate is the rate that exactly discounts estimated future cash payments or receipts throughout the expected

life of the financial instrument, or, when appropriate, a shorter period, to the net carrying amount of the

financial asset or financial liability. When calculating the effective interest rate, the Fund estimates cash flows

considering all contractual terms of the financial instrument but does not consider future credit losses. The

calculation includes all fees and points paid or received between parties to the contract that are an integral

part of the effective interest rate, transaction costs and all other premiums or discounts.

18

SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

FOR THE FINANCIAL YEAR ENDED 30 SEPTEMBER 2015 (CONTINUED)

K

CREATION AND CANCELLATION OF UNITS

The Fund issues cancellable units, which are cancelled at the unitholder’s option and are classified as equity.

Cancellable units can be put back to the Fund at any time for cash equal to a proportionate share of the

Fund’s Net Asset Value or “NAV”. The outstanding units are carried at the redemption amount that is payable

as at the date of the statement of financial position if the unitholder exercises the right to put the unit back to

the Fund.

Units are created and cancelled at the unitholder’s option at prices based on the Fund’s NAV per unit at the

time of creation or cancellation. The Fund’s NAV per unit is calculated by dividing the net assets attributable

to unitholders with the total number of outstanding units.

L

UNITHOLDERS’ CAPITAL

The unitholders’ capital to the Fund meets the definition of puttable instruments classified as equity

instruments under MFRS 132 “Financial Instruments: Presentation”.

The units in the Fund are puttable instruments which entitle the unitholders to a pro-rata share of the net

asset of the Fund. The units are subordinated and have identical features. There is no contractual obligation

to deliver cash or another financial asset other than the obligation on the Fund to repurchase the units. The

total expected cash flows from the units in the Fund over the life of the units are based on the change in the

net asset of the Fund.

M

SEGMENT REPORTING

Operating segments are reported in a manner consistent with the internal reporting used by the chief

operating decision-maker. The chief operating decision-maker, who is responsible for allocating resources

and assessing performance of the operating segments, has been identified as the strategic asset allocation

committee of the Manager that makes strategic decisions.

N

CRITICAL ACCOUNTING ESTIMATES AND JUDGMENTS IN APPLYING ACCOUNTING POLICIES

The preparation of financial statements in conformity with the Malaysian Financial Reporting Standards

requires the use of estimates and assumptions that affect the reported amounts of assets and liabilities as at

the date of the financial statements and the reported amounts of revenues and expenses during the financial

year. Although these estimates are based on the Manager’s best knowledge of current events and actions,

actual results could differ from those estimates.

The Fund makes estimates and assumptions concerning the future. The resulting accounting estimates will,

by definition, rarely equal the related actual results. To enhance the information contents on the estimates,

certain key variables that are anticipated to have material impacts to the Fund’s results and financial position

are tested for sensitivity to changes in the underlying parameters.

Estimates and judgments are continually evaluated by the Manager and are based on historical experience

and other factors, including expectations of future events that are believed to be reasonable under the

circumstances.

19

NOTES TO THE FINANCIAL STATEMENTS

FOR THE FINANCIAL YEAR ENDED 30 SEPTEMBER 2015

1

INFORMATION ON THE FUND

The Unit Trust Fund was constituted under the name HwangDBS Select Dividend Fund (the “Fund”)

pursuant to the execution of a Deed dated 24 February 2011. The Fund has changed its name from

HwangDBS Select Dividend Fund to Hwang Select Dividend Fund as amended by the First Supplemental

Deed dated 18 January 2012 and from Hwang Select Dividend Fund to Affin Hwang Select Dividend Fund as

amended by the Second Supplemental Deed dated 27 June 2014 (the “Deeds”) entered into between Affin

Hwang Asset Management Berhad (the “Manager”), CIMB Islamic Trustee Berhad, (the “Trustee”) and the

registered unitholders of the Fund.

The Fund commenced operations on 28 March 2011 and will continue its operations until terminated by the

Trustee as provided under Clause 12.1 of the Deed.

The Fund may invest in any of the following investments:

(a)

(b)

(c)

(d)

(e)

(f)

(g)

(h)

Securities listed on Bursa Malaysia and throughout the Asia-Pacific region where the regulatory

authorities are members of the International Organization of Securities Commission (IOSCO);

Fixed deposit and money market deposits with commercial banks and investment banks;

Others money market instruments such as negotiable certificates of deposits and bankers’

acceptance;

Government bonds, treasury bills and other government approved or guaranteed bonds;

Debentures, including private debt securities and bonds;

Warrants;

Derivatives for hedging purposes; and

Any other form of investments permitted by the Securities Commission (“SC”) which is in line with

the objective of the Fund.

All investments will be subjected to the SC’s Guidelines on Unit Trust Funds, the Deed and the objective of

the Fund.

The main objective of the Fund is to provide a combination of regular income and capital growth over the

medium to long term period.

The Manager is a company incorporated in Malaysia. The principal activities of the Manager are

establishment and management of unit trust funds and private retirement schemes as well as providing fund

management services to private clients.

The financial statements were authorised for issue by the Manager on 20 November 2015.

20

NOTES TO THE FINANCIAL STATEMENTS

FOR THE FINANCIAL YEAR ENDED 30 SEPTEMBER 2015 (CONTINUED)

2

FINANCIAL INSTRUMENTS, RISK MANAGEMENT OBJECTIVE AND POLICIES (CONTINUED)

Financial instruments are as follows:

Note

2015

Quoted equities

Cash and cash equivalents

Dividend receivable

Amount due from Manager

Amount due from brokers

Loans and

receivables

RM

Financial

assets at fair

value through

profit or loss

RM

Total

RM

8

9

160,381,848

160,381,848

35,347,638

35,347,638

102,336

102,336

84,121

84,121

6,780,463

6,780,463

───────── ───────── ─────────

42,314,558

160,381,848

202,696,406

═════════ ═════════ ═════════

8

9

157,301,380

157,301,380

52,259,942

52,259,942

89,337

89,337

2,126,798

2,126,798

671,667

671,667

───────── ───────── ─────────

55,147,744

157,301,380

212,449,124

═════════ ═════════ ═════════

Total

2014

Quoted equities

Cash and cash equivalents

Dividend receivable

Amount due from Manager

Amount due from brokers

Total

All current liabilities are financial liabilities which are carried at amortised cost.

The Fund is exposed to a variety of risks which include market risk (including price risk, interest rate risk, and

currency risk), credit risk, liquidity risk and capital risk.

Financial risk management is carried out through internal control processes adopted by the Manager and

adherence to the investment restrictions as stipulated by the SC’s Guidelines on Unit Trust Funds.

Market risk

(a)

Price risk

Price risk arises mainly from the uncertainty about future prices of investments. It represents the

potential loss the Fund might suffer through holding market positions in the face of price movements.

The Manager manages the risk of unfavourable changes in prices by continuous monitoring of the

performance and risk profile of the investment portfolio.

21

NOTES TO THE FINANCIAL STATEMENTS

FOR THE FINANCIAL YEAR ENDED 30 SEPTEMBER 2015 (CONTINUED)

2

FINANCIAL INSTRUMENTS, RISK MANAGEMENT OBJECTIVE AND POLICIES (CONTINUED)

Market risk (continued)

(a)

Price risk (continued)

The Fund’s overall exposure to price risk was as follows:

2015

RM

Quoted investments

Quoted equities designated at fair value through

profit or loss

2014

RM

160,381,848

157,301,380

═════════ ═════════

The following table summarises the sensitivity of the Fund’s profit after taxation and net asset value

to price risk movements. The analysis is based on the assumptions that the market price increased

by 5% and decreased by 5% with all other variables held constant. This represents management’s

best estimate of a reasonable possible shift in the quoted securities, having regard to the historical

volatility of the prices.

% Change in price

Market value

RM

Impact on

profit after

tax/NAV

RM

152,362,756

160,381,848

168,400,940

═════════

(8,019,092)

8,019,092

═════════

149,436,311

157,301,380

165,166,449

═════════

(7,865,069)

7,865,069

═════════

2015

-5%

0%

+5%

2014

-5%

0%

+5%

(b)

Interest rate risk

Interest rate risk arises from the effects of fluctuations in the prevailing levels of market interest rates

on the fair value of financial assets and liabilities and future cash flows.

The Fund’s exposure to the interest rate risk is mainly confined to short term deposit placement with

a financial institution. The Manager overcomes this exposure by way of maintaining deposits on a

short term basis.

The Fund’s exposure to interest rate risk associated with deposit with a licensed financial institution

is not material as the deposit is held on a short term basis.

22

NOTES TO THE FINANCIAL STATEMENTS

FOR THE FINANCIAL YEAR ENDED 30 SEPTEMBER 2015 (CONTINUED)

2

FINANCIAL INSTRUMENTS, RISK MANAGEMENT OBJECTIVE AND POLICIES (CONTINUED)

Market risk (continued)

(c)

Currency risk

Currency risk is associated with investments denominated in foreign currencies. When the foreign

currencies fluctuate in an unfavourable movement against Ringgit Malaysia, the investments will

face currency losses in addition to the capital gain/loss. The Manager will evaluate the likely

directions of a foreign currency versus Ringgit Malaysia based on considerations of economic

fundamentals such as interest rate differentials, balance of payments position, debt levels, and

technical chart considerations.

The following table sets out the foreign currency risk concentrations and counterparties of the Fund.

Quoted

equities

RM

Cash

and cash

equivalents

RM

Other

assets*

RM

Australian Dollar

Hong Kong Dollar

24,978,197

Indonesian Rupiah

2,026,284

Korean Won

1,204,058

Philippines Peso

2,392,366

Singapore Dollar

8,267,735

Thailand Baht

4,504,017

United States Dollar

─────────

43,372,657

═════════

2

1,226,670

157,291

2,998,511

────────

4,382,474

════════

963,824

13,687

609,584

────────

1,587,095

════════

2

- 27,168,691

2,026,284

1,217,745

3,001,950

(336,716)

8,088,310

4,504,017

2,998,511

──────── ─────────

(336,716) 49,005,510

════════ ═════════

2

1,193,575

560,641

3,390,525

────────

5,144,743

════════

326,331

345,336

33,355

────────

705,022

════════

2

(1,180,776) 16,730,193

8,426,924

5,659,451

9,803,079

7,268,772

8,902,315

3,390,525

──────── ─────────

(1,180,776) 60,181,261

════════ ═════════

2015

Other

payables**

RM

Total

RM

2014

Australian Dollar

Hong Kong Dollar

16,391,063

Indonesian Rupiah

8,081,588

Korean Won

5,659,451

Philippines Peso

9,769,724

Singapore Dollar

6,708,131

Thailand Baht

8,902,315

United States Dollar

─────────

55,512,272

═════════

* Other assets consist of dividend receivable and amount due from brokers.

** Other payables consist of amount due to brokers.

23

NOTES TO THE FINANCIAL STATEMENTS

FOR THE FINANCIAL YEAR ENDED 30 SEPTEMBER 2015 (CONTINUED)

2

FINANCIAL INSTRUMENTS, RISK MANAGEMENT OBJECTIVE AND POLICIES (CONTINUED)

Market risk (continued)

(c)

Currency risk (continued)

The table below summarises the sensitivity of the Fund's profit after tax and net asset value to

changes in foreign exchange movements. The analysis is based on the assumption that the foreign

exchange rate changes by 5%, with all other variables held constant. This represents management's

best estimate of a reasonable possible shift in the foreign exchange rate, having regard to historical

volatility of this rate. Any increase/decrease in foreign exchange rate will result in a corresponding

decrease/increase in the net assets attributable to unitholders by approximately 5%. Disclosures

below are shown in absolute terms, changes and impacts could be positive or negative.

Change

in price

%

Impact on

profit after

tax/NAV

RM

2015

Australian Dollar

Hong Kong Dollar

Indonesian Rupiah

Korean Won

Philippines Peso

Singapore Dollar

Thailand Baht

United States Dollar

5

5

5

5

5

5

5

5

1,358,435

101,314

60,887

150,097

404,416

225,201

149,926

─────────

2,450,276

═════════

5

5

5

5

5

5

5

5

836,510

421,346

282,973

490,154

363,439

445,116

169,526

─────────

3,009,064

═════════

2014

Australian Dollar

Hong Kong Dollar

Indonesian Rupiah

Korean Won

Philippines Peso

Singapore Dollar

Thailand Baht

United States Dollar

24

NOTES TO THE FINANCIAL STATEMENTS

FOR THE FINANCIAL YEAR ENDED 30 SEPTEMBER 2015 (CONTINUED)

2

FINANCIAL INSTRUMENTS, RISK MANAGEMENT OBJECTIVE AND POLICIES (CONTINUED)

Credit risk

Credit risk refers to the ability of an issuer or counterparty to make timely payments of interest, principals and

proceeds from realisation of investment. The Manager manages the credit risk by undertaking credit

evaluation to minimise such risk.

The settlement terms of amount due from are governed by the relevant rules and regulations as prescribed

by the respective stock exchanges.

Credit risk arising from placements on deposits in licensed financial institutions is managed by ensuring that

the Fund will only place deposits in reputable licensed financial institutions.

The settlement terms of the proceeds from the creation of units receivable from the Manager are governed by

the Securities Commission's Guidelines on Unit Trust Funds.

The following table sets out the credit risk concentrations and counterparties of the Fund:

2015

AAA

AA3

Others

Cash

and cash

equivalents

RM

Other

assets*

RM

Total

RM

9,572,645

25,774,993

─────────

35,347,638

═════════

6,966,920

─────────

6,966,920

═════════

9,572,645

25,774,993

6,966,920

─────────

42,314,558

═════════

21,075,871

31,184,071

─────────

52,259,942

═════════

2,887,802

─────────

2,887,802

═════════

21,075,871

31,184,071

2,887,802

─────────

55,147,744

═════════

2015

AAA

AA3

Others

* Other assets consist of dividend receivables, amount due from Manager and amount due from

The financial assets of the Fund are neither past due nor impaired.

25

brokers.

NOTES TO THE FINANCIAL STATEMENTS

FOR THE FINANCIAL YEAR ENDED 30 SEPTEMBER 2015 (CONTINUED)

2

FINANCIAL INSTRUMENTS, RISK MANAGEMENT OBJECTIVE AND POLICIES (CONTINUED)

Liquidity risk

Liquidity risk is the risk that the Fund will encounter difficulty in meeting its financial obligations. The Manager

manages this risk by maintaining sufficient level of liquid assets to meet anticipated payment and

cancellations of unit by unitholders, liquid assets comprise cash, deposits with licensed financial institutions

and other instruments, which are capable of being converted into cash within 7 days.

The table below analyses the Fund's financial liabilities into relevant maturity groupings based on the

remaining period at the statement of financial position date to the contractual maturity date.

The amounts in the table below are the contractual undiscounted cash flows.

Within

one month

RM

2015

Amount due to Manager

- management fee

- cancellation of units

Amount due to Trustee

Amount due to brokers

Auditors’ remuneration

Tax agent’s fee

Other payables and accruals

2014

Amount due to Manager

- management fee

- cancellation of units

Amount due to Trustee

Amount due to brokers

Auditors’ remuneration

Tax agent’s fee

Other payables and accruals

Between

one month

to one year

RM

Total

RM

246,737

246,737

607,206

607,206

13,159

13,159

2,333,053

2,333,053

7,500

7,500

6,450

6,450

15,594

7,000

22,594

───────── ───────── ─────────

3,215,749

20,950

3,236,699

════════ ════════ ════════

249,713

249,713

118,551

118,551

13,318

13,318

1,180,776

1,180,776

7,500

7,500

6,450

6,450

6,160

6,160

───────── ───────── ─────────

1,562,358

20,110

1,582,468

════════ ════════ ════════

Capital risk

The capital of the Fund is represented by equity consisting of unitholders’ capital and retained earnings. The

amount of equity can change significantly on a daily basis as the Fund is subject to daily subscriptions and

redemptions at the discretion of unitholders. The Fund’s objective when managing capital is to safeguard the

Fund’s ability to continue as a going concern in order to provide returns for unitholders and benefits for other

stakeholders and to maintain a strong capital base to support the development of the investment activities of

the Fund.

26

NOTES TO THE FINANCIAL STATEMENTS

FOR THE FINANCIAL YEAR ENDED 30 SEPTEMBER 2015 (CONTINUED)

3

FAIR VALUE ESTIMATION

Financial instruments comprise financial assets and financial liabilities. Fair value is the price that would be

received to sell an asset or paid to transfer a liability in an orderly transaction between market participants at

the measurement date.

The fair value of financial assets traded in active markets (such as trading securities) is based on quoted

market prices at the close of trading on the period end date.

An active market is a market in which transactions for the asset take place with sufficient frequency and

volume to provide pricing information on an ongoing basis.

The fair value of financial assets that are not traded in an active market is determined by using valuation

techniques.

(i)

Fair value hierarchy

The table below analyses financial instruments carried at fair value. The different levels have been

defined as follows:

• Quoted prices (unadjusted) in active market for identical assets or liabilities (Level 1)

• Inputs other than quoted prices included within Level 1 that are observable for the asset or liability,

either directly (that is, as prices) or indirectly (that is, derived from prices) (Level 2)

• Inputs for the asset and liability that are not based on observable market data (that is, unobservable

inputs) (Level 3)

The level in the fair value hierarchy within which the fair value measurement is categorised in its entirety

is determined on the basis of the lowest level input that is significant to the fair value measurement in its

entirety. For this purpose, the significance of an input is assessed against the fair value measurement in

its entirety. If a fair value measurement uses observable inputs that require significant adjustment

based on unobservable inputs, that measurement is a Level 3 measurement. Assessing the

significance of a particular input to the fair value measurement in its entirety requires judgment,

considering factors specific to the asset or liability.

The determination of what constitutes ‘observable’ requires significant judgment by the Fund. The Fund

considers observable data to be that market data that is readily available, regularly distributed or

updated, reliable and verifiable, not proprietary and provided by independent sources that are actively

involved in the relevant market.

The following table analyses within the fair value hierarchy the Fund’s financial assets (by class)

measured at fair value:

2015

Financial assets at fair value

through profit or loss

- quoted equities

Level 1

RM

Level 2

RM

Level 3

RM

Total

RM

160,381,848

- 160,381,848

═════════ ════════ ════════ ════════

27

NOTES TO THE FINANCIAL STATEMENTS

FOR THE FINANCIAL YEAR ENDED 30 SEPTEMBER 2015 (CONTINUED)

3

FAIR VALUE ESTIMATION (CONTINUED)

(i)

Fair value hierarchy (continued)

The following table analyses within the fair value hierarchy the Fund’s financial assets (by class)

measured at fair value (continued):

2014

Financial assets at fair value

through profit or loss

- quoted equities

Level 1

RM

Level 2

RM

Level 3

RM

Total

RM

157,301,380

- 157,301,380

═════════ ════════ ════════ ════════

Investments whose values are based on quoted market prices in active markets, and are therefore

classified within Level 1, include active listed equities. The Fund does not adjust the quoted prices for

these instruments.

(ii)

4

The carrying value of cash and cash equivalents, dividend receivable, amount due from Manager,

amount due from brokers and all current liabilities are a reasonable approximation of the fair values due

to their short term nature.

MANAGEMENT FEE

In accordance with the Deed, the Manager is entitled to a management fee at a rate not exceeding 3.00%

per annum on the NAV of the Fund calculated on a daily basis.

For the financial year ended 30 September 2015, the management fee is recognised at a rate of 1.50%

(2014: 1.50%) per annum on the NAV of the Fund calculated on a daily basis.

There will be no further liability to the Manager in respect of management fee other than the amount

recognised above.

5

TRUSTEE FEE

In accordance with the Deed, the Trustee is entitled to an annual fee at a rate not exceeding 0.10% per

annum on the NAV of the Fund, exclusive of foreign custodian fees, subject to a minimum fee of RM18,000

per annum.

For the financial year ended 30 September 2015, the Trustee fee is recognised at a rate of 0.08% (2014:

0.08%) per annum on the NAV of the Fund calculated on a daily basis, subject to a minimum fee of

RM18,000 per annum, exclusive of foreign custodian fees.

There will be no further liability to the Trustee in respect of Trustee fee other than the amount recognised

above.

28

NOTES TO THE FINANCIAL STATEMENTS

FOR THE FINANCIAL YEAR ENDED 30 SEPTEMBER 2015 (CONTINUED)

6

TAXATION

Current taxation

– local

– foreign

Under provision in prior financial year

2015

RM

2014

RM

10,118

134,587

─────────

144,705

═════════

13,919

68,582

62,108

─────────

144,609

═════════

The numerical reconciliation between net (loss)/profit before taxation multiplied by the Malaysian statutory

tax rate and tax expense of the Fund is as follows:

2015

RM

Net (loss)/profit before taxation

Tax at Malaysian statutory rate of 25% (2014: 25%)

Tax effects of:

Investment income not subject to tax

Expenses not deductible for tax purposes

Restriction on tax deductible expenses for Unit Trust Funds

Income subject to different tax rate

Foreign income subject to foreign tax rate

Under provision in prior financial year

Tax expense

29

2014

RM

(514,142)

─────────

15,719,919

─────────

(128,536)

3,929,980

(1,306,487)

597,010

838,013

10,118

134,587

─────────

144,705

═════════

(4,891,329)

409,389

551,960

13,919

68,582

62,108

─────────

144,609

═════════

NOTES TO THE FINANCIAL STATEMENTS

FOR THE FINANCIAL YEAR ENDED 30 SEPTEMBER 2015 (CONTINUED)

7

DISTRIBUTIONS

Distribution to unitholders are from the following sources:

Dividend income

Interest income

Net realised gain on sale of investment

Previous year’s realised income

6,807,817

14,272,985

─────────

21,080,802

(5,580,212)

─────────

15,500,590

═════════

Gross realised income

Less: Expenses

Net distribution amount

2014

RM

2015

RM

77,637

16,902,017

─────────

16,979,654

(4,494,614)

─────────

12,485,040

═════════

During the financial year 30 September 2015, distributions (sen) were made as follows:

2015

RM

09.12.2014

23.06.2015

0.020

0.025

─────────

0.045

═════════

Gross/net (sen) distribution per unit

During the financial year 30 September 2014, distributions (sen) were made as follows:

2014

RM

10.12.2013

12.06.2014

0.030

0.030

─────────

0.060

═════════

Gross/net (sen) distribution per unit

Gross distribution per unit is derived from gross realised income less expenses divided by the number of

units in circulation, while net distribution per unit is derived from gross realised income less expenses and

taxation divided by the number of units in circulation.

Included in distributions for the financial year is an amount of RM14,272,985 (2014: RM16,902,017) made

from previous year’s realised income.

30

NOTES TO THE FINANCIAL STATEMENTS

FOR THE FINANCIAL YEAR ENDED 30 SEPTEMBER 2015 (CONTINUED)

8

FINANCIAL ASSETS AT FAIR VALUE THROUGH PROFIT OR LOSS

2015

RM

Designated at fair value through profit or loss

at inception

- quoted equities – local

- quoted equities – foreign

117,009,191 101,789,108

43,372,657 55,512,272

───────── ─────────

160,381,848 157,301,380

═════════ ═════════

Net (loss)/gain on financial assets at fair value through

profit or loss

- realised gain on sale of investments

- unrealised (loss)/gain

(a)

2014

RM

13,862,033

7,895,448

(17,367,904)

8,748,143

───────── ────────

(3,505,871) 16,643,591

═════════ ════════

Quoted equities – local

(i)

Quoted equities – local as at 30 September 2015 are as follows:

Aggregate

cost

RM

Quantity

CONSUMER GOODS

Carlsberg Brewery Malaysia Bhd

Guinness Anchor Bhd

QL Resources Bhd

Sarawak Oil Palms Bhd

Spritzer Bhd

CONSUMER SERVICES

Berjaya Auto Bhd

FINANCIAL SERVICES

Allianz Malaysia Bhd

Bursa Malaysia Bhd

Hong Leong Financial Group Bhd

Malayan Banking Bhd

Public Bank Bhd

Tune Protect Group Bhd

Fair

value

RM

Percentage

of NAV

%

344,800

4,067,965

4,123,808

2.07

110,700

1,439,159

1,496,664

0.75

1,236,900

4,215,566

4,947,600

2.48

637,000

3,705,424

3,019,380

1.51

2,573,000

5,453,298

4,734,320

2.37

───────── ───────── ───────── ─────────

4,902,400

18,881,412

18,321,772

9.18

───────── ───────── ───────── ─────────

1,962,300

3,434,062

3,787,239

1.90

───────── ───────── ───────── ─────────

863,500

4,680,074

8,980,400

4.50

663,600

5,722,805

5,328,708

2.67

597,100

9,175,691

8,311,632

4.17

914,507

8,340,973

7,819,035

3.92

494,700

9,377,409

8,657,250

4.34

1,973,300

3,874,784

2,545,557

1.28

───────── ───────── ───────── ─────────

5,506,707

41,171,736

41,642,582

20.88

───────── ───────── ───────── ─────────

31

NOTES TO THE FINANCIAL STATEMENTS

FOR THE FINANCIAL YEAR ENDED 30 SEPTEMBER 2015 (CONTINUED)

8

FINANCIAL ASSETS AT FAIR VALUE THROUGH PROFIT OR LOSS (CONTINUED)

(a)

Quoted equities – local (continued)

(i)

Quoted equities – local as at 30 September 2015 are as follows (continued):

Aggregate

cost

RM

Quantity

HEALTHCARE

Pharmaniaga Bhd

INDUSTRIALS

Lingkaran Trans Kota Holdings Bhd

OIL & GAS

CLIQ Energy Bhd

Reach Energy Bhd

Sona Petroleum Bhd

PROPERTIES

IGB Corporation Bhd

MKH Bhd

TELECOMMUNICATIONS

Axiata Group Bhd

Telekom Malaysia Bhd

TECHNOLOGY

Inari Amerton Bhd

UTILITIES

Tenaga Nasional Bhd

Fair

value

RM

Percentage

of NAV

%

565,400

3,491,345

3,675,100

1.84

───────── ───────── ───────── ─────────

482,500

2,228,022

2,451,100

1.23

───────── ───────── ───────── ─────────

4,120,000

2,763,530

2,781,000

1.39

11,636,700

7,781,622

7,040,204

3.53

7,866,300

3,356,628

3,421,840

1.72

───────── ───────── ───────── ─────────

23,623,000

13,901,780

13,243,044

6.64

───────── ───────── ───────── ─────────

920,800

2,270,785

2,292,792

1.15

1,477,120

4,703,155

3,338,291

1.67

───────── ───────── ───────── ─────────

2,397,920

6,973,940

5,631,083

2.82

───────── ───────── ───────── ─────────

815,161

5,698,064

4,687,176

2.35

1,002,177

7,605,060

6,694,542

3.36

───────── ───────── ───────── ─────────

1,817,338

13,303,124

11,381,718

5.71

───────── ───────── ───────── ─────────

436,800

1,346,177

1,476,384

0.74

───────── ───────── ───────── ─────────

249,900

2,817,041

2,998,800

1.50

───────── ───────── ───────── ─────────

32

NOTES TO THE FINANCIAL STATEMENTS

FOR THE FINANCIAL YEAR ENDED 30 SEPTEMBER 2015 (CONTINUED)

8

FINANCIAL ASSETS AT FAIR VALUE THROUGH PROFIT OR LOSS (CONTINUED)

(a)

Quoted equities – local (continued)

(i)

Quoted equities – local as at 30 September 2015 are as follows (continued):

Aggregate

cost

RM

Quantity

REITS

Capitaland Malaysia Mall Trust

IGB Bhd

Sunway Bhd

Total quoted equities – local

Accumulated unrealised loss on

quoted equities – local

Percentage

of NAV

%

2,944,500

3,886,740

4,063,410

2.04

4,659,300

6,025,393

5,917,311

2.97

1,571,200

2,253,779

2,419,648

1.21

───────── ───────── ───────── ─────────

9,175,000

12,165,912

12,400,369

6.22

───────── ───────── ───────── ─────────

51,119,265

═════════

119,714,551

117,009,191

═════════

58.66

═════════

(2,705,360)

─────────

117,009,191

═════════

Total quoted equities – local

(ii)

Fair

value

RM

Quoted equities – local as at 30 September 2014 are as follows:

Aggregate

cost

RM

Quantity

OIL & GAS

Dialog Group Bhd

Icon Offshore Bhd

Reach Energy Bhd

Sapura-Kencana Petroleum Bhd

TECHNOLOGY

Globetronics Technology Bhd

BASIC MATERIALS

Pantech Group Holding Bhd

CONSUMER SERVICES

Berjaya Auto Bhd

Fair

value

RM

Percentage

of NAV

%

2,213,970

3,587,910

3,785,889

1.80

403,000

745,550

616,590

0.29

8,704,000

6,039,544

5,614,080

2.66

1,267,900

5,263,748

5,223,748

2.48

───────── ───────── ───────── ─────────

12,588,870

15,636,752

15,240,307

7.23

───────── ───────── ───────── ─────────

490,800

1,593,844

2,292,036

1.09

───────── ───────── ───────── ─────────

1,280,200

1,232,833

1,369,814

0.65

───────── ───────── ───────── ─────────

2,799,100

6,824,829

9,572,922

4.54

───────── ───────── ───────── ─────────

33

NOTES TO THE FINANCIAL STATEMENTS

FOR THE FINANCIAL YEAR ENDED 30 SEPTEMBER 2015 (CONTINUED)

8

FINANCIAL ASSETS AT FAIR VALUE THROUGH PROFIT OR LOSS (CONTINUED)

(a)

Quoted equities – local (continued)

(ii)

Quoted equities – local as at 30 September 2014 are as follows:

Aggregate

cost

RM

Quantity

INDUSTRIALS

Bumi Armada Bhd

Westports Holdings Bhd

CONSUMER GOODS

IJM Plantation Bhd