Exchange Rates 2001-2005: Euro vs US Dollar

advertisement

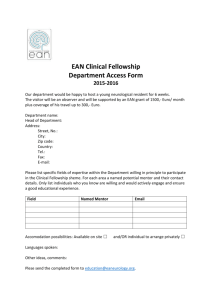

NOTE Policy Department Structural and Cohesion Policies THE EXCHANGE RATES OF THE EURO VS OTHER MAIN CURRENCIES AND THEIR IMPACT ON EU TOURISM TRANSPORT AND TOURISM June 2007 EN Directorate General Internal Policies of the Union Policy Department Structural and Cohesion Policies TRANSPORT AND TOURISM THE EXCHANGE RATES OF THE EURO VS OTHER MAIN CURRENCIES AND THEIR IMPACT ON EU TOURISM NOTE Content: This note examines exchange rate changes between the Euro and five other key currencies: the US dollar, Japanese yen, Chinese yuan, Russian rouble, and British pound. It is analysed if exchange rates have had a measurable impact on the flow of tourists from each of the five key currency counties to Europe (in particular the Euro area). IP/B/TRAN/IC/2007-007 PE 379.231 18/06/2007 EN This note was requested by the European Parliament's Committee on Transport and Tourism. This paper is published in the following language: - Original: EN. Author: Kevin MILLINGTON Acorn Consulting Partnership Ltd Responsible Official: Nils DANKLEFSEN Policy Department Structural and Cohesion Policies European Parliament B-1047 Brussels E-mail: ipoldepb@europarl.europa.eu Manuscript completed in June, 2007. This note is available on the Internet at: http://www.europarl.europa.eu/activities/expert/eStudies.do?language=EN Brussels, European Parliament, 2007. The opinions expressed in this document are the sole responsibility of the author and do not necessarily represent the official position of the European Parliament. Reproduction and translation for non-commercial purposes are authorized, provided the source is acknowledged and the publisher is given prior notice and sent a copy. The exchange rates of the euro vs. other main currencies and their impact on EU tourism Executive Summary 1. For the purposes of this briefing paper, the exchange rates of the following five currencies have been chosen for analysis against the euro: the US dollar, Japanese yen, Chinese yuan, Russian rouble, and British pound. 2. Although there have been fluctuations in the exchange rate between the euro and the five currencies identified for analysis, generally speaking the euro has strengthened against all five over the period 2001-2005. This means that residents of the United States, Japan, China, Russia and the United Kingdom need to spend more of their own currency to buy one euro. 3. With the exception of the British pound, the strengthening of the euro against the other four currencies was similar – that is between 23% and 28% when comparing the exchange rate in January 2001 and December 2005. By comparison the euro only strengthened by around 8% against the pound. 4. Tourist arrivals in the euro area from the United States and Japan declined over the period 20012005, whilst arrivals from China, Russia and the UK increased. Growth in the China market was substantial, largely due to a considerable number of European destinations acquiring an Approved Destination Status (ADS) from the Chinese government over the period, thus opening up their countries to Chinese travellers. 5. Analysis of the exchange rates between the euro and the five currencies, and the corresponding tourist flows between the source destinations and Europe (but particularly the euro area), indicates that there is no conclusive evidence that the increasing strength of the euro over the period 2001-2005 has had a negative impact on inbound tourism. 6. A large number of studies undertaken over the last 30 years indicate that exchange rates do affect the flows of tourists between countries, however their influence is usually smaller than other factors such as the cost of living at the destination, the cost of transport to the destination, and non-monetary factors such as safety. Also, the volume of trips is not always affected by exchange rates, but instead the behaviour of tourists at their destination – most commonly displayed by a shorter length of stay and/or lower average daily expenditure. 7. As a consequence of the relatively minor influence of exchange rates, it is likely that only in situations where all other factors that affect tourist flows remain equal, would exchange rates have a measurable impact on the destination choice of tourists. 8. There do not appear to be any examples of national or regional tourism administrations developing or implementing policies or action plans to respond to adverse or positive changes to exchange rates. However, it is common for the tourism trade (such as tour operators) to establish their contracts (for example with hotels) with fixed exchange rates. iii PE 379.231 The exchange rates of the euro vs. other main currencies and their impact on EU tourism 9. National and regional tourism administrations can benefit from fluctuating exchange rates, in particular minimise the effects of a strong euro, by targeting those markets that are less sensitive to exchange rates (such as business travellers and higher spending tourists), increasing marketing activities in destinations whilst exchange rates are favourable (and therefore less expensive), by ensuring they do not rely too heavily on one market, and developing a unique product that ensures tourists do not have a viable alternative. Alternatively, a weak euro could offer the opportunity for destinations to attract border crossers and day-trippers, as these are known to be most likely to respond to currency fluctuations. PE 379.231 iv The exchange rates of the euro vs. other main currencies and their impact on EU tourism List of figures Figure 1. Exchange Rates 2001-2005: Euro vs US Dollar ...............................................................3 Figure 2. Exchange Rates 2001-2005: Euro vs Japanese Yen..........................................................4 Figure 3. Exchange Rates 2001-2005: Euro vs Chinese Yuan.........................................................6 Figure 4. Exchange Rates 2001-2005: Euro vs Russian Rouble ......................................................7 Figure 5. Exchange Rates 2001-2005: Euro vs British Pound .........................................................9 Figure 6. US: Percentage Change in Exchange Rate and Arrivals.................................................12 Figure 7. Japan: Percentage Change in Exchange Rate and Arrivals.............................................14 Figure 8. China: Percentage Change in Exchange Rate and Arrivals ............................................15 Figure 9. Russia: Percentage Change in Exchange Rate and Arrivals ...........................................17 Figure 10. UK: Percentage Change in Exchange Rate and Arrivals ................................................18 The exchange rates of the euro vs. other main currencies and their impact on EU tourism List of tables Table 1. US Tourist Arrivals in All Types of Accommodation ......................................................11 Table 2. Japanese Tourist Arrivals in All Types of Accommodation .............................................13 Table 3. Chinese Tourist Arrivals in All Types of Accommodation...............................................15 Table 4. Russian Tourist Arrivals in All Types of Accommodation...............................................16 Table 5. UK Tourist Arrivals at International Borders....................................................................18 PE 379.231 vi The exchange rates of the euro vs. other main currencies and their impact on EU tourism TABLE OF CONTENTS Page Executive Summary ......................................................................................................................... iii List of figures ......................................................................................................................................v List of tables...................................................................................................................................... vi 1. Introduction ................................................................................................................................1 2. Exchange Rate Fluctuations: 2001-2005 ..................................................................................2 2.1. Overview ..............................................................................................................................2 2.2. The US Dollar ......................................................................................................................2 2.3. The Japanese Yen.................................................................................................................2 2.4. The Chinese Yuan ................................................................................................................2 2.5. The Russian Rouble .............................................................................................................2 2.6. The British Pound ..............................................................................................................10 3. Tourist Flows to Europe ..........................................................................................................10 3.1. Introduction ........................................................................................................................10 3.2. Arrivals from the United States..........................................................................................11 3.3. Arrivals from Japan............................................................................................................12 3.4. Arrivals from China ...........................................................................................................14 3.5. Arrivals from Russia ..........................................................................................................16 3.6. Arrivals from the UK .........................................................................................................17 4. Effects of Currency Changes on Travel Patterns..................................................................19 4.1. Introduction ........................................................................................................................19 4.2. Key Determinants of Tourist Flows...................................................................................20 4.3. Key Exchange Rate Impacts ..............................................................................................20 4.4. Impacts of Currency Changes in Europe ...........................................................................21 4.5. Policies and Actions to Respond to Exchange Rate Fluctuations......................................21 5. Recommendations ....................................................................................................................22 Bibliography .....................................................................................................................................23 The exchange rates of the euro vs. other main currencies and their impact on EU tourism PE 379.231 viii The exchange rates of the euro vs. other main currencies and their impact on EU tourism 1. Introduction There have been numerous studies undertaken over the years regarding the impact of exchange rates on tourism flows between countries. These studies all have very different outcomes, and there do not appear to be any common conclusions. However, in general it is widely accepted that changes in exchange rates do have an impact on visitor flows to various extents. The value of one currency against another is known as the exchange rate, and discussions about exchange rate movements can involve a number of different terms that in fact refer to the same thing. For example, the statements “the dollar is depreciating against the euro” and “the euro is strengthening against the dollar” mean the same thing, but have opposite implications for Americans and those Europeans living in the euro area. An exchange rate quotation is given by stating the number of units of a price currency can be bought in terms of a unit currency. For example, in a quotation that says the Euro-US Dollar exchange rate is 1.2 dollars per euro, the price currency is the dollar and the unit currency is the euro. The usual unit currency varies by geographic location. For example, British newspapers quote exchange rates with British pounds as the unit currency. For the tourist, if their currency is strengthening against another currency, it enables them more to buy more of that currency with one unit of their own currency. Therefore, if a unit currency is strengthening (or appreciating) - i.e. if the currency is becoming more valuable - then the exchange rate number increases. Conversely if the price currency is strengthening, the exchange rate number decreases and the unit currency is depreciating. This study examines exchange rate changes between the euro and five other key currencies: the US dollar, Japanese yen, Chinese yuan, Russian rouble, and British pound, over the five year period 2001-2005. The British pound was chosen in addition to the four currencies identified in the brief due to the importance of the outbound market from the UK. The period 2001-2005 has been selected due to statistics related to tourism flows only being currently available up to the end of 2005. The 12 countries that have been within the euro area during the period 2001-2005 have been selected for specific analysis within this Briefing Paper, these are: Austria, Belgium, Finland, France, Germany, Greece, Ireland, Italy, Luxembourg, Netherlands, Portugal and Spain. Only Denmark, Sweden and the UK have been included as those countries outside the euro area, as they have been members of the European Union since 2001. During the period of analysis covered by this Briefing Paper (2001-2005) there has been a considerable strengthening of the euro against all five of the currencies of the source markets selected for analysis, thereby, in theory, making euro area countries more expensive to visit for Americans, Japanese, Chinese, Russians and the British. If a strong euro does indeed discourage tourists visiting the euro area, then it is important to address this issue. 1 PE 379.231 The exchange rates of the euro vs. other main currencies and their impact on EU tourism 2. Exchange Rate Fluctuations: 2001-2005 2.1. Overview Although there have been fluctuations over the period 2001-2005, generally speaking the Euro has strengthened against all five currencies being analysed (the US dollar, Japanese yen, Chinese yuan, Russian rouble and British pound). This means that for residents in these five countries, they will need to spend more of their own currency to buy a euro. This would appear to indicate, therefore, that travelling to any country in the euro area has become more expensive for these residents. This is usually, although not necessarily, true as will be discussed later. 2.2. The US Dollar The average exchange rate of the US dollar to the euro in January 2001 was 0.94 (that is, USD 0.94 bought EUR 1.00). By December 2005, the average exchange rate of the US dollar to the euro was 1.19 (that is, USD 1.19 bought EUR 1.00), a rise of 26.6%. During this period, the euro peaked in December 2004 when the exchange rate hit an average of USD 1.34 to EUR 1.00, a rise of 42.6%. The fluctuating exchange rates between the US dollar and the euro are shown in Figure 1. 2.3. The Japanese Yen There has been a steady strengthening of the euro against the yen over the period 2001-2005. In 2001, JPY 109.39 bought EUR 1.00, however by December 2005, the euro had strengthened considerably, with JPY 140.38 buying EUR 1.00 – an increase of 28.3%. The fluctuating exchange rates between the yen and the euro are shown in Figure 2. 2.4. The Chinese Yuan Until 21st July 2005, the Chinese Yuan was pegged to the US dollar. Since then, China has fixed its exchange rate based on a basket of currencies. However, this means that for the period 2001-2005, the exchange rate of the yuan and the euro largely reflects that between the US dollar and the euro, as can be seen in Figure 3. This means that there has been a gradual strengthening of the euro against the yuan, which peaked in December 2004. In January 2001, CNY 7.76 bought EUR 1.00, whilst by December 2005, CNY 9.58 bought EUR 1.00, an increase of 23.5%. This peaked in December 2004 when CNY 11.10 bought EUR 1.00, an increase of 46%. 2.5. The Russian Rouble Similar to the US dollar and Chinese yuan, the Russian rouble was at its weakest against the euro in December 2004. As with all the other currencies, there has been a general strengthening of the euro against the rouble over the period 2001-2005, starting out at RUB 26.65 for EUR 1.00 in January 2001 and reaching RUB 34.17 in December 2005, an increase of 28.2%. However in December 2004 it reached RUB 37.37, an all time high for the period, corresponding to an increase of 40.2% on the January 2001 exchange rate. The fluctuating exchange rates between the rouble and the euro are shown in Figure 4. PE 379.231 2 The exchange rates of the euro vs. other main currencies and their impact on EU tourism Figure 1. Exchange Rates 2001-2005: Euro vs US Dollar Average Rate: US Dollars to buy 1 Euro Number of US Dollars required to buy 1 Euro 2001 2002 2003 2004 2005 1.40 Jan 0.94 0.88 1.06 1.26 1.31 1.20 Feb 0.92 0.87 1.08 1.26 1.30 Mar 0.91 0.88 1.08 1.23 1.32 Apr 0.89 0.89 1.09 1.20 1.29 May 0.88 0.92 1.16 1.20 1.27 Jun 0.85 0.96 1.17 1.21 1.22 Jul 0.86 0.99 1.14 1.23 1.20 Aug 0.90 0.98 1.12 1.22 1.23 Sep 0.91 0.98 1.13 1.22 1.22 Oct 0.90 0.98 1.17 1.25 1.20 Nov 0.89 1.00 1.17 1.30 1.18 Dec 0.89 1.02 1.23 1.34 1.19 0.89 0.95 Ave Source: www.x-rates.com. 1.13 1.24 1.24 1.00 0.80 0.60 0.40 0.20 0.00 2001 2002 2003 US Dollars to buy 1 Euro (2001) 0.96 0.94 0.92 0.90 0.88 0.86 0.84 0.82 0.80 Jan Feb Mar Apr May Jun Jul Aug Sep Oct Nov Dec Oct Nov Dec Oct Nov Dec US Dollars to buy 1 Euro (2002) 1.05 1.00 0.95 0.90 0.85 0.80 0.75 Jan Feb Mar Apr May Jun Jul Aug Sep US Dollars to buy 1 Euro (2003) 1.25 1.20 1.15 1.10 1.05 1.00 0.95 Jan Feb Mar Apr May Jun Jul Aug Sep 2004 2005 The exchange rates of the euro vs. other main currencies and their impact on EU tourism US Dollars to buy 1 Euro (2004) 1.40 1.35 1.30 1.25 1.20 1.15 1.10 Jan Feb Mar Apr May Jun Jul Aug Sep Oct Nov Dec Oct Nov Dec US Dollars to buy 1 Euro (2005) 1.35 1.30 1.25 1.20 1.15 1.10 Jan Figure 2. Feb Mar Apr May Jun Jul Aug Sep Exchange Rates 2001-2005: Euro vs Japanese Yen Average Rate: Japanese Yen to buy 1 Euro Number of Japanese Yen required to buy 1 Euro 2001 2002 2003 2004 2005 160.00 Jan 109.39 117.15 126.20 134.30 135.61 140.00 Feb 106.99 116.36 128.70 134.87 136.56 120.00 Mar 110.33 114.89 128.13 133.06 138.76 100.00 Apr 110.47 115.92 130.23 129.05 138.70 May 106.60 115.86 135.62 134.62 135.34 Jun 104.37 117.85 138.14 132.92 132.18 Jul 107.25 117.12 134.90 134.29 134.74 Aug 109.37 116.38 132.39 134.39 136.00 Sep 108.24 118.73 129.30 134.58 136.14 Oct 109.85 121.57 128.21 136.03 138.09 Nov 108.66 121.72 127.70 136.13 139.61 Dec 113.70 124.23 132.48 139.17 140.38 Ave 108.77 118.16 131.05 134.43 136.85 80.00 60.00 40.00 20.00 0.00 2001 2002 2003 2004 Source: www.x-rates.com Japanese Yen to buy 1 Euro (2001) 116.00 114.00 112.00 110.00 108.00 106.00 104.00 102.00 100.00 98.00 Feb PE 379.231 Mar Apr May Jun Jul 4 Aug Sep Oct Nov Dec Ave 2005 The exchange rates of the euro vs. other main currencies and their impact on EU tourism Japanese Yen to buy 1 Euro (2002) 126.00 124.00 122.00 120.00 118.00 116.00 114.00 112.00 110.00 Feb Mar Apr May Jun Jul Aug Sep Oct Nov Dec Ave Oct Nov Dec Oct Nov Dec Oct Nov Dec Japanese Yen to buy 1 Euro (2003) 140.00 138.00 136.00 134.00 132.00 130.00 128.00 126.00 124.00 122.00 120.00 Jan Feb Mar Apr May Jun Jul Aug Sep Japanese Yen to buy 1 Euro (2004) 140.00 138.00 136.00 134.00 132.00 130.00 128.00 126.00 124.00 122.00 Jan Feb Mar Apr May Jun Jul Aug Sep Japanese Yen to buy 1 Euro (2005) 142.00 140.00 138.00 136.00 134.00 132.00 130.00 128.00 Jan Feb Mar Apr May Jun Jul Aug Sep The exchange rates of the euro vs. other main currencies and their impact on EU tourism Figure 3. Exchange Rates 2001-2005: Euro vs Chinese Yuan Average Rate: Chinese Yuan to buy 1 Euro Number of Chinese Yuan required to buy 1 Euro 2001 2002 2003 2004 2005 12.00 Jan 7.76 7.31 8.80 10.46 10.86 10.00 Feb 7.62 7.21 8.93 10.46 10.77 Mar 7.52 7.26 8.99 10.15 10.91 Apr 7.39 7.34 8.99 9.92 10.71 May 7.24 7.59 9.56 9.93 10.50 Jun 7.06 7.91 9.66 10.05 10.06 2.00 Jul 7.13 8.27 9.41 10.15 9.90 0.00 Aug 7.46 8.10 9.23 10.09 10.00 Sep 7.53 8.12 9.33 10.12 9.91 Oct 7.49 8.12 9.69 10.35 9.72 Nov 7.35 8.29 9.68 10.75 9.53 Dec 7.38 8.44 10.18 11.10 9.58 7.41 7.84 Ave Source: www.x-rates.com. 9.38 10.29 10.19 8.00 6.00 4.00 2001 2002 2003 2004 Chinese Yuan to buy 1 Euro (2001) 8.00 7.80 7.60 7.40 7.20 7.00 6.80 6.60 Jan Feb Mar Apr May Jun Jul Aug Sep Oct Nov Dec Oct Nov Dec Oct Nov Dec Chinese Yuan to buy 1 Euro (2002) 8.60 8.40 8.20 8.00 7.80 7.60 7.40 7.20 7.00 6.80 6.60 6.40 Jan Feb Mar Apr May Jun Jul Aug Sep Chinese Yuan to buy 1 Euro (2003) 10.50 10.00 9.50 9.00 8.50 8.00 Jan PE 379.231 Feb Mar Apr May Jun 6 Jul Aug Sep 2005 The exchange rates of the euro vs. other main currencies and their impact on EU tourism Chinese Yuan to buy 1 Euro (2004) 11.20 11.00 10.80 10.60 10.40 10.20 10.00 9.80 9.60 9.40 9.20 Jan Feb Mar Apr May Jun Jul Aug Sep Oct Nov Dec Oct Nov Dec Chinese Yuan to buy 1 Euro (2005) 11.50 11.00 10.50 10.00 9.50 9.00 8.50 Jan Figure 4. Feb Mar Apr May Jun Jul Aug Sep Exchange Rates 2001-2005: Euro vs Russian Rouble Number of Russian Roubles required to buy 1 Euro Average Rate: Russian Rouble to buy 1 Euro 40.00 2001 2002 2003 2004 2005 Jan 26.65 27.00 33.83 36.40 36.65 Feb 26.36 26.84 34.16 36.06 36.40 Mar 21.11 27.25 33.96 34.99 36.44 20.00 Apr 25.76 27.62 33.89 34.99 35.97 15.00 May 25.45 28.65 35.72 34.79 35.49 10.00 Jun 24.87 30.01 35.58 35.26 34.67 5.00 Jul 25.17 31.32 34.50 35.67 34.55 Aug 26.46 30.87 33.87 35.63 35.02 Sep 26.86 31.05 34.48 35.69 34.74 Oct 26.77 31.13 35.27 36.34 34.33 Nov 26.50 31.89 34.87 37.13 33.92 Dec 26.89 32.44 36.18 37.37 34.17 25.71 29.70 Ave Source: www.x-rates.com. 34.70 35.85 35.17 35.00 30.00 25.00 0.00 2001 2002 2003 2004 Russian Rouble to buy 1 Euro (2001) 30.00 25.00 20.00 15.00 10.00 5.00 0.00 Jan Feb Mar Apr May Jun Jul Aug Sep Oct Nov Dec 2005 The exchange rates of the euro vs. other main currencies and their impact on EU tourism Russian Rouble to buy 1 Euro (2002) 35.00 30.00 25.00 20.00 15.00 10.00 5.00 0.00 Jan Feb Mar Apr May Jun Jul Aug Sep Oct Nov Dec Oct Nov Dec Oct Nov Dec Oct Nov Dec Russian Rouble to buy 1 Euro (2003) 36.50 36.00 35.50 35.00 34.50 34.00 33.50 33.00 32.50 Jan Feb Mar Apr May Jun Jul Aug Sep Russian Rouble to buy 1 Euro (2004) 38.00 37.50 37.00 36.50 36.00 35.50 35.00 34.50 34.00 33.50 33.00 Jan Feb Mar Apr May Jun Jul Aug Sep Russian Rouble to buy 1 Euro (2005) 37.00 36.50 36.00 35.50 35.00 34.50 34.00 33.50 33.00 32.50 Jan PE 379.231 Feb Mar Apr May Jun 8 Jul Aug Sep The exchange rates of the euro vs. other main currencies and their impact on EU tourism Figure 5. Exchange Rates 2001-2005: Euro vs British Pound Average Rate: UK Pound to buy 1 Euro Number of British Pounds required to buy 1 Euro 2001 2002 2003 2004 2005 0.70 Jan 0.63 0.62 0.66 0.69 0.70 0.68 Feb 0.63 0.61 0.67 0.68 0.69 Mar 0.63 0.62 0.68 0.67 0.69 Apr 0.62 0.61 0.69 0.66 0.68 May 0.61 0.63 0.71 0.67 0.68 0.62 Jun 0.61 0.64 0.70 0.66 0.67 0.60 Jul 0.61 0.64 0.70 0.67 0.69 0.58 Aug 0.63 0.64 0.70 0.67 0.69 Sep 0.62 0.63 0.70 0.68 0.68 Oct 0.62 0.63 0.70 0.69 0.68 Nov 0.62 0.64 0.69 0.70 0.68 Dec 0.62 0.64 0.70 0.70 0.68 Ave 0.62 0.63 0.69 0.68 0.68 0.66 0.64 2001 2002 2003 2004 Source: www.x-rates.com UK Pound to buy 1 Euro (2001) 0.635 0.630 0.625 0.620 0.615 0.610 0.605 0.600 Jan Feb Mar Apr May Jun Jul Aug Sep Oct Nov Dec Oct Nov Dec Oct Nov Dec UK Pound to buy 1 Euro (2002) 0.645 0.640 0.635 0.630 0.625 0.620 0.615 0.610 0.605 0.600 0.595 Jan Feb Mar Apr May Jun Jul Aug Sep UK Pound to buy 1 Euro (2003) 0.720 0.710 0.700 0.690 0.680 0.670 0.660 0.650 0.640 0.630 Jan Feb Mar Apr May Jun Jul Aug Sep 2005 The exchange rates of the euro vs. other main currencies and their impact on EU tourism UK Pound to buy 1 Euro (2004) 0.710 0.700 0.690 0.680 0.670 0.660 0.650 0.640 Jan Feb Mar Apr May Jun Jul Aug Sep Oct Nov Dec Oct Nov Dec UK Pound to buy 1 Euro (2005) 0.705 0.700 0.695 0.690 0.685 0.680 0.675 0.670 0.665 0.660 0.655 Jan 2.6. Feb Mar Apr May Jun Jul Aug Sep The British Pound The strengthening of the euro against the pound over the period 2001-2005 has not been as extreme as amongst the other currencies. In January 2001, GBP 0.63 exchanged for EUR 1.00, and by December 2005 the euro had strengthened to GBP 0.68, an increase of 7.9%. The Euro was strongest in May 2003 when GBP 0.71 exchanged for EUR 1.00. The fluctuating exchange rates between the pound and the euro are shown in Figure 5. 3. Tourist Flows to Europe 3.1. Introduction In order to assess whether the strengthening of the euro has had an effect on the flow of tourists to Europe, and in particular countries in the euro area, tourist flows from each of the five key-currency countries have been analysed: that is the United States, Japan, China, Russia and the United Kingdom. There are several inherent difficulties when undertaking such a task, most if which lie in the different ways countries (in particular those in Europe) measure tourist arrivals. There are four main units of measure being used: • • • • Arrivals at international frontiers of the country. Arrivals at hotels and similar accommodation establishments in the country. Arrivals at all types of accommodation in the country Number of nights spent in all types of accommodation in the country Although the different units of measurement allow changes in tourist activity to be assessed from one year to the next, they prevent aggregation except amongst countries using the same unit. PE 379.231 10 The exchange rates of the euro vs. other main currencies and their impact on EU tourism 3.2. Arrivals from the United States Arrivals at all types of accommodation, from the United States, to the euro area countries (excluding Ireland and France which measure arrivals differently) declined from 10.1 million in 2001 to 8.7 million in 2003 – a decrease of 14.5%. Arrivals then started to grow again and reached 10.5 million in 2005, as shown in Table 1. Arrivals in France declined considerably over the period 2001-2005, and therefore when including this significant market, even though the base is different (arrivals are only measured at hotels and similar establishments) there was a reduction of around one million tourists between 2001 and 2005. Arrivals in the non-euro area countries also suffered a dip during the period 2001-2005, which was most extreme in 2003, although the decline was less severe. Outbound tourist statistics from the United States over the period 2001-2005 are heavily influenced by the terrorist attacks of 11th September 2001, the Gulf War in 2003, and to a lesser extend the outbreak of Severe Acute Respiratory Syndrome (SARS), also in 2003. Such major global events make it very difficult to identify more subtle influences of travel behaviour such as those generated by exchange rates. However, Figure 6 (below) shows percentage changes (year on year) for the exchange rate between the US dollar and the Euro (a negative indicates a strengthening of the euro – that is, one euro costs more US dollars), as well as changes in the number of tourist arrivals at euro area destinations (where these can be aggregated) and at non-euro area destinations. If there is a close correlation between euro exchange rate changes and tourist flows to the euro area, then the blue and red bars on the chart should point in the same direction. In Figure 6, there appears to be a correlation between the exchange rate and euro area tourist arrivals in 2002 and 2003, however in 2004, although the exchange rate improves only slightly for those in the US, there is a significant improvement in tourist arrivals, with the actual number of arrivals growing for the first time since before September 11th. Table 1. US Tourist Arrivals in All Types of Accommodation Euro area Austria Belgium Finland France (2) Germany Greece Ireland (1) Italy Luxembourg Netherlands Portugal Spain Euro area total Not inc Ireland/France 2001 2002 2003 2004 2005 639,271 325,971 101,035 4,501,448 1,923,916 490,084 829,000 3,719,477 26,135 993,000 265,183 1,645,897 15,460,417 10,129,969 512,384 301,280 90,272 3,517,740 1,768,275 365,067 759,000 3,470,134 24,356 886,000 244,622 1,472,392 13,411,522 9,134,782 484,651 274,906 82,822 2,602,455 1,681,350 318,251 809,000 3,289,349 20,587 830,000 216,171 1,458,359 12,067,901 8,656,446 545,945 288,709 93,484 2,895,490 1,925,626 373,143 867,000 4,072,949 22,056 905,000 220,242 1,442,152 13,651,796 9,889,306 548,376 292,050 87,054 3,159,417 1,949,825 581,095 854,000 4,334,644 23,113 971,000 226,732 1,455,436 14,482,742 10,469,325 The exchange rates of the euro vs. other main currencies and their impact on EU tourism Non-Euro area Denmark UK Sweden (3) Non-Euro area (Ex Sweden) 73,861 3,580,000 423,716 65,582 3,611,000 391,795 66,014 3,346,000 364,779 110,464 3,616,000 383,202 122,892 3,438,000 420,944 3,653,861 3,676,582 3,412,014 3,726,464 3,560,892 Notes: (1) Arrivals at national borders. (2) Arrivals at hotels and other similar establishments. (3) Overnight stays in all types of accommodation establishments. Source: UNWTO. Figure 6. US: Percentage Change in Exchange Rate and Arrivals 20.00 15.00 10.00 % change 5.00 0.00 -5.00 2002 2003 2004 2005 -10.00 -15.00 -20.00 Exchange Rate Eurozone Arrivals Non-Eurozone Arrivals Therefore, for the United States, the link between the exchange rate and tourist arrivals in the euro area does not appear to be strong, although the rather extreme global events over the period 20012003 are likely to have masked any obvious effects the strengthening euro may have otherwise had. 3.3. Arrivals from Japan Over the period 2001-2005, tourist arrivals in euro area countries (with the exception of Ireland and France which measure arrivals differently) declined by an average of 3.9% per annum, although there was year-on-year growth in arrivals in 2002 and 2004 (if France and Ireland are included the trend is similar – declining by 2.8% per annum). Arrivals in non-euro area destinations also show almost alternating years of growth and decline. PE 379.231 12 The exchange rates of the euro vs. other main currencies and their impact on EU tourism Table 2. Japanese Tourist Arrivals in All Types of Accommodation Euro area Austria Belgium Finland France (2) Germany Greece Ireland (1) Italy Luxembourg Netherlands Portugal Spain Euro area total Not inc Ireland/France Non-Euro area Denmark UK Sweden (3) Non-Euro area (Ex Sweden) 2001 2002 2003 2004 2005 255,162 140,057 82,317 1,475,345 779,150 118,515 22,000 1,543,477 n/a 183,000 70,881 576,771 5,246,675 3,749,330 240,146 154,138 74,173 1,521,790 762,471 106,593 22,000 1,815,520 n/a 187,000 95,561 596,382 5,575,774 4,031,984 222,275 114,452 69,063 1,253,753 646,778 94,443 22,000 1,603,479 n/a 139,000 79,726 545,653 4,790,622 3,514,869 256,541 126,523 70,694 1,398,020 715,209 96,208 31,000 1,656,214 n/a 164,000 117,428 578,777 5,210,614 3,781,594 278,686 111,985 70,434 1,459,097 730,232 91,212 19,000 1,657,688 n/a 158,000 98,185 n/a 4,674,519 3,196,422 27,299 289,000 130,350 29,585 320,000 137,598 28,317 273,000 109,557 39,631 242,000 118,177 39,963 269,000 114,935 316,299 349,585 301,317 281,631 308,963 Notes: (1) Arrivals at national borders. (2) Arrivals at hotels and other similar establishments. (3) Overnight stays in all types of accommodation establishments. Source: UNWTO. Figure 7 (below) shows that in 2002, whilst the euro strengthens against the yen (meaning that it costs more yen to buy one euro) there is an increase in arrivals from Japan to euro area countries of over 7%. It is not absolutely apparent why this is, although following the events of September 11th, several Japanese tourists might have switched destinations from America to Europe. The exchange rates of the euro vs. other main currencies and their impact on EU tourism Figure 7. Japan: Percentage Change in Exchange Rate and Arrivals 15 10 % change 5 0 2002 2003 2004 2005 -5 -10 -15 -20 Exchange Rate Eurozone Arrivals Non-Eurozone Arrivals In 2003, the euro strengthens further, and this time there is a decline in Japanese tourists to both euro area and non-euro area countries. The rate of strengthening of the euro against the yen slows down in 2004 and 2005, although the growth in Japanese arrivals to euro area countries is short lived (only in 2004), with a decline in numbers again in 2005. There is clearly no obvious correlation between the euro-yen exchange rate and tourist arrivals in euro area countries based on the data above, with the shrinking Japanese economy having a greater effect on the fluctuating demand for outbound holidays. 3.4. Arrivals from China China is still very much an emerging market, and therefore the travel patterns observed are very different to those of the more traditional markets such as the United States and Japan. The Approved Destination Status (ADS) is a program developed by the Chinese government to establish a well-managed, orderly and controlled system of travel abroad for its citizens. It is based on a bilateral agreement whereby a foreign government allows Chinese tourists to travel to its territory. Essentially, when a country achieves ADS, they can expect to experience an increase in the number of Chinese visitors who travel for leisure purposes. Most countries in Europe were only awarded ADS in 2004 (Austria, Belgium, Finland, France, Germany, Greece, Netherlands, Italy, Luxembourg, Portugal, Spain, Sweden and the UK) and therefore Europe is experiencing a significant increase in Chinese arrivals at present. Over the period 2001-2005 arrivals from China in the euro area countries (excluding France) grew by an average of 37.3% per annum. PE 379.231 14 The exchange rates of the euro vs. other main currencies and their impact on EU tourism Table 3. Chinese Tourist Arrivals in All Types of Accommodation 2001 2002 2003 2004 2005 Euro area Austria Belgium Finland France (2) Germany Greece Ireland (1) Italy Luxembourg Netherlands Portugal Spain Euro area total Euro area not France n/a 62,037 24,992 n/a 237,183 n/a n/a 393,543 n/a n/a 9,963 n/a 727,718 727,718 n/a 112,652 44,577 n/a 270,459 n/a n/a 531,449 n/a n/a 10,662 n/a 969,799 969,799 n/a 107,016 40,755 n/a 268,057 n/a n/a 480,225 n/a n/a 9,844 n/a 905,897 905,897 172,361 114,456 49,384 n/a 387,375 n/a n/a 727,647 n/a 82,000 15,870 n/a 1,549,093 1,549,093 176,777 1,087,702 37,435 472,296 418,235 26,699 n/a 724,444 n/a 96,000 16,577 n/a 3,056,165 2,583,869 Non-Euro area Denmark UK Sweden (3) n/a 286,000 n/a n/a 275,000 n/a n/a 327,000 n/a n/a 311,000 23,047 n/a 334,000 70,097 Notes: (1) Arrivals at national borders. (2) Arrivals at hotels and other similar establishments. (3) Overnight stays in all types of accommodation establishments. Source: UNWTO. Figure 8. China: Percentage Change in Exchange Rate and Arrivals 80 70 60 % change 50 40 30 20 10 0 -10 2002 2003 2004 2005 -20 -30 Exchange Rate Eurozone Arrivals Non-Eurozone Arrivals The exchange rates of the euro vs. other main currencies and their impact on EU tourism China is too new a market to be able to assess in terms of the impact of the exchange rate of the euro on the yuan with other variables such as ADS having a greater impact. Improved living standards and prosperity is also enabling more Chinese to travel abroad. Figure 8 clearly shows that despite a small decline in arrivals in 2003, growth has been considerable against the background of a strengthening euro, although in 2005 the trend was reversed slightly. 3.5. Arrivals from Russia Arrivals to euro area countries (excluding France) from Russia have increased from 1.2 million in 2001 to 1.5 million in 2005, and average growth rate of 5.7% per annum (the inclusion of France makes little difference, generating an average growth rate of 5.9%). This represents strong growth over the years 2004-2005, as there was little or no growth during 2002 and 2003. Table 4. Russian Tourist Arrivals in All Types of Accommodation Euro area Austria Belgium Finland France (2) Germany Greece Ireland (1) Italy Luxembourg Netherlands Portugal Spain Euro area total Euro area not France Non-Euro area Denmark UK Sweden (3) 2001 2002 2003 2004 2005 n/a 33,535 204,459 258,070 252,611 n/a n/a 352,370 n/a 57,000 27,318 263,497 1,448,860 1,190,790 n/a 33,039 215,159 313,342 270,138 n/a n/a 360,373 n/a 48,000 27,369 218,423 1,485,843 1,172,501 n/a 34,061 194,388 325,985 276,781 n/a n/a 381,340 n/a 53,000 25,762 210,765 1,502,082 1,176,097 n/a 37,700 190,190 301,435 292,840 n/a n/a 453,064 n/a 61,000 33,997 224,973 1,595,199 1,293,764 109,818 49,176 221,088 339,305 319,026 166,989 n/a 518,828 n/a 69,000 32,022 1,825,252 1,485,947 n/a n/a 84,444 n/a n/a 114,054 n/a n/a 113,137 n/a n/a 132,016 n/a n/a 132,536 Notes: (1) Arrivals at national borders. (2) Arrivals at hotels and other similar establishments. (3) Overnight stays in all types of accommodation establishments. Source: UNWTO. Over the period 2001-2002 and 2002-2003, the euro strengthened considerably against the rouble, which means that Russians had to spend more roubles to buy one euro. During this period there was little or no growth in arrivals of Russians in euro area countries, as shown in Figure 9. PE 379.231 16 The exchange rates of the euro vs. other main currencies and their impact on EU tourism Figure 9. Russia: Percentage Change in Exchange Rate and Arrivals 20 15 % change 10 5 0 -5 2002 2003 2004 2005 -10 -15 -20 Exchange Rate Eurozone Arrivals However, in 2004 the strengthening of the euro against the rouble slowed down and in 2005, it weakened against the rouble. During these two years, arrivals to euro area countries increased considerably. There is no proof that the exchange rate caused this fluctuation – it is more likely to have been due to the rising levels of disposable income following strong growth in Russian economy, together with growing confidence following the end of Saddam Hussein’s regime in Iraq, or due to a number of domestic issues in Russia itself. However, there does appear to be a reasonably logical correlation between the euro-rouble exchange rate and visitor arrivals in euro area countries. 3.6. Arrivals from the UK Over the period 2001 to 2005, the number of UK tourists visiting the euro area countries has increased from 41.8 million to 44.2 million, representing a modest average annual growth rate of 1.4%. Similarly, arrivals from the UK to countries in the non-euro area grew by an average annual rate of 1%, as shown in Table 5. The strengthening of the euro against the pound in 2002 and (in particular) in 2003, as shown in Figure 10 appears to have had no effect on the growth of arrivals in euro area countries from the UK over the same period, although it could be argued that the growth rate of around 3% would have been significantly higher if the exchange rate had been more favourable. In 2004, there was a weakening of the euro against the pound, however at the same time there was a stagnation of the number of tourists travelling from the UK to euro area countries (i.e. no significant change in numbers). In 2005, the euro strengthened slightly, and the number of tourists to euro area countries also declined. These findings for the UK do not correlate to what might be expected, at least for the period 2002-2004, thus indicating that either the exchange rate between the euro and the pound has no or little impact on tourist flows from the UK to euro area countries, or that other factors are obscuring any impacts that are occurring. The exchange rates of the euro vs. other main currencies and their impact on EU tourism Table 5. UK Tourist Arrivals at International Borders Euro area Austria Belgium Finland France Germany Greece Ireland Italy Luxembourg Netherlands Portugal Spain Euro area total 2001 (000) 2002 (000) 2003 (000) 2004 (000) 2005 (000) 569 1,738 167 11,959 2,242 3,215 3,930 2,471 69 2,095 1,598 11,790 41,843 725 1,784 146 12,112 2,275 2,958 3,965 2,650 74 2,149 1,779 12,525 43,142 619 1,964 174 11,957 2,140 2,857 3,913 2,905 88 2,145 1,891 13,763 44,416 781 1,799 183 11,602 2,336 2,709 4,125 2,974 95 2,165 1,804 13,833 44,406 769 1,733 146 11,094 2,493 2,435 4,221 3,374 110 2,174 1,855 13,837 44,241 309 413 722 302 379 681 292 381 673 356 375 731 337 414 751 Non-Euro area Denmark Sweden Non-Euro area Total Source: International Passenger Survey. Figure 10. UK: Percentage Change in Exchange Rate and Arrivals 10.00 8.00 6.00 % change 4.00 2.00 0.00 -2.00 2002 2003 2004 2005 -4.00 -6.00 -8.00 -10.00 Exchange Rate PE 379.231 Eurozone Arrivals 18 Non-Eurozone Arrivals The exchange rates of the euro vs. other main currencies and their impact on EU tourism 4. Effects of Currency Changes on Travel Patterns 4.1. Introduction A large number of studies have been attempted to determine the effect of exchange rates on tourist demand, with varying results. In some studies, the demand for international tourism was found to be highly exchange rate elastic (i.e. changes in the exchange rate between two countries triggered large changes in tourist flows), yet other studies have demonstrated low elasticities. Further, the statistical significance of exchange rates as a determinant of tourism demand has been found to be highly variable. Indeed, a study by the Economic Intelligence Unit (EIU) 1 on the impact of exchange rate fluctuations on tourism concluded that “it is probably that it is only in a stable world where all things remained equal from one year to the next, that changes in exchange rates would have a measurable impact on tourist choice”. Most of these studies have examined tourism between pairs of origin and destination countries over time, although a smaller number have examined the pattern of demand across a range of countries rather than time – the theory being that tourist flows are affected by more than just one exchange rate between two currencies (that is, a tourist may choose country A over country B not because the exchange rate with country B is particularly unfavourable, but because the exchange rate with country A is exceptionally favourable). Some studies have shown that different countries are affected to different degrees by exchange rate fluctuations, i.e. we all react differently. For example a study by the Canadian Tourism Commission (CTC) 2 showed that a 10% strengthening of the Canadian dollar against the US dollar generates a 16% increase in Canadians’ overnight travel to the United States. However, a 10% strengthening of the US dollar against the Canadian dollar only increases Americans’ overnight travel to Canada by 4%. A recent study on the effect of Economic and Monetary Union (EMU) 3 on tourism has concluded that the elimination of the exchange rates between euro area countries has not been particularly significant in changing the flow of tourists between these countries. This finding is consistent with the findings of studies that have assessed the impact of exchange rate changes on other industries, which have proved to be inconclusive. The EMU effect on tourism seems to be mainly focussed on other factors such as the elimination of transaction costs arising from the need for exchanging different currencies, the increase in market transparency, and the expansion of business tourism as a consequence of the positive impact of the EMU on trade. 1 2 3 Economic Intelligence Unit (1975). Currency changes, exchange rates and their effects on tourism. International Tourism Quarterly, Special Article No. 18, 4, 34-45. http://www41.statcan.ca/4007/ceb4007_001_e.htm (accessed 01/04/07). Review of International Economics (2007), The Effect of EMU on Tourism, Volume 15, Issue 2, 302-312. The exchange rates of the euro vs. other main currencies and their impact on EU tourism 4.2. Key Determinants of Tourist Flows It is important to remember that the factors that affect tourist flows are highly complex. Whilst fluctuations in exchange rates affect the price of tourist trips, other important price factors include the cost of living and cost of tourism services in the destination, and the cost of transportation between the origin and destination. Many studies have tried to evaluate the separate effect of these three components (exchange rate, cost of living/services, and price of transport) on the basis that tourists might respond differently to each. In particular, it has often been suggested that tourists are well informed on exchange rates but have much less knowledge of price levels in the destination they are visiting. Tourists may base their decisions prior to departure on knowledge of exchange rates, but might alter their intended length of stay and level of spending on arrival as they adjust to local currency prices. Other travel determinants, such as unexpected events, can cause substantial changes in the tourism economy – and there are several key examples over the period 2001-2005. The events of September 11th had a significant impact on global tourism, as did the war in Iraq in 2003 and the SARS outbreak in the same year. These events can have such a significant impact of tourist flows that they obscure more subtle changes caused by shifting exchange rates. 4.3. Key Exchange Rate Impacts Previous studies have identified a number of impacts of unfavourable exchange rates. These include: • Less travel abroad or to countries with a different currency. • Travel to different destinations: exchange rate fluctuations tend to have a greater effect on short haul travel (and even more so on day trips) than long haul travel. Countries that attract a high proportion of long haul tourists (such as Australia) have observed that the impact of exchange rate fluctuations is limited. Whilst the exchange rate can have an impact on how much money is spent at the destination, the actual travel decision, which is generally made months in advance, tends not to be affected. • Tourists are more likely to reduce their length of stay or average daily expenditure rather than decide not to visit a destination. On the contrary, various reverse effects have been observed resulting from a favourable exchange rate. These include: • Spending on additional goods and services. • A shift in travel and spending from other destinations. • Attraction of new tourists – that is people who would not have travelled otherwise. • Attraction of border shoppers (persons living close to another country travelling for the purpose of shopping). PE 379.231 20 The exchange rates of the euro vs. other main currencies and their impact on EU tourism 4.4. Impacts of Currency Changes in Europe The analysis of the exchange rates and tourist flows over the period 2001-2005 in Section 3 of this Briefing Paper shows that there is no conclusive evidence that the increasing strength of the euro over the period had a negative impact on inbound tourism from the key source markets identified. There are several reasons for this, the most prominent is the significance of other factors that influenced tourism over this period: September 11th, the Gulf War and SARS. The impact of these makes it almost impossible to identify any individual trends due to exchange rate fluctuations. There are a number of national tourism administrations across Europe that have claimed the weak US dollar (in particular) is costing the tourism sector a considerable amount of revenue. However, most of these comments are anecdotal as it is difficult to strictly evaluate the impact that the exchange rates have had whilst excluding all the other factors. 4.5. Policies and Actions to Respond to Exchange Rate Fluctuations There do not appear to have been any reactions to changing exchange rates between the euro and other key global currencies at an institutional level. National and regional tourism administrations in Europe have not set out any policies or action plans to respond to adverse or positive exchange rates. The reason for this could, in part, be the lack of conviction of the impact exchange rates have on tourist flows. However it is almost certainly also due to the complex factors that determine tourist demand, and that it is just one aspect amongst many of which the relevant administrations have little control. Nevertheless, it is common for the tourism trade (such as tour operators) to establish their contracts with fixed exchange rates so that they are not at the mercy of constantly shifting rates. 4 4 A number of studies are referred to in this section. A good reference point for all the key studies undertaken up to 1975 can be found in Economic Intelligence Unit, Currency Changes: Exchange Rates and their Effects on Tourism; International Tourism Quarterly, Special Article No. 18, 4, 34-45. More recent studies are referenced in Review of International Economics (2007), The Effect of EMU on Tourism, Volume 15, Issue 2, 302-312. The exchange rates of the euro vs. other main currencies and their impact on EU tourism 5. Recommendations Whilst the national and regional tourism administrations may not be able to control exchange rates, there are various policies and procedures they could put in place to minimise the effects of a strong euro and maximise the effects of a weak one. Minimise the effects of a strong euro: • Target those markets that are less sensitive to exchange rates. These are typically business travellers, long haul holiday tourists, and those tourists buying high quality products (in particular tailor-made trips and five star hotel seekers – these are less likely to be concerned about the exchange rate). • Increase marketing activities whilst the exchange rate is favourable. Whilst a strong currency means that inbound tourist may be discouraged from travelling, it does provide the opportunity for both the national and regional tourism authorities of a country, as well as the private sector, to buy more advertising space and other promotional activities in the markets they are attempting to attract for an unchanged amount of euros (or alternatively buy an unchanged amount of advertising space or promotional activities for fewer euros). • Do not rely on one key market. By developing a broad range of source markets for tourists, the overall impact on the tourism industry due to an adverse exchange rate with one or two other countries will be minimised. • Make your destination unique. A destination that is unique will be less affected by changes to exchange rates than destinations that differ little from other alternatives. Maximise the effects of a weak euro: • Attract border crossers and day-trippers (or the short break market) – essentially these will be residents of non-euro area countries such as (at present) the UK and Switzerland – through targeted marketing campaigns highlighting the benefits of shopping and leisure trips. PE 379.231 22 The exchange rates of the euro vs. other main currencies and their impact on EU tourism Bibliography Canadian Tourist Commission website: http://www41.statcan.ca/4007/ceb4007_001_e.htm (accessed 01/04/07). Economic Intelligence Unit (1975). Currency Changes, Exchange Rates and their Effects on Tourism; International Tourism Quarterly, Special Article No. 18, 4, 34-45. Foresight (2005), VisitBritain, Issue 15, January International Passenger Survey website: http://www.statistics.gov.uk/ssd/surveys/international_passenger_survey.asp Review of International Economics (2007). The Effect of EMU on Tourism. Volume 15, Issue 2, 302-312. Tourism Sector Monitor (2003), Special Focus: The Effect of Exchange Rate Movements on Cross Border Travel, British Colombia Stats, September 2003. The Journal of Tourism Studies (1993), Currency Exchange Rates and the Demand for International Tourism, Geoffrey Crouch, Vol 4, No 2. Tiago Stock Consulting website: http://www.x-rates.com/. United Nations World Tourism Organization (UNWTO) statistics website: http://caliban.wtoelibrary.org/vl=2135673/cl=21/nw=1/rpsv/home.htm. Visit Scotland Research Bulletin (2006), Dollar Exchange Rate Impact on Inbound Tourism, December.