1. Overview of Australian GST

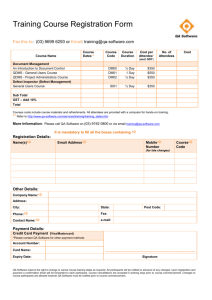

advertisement

INVESTMENT IN AUSTRALIAN COMMERCIAL PROPERTY – GOODS AND SERVICES TAX AUGUST 2012 1. Overview of Australian GST 1.1 Introduction: scope and operation GST is imposed on ‘taxable supplies’ at the rate of 10% and is similar in scope and operation to the VAT regimes of the European Union, Singapore and Canada. With the exception of residential property (and its iterations such as retirement villages and commercial residential premises), there are no exemptions or exclusions peculiar to property transactions, although there are a number of special rules which are relevant. Like most similar systems, registered GST taxpayers account for a GST liability on taxable supplies they make. Supplies which are characterised as ‘input-taxed’ (eg financial supplies or residential rent) or ‘GST-free’ (eg supplies of a ‘going concern’ or exports to an entity that is neither in Australia nor an income tax resident of Australia) are not subject to GST. A supply that that would be characterised as both input-taxed (eg issuing shares) and GST-free (eg where those shares are issued to a non-resident acting through a non-Australian business presence) will be characterised as GSTfree. While no GST liability arises under either characterisation, the distinction is important when input tax credit recovery is considered on related costs. In many but not all instances, registered taxpayers can reclaim an input tax credit for the GST component of the acquisitions they make. Qualifying ‘tax invoices’ must be held to claim, and only the recipient – not a third party payer – can claim. The entitlement to claim an input tax credit for an acquisition largely depends on the use to which the acquisition is to be put (see 1.2 below). As a commercial matter, a supplier’s GST liability is usually passed on to the recipient by way of an increased charge if the contract allows (ie a vendor increases the price otherwise payable by 10% on account of GST). It is common practice for contracts to contain a standalone provision dealing with the calculation and timing of this GST payment. 1.2 Input tax credit recovery – taxable and input-taxed supplies Because GST is passed on in the form of increased or additional charges as a commercial matter, it is cost neutral for most businesses where input tax credits (ITC) are available on acquisitions (subject to timing/cash-flow and any additional stamp duty costs). If the sum of an entity’s available ITCs in any given tax period exceeds the GST payable on its taxable supplies, this excess will be received as a refund once the GST return is lodged. Entitlement to ITCs for acquisitions made in the course of business activities largely turn on the intended use of those acquisitions. ITCs will be available for acquisitions made in the course of an enterprise, except to the extent that they relate to making input-taxed supplies (eg financial supplies or leasing residential premises). The sale or leasing of commercial property will be a taxable supply. As a result, related acquisitions including the purchase of land or premises, construction services and ongoing operating costs such as the services of letting agents, cleaning and maintenance will all give rise to full input tax credits. As a result, GST will not be a net cost for acquisitions directly related to the commercial property, including its initial purchase. However, issuing, selling or buying company shares or units in a trust are ‘input-taxed financial supplies’. Similarly, borrowing/lending or issuing/acquiring debt instruments are also input taxed financial supplies. Page 1 . As a result, while those transactions will not give rise to a GST liability themselves, establishing and/or financing an investment structure in Australia will give rise to an indirect net GST cost as input tax credits on related transaction costs (eg legal and other professional services) cannot be claimed in full. Having said that, there are some concessions allowing partial, and in some cases full, ITC recovery notwithstanding that input-taxed financial supplies are made: 1 For certain services a partial ITC can be claimed even though they are used to make input-taxed financial supplies. This ‘reduced input tax credit’ (RITC) rate is 75%, meaning that a net GST cost of 2.5% will be suffered for entities other than ‘managed investment schemes’ or certain superannuation funds. Those entities are entitled to claim a 55% RITC (ie a 4.5% net GST cost) for all services and 75% (ie a 2.5% net GST cost) for certain services such as portfolio management services. The RITC regime is unique to Australian GST. 2 ITCs can be claimed in full for acquisitions related to a ‘borrowing’ provided that the funds are used (directly) to make taxable supplies. Thus, ITCs can be claimed for legal services in respect of a loan where the funds are used by the borrower to directly acquire commercial property for leasing. This concession does not apply if the funds are used by the borrower to on-lend or to fund an equity contribution. 3 A de minimus ‘financial acquisitions threshold’ allows entities that make only minor input-taxed financial supplies to claim ITCs in full. The threshold is based on relevant ITCs not exceeding either A$150,000 pa or 10% of total annual ITCs. These thresholds apply on a GST based on group-wide basis. 4 While not strictly a concession, because of the operation of the ‘export’ rules, financial supplies with a non-resident counterparty (eg issuing units/shares to a non resident parent entity or borrowing from a non-resident lender) are characterised as GST-free supplies. As a result, ITCs on related acquisitions can be claimed in full. 5 Finally, input-taxed supplies between members of a GST group will effectively be ignored for GST recovery purposes. 1.3 Entities and GST registration GST recognises most ‘entity’ types as separate taxpayers including companies, trusts (separate and distinct from the trustee and the unit holders/beneficiaries) and partnerships (separate and distinct from the underlying partners/participants). Unincorporated joint ventures are not generally recognised as entities for GST purposes, but the extended definition of ‘partnership’ often encompasses such arrangements, especially with respect to the joint ownership of property. An entity will be required to register for GST if it is carrying on an enterprise and the annual turnover from its supplies that have the necessary connection with Australia exceed (or are expected to exceed) A$75,000 pa. Supplies involving real property (eg sales, leasing etc) will be relevantly connected with Australia if the real property is in Australia. While carrying on a business will constitute an ‘enterprise’ which may require GST registration, the statutory definition is extended to encompass one-off ventures and expressly includes the leasing of real property (ie holding and leasing property is, by definition, carrying on an enterprise). A non-Australian entity may register for GST (eg an entity with a direct holding in Australian property) and must also register if over the A$75,000 threshold. An entity must also register for an ABN if leasing non-residential property (eg office, industrial or retail buildings) in order to avoid ‘no ABN withholding tax’ being withheld from the rent payments by tenants. Registering for GST is reasonably straightforward and can be completed online. However, significant information must be provided as part of the registration application, particularly for non-residents. Page 2 . Many related entities (eg companies with 90% common ownership or wholly owned trusts) may elect to form a GST group which is then treated for most GST purposes as a single entity. Transactions between members of a GST group are disregarded and single combined GST returns are lodged. Subject to the quite complex membership rules (which are subject to announced but as yet unlegislated simplification), a GST group can combine different types of entities. However, GST grouping is voluntary and not all eligible entities need join a GST group and a single economic group may have numerous GST groups (but without overlapping membership). In addition to the administrative simplicity of ignoring intra-GST group supplies and lodging consolidated GST returns, GST grouping is often advantageous where there are significant internal funding arrangements. The nominated ‘representative member’ of the GST group is primarily liable for the entire group’s GST liability. However, all GST group members are jointly and severally liable in the event of a default by the representative member. That joint and several liability can be limited to each member’s reasonable allocation of the overall liability if an Indirect Tax Sharing Agreement (ITSA) is entered into. ITSAs also allow a member to make a ‘clear exit’ from the GST group if an appropriate payment is made. Financiers often require GST groups to enter into an ITSA to limit the exposure of a borrower to the GST debts of the group. In addition to an ITSA, GST groups will often enter into a non-statutory Indirect Tax Funding Agreement to regulate payments between them necessary to fund the GST group’s GST liability. 1.4 Ongoing GST lodgement obligations Most GST-registered entities will account for GST on an accruals/invoice basis (as opposed to a cash received/paid basis) and lodge GST returns (on Business Activity Statements) with the Australian Taxation Office (ATO) for each calendar month ‘tax period’. If turnover is less than A$20 million pa, quarterly GST returns can be lodged. GST liabilities on taxable supplies and input tax credit entitlements for ‘creditable acquisitions’ are offset each month with the resulting ‘net amount’ being payable to the ATO by the taxpayer (if positive) or paid by the ATO, possibly after some investigation, as a refund to the taxpayer (if negative). Page 3 . 2. Illustrative investment structure To illustrate the GST consequences arising out of the acquisition by a non-resident investor of Australian property, we have outline below the GST treatment of the steps involved in a common investment structure for commercial property. 2.1 The investment structure Relevant steps 1 Issue of units in Head Trust 2 Supply of shareholder loan or equity by Parent Co to Head Trust 3 Issue of units in Sub-trust 4 Shareholder loan or equity by Head Trust to Sub-trust 5 External borrowing by Sub-trust 6 Purchase of the Property by Sub-trust 7 Lease of property by Sub-trust. 2.2 Summary of the GST consequences The illustrative investment structure as set out above generally results in the GST outcomes set out in the following table for acquisitions by Head Trust or Sub-trust (as applicable) after they are created and registered for GST. Parent Co need not register for Australian GST, however the Head Trust and Sub-trust should do so at the earliest opportunity and must do so prior to acquisition of the subject property. In this regard we note that any costs under an engagement with Parent Co should not be subject to GST as it is a non-resident and not in Australia – so long as the service or advice is not provided to Head Trust, Sub-trust or another Australian entity. If the services are to be provided to an Australian entity we suggest that entity engage the supplier in order to avoid Parent Company incurring GST it cannot recover (or, but not preferred, Parent Company could register for GST). Page 4 . STEP / SUPPLY GST TREATMENT GST RECOVERY OF TRANSACTION COSTS 1. ISSUE OF UNITS IN HEAD TRUST No GST: primarily an input-taxed financial supply but also a GSTfree supply to Parent Co (if a nonresident, not ‘in Australia’). ITCs for transaction costs incurred by Head Trust (eg legal fees etc) recoverable in full. No GST: Full ITC recovery for Head Trust as its borrowing/issue supplies are GST-free. 2. SUPPLY OF SHAREHOLDER LOAN OR EQUITY BY PARENT CO TO HEAD TRUST 3. ISSUE OF UNITS IN SUB-TRUST • an out-of-scope supply by Parent Co . • Borrowing/issue by Head Trust is inputtaxed, but also GST-free. (as Parent Co is a non-resident). No GST: input-taxed financial supply. Will be disregarded after a GST group is formed. If Parent Co was either an income tax resident or was acting through an Australian business presence, ITCs could not be claimed unless a concession applied (eg the FAT or RITCs for particular costs). Neither Head-Trust nor Sub-trust can recover ITCs unless concessional treatment is available (eg RITCS or the FAT). Once they are GST-grouped, ITCs may be available as the relevant costs could relate to the GST group making taxable supplies of commercial property. 4. SHAREHOLDER LOAN OR EQUITY BY HEAD TRUST TO SUB-TRUST No GST: input-taxed financial supply. Will be disregarded after a GST group is formed. No ITCs (subject to concessions) for Head Trust as lender/subscriber. If debt: Full ITCs for Sub-trust (as borrower) as the borrowed funds will be used to acquire commercial property and thus make taxable supplies on acquisition of the property. If equity: ITC denial for Sub-trust subject to available concessions. If GST grouped: full ITCs for both Head trust and Subtrust. 5. EXTERNAL BORROWING BY SUB-TRUST No GST: input-taxed financial supply(if Australian lender) or GST-free supply (if non resident lender). Full ITCs as either the funds borrowed will be used to make taxable supplies (Australian lender) or the loan is GST-free (non-resident lender). 6. PURCHASE OF THE PROPERTY BY SUB-TRUST GST payable, unless ‘going concern’ treatment is available and adopted (see 3.1 below). Full ITC recovery on the purchase of the property (if going concern not adopted) and related transaction costs (whether or not going concern treatment adopted). Timing of ITC recovery, especially on the purchase of the property if going concern treatment is not adopted, is an important consideration. 7. LEASE OF PROPERTY BY SUBTRUST Taxable supplies by Sub-trust The rent on the leases should be grossed up for GST which is then remitted to the ATO. Page 5 . 3. Other issues to consider 3.1 Supply of a Going Concern (SOGC) This is the key GST concession considered on the acquisition of commercial property. While the sale of commercial property would generally be subject to 10% GST, if SOGC treatment is available the sale is GST-free and GST is not payable. The vendor and purchaser must agree in writing to adopt SOGC treatment – this agreement is usually documented in the sale contract. As GST is (usually) funded by the purchaser, the vendor is often indifferent. However, SOGC is important to purchasers as the cashflow/timing cost of paying a 10% GST amount to the vendor then waiting to receive the benefit of the ITC from the ATO is eliminated plus some stamp duty is also saved. Stamp duty is collected on the GST inclusive purchase price, thus if SOGC treatment is not adopted, stamp duty must also be paid on the GST amount charged to the purchaser by the vendor. That is a permanent cost. Given that the GST definition of ‘enterprise’ encompasses the leasing of real property, the sale of a leased commercial property will qualify as the GST-free supply of a going concern. Subject to the particular facts, SOGC treatment will also usually be available for: 1 A partially vacant/partially tenanted property where the vacant areas have been leased and are actively marketed or are subject to refurbishment 2 A new building, whether construction is complete or not, sold with pre-existing agreements for lease 3 A development where all relevant contracts (eg designs, construction etc) are transferred by the vendor to the purchaser—however this is often very difficult to establish in practice. Because the vendor is the relevant taxpayer with any GST liability, it bears the statutory risk of the parties incorrectly adopting SOGC treatment (ie liability for GST and any associated penalties and interest). Given this statutory risk and the fact that the benefit of SOGC treatment accrues to the purchaser (ie cashflow and stamp duty), it is usual for a vendor to require a full indemnity for the purchaser and, if there is any doubt, for the purchaser to seek a ruling to eliminate the indemnity risk. 3.2 Margin scheme The margin scheme is often raised in the context of property transactions. This is a special rule regarding the calculation of GST on the sale of eligible real property and is also unique to Australian GST although similar to ‘second hand goods’ provisions in other jurisdictions. While GST is usually calculated on the full selling price, the margin scheme calculates GST on the difference between that selling price and a prescribed cost base (usually either the value of the property at 1 July 2000 if held then or its purchase price if acquired later). While that lower GST sounds attractive, the margin scheme is usually limited to residential property developments because there is no ITC entitlement on the purchase. For a commercial developer, ITCs on the acquisition of the property can be claimed in full. Likewise, tenants or subsequent purchasers can also claim ITCs such that GST should not be a net cost on property transactions for commercial developments (noting SOGC treatment may be available). While the GST liability is reduced if the margin scheme is applied, ITCs cannot be claimed. GST therefore becomes a cost. The margin scheme is usually therefore reserved for residential developments where the end private purchasers cannot claim ITCs such that this lower overall GST (but with ITC denial) is a saving. Page 6 . 3.3 GST on purchase comparisons The following table illustrates the benefit to the purchaser associated with an acquisition of commercial property being eligible to be treated as a GST-free SOGC compared to a normal taxable supply or a margin scheme supply (in a ‘price plus GST’ contract). The net saving is in stamp duty not being assessed on the GST amount charged, which is a permanent saving to the purchaser. In addition, the cash flow saving arises because the purchaser does not have to wait for the benefit of the ITC to be received from the ATO, which could be up to eight weeks after settlement. The example is based, for illustrative purposes only, on an flat 5.5% stamp duty rate (rates will vary depending on the property location) and a margin scheme cost base of $10 million. GST-FREE SOGC ($A) 10% TAXABLE SUPPLY ($A) MARGIN SCHEME TAXABLE SUPPLY ($A) 20,000,000 20,000,000 20,000,000 0 2,000,000 1,000,000 STAMP DUTY 1,100,000 1,210,000 1,155,000 GROSS COST 21,100,000 23,210,000 22,155,000 (0) (2,000,000) 0 21,100,000 21,210,000 22,155,000 0 110,000 1,055,000 PURCHASE PRICE GST ITC NET COST ADDITIONAL COST 3.4 Ongoing GST liabilities and recovery Following purchase of the commercial property, the Sub-trust will make taxable supplies to tenants. It will therefore have ongoing GST liabilities to be included in its GST returns. Broadly, the GST payable in respect of leases will arise on a period basis (eg monthly) in accordance with the rental periods, and cover all rent, outgoings and other charges to the tenant. Property due diligence before purchase should confirm that the Sub-trust will be entitled to increase the (GST-exclusive) rent and outgoings by an amount to cover its GST liability. As the provision of the tenancy will be a taxable supply, ITCs can be claimed in full for the various acquisitions made in connection with the operation of the property such as insurance, cleaning and maintenance services. Tenants will require, and request, tax invoices from the owner for the rent so they can claim ITCs on the GST charged (as applicable). It is common for a property owner such as Sub-trust to appoint a property manager/agent to deal with the day-to-day operation of the property and issue tax invoices. As principal, Sub-trust remains primarily responsible for the payment of GST and claiming ITCs. Page 7 . 3.5 Lease incentives In order to obtain, or retain, a tenant for commercial premises, it is common for a property owner to provide a potential tenant with a lease incentive as an inducement to lease (eg rent free periods, undertaking the tenant’s fit-out, cash payment etc). The GST treatment of such lease incentives will depend on whether they are consideration for a separate supply of an agreement by the tenant to enter into the lease or a condition of the supply of the leased premises. Broadly, where the lease incentive is a condition of the supply of the leased premises to the tenant, which is generally the case where the landlord retains title in the fit-out or provides rent free periods, it will be treated as part of as the taxable supply of the commercial premises by way of lease. The Sub-trust, as owner/ landlord, will be required to remit GST on the rental payment and should be entitled to an ITC on associated costs incurred in providing the lease incentive (eg costs for fit-out it owns), subject to holding a tax invoice. However, where a lease incentive is paid by the Sub-trust in consideration of the tenant entering, or agreeing to enter, into the lease, the tenant makes a separate supply to the landlord (eg a cash payment – whether for the tenant-owned fit-out or otherwise). The supply of the premises by the landlord is a separate supply from the supply by the tenant. In this case, where the supply is a taxable supply, the Sub-trust will require a tax invoice from the tenant in order to be able to claim an ITC in respect of any GST charge on the lease payment. Page 8 . CONTACTS David Sinn Partner, Head of Commercial Real Estate, Herbert Smith Freehills Brisbane Telephone +61 3 9288 1509 Email david.sinn@hsf.com Simon Taskunas Partner, Herbert Smith Freehills Singapore Telephone +65 6236 9946 Email simon.taskunas@hsf.com Michael Back Partner, Head of Brisbane Office, Herbert Smith Freehills Brisbane Telephone +61 7 3258 6611 Email michael.back@hsf.com Jinny Chaimungkalanont Partner, Herbert Smith Freehills Brisbane Telephone +61 2 9322 4403 Email jinny.chaimungkalanont@hsf.com Simon Clark Director, Greenwoods & Freehills Brisbane Telephone +61 2 9225 5957 Email simon.clark@gf.com.au@hsf.com Andrew Howe Director, Greenwoods & Freehills Brisbane Telephone +61 2 9225 5919 Email andrew.howe@gf.com.au Page 9 . HERBERTSMITHFREEHILLS.COM GF.COM.AU