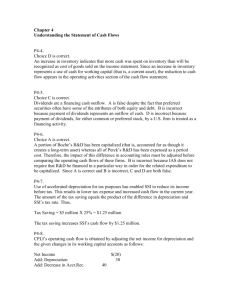

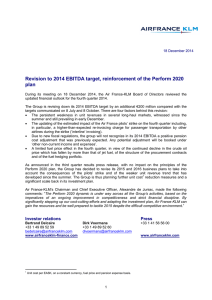

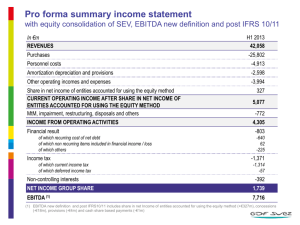

Placing EBITDA into Perspective

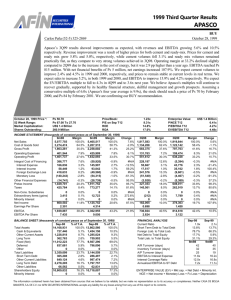

advertisement