Understanding the difference

between “covered” and

“noncovered” securities

Federal Cost Basis Reporting Regulations (“Regulations”) are taking effect over a three-year phase-in period

that began in 2011. During this period, different types of securities have and will become “covered” and subject

to new 1099-B cost basis reporting to the IRS. The phase-in of the various types of securities is as follows:

··Equities (including foreign securities and ADRs) – January 1, 2011

··Mutual Funds – January 1, 2012

··Fixed Income, Options and Structured Notes – January 1, 2013

Brokerage firms are required to report gross proceeds from sales and dispositions for cash for “covered” and “noncovered”

securities. For “covered” securities, brokerage firms are also required to report the following information on Form 1099-B:

··Adjusted basis of the tax lots sold

··Acquisition date of the tax lots sold

··Classification of any gain or loss as short-term or long-term

For the 2011 tax year, the IRS has introduced the new Form 8949 that you must complete and attach to Schedule D when

filing your tax return.

“Covered” Securities

A “covered” security refers to a security you have purchased on or after the effective date (above) or to a security that

has been transferred to your account from an account in which the security was already “covered.” As required by the

Regulations, when you sell covered securities we will report to the IRS not only the gross proceeds from the

sale, but also the cost basis, the date of acquisition and whether any gain or loss with respect to such

securities is long-term or short-term.

Example of a “Covered” Transaction

John Q Customer purchased ABC Inc. stock on 04/21/11 and subsequently sold the position on 05/25/11. Since ABC Inc.

stock is an equity purchased on or after January 1, 2011, it is “covered” under the new cost basis legislation. As a result,

the cost basis for ABC Inc. stock is IRS-reportable and is listed in the “Covered Transactions” section of the Tax Reporting

Merrill Lynch Wealth Management makes available products and services offered by Merrill Lynch, Pierce, Fenner & Smith Incorporated, a registered

broker-dealer and member SIPC, and other subsidiaries of Bank of America Corporation.

Investment products:

Are Not FDIC Insured

Are Not Bank Guaranteed

May Lose Value

Account No.

Taxpayer No.

123-96000

XXX-XX-6789

Page

9 OF 25

JOHN Q CUSTOMER

2011 TAX REPORTING STATEMENT

The Capital Gain and Loss Transaction section is provided to facilitate your review and the preparation of your tax return. In calculating gain (loss), unless otherwise noted, it was assumed that the oldest position was liquidated

first, and that an election was in effect to amortize the premium paid on the purchase of taxable bonds. The gain (loss) information may not include return of capital, sales load deferral or wash sales adjustments. RICs (which

may include mutual funds and unit investment trusts) may reclassify principal distributions as capital gains. The Cost Basis for these securities may not have been adjusted on your statement to reflect such reclassifications.

Please refer to information provided by the RIC and discuss with your tax advisor. Securities distributed from a retirement account reflect the tax basis on the date of distribution. Other methods for calculating gain (loss) are

available. The cost basis for most Original Issue Discount (“OID”) obligations includes the accretion of OID. For purposes of allocating original purchase price to the components of an equity unit consisting of a purchase contract and a debt security subject to a remarketing event, we assumed that the fair market value of the debt security on purchase date was equal to its adjusted issue price. The difference between your original cost and the

amount allocable to the debt component was allocated to the purchase contract. In making adjustments to the cost basis of the purchase contract, it was assumed that the unit holder included contract adjustment payments in

income when received. Data from Forms 1099 (reportable Dividend and Interest) is also repeated in this summary for your convenience. Additionally, we have included items such as margin interest and select account fees if

applicable. Please discuss the deductibility of these items with your tax advisor. For select clients, we have also included a summary of Visa charges and checking activity.Merrill Lynch is neither a tax return preparer or tax

advisor. Please see your tax advisor for more information.

Statement, as indicated below. You will use information provided in this section of the Tax Reporting statement to complete

Part I of Form 8949. Specifically for “covered” securities with basis reported to the IRS, you will check box (A) and list the

transaction details in the appropriate columns of the Form 8949. (See the section “Completing Form 8949.”)

1099-B

Quantity

Transaction

Description

Date Acquired

Cover of Short

2011 PROCEEDS FROM BROKER AND BARTER EXCHANGE TRANSACTIONS

Date Liquidated

Short Sale

Amount

Cost Basis

Adjustments

Gain or (Loss)

35,500.22

35,008.95

0.00

491.27

2,356.40

3,546.80

5,903.20

0.00

0.00

0.00

0.00

0.00

0.00

2,356.40

3,546.80

5,903.20

41,403.42

35,008.95

0.00

6,394.47

0.00

(92.02)

(OMB 1545-0715)

Remarks

SHORT TERM CAPITAL GAINS AND LOSSES

COVERED TRANSACTIONS

APPLE

ABC Inc.INC

100.0000

Sale

ABC Materials

Inc.

APPLIED

MATERIAL

INC

10.2673

Sale

10.7613

Sale

Security Subtotal

CUSIP Number

04/21/11

037833100

05/25/11

CUSIP Number

02/02/11

06/29/11

038222105

02/02/11

06/29/11

Covered Short Term Capital Gains and Losses Subtotal

NONCOVERED TRANSACTIONS

COCA COLA INC

10.0000

Sale

“Noncovered”

Securities

NEW YORK CITY SER D

FULLY RFD REF OID PRF 04

CUSIP Number

12/19/10

Account No.

456789123

11/03/11 123-96000

CUSIP Number

64966BA78

Taxpayer No.

408.20

500.22

XXX-XX-6789

Page

9 OF 25

Securities

purchased

MAR

93 06.000%MAR15

28prior to the effective date (above) are considered “noncovered,” for which we will report only the gross

JOHN

Q CUSTOMER

10000.0000

Redemption

12/24/10

04/01/11

5,075.00

5,300.00

0.00

(225.00)

proceeds to the IRS. Equities purchased prior to2011

January 1, 2011, mutual funds purchased prior to January 1, 2012, and

NEW YORK ST EGY RESH DEV

CUSIP Number

64984EBH7 TAX REPORTING STATEMENT

OID

PFR

04

other

securities—i.e.,

fixed

options

andandstructured

notes—purchased

prior

tootherwise

January

2013

will be

The ATRV

Capital

GainAMBAC

and Loss AMT

Transaction

sectionincome,

is provided to facilitate

your review

the preparation of your

tax return. In calculating gain (loss),

unless

noted, 1,

it was

assumed are

that theand

oldest position

was liquidated

93 an

06.000%MAR15

28 to amortize the premium paid on the purchase of taxable bonds. The gain (loss) information may not include return of capital, sales load deferral or wash sales adjustments. RICs (which

first,MAR

and that

election was in effect

Redemption

12/24/10

03/15/11

10,100.00(c)

0.00

0.00 to reflect

(L) such

may10000.0000

include mutual

funds

and unit investmentAny

trusts) may

reclassify

distributions as

capital gains.

The Cost

Basis for these

securities

may not have been

adjusted

on your

considered

“noncovered.”

sale

ofprincipal

a security

that

is 10,100.00

not

considered

“covered”

will

still

bestatement

included

onreclassifications.

the tax

Please refer to information provided by the RIC and discuss with your tax advisor. Securities

distributed

the tax basis

are

Account

No. from a retirement account reflect

Taxpayer

No. on the date of distribution. Other methods for calculating gain (loss)

Page

THORNBURG

MTG

COM

CUSIP

Number

885218107

available.

The cost

basisINC

for most

Original

Issue Discount

(“OID”)

obligations

includes

the accretion

of OID.

For cost

purposes of

allocating amount

original purchasewill

price tonot

the components

of an equity unit consisting

of a purchase

conreporting

statement

with

its10/23/10

adjusted

cost

basis

but

the

basis

be transmitted

to the

IRS.

123-96000

XXX-XX-6789

9 OF

25

tract1000.0000

and a debt security

subject to a remarketing event,

we assumed that the09/28/11

fair market

value of the debt

security on purchase date

was equal to its adjusted issue

between your original cost

and the

Sale

28,935.57

27,692.03

0.00 price. The difference

1,243.54

amount allocable to the debt component was allocated to the purchase contract. In making adjustments to the cost basis of the purchase contract, it was assumed that the unit holder included contract adjustment payments in

income when received.

Data from Forms 1099 (reportable

Dividend and Interest) is also repeated in this summary for your convenience. Additionally, we have included items such as margin interest and select account fees if

Example

of a “Noncovered”

Transaction

11landcor113011.qxp

applicable.

Please discuss the deductibility of these items with your tax advisor. For select clients, we have also included a summary of Visa charges and checking activity.Merrill Lynch is neither a tax return preparer or tax

advisor. Please see your tax advisor for more information.

Q CUSTOMER

John QJOHN

Customer

purchased XYZ Inc. stock on 12/19/10 and subsequently sold the position on 11/03/11. Since XYZ Inc.

1099-B

2011 PROCEEDS

FROM BROKER

AND BARTER EXCHANGE TRANSACTIONS

(OMB 1545-0715)

2011 TAX REPORTING

STATEMENT

stock was acquired

prior to theDate

effective

January 1, 2011, the

cost basis will not be reportable to the IRS and

Transaction

Acquireddate

Dateof

Liquidated

The Capital

Gain and Loss

Transaction section is provided

to facilitate

your review

the preparation of your

tax return. In calculating

(loss), unless

otherwise noted, itGain

was assumed

that the

oldest position was liquidated

Quantity

Description

Cover

of Short

Shortand

Sale

Amount

Cost gain

Basis

Adjustments

or (Loss)

Remarks

and that

election

was in effect to amortizeTransactions”

the premium paid on the section

purchase of taxable

bonds.Tax

The gain

(loss) information

may not include return

capital, sales loadbelow.

deferral or wash

adjustments.

RICs (which

is first,

listed

inanthe

“Noncovered

of the

Reporting

Statement,

asofindicated

Yousales

will

use details

may

includeTERM

mutual funds

and unitGAINS

investment

trusts)LOSSES

may reclassify principal distributions as capital gains. The Cost Basis for these securities may not have been adjusted on your statement to reflect such reclassifications.

SHORT

CAPITAL

AND

Please refer to

information

provided by the

RIC

and discuss

with your tax advisor.

Securities distributed

from

a retirement account

reflect

the

tax basis8949.

on the dateSpecifically

of distribution. Other methods

for calculating gain (loss) are

provided

in

this

section

of

the

Tax

Reporting

statement

to

complete

Part

I

of

Form

for

“noncovered”

COVERED

TRANSACTIONS

available.

The cost

basis for most Original Issue Discount (“OID”) obligations includes the accretion of OID. For purposes of allocating original purchase price to the components of an equity unit consisting of a purchase contract and a debt security subject to a remarketing event, we assumed that the fair market value of the debt security on purchase date was equal to its adjusted issue price. The difference between your original cost and the

securities

basis is not reported

the

IRS, you will check box (B) and list the transaction details in the appropriate

APPLEallocable

INC into which

Numberto

037833100

amount

the debt component was allocatedCUSIP

to the purchase

contract.

In making adjustments to the cost basis of the purchase contract, it was assumed that the unit holder included contract adjustment payments in

100.0000

04/21/11

05/25/11

35,008.95

0.00 items such as491.27

income

when received.Sale

Data from Forms 1099 (reportable

Dividend and Interest)

is also repeated in this 35,500.22

summary for your convenience.

Additionally, we have included

margin interest and select account fees if

columns

of

the

Form

8949.

(See

the

section

“Completing

Form

8949.”)

applicable. Please discuss the deductibility of these items with your tax advisor. For select clients, we have

also included

a summary of Visa charges and checking activity.Merrill Lynch is neither a tax return preparer or tax

advisor.

Please

see your tax

APPLIED

MATERIAL

INCadvisor for more information.

CUSIP Number

10.2673

10.7613

1099-B

Sale

Sale

Security Subtotal

Transaction

Quantity

Description

Covered Short Term Capital Gains and

038222105

02/02/11

02/02/11

2,356.40

0.00

0.00

2,356.40

06/29/11

06/29/11

3,546.80

0.00 EXCHANGE

0.00TRANSACTIONS

3,546.80

2011

PROCEEDS FROM

BROKER AND BARTER

5,903.20

0.00

0.00

5,903.20

Date Acquired

Date Liquidated

Cover of Short Short Sale

Amount

Cost Basis

Adjustments

Gain or (Loss)

Losses Subtotal

41,403.42

35,008.95

0.00

6,394.47

SHORT TERM CAPITAL GAINS AND LOSSES

NONCOVERED TRANSACTIONS

COVERED TRANSACTIONS

COCA

CUSIP Number

XYZ

Inc.COLA INC

APPLE

INC

CUSIP Number

10.0000

Sale

12/19/10

100.0000

Sale

04/21/11

XYZ

CITY

SERCITY

D SER D

NEW

YORK

CUSIP Number

APPLIED

INCPRF 04

CUSIP Number

FULLY MATERIAL

RFD REF OID

10.2673

Sale

02/02/11

MAR

93 06.000%MAR15

28

10.7613

Sale

06/29/11

10000.0000

Redemption

12/24/10

Security Subtotal

NEW YORK ST EGY RESH DEV

CUSIP Number

Covered

Term

Capital

Gains and Losses Subtotal

ATRV

OIDShort

AMBAC

AMT

PFR 04

MAR 93 06.000%MAR15 28

NONCOVERED

TRANSACTIONS

10000.0000

Redemption

12/24/10

456789123

037833100

11/03/11

05/25/11

64966BA78

038222105

02/02/11

06/29/11

04/01/11

408.20

35,500.22

500.22

35,008.95

0.00

0.00

(92.02)

491.27

2,356.40

3,546.80

5,075.00

5,903.20

0.00

0.00

5,300.00

0.00

0.00

0.00

0.00

0.00

2,356.40

3,546.80

(225.00)

5,903.20

41,403.42

35,008.95

0.00

6,394.47

03/15/11

10,100.00

10,100.00(c)

0.00

0.00

12/19/10

10/23/10

11/03/11

09/28/11

408.20

28,935.57

500.22

27,692.03

0.00

0.00

(92.02)

1,243.54

CUSIP Number

10/23/10

885218107

09/28/11

28,935.57

27,692.03

0.00

1,243.54

64984EBH7

New

Form

8949

and changesCUSIP

to Schedule

D for the 2011 tax year

COCA

COLA INC

CUSIP

Number

456789123

THORNBURG

MTG INC COM

Number

885218107

10.0000

1000.0000

Sale

Sale

(OMB 1545-0715)

Remarks

(L)

ForNEW

taxYORK

year

2011, the IRS has CUSIP

created

the new

Form 8949 that must be completed and attached to Schedule D. In

CITY SER D

Number

64966BA78

11landcor113011.qxp

FULLY

RFD

REF OID

PRF 04has made changes to the Proceeds from Broker and Barter Exchange Transactions sections of the

addition,

Merrill

Lynch

MAR 93 06.000%MAR15 28

10000.0000

Redemption

04/01/11

5,075.00

5,300.00

0.00

Tax Reporting

statement.

It now12/24/10

includes a consolidated

gross

proceeds and

gain/loss section

that(225.00)

segregates short-term

NEW YORK ST EGY RESH DEV

CUSIP Number

64984EBH7

gainsATRV

and

gains

OIDlong-term

AMBAC AMT PFR

04 as either “covered” or “noncovered” transactions. The information in this new section will provide

MAR 93 06.000%MAR15 28

you with

the necessary

to complete

You should 10,100.00(c)

complete Form 0.00

8949 before 0.00

completing

Schedule D.

10000.0000

Redemption information

12/24/10

03/15/11Form 8949.

10,100.00

(L)

THORNBURG MTG INC COM

1000.0000

Sale

11landcor113011.qxp

The IRS has also made major revisions to Schedule D, which now acts as a summary of all capital gain and loss

transactions. You are required to list the individual sale transactions on Form 8949. If the gain or loss is short-term,

the gain or loss should be included on Part I of Form 8949. If the gain or loss is long-term, the gain or loss should be

reported on Part II of Form 8949. You may need to attach multiple copies of Form 8949 to Schedule D to reflect different

transaction types during the 2011 tax year. A separate Form 8949 is required for gains and losses if you:

··Have the basis reported on the Form 1099-B you received

··Do not have the basis reported on Form 1099-B

··Did not receive a Form 1099-B

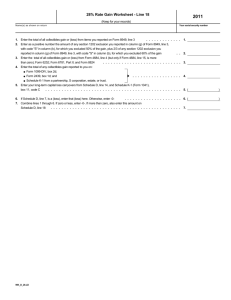

Completing Form 8949

Part I of Form 8949 is broken out into columns (a) through (g). The illustration below shows where you can obtain the

required information needed to complete this form. For “covered” securities, the information may all be obtained from

Form 1099-B. You can indicate which category your gains and losses fall under by checking either box (A), (B) or (C) on

Form 8949. You will need to include on each Form 8949 only those transactions described in the text for the box you check;

i.e., either (A), (B) or (C). If you have more than one type of transaction and otherwise would have checked multiple boxes,

a separate Form 8949 is required for each type. For example, if you check box (A) in Part I of the Form 8949, you will need

to include only short-term gains and losses from “covered” transactions. If you check box (B) in Part I of the Form 8949, you

will need to include only short-term gains and losses from “noncovered” transactions.

Form

8949

Department of the Treasury

Internal Revenue Service (99)

Sales and Other Dispositions of Capital Assets

2011

▶ See Instructions for Schedule D (Form 1040).

more information about Form 8949, see www.irs.gov/form8949

▶ Attach to Schedule D to list your transactions for lines 1, 2, 3, 8, 9, and 10.

▶ For

Name(s) shown on return

Part I

OMB No. 1545-0074

Attachment

Sequence No. 12A

Your social security number

Example A. Employee

123 45 6789

Short-Term Capital Gains and Losses—Assets Held One Year or Less

Note: You must check one of the boxes below. Complete a separate Form 8949, page 1, for each box that is checked.

*Caution. Do not complete column (b) or (g) until you have read the instructions for those columns (see the Instructions for Schedule

D (Form 1040)). Columns (b) and (g) do not apply for most transactions and should generally be left blank.

X (A) Short-term transactions reported on

Form 1099-B with basis reported to the IRS

1

(a)

Description of property

(Example: 100 sh. XYZ Co.)

20.0000 shares ABC Co.

(B) Short-term transactions reported on Form

1099-B but basis not reported to the IRS

(b)

Code, if any,

for column (g)*

(c)

Date acquired

(Mo., day, yr.)

(d)

Date sold

(Mo., day, yr.)

(e)

Sales price

(see instructions)

04-05-11

04-25-11

940.97

Trade Date on

Form 1099-B

Quantity and

Description on

Form 1099-B

(C) Short-term transactions for which

you cannot check box A or B

Date of Purchase

as reflected on

Form 1099-B and

Trade

Confirmation

(f)

(g)

Cost or other basis

Adjustments to

(see instructions) gain or loss, if any*

991.00

Cost Basis on

Confirmation and

Form 1099-B

Gross Proceeds on

Form 1099-B

Form 8949 is used to list all of your capital gain and loss transactions; the subtotals from this form are then carried over

to Schedule D (Form 1040), where gain or loss is calculated in the aggregate.

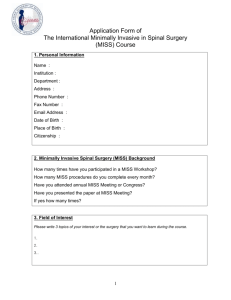

Completing Your Schedule D

Schedule D has been revised for tax year 2011, and is now a summation of short- and long-term capital gains and losses

from Form(s) 8949. You will need to complete Form 8949 first, and then carry over the subtotals from Form(s) 8949 column

(e) Sales Price and column (f) Cost or Other Basis to Schedule D column (e) and (f). You may then calculate column (h) of

Schedule D by combining columns (e), (f) and (g).

SCHEDULE D

(Form 1040)

Department of the Treasury

Internal Revenue Service (99)

Name(s) shown on return

Part I

OMB No. 1545-0074

Capital Gains and Losses

▶

Attachment

Sequence No. 12

Your social security number

Example A. Employee

123 45 6789

Short-Term Capital Gains and Losses—Assets Held One Year or Less

Complete Form 8949 before completing line 1, 2, or 3.

This form may be easier to complete if you round off cents to

whole dollars.

1 Short-term totals from all Forms 8949 with

checked in Part I . . . . . . . . . .

2 Short-term totals from all Forms 8949 with

checked in Part I . . . . . . . . . .

3 Short-term totals from all Forms 8949 with

checked in Part I . . . . . . . . . .

box

. .

box

. .

box

. .

A

.

B

.

C

.

(e) Sales price from (f) Cost or other basis

Form(s) 8949, line 2,

from Form(s) 8949,

line 2, column (f)

column (e)

940.97

(

991.00

(g) Adjustments to

gain or loss from

Form(s) 8949,

line 2, column (g)

(h) Gain or (loss)

Combine columns (e),

(f), and (g)

(50.03)

)

(

)

(

)

(50.03)

4 Short-term gain from Form 6252 and short-term gain or (loss) from Forms 4684, 6781, and 8824 .

5 Net short-term gain or (loss) from partnerships, S corporations, estates, and trusts from

Schedule(s) K-1 . . . . . . . . . . . . . . . . . . . . . . . . . . . .

6 Short-term capital loss carryover. Enter the amount, if any, from line 8 of your Capital Loss Carryover

Worksheet in the instructions

. . . . . . . . . . . . . . . . . . . . . . .

7 Net short-term capital gain or (loss). Combine lines 1 through 6 in column (h). If you have any

long-term capital gains or losses, go to Part II below. Otherwise, go to Part III on the back

. . .

Part II

2011

Attach to Form 1040 or Form 1040NR. ▶ See Instructions for Schedule D (Form 1040).

▶ Use Form 8949 to list your transactions for lines 1, 2, 3, 8, 9, and 10.

4

5

6

(

)

7

Long-Term Capital Gains and Losses—Assets Held More Than One Year

Complete Form 8949 before completing line 8, 9, or 10.

This form may be easier to complete if you round off cents to

whole dollars.

(e) Sales price from (f) Cost or other basis

Form(s) 8949, line 4,

from Form(s) 8949,

line 4, column (f)

column (e)

(g) Adjustments to

gain or loss from

Form(s) 8949,

line 4, column (g)

8 Long-term totals from all Forms 8949 with box A

(

)

checked in Part II

. . . . . . . . . . . .

9 Long-term totals from all Forms 8949 with box B

(

)

checked in Part II

. . . . . . . . . . . .

10 Long-term totals from all Forms 8949 with box C

(

)

checked in Part II . . . . . . . . . . . . .

11 Gain from Form 4797, Part I; long-term gain from Forms 2439 and 6252; and long-term gain or (loss)

from Forms 4684, 6781, and 8824 . . . . . . . . . . . . . . . . . . . . . .

11

12 Net long-term gain or (loss) from partnerships, S corporations, estates, and trusts from Schedule(s) K-1

12

13 Capital gain distributions. See the instructions . . . . . . . . . . . . . . . . . .

14 Long-term capital loss carryover. Enter the amount, if any, from line 13 of your Capital Loss Carryover

Worksheet in the instructions

. . . . . . . . . . . . . . . . . . . . . . .

15 Net long-term capital gain or (loss). Combine lines 8 through 14 in column (h). Then go to Part III on

the back . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

13

For Paperwork Reduction Act Notice, see your tax return instructions.

Cat. No. 11338H

(h) Gain or (loss)

Combine columns (e),

(f), and (g)

14 (

)

15

Schedule D (Form 1040) 2011

For additional questions, please contact your Financial Advisor.

The case studies presented are hypothetical and do not reflect specific strategies we may have developed for actual clients. They are for illustrative purposes only and intended to demonstrate the capabilities of

Merrill Lynch and/or Bank of America. They are not intended to serve as investment advice since the availability and effectiveness of any strategy is dependent upon your individual facts and circumstances. Results

will vary, and no suggestion is made about how any specific solution or strategy performed in reality.

Any tax statements contained herein were not intended or written to be used, and cannot be used, for the purpose of avoiding U.S. federal, state or local

tax penalties. Neither Merrill Lynch nor its Financial Advisors provide tax, accounting or legal advice. Clients should review any planned financial transactions

or arrangements that may have tax, accounting or legal implications with their personal professional advisors.

© 2012 Bank of America Corporation. All rights reserved. | ARI2K2R0 | SHEET-03-12-1175 | L-04-12 | Code 470040PM-0412 | 10% post-consumer content.