The Interview: Heart of a Fraud Investigation by James A. Gravitt

advertisement

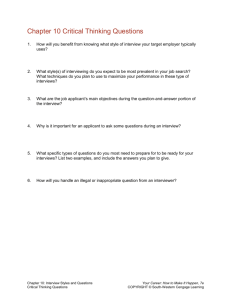

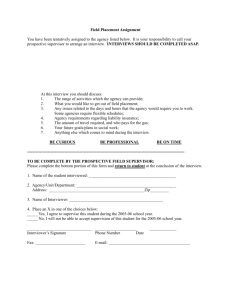

The Interview: Heart of a Fraud Investigation by James A. Gravitt, CPA, CBA, ABV, CFE If conducted well, interviews of suspects in an alleged fraud scheme can yield crucial evidence that stands up in court and can lead to a conviction. If handled poorly, a fraud case becomes more difficult to prove or may even become irretrievably lost. What are the elements of a successful interview process in a fraud investigation? Forensic or investigative accountants (including those designated as Certified in Financial Forensics (CFF) 1 and Certified Fraud Examiners (CFE) 2 are often asked to assist attorneys and business owners in uncovering fraud. While their work does not result in the finding of fraud (this calls for a legal conclusion by a judge or jury), CFFs and CFEs provide the groundwork that may lead the fact finder inescapably to this conclusion. Accordingly, forensic accountants need to approach every investigation with the expectation of a court proceeding – although in practice, many cases are settled. Proof of scienter – willfulness or intent to defraud – is required in order to prevail in a matter of white collar or financial crime. Acting with “intent to defraud” means acting intentionally to cheat or deceive. Experienced fraudsters, who understand the need to prove intent, will often attempt to explain their actions as mistakes, accidents or unintentional conduct. An effective interviewer may be able to establish a pattern of lying and deception that will aid in proving intent to defraud. The American Institute of Certified Public Accountants (AICPA) Forensic and Valuation Services Section recently issued a practice aid (discussed throughout this article) “Conducting Effective Interviews” that highlights the crucial ingredients determining success. At the outset, it should be remembered that forensic accountants are objective fact finders who normally do not interrogate a witness with the intent of obtaining a confession. Still, CFEs and CFFs may be part of an investigation involving multiple interviews where some degree of confrontation is likely. Each fraud investigation begins with an investigation plan that includes a strategy for interviews that will be sufficiently thorough. For example, an interview with a set completion time may fail to be thorough enough, as the person being interviewed may simply focus on “running out the clock.” The forensic accountant gains the confidence of the interviewee by asking questions the interviewee should know, and by remaining objective and fair. To listen actively means paying attention to what is said and what is not said, while observing (via nonverbal cues) how it is communicated. 1 Certified in Financial Forensics is a designation awarded by the American Institute of Certified Public Accountants. 2 Certified Fraud Examiner is a designation awarded by the Association of Certified Fraud Examiners, headquartered in Austin, Texas. 500 W Market St Louisville, KY 40202 (502) 588-8400 www.hlinvestmentbanking.com The Interview: Heart of a Fraud Investigation Page 2 The investigation plan outlines the nature of the case, lists possible witnesses, has a preliminary order of interviews, lists appropriate data, documents and information to obtain, identifies key issues to resolve, and contains steps that should be completed before interviews begin. An interview plan compliments the investigation plan and includes interview goals, an order of questions, who will be the lead interviewer, who will be taking notes (where interviews are conducted by two people), and safety considerations for the interviewer. As part of an investigation team, forensic accountants should work in close consultation with attorneys. Retention by counsel as consultants may allow interviews to be protected by legal privilege. Without protection, interviewers may be forced to disclose information that could inadvertently harm an interviewee, exposing the forensic accountant to negative legal ramifications. While interviews usually begin with neutral witnesses and move toward corroborating witnesses and suspects, it is not always possible to follow this order. Early interviews with suspects may be necessary if evidence is at risk of destruction, if the suspect is leaving the organization, or if threats to other witnesses are being made. Experienced interviewers are careful to sequence questions in a way that will elicit useful responses. For example, the witness’s body language is first “calibrated” by asking open and general questions and observing answering patterns. A witness may exhibit signs of nervousness that are not being caused by false answers, but are simply a reaction to the stress of being interviewed. Interview questions can be categorized as informational, open, closed, leading, attitudinal, admission seeking, and closing. Generally, it is best to obtain general information before seeking details on a matter under investigation. The types of questions are interspersed throughout the interview as it moves to a conclusion. It is important for the interviewer to control his/her own emotions during the interview and avoid negative reactions from the witness that may result in early termination of the interview. Closing questions should summarize key facts and elicit information about other witnesses or documents that may prove useful in the investigation. The witness should receive the interviewer’s contact information so that any information that was left out or forgotten can be communicated. If a decision is made to solicit admissions from the interviewee, the CFF or CFE must proceed with extreme care. As noted above, interviewers should consult with legal counsel prior to the interview to discuss potential legal implications. For statements to be admitted in court, admissions must be voluntary and not obtained under threat or coercion. Even the physical setting for the interview can be considered as threatening to the witness. Admission seeking questions should carefully ask and document the voluntary nature of the confessions. Also, the interviewer should ask questions to document the intent and state of mind (important elements for proving fraud) of the suspect at the time of commission of the alleged acts. The Interview: Heart of a Fraud Investigation Page 3 Written documentation of interviews should be prepared soon after the interview’s conclusion. The report should be closely compared to the interview notes, and the interviewer should consult with counsel to determine if the interview notes should be retained, as they may be requested by opposing counsel. In addition, it may be useful to state in the report the timing of significant events in the interview, including breaks, in order to document a lack of coercion. Successful interviews are critical in determining the who, what, when, where, how and why of a forensic investigation. CFFs and CFEs work closely with attorneys and their clients to uncover and properly document the factual basis for obtaining successful outcomes in matters of white collar crime. Forensic and investigative accounting is an area of increased emphasis in the accounting profession. Therefore, it is advisable for legal counsel to team with qualified, trained and experienced accounting professionals when there is a need for these types of services. © 2010. No part of this newsletter may be reproduced or distributed without the express written consent of J.J.B. Hilliard, W.L. Lyons, LLC. Although the information in this newsletter is believed to be reliable, we do not guarantee its accuracy, and such information may be condensed or incomplete. This newsletter is intended for information purposes only, and is not intended as financial, investment, legal or consulting advice.