Pre-Budget Statement by United Left Alliance

advertisement

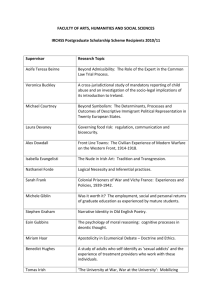

Pre-Budget Statement by United Left Alliance DON’T PAY THE DEBT – End Austerity – Invest in jobs Contents 1. Executive Summary ................................................................................................. 4 2. Budget 2013: Hurting Without Working ................................................................ 10 3. Don't pay the debt – It’s unsustainable ................................................................. 13 4. Abolish the USC for those under 40,000 - Increase total income tax-take on the wealthiest 5% by €2.5 billion ..................................................................................... 15 5. Introduce a 'Millionaires Tax', a wealth tax on net assets over €1 million to raise €2.8 billion in 2013 .................................................................................................... 17 6. Introduce the Financial Transactions Tax............................................................... 19 7. Increase corporation tax to 15% and ensure minimum effective rate of 12.5% .... 20 8. Take full control of the banks -write down mortgage debt .................................... 21 9. Lend to small businesses – Introduce differential rates and rent controls ............. 22 10. Strategic investment – Public works programmes to create 180,000 jobs directly. .................................................................................................................................. 23 11. A Major three-year programme of direct state Council housing provision – costing €3 billion per year but self-financing over 10 years ....................................... 27 12. Halt the privatisation of state companies & the give-away of natural resources. 29 13. Reverse the cuts .................................................................................................. 31 14. Conclusion ........................................................................................................... 32 Appendix 1: In figures ................................................................................................ 33 1. Executive Summary Repudiate Debt – End Austerity. Invest in jobs and services. The ULA proposes a socialist alternative to the budget proposals of the government and the other parties in the Dáil. We say that those who are responsible for the crisis should pay for it, not those who are the social and economic victims - the ordinary working people of Ireland. We proposes to take the burden of the crisis off working people, improve their lives and revive the Irish economy. This can only be done by taking the decision-making of the banks and finance houses out of the hands of management whose only goal is profit; and embarking on a major public investment program. If the current investment rate of 10% of GDP (EU average is 18.5%) continues, Ireland will become an economic backwater with impoverishment for generations and run down public services. Only a reversal of current policies can stop that. We propose to repudiate all debt deriving from the financial crash that started in 2008. We propose to raise additional revenue from increases of income tax on the richest in our society; to introduce a wealth tax and a financial transaction tax; and to impose a minimum effective rate of 12.5% corporation tax, with a nominal rate of 15%. As part of democratic public control of the banks, mortgages should be written down. There should be increased lending to domestic small business. The state however, must invest in public infrastructure including schools, hospitals, water, public transport, energy and state-built housing. The privatisation of state-owned enterprises and utilities must stop; our natural resources must be nationalised and the public service cuts of recent years reversed. 1.1 Deficit, expenditure and revenue-raising measures: Deficit and expenditure: Revenue generating measures: The primary deficit for 2013, without the €9.1 billion debt-interest payment and without the government's proposed cuts and tax increases would be €6 billion. Interest payments on the remaining debt after repudiation: €1.6 billion. Reversal of cuts: €3 billion. Corporation Tax: €5 billion Wealth Tax: €2.8 billion Financial Transactions Tax: €0.5 billion Income Tax: €2.5 billion Total revenue raised: €10.8 billion Total deficit to be closed: €10.6 billion 1.2 Don't pay the debt – It’s not ours! The ULA proposes to write down the national debt to pre-crash levels and halt all debt-interest payments incurred as a consequence of the crash. In 2007, prior to the economic collapse, Irish general government debt stood at €47.4 billion (debt to GDP ratio of 24.9%). It is now €192 billion (Debt/GDP 117.7%) 1 This ballooning of state debt resulted entirely from the actions of developers, bankers and the politicians who facilitated them. It is an odious debt which does not benefit the mass of the population, was taken on without their permission and is now the cause of their deepening poverty. Interest payments on the debt in 2013 will be €9.1 billion.2 The resulting rise in the fiscal deficit is crippling the economy. If the government's planned austerity for 2013 was cancelled, as we propose, there would be primary budget deficit of €6 billion. 3 Writing down the Irish debt to the pre-crash figure of €47.4 billion would reduce debt-interest to approximately €1.6 billion next year – at an interest rate of about 4%.4 Repudiating the debt would also mean cancelling the planned €3 billion in annual payments to Anglo-Irish Bank and any further payment of debts to bondholders in BOI, AIB or other private banks. These amount to €17.4 billion in 2013, €5.9bn in 2014, €11.6bn in 2015 5 1 http://www.ntma.ie/business-areas/funding-and-debt-management/debt-profile/debt-projections/ 2 Department of Finance Stability Programme update April 2012 3Assuming a primary balance of -3.6% of GDP, without the cuts, which allows for a multiplier effect of 0.5 for not implementing the €3.5 billion in austerity. 4The write-down to be calculated by a debt audit commission to pay back those with proven need, such as pension funds and ordinary people. 5The detail of bond payments available here http://namawinelake.wordpress.com/2011/06/03/when-are-bondholders-in-irish-banks-due-to-be-paid/http://namawinelake. wordpress.com/2011/06/03/when-are-bondholders-in-irish-banks-due-to-be-paid/ 1.3 Public Investment Program: Net cost €15 billion over three years Redirect money held by Irish banks to pay bondholders (€17.4 billion available for 2013 alone) to a Jobs Fund. Other sources: a Jobs Bond, NPRF investment, pension funds and Credit Unions 1.4 Revenue Raising Measures: Increase total income tax-take on the wealthiest 5% by €2.5 billion Through a combination of graduated tax bands for incomes in excess of €100,000 (50%), €150,000 (60%), €200,000 (70%) and the establishment of a sliding scale of new minimum effective tax rates on incomes over €100,000 per year, the ULA proposes to increase the annual tax take from this group by €2.5 billion. Introduce a 'Millionaires Tax' to raise €2.8 billion in 2013; set up a wealth and assets register. Central Bank data for Quarter two of 2012 6 show that there were €446.4 billion worth of net assets, when debts and liabilities are subtracted. A 5% wealth tax on assets in excess of €1 million would raise €2.8 billion in 2013. Introduce a Financial Transaction Tax. A tax on bond and share trading of 0.1% and on derivatives of 0.01% would raise an estimated €500 million. Impose an effective corporation tax rate of 12.5%, rising to nominal 15% In 2010 companies registered in Ireland declared pre-tax profits of just under €70 billion but only paid €4.2 billion in tax – an effective rate of below 6.5%. An effective rate of 12.5% would raise €4 billion and an increase to 15% would raise another €1 billion. Total: €5 billion. 1.5 Put People First: Abolish USC and Household Tax, and reverse the cuts. (cost €2.9 billion) Abolish the USC for those under €40,000 and reduce it by 50% for those earning between €40,000 and €70,000: cost €2.5 billion. Abolish Household Tax. Cost: €160 million. Lift the SNA caps – train & hire 5000 SNA’s & resource teachers Reverse the cuts to disability, mental health and childcare services: €50 million Reverse cuts in fuel allowance: €51 million Re-instate the one million home-help hours: €20 million Reverse the change to the income disregard for lone parents, restore entitlement to one parent family payment to 15years; restore the qualified child increase to those on CE schemes 6 Central Bank of Ireland Quarterly Financial Accounts for Ireland Q2 2012 published November 2012 & restore concurrent payments: €20.7 million Reverse the cuts to CE schemes, Back to Education allowance and jobs initiative: €35.9 million Reverse the cuts to rent supplement: €55 million Reverse last two years increase in the current student contribution (registration fee): €33 million Reverse the reductions in 3rd level and postgraduate grants: €15.4 million Total cost of reversing cuts: €2.9 billion Write down mortgage debt Resolve the mortgage crisis through a write-down to current market value of owner-occupier mortgages given out between 2002-2008. The banks have been given money to cover losses on mortgages. Any shortfall should be covered by non-payment of bondholders. Remove the bank veto in personal insolvency legislation; enshrine in law protection of the family home; no repossessions. 1.6 Invest in Jobs: Lend to small businesses – differential rates and rent controls Bring in a progressive system of differential rates based on profitability; end upward only rent reviews; bring in rent controls. Increase credit for small businesses and farmers through democratic public ownership of the banks. €24 billion public investment to directly create 180,000 jobs – net cost €15 billion The current investment rate of 10% of GDP a year will turn Ireland into an economic backwater, with continued unemployment around 15% and mass emigration. Private investment has dried up – down €32 billion a year since 2007. A €24 billion investment program over three years would put 180,000 directly to work. At wages of €35,000 it would cost €2.7 billion p/a on top of current jobless benefits. Indirectly another 120,000 jobs would be created – a total of 300,000. The net cost to the state after three years would be €15 billion, as a result of the increased tax revenue and higher GDP.7 Funding would come from the €17.4 billion the banks have for bond payments; from the launch of a Jobs Bond; from social investment by the Credit Union movement; from investment by Irish pension funds; and from the NPRF. 7See further Rory O'Farrell, An Examination of the Effects of an Investment Stimulus (http://www.nerinstitute.net/download/pdf/neri_working_paper_rof_no_4.pdf), which using the Hermin model estimates the up-front net cost of a €1 billion investment to be €575 million. Therefore a €24 billion public investment programme would have a net cost to the state of €15 billion. A three-year program of state-built housing provision – costing €3 billion per year but self-financing over 10 years. Provide 100,000 new Council houses over three years using empty housing and new build; transfer all suitable empty housing to local Councils; build Council housing to meet needs and eliminate waiting lists; a new state construction company employing 30,000 to refit / build 33,000 houses per year for three years. 1.7 Public Wealth not Private Profit Take full control of the banks. Irish banks are among the best capitalised in Europe due to their bail-out. AIB is already 99% state-owned and Bank of Ireland is 15% state owned. We propose full nationalisation with direct public control of the banks and finance institutions, including their mortgage portfolios, without compensation except on the basis of proven need. End the privatisation of state companies and the give-away of natural resources. Estimates of the value of Irish oil and gas reserves range from €420 billion to €1500 billion. Current tax on the multinationals which extract it is the lowest in the world. Set up a state gas and oil company to develop reserves. Abolish current licences and re-nationalise all oil and gas reserves. The government plans to sell off our state enterprises. We say stop all privatisations and renationalise of all privatised industries. Develop the economy and natural resources in an environmentally sustainable manner. 1.8 Conclusion If we repudiate the crash-debt, the interest on it would no longer inflate the fiscal deficit. The remaining deficit could be covered by revenue raised from those who can afford to pay. A public investment program could be funded by redirecting the money for bondholders being held by the banks, as well as from other funds. These proposals however, are not a comprehensive solution to the crisis we face. We present them to show that contrary to the claims of government, the ‘Troika’ and economic “experts”, the resources do exist to provide an alternative to austerity, cut-backs and privatisation. The problems we are facing are not an aberration but are a manifeststion of a deep structural crisis of global capitalism. This is shown by the failure over the last four years to stem the financial crisis across Europe: attempts to increase competitiveness and profitability, through austerity and privatisation, have boosted some profits; but the crisis has deepened and millions are being immiserated. A radical alternative is required if Ireland is not to slide into economic backwardness. The alternative we propose will not be implemented by the current parties in the Dáil or by the Irish state, which consistently defends the status quo. The working people of Ireland will have to challenge the vested interests of big business and the Irish establishment in order to bring even the modest proposals above into being. The ULA will play its part in that challenge – and advocate a Europe-wide and international movement of workers, women, the unemployed, young people and pensioners to challenge the failed doctrine of austerity and private profit. 2. Budget 2013: Hurting Without Working The government strategy pursued since the economic collapse at the end of 2007, first by Fianna Fail and then continued by the new Fine Gael/Labour coalition, has been a social and economic disaster. At a human and social level, the devastating impact of austerity is very clear. Unemployment remains at crisis levels with 435,200 8 people now signing on and an official unemployment rate of 15.1%9, with youth unemployment at almost 30%. 10 These figures would be far worse were it not for a huge exodus from the country of approximately 87,10011 people in the last year ending April 2012 through emigration. Poverty has increased substantially with 700,00012 people now living on or below the poverty line, including over 200,00013 children. 10% of the population now experience food poverty.14 More than 1.8 million people have €100 or less left after they pay for essentials.15 The Irish League of Credit Unions has recently reported the shocking fact that 40% of people are now borrowing to pay basic bills16. Suicide and homelessness are also dramatically on the rise. 8 Live register seasonally adjusted Total 9 Eurostat 10http://www.socialjustice.ie/sites/default/files/fil e/2012-09%20-%20EU%20Employment%20a nd%20Social%20Situation%20-%20Sept-201 2_EN.pdf 11 CSO figures April 2011 to April 2012 12 Social Justice Ireland – Shaping Ireland’s Future report 13 Ibid 14 CSO 15 Safefood report commissioned by Department of Social Protection - 'Measuring Food Poverty in Ireland - the indicator and its implications' 16 Irish League of Credit Unions (ILCU) quarterly 'What's Left' Tracker for 2012 – published July 2012 This is not just a social crisis. It is perfectly clear, as predicted by the ULA, that from the point of view of the economy as a whole, the strategy of austerity is also failing disastrously. It is worth briefly characterising the strategy that has been pursued to date in response to the crisis: To guarantee all the losses of private banks and investors through sovereign borrowing to the tune of €64 billion and further borrowing to cover for a dramatic increase in the budget deficit arising from the collapse of the property market, employment, consumer demand, investment and state revenues. To pay for these borrowings and attempt to close the budget deficit with five austerity budgets to date – resulting in dramatic cuts in the income of low and middle households and the slashing of public spending. To justify this approach on the basis that bailing out banks and cutting costs in the economy, even if causing short term pain, would in the medium term lead to renewed bank lending, market confidence and investment - thus eventually boosting growth and making the debt and deficit sustainable in the long term. Co-operating fully with EU demands for fiscal consolidation, in the hope the EU would also provide Ireland with some debt relief – thus accelerating our return to economic sustainability. It is now increasingly obvious that reality has not worked out accordingly. Instead, austerity has worked in the interests of international bondholders and a section of big business, while driving down the living standards of the majority. Over €26 billion was transferred to bondholders in 201217 , while profits for big business have risen by €8.6 billion since 2009 in Ireland. As profits have increased, unit labour costs have fallen by almost 13%.18 However, this strategy 19 of vicious 'internal devaluation', while increasing profitability for some sections of big business has been disastrous for the economy as a whole. The real and predictable effect of the strategy has been a ballooning of the national debt to the point where the gross government debt is expected to reach 122.5% of GDP in 2013 20. While the primary deficit has been substantially reduced, the overall deficit remains very large with the bulk of it now being made up of interest on debt. Growth in the economy, particularly the domestic economy, has collapsed as unemployment and lower incomes, resulting from continued austerity, have massively contracted demand. Banks have refused to lend to small businesses, which they deem too risky and also refuse to offer substantial debt relief to mortgage holders, many of whom have lost their jobs and are in serious financial difficulty – leading to more closures, more unemployment, further reductions in demand and even greater reluctance on the part of the banks to lend. With private sector lending and consumer demand paralysed, the only other possible 17 €6.4 billion in payments on sovereign debt (Department of Finance, Medium Term Fiscal Statement, November 2012) plus €19.9 billion in payments by bailed out banks. Source for bank payments: bondwatchireland.blogspot.com, figures accessed from Bloomberg terminal in May 2011. 18 http://ec.europa.eu/economy_finance/eu/forec asts/2012_autumn/ie_en.pdf 19 National Income and Expenditure Accounts 2011 20 European Commission Autumn Forecast 2012 (http://ec.europa.eu/economy_finance/publication s/european_economy/2012/pdf/ee-2012-7_en.pdf ) economic driver is public spending and investment, and yet this is the area on which the troika, government and media are focussing most of their vitriol and making demands for even more retrenchment. However, the most decisive reason for the continuing deepening of the crisis has been the dramatic collapse of investment. Gross capital fixed investment has fallen by almost 70% in nominal terms. The total collapse of investment at €32.3 billion since 2007 is greater than the overall decline in GDP of around €30 billion. 21 While there has been some new Foreign Direct Investment (FDI) this has not even come close to compensating for the dramatic collapse of investment since 2007, with the result that there was a further net loss of 33,000 jobs in the economy last year. At a European level, hopes for a deal on Ireland’s debt have come to nothing and the impact of similar austerity being imposed on other troubled economies in Europe has pushed the Eurozone back into recession. 22 This in turn is choking off export markets for Irish goods, leading to a dramatic down-grading of forecasts for growth in the Irish economy. Against this background further austerity, as envisaged by the government in the form of social welfare cuts, property taxes, water charges and further cuts in public spending, can only do more economic damage and accelerate the downward economic spiral. The IMF has belatedly and grudgingly acknowledged the disastrous downward spiral caused by their policies of austerity in their recent World Economic Outlook report.23 In their usually understated and technocratic language they refer to the fact that the “multiplier” and “spill-over” effects of “fiscal consolidation” have been worse than they predicted. 21 National Income and Expenditure Accounts 2011 22 Eurostat 23 World Economic Outlook, October 2012 Coping with High Debt and Sluggish Growth However, this revelation has not resulted in any conversion from the failed doctrine of austerity to one focused first and foremost on creating jobs and encouraging growth. left that austerity would turn recession into depression are rapidly being vindicated. On the contrary, the austerity policies that have crippled growth in the periphery countries are being generalised to the core of Europe, with the effect that the whole of the EU is now tipping back into recession. Europe as a whole is facing a deep crisis. Radical measures that break with the logic of “markets” are required, both in Ireland and across Europe that put the needs of the working people before the interests of bondholders, bankers and big business. There is a need for active struggle to demand policies that prioritise the need for jobs, public services and growth,using public investment and democratic socialist planning to chart a way out of the current crisis. Socially or economically, we simply can’t go on like this. The price we will pay if we don’t is most visibly apparent in Greece where vicious and relentless austerity has effectively torn Greek society apart. The predictions of those on the We must urgently adopt a radically different approach to dealing with the crisis. 3. Don't pay the debt – It’s unsustainable The Irish debt situation is entirely unsustainable. The failure of the government at successive EU summits to achieve tangible progress on a debt deal for Ireland has now reached a stage where more radical measures are the only serious option. Unless action is taken to relieve Ireland of the debts resulting from the financial gambling of banks and speculators in the period 2002-2008, the economy will sink under its weight. In 2007 prior to the economic collapse, Irish general government debt stood at €47.4 billion (debt to GDP ratio of 24.9%). It now stands at an enormous €192 billion (Debt/GDP 117.7%) 24 This staggering increase in our debt resulted entirely from the actions of developers, bankers (both here and in Europe) and politicians (both here and in Europe) that facilitated their greed. Interest payments on this debt next year will amount to €9.1 billion. 25 It is this odious debt and the resulting dramatic rise in the deficit, incurred through no fault of ordinary citizens, which is currently crippling the economy. If none of the planned austerity for 2013 took place as the ULA proposes, there would be primary budget deficit of €6 billion.26 This is not the €15 billion deficit the government constantly refer to (which is the figure only if we include interest on debt and the cost of the bank bail-out). In a normal situation, a €6 billion deficit and a €47.7 billion debt would not be calamitous and could be dealt with through a growth and investment strategy and higher taxes on wealth and top earners. But attempting to close a €15 billion deficit and a debt of €192 billion, made up mostly of private gambling losses and the ensuing costs, is both economically unsustainable and morally unacceptable. Against this background, the only fair and economically sane approach to adopt is to refuse to pay all debt repayments beyond those that can fairly be attributed to the Irish people. This would mean cancelling or writing down the Irish debt to the pre-crash figure of €47.4 billion, which would amount to approximately €1.6 billion in interest next year at an average interest rate of about 4%. 27 It would obviously mean also immediately ceasing the planned €3 billion in annual payments to Anglo-Irish Bank and any further payment of debts to bondholders in BOI, AIB or other private banks, which amount to €17.4 billion in 2013, €5.9bn in 2014, €11.6bn in 2015 28 The banks have been bailed out with €64 billion of taxpayers' funds in order to pay these bonds. When the Central Bank stress tested the banks in early 2011, they assumed that these bonds would all be paid. 29 The banks are therefore fully capitalised to pay them, together with being sufficiently 24 http://www.ntma.ie/business-areas/funding-and-debt-management/debt-profile/debt-projections/ 25 Department of Finance Stability Programme update April 2012 26 Assuming a primary balance of -3.6% of GDP, without the cuts, which allows for a multiplier effect of 0.5 for not implementing the €3.5 billion in austerity. 27 The write-down to be calculated by a debt audit commission to pay back those with proven need, such as pension funds and ordinary people. 28 The detail of bond payments available here http://namawinelake.wordpress.com/2011/06/03/when-are-bondholders-in-irish-banks-due-to-be-pa id/ 29 capitalised to withstand €5.7 billion of mortgage defaults. Instead of paying the bondholders, the money should be diverted to public investment and to write down mortgages, with only those proving need, such as pension funds and ordinary workers, receiving repayment of their bonds. To put this another way, the cost of Ireland repudiating the odious debt, would only be the same as the amount the government, under the dictates of the “Troika,” intends to strip out of the economy in new cuts and taxes in the next two budgets. However, adopting this approach would not require austerity for years to come. Even threatening such a move would put pressure on the ECB to start discussing debt write-off in a way the “best boy in the class” routine has failed to do. The worst case scenario, if we repudiated this odious debt and Ireland was unable to access the international markets, is that we will have to achieve a €7.6 billion adjustment (made up of a primary deficit of €6 billion and €1.6 billion in interest on the newly written down debt) – an adjustment that could be made through a combination of higher taxes on incomes over €100,000 per year, wealth taxes, an increased corporate tax take and the introduction of a Financial Transaction Tax. However, the ULA wishes to go further. We do not simply wish to balance the books. We wish to raise investment funds to finance a stimulus programme to create jobs, strategic investment and to protect the vulnerable in Irish society. We also want to see the devastating cuts implemented so far reversed. In addition to the €7.6 billion that the state would need to raise to cover the primary deficit and interest payments, we estimate that the state would need to raise a further €15 billion to finance a public works and strategic investment programme that would put 180,000 people directly back to work. http://www.centralbank.ie/regulation/industry-sectors/credit-institutions/Documents/The%20Financ ial%20Measures%20Programme%20Report.pdf 4. Abolish the USC for those under 40,000 Increase total income tax-take on the wealthiest 5% by €2.5 billion The Universal Social Charge (USC) has had an extraordinarily damaging effect on low and middle income families and on the domestic economy. This savage cut in income for the majority of households must be reversed to lift these families back from the brink of poverty and to re-inject badly needed demand into the domestic economy. The ULA proposes the abolition of the USC for all those earning less than €40,000 per year and halving of the USC from 7% to 3.5% for those earning between €40,000 and €70,000 per year. This would cost €2.5 billion per year and could be paid for through a corresponding increase in tax on the top 5% of earners. According to the Dept. of Finance, the top 5% of earners – numbering 108,250 income earners have total gross earnings of €20.122 billion and earn in excess of €100,000 per year. This group pays total tax (incl USC & PRSI) of €7.145 billion (an effective rate of 36 %.) Average gross earnings among this group are €185,885 per year, with the income range going from €100,000 per year up to the 120 very highest earners, who have average earnings of over €8.612 million per year. Through a combination of graduated tax bands for incomes in excess of €100,000 (50%), €150,000 (60%), €200,000 (70%) and the establishment of a sliding scale of new minimum effective tax rates on incomes over €100,000 per year, the ULA proposes to increase the annual tax take from this group by €2.5 billion. This tax increase would be progressively graduated with those earning just over €100,000 per year seeing significantly smaller tax increases than those in the very highest earning brackets. The current range of effective tax rates on this 5% of earners goes from 31.33% on those earning €100-120,000 per year to 43.47% on those earning over €2.5 million per year. The new proposed sliding scale of effective tax rates would at 37% on those earning €100-120,000 reaching to 60% on those earning over €1 million per year. Raising tax rates on this small group of top earners would not damage the domestic economy in the manner of previous austerity measures that have significantly reduced the spending power of low and middle income earners, who spend most of their money in the domestic economy. Top earners on the other hand, with significant surplus income, are far more likely to account for the high level of savings currently evident in the Irish economy – money that needs to be re-injected into the economy. Some examples: *Currently, someone earning €34,700 per year, after tax receives on average €29,600 in take home pay. After the removal of the USC, their take home pay will increase to approximately €31,350. *Currently, someone earning €44,600, after tax receives on average €36,000 in take home pay. After the reduction in USC, their take home pay will increase to approximately €38,200. *Currently, someone earning €109,000 per year, after tax, receives on average €75,000 in take home pay (effective rate 31.33%). Under the new scale this would be reduced to approximately €69,700 per year (effective rate 36%). *Currently, someone earning €169,000 per year, after tax, receives on average €109,000 in take home pay (effective rate 35.44%). Under the new scale this would be reduced to approximately €91,500 (effective rate 46%). *Currently someone earning €272,000 per year, after tax receives on average €170,000 in take home pay (effective rate 37.23%). Under the new scale this would be reduced to approximately €125,200 (effective rate 54%). (See appendix for full table) 5. Introduce a 'Millionaires Tax', a wealth tax on net assets over €1 million to raise €2.8 billion in 2013 The ULA opposes outright the government plan to impose property taxes on ordinary households in 2013 and proposes as an alternative an emergency wealth tax of 5% on net assets over a threshold of €1 million, raising €2.8 billion in 2013. Regardless of whether the government impose a property tax based on market value as has been signalled or in the form a site value tax as proposed by others, a home tax will involve an intolerable and unfair burden on hundreds of thousands of families. Such an extra burden on low and middle income families will also further depress domestic demand and result in more damage to the domestic economy. Crucially, neither a market value nor a site value based tax on the home takes any account of ‘ability to pay’ nor whether or not the property generates income for the owner. At any time such taxes on the home would result in unfairness and major anomalies. However, in the current dire economic situation, with over 169,000 households in mortgage distress and 1.8 million households with less than €100 per month after bills are paid, either model will certainly plunge hundreds of thousands of families deeper into financial difficulty and drive many into outright poverty. For vast numbers of people, such a tax will simply be un-payable. The figure floated by Minister for Finance, Michael Noonan, for example of 0.25% of market value, would mean an extra burden of €500 per year for someone with an average home valued at €200,000 per year. For the unemployed, those in mortgage distress and many pensioners this would be a recipe for financial devastation. The alternative to an unjust tax on the family home is a millionaire tax. The ULA was the first political grouping in Ireland to propose a wealth tax, and although subject to widespread ridicule for the proposal, other parties have now taken up the call for a wealth tax and such a tax is now being discussed widely. Wealth taxes exist in a number of countries in Europe and a number of other countries are currently considering introducing them. Contrary to repeated claims by the government that there is “no pot of gold” on which to impose a wealth tax, annual figures produced by both the CSO and the CBI there are very substantial wealth and assets still in Ireland. Figures published for Quarter two of 2012 30 show that there is €446.4 billion worth of net household assets in the state, when debts and liabilities are subtracted. The figures show that while the value of property assets has fallen considerably from the height of the property boom, the value of financial assets has started to rise over recent years. These net assets are split approximately 50-50 between property and financial assets. Currently, there are no publicly available government figures on the distribution of these assets. . The Household Finance and Consumption survey planned for 2013 is completely inadequate. 31 This is 30 Central Bank of Ireland Quarterly Financial Accounts for Ireland Q2 2012 published November 2012 31 See PQ Ref No: 45930/12 to Minister for Finance from Joe Higgins TD something that must be addressed immediately and would require the establishment of a register of wealth and assets in the state. However, in the BOI updated Wealth of the Nation 32 report estimated that the wealthiest 5% held 40% of these assets, with the wealthiest 1% owning 20% of these assets. That report also estimated a total of 33,000 of net worth millionaires in the state (approximately 1% of the adult population). It is also fair to assume that the assets of the wealthiest are those most unencumbered by debts and liabilities, particularly mortgage debts, and even where these assets are property assets; they are more likely to be revenue producing commercial property assets rather than family homes. It is also fair to assume that the 50% of assets that are financial are more likely to be concentrated in the hands of the wealthiest, as this group is more likely to be able to accumulate savings and have surplus wealth for financial investment. Based on the available figures on wealth and assets, and the available estimates on the distribution of these assets, the ULA proposes a 5% emergency wealth directed at net wealth in excess of €1 million. Taking the figure of millionaires owning 20% of the total net assets of €446.4 billion, that means they have a total wealth of €89 billion. The wealth over a threshold of €1 million which would be taxable equates to €56 billion. A 5% wealth tax on their assets in excess of €1 million would raise €2.8 billion. The ULA proposes: *An emergency 5% millionaires' tax on assets over €1,000,000 - to raise €2.8 billion. *The establishment of a comprehensive national wealth and assets register. 32 http://www.eapn.ie/eapn/wp-content/uploads/2010/04/Bank-of-Ireland-Wealth-of-Nation-Report-20 07.pdf 6. Introduce the Financial Transactions Tax The government’s refusal to introduce even the minimal EU proposal for a FTT exposes the lie behind their claim that they are managing the current economic crisis in the interests of ordinary citizens. They claim they support an FTT in principle but are adamant they will not introduce it unless every other country in Europe imposes it, particularly citing British opposition to the FTT. This opposition to a proposal to put a minimal 0.1% tax on transactions of bonds and shares and 0.01% on transactions of derivatives, on a sector that bears the greatest responsibility for the current international economic crisis provides the starkest evidence that their priority is the protection of the bankers and speculators rather that caused the crisis rather than the working people who are its victims. It was recently revealed that IFSC registered companies in 2011 paid a pitiful €466million 33 in corporation tax, which is less than 1% of the overall tax-take. Since the establishment of the IFSC in 1987, international financial capital has flocked to Ireland taking advantage of our low tax rate. This has culminated in Ireland issuing 24% 34 of the Eurozone’s shares in 2009, whilst the economy only makes up 1%35 of the EU’s GDP. Additionally €236 trillion of funds are managed here and as well as 40%37 of hedge fund assets. Considering Britain’s much higher corporation tax rate the argument that the markets will migrate to London and result in job losses doesn’t add up. The EU’s FTT proposal is minimal and frankly inadequate. It is estimated that the proposed taxes would raise somewhere in the region of between €490 million and €730 million. 38 The United Left Alliance is in favour of the introduction of such a financial transactions tax as a first step. However, it warns that without the financial system being taken into democratic public ownership and used as a public utility for society, the diktats of the financial markets will remain ever present. The ULA calls for: *The introduction of a Financial Transactions Tax to raise between €490 and €730 million (estimate €500 million) 33 http://debates.oireachtas.ie/dail/2012/07/17/unrevised2.pdf 34 http://www.centralbank.ie/polstats/stats/investfunds/Documents/The%20Investment%20Funds%20Ind ustry%20in%20Ireland%20-%20A%20Statistical%20Overview.pdf 35 http://www.gfmag.com/gdp-data-country-reports/631-the-european-union-gdp-economic-report.html#a xzz2CPPIrt9l 36 http://www.irishfunds.ie/statistics/ 37 http://www.irishfunds.ie/fs/doc/statistics/statistics-factsheet-september-2012.pdf 38 http://debates.oireachtas.ie/dail/2012/07/05/00026.asp 7. Increase corporation tax to 15% and ensure minimum effective rate of 12.5% The 12.5% corporation tax rate is the sacred cow of the Irish political establishment. It seems we can impose brutal cuts on the incomes and services of the poor, the disabled and the vulnerable but we are now allowed even contemplate asking profitable corporations to make an extra contribution to the state in a time of unprecedented economic emergency. The policy of refusing to even slightly increase the tax burden on profitable companies, while ordinary people are being driven into poverty and despair is an obscenity. It is even more shocking when we discover that many of the most profitable companies in the country pay very considerably less than the extremely low nominal rate of 12.5%. For example, one of the most profitable companies in Ireland last year US owned GE Capital Aviation Funding – a company 'based' in Shannon with no employees in Ireland– declared profits of €606 million and only paid $379,000 in corporation tax on its profits (an effective rate 0.5%).39 If the company had paid the 12.5% rate they would have paid $95.6 million. It has also been widely reported that Google is only paying 2% on profits that it is routing through Ireland. 40 In questions to the Minister for Finance, attempting to ascertain the effective corporation tax paid by companies registered in Ireland, the minister claimed that he could not provide this information as it was too complex to calculate. However, one study of taxes in the IFSC found that the effective corporation tax rate in Ireland is more likely to be somewhere between 4% and 7%. Further questions put to the Minister for Finance appear to confirm that profitable corporations in this country are paying far less than the nominal 12.5% rate. For example, in 2010 companies registered in Ireland declared pre-tax profits of just under €70 billion but only paid €4.2 billion in tax – an effective rate of below 6.5%. Certainly, whatever the precise figure, it is clear that rigorously imposing the 12.5% rate as a minimum effective rate would significantly increase tax revenues. In addition the ULA believes it would be quite possible to increase the corporation tax rate to 15%. Based on the available figures from revenue, imposing an effective rate of 12.5% would yield an extra over €4 billion per year. The ULA proposes: *Increase the nominal corporation tax rate to 15% and impose a minimum effective corporation tax rate of 12.5% to raise €5 billion 39 http://www.irishtimes.com/newspaper/finance/2012/0620/1224318257525.html 40 http://www.irishtimes.com/newspaper/breaking/2012/1104/breaking31.html 8. Take full control of the banks -write down mortgage debt As the mortgage crisis deepens it is imperative that the State takes immediate steps to relieve increasing pressure on mortgage holders and alleviates the negative impact it is having on consumer spending and the domestic economy. Recent figures show that an astonishing one in five mortgages (22.1%) are in arrears or have been restructured.41 Over 160,000 are in some form of mortgage distress. 42 Put simply, people weighed down with unsustainable mortgages do not spend in the economy. Unless holders of distressed mortgages are given very significant relief on their mortgages, their debts will continue to prevent significant economic recovery. The government often joins with the chorus of criticism of the banks’ failure to deal with the mortgage debt problem, but absolve themselves of responsibility. This is despite the fact that the state effectively owns these same banks. Therefore the Government shares responsibility for the horrendous treatment of mortgage holders in this country. Incredibly, the new personal insolvency bill being proposed by the government as the means to deal with the personal debt crisis gives the banks a veto on the new debt resolution schemes it is proposing. The answer to this log-jam is clear. The state must assert full control over the banks that we the people have bailed-out and re-capitalised. Irish banks are among the best capitalised in Europe following their bail-out and have been specifically provisioned to deal with losses on mortgages given out during the period of the property bubble. The ULA proposes: Remove the bank veto in personal insolvency legislation and enshrine in law protection of the family home No repossessions Full nationalisation with direct public control of the banks and finance institutions, including taking over of their mortgage portfolios, without compensation for financial institutions, except on the basis of proven need. Across the board write-down of mortgages for owner occupiers given out between 2002-2008 to current market value, with any shortfall in the amount provided for in the banks capitalisation being paid for from the non-payment of the banks’ bondholders. 41 http://www.centralbank.ie/polstats/stats/mortgagearrears/Documents/2012q2_ie_mortgage_arrears_stat istics.pdf 42 http://www.centralbank.ie/polstats/stats/mortgagearrears/Documents/2012q2_ie_mortgage_arrears_ statistics.pdf 9. Lend to small businesses – Introduce differential rates and rent controls The main political parties in this country – not least the government constantly declare themselves to be champions of small businesses, claiming that this sector will be the key driver in any economic recovery. The ULA believes public enterprise and public works must play the central role to redevelop the economy on a sustainable basis. However, we do believe that small businesses should be able to avail of cheap credit and in the context of strong public investment could assist with economic growth. It is also ironic that the government should claim to be supporters of small businesses when in fact their austerity policies have reduced domestic demand by over 20% 43, which many small businesses depend on, resulting in the collapse of five businesses, predominantly small businesses, per day.44 However, even setting aside the question of austerity and its impact on demand, the government have failed utterly to act on calls by small businesses to deal with the crisis they are now facing. Many are simply unable to access necessary credit, despite state ownership of the key banks. Consistently, small businesses have called for action on rates, upward only rent reviews, and the failure of the banks to extend credit to struggling small businesses. The government’s failure to do this is a result of its savage cuts to local government funding, its unwillingness to challenge NAMA and other big landlords on the issue of rents, and its refusal to assert control over the lending policies of the banks that the public have bailed-out and re-capitalised. The ULA calls for: The introduction of a progressive system of differential rates based on profitability Empty shops and industrial units should be used for start-up enterprises. The ending of upward only rent reviews and rent controls Democratic public ownership and control of the banks in order to ensure a significant increase in the availability of credit for small businesses and farmers. 43 http://files.nesc.ie/nesc_secretariat_papers/nesc_secretariat_paper_01_2011_executive_summary.pdf 44 http://www.rte.ie/news/2011/1201/economy.html 10. Strategic investment – Public works programmes to create 180,000 jobs directly. Creating jobs must be the absolute priority, if we are to have any chance of charting a way out of the current crisis. Simply focusing on balancing books, tackling deficits and debts without a primary objective of creating jobs and promoting economic growth is utterly self-defeating, and a recipe for accelerating the downward spiral we are now caught in – guaranteeing to turn a recession into a depression. Leaving job creation to the markets and private capital, as has been attempted over the last four years has been an absolute failure. Despite stuffing the private banks in this country and across Europe with public cash, the banks still refuse to lend or invest in the economy. They are entirely focused on restoring their balance sheets. Indeed from their own point of view, as profit making entities they are acting rationally, as they are aware that high levels of unemployment and depressed consumer demand make lending to business a very risky business. Similarly, private capital is reluctant to invest against a background of a contracting domestic and European economy. Investment in the Irish economy has fallen calamitously as the figures below demonstrate45: Gross Domestic Fixed capital Formation 2005 €43.5 billion 2006 €48.3 billion 2007 €48.4 billion 2008 €39.3 billion 2009 €25.6 billion 2010 €18.7 billion 2011 €16.1 This is a phenomenon that is common across the developed capitalist world, whereby big business is choosing not to invest, with the Economist in mid-2010 reporting that “business investment is as low as it has ever been as a share of GDP.”46. This has continued since.47 Meanwhile profits have increased. The result is an unprecedented amount of wealth being hoarded by major corporations (an estimated €3 trillion in the EU48). This is because of the widespread existence of excess capacity and an absence of confidence among private capitalists in future profitability, given the depth of the crisis and the prospect of a break-up or radical restructuring of the Eurozone. Ireland is an even more extreme case. The percentage of GDP that is invested is now at just over 10%, 45 National Income and Expenditure Accounts 2011 46 The Economist http://www.economist.com/node/16485673 47 See David McNally, “Slump, Austerity and Resistance” in The Crisis and the LeftMerlin Press, 2011 48 Financial Times HYPERLINK "#_blank" Lex Column 21 March 2012) a figure that compares very unfavourably with the European average of 18.5%. In order to bring the level of investment in Ireland up to the EU-27 average of 18.5%49, an additional €13.6 billion of investment would be needed annually. Quite simply, profit motivated private banks and big business cannot and will not break this log-jam. The only way to reverse the downward spiral is for the state to intervene by asserting control over the banks to dictate their lending and investment policies, and similarly through progressive wealth and corporate taxation (as described above), to marshal surplus wealth and resources in the economy and invest them rationally to create jobs and meet real social needs. More fundamentally, this collapse of private investment, despite increasing profits shows how the profit system does not work for ordinary people. For example, the fact that €3 trillion sits idle across the EU, while 25 million workers are in enforced idleness across Europe, demonstrates the irrationality of the capitalist system from the point of view of the majority. Only democratic planning of investment and the economy as a whole, through democratic public ownership of the key sections of the economy, can provide sustainable growth. There are many areas where there are clear social needs and demands, and where similarly, there are the human and other resources and capacities to meet these demands, if the investment is made. These are not always needs that will generate surpluses in the short term, as private capital demands, but are ones that can generate sustainable jobs and real social wealth in the medium to long term. The government, of course, claims that they simply do not have the money for this kind of investment. However, as we have already said, much of the reason for this is because of their failure to impose adequate taxes on the large accumulations of wealth, profits and incomes in the hands of a tiny minority of super-wealthy individuals and companies. The investment funds needed could be found by implementing the tax income, wealth, corporate and FTT measures proposed above. In particular, wealth could be directly diverted from paying the debts of the banks in state hands, towards job creation. Furthermore, the state is also currently wasting enormous resources maintaining over 400,000 people in forced un- or underemployment. The government have regularly admitted that the total cost of maintaining someone in unemployment, through direct unemployment payments and other costs such as rent allowances, medical cards, mortgage interest supplements etc, is in the region of €20,000 per year. The initial spiral in unemployment began with the loss of approximately 130,000 construction jobs, and was then further accelerated through the negative knock-on or “multiplier” effects of collapsing demand, leading to further job losses. Further demand reduction and job losses, of course, resulted from four years of cuts in incomes for those in work and those dependent on state payments. The ULA advocates a three year emergency jobs and economically and socially useful public works programme to; Train and employ 25,000 childcare workers to operate state run crèche facilities; and 5,000 SNA's and Resource Teachers to meet educational needs. Train and employ 10,000 adult education teachers to tackle literacy and numeracy problems 49 http://epp.eurostat.ec.europa.eu/statistics_explained/index.php/National_accounts_%E2%80%93_G DP and teach computer applications to long term unemployed. Establish computer software training/conversion courses for 10,000 unemployed in ITs. Establish a State Construction Company to; complete all planned Local Authority Regeneration Projects; replacement of all non-compliant water mains throughout the state; Develop a national rainwater harvesting programme; develop sustainable urban drainage and complete all necessary flood relief systems; Replace or upgrade all cess pits, septic tanks prioritising connections to effluent treatment plants in rural areas; construct new road base and wearing coarse to survive weather extremes; retrofit all public buildings with insulation and proper ventilation. Directly employ 70,000 workers/apprentices to carry out these works and also develop public transport, broadband and tourism infrastructure, community and primary care, education, arts and culture projects, renewable energy projects, agri-food and forestry. Directly employ 30,000 works in building new homes and adapting NAMA owned homes to provide direct Council provision. (details below). For state led development of our renewable energy, with 30,000 jobs being created in developing Ireland’s potential as an exporter of electricity generated through wind and wave energy. The jobs potential of the renewable energy supply chain in relation to development of our ports, marine services, fabrication of towers, blades and offshore platforms, foundations subsea cables , engineering services and may other areas will not be realised in this country if it is left to the private sector. Assuming a reasonably conservative jobs multiplier these measures could create another 120,000 jobs taking 300,000 in total off the dole. Aiming at a reasonable average salary of €35,000 per year for those to be directly employed by the state, it would cost the state €2.7 billion per year on top of current social welfare and other costs to put 180,000 people directly back to work or on apprenticeships, or in adult education and training Taking into account capital costs and time-frame to set this number of people directly back to work , a reasonable investment programme would require in the region of €24 billion over three years. In many of these areas the initial capital investment costs could be recovered in the medium to long-term through renewed economic growth and improved exchequer revenues. Significant tax revenue would also increase to the state as a result of 300,000 more people at work. The net cost of a €24 billion investment programme to the state would be €15 billion, as a result of the significantly increased tax revenue as a result of higher GDP.50 This jobs programme (net cost of €15 billion) could be funded through: a) The diversion of the payments currently owed to bondholders of the bailed out banks in 2013 into a Jobs Fund, from where it would be spent on these public investment projects. Irish banks including BOI, AIB and others have reserves for bond payments amounting to €17.4 billion in 2013, €5.9bn in 2014, €11.6bn in 2015. 50 See further Rory O'Farrell, An Examination of the Effects of an Investment Stimulus (http://www.nerinstitute.net/download/pdf/neri_working_paper_rof_no_4.pdf), which using the Hermin model estimates the up-front net cost of a €1 billion investment to be €575 million. Therefore a €24 billion public investment programme would have a net cost to the state of €15 billion. and b) The launch of a state-backed Jobs Bond, repayable over ten years and with a yearly interest rate of 3%. The Irish League of Credit Unions has suggested such a bond and says it has approximately €1 billion available to invest. The balance could be raised by tax changes aimed at penalising pension funds that invest outside of Ireland and encouraging investment in the state by the €78 billion held by Irish pension. Any further shortfall should come from the National Pension Fund's Discretionary Portfolio, valued at €5.8 billion at 30 June 2012. Capital and interest payments would cost €2 billion a year over ten years. For two thirds the cost of pouring money into the black hole left by Anglo Irish and National Irish Bank a huge inroad could be made into unemployment and economic stagnation replaced by real and sustainable growth in the economy. As the economy recovers all of the austerity measures affecting those on low to moderate incomes could be reversed, further stimulating demand, economic activity and jobs growth. 11. A Major three-year programme of direct state Council housing provision – costing €3 billion per year but self-financing over 10 years The continuing crisis in the provision of social housing with 100,000 families on the housing list where, according to the census, 340,000 houses and apartments lie empty across the state, is not only a moral obscenity, it is also an enormous economic and financial scandal. The failure of the state to provide Council housing directly through a combination existing housing stock in the possession of NAMA or state owned banks, and new build where more than 100,000 building workers are currently unemployed, is quite simply outrageous. This failure has a direct cost to the state of €500 million a year in rent allowance payments and leasing arrangements to private landlords. It has a further cost of approximately €500 million in rents foregone to the state, where if the state provided council housing directly to those on the housing list they would not only save the €500 billion currently being paid-out but would also generate in the region of €500 million per year in extra rental revenue. Incredibly, the new government intends to institutionalise and increase this enormous waste of money by moving away altogether from direct council housing provision, which is now to be replaced with more long term leasing arrangements with private or commercial owners of property. When challenged on these points the government claims it is attempting to identify NAMA property for social housing use and also claims it does not have the capital funds for council housing investment. This is nonsense. Firstly, the number of houses identified by NAMA for social housing use is paltry at just over 4,000. This figure barely scratches the surface of the 100,000 currently on the housing list and is a tiny fraction of the housing now lying empty across the state. While it is true, that not all empty residential property will be suitable for social housing use, it is clear that any serious effort by the government could yield a far larger quantum of the empty housing for social use, in a way that would substantially reduce the housing waiting list and reduce the enormous rent allowance bill. Furthermore, for that portion of necessary council housing that could not be filled with currently empty housing units, direct build by the state would make economic sense. The initial capital outlay required for any new direct build would be guaranteed to make a return, through rent allowance saved and rental revenue generated, in the medium to long term – more than covering the cost of the initial outlay. Furthermore, a state programme of council housing construction would put thousands of unemployed building workers back to work, yielding further savings on the social welfare bill and providing a stimulus to consumer demand. The estimated initial cost of such a programme would be €3 billion per year over three years but could be self-financing within10 years, thereafter yielding an extra €1 billion per year in rental revenue to the state. The ULA proposes, as part of the public investment programme: A new state housing programme to provide 100,000 new Council houses over 3 years through the use of empty housing units and new build. The immediate identification and transfer of all suitable empty housing into local authority ownership for the provision of council housing. A public works programme of council housing construction to make up the balance of housing needed to eliminate the housing waiting list. Direct employment by a new state construction company of 30,000 building workers to carry out refitting works and construction work on 33,000 houses per year for the 3 year programme. The phasing out of the rent allowance and leasing system - except on a short term basis where such is needed to make up temporary shortfalls in council housing. 12. Halt the privatisation of state companies & the give-away of natural resources. The government’s current commitment to sell state assets and enterprises under the “Troika” programme is utterly indefensible at every level. Currently, the government intends to sell the harvesting rights for the state forestry company, Coillte and plans to sell off substantial parts of Bord Gais. Other state enterprises that may come into the firing line, include ESB, Water services, Transport and health services, Harbours and Ports and others. It is simply incredible that companies that have been historically profitable and could act as vehicles for developing strategic enterprise and employment would even be considered for sale. Similarly, the idea that vital infrastructure in areas such as water services, transport, ports should be sold and left up to the vagaries of unstable profit-driven markets defies all logic, when we look at the economic disaster that resulted from allowing the financial system and the property sector to be dominated by private, for profit interests. The ULA would immediately abandon any plan for the sale of these vital state assets and resources, and instead invest in these assets as vehicles to drive industrial and economic development and to create jobs. The existing regime for managing Ireland’s natural resources, particularly, the tax and licensing regime for developing Ireland’s oil and gas reserves, is equally scandalous – amounting to a give-away of valuable and vital resources. The recently published pamphlet by the Dublin Shell to Sea group, Liquid Assets: Ireland’s oil and gas resources and how they could be managed for the people’s benefit, shows the extent to which enormous likely reserves of oil and gas around Irish waters are effectively being handed-over to private companies and multi-nationals. These resources, should be helping to generate employment and revenues for the country instead of lining the pockets of Petroleum industry. The Government estimates that these reserves have a value of €420 billion, in reality this is a very conservative figure and only comprises oil and gas fields off the West coast. The total amount is likely to be considerably more if reserves off the East and South coasts are also included. This does not take account of further oil and gas reserves off Ireland’s south coast. Liquid Assets details estimates from the oil companies, of over 20 billion barrels of oil equivalent in Irish territorial waters. Based on these estimates at current prices, these reserves would have a value of over €1.5 trillion. Rising oil and gas prices and significant advances in exploration and extraction technology mean these reserves will become even more attractive to explore and more commercially viable to develop over the coming years. However, the current regime for licensing and taxing the development of these resources is such that the Irish people will get little or nothing from them. At 25% corporation tax the state has the lowest tax take of any country in the world on gas and oil production, and there are no state royalties whatsoever. In reality, the effective tax rate is far lower than this, as the private oil companies can write-off all costs and losses on any exploratory work done anywhere in Irish waters over the previous 25 years. When oil or gas is found and a licence is granted for extraction, the state through a long-term leasing arrangement hands over complete ownership and control to the private oil companies. There is no legal requirement on the private companies to provide local employment or to supply the Irish market with the gas and oil they produce. Any gas or oil they might supply to Ireland will be sold to us at full market price. This unprecedented regime for managing resources compares shamefully with Venezuela, for example, where the state take is over 90%, in Norway it is 78%, and the international average tax take is 68%. In virtually all other countries, the state directly participates in all stages of the process of developing gas and oil reserves, through production-sharing arrangements or direct state control through state oil and gas companies, and never hands over ownership of the resource to the private companies. Thus as well as receiving a far higher financial benefit from the development of their resources, they develop an indigenous industry and skills base, and have much more control over environmental concerns and other social impacts. With the nationalisation of all oil and gas reserves, a real discussion could be had in society about what portion of these resources to extract, taking into account the environmental cost. The ULA calls for Renationalisation of all privatised strategic enterprises taking services and resources out of the hand of private industry No privatisation of Coilte, Bord Gais or other state enterprises - no further hike in costs to appeal to prospective investors The establishment of a state owned gas and oil company to manage and develop of oil and gas reserves. The abolition of the current licensing regime and the re-nationalisation of all oil and gas reserves, potential and actual. 13. Reverse the cuts The ULA is committed to the reversal of the disastrous austerity that has been implemented since the crisis. The ULA proposes that the following cuts would be reversed in 2013: Abolish the Universal Social Charge for those earning less than 40,000 per year and cut the USC by 50% for those earning between 40,000 and 70,000: €2.5 Abolish the Household Tax: €160 million Lift the SNA caps – train & hire 5000 SNA’s & resource teachers Reverse the cuts to disability, mental health and childcare services: €50 million Reverse cuts in fuel allowance: €51 million Re-instate the 1 million home-help hours: €20 million Reverse the change to the income disregard for lone parents, restore entitlement to one parent family payment to 15years, restore the qualified child increase to those on CE schemes & restore concurrent payments: €20.7 million Reverse the cuts to CE schemes, Back to Education allowance and jobs initiative: €35.9 million Reverse the cuts to rent supplement: €55 million Reverse last two years increase in the current student contribution (registration fee): €33 million Reverse the reductions in 3rd level and postgraduate grants: €15.4 million Restore Christmas bonus to all welfare recipients, including pensioners: €230 million Total cost of reversing cuts: €3.1 billion The other cuts implemented so far should be reversed on the basis of economic growth and democratic planning. 14. Conclusion The economic crisis in Ireland has its own distinct national features but the international character of the current crisis, extending across Europe, the US and beyond, since the financial crash of 2007, make it clear that the situation we are facing in this country is not an aberration but rather part of a deep structural crisis of global capitalism. This is confirmed by the failure over the last four years to stem the crisis through market based solutions focused on restoring competitiveness and profitability through austerity and privatisation. In fact, the crisis has spread and deepened as a direct result of the application of these market-based solutions to a crisis that arose, in the first place, from the anarchic and irrational character of capitalist markets. Against such a background, the budgetary proposals put forward by the ULA can in no way offer a comprehensive solution to the crisis we face. The Irish economy is indissolubly linked to the wider European and global economy. Any alternative policies proposed here can only offer a temporary amelioration of the impact this crisis and its effects unless they are part of a wider European and global movement to break with logic of profit and capital. In putting forward these proposals, the ULA is attempting to show that contrary to the repeated claims of government, the ‘Troika’ and economic “experts” the resources do exist to provide an alternative to the policies of austerity, cut-backs and privatisation. However, such alternative policies cannot be implemented and will not be successful without a radical challenge by the people of this country and the people’s of Europe to an economic system that prioritises profit over people. In offering these alternative economic proposals, the ULA pledges itself to expend every effort to play its part in building a Europe-wide and international movement of workers, the unemployed, young people and pensioners to challenge the failed doctrine of austerity and private profit. Appendix 1: In figures Primary deficit: €6 billion Interest payments on the remaining debt after repudiation: €1.6 billion Reversal of cuts: €3.1 billion Total deficit to be closed: €10.7 billion Revenue generating measures: Corporation Tax: €5 billion Wealth Tax: €2.8 billion Financial Transactions Tax: €0.5 billion Income Tax: €2.5 billion Total: €10.8 billion Public Investment Programme (net cost of €15 billion) to be funded by: *Re-direction from bank bond repayments to Jobs Fund *Jobs Bond scheme *NPRF