Front-End Focus Overall Study

advertisement

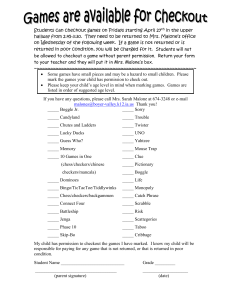

Retailer Presentation Agenda Front-End Focus Summary z Current Situation z Consumer Insights z Strategic Insights 1989-83 Retailer Presentation /7-08-03/N:ppt z Best Practices z Appendix 1 The Front-End Situation Front-End checkout is a critical location in the store z The only location everyone passes z Significant source of impulse sales z Critical location to maximize customer satisfaction Retailers are facing a changing landscape 1989-83 Retailer Presentation /7-08-03/N:ppt z There are more categories available at the checkout z Consumers are changing the way they shop z New technology is changing the transaction 2 The Checkout Is The Only Store Location All Shoppers Visit % Shoppers Visiting By Department 100 47 1989-83 Retailer Presentation /7-08-03/N:ppt 39 32 27 16 Checkout Dairy Frozen Dry Grocery General Merch. HBC SOURCE: Marsh Superstudy. 3 Consumers Spend Significant Time At The Checkstand Checkout Time 30 25 5 20 10 1989-83 Retailer Presentation /7-08-03/N:ppt 15 Shopping Time Shoppers spend 5-7 minutes at the checkout SOURCE: DHC Analysis. 4 The Front-End Checkstands Deliver $5.5 Billion In Sales To Supermarkets, But Significant Opportunities Still Exist Dollar Sales Of Products Sold At Front-End Checkstands Dollar Opportunity For Improvement Of Front-End Merchandising $5.5 Billion 1989-83 Retailer Presentation /7-08-03/N:ppt $2.0 Billion z Improving Front-End Checkout Merchandising could yield an additional $2 billion Source: FEF Study. DHC Analysis. 5 Improving Conversion Rates Of Consumers Purchasing Off The Checkout Is A Key Opportunity For Retailers % Grocery Shoppers Purchasing At Checkout Today % Grocery Shoppers Purchasing At Checkout Today By Checkout Type (Each Lane = 100%) 20% 18% 1989-83 Retailer Presentation /7-08-03/N:ppt No 82% 17% Yes 18% 12% Total Regular Express SelfCheckout z Purchase Penetration is lower on Express & Self-Checkout Lanes which is influenced by limited or no merchandising Source: FEF Study 6 Front-End Focus Sponsors Front-End Focus is a major initiative sponsored by: z Masterfoods USA z The Wm. Wrigley Jr. Company z Time Distribution Services (TDS), a division of AOL Time Warner 1989-83 Retailer Presentation /7-08-03/N:ppt z In partnership with Dechert-Hampe & Company, an independent consulting firm. 7 Front-End Focus Elements Through a comprehensive study of: z Consumer research z Retailer data analysis z Store testing The study defines: 1989-83 Retailer Presentation /7-08-03/N:ppt z Best Practices in merchandising z Ways to improve consumer shopping satisfaction z How to maximize Front-End performance 8 Front-End Focus Objectives Front-End Focus is designed to help retailers & manufacturer work together to z Gain new insights on consumer attitudes & buying behavior relative to the Front-End checkstand z Determine the impact of new developments such as self- checkout on consumer buying behavior & product sales 1989-83 Retailer Presentation /7-08-03/N:ppt z Identify opportunities to maximize sales & profit performance through implementation of Best Practices z Improve the overall productivity of the Front-End through collaboration among all the major stakeholders 9 1989-83 Retailer Presentation /7-08-03/N:ppt Scope Of The Front-End Focus Study z Research was conducted in partnership with eight leading retailers representing over 5,500 stores & 20% of U.S. Grocery Volume z Retailers provided SKU level data for almost 500 stores over a 6 month timeframe of January 1, 2002, through June 30, 2002 z Checkout planograms were collected & all stores were audited at the lane level to identify merchandising conditions z In-Store research with 1,326 consumers was conducted relative to checkout attitudes & purchase behavior at Regular, Express & SelfCheckout lanes z All research & analysis was performed by Dechert-Hampe & Company in order to ensure objective conclusions 10 1989-83 Retailer Presentation /7-08-03/N:ppt The Study Includes Data On Over Twenty Major Categories z Candy z Gum z Cookies/Crackers z Mints z Salty Snacks z Nutrition / Granola z Batteries z Meat / Other Snacks z Film/Cameras z Razors / Blades z Oral Care z Cosmetics / HBC z Magazines z Lip Care z Phone Cards z Audio / Video z Carbonated Beverages z Other General Merchandise z Non-Carbonated Beverages Source: FEF Study. DHC Analysis. 11 Front-End Focus Average Store Front-End Focus Average Store Store Volume (MM ACV) 1989-83 Retailer Presentation /7-08-03/N:ppt Checkout Sales (Per MM ACV) $22.3 $11,745 Checkout Items Carried 310 Checkout Square (Facing) Footage 50 Checkout Linear (Shelf) Footage 76 Checkout Lanes 10.7 Express 1.9 Regular/Self-Checkout 8.8 Coolers 4 Sales Of A Typical Checkstand $24,531 Profit From A Typical Checkstand $8,316 Source: FEF Study; DHC Analysis 12 Interviews With Grocery Retailers Identified Key Questions Regarding The Front-End z What is the value of the Front-End? How profitable is it? z What categories are driving Front-End sales & profits? z What categories should I stock on the Front-End? z Should I merchandise Self-Checkouts & Express Lanes? z What is the right amount of merchandising space to allocate to the check lanes? z How many Beverage coolers do I need in my stores? 1989-83 Retailer Presentation /7-08-03/N:ppt z What is the value of following Best Practices?” z How many items should I carry at the Front-End? z How much space should I provide to Confectionery, Magazines & GM/HBC? z What does an optimum Front-End look like? 13 Consumer Learning Retailers Need To Increase Purchase Levels At The Checkout Frequency Of Purchase At Grocery Checkout 46% 40% 38% 38% 1989-83 Retailer Presentation /7-08-03/N:ppt 16% Once A Week Or More 1-3 Times Per Month 22% 1998 2002 Less Than Once A Month z Retailers must focus on Front-End categories/items that are purchased frequently by many consumers Source: FEF Study 15 Candy, Gum/Mints, Magazines & Soft Drinks Are The Categories Most Commonly Purchased At Checkout % of Shoppers Buying At Checkout – National Sample 1989-83 Retailer Presentation /7-08-03/N:ppt Category Gum/Mints Candy Magazines Soft Drinks Batteries Non-Carbonated Drinks Film/Cameras Cookies/Crackers Salty Snacks Lip Care Cigarettes/Tobacco Razors/Blades Nutrition Bars Oral Care Books Phone/Gift Cards Cosmetics Audio/Video/CD z Within Last Year 72% 69% 48% 35% 28% 18% 15% 13% 13% 13% 11% 10% 6% 5% 5% 5% 3% 3% Once a Month Or More 63% 58% 34% 29% 11% 15% 5% 10% 11% 5% 9% 5% 4% 3% 5% 2% 2% 1% Retailers must question the value of having a significant number of low penetration categories/items represented at the checkout Source: FEF Study 16 Magazines & Confections Are Also The Highest Impulse Purchases % Impulse Items 84% Magazines Candy 80% Gum/Mints 71% 67% Books CD's/Video/Audio 65% Salty Snacks 61% Soft Drinks 57% Lip Care 57% Cookies/Crackers 56% Non-Carb. Drinks 49% Nutrition Bars 49% 1989-83 Retailer Presentation /7-08-03/N:ppt Film/Cameras 44% 42% Batteries Razors/Blades 39% Phone Cards Cigarettes Cosmetics Oral Care 30% 23% 21% 17% Source: FEF Study 17 Key Categories To Carry At The Checkout Score High On Penetration, Frequency & Impulse 1989-83 Retailer Presentation /7-08-03/N:ppt Low Penetration Low Frequency Low Impulse Nutrition Bars Film/Cameras Razors/Blades Lip Care Oral Care Cosmetics Phone Cards Books Audio/Video/CD Mixed Score Non-Carbonated Drinks Salty Snacks Cookies/Crackers Batteries High Penetration High Frequency High Impulse Gum/Mint Candy Magazines Soft Drinks z FEF needs to highlight the value of having high penetration, high frequency, and high impulse items at every checkout Source: FEF Study. DHC Analysis. 18 Consumers Do Not Generally “Shop” Across Checkout Lanes % Agree Completely/Somewhat 1989-83 Retailer Presentation /7-08-03/N:ppt National You sometimes select an item from one checkout counter and then go to another lane to check out 32% Sometimes you have to look at all of the checkout counters in the store just to find an item you want 18% You often select a certain checkout lane because of the particular items displayed there 16% z This underscores the importance of stocking key items at every lane Source: FEF Study 19 A Higher Percentage Of Self-Checkout Users Shop More Frequently Frequency Of Grocery Shopping 9% 24% 15% 24% Less Than Once A Week Once A Week 1989-83 Retailer Presentation /7-08-03/N:ppt More Than Once A Week 67% 61% Self-Checkout Non Self-Checkout z Merchandising self-checkout lanes can result in more frequent purchases Source: FEF Study 20 Self-Checkout Users Purchase Fewer Items Per Shopping Trip Due To The Express Nature Of These Shopping Trips Purchases Per Trip - National $42 20 Self-Checkout Non Self-Checkout $23 1989-83 Retailer Presentation /7-08-03/N:ppt 10 Units Dollars z Getting self-checkout shoppers to purchase additional items from the checkout can be a key strategy for retailers Source: FEF Study 21 Still, Some Self-Checkout Users Purchase Larger Numbers Of Items % Of Shopping Trips By Number Of Items Purchased 59% 46% 30% 29% Self-Checkout Regular Lane 24% 1989-83 Retailer Presentation /7-08-03/N:ppt 12% <10 Items 10-19 Items 20 Or More Items z Over time self-checkout lanes will become more mainstream with mainstream purchase habits Source: FEF Study 22 Self-Checkout Usage Is Skewed Toward Younger Shoppers But There Are Some Older Users % Shoppers Using Self-Checkout By Age 23% 16% 13% 5% 1989-83 Retailer Presentation /7-08-03/N:ppt 18-24 32% 27% 25-34 Regular Lane 22% 17% 9% 16% 10% 35-44 45-54 Self-Checkout 55-64 10% 65+ Age Grouping z Current merchandising of self-checkout lanes should be geared to the younger shopper Source: FEF Study 23 Front-End Focus Strategic Insights Key Strategies For The Front-End z Recognize the value of the Front-End to store sales & profits z Manage the Front-End as a department with a dedicated manager z Base decisions on total profits from sales revenue & placement fees z Focus on the power categories that drive Front-End sales & 1989-83 Retailer Presentation /7-08-03/N:ppt profits z Take advantage of the growth opportunity by adopting the Best Practices of top performing retailers 25 What Is The Value Of The Front-End In Retail Sales Dollars & Profits? z The Front-End generates $5.5 Billion in sales & represents 1.6% of store profit Total Front-End Checkout Sales 1989-83 Retailer Presentation /7-08-03/N:ppt $4.3 Billion Total Grocery $ Sales 1997 $334.5 Billion +28% Front-End Checkout $5.5 Billion 1.6 1.2 % Store Sales 2002 $398.2 Billion % Store Profits +19% Strategy: Recognize the value of the Front-End in sales & profits Source: FEF Study. Progressive Grocer. 26 How Should The Front-End Be Managed? z The Front-End is larger than many other retail categories/departments % Of Supermarket Dollar Sales 2.5 2.2 1989-83 Retailer Presentation /7-08-03/N:ppt 1.3 Pharmacy Bakery Pet Food 1.2 1.1 Total FrontEnd Checkouts** Total General Merchandise Department 0.9 Deli (SelfServe) 0.8 Total Detergents 0.7 Total Canned Vegetables Strategy: The Front-End should be managed as a department with its own Category Manager Source: DHC Analysis. A.C. Nielsen 52 weeks ending 12/28/02. Progressive Grocer, **FEF Study. 27 How Profitable Is The Front-End? z Gross Margins are much higher on the Front-End checkstand generating greater Profit Dollars Percent Of Total Profits** Gross Margin % 12.2% 33.9% 1989-83 Retailer Presentation /7-08-03/N:ppt Front-End Checkstands 25.0% Supermarket Total* 87.8% Gross Margin Dollars 12.2% Placement Fees 8.4% Racks Profits 3.8% Cost Of Racks z The majority of Total Profit Dollars are driven by selling product, not product placement fees Strategy: The Front-End should be managed to maximize total revenue including both profit from sales & placement fees *- Source: Progressive Grocer 9/15/2002. **- Includes Gross Margin % & Placement Fees. Source: FEF Study. DHC Analysis. 28 What Is The Opportunity For Improved Front-End Performance? Top Performing Retailers have a 36% advantage in performance A $2 Billion opportunity for the industry + 36% opportunity between average & top performing stores Total Checkout Sales Per $ MM ACV Index 135 99 1989-83 Retailer Presentation /7-08-03/N:ppt 70 Poor Performing Stores z Moving Medium Performing Stores Top Performing Stores Poor & Medium performing stores to Top performing stores could yield an additional $2 Billion in sales Strategy: Take advantage of this opportunity by adopting the Best Practices of Top Performing Retailers Source: FEF Study. DHC Analysis. 29 What Categories Drive Front-End Sales & Profits? 1989-83 Retailer Presentation /7-08-03/N:ppt z Magazines, Confectionery & Beverages generate 80% of sales profits Category Share of Checkout Dollar Sales Share of Checkout Total Profits1 Magazines Confectionery* Beverages** Film/Cameras Snacks*** Batteries Razors/Blades Other GM/HBC Cookies/Crackers Oral Care Phone Cards Lip Care 33.7% 31.7% 14.6% 4.5% 3.9% 3.4% 3.4% 2.0% 0.8% 0.7% 0.7% 0.6% 30.0% 33.8% 16.2% 3.6% 3.0% 4.7% 2.9% 2.2% 0.6% 0.8% 0.6% 0.9% 80% 80% Strategy: Focus on the key categories to maximize checkout performance *- Includes Candy, Gum, Mints. ** - Includes Carbonated & Non-Carbonated Drinks. *** - Includes Salty, Meat, Nutritional. 1 - Includes Gross Margin & Placement Fees. Source: FEF Study. DHC Analysis. 30 What Categories Provide The Greatest Opportunity At The Front-End? z The largest opportunity gap exists with Confectionery, Magazines & Beverages 1989-83 Retailer Presentation /7-08-03/N:ppt Sales Per $ MM ACV Difference Between Medium & Top Performing Stores Category Growth Opportunity Per $ MM ACV % Of Total Growth Confectionery $1,501 36.0% Magazines $1,262 30.3% Beverages $577 13.9% Film/Cameras $150 3.6% Razor/Blades $130 3.1% Batteries $89 2.1% All Other $456 11.0% Total $4,165 100% 80% Strategy: Focus performance improvement on the key categories that offer the greatest opportunity Source: FEF Study. DHC Analysis. 31 Best Practices How Should I Decide What Categories To Stock At The Front-End? Best Practice: Manage the Front-End based on consumer buying behavior. Focus on categories that have high Household Penetration, Purchase Frequency & provide impulse purchases 1989-83 Retailer Presentation /7-08-03/N:ppt Low Penetration Low Frequency Low Impulse Nutrition Bars Film/Cameras Razors/Blades Lip Care Oral Care Cosmetics Phone Cards Books Audio/Video/CD 1. 2. 3. Mixed Score High Penetration High Frequency High Impulse Non-Carbonated Drinks Salty Snacks Cookies/Crackers Batteries Gum/Mint Candy Magazines Soft Drinks Give broad exposure to the “High” categories: Confectionery, Magazines & Soft Drinks Provide some exposure to “Mixed” categories, but not a key focus Limit exposure of the “Low” categories to top sellers. These are usually available elsewhere in the store Source: FEF Study. DHC Analysis. 33 What Categories Should I Stock At The Front-End? Best Practice: Focus on Confectionery & Magazines to drive consumer buying at the Front-End 1989-83 Retailer Presentation /7-08-03/N:ppt Percent of Front-End Shoppers that Category $ Share Of Checkstand Purchased At Checkout Within Last Year Purchased At Checkout Once A Month Or More Percent Of Purchases That Were Impulse Magazines 33.7% 48% 34% 84% Gum/Mints 17.3% 72% 63% 71% Candy 14.4% 69% 58% 80% Carbonated Beverages 11.1% 35% 29% 57% Non-Carb. Beverages 3.5% 18% 15% 49% Source: FEF Study. DHC Analysis. 34 How Much Space & How Many Items Are Needed At The Checkout? Best Practice: Allocate at least 76 linear feet to each checkout & carry 301 to 350 items, at the Front-End Total Checkout Sales Per $ MM ACV Index By Linear Feet/Lane By Number Of Items Per Store 125 100 88 98 106 108 112 96 104 101 75 108 98 108 89 85 72 50 Sales/MM ACV Index 1989-83 Retailer Presentation /7-08-03/N:ppt 25 Under 65' 66'-75' 76'-85' 86'+ Sales/MM ACV/Per Item Index 0 Under 250 250-300 301-325 326-350 Over 350 # Of Items The typical store had 76 linear feet per lane & carried 310 items across all lanes on the Front-End z Top Performing Stores dedicated more space & carried up to 350 items z Source: FEF Study. DHC Analysis. 35 What Is The Best Way To Merchandise Confectionery? Best Practice: Stock some Confectionery on both sides of the lane Confectionery Sales Per $ MM ACV Index 1989-83 Retailer Presentation /7-08-03/N:ppt 96 Confectionery One Side 115 Confectionery Both Sides Total Checkout Sales Per $ MM ACV Index 98 Confectionery One Side 106 Confectionery Both Sides Increased consumer exposure to Confectionery drives checkout purchases z Stores stocking Confectionery on both sides realize greater Confectionery & Total Checkout Performance z Source: FEF Study. DHC Analysis. 36 Do I Need To Stock Confectionery On Every Lane? Best Practice: Stock a selection of Confectionery items on every lane Sales Per $ MM ACV Index Confectionery 98 Total Checkout 106 116 83 73 89 99 101 107 1989-83 Retailer Presentation /7-08-03/N:ppt 55 1%-50% 51%-75% 76%-85% 86%-95% 96%-100% % Of Lanes Stocking 1%-50% 51%-75% 76%-85% 86%-95% 96%-100% % Of Lanes Stocking z Retailers that stock Confectionery on every lane enjoy greater performance Source: FEF Study. DHC Analysis. 37 How Should Magazines Be Merchandised At The Front-End? Best Practice: Magazines should be merchandised both in the lane & on end caps Magazine Sales Per $ MM ACV Index 87 1989-83 Retailer Presentation /7-08-03/N:ppt End Cap Only 95 In The Lane/Over Belt Only 102 In The Lane+End Cap Total Checkout Sales Per $ MM ACV Index 92 End Cap Only 102 94 In The Lane/Over Belt Only In The Lane+End Cap z This provides for an enhanced consumer purchasing opportunity z Both Magazine & Total Checkout performance is improved Source: FEF Study. DHC Analysis. 38 How Many Beverage Coolers Do I Need In My Stores? Best Practice: Beverage Coolers should be located on 26 to 33% of lanes Beverage Sales Per $ MM ACV Index By Percent Of Lanes Stocking 98 1989-83 Retailer Presentation /7-08-03/N:ppt 25% Or Less 102 26%-33% 101 34%-50% Total Checkout Sales Per $ MM ACV Index 99 Over 50% 90 25% Or Less 97 26%-33% 108 103 34%-50% Over 50% % Lanes With Cooler z Beverage sales do not increase significantly by simply adding coolers z Total checkout sales are higher, but this is driven by other factors Source: FEF Study. DHC Analysis. 39 Increased Checkout Performance Is Driven By Confectionery, Not Coolers Total Checkout Sales Per $MM ACV Index 90 97 103 108 1989-83 Retailer Presentation /7-08-03/N:ppt Confectionery G.M. and Other Magazines Beverages 25% Or Less 26% -33% 34% -50% Over 50% % Lanes With Cooler % of Lanes With Confectionery # of Confectionery UPC’s Carried z 72% 112 79% 118 92% 121 96% 131 Stores with more Coolers also stock and sell more Confectionery. It is this, not the Coolers, that drives total performance. Source: FEF Study. DHC Analysis. 40 Increased Checkout Performance Is Driven By Confectionery, Not Coolers Total Checkout Sales Per $MM ACV Index 120 120 102 100 98 97 90 80 104 108 Confectionery Total Checkout 103 101 99 Beverages 91 83 1989-83 Retailer Presentation /7-08-03/N:ppt 60 25% Or Less 26%-33% 34%-50% Over 50% % Lanes With Cooler % of Lanes With Confectionery # of Confectionery UPC’s Carried z 72% 112 79% 118 92% 121 96% 131 Stores with more Coolers also stock and sell more Confectionery. It is this, not the Coolers, that drives total performance. Source: FEF Study. DHC Analysis. 41 How Many Magazine Titles Should I Carry? Best Practice: Maximize Magazine sales by focusing on best selling titles Magazine Sales Per $ MM ACV Index 98 1989-83 Retailer Presentation /7-08-03/N:ppt 50-68 102 69-79 100 80-100 Number Of Titles 115 102 80 62% 70% 79% % Best Sellers z Stocking more Magazine titles is not as important as carrying the right assortment Source: FEF Study. DHC Analysis. 42 Should Confectionery Be Stocked On The Express Lanes? Best Practice: Stock Confectionery on Express as well as Regular lanes Sales Per $ MM ACV Index Total Confectionery Sales 104 1989-83 Retailer Presentation /7-08-03/N:ppt 84 Confectionery Not On Express Lanes z z Confectionery On Express Total Checkout Sales 91 Confectionery Not On Express Lanes 102 Confectionery On Express Confectionery is the most common purchase at the express lane Stores stocking Confectionery on express lanes outperform stores that don’t Source: FEF Study. DHC Analysis. 43 Should I Merchandise Self-Checkout Lanes? Best Practice: Be sure to merchandise self-checkout lanes to avoid lost sales Frequency Of Grocery Shopping 1989-83 Retailer Presentation /7-08-03/N:ppt 9% 24% 15% 24% 67% 61% Self-Checkout Non Self-Checkout More Than Once A Week % Of Grocery Shoppers Who Purchase At Checkout Today (Each Lane = 100%) Once A Week 20% Regular Lane 17% Express Lane 12% Self-Checkout Lane Less Than Once A Week z Self-checkout shoppers shop more frequently but fewer shoppers actually purchase at the checkstand Source: FEF Study. DHC Analysis. 44 How Should I Merchandise My Self-Checkout Lanes? Best Practice: Merchandise self-checkout lanes with “High Penetration” & frequently purchased categories such as Confectionery & Magazines Consumers % That Agree Completely/Somewhat You often select a certain checkout lane because of the particular items displayed there 1989-83 Retailer Presentation /7-08-03/N:ppt You sometimes select an item from one checkout counter & then go to another lane to check out 16% % Purchased Product At Grocery Checkout Today (Each Lane = 100%) 12 14 10 4 32% All SelfCheckout Lanes Self-Checkout With Full Merchandising Self-Checkout With Limited Assortment Self-Checkout With No Product Merchandising z Consumers do not generally “shop” across checkout lanes z Merchandising at a self-checkout checkout is extremely important Source: FEF Study. DHC Analysis. 45 What Percentage Of My Space Should I Allocate To The Confectionery Category? Best Practice: Allocate at least 51% of the linear feet available to Confectionery to drive higher sales Sales Per $ MM ACV Index Total Confectionery 91 1989-83 Retailer Presentation /7-08-03/N:ppt 33%-42% 100 43%-50% Total Checkout 106 51% And Above 93 33%-42% 106 99 43%-50% 51% And Above % Of Linear Space Allocated To Confectionery z Providing adequate space to Confectionery drives both Confectionery & Total Checkout Sales Source: FEF Study. DHC Analysis. 46 What Size Confectionery Rack Do I Need? Best Practice: Where space allows, use a Confectionery Rack of 49” or more Confectionery Sales Per $ MM ACV Index 116 Total Checkout Sales Per $ MM ACV Index 130 1989-83 Retailer Presentation /7-08-03/N:ppt 92 48" And Under 49"-55" *Over 55" 48" And Under 115 108 98 94 99 101 49"-55" 104 *Over 55" Width Of Confectionery Rack z A wider Confectionery rack can result in greater sales & total checkout performance *- Limited store count. Source: FEF Study. DHC Analysis. 47 How Much Space Should I Allocate To The GM/HBC Categories? Best Practice: Provide GM/HBC with no more than 15% of the linear feet available at the checkout Sales Per $ MM ACV Index Total GM/HBC* Total Checkout 116 94 96 100 98 1989-83 Retailer Presentation /7-08-03/N:ppt Less than 6%-10% 11%-15% 16% And 5% Over 102 101 93 Less than 6%-10% 11%-15% 16% And 5% Over % Of Linear Space Allocated To GM/HBC* z At 16% of space & over, GM/HBC* sales increase but total checkout sales suffer *- Includes Batteries, Razors/Blades, Cameras/Film, Lip Care, Oral Care, Lighters, Phone Cards, Hair Care, Analgesics, etc. Source: FEF Study. DHC Analysis. 48 How Much Space Should I Devote To Each Major Group Of Products At The Front-End? Best Practice: Allocate space to optimize the total checkout performance 1989-83 Retailer Presentation /7-08-03/N:ppt Recommended Space Allocations Category % Linear Feet What Does That Mean? Confectionery 50%+ Confectionery on every lane with at least a 48” wide rack Magazines 30-33% Magazines on every lane with placement over the belt and on end caps where coolers are not in place. GM/HBC* 7-10% 18” to 24” rack on lanes where coolers do not exist. No more than 75% of the lanes. Beverages 2-4% Coolers no more than every 3 lanes. Snacks** 2-3% Carried on top of Beverage coolers. Cookies/Crackers 1-2% Carried on top of Beverage coolers. z Leading retailers balance space to profits within the suggested ranges *- Includes Batteries, Razors/Blades, Cameras/Film, Lip Care, Oral Care, Lighters, Phone Cards, Hair Care, Analgesics, etc. **- Includes Salty, Meat, Nutritional. Source: FEF Study. DHC Analysis. 49 1989-83 Retailer Presentation /7-08-03/N:ppt Take Advantage Of The $2 Billion Opportunity By Implementing The Best Practices At The Front-End z Top performing retailers have at least 76 linear feet of merchandising space on a lane & carry 301 to 350 items at the Front-End z Products merchandised at the checkout should be driven by consumer buying behavior. Select items with high penetration, high frequency & impulse appeal z Focus should be on the top categories that represent 80% of sales & profits: Confectionery, Magazines & Beverages z Carry Confectionery on all the lanes including express. Merchandise it on both sides of the consumer. Where space allows, use at least a 49” rack z Maximize Magazine presence at the Front-End. Merchandise Magazines on end caps as well as in the lane to enable consumer buying opportunities 50 The Best Practices At The Front-End (Cont’d) z Make sure top selling Magazine titles are broadly available. It is more important to carry the right titles than a large number of titles at the Front-End z Place Beverage coolers on end caps at 26% to 33% of the checkout lanes. Unlike other categories, the majority of Beverage sales are in a few key items z Provide up to 15% of linear space for GM/HBC. Remember 1989-83 Retailer Presentation /7-08-03/N:ppt that most of these items are need driven & located elsewhere in the store. Focus on just a few key items in each category z Be sure to merchandise the self-checkout lanes. Most consumers do not shop across the lanes. At a minimum, carry an assortment of popular Confectionery & Magazines 51 Best Practices Checklist BEST PRACTICES CHECKSTAND • • • • Devote at least 76 linear feet Stock 301 to 350 items Generate at least 80% of sales from power categories of Confectionery, Magazines, Beverages Merchandise self-scan lanes with Confectionery and Magazines CONFECTIONERY • • • • Stock on all lanes Allocate 51% or more space Rack size at least 49” Stock on both sides of aisle 1989-83 Retailer Presentation /7-08-03/N:ppt MAGAZINES • • • Merchandise end-cap and in-line Allocate at least 30-33% of space Focus on best sellers – 79% BEVERAGES • Beverage coolers on 26-33% of lanes GM/HBC • Allocate 11-15% of space 52 Contact Information 1989-83 Retailer Presentation /7-08-03/N:ppt For more information, call Bill Dusek or Ray Jones at 847-559-0490 53 Appendix Consumer Findings Magazines, Confectionery, And Beverages Are Impulse Categories That Have High Household Penetration And Are Purchased Frequently Percent Of Front-End Shoppers That: Purchased At Checkout Within Last Year Purchased At Checkout Once A Month Or More Percent Of Checkout Purchases That Were Impulse Magazines 48% 34% 84% Candy 69% 58% 80% Gum/Mints 72% 63% 71% Carbonated Beverages 35% 29% 57% Non-Carbonated Beverages 18% 15% 49% Batteries 28% 11% 42% Film/Cameras 15% 5% 44% Razors/Blades 10% 5% 39% Salty Snacks (Salty, Meat, Nutritional) 13% 11% 61% Cookies/Crackers 13% 10% 56% Oral Care 5% 3% 21% Lip Care 13% 5% 57% Other GM/HBC 3% 2% 21% Phone Cards 5% 2% 30% 1989-83 Retailer Presentation /7-08-03/N:ppt Category Source: FEF Study 56 Shoppers Like The Convenience Of Self-Checkout % of Shoppers 1989-83 Retailer Presentation /7-08-03/N:ppt Likes about Self-Checkout Dislikes about Self-Checkout Convenience 88% Need Attendant help 13% Quick/Save Time 62% Codes don’t checkout 11% No or shorter line 35% Need for lookups 10% Do not deal with store employees 14% Payment issues 4% Hard to use coupons 4% Slow 4% Need to use instructions 4% Limit on number of items 4% Bag own groceries 4% z There are a few common concerns, but none are major Source: FEF Study 57 Ethnic Consumers Tend To Be Heavy Buyers At The Front-End Checkout FRONT-END PURCHASE FREQUENCY INDICES 1989-83 Retailer Presentation /7-08-03/N:ppt Index Of African-American & Hispanic Consumers To All Consumers AfricanAmerican Consumers Hispanic Consumers Heavy (Once a Week or More) 128 150 Medium (1-3 Times Per Month) 105 92 41 23 Light (Less Than Once A Month) z Ethnic consumers purchase products carried at the checkstand more frequently Source: FEF Study. DHC Analysis. 58 Ethnic Consumers Purchase More Impulse Categories Such As Confectionery, Carbonated Beverages, And Cookies FRONT-END PURCHASE FREQUENCY INDICES % Purchased In Last Year Index Of African-American & Hispanic Consumers To All Consumers 1989-83 Retailer Presentation /7-08-03/N:ppt African-American Consumers Hispanic Consumers Gum/Mint 114 106 Candy 114 103 Carbonated Beverages 134 140 Batteries 118 114 Non-Carbonated Beverages 144 56 Film/Cameras 113 147 Cookies/Crackers 161 154 Lip Care 138 115 Phone/Gift Cards 180 200 z Phone Cards are also a category that a higher percentage of AfricanAmerican and Hispanic consumers purchase Source: FEF Study. DHC Analysis. 59 Consumers Tend To Switch Lanes For Need, Not Impulse z Only 33% of consumers said they would switch lanes to buy something at checkout 1989-83 Retailer Presentation /7-08-03/N:ppt Switching Index By Category Gum/Mints Magazines Candy 64 67 75 Film Soft Drinks Batteries 103 125 125 Razors Cigarettes 180 278 Impulse Need Source: FEF Study 60 Other Findings Confectionery And Magazines Contribute Almost 2/3 Of Front-End Sales And Profits 1989-83 Retailer Presentation /7-08-03/N:ppt Category Dollar Shares Share of Total Profits* Magazines 33.7% 30.0% Total Confections 31.7% 33.8% Candy 14.4% 14.7% Gum 12.4% 13.6% Mints 4.9% 5.5% Total Beverages 14.5% 16.2% Carbonated 10.9% NA# Non-Carbonated 3.6% NA# Film/Cameras 4.5% 3.7% Salty Snacks** 3.9% 3.1% Batteries 3.4% 3.9% Razors/Blades 3.4% 3.0% Other GM/HBC 2.0% 2.6% Cookies/Crackers 0.8% 1.0% Oral Care 0.7% 0.8% Phone Cards 0.7% 1.0% Lip Care 0.6% 0.9% *- Includes Gross Margin & Rack Fees. **- Includes Salty, Meat, Nutritional. #- Cooler fees not broken out by Carbonated vs. NonCarbonated. Source: FEF Study 62 Magazines And Confectionery Generate 66% Of Front-End Sales And Occupy 78% Of The FrontEnd Space Dollar Shares 33.7% Magazines Total Confections 22.6% 12.4% 4.9% Total Beverages 1989-83 Retailer Presentation /7-08-03/N:ppt 47.9% 14.4% Gum Carbonated 30.7% 31.7% Candy Mints Share of Linear Feet 14.5% 10.9% Non-Carbonated 3.6% Salty Snacks* 3.9% Film/Cameras 16.4% 8.9% 4.3% 3.1% 1.2% 3.7% 4.5% 1.7% Razors/Blades 3.4% 0.9% Batteries 3.4% 1.7% Other GM/HBC 2.0% 3.9% Cookies/Crackers 0.8% 2.1% Oral Care 0.7% 0.7% Lip Care 0.6% 1.4% Phone Cards 0.5% 1.0% Source: FEF Study *- Includes Salty, Meat, Nutritional. 63 What Is The Impact Of Having Confection Free Lanes? Best Practice: Stock a selection of Confectionery items on every lane. Sales Per $ MM ACV Index Total Confectionery Sales Total Checkout Sales 111 95 1989-83 Retailer Presentation /7-08-03/N:ppt 84 Stores With Confectionery Free Lanes z Stores Without Confectionery Free Lanes Stores With Confectionery Free Lanes 103 Stores Without Confectionery Free Lanes Retailers that do not have Confectionery free lanes enjoy a greater performance for Confectionery and the total checkout Source: FEF Study. DHC Analysis. 64 Miscellaneous 1989-83 Retailer Presentation /7-08-03/N:ppt Profit Assumptions Were Generated With The Assistance Of Alliance Retailers And The Source Interlink Companies Category Gross Margin* Rack Fees# Commitment* Magazines 30% $22.28 Per Pocket 3 Years Candy 36% $2.00 Per Inch 3 Years Gum 40% $2.00 Per Inch 3 Years Mints 40% $2.00 Per Inch 3 Years Carbonated Beverages 40% $500 Per Cooler 1 Year Non-Carbonated Beverages 35% $500 Per Cooler 1 Year Batteries 35% $17.50 Per Peg 1 Year Film/Cameras 25% $13.50 Per Peg 1 Year Razors/Blades 30% $13.50 Per Peg 1 Year Salty Snacks (Salty, Meat, Nutritional) 28% $2.00 Per Inch 3 Years Cookies/Crackers 40% $2.00 Per Inch 3 Years Oral Care 30% $13.50 Per Peg 1 Year Lip Care 30% $13.50 Per Peg 1 Year Other GM/HBC 40% $13.50 Per Peg 1 Year Phone Cards 35% $13.50 Per Peg 1 Year Source: *- Retailer Input. #- Interlink Companies. 66 1989-83 Retailer Presentation /7-08-03/N:ppt Other Categories Have Invaded The Checkout Lanes z Candles z Children’s Toys z Stuffed Animals z Match Box Cars z Coloring Books z Fireplace Logs z Work Gloves z Dieting Aids z Ear Plugs z Bagged Candy z Cotton Balls z Trading Cards z Walkie Talkies z Facial Tissue z Canned Cookies z Plastic Table Clothes z Ribbons z Air Fresheners z Charcoal Lighter Fluid z Long Neck Lighters z Remote Control Cars z Maps z Playing Cards z Hair Brushes z Greeting Cards z Children Stickers z Crayons z Small Dolls z Rubber Gloves z Scouring Pads z Paper Cups z Scotch Tape z Balloons z Eye Glass Repair Kits z Scissors z Vitamins z Analgesic Rubs z Bakery z Doughnuts z Pizza Cutters z Lint Traps z Windshield Solvent z Rotisserie Chicken z Foot Stones z Blowing Bubbles Source: FEF Study 67