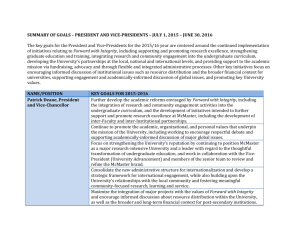

annual financial report 2012/2013

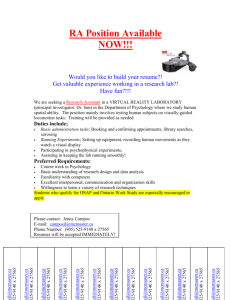

advertisement