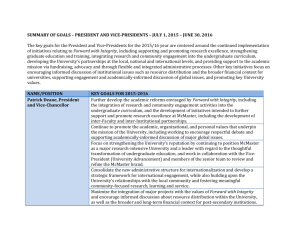

2007 Financial Statements for year ended April 30, 2007

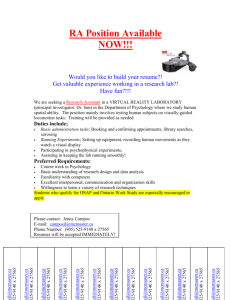

advertisement