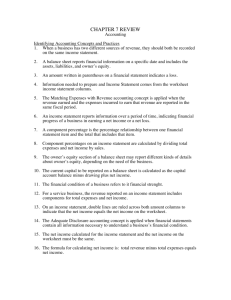

Community Resource Center (Clt)

advertisement