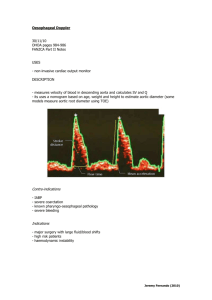

state consumer protection act pilot study

advertisement