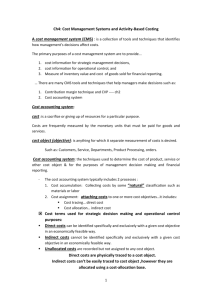

Measuring Cost of Operations

advertisement