The Importance of Financial Controls

advertisement

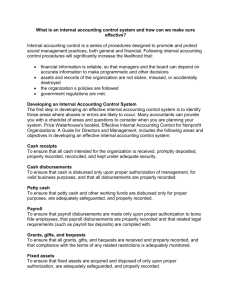

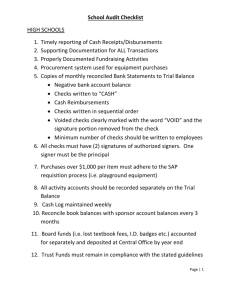

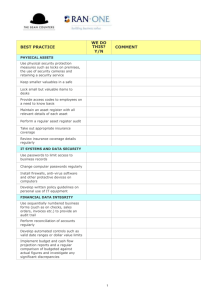

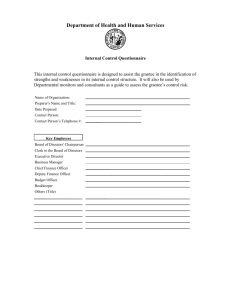

The Importance of Financial Controls Running a well-managed, healthy business requires the use of financial controls. A business owner needs to be on top of its revenue sources, expenses, cash flow, inventory levels, etc. If you don’t know where your money is going, it could soon be gone. It doesn’t matter how unique and wonderful your business is, your business can’t survive without cash flow. Money coming in is the vital component that keeps your business financially healthy. If you budget wisely and know the interval of your monthly income and expenses, you won’t have to worry about running out of money. In addition, all businesses need to manage inventory. It is your money sitting on a shelf and it represents a large portion of your business investment. Without adequate records and controls to manage this, slow moving inventory becomes dated and costly. Another important reason for financial controls is to help prevent employee theft. Are you doing everything you can to prevent employee theft in your business? You should do the following: Have separate employees handle bank reconciliation and financial transactions. The person making the deposits should never be the one doing the reconciling. Such a "division of labor" also works well for disbursements - have different employees pay vendor bills and monitor invoices and balances due. Spot-check your vendor list for companies you don’t recognize, and make sure charges are correctly entered into your computer system. When signing checks, use only original invoices, no photocopies, and make sure the invoice is dated and marked paid. Above all, let employees know you’re watching things. Ask for explanations. Be seen reconciling the bank statement - and have it mailed to your home. Good financial records are like the instruments on an airplane, they keep you posted of your progress to goals, your direction and efficiency. Without them you’re flying blind with no controls to guide you to your destination. For your convenience, below is a checklist of financial controls important to running a business that you can print off and use. This list is provided by the United States Small Business Administration (SBA) website. This website has very valuable information for small business. To locate this website and other websites that serve as good business resources go to Western Bank’s website at www.western-bank.com and click on tools and then on resources. Financial Controls Checklist – Provided By U.S. Sba Website How well are you managing the financial aspects of your business? Implementing and maintaining internal financial controls are important aspects of running a successful business. Review the checklist below. Owners of well-managed businesses should be able to answer ‘yes’ to most of the following questions: 1. General Is a chart of accounts used? Is it detailed enough to give adequate management information? Is a double entry bookkeeping system used? Who approves journal entries? Does the owner understand the form and contents of the financial statements? Does the owner use budgets and cash projections? Are they compared to actual results Are major discrepancies investigated? Are comparative financial statements produced? Are the books and records kept up-to-date and balanced? Who is responsible for producing financial information? Are reasonable due dates imposed? Is staff cross-trained in accounting functions? Are annual vacations required? Are storage facilities safe from fire, etc.? Is access to accounting records restricted when appropriate? Are employees bonded? Is insurance coverage regularly reviewed? Is there a records retention schedule used? Is the owner satisfied that all employees are competent and honest? Are job references checked? 2. Revenues Is there a policy for credit approval? Are credit files kept current? Are credit checks done regularly? Are sales orders approved for: o Price o Terms o Credit Account balance limits? Are all sales orders recorded on pre-numbered forms and are all numbers accounted for? Are sales invoices compared to shipping documents? Are sales invoices recorded promptly? Are credit memos pre-numbered, accounted for, approved? Are monthly statements for outstanding balances reviewed by the owner? Mailed by the owner or responsible employee other than the bookkeeper? Is accounts receivable subsidiary ledger balanced monthly to control account? Is an aging schedule of customers’ accounts prepared monthly? Are write-offs and other adjustments to customer accounts authorized by the owner? 3. Cash Receipts Does the owner or a responsible employee other than the bookkeeper or person who maintains accounts receivable detail: o Open the mail and pre-list all cash receipts before turning them over to the bookkeeper? o Stamp all checks with restrictive endorsement "for deposit only" before turning them over to the bookkeeper? o Compare daily pre-listing of cash receipts with: Cash receipts journal? Duplicate deposit slip? Are cash receipts deposited intact on a daily basis? Are cash receipts posted promptly to appropriate journals? Are cash sales controlled by cash registers or pre-numbered cash receipts forms? 4. Cash Disbursements Are all disbursements except for petty cash made by check? Are checks pre-numbered and all numbers accounted for? Are all checks recorded when issued? Are all unused checks safeguarded, with access limited? Is a mechanical check protector used to inscribe amounts as a precaution against alterations? Are voided checks retained and mutilated? Are all checks signed by the owner? If a signature plate is used, is it under the sole control of the owner? Are supporting documents, processed invoices, receiving reports, purchase orders, presented with the checks and reviewed by the owner before s/he signs the checks? Are supporting documents for checks properly cancelled to avoid duplicate payment? Are checks payable to cash prohibited? Are signed checks mailed by someone other than the person who writes the checks? Are bank statements and cancelled checks: o Received directly by the owner? o Reviewed by the owner before they are given to the bookkeeper? Are bank reconciliations prepared: o Monthly for all accounts? o By someone other than the person authorized to sign checks or use a signature plate than the owner? Are bank reconciliations reviewed and are adjustments of the cash accounts approved by the owner. Are all disbursements from petty cash funds supported by approved vouchers? Is there a predetermined maximum dollar limit on the amounts of individual petty cash disbursements? o Are petty cash funds on an impress basis and kept in a safe place? o Reasonable in amount so that the fund ordinarily requires reimbursement at least monthly? o Controlled by one person? o Periodically counted by someone other than the custodian? 5. Accounts Payable Are vendor invoices: Matched with applicable purchasing orders? Matched with applicable receiving reports? Reviewed for correctness of o Quantities received? o Prices charged? o Clerical accuracy? o Account distribution? Are all available discounts taken? Is there written evidence that invoices have been properly processed before payment? Are there procedures which provide that direct shipments to customers, if any are properly billed to them? Does the owner verify that the trial balance of accounts payable agrees with the general ledger control account? Are expense reimbursement requests: o Submitted properly? o Adequately supported? o Approved before payment? 6. Receiving Are all materials inspected for condition and independently counted, measured, or weighed when received? Are receiving reports used and prepared promptly? Are receiving reports subjected to the following: o Pre-numbering and accounting for the sequence of all numbers? o Copies promptly provided to those who perform the purchasing and accounts payable function? o Controlled so that liability may be determined for materials received buy not yet invoiced? 7. Payroll Are all employees hired by the owner? Are individual personnel files maintained? Is access to personnel files limited to the owner or a designee who is independent of cash functions? Are wages, salaries, commission and piece rates approved by the owner? Is proper authorization obtained for payroll deductions? Is gross pay determined using authorized rates and: o Adequate time records for employees paid by the hour? o Piecework records for employees whose wages are based on production? o Are piecework records reconciled with sales records? o Are sales people’s commission records reconciled with sales records? If employees punch time clocks, are the clocks located so they may be watched by someone in authority? Are time records for hourly employees approved by a foreman or supervisor? Would the owner be aware of the absence of any employee? Is the clerical accuracy of the payroll checked? Are payroll registers reviewed by the owner? Does the owner approve, sign, and distribute payroll checks? If employees are paid in cash, does the owner compare the cash requisition to the net payroll? Does the owner maintain control over unclaimed payroll checks? Your business is unique, please consult with an appropriate advisor before making any decisions based on this information. While all information was obtained from resources believed to be reliable, Western Bank and its marketing affiliate cannot guarantee that the information is complete or accurate. Western Bank’s Business Line is intended to provide general information only and should not be construed as legal, accounting, tax or other professional advice.