the history of electric deregulation in texas

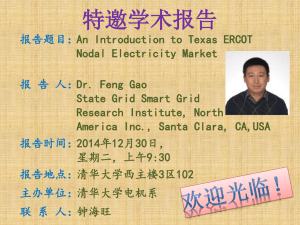

advertisement