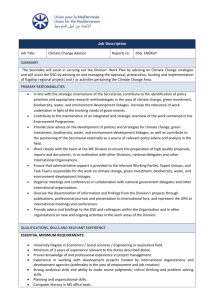

Annual Report - DSG International (Thailand)

advertisement