Annual Report 2011 (PDF:7.11MB)

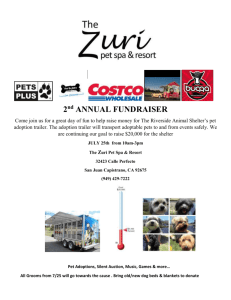

advertisement