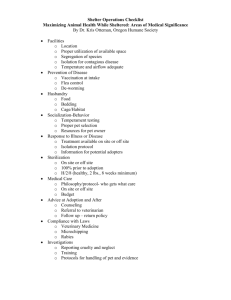

Annual Report 2010

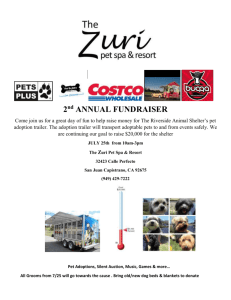

advertisement