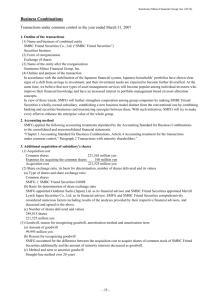

Annual Report 2009 (PDF:6.11MB)

advertisement