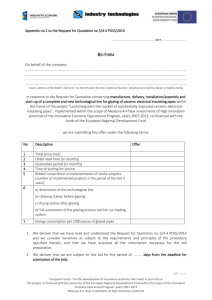

Introduction to Australian takeovers

advertisement

Introduction to

Australian takeovers

2014

Contents

Introduction

4

When do the takeover rules apply?

4

Deciding between types of bids, or scheme

5

Consideration

5

Speed

5

Conditions

5

Payment to target holders

5

Costs

5

Proportional offers

5

Significant ownership thresholds

6

Issues before announcing the bid

6

Acquiring a pre-bid stake

6

Choice of bid vehicle

7

Insider trading

7

The initial approach

7

Agreement with Target

7

Minimum bid price

8

Cash consideration

8

Potential prospectus level disclosure

8

Offer period

9

Conditions

9

Capital gains tax relief for scrip takeovers

9

Constraints outside the Corporations Act

9

Competition issues

9

Foreign investment rules

10

Banking and insurance companies

11

Broadcasting

11

Issues that may arise during the offer period

11

Acquiring securities on-market during the bid period

11

Variation in bid price

12

Supplementary takeover documents

12

MINTER ELLISON | INTRODUCTION TO AUSTRALIAN TAKEOVERS 2014

2 of 23

Waiver of conditions

12

Extension of offer period

12

Withdrawal

13

Sale into a rival bid

13

Compulsory acquisition

13

Schemes of Arrangement

13

Schemes versus Takeovers

13

Procedural differences

14

Process of a scheme

14

Drafting the scheme documents

14

First Court hearing

14

Dispatch information to shareholders

14

Shareholders' meeting

14

Second Court hearing

15

Approval and implementation

15

Takeovers Panel

15

Powers

15

Declaration of unacceptable circumstances

15

Membership

15

Proceedings

16

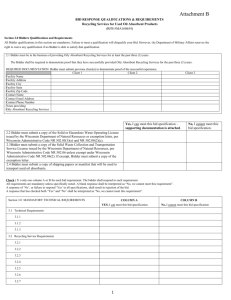

Timetables

17

Indicative timetable for an off-market bid

17

Indicative timetable for a market bid

18

Indicative timetable for a scheme of arrangement

19

About Minter Ellison

21

Minter Ellison offices

22

MINTER ELLISON | INTRODUCTION TO AUSTRALIAN TAKEOVERS 2014

3 of 23

Introduction

When do the takeover rules apply?

The takeover provisions in the Corporations Act 2001 (Cth) (Corporations Act) prohibit a person from acquiring

voting shares or interests above the 20% level, unless the person uses one of several permitted transaction

types.

The provisions apply where a person acquires a 'relevant interest' in:

• voting shares in a listed company

• voting shares in an unlisted company with more than 50 members

• voting interests in a listed managed investment scheme,

with the result of increasing that person's 'voting power' in the target company to more than 20%.

A person has a relevant interest where they can exercise or control the voting rights attached to the securities

or dispose of, or control the disposal of, the securities. Relevant interests can also arise in other circumstances,

such as certain agreements relating to target securities entered into with a target holder.

Voting power is the aggregate percentage of total votes in the target in which a person and the person's

associates have a relevant interest.

In the context of a takeover, a person's associate is:

• if the person is a body corporate – another body corporate controlled by, controlling or with the same

controller as, the person

• another person with whom there is, or is proposed to be, an arrangement for the purpose of controlling or

influencing the target board's composition or the conduct of the target's affairs

• another person with whom they are acting, or proposing to act, in concert in relation to the target's affairs.

There are two kinds of takeover bids:

• off-market bids – where offers for unquoted or quoted securities are sent directly to target holders

• market bids – where a bidder's broker offers to buy quoted securities through the relevant stock exchange.

A takeover bid can be made for different types of securities, including:

• voting shares

• non-voting shares

• options over shares or other securities

• convertible notes, and

• debentures.

A scheme of arrangement can be used as an alternative to a friendly off-market takeover bid.

'Among the permitted transaction types which is an exception to the 20% voting power

limit is the acquisition of voting shares or interests under a takeover bid or a scheme of

arrangement.'

MINTER ELLISON | INTRODUCTION TO AUSTRALIAN TAKEOVERS 2014

4 of 23

Deciding between types of bids, or scheme

Market bids are relatively uncommon because they cannot be made subject to the types of conditions that

bidders normally require. Most commonly, a bidder will choose between making an off-market bid and (for a

friendly transaction) a scheme of arrangement. This decision will depend on the bidder's attitude to a number

of factors, including those detailed below.

Consideration

Under an off-market bid or scheme, a bidder's consideration may be cash, securities (for example, shares

('scrip') in the bidder, interests in a managed investment scheme, convertible notes or options), or a

combination of both. Under a market bid, a bidder can only offer cash.

Speed

A market bid is usually the quickest way to obtain a holding above 20% because the bidder can acquire

securities on the relevant stock exchange from the date of the announcement. For an off-market bid, the

bidder cannot purchase shares on market above the 20% level until the offers are unconditional or are subject

only to certain 'prescribed occurrence' conditions (concerning the target's share capital, solvency, business or

property). Shares are acquired under a scheme only when the scheme is approved and implemented.

Conditions

An offer can only be made with conditions using an off-market bid or scheme. Conditions may be important

where, for example, a bidder wishes to reach the 90% threshold required for compulsory acquisition (a

financier may require this to facilitate security over assets) or to make sure that the target does not sell key

assets during the bid period.

Unaccepted offers under a market bid can be withdrawn where the target is affected by a 'prescribed

occurrence', but only if the bidder's voting power is at or below 50% when that event occurs.

Payment to target holders

Under a market bid target shareholders receive payment in accordance with the relevant exchange's ordinary

settlement rules. Under a conditional off-market bid payment is generally not required until one month after

the offers become unconditional. However, a person accepting an offer under a market bid will not receive any

subsequent increases in the bid price. Under an off-market bid, all target holders, including those who

previously accepted, obtain the benefit of any increase in the bid price. On implementation of a scheme, all

target shareholders receive the final scheme price.

Costs

Brokerage is not payable in an off-market bid or scheme by the bidder or holders of the securities the subject

of the bid or scheme, whereas holders pay their own brokerage when accepting a market bid (unless the bidder

has made other arrangements). Stamp duty is generally not payable on transfers of quoted securities.

However, if the target has land holdings in Australia, the bidder may be liable (in some cases) for 'landholder'

or 'land rich' stamp duty at asset transfer rates calculated on the value of the land or land-related assets

directly or indirectly held by the target.

Proportional offers

Under an off-market bid or scheme, a bidder can offer to buy all or a specified proportion of the securities held

by each target holder. Under a market bid, the bidder must offer to buy all of the securities held by target

holders.

MINTER ELLISON | INTRODUCTION TO AUSTRALIAN TAKEOVERS 2014

5 of 23

Significant ownership thresholds

In addition to the 20% voting power limit, if you hold:

• any number of securities in a listed entity – the Australian Securities and Investments Commission (ASIC) or

the listed entity can trace beneficial ownership of the securities

• 5% or above – substantial holding information for listed bodies must be given to the stock exchange within

two business days once the 5% level is reached and then for any change of 1% (during a takeover, the

deadline is 9.30am on the next trading day)

• over 10% of a class of securities – you can prevent post-bid compulsory acquisition of that class (however,

see 'Compulsory acquisition' on page 11)

• 15% and above – if you are not Australian you may need Foreign Investment Review Board approval (this

requirement also applies where non-Australians collectively hold 40% or more (see the foreign investment

rules on page 8))

• over 25% of voting shares – you can block special resolutions (including changes to the body's constitution)

• over 50% of voting shares – you can pass ordinary resolutions (including appointing your nominees to the

target board and removing existing target directors)

• over 75% of voting shares – you can pass special resolutions

• 90% of a class of securities or of the company – you may be able to use one of two different methods of two

different compulsory acquisition of the outstanding securities (see 'Compulsory acquisition' on page 11)

• 100% of the fully diluted share capital – you have access to the target's cashflows, can group the target and

its subsidiaries with your own entities for tax purposes and avoid the need to have regard to minority

interests.

Issues before announcing the bid

Acquiring a pre-bid stake

Many bidders prefer to acquire a pre-bid stake up to the 20% threshold for a number of reasons:

• to put the bidder in a position to block any competing bidder from reaching the 90% compulsory acquisition

threshold (see page 11)

• to reduce the number of shares for which the bidder has to bid

• to lower the bidder's average acquisition price

• to give the bid momentum.

The common ways a bidder acquires a pre-bid stake include:

• directly purchasing target securities on or off-market

• entering into a pre-bid agreement with particular target holders, obliging them to accept the bidder's offer

• entering into a call option in relation to certain target securities.

In acquiring any pre-bid stake, a bidder should know that some agreements are prohibited by the Corporations

Act. For example, where securities are acquired from a target holder in the six months before the bid, a bidder

and its associates cannot provide a benefit to the target holder that is linked to the bid price (such as a 'top-up'

payment).

Acquiring a pre-bid stake for a scheme can be problematic, although there is one method for doing this which

Minter Ellison has used successfully for clients.

MINTER ELLISON | INTRODUCTION TO AUSTRALIAN TAKEOVERS 2014

6 of 23

Choice of bid vehicle

The taxation treatment of bid vehicles should be considered when deciding whether the company making the

offer should be:

• an Australian incorporated company

• a company incorporated offshore, or

• a special purpose or existing entity.

Insider trading

A person who knows about a bid before it is publicly announced needs to be mindful of insider trading laws.

These provisions prohibit trading based upon, and the communication of, price-sensitive information that is not

generally available to the market. However, a bidder and its officers and agents do not breach the prohibition

if the bidder makes the pre-bid purchases and the only price-sensitive information is the bidder's intention to

purchase securities in the target.

The initial approach

The initial approach to the target requires careful consideration. A bidder will need to consider who from the

target should be approached (eg the target's chairman), and by whom from the bidder. A bidder will also need

to consider whether the proposal should be phrased as a willingness by the bidder to consider a transaction on

specified terms, or be expressed as a proposal to make a takeover bid with a preference that the target

directors recommend the bid (see 'Agreement with Target Directors' directly below).

Relevant factors to consider in planning the initial approach to the target includes:

• the operation of takeover regulation

• the risk that the target will make premature disclosure

• likely target board and shareholder perceptions of value

• target shareholder sentiment

• the personalities of key target directors or executives.

Agreement with Target

A 'hostile' takeover bid can occur without involvement of the target before announcement. In practice, many

takeover bids occur on terms which have been negotiated between the bidder and the target prior to

announcement of the bid. This usually results in a recommendation by the target directors that shareholders

accept the bid in the absence of a higher offer.

When a takeover is negotiated between the bidder and the target, its terms are sometimes included in a bid

implementation agreement (BIA). The BIA will usually include provisions about:

• the bid price

• any conditions of the bid

• provision for dispatch of offers by the bidder. Sometimes, arrangements are made for the joint dispatch of

the bidder's statement and target's statement to target shareholders, to expedite the offer process

• board transition arrangements at different levels of control, and

• lock-up devices including 'no shop' and 'no talk' restrictions, and break fees.

For a scheme, the equivalent document is a scheme or merger implementation agreement.

MINTER ELLISON | INTRODUCTION TO AUSTRALIAN TAKEOVERS 2014

7 of 23

The lock-up devices typically seek to restrict the target from soliciting a higher offer from another party ('no

shop' clauses) or dealing with other interested potential bidders which approach the target ('no talk' clauses).

No talk clauses should be qualified by what is known as the target directors' fiduciary out. The fiduciary out

means that if another bidder offers more attractive terms than the existing bid, the directors' fiduciary

obligations may require consideration of the rival offer, in which case the no talk clause would not prevent the

directors from dealing with the rival bidder.

Break fees are another form of lock-up device. Where these have been agreed, the target is required to pay

the bidder an agreed sum as compensation for the costs incurred in making the takeover proposal if the

bidder's takeover is not successful, in circumstances where there has been a break fee 'trigger event'. Under

the Takeovers Panel's Guidance Note 7, break fees should generally not exceed 1% of the equity value of the

target. Circumstances triggering payment of a break fee typically include where the target's directors change

their recommendation of support for the bid, and material breaches of the target's obligations in the

implementation agreement.

Minimum bid price

Any purchases by the bidder or an associated person in the four months before the bid will set the minimum

offer price. This includes where the consideration used for pre-bid purchases (such as the bidder's own

securities) is different from that offered under the bid (for example, cash).

If the pre-bid consideration or bid consideration is quoted securities issued by the bidder, to ensure compliance

with the minimum bid price rule the bidder will need to value the consideration in the ordinary course of

trading in the two full trading days before both any pre bid purchase and the time when the bidder makes

offers under the bid. The bidder's statement must disclose any pre-bid purchases by both the bidder and its

associates. If the consideration for the pre-bid purchase was neither cash nor a quoted security, an expert will

need to determine whether the value stated in the bidder's statement is fair and reasonable.

The same principles apply to a scheme.

Cash consideration

If cash is included as consideration under the bid, the bidder's statement must detail:

• any cash amounts held by the bidder to pay the consideration

• the identity of any other person who is to provide the cash, directly or indirectly

• the arrangements under which the cash will be provided by that other person.

For example, the bidder's statement should summarise the principal terms of any agreements with financiers,

particularly the ultimate source of the funds (if known), any material conditions affecting the availability of

funds and the amount that may be drawn down.

Depending on the nature and identity of the financier (eg whether it is a bank, well known to Australian

shareholders or a lesser known bank or company) details of that financier's financial position may need to be

provided.

The same principles apply to a scheme.

Potential prospectus level disclosure

If any securities are offered as consideration under the bid or scheme and the bidder is the issuer of the

securities or controls the issuing body, the bidder's statement or scheme booklet must contain the information

required for a prospectus. In general, this means all information investors and their professional advisers

would reasonably require to make an informed assessment of:

• the rights and liabilities attaching to the securities offered; and

MINTER ELLISON | INTRODUCTION TO AUSTRALIAN TAKEOVERS 2014

8 of 23

• the assets and liabilities, financial position and performance, profits and losses and prospects of the body

that issues the securities.

If the securities offered by the bidder are in a class that is quoted on a prescribed stock market, it is likely that

the bidder's statement or scheme booklet need only contain 'transaction specific' information about the effect

of the proposed transaction on the bidder and the rights and liabilities attaching to the securities offered.

A due diligence exercise is needed to ensure disclosure requirements are met. The transaction announcement

should be scheduled to allow sufficient time for this to be completed.

Offer period

Offers under both market and off-market bids must remain open for at least one month, and not more than 12

months. For a scheme, it is usually about a month from dispatch of the scheme booklet to target shareholders

until those shareholders vote on implementation of the scheme.

Conditions

Only an off-market bid or scheme can be conditional. Typical conditions include:

• a minimum acceptance condition of either 50% or 90% (for a bid) or a minimum target shareholder approval

threshold of 75% of shares voted (and 50% of shareholders who vote) for a scheme

• 'no material adverse change' conditions

• receipt of necessary regulatory approvals, for example foreign investment or competition approvals

• there not being a specified fall in a market index during the bid period

• that certain changes do not occur to the target during the bid period, such as the target altering its capital,

disposing of substantial assets or winding up.

Capital gains tax relief for scrip takeovers

Capital gains tax relief may be available to some target holders in scrip-for-scrip transactions in certain

circumstances. The key requirements are that:

• the bidder must acquire or increase its shareholding to at least 80% of the voting shares or units in the

target

• target holders must receive a similar type of security to that which they held (for example, share for share,

unit for unit, or option for option).

This relief can apply to both off-market bids and schemes of arrangement.

Constraints outside the Corporations Act

Competition issues

The Australian Competition and Consumer Act 2010 (in this section referred to as the 'Act') prohibits an

acquisition of shares or assets that would have the effect or likely effect of substantially lessening competition

in a substantial market in Australia or in a state, territory or region of Australia. Acquisitions that occur outside

Australia are subject to the Act when a person consequently acquires a controlling interest in a corporation

carrying on business in a market in Australia.

The Australian Competition and Consumer Commission (ACCC) administers the merger provisions of the Act

and has released guidelines outlining its administration and enforcement policy. Parties are encouraged to

approach the ACCC as soon as there is a real likelihood that a proposed acquisition may proceed. As a general

guideline, the ACCC should be notified of a proposed acquisition where the products of a bidder and target are

substitutes or complements and the post acquisition market share of the merged entity will be greater than

MINTER ELLISON | INTRODUCTION TO AUSTRALIAN TAKEOVERS 2014

9 of 23

20% of the relevant market. While there is no statutory requirement to apply for approval for a proposed

acquisition, there are three avenues available to parties seeking to have a proposal considered and assessed:

• apply to the ACCC for an informal (non-binding) review

• apply to the ACCC for formal clearance

• apply to the Australian Competition Tribunal (Tribunal) for authorisation of a proposed acquisition on public

benefit grounds (for mergers and acquisitions which might otherwise substantially lessen competition).

If the ACCC grants formal clearance or the Tribunal grants an authorisation the acquirer is protected from

claims that the acquisition has the effect of substantially lessening competition. Although there is no statutory

immunity with informal clearance, it is the most common process. The ACCC is prepared to indicate, after

considering the effect of a proposed acquisition, whether it intends to take any action if the acquisition were to

proceed. If the ACCC advises that it does not intend to take any action it invariably reserves the right to reopen the matter should it receive new information or become aware that information already supplied is

incomplete or incorrect.

Any takeover offer for an Australian company may also have anti-trust implications in offshore jurisdictions.

Foreign investment rules

Generally speaking, Australia's foreign investment rules encourage foreign ownership in Australia that is not

contrary to the national interest. The Foreign Acquisitions and Takeovers Act 1975 (in this section referred to

as the 'Act') requires notification and approval for certain proposed acquisitions that may result in foreign

ownership exceeding prescribed levels in Australian businesses or companies. The Foreign Investment Review

Board (FIRB) administers the Act and the Federal Government's foreign investment policy. The Treasurer

(advised by FIRB) can prevent an acquisition or require its reversal if the Act is breached or the acquisition is

considered contrary to the national interest.

It is compulsory for foreign persons to notify FIRB of certain types of investment proposals, including:

• the acquisition of a substantial interest (see below) in an Australian target that has gross assets of, or where

the proposal values the target at, A$248 million (this threshold is indexed annually on 1 January) or more

• the acquisition of a substantial interest in a foreign target with Australian subsidiaries or assets that are

valued at A$248 million or more

• arrangements under which an Australian business valued at more than, or having gross assets exceeding,

A$248 million becomes controlled by foreign persons

• direct investment by a foreign state, or an entity owned or controlled by a foreign state, irrespective of the

size of the proposal, and

• acquisitions of interests in Australian urban land.

If the investor is a US foreign person, special exemption thresholds apply. The current thresholds are A$248

million for investments in 'prescribed sensitive sectors' or by an entity controlled by the US Government, or

A$1,078 million in any other case. Also, the Act does not apply to investment by US foreign persons in those

financial sector entities subject to the operation of the Financial Sector (Shareholders) Act 1998 (see below).

A foreign person (individual, corporation or trustee) acquires a substantial interest in an Australian corporation

if that person:

• together with associates, directly or indirectly, acquires an interest in or control of 15% or more of the

shares or voting power of the corporation

• directly or indirectly acquires an interest in or control of shares or voting power of, the corporation with the

consequence that the person and its associates, together with all other foreign persons and their associates,

hold interests in or control of 40% or more of the shares or voting power of the corporation, or

• already holds a substantial interest and there is any increase in that interest.

MINTER ELLISON | INTRODUCTION TO AUSTRALIAN TAKEOVERS 2014

10 of 23

Banking and insurance companies

The Financial Sector (Shareholdings) Act 1998 regulates the ownership and control of banking and insurance

companies. There is a 15% shareholding limit (measured by the voting power of the person and associated

persons) in financial sector companies, namely:

• bodies carrying on a banking business under the Banking Act 1959

• companies carrying on insurance business under the Insurance Act 1973

• companies registered under the Life Insurance Act 1995

• a holding company of any of the above.

The Treasurer may approve holdings exceeding the prescribed limit on national interest grounds, and may also

act where a person is considered to have practical control even if they are below the prescribed limit.

In addition, the Insurance Acquisitions and Takeovers Act 1991 regulates the control of, and the compulsory

notification of proposals relating to:

• acquisitions or leasing of assets of Australian-registered insurance companies

• entering into agreements relating to directorships of Australian-registered insurance companies.

Broadcasting

Under the Broadcasting Services Act 1992 there is a range of control limitations relating to the ownership and

control of commercial radio, commercial television and datacasting services. The purpose is to 'encourage

diversity in the control of the more influential broadcasting services'.

The restrictions include that a person must not be in a position to exercise control of:

• commercial television broadcasting licences whose combined licence area population exceeds 75% of the

Australian population. More than one commercial television broadcasting licence in the same licence area

• more than two commercial radio broadcasting licences in the same licence area

• a commercial television broadcasting licence and a datacasting transmitter licence.

Issues that may arise during the offer period

Acquiring securities on-market during the bid period

For off-market bids, the bidder can purchase target securities on the stock exchange after the bidder's

statement has been given to the target, even if the bidder's voting power in the target exceeds 20%, if:

• the bid is unconditional or only has certain 'prescribed occurrence' conditions concerning the target's share

capital, solvency, business or property, and

• the securities are purchased in an 'on-market' transaction as defined in the operating rules of the stock

exchange (which in the case of the Australian Securities Exchange (ASX) would exclude crossings that are

pre-arranged between principals).

If cash is not offered as consideration under an off-market bid, an on-market purchase will require the bidder

to offer a cash alternative under the bid. For market bids, on-market purchases are allowed immediately after

the announcement is made provided they are in the ordinary course of trading.

Under ASIC market integrity rules, a bidder cannot acquire target securities on the ASX for a price that varies

from the bid price without first making an announcement to the ASX. The ASX will then impose a one-hour

trading halt to allow the market to become informed of the bidder's intention.

MINTER ELLISON | INTRODUCTION TO AUSTRALIAN TAKEOVERS 2014

11 of 23

Variation in bid price

A bidder can increase the bid price under an off-market bid by increasing the cash sum or number of securities

offered, or by offering an additional or alternative form of consideration (eg offering a cash or scrip

alternative). If an alternative form of consideration is offered, all target holders under the off-market bid,

including those that have already accepted the bid, will have the option of making a fresh election as to the

form of consideration they may receive.

To effect the bid price increase, the bidder can either send a notice in accordance with the variation of offers

procedure or, where the consideration offered by the bidder is all cash, make on-market purchases, if allowed,

above the offer price, in which case the purchase price will be deemed to be the new bid price (if the

consideration offered is not fully cash, then if an on-market purchase is made, the bidder will be required to

offer a full-cash alternative to all target shareholders). All target holders under the off-market bid, including

those that have already accepted the bid, will get the benefit of the increased price.

Market bids can similarly have an increase in the bid price through a purchase on-market above the offer price

(except in the last five trading days of the offer period). However, target holders that have already accepted

the offer will not get the benefit of the increased price.

A bidder can at any stage announce that the offer price will not be increased, in order to encourage holders to

accept its offer. In accordance with ASIC policy, the bidder may not announce that the offer price is final and

then subsequently increase the price.

Supplementary takeover documents

Bidders and targets are required to issue supplementary disclosure documents when they become aware that a

new circumstance has arisen that needs to be disclosed, or that their original statement contains a misleading

or deceptive statement or an omission. The supplementary document must be sent as soon as practicable to:

• for all bids – ASIC and the other party (target or bidder)

• for quoted target securities - the stock exchange

• for unquoted target securities - all target holders who have not accepted the offer.

Waiver of conditions

Any conditions may either be:

• fulfilled

• waived by formal declaration of the bidder

• breached (all acceptances will be void unless the condition is fulfilled or waived before the required time).

Conditions generally cannot be waived by the bidder in the last seven days of the offer period. This allows

target holders at least one week to decide whether to accept an unconditional bid.

Extension of offer period

The offer period is automatically extended for 14 days if, within the last seven days:

• for off-market bids – the consideration is increased

• for all bids – the bidder's voting power in the target increases to more than 50%.

A bidder can also choose to extend the offer period, provided it does not remain open for more than 12

months in total. However, except where a rival bidder makes or increases offers for the target securities, it is

not possible to extend the offer period for:

• market bids – in the last five trading days of the offer period

MINTER ELLISON | INTRODUCTION TO AUSTRALIAN TAKEOVERS 2014

12 of 23

• conditional off-market bids – less than seven days before the end of the offer period (this period could be up

to 14 days depending on when the bidder has decided to give notice of the status of the conditions).

If an extension of a conditional bid delays payment by more than a month, those who have already accepted

can withdraw their acceptance. Once the bid is unconditional, it may be extended at any time before the close

of the offer period.

Withdrawal

The bidder can only withdraw unaccepted offers:

• for all bids – with ASIC's written consent (for example, this is possible where a rival bid is announced at a

higher price and the other features of the rival bid are not less attractive)

• for market bids – if the bidder's voting power is no more than 50% and certain circumstances affecting the

target's solvency, share capital, business or property occur.

Sale into a rival bid

As a general rule, the bidder cannot dispose of any target securities in the bid class during the bid period for

any type of bid. However, the bidder may dispose of securities after a rival bidder has made a takeover offer or

increased the consideration offered for the same securities.

Compulsory acquisition

Compulsory acquisition powers are available under the Corporations Act:

• following a takeover bid ('post-bid compulsory acquisition power') – if the bidder and its associates have

relevant interests in at least 90% (by number) of the securities in the bid class and acquired at least 75% (by

number) of the securities that were subject to the bid, or

• within six months of reaching either of the following thresholds ('general compulsory acquisition power') – if

a person and any related companies have:

- full beneficial interests (direct ownership or ownership through a nominee) in at least 90% (by number) of

the securities of a particular class, the person can compulsorily acquire the remaining securities in that

class

- full beneficial interests in at least 90% (by value) of all the securities in the company that are either shares

or convertible into shares and the person has 90% voting power in the company, the person can

compulsorily acquire the company's remaining shares and securities convertible into shares.

For the general compulsory acquisition power, an independent expert (nominated by ASIC) must issue a report

stating whether the consideration offered is 'fair value' for the securities and, if relevant, whether the

threshold for 90% (by value) of the company's securities is met.

Schemes of Arrangement

Schemes versus Takeovers

There may be reasons for a bidder to prefer a scheme of arrangement to a conventional takeover bid.

Schemes are frequently used in 'friendly' takeovers as they provide the certainty of an 'all or nothing' outcome,

a relatively definite timetable and a lower approval threshold to achieve 100% ownership.

A scheme is a statutory procedure under the Corporations Act that allows a company to reorganise its capital

structure to achieve a desired commercial outcome, including transferring 100% ownership and control of the

company to a bidder.

MINTER ELLISON | INTRODUCTION TO AUSTRALIAN TAKEOVERS 2014

13 of 23

Procedural differences

Unlike a bid, a scheme is a legal process initiated by the target company, which will manage and control the

process under the supervision of the Court.

The bidder's role is generally confined to:

• negotiating and entering into the Merger Implementation Agreement (MIA) setting out the key terms and

conditions of the parties' commercial agreement and regulating the bidder's involvement and obligations,

and

• providing input into the target's explanatory statement to shareholders.

As a result, the bidder will need to ensure that the target's directors are receptive to the terms of the bidder's

proposal, in order for a scheme to be implemented.

Process of a scheme

A scheme requires the target company to obtain shareholder and Court approval for the proposal.

It typically takes approximately three months from the date that the MIA is signed to complete a takeover

scheme. While the process may take longer than a bid, the timetable for a scheme has the benefit of being

relatively certain.

See the indicative timetable for a scheme of arrangement on page 17 for further details about the scheme of

arrangement process.

Drafting the scheme documents

Upon negotiating the terms of the MIA with the bidder, the target will draft the notice of a meeting of its

shareholders to vote on the proposed scheme and, to accompany the notice, the terms of the proposed

scheme, an explanatory statement providing the information required for an informed voting decision, and in

most cases an independent expert's report. These scheme documents, referred to as the Scheme Booklet, are

reviewed in draft by ASIC.

First Court hearing

Following ASIC's review of the Scheme Booklet, the target will apply to the Court for an order convening a

meeting of its shareholders to consider and vote on the proposed scheme. The Court will consider whether it is

likely to approve the scheme should the shareholders vote in favour of it, and whether to approve the Scheme

Booklet.

Dispatch information to shareholders

When the Court grants approval for the target to convene the scheme meeting, the target will register the

Scheme Booklet with ASIC and arrange for it to be dispatched to shareholders ahead of the meeting of

shareholders.

Shareholders' meeting

For a listed company, a meeting of shareholders can be convened to vote on the scheme after at least 28 days

from when the Scheme Booklet is dispatched (21 days for non-listed companies).

The key advantage of a scheme for a bidder is the lower threshold needed to achieve 100% ownership. To

succeed, each class of the target's shareholders must approve the scheme with the following majorities:

• headcount test – a simple majority in number (more than 50%) of shareholders who vote, and

• voted shares test – at least 75% of the total number of votes cast.

The composition of classes of target stockholders for the purposes of a scheme is a complex question that is

determined by the Court at the first Court Hearing.

MINTER ELLISON | INTRODUCTION TO AUSTRALIAN TAKEOVERS 2014

14 of 23

Second Court hearing

When approved by the requisite majority of shareholders, the target will notify ASIC and apply for a second

hearing before the Court.

The Court has a discretion to either approve or decline to approve a scheme, but will not substitute its

assessment of the commercial merits of the scheme for that of the majority shareholders who voted in favour

of it.

There is however scope for any of the target's shareholders to appear at the second hearing and petition the

Court not to approve the proposed scheme, if they believe it prejudices their interests or that it has not met

legal requirements. ASIC may also appear if it objects to the proposed scheme.

Approval and implementation

Once the Court approves the scheme, it will become legally binding on all shareholders of the target, including

those who voted against the scheme or omitted to vote, as soon as the Court's order is lodged with ASIC.

The final step is for the scheme to be implemented according to its terms.

Takeovers Panel

The Takeovers Panel (Panel) is the main forum for resolving takeover disputes. Only ASIC or another public

authority may commence court proceedings in relation to a takeover bid before the end of the bid period.

Powers

Declaration of unacceptable circumstances

The Panel has the power to make a declaration of unacceptable circumstances where either:

• there has been, or is likely to be, a breach of any of the takeover provisions

• even if there is no breach, there are circumstances that are unacceptable given their effect, or likely effect,

on the control of, or an acquisition of a substantial interest in, the target.

Before making a declaration, the Panel must have regard to the purposes of the takeover provisions. These

include that the acquisition of control takes place in an efficient, competitive and informed market, and that all

target holders have a reasonable and equal opportunity to participate in any benefits under the bid.

Although the Panel cannot direct a person to comply with a requirement of the takeover provisions, it can

make a broad range of orders to protect the interests of any person affected by unacceptable circumstances.

This includes orders requiring divestiture or preventing an acquisition, or registration of a transfer, of

securities. Contravening a Panel order is an offence and a court can enforce the order.

If an application to the Panel is unsuccessful, a court's powers after the bid period are limited if the court finds

that conduct contravenes the Corporations Act. The court can generally only make an order requiring a person

to pay money to another (such as compensation in civil proceedings or a penalty for a criminal offence). This

means that a court cannot 'unwind' a transaction if the Panel has refused to make a declaration of

unacceptable circumstances.

Membership

Panel members are appointed based upon their experience in business, company administration, financial

markets, law, economics and accounting. They are currently appointed on a part-time basis. Members are

assisted by a full-time Executive, which facilitates enquiries, provides policy advice and supports the Panel in

proceedings (including receiving all applications to the Panel).

MINTER ELLISON | INTRODUCTION TO AUSTRALIAN TAKEOVERS 2014

15 of 23

Proceedings

Any person whose interests are affected can apply for a declaration of unacceptable circumstances within two

months of the circumstances occurring, or a longer period if the Panel grants an extension. Where an

application is made and the Panel decides to conduct proceedings, the President selects three members to be

the 'sitting Panel' deciding the matter.

The Panel is required to act as fairly and reasonably, with as little formality, and in as timely a manner, as is

permitted by the legislation and a proper consideration of the matter.

Before making a declaration or order, the Panel must give the persons affected by it, parties to the proceedings

and ASIC an opportunity to make submissions. Proceedings are determined on written submissions. The Panel

can require witnesses to give evidence under oath and produce documents. Although the Panel is not bound

by the rules of evidence, it must provide procedural fairness where it is consistent with the legislation.

An application for review of an order or declaration of the Panel can be made by ASIC or a party to the

proceedings within two business days of that order or declaration. However, if the initial Panel's decision was

not to make a declaration or order, an application for review can only be made with the consent of the

President of the Panel. The review Panel has the same powers as the Panel first deciding the matter, and

consists of different members.

MINTER ELLISON | INTRODUCTION TO AUSTRALIAN TAKEOVERS 2014

16 of 23

Timetables

Indicative timetable for an off-market bid

Set out below is an indicative timetable and list of key steps for an off-market bid

Week

Step

1. Bidder announces intention

to make a bid and lodges

bidder's statement and offer

document with ASIC

2. Bidder sends the bidder's

statement and offer

document to the target and

ASX and notifies ASIC of

delivery to the target (within

21 days after step 1)

3. Bidder sends the Bidder's

statement and offer to target

shareholders and notifies

ASIC and ASX (within 14-28

days after step 2 and within

2 months after

announcement)

4. The target must send its

target statement to the

bidder, each of its

shareholders, ASIC and ASX

(within 15 days after

receiving notice that step 3

has been done)

5. Offer period of 1 month

(minimum) – 12 months

(maximum) (commencing

the date of step 3)

6. If the compulsory acquisition

thresholds are met at the

end of the offer period,

commence the compulsory

acquisition process

1

2

3

4

5

6

7

8

9

10

11

Day 1

Day 1 (earliest) - Day 22

(latest)

Day 15

(earliest) –

Day 29 (latest)

(assuming step 2 is done on Day 1)

Day 15

(earliest) –

Day 30 (latest)

(assuming all offers sent on Day 15)

Minimum offer period

Generally takes 4-6 weeks to complete

process

MINTER ELLISON | INTRODUCTION TO AUSTRALIAN TAKEOVERS 2014

17 of 23

12

Indicative timetable for a market bid

Set out below is an indicative timetable and list of key steps for a market bid

Week

Step

1. Bidder's broker announces

bid and Bidder sends bidder's

statement to ASX, target and

ASIC

2. Bidder sends the bidder's

statement (and any other

document submitted to ASX)

to the target's shareholders

(within 14 days after step 1)

3. Target sends the target's

statement to ASX, the

bidder, ASIC and each of its

shareholders (within 14 days

after step 1)

4. Bidder makes offers for

shares on ASX (the day

immediately following the

end of the 14 day period in

step 3 and within 2 months

after announcement).

5. Offer period of 1 month

(minimum) – 12 months

(maximum) commencing the

day after step 4.

6. If the compulsory acquisition

thresholds are met at the

end of the offer period,

commence the compulsory

acquisition process

1

2

3

4

5

6

7

8

9

10

11

Day 1

Day 1 (earliest) Day 15 (latest)

Day 1 (earliest) –

Day 15 (latest)

Day

16

Minimum 1 month offer

period

Generally takes 4-6 weeks to complete

process

MINTER ELLISON | INTRODUCTION TO AUSTRALIAN TAKEOVERS 2014

18 of 23

12

Indicative timetable for a scheme of arrangement

Set out below is an indicative timetable and list of key steps for a scheme of arrangement

Week

Step

1.

Sign scheme implementation

agreement and announce

scheme to ASX

2.

Target company to file an

application with the Court to

permit the convening of a

shareholders' scheme meeting

3.

Give ASIC 14 days notice of the

application in Step 2 by lodging

the draft Scheme Booklet for

review

4.

5.

6.

First court hearing date to

approve the convening of a

shareholders' scheme meeting

Announce to ASX that the

Court has made orders

permitting the convening of a

shareholders' meeting to

consider and vote on the

proposed scheme

Typeset and print Scheme

Booklet to be sent to

shareholders

7.

Lodge a copy of the final,

printed Scheme Booklet with

ASIC and the ASX and despatch

to shareholders

8.

Shareholders' meeting held to

vote on the proposed scheme

– not less than 28 days after

step 7

9.

Announce results of meeting

to ASX

1

2

3

4

5

6

7

8

9

10

11

Generally takes 4-6 weeks

before step 2 below

ASIC needs 14 days notice of

scheme to review scheme

documents below

Day 15 (at the

earliest)

Same day as first

court hearing

Generally takes up to 7 days to

complete after first court hearing

On the same day as the scheme

meeting results are known

MINTER ELLISON | INTRODUCTION TO AUSTRALIAN TAKEOVERS 2014

19 of 23

12

Week

Step

10.

11.

12.

1

2

3

4

5

6

7

8

9

10

11

12

Second court hearing to

approve the proposed scheme

Generally takes 4-6 weeks

Lodge with ASIC an office copy

of the Court order approving

the scheme. Provide a similar

copy to the ASX

Ideally on the same day as the

before step 2 below

Court approves the scheme

Implement the court approved

scheme

MINTER ELLISON | INTRODUCTION TO AUSTRALIAN TAKEOVERS 2014

20 of 23

About Minter Ellison

Minter Ellison is the largest Australian-based international law firm, with more than 290 partners and 900 legal

staff worldwide. We have offices in Adelaide, Auckland, Beijing, Brisbane, Canberra, Darwin, Gold Coast, Hong

Kong, London, Melbourne, Perth, Shanghai, Sydney, Wellington and Ulaanbaatar.

Our expertise and depth of resources mean that we can offer a tailored client team with a comprehensive

understanding of your industry sector and the commercial drivers that impact on your business. Our lawyers

deliver practical and commercial solutions that help you to achieve your business goals.

We provide strategic and legal advice to Fortune 500 companies and other large global corporations in relation

to their opportunities in the regions in which we operate.

Minter Ellison's M&A team has advised on some of the largest and most complex M&A transactions in

Australia. Our team is consistently ranked among the leaders in industry M&A league tables.

Our M&A expertise includes hostile and recommended takeover bids, schemes of arrangement, market entry

and exit, mergers and demergers, dual track and other structured sale processes, privatisations, risk

identification and allocation, spin-offs and trade sales and other private treaty transactions.

For more information about Minter Ellison's mergers and acquisitions practice please visit:

http://www.minterellison.com/public/connect/Internet/Home/Expertise/Areas%2Bof%2BExpertise/Mergers%

2Band%2BAcquisitions/

For more information about Minter Ellison please visit: www.minterellison.com.

© Minter Ellison

Disclaimer

Introduction to Australian Takeovers was prepared by Minter Ellison Lawyers. This document contains a summary only of

Australian takeover law as at 1 January 2014.

It is not intended to be comprehensive nor is it intended to be a substitute for legal advice.

Professional advice should be sought before applying the information to particular circumstances. While care has been

taken in the preparation of this guide, no liability is accepted for any errors it may contain.

MINTER ELLISON | INTRODUCTION TO AUSTRALIAN TAKEOVERS 2014

21 of 23

Minter Ellison offices

Australia and New Zealand

Sydney

Canberra

Adelaide*

Aurora Place

88 Phillip Street

Sydney NSW 2000

Tel +61 2 9921 8888

Fax +61 2 9921 8123

25 National Circuit

Forrest

Canberra ACT 2603

Tel +61 2 6225 3000

Fax +61 2 6225 1000

Grenfell Centre

25 Grenfell Street

Adelaide SA 5000

Tel +61 8 8233 5555

Fax +61 8 8233 5556

Costas Condoleon, Ron Forster,

James Philips

Neal Parkinson

Dan Marks

Melbourne

Brisbane

Gold Coast*

Rialto Towers

525 Collins Street

Melbourne VIC 3000

Tel +61 3 8608 2000

Fax +61 3 8608 1000

Waterfront Place

1 Eagle Street

Brisbane QLD 4000

Tel +61 7 3119 6000

Fax +61 7 3119 1000

159 Varsity Parade

Varsity Lakes QLD 4227

Tel +61 7 5553 9400

Fax +61 7 5575 9911

Jeremy Blackshaw, John Steven,

Bart Oude-Vrielink

Bruce Cowley

John Witheriff

Perth

Darwin*

Auckland*

Allendale Square

77 St Georges Terrace

Perth WA 6000

Tel +61 8 6189 7800

Fax +61 8 6189 7999

Level 1

60 Smith Street

Darwin NT 0800

Tel +61 8 8901 5900

Fax +61 8 8901 5901

Minter Ellison Rudd Watts

88 Shortland Street

Auckland

Tel +64 9 353 9700

Fax +64 9 353 9701

Adam Handley

Lachlan Drew

Cathy Quinn

Asia

Wellington*

Hong Kong

Beijing

Minter Ellison Rudd Watts

125 The Terrace

Wellington

Tel +64 4 498 5000

Fax +64 4 498 5001

Level 25

One Pacific Place

88 Queensway

Hong Kong SAR

Tel +852 2841 6888

Fax +852 2810 0235

Unit 1022 Level 10 China World Tower One

1 jianguomenwai Avenue

Beijing 100004

People’s Republic Of China

Tel +86 10 6535 3400

Fax +86 10 6505 2360

Fred Kinmonth

Jem Li

London

Ulaanbaatar

Shanghai

10 Dominion Street

London EC2M 2EE

Tel +44 20 7448 4800

Fax +44 20 7448 4848

Suite 612 Level 6 Central Tower

Great Chinggis sKhaan's Square 2

Sukhbaatar District 8

Ulaanbaatar 14200

Mongolia

T+976 7700 7780

F+976 7700 7781

Suite 4006-4007

40th Floor Citic Square

1168 Nanjing Road West

Shanghai 200041

People’s Republic of China

Tel +86 21 2223 1000

Fax +86 21 2223 1099

Elisabeth Ellis

Yi Yi Wu

Paul Foley

United Kingdom

Michael Whalley, Michael Wallin

* Minter Ellison Legal Group member

To email an individual lawyer, use firstname.lastname@minterellison.com, except for those in New Zealand where

firstname.lastname@minterellison.co.nz should be used.

MINTER ELLISON | INTRODUCTION TO AUSTRALIAN TAKEOVERS 2014

22 of 23

ME_112188187_1 (W2007)

MINTER ELLISON | INTRODUCTION TO AUSTRALIAN TAKEOVERS 2014

23 of 23