MN3028 Managerial economics.indd

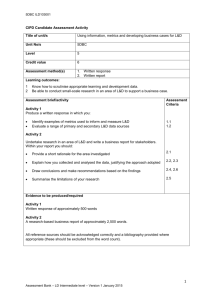

advertisement

Examiners’ commentaries 2014 Examiners’ commentaries 2014 MN3028 Managerial economics Important note This commentary reflects the examination and assessment arrangements for this course in the academic year 2013–14. The format and structure of the examination may change in future years, and any such changes will be publicised on the virtual learning environment (VLE). Information about the subject guide and the Essential reading references Unless otherwise stated, all cross-references will be to the latest version of the subject guide (2011). You should always attempt to use the most recent edition of any Essential reading textbook, even if the commentary and/or online reading list and/or subject guide refers to an earlier edition. If different editions of Essential reading are listed, please check the VLE for reading supplements – if none are available, please use the contents list and index of the new edition to find the relevant section. General remarks Learning outcomes At the end of this course and having completed the Essential reading and Learning activities, you should be able to: • prepare for Marketing and Strategy courses by being able to analyse and discuss consumer behaviour and markets in general • analyse business practices with respect to pricing and competition • define and apply key concepts in decision analysis and game theory. Format of the examination The examination is three hours long and comprises two sections. You have to answer all four questions in Section A (12.5 marks each) and two questions in Section B (25 marks each). Planning your time in the examination The marks for each question correspond roughly to the proportion of time you are expected to spend on it. Try not to spend too much time on any one question. You can always go back to it later if you have time left. When you select which questions to answer in Section B, take time to read all the questions (and all parts of each question). Often candidates select a question on the basis of the ‘topic’ of the question only to realise that they are able to answer at most the first part of the question. If you end up doing terribly complicated calculations taking up several pages it is highly likely that you have misinterpreted the question or made a mistake – go back and check the question and your answer. The same 1 MN3028 Managerial economics applies, of course, if you find negative prices or quantities, or probabilities greater than one or less than zero. Write down clearly what you are doing as the Examiners award marks for correct logic and development even if there are numerical mistakes. What are the Examiners looking for? We are looking for evidence that you have truly understood the material and can apply this knowledge. Memorising answers to past questions will not get you very far. You should have the confidence to tackle the questions from first principles. Of course, you will only have this confidence if you have worked consistently throughout the year to familiarise yourself with the way of thinking that this subject requires. How to do well in the examination A key success factor is obviously the time spent preparing and, as mentioned before, an early start is definitely required. It is impossible to acquire the thinking skills you need in the last few weeks before the examination. It is not good enough to simply repeat the material from the subject guide. You must understand it! A good way to check whether you really understand the material is to try to explain it to a friend. You also have to spend a lot of time thinking about questions/problems/ exercises. Never look at answers or solutions until you have spent at least an hour or two trying to figure out the solution yourself. Obviously during the examination you will not have that much time, but the more time you spend thinking about how to solve problems during the year, the easier your revision and the examination will be. Especially for the essay questions, do not write down everything you know about a topic which is vaguely related to the question. Answer the question! We do not expect polished essays with nicely constructed sentences, and the use of bulleted lists is acceptable where appropriate. The main thing is to show that you have understood the material. You can give evidence of your understanding through clear exposition, including models and numerical and verbal examples (preferably your own). Diagrams should be clear. It is not important that the axes are drawn as straight lines, etc. but diagrams have to be neat enough to illustrate the point you are making. Amazingly, we often find that candidates have not read the subject guide properly. You do not need to read anything else to do well in this course, so make sure you read and understand the subject guide. 2 Examiners’ commentaries 2014 Question spotting Many candidates are disappointed to find that their examination performance is poorer than they expected. This can be due to a number of different reasons and the Examiners’ commentaries suggest ways of addressing common problems and improving your performance. We want to draw your attention to one particular failing – ‘question spotting’, that is, confining your examination preparation to a few question topics which have come up in past papers for the course. This can have very serious consequences. We recognise that candidates may not cover all topics in the syllabus in the same depth, but you need to be aware that Examiners are free to set questions on any aspect of the syllabus. This means that you need to study enough of the syllabus to enable you to answer the required number of examination questions. The syllabus can be found in the Course information sheet in the section of the VLE dedicated to this course. You should read the syllabus very carefully and ensure that you cover sufficient material in preparation for the examination. Examiners will vary the topics and questions from year to year and may well set questions that have not appeared in past papers – every topic on the syllabus is a legitimate examination target. So although past papers can be helpful in revision, you cannot assume that topics or specific questions that have come up in past examinations will occur again. If you rely on a question spotting strategy, it is likely you will find yourself in difficulties when you sit the examination paper. We strongly advise you not to adopt this strategy. 3 MN3028 Managerial economics Examiners’ commentaries 2014 MN3028 Managerial economics – Zone A Important note This commentary reflects the examination and assessment arrangements for this course in the academic year 2013–14. The format and structure of the examination may change in future years, and any such changes will be publicised on the virtual learning environment (VLE). Information about the subject guide and the Essential reading references Unless otherwise stated, all cross-references will be to the latest version of the subject guide (2011). You should always attempt to use the most recent edition of any Essential reading textbook, even if the commentary and/or online reading list and/or subject guide refers to an earlier edition. If different editions of Essential reading are listed, please check the VLE for reading supplements – if none are available, please use the contents list and index of the new edition to find the relevant section. Comments on specific questions Candidates should answer SIX of the following TEN questions: FOUR from Section A (12.5 marks each) and TWO from Section B (25 marks each). Candidates are strongly advised to divide their time appropriately. Section A Answer all four questions from this section (12.5 marks each). Question 1 Consider a monopolist who can make a take-it-or-leave-it offer to a single consumer. The monopolist’s cost function is given by C(q) = 4q. The consumer has a budget of m = 100. The consumer’s utility function is given by U(y,q) = y1/2 + 2q where q is the quantity of the monopolist’s product and y denotes remaining money. What is the optimal offer to the consumer? Reading for this question The reading for this question is in Chapter 10 of the subject guide. Approaching the question The monopolist maximises profit which equals the payment (R) he gets from the consumer minus his costs: Max R – 4q (1) The constraint is that the consumer must not prefer going without the monopolist’s products to paying R for q units: s.t. U(y – R,q) ≥ U(m,0) At the optimum the consumer will be indifferent i.e. U(y – R,q) = U(m,0), or (100 – R)1/2 + 2q = (100)1/2. Solving for q gives q = 5 – 1/2(100 – R)1/2. 4 Examiners’ commentaries 2014 Substituting this into (1) and maximising w.r.t. R gives R = 99 and therefore q = 4.5. We can then check that the consumer is indeed indifferent between taking and leaving the offer: U(100 – 99,4.5) = U(100) = 10. We also need to check that the monopolist is making positive profits: 99 – 4(4.5) > 0. Very few candidates answered this question correctly in 2014. The vast majority of candidates failed to utilise the consumer’s indifference constraint to solve the problem. A few tried to use the marginal cost equal to marginal revenue approach but this is clearly inappropriate here and indicates an attempt to blindly apply rules rather than to think through the problem. Question 2 Show that, for linear demand (p = a – bq), per unit consumer surplus (consumer surplus divided by quantity sold) equals 0.5p/η where η is price elasticity. Reading for this question The reading for this question is in Chapter 9 of the subject guide. Approaching the question Consumer surplus is given by triangle A, (a – p)2/(2b). Hence, per unit consumer surplus equals (a – p)/2. Most candidates were not able to identify consumer surplus as the triangle A under the demand curve. Neither were they able to define consumer surplus analytically or derive its formula for linear demand. Question 3 Consider a market with two firms, A and B. Market demand equals Q = 20 – p. The firms have identical and constant marginal costs c and zero fixed costs. Reading for this question The reading for this question is in Chapter 11 of the subject guide. Approaching the question a. Suppose firms set prices simultaneously. What are the equilibrium prices and profits? Both firms set price equal to marginal cost and profits are zero. 5 MN3028 Managerial economics b. Suppose firm B is able to delay its pricing decision until after it has observed the price set by firm A. Find the subgame perfect equilibria. Firm A will not set a price below c. If firm A sets any price above c, firm B would undercut. In this setup firm A can never make a profit. At a subgame perfect equilibrium, A sets any price ≥ c and B slightly undercuts any price > c and matches a price = c. Very few candidates answered this question correctly in 2014. Most candidates tried to find a Cournot equilibrium which is not at all what the question is asking you to do. You must read the question carefully. You get no marks for answering a different question. Question 4 Consider the following version of the finite alternating offer bargaining game. Players divide a cake of size 1 and discount their payoffs after each rejection with discount factor δ (0 < δ <1). In this version, player 1 gets to make the first three offers. If player 2 rejects all 3 offers, he gets to make the final offer. If player 1 rejects this final offer, both players get zero. What is the subgame perfect equilibrium in this game? Reading for this question The reading for this question is in Chapter 3 of the subject guide. Approaching the question (x, 1 – x) Offer to keep x 1 Accept 2 δy, δ(1–y)) Reject Accept Offer to keep y 1 2 Reject 1 Offer to keep z 2 Accept δ2z, δ2(1–z)) 1 Reject Offer to keep α Accept Reject (0, 0) 6 (δ3(1– α), δ3α) Examiners’ commentaries 2014 At the final decision node, player 1 will accept any and therefore player 2 will set α =1. At player 2’s last decision node, he has a choice now of 3 or 2(1 – z). Player 1 sets z such as to make player 2 indifferent, i.e. z = 1 – . At player 2’s second decision node, he has a choice now of 2(1 – (1 – )) or (1 – y). Player 1 sets y such as to make player 2 indifferent, i.e. y = 1 – 2. At player 2’s first decision node, he has a choice now of (1 – (1 – 2)) or 1 – x. Player 1 sets x such as to make player 2 indifferent, i.e. x = 1 – 3. Candidates answered this question reasonably well in 2014 and it was clear that they had prepared the topic. A common mistake was not realising that the ordering of offers is non-standard and that therefore the model from the subject guide should not be reproduced exactly. Some candidates attempted to reproduce a solution from similar questions in previous examination papers, which was also wrong. The lesson is not to memorise but think for yourself! Surprisingly many candidates made small (but significant) calculation mistakes so they came up with a similar, but still incorrect solution. Section B Answer two questions from this section (25 marks each). Question 5 Joanna’s utility of money function is given by U(x) = (x/10)2. She has to make a choice between two lotteries, A and B, with outcomes and probabilities given in the table below. Lottery A Lottery B Outcome Probability Outcome Probability 110 1/2 90 p 130 1/2 150 1–p Reading for this question The reading for this question is in Chapter 1 of the subject guide. Approaching the question a. Find the probability p for which Joanna is indifferent between the two lotteries. We need to find the probability p such that U(A) = U(B). U(A) = 0.5U(110) + 0.5U(130) = 0.5(11)2 + 0.5(13)2 (1) U(B) = pU(110) + (1 – p)U(130) = p(9) + (1 – p)(15) 2 2 (2) Equating (1) and (2) and solving for p gives p = 160/288 = 0.56. b. Is Joanna risk averse, risk neutral or risk loving? Risk loving. The utility of money function is convex. c. Calculate the certainty equivalent of lottery A and compare it to its expected value. The certainty equivalent is the sum of money which gives the same utility as the lottery, so U(CE) = U(A) = 145 As U(CE) = (CE/10)2, CE = 10(145)1/2 = 120.4. The expected value of lottery A equals 120 which is less than the CE as Joanna is risk loving. 7 MN3028 Managerial economics d. Set p = 0.6. For what percentage increase in outcomes in lottery B is Joanna indifferent between the two lotteries? Suppose we increase the outcomes in lottery B by x%, then the expected utility equals (0.6)81(1 + x)2 + (0.4)225(1 + x)2 Setting this equal to U(A) = 145 gives x = 0.023. Increasing the payoffs in B by 2.3% makes Joanna indifferent between the two lotteries. Candidates in 2014 expected a decision theory question and many chose it. The question was effective in discriminating between good and bad scripts. Many candidates, though obviously planning to answer a decision analysis question, do not understand the difference between expected utility and expected value. Question 6 Seller A has a potential buyer with a valuation v drawn from a uniform distribution on [0,1]. The buyer’s valuation is private information to the buyer. A’s valuation is zero. Both parties are risk neutral. Reading for this question The reading for this question is in Chapter 4 of the subject guide. Approaching the question a. What is the best take-it-or-leave-it price offer A could make? What is the resulting expected profit? If A charges x, he receives x if v > x and nothing otherwise. Hence expected profit equals x(1 – x) which is maximised at x = 1/2 and the resulting expected profit is ¼. b. Seller B also has a single item, which she values at zero, but she differs from A in two respects. Firstly, she has two bidders, each with private valuations drawn independently from a uniform distribution on [0,1]. Secondly, she may only hold an English auction with no reserve price. What is her expected profit? In an English auction the expected profit equals the expected value of the second highest valuation, i.e. 1/3. c. Suppose seller B held an English auction with n+1 bidders, each with private valuation drawn independently from a uniform distribution on [0,1]. What would be her expected profit? In an English auction with n + 1 bidders, the expected profit equals the expected value of the second highest valuation, i.e. n/(n + 2). d. Suppose A has n potential buyers each with private valuation drawn independently from a uniform distribution on [0,1]. Determine the optimal take-it-or-leave-it offer and the resulting expected profit. Suppose A charges x. His profit will be x if at least one of the potential buyers has v > x and zero otherwise. Hence, expected profit equals x Prob(at least one buyer has v >x ) = x (1-Prob(all buyers have v < x)) = x(1 – xn) Maximising this w.r.t. x yields x = 1/(n + 1)1/n. Hence, expected profit is n/(n + 1)1/n+1. Many candidates who attempted this question in 2014 appear to have memorised the material without understanding it, which results in poor performance. 8 Examiners’ commentaries 2014 Question 7 Consider a contest with n risk neutral players who spend ei (i = 1,…,n) in an attempt to win a single prize of value M. The probability of player i winning the contest equals the ratio of ei to the total amount spent (i.e. sum of ei s). Reading for this question The reading for this question is in Chapter 2 of the subject guide. Approaching the question a. Find the equilibrium expenditure levels ei. Player i maximises M Prob(i wins) – ei. Substituting and differentiating the expected payoff w.r.t. ei gives the following first order condition: M e j ei e 2 1 0 j We can now use symmetry and set all ei equal to e which yields So that the equilibrium effort level equals e = M(n – 1)/n2 and total expenditure equals M(n – 1)/n. b. Assume n is even and divide the n players into two equal size groups. The contest now consists of two stages. In the first stage, players within each group compete for a chance to participate in the second round. The winners from each group then enter a second round in which they compete for the prize of value M as before. In each round the probability of player i winning equals the ratio of ei to the total amount spent (i.e. sum of ei s). Find the equilibrium expenditure levels in both rounds and compare total expenditure to your answer in a). In the second round there are two contestants and we know from a) that each will set e = M/4 and the expected payoff for each is M/4. In the first round the expected payoff for player i is then M/4 Prob(i wins out of n/2 contestants) – ei. Proceeding as in a) we find that the first stage equilibrium effort level equals M(n – 2)/(2n2) and total expenditure over the two rounds equals M n 2 M M (n 1) n 2 2 n 4 2n The total effort level is the same as in a). Although this question is not that difficult IF you understand what a Nash equilibrium is, almost nobody attempted it. 9 MN3028 Managerial economics Question 8 Show, using graphs, a. if firms are price takers in the labour market, a minimum wage imposition creates unemployment, and b. for a monopsony in the labour market, a minimum way imposition may increase employment. In addition to graphs, provide the intuition for your answers. Reading for this question The reading for this question is in Chapter 7 of the subject guide. Approaching the question The answers given here varied considerably in quality. It was clear that several candidates had tried to memorise the analysis, including the graphs, without understanding it and it showed. Others gave good explanations in their answers. Question 9 Explain what is meant by moral hazard and adverse selection. What problems do moral hazard and adverse selection create? Reading for this question The reading for this question is in Chapter 4. Approaching the question This question was very popular. Many candidates in 2014 appear to have understood the concept of adverse selection but only a few understood moral hazard and were able to distinguish it from adverse selection. Question 10 a. Explain the efficiency wage model including the minimum cost implementation problem. b. Give an efficiency wage based explanation for rising wage profiles. Reading for this question The reading for this question is in Chapter 8 of the subject guide. Approaching the question Very few candidates chose this question in 2014. Those who did answered the question by attempting to reproduce the analysis in the subject guide. The minimum cost implementation problem was not understood by many of the candidates as was clear from the imprecise wording. A good answer would have explained the parameters of the model in some detail and would have given some plausible examples. Applying the efficiency wage model to rising wage profiles was done well by and large. 10 Examiners’ commentaries 2014 Examiners’ commentaries 2014 MN3028 Managerial economics Important note This commentary reflects the examination and assessment arrangements for this course in the academic year 2013–14. The format and structure of the examination may change in future years, and any such changes will be publicised on the virtual learning environment (VLE). Information about the subject guide and the Essential reading references Unless otherwise stated, all cross-references will be to the latest version of the subject guide (2011). You should always attempt to use the most recent edition of any Essential reading textbook, even if the commentary and/or online reading list and/or subject guide refers to an earlier edition. If different editions of Essential reading are listed, please check the VLE for reading supplements – if none are available, please use the contents list and index of the new edition to find the relevant section. Comments on specific questions Candidates should answer SIX of the following TEN questions: FOUR from Section A (12.5 marks each) and TWO from Section B (25 marks each). Candidates are strongly advised to divide their time appropriately. Section A Answer all four questions from this section (12.5 marks each). Question 1 In the last stage of the Golden Balls TV show, two contestants independently and simultaneously choose ‘Steal’ or ‘Split’. If both choose Steal, both get nothing. If both choose Split, each gets half of the jackpot. If one chooses Steal and the other Split, the one that chooses Steal gets the entire jackpot and the one that chooses Split gets nothing. Write down the normal form for this game and find the Nash equilibria in pure strategies. Reading for this question The reading for this question is in Chapter 2 of the subject guide. Approaching the question Steal Split Steal 0,0 1,0 Split 0,1 0.5,0.5 All strategy combinations apart from (Split, Split) are Nash equilibria. A simple question but amazingly effective in discriminating between scripts. Most candidates in 2014 got the normal form right though some insisted on displaying the extensive form. You must answer the question! Very few candidates were able to identify all Nash equilibria. 11 MN3028 Managerial economics Question 2 Firm D is a dominant price-setting firm. It has zero fixed costs and marginal costs of 1. There are also a number of price taking fringe firms supplying the same market. The total quantity supplied by these fringe firms is given by q = 3p where p is the unit price. Total demand is given by Q = 100-p. How much should firm D produce to maximise its profit? How much will the fringe firms produce? What is the resulting price? Reading for this question The reading for this question is in Chapter 11 of the subject guide. Approaching the question The demand faced by firm D equals QD=100 – p – 3p = 100 – 4p. Inverse demand is p = (100 – QD)/4 and hence MRD = 25 – QD/2. Equating firm D’s marginal revenue and marginal cost yields QD = 48 and p = 13. The fringe firms produce 39 units. To check our calculations we can substitute total output in market demand and find 48 + 39 = 100 – 13. Most candidates in 2014 knew that profit optimisation requires marginal revenue to be equal to marginal cost and the majority of candidates could more or less carry out the calculations. However, some candidates couldn’t correctly calculate marginal revenue. It is very important that you understand the concept of marginal revenue i.e. it is the derivative of revenue with respect to quantity. Question 3 A firm has production function q = K1/2L1/2 where q is output, K is capital and L is labour. The firm faces input prices r and w for capital and labour respectively. Reading for this question The reading for this question is in Chapter 7 of the subject guide. Approaching the question a. Carefully state the firm’s cost minimisation problem for a given quantity q and find the marginal products of capital and labour. The firm wants to minimise expenditure on inputs, i.e. rK + wL, subject to producing output q= K1/2L1/2. MPK = 1/2K-1/2L1/2 MPL = 1/2K1/2L-1/2 b. Derive the conditional input demand for capital. At the cost minimum in (a), the ratio of marginal products equals the input price ratio, i.e. L/K = r/w or L = rK/w. Substituting this in the production function gives q = K1/2(rK/w)1/2 = K(r/w)1/2 so that the conditional demand for capital equals K(q) = q(w/r)1/2. Most candidates in 2014 could correctly calculate the marginal products and many of them could then derive the conditional input demand for capital. A small number of candidates didn’t calculate correctly but their general approach was correct. However, many candidates didn’t state the cost minimisation problem at all, although they had no problem doing the calculations. 12 Examiners’ commentaries 2014 Question 4 Consider the following bargaining game. Player 1 offers the division of a cake of size 1 to player 2. Player 2 can either accept or reject. If he accepts, the proposed division is realised. If player 2 rejects, then player 1 can once more propose a division which player 2 can accept or reject. If player 2 rejects this second offer, he can propose a division to player 1 and player 1 can accept or reject. If player 1 rejects, player 2 can make another offer. If player 1 rejects this second offer, the game ends and both players get nothing. Both players discount their payoffs after each rejection with discount factor δ (0 < δ < 1). What is the subgame perfect equilibrium of this game? Reading for this question The reading for this question is in Chapter 3 of the subject guide. Approaching the question See game tree below. At the final decision node, player 1 will accept any and therefore player 2 will set = 1. At player 1’s next to last decision node, he has a choice now of 0 or 2(1 – z). Player 1 sets z such as to make player 2 indifferent, i.e. z = 1. At player 2’s second decision node, he has a choice now of 2 or (1 – y). Player 1 sets y such as to make player 2 indifferent, i.e. y = 1 – . At player 2’s first decision node, he has a choice now of (1 – (1 – )) or 1 – x. Player 1 sets x such as to make player 2 indifferent, i.e. x = 1 – 2. Candidates answered this question reasonably well in 2014 and it was clear that they had prepared the topic. A common mistake by candidates was that they did not realise that each player could offer twice instead of only once as in the standard model. You must read the question carefully! Surprisingly many candidates made small (but significant) calculation mistakes so they came up with a similar but still incorrect solution. 13 MN3028 Managerial economics (x, 1 – x) Offer to keep x Accept 1 2 δy, δ(1–y)) Accept Reject Offer to keep y 1 2 Offer to keep z 1 Accept Reject δ2(1–z)δ2z) 2 Offer to keep α 1 Accept Reject (0, 0) (δ3(1– α), δ3α) Section B Answer two questions from this section (25 marks each). Question 5 The LSE Senior Common Room holds an annual auction for the sale of periodicals and newspapers. The auction has an unusual format in that bidders can either submit a sealed bid or show up at an English auction at a specified time when all sealed bids have been received. The English auction starts at the highest submitted bid. Clearly, given the auction format, it is not rational for a bidder who plans to be present at the English auction to submit a sealed bid (the only effect this could have would be to potentially raise the starting bid in the English auction). Assume there are n bidders and n1 of these submit a sealed bid, the others show up at the auction. Bidders have independently drawn valuations from a uniform distribution on [0,1]. Reading for this question The reading for this question is in Chapter 5 of the subject guide. 14 Examiners’ commentaries 2014 Approaching the question a. Assume the highest sealed bid is b. What are the posssible outcomes at the end of the English auction? If there are no further bids in the English auction, the periodical is sold at b. If there is one bid in the English auction, it is sold at b+. If there is more than 1 bid in the English auction, the periodical is sold at the second highest valuation of bidders in the English auction. b. Show that all participants in the sealed bid auction bidding a fraction (n-1)/n of their valuation is a Nash equilibrium. (Note: do not give the analysis for standard first price sealed bid auctions or you will get zero marks for this part of the question). Let’s consider the bidding strategy of bidder 1 in the sealed bid auction. Assume all other sealed bid auction bidders bid a fraction of their valuation, i.e. bi = fvi where 0<f<1. In order for bidder 1 to win, he has to beat all the other sealed bids and all participants in the English auction should have valuations below bi. Hence, the probability that bidder 1 wins is given by b 1 f n1 1 b1n n1 The expected gain to bidder 1 is (v1 – b1) multiplied by the above probability. Optimising expected gain yields b1= v(n – 1)/n. c. In this auction format, does the bidder with the highest valuation always win? Explain your answer. No. It is possible for a bidder in the English auction to win although his valuation is lower than that of the bidder with the highest sealed bid, i.e. when (n – 1)vs /n < vw< vs, where vs is the highest valuation among sealed bid bidders and vw is the highest valuation among English auction bidders. d. What is the probability that a participant in the sealed bid auction with valuation v wins? The probability of winning for a sealed bid participant with valuation v equals v n1 1 (n 1)v n n n1 n 1 n n n1 v n 1 This probability increases in v and increases in n1 (given n). e. What is the expected gain for a sealed bid participant with valuation v? The expected gain for a sealed bid bidder equals v – b = v – (n – 1) v/n = v/n multiplied by the above probability: vn n 1 n n n n1 The expected gain is increasing in v and increasing in n1 (given n). f. What is the probability that an English auction participant with valuation v wins? Compare this result to your answer to (d). The probability of winning for an English auction participant with valuation v is the probability that all sealed bids are below v and all other valuations in the English auction are below v: 15 MN3028 Managerial economics n 1 iinsealedbid P vi v jinEnglishauction P(v j v) n Case 1: nv/(n – 1) < 1 In this case the above expression equals This probability is increasing in v and increasing in n1 (given n). Case 2: nv/(n – 1)>1 In this case the probability of winning equals v n n1 1 This probability is increasing in v and increasing in n1 (given n). In both cases the probability of winning given a valuation v is higher in the English auction than in the sealed bid auction. Question 6 The London School of Management wants to devise a scheme which allocates a given number of lectures and classes fairly to its faculty. Teachers have utility functions of the following form: U(L,C) = K – L – wC, where K and w are constants, L is the number of lecture hours per week and C is the number of class hours per week. The teaching point scheme assigns points to lectures and classes, a class gets 1 point and a lecture gets z points, and each teacher has a target of P points. Reading for this question The reading for this question is in Chapter 6 of the subject guide. Approaching the question a. Show that teachers will want to do only classes (and no lectures) or only lectures (and no classes) unless wz = 1. Teachers maximise U(L,C) subject to zL + C = P. The indifference curves and the budget constraint are linear. The only possible optima are corner solutions unless the budget constraint has the same slope as the indifference curves, i.e. 1/w = z. b. Assume z = 1/w. To find w, we ask the following question: ‘Teaching load A consists of 3 lecture hours per week (and no classes) and teaching load B consists of x class hours per week (and no lectures). What is the maximum x for which you would prefer B to A? ‘ Show how the answer to this question can be used to determine w. What is w? What is z? (Note that we are assuming that people answer truthfully which in practice could be assured by making the answers binding e.g. if someone says they would prefer to teach 30 class hours rather than 3 lecture hours they could be told to teach 30 class hours.) If a teacher answers x then he is indifferent between (L,C) = (3,0) and (L,C) = (0,x). Hence, U(3,0) = K – 3 = U(0,x)=K – wx so that w=3/x and thus z = x/3. Very few candidates realised that the indifference curves are linear. 16 Examiners’ commentaries 2014 Question 7 The manager of a large pharmaceutical company has to decide whether to invest in the development of a new drug. The first stage of the drug development costs $2 million and will result in a drug prototype with 10% probability (with 90% probability the first stage will be unsuccessful and the investment is lost). If the first stage is successful the manager can either sell the prototype to another company or enter into clinical trials and if they are successful bring the final drug to market. If the manager decides to sell to another company he knows that he will receive either a price of $32 million or a price of $12 million, with both prices equally likely. If the manager decides to enter clinical trials this will cost another $2 million. The trials will be successful with probability 50%. In that case the drug can be brought to the market where it generates a profit of $44 million. If the clinical trials are unsuccessful the prototype is worthless to everybody. Reading for this question The reading for this question is in Chapter 1 of the subject guide. Approaching the question a. Draw the decision tree. What should the (risk-neutral) manager do? Invest 1st stage prototype 0.2 0.2 No prototype 20 sell 0.1 0.9 -2 Clinical trials Don’t invest 18 0 0.5 -4 20 1/2 1/2 0.5 10 30 40 The payoffs in the decision tree above are in $m. The manager should invest in the first stage and sell if there is a prototype. b. Assume that if there is a prototype a market expert can predict with certainty the price another company is willing to pay for the drug prototype (prior to clinical trials and before the decision whether to sell the prototype is made). How much would the manager be willing to pay for that advice? At the point where there is a prototype, if the manager knows the price is 32 he would sell and end up with 30; if the manager knows the price is 12 he would not sell and end up (in EV) with 18. Hence, with perfect information the manager would have 30(1/2) + 18(1/2) = 24. Without perfect information he gets 20. Therefore he should be willing to pay up to 4 for the advice. c. Ignore part (b) for this question. Assume that another expert can predict whether the first stage of the drug development will be successful or not. What should the expert charge for her advice? If success is predicted, investment should go ahead and the expected payoff is 20. If failure is predicted, investment should not go ahead and 17 MN3028 Managerial economics the payoff is zero. Hence, with perfect information the expected payoff is 20(0.1) + 0(0.9) = 2. Without perfect information the expected payoff is 0.2. Hence the expert can charge up to 1.8 for her advice. A huge proportion of candidates chose this question in 2014, presumably because decision analysis is a topic they have all studied and the question did not look especially complicated. Many candidates did fairly well in part (a). Some puzzlingly got the decision tree right but not the correct decisions, and others only specified what to do at the first decision but not at the second. Parts (b) and (c) were answered very poorly. Candidates obviously had little idea of the problem they were required to solve and calculated differences between two outcomes that were not clearly related to the question. Consequently, very few candidates got full marks for this question, and it seemed that few actually spent the allotted 45 minutes on it. Many candidates failed to check their answers to make sure they made sense. Question 8 A monopolist book seller sells in two markets. Resale is impossible. Assume constant marginal costs and linear demand in both markets. a. Show, using graphs, how the monopolist determines prices in both markets. b. Now assume resale is possible, i.e. it is possible to buy in the cheaper market and resell, at a unit cost c, in the more expensive market. Explain how the monopolist will adjust to this new scenario. Reading for this question The reading for this question is in Chapter 10 of the subject guide. Approaching the question Candidates vaguely remembered the graphs in the subject guide but most made mistakes which showed they had not understood the material. For (a), the graphs need to indicate that in each market marginal revenue equals marginal cost. For (b), candidates have to realise that if the seller is going to operate in both markets then the price difference cannot exceed c. Question 9 a. Explain the concepts of moral hazard and adverse selection. b. Discuss how moral hazard can create a problem in the insurance market. c. Discuss how adverse selection can be a problem when a firm introduces a voluntary redundancy scheme. Reading for this question The reading for this question is in Chapter 4 of the subject guide. Approaching the question This question was very popular in 2014. The vast majority of candidates appear to understand the concept of adverse selection. However, only a small number of candidates understand moral hazard and many candidates confused the concept with adverse selection. Very few candidates could apply their knowledge to the context of a voluntary redundancy scheme. In such a scheme, the most productive workers (those who can find new jobs easily) are more likely to take advantage of the offer of voluntary redundancy. 18 Examiners’ commentaries 2014 Question 10 Suppose that a firm is a monopoly in the output market and a monopsony in the input market. There is only one input. Explain, using graphs and equations, how the firm determines its input demand and its output level. Reading for this question The reading for this question is in Chapter 7 of the subject guide. Approaching the question Very few candidates in 2014 gave an answer which analysed a firm which is both a monopoly and a monopsony although this is clearly what is required. The best answers demonstrated understanding of the concepts involved and gave clear and thorough explanations and graphs. A good starting point for this question is to write out the firm’s profit function and then find the optimal input level. 19