KEY ISSUES TO BE FURTHER DISCUSSED AT THE

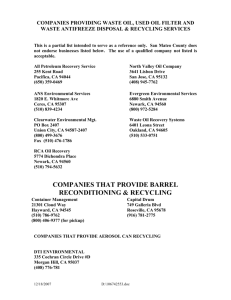

advertisement