BarthReport_2014-2015

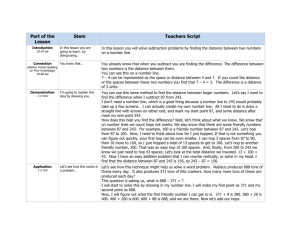

advertisement