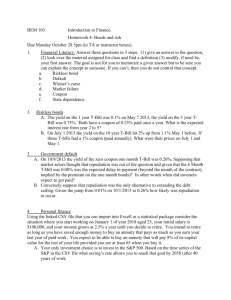

Day 1 Presentations

advertisement