20% of Adults Use Software to Pay Taxes

advertisement

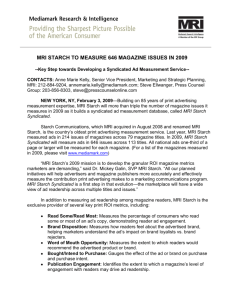

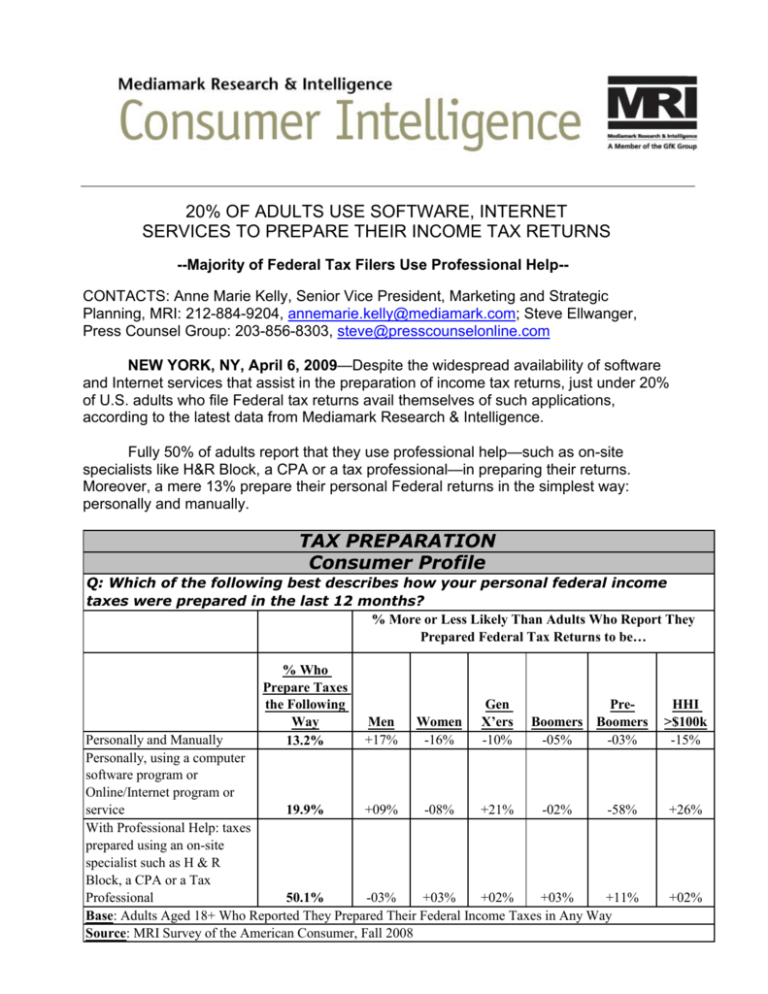

20% OF ADULTS USE SOFTWARE, INTERNET SERVICES TO PREPARE THEIR INCOME TAX RETURNS --Majority of Federal Tax Filers Use Professional Help-CONTACTS: Anne Marie Kelly, Senior Vice President, Marketing and Strategic Planning, MRI: 212-884-9204, annemarie.kelly@mediamark.com; Steve Ellwanger, Press Counsel Group: 203-856-8303, steve@presscounselonline.com NEW YORK, NY, April 6, 2009—Despite the widespread availability of software and Internet services that assist in the preparation of income tax returns, just under 20% of U.S. adults who file Federal tax returns avail themselves of such applications, according to the latest data from Mediamark Research & Intelligence. Fully 50% of adults report that they use professional help—such as on-site specialists like H&R Block, a CPA or a tax professional—in preparing their returns. Moreover, a mere 13% prepare their personal Federal returns in the simplest way: personally and manually. TAX PREPARATION Consumer Profile Q: Which of the following best describes how your personal federal income taxes were prepared in the last 12 months? % More or Less Likely Than Adults Who Report They Prepared Federal Tax Returns to be… % Who Prepare Taxes the Following Way 13.2% Men +17% Women -16% Gen X’ers -10% PreBoomers Boomers -05% -03% Personally and Manually Personally, using a computer software program or Online/Internet program or 19.9% service +09% -08% +21% -02% -58% With Professional Help: taxes prepared using an on-site specialist such as H & R Block, a CPA or a Tax Professional 50.1% -03% +03% +02% +03% +11% Base: Adults Aged 18+ Who Reported They Prepared Their Federal Income Taxes in Any Way Source: MRI Survey of the American Consumer, Fall 2008 HHI >$100k -15% +26% +02% Of those adults who file personal Federal taxes, the demographic known as Generation X (born between 1965 and 1976) are 21% more likely to use a computer or online/Internet tax preparation program or service. Moreover, filers living in households with a greater than $100k annual income are 26% more likely to use these tools for tax preparation. At the other end of the age spectrum, Pre Boomers--the age group born before 1946--are the most likely to use professional help; they are 11% more likely than all U.S. adult tax filers to avail themselves of professional help in preparing Federal tax returns. “It’s interesting that half of all adults who file personal federal taxes feel the need to pay for professional assistance despite the wide availability of software programs,” said Anne Marie Kelly, SVP, Marketing and Strategic Planning, MRI. “This probably speaks to the complexity of our tax code and the anxiety many taxpayers feel about tackling the forms on their own.” ******** About MRI… Founded in 1979, MRI interviews approximately 26,000 U.S. adults in their homes each year, asking about their use of media, their consumption of products and their lifestyles and attitudes. MRI is the country's leading provider of magazine audience and multimedia research data. The company releases data from its Survey of the American Consumer (adults 18+) twice yearly, in the spring and fall. MRI data have become the basic media-planning currency for the majority of the media plans that are created each year by national advertisers and their agencies. The company's 26,000 in-home interviews each year represent the biggest survey of its kind. MRI Starch, a leader in providing marketing intelligence on print advertising effectiveness, is a division of MRI. MRI is part of GfK Group AG, Nuremberg, Germany. The GfK Group is the No. 4 market research organization worldwide. Its activities cover the three business sectors of Custom Research, Retail and Technology and Media. The Group has 115 companies covering more than 100 countries. Of a total of approximately 10,000 employees, more than 80% are based outside Germany. For more information, please visit http://www.mediamark.com/.