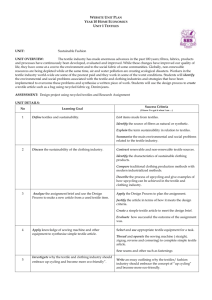

Improving Global Market Competitiveness of the Textile

advertisement