ECO364 - International Trade - Chapter 3

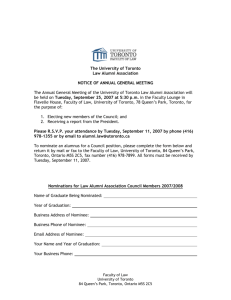

advertisement

ECO364 - International Trade

Chapter 3 - Heckscher Ohlin

Christian Dippel

University of Toronto

Summer 2009

Christian Dippel (University of Toronto)

ECO364 - International Trade

Summer 2009

1 / 103

The Heckscher-Ohlin Model

Model Set-Up

Difference To Ricardo

I

In Ricardo:

I

I

I

everyone wins from Trade.

there is only one factor of production

outcome is complete specialization

I

This is very simplistic

I

The Heckscher-Ohlin model aims to remedy some of these

shortcomings.

I

It is more complex than Ricardo but gives far more subtle and

nuanced predictions.

Christian Dippel (University of Toronto)

ECO364 - International Trade

Summer 2009

2 / 103

The Heckscher-Ohlin Model

Model Set-Up

Framework

I

2x2x2 Model: 2 Countries, 2 Goods (Outputs), 2 Factors (Inputs).

I

No productivity differences. All countries share the same technology.

I

Identical Homothetic Preferences.

I

Output can be produced with different input mixes (depending on

relative input prices).

I

Factors are mobile across sectors.

Countries differ in the relative abundance of factors. This is the key

of Comparative Advantage in the HO Model.

I

I

HO is often referred to as the factor proportions theory.

Christian Dippel (University of Toronto)

ECO364 - International Trade

Summer 2009

3 / 103

The Heckscher-Ohlin Model

Model Set-Up

Preview of Insights to Come

I

Factor Abundance determined at Country Level

I

Factor Intensity determined at Industry (=Sector) Level

I

Specialization according to both Factor Abundance and Intensity

I

Countries gain from Trade but Industries may loose and Factors may

loose

I

Trade has Subtle Effects on Industrial Restructuring

I

Under certain conditions, Factor Prices (e.g. wages) are equalized

across countries

Christian Dippel (University of Toronto)

ECO364 - International Trade

Summer 2009

4 / 103

The Heckscher-Ohlin Model

I

Model Set-Up

Recall patterns of specialization from the first class:

Table: Trade by Commodities (1995)

Type of Goods

Canada

Machinery

0.383

Food and Live Animals

0.066

Chemicals

0.059

Misc. Manufactures

0.049

Source: Robert Feenstra, “World Trade

I

China

Thailand

United States

0.230

0.045

0.041

0.455

Flows”

0.382

0.190

0.031

0.196

0.472

0.072

0.109

0.113

Canada and the United States specialize in skilled labor/capital

intensive goods while China and Thailand specialize in goods that use

unskilled labor relatively intensively.

Christian Dippel (University of Toronto)

ECO364 - International Trade

Summer 2009

5 / 103

The Heckscher-Ohlin Model

Model Set-Up

Set-Up Again

1. Two countries.

2. Two goods.

3. Two productive factors

I

Because of (1)-(3), this is referred to as the 2x2x2 model.

4. Constant returns to scale

5. Perfect competition (all agents are price takers).

6. Countries differ only in terms of their (relative) factor endowments.

7. Factors are immobile across countries but mobile across sectors.

8. Identical Homothetic Preferences

Christian Dippel (University of Toronto)

ECO364 - International Trade

Summer 2009

6 / 103

The Heckscher-Ohlin Model

Model Set-Up

We first set up the equilibrium relations between goods prices, factor

prices and factor inputs

1. Derive relationship between relative factor prices and relative factor

demand.

I

I

Based on firm profit maximization.

FF curves (to be derived).

2. Derive relationship between relative goods prices and relative factor

prices.

I

I

Based on iso-value and iso-cost curves from Lerner diagram (to be

derived).

SS curve (to be derived).

3. Use (1) and (2), derive three-way relationship between relative factor

prices, relative factor demand and relative goods prices (see slide

33/98 for an application).

Christian Dippel (University of Toronto)

ECO364 - International Trade

Summer 2009

7 / 103

The Heckscher-Ohlin Model

Model Set-Up

This is a General Equilibrium (GE) Framework. It is important to

remember what GE means (as opposed to Partial Equilibrium):

1. Firms maximize profits

2. Consumers maximize utility

I

I

Utility/Preferences stay in the background throughout the analysis

Because of homothetic preferences: Relative Demand unaffected by

income

3. Labor markets clear

I

This is the basic set-up for any GE Framework!

I

The equilibrium is a set of (factor market clearing) factor prices,

(goods market clearing) goods prices and sector-specific factor

allocations.

Christian Dippel (University of Toronto)

ECO364 - International Trade

Summer 2009

8 / 103

The Heckscher-Ohlin Model

Model Set-Up

We consider a small open economy where prices are exogenously given and

predict:

1. What happens to equilibrium relative factor prices and factor demand

if goods prices change (can be interpreted as movement from autarky

to free trade).

I

Stolper-Samuelson Theorem and Jones Magnification.

2. What happens to equilibrium relative factor prices and the production

structure (sectorial composition) if the distribution of productive

factors changes (can interpret as immigration).

I

Factor Price Insensitivity and Rybczynski Theorem.

3. Who specializes in what:

I

Heckscher-Ohlin Theorem

Christian Dippel (University of Toronto)

ECO364 - International Trade

Summer 2009

9 / 103

The Heckscher-Ohlin Model

I

General Equilibrium in a Small Open Economy

To determine the optimal factor-intensity, we use the iso-value and

iso-cost lines in the following Lerner Diagram.

Figure: Lerner Diagram

Christian Dippel (University of Toronto)

ECO364 - International Trade

Summer 2009

10 / 103

The Heckscher-Ohlin Model

I

General Equilibrium in a Small Open Economy

The iso-value curves map combinations of capital and labor that

yield $1 of output.

I

I

Start with 1 = p x F x (K , L).

For a given value of p x , what values of K and L produce $1 of output?

Christian Dippel (University of Toronto)

ECO364 - International Trade

Summer 2009

11 / 103

The Heckscher-Ohlin Model

I

General Equilibrium in a Small Open Economy

Some iso-value schedules where px,3 < px,2 < px,1 ... (at a lower

price, firm needs more inputs to yield $1 of input)

Figure: Lerner Diagram

Christian Dippel (University of Toronto)

ECO364 - International Trade

Summer 2009

12 / 103

The Heckscher-Ohlin Model

I

General Equilibrium in a Small Open Economy

The iso-cost curve gives combinations of capital and labor that (as a

bundle) cost $1. Values of w and r are taken as given. It is derived

from the following equation

wL + rK = 1

K=

Christian Dippel (University of Toronto)

1

r

−

w

r L

ECO364 - International Trade

Summer 2009

13 / 103

The Heckscher-Ohlin Model

General Equilibrium in a Small Open Economy

Figure: Lerner Diagram

Christian Dippel (University of Toronto)

ECO364 - International Trade

Summer 2009

14 / 103

The Heckscher-Ohlin Model

I

General Equilibrium in a Small Open Economy

If w and r rise by the same proportion, the iso-cost curve shifts in

parallel. Using less K and L now costs $1

Figure: Lerner Diagram

Christian Dippel (University of Toronto)

ECO364 - International Trade

Summer 2009

15 / 103

The Heckscher-Ohlin Model

General Equilibrium in a Small Open Economy

With zero profits, both revenue and costs are equal to 1. Therefore, K and

L must lie on both curves.

Figure: Lerner Diagram

Christian Dippel (University of Toronto)

ECO364 - International Trade

Summer 2009

16 / 103

The Heckscher-Ohlin Model

General Equilibrium in a Small Open Economy

I

Equilibrium has to be at point of tangency (demonstrated on next few

slides)

I

The straight line from the origin to the point of tangency is called the

Output Expansion Path (OEP)

The slope of the OEP gives us the factor intensity in a sector.

I

I

A flatter OEP in our graph means a sector is more labor intensive

Christian Dippel (University of Toronto)

ECO364 - International Trade

Summer 2009

17 / 103

The Heckscher-Ohlin Model

I

General Equilibrium in a Small Open Economy

Value of output is $1 and costs are less than $1. Positive profits (firm

entry). Not an equilibrium.

Christian Dippel (University of Toronto)

ECO364 - International Trade

Summer 2009

18 / 103

The Heckscher-Ohlin Model

I

General Equilibrium in a Small Open Economy

Could use a different mix of K and L to attain positive profits. Not

an equilibrium.

Christian Dippel (University of Toronto)

ECO364 - International Trade

Summer 2009

19 / 103

The Heckscher-Ohlin Model

I

General Equilibrium in a Small Open Economy

Could use a different mix of K and L to attain positive profits. Not

an equilibrium.

Christian Dippel (University of Toronto)

ECO364 - International Trade

Summer 2009

20 / 103

The Heckscher-Ohlin Model

I

General Equilibrium in a Small Open Economy

Value of output is $1 and costs are more than $1. Negative profits

and firm exit. Not an equilibrium.

Christian Dippel (University of Toronto)

ECO364 - International Trade

Summer 2009

21 / 103

The Heckscher-Ohlin Model

I

General Equilibrium in a Small Open Economy

With a second good of another factor intensity, we can add a second

iso-value curve.

Figure: Lerner Diagram

Christian Dippel (University of Toronto)

ECO364 - International Trade

Summer 2009

22 / 103

The Heckscher-Ohlin Model

I

General Equilibrium in a Small Open Economy

The preceding slide determines equilibrium factor intensities ( KLTT , KLCC )

in both sectors

I

I

for a given set of goods prices pC , pT

and a given set of input prices w , r

I

These goods prices and input prices are an equilibrium because both

iso-value lines are tangent to the iso-cost curve

I

Suppose that pT increases. In order to produce $1 worth of textiles,

fewer inputs are needed.

I

Consequently, the iso-value curve T shifts in while the iso-value

curve C does not move

Christian Dippel (University of Toronto)

ECO364 - International Trade

Summer 2009

23 / 103

The Heckscher-Ohlin Model

General Equilibrium in a Small Open Economy

Figure: Lerner Diagram

Christian Dippel (University of Toronto)

ECO364 - International Trade

Summer 2009

24 / 103

The Heckscher-Ohlin Model

General Equilibrium in a Small Open Economy

I

Now, there are profit opportunities in the textile sector because costs

are unchanged but revenue has increased.

I

Capital and labor flow into the textile sector.

I

Because textiles are relatively labor intensive (flatter OEP), labor’s

wage is bid up more than capital’s rental rate.

(w /r ) rises in response to pT /pc increasing.

I

I

I

Importantly, r actually falls in this case to allow for non-negative

profits in the Computer-sector

Intuition: for every unit of labor that shifts from the Computer to

Textile-sector, Computer-firms want to free up more capital than

textile-firms are demanding.

Christian Dippel (University of Toronto)

ECO364 - International Trade

Summer 2009

25 / 103

The Heckscher-Ohlin Model

I

General Equilibrium in a Small Open Economy

note that r has to fall if pC is fixed.

Figure: Lerner Diagram

Christian Dippel (University of Toronto)

ECO364 - International Trade

Summer 2009

26 / 103

The Heckscher-Ohlin Model

General Equilibrium in a Small Open Economy

This relationship between goods and factor prices is represented in the SS

curve:

Christian Dippel (University of Toronto)

ECO364 - International Trade

Summer 2009

27 / 103

The Heckscher-Ohlin Model

General Equilibrium in a Small Open Economy

I

This SS curve gives us the relationship between goods prices and

factor prices

I

What about the relationship between factor prices and factor

intensities?

I

We saw that a rise in PT /PC raises w /r

This makes labor more expensive and naturally leads to substitution

effects where each firm demands a higher K /L ratio

I

I

I

Note that for markets to clear this has to imply that the labor-intensive

sector expands (intuition: PT rises)

There is therefore a positive relationship between w /r and K /L in

both sectors

Christian Dippel (University of Toronto)

ECO364 - International Trade

Summer 2009

28 / 103

The Heckscher-Ohlin Model

General Equilibrium in a Small Open Economy

restructuring if w /r increases

Figure: Lerner Diagram

Christian Dippel (University of Toronto)

ECO364 - International Trade

Summer 2009

29 / 103

The Heckscher-Ohlin Model

I

I

General Equilibrium in a Small Open Economy

There is therefore a positive relationship between w /r and K /L in

both sectors

Supposing computers are relatively capital intensive (F C F C is below

and to the right of F T F T ):

Christian Dippel (University of Toronto)

ECO364 - International Trade

Summer 2009

30 / 103

The Heckscher-Ohlin Model

General Equilibrium in a Small Open Economy

I

We can soon combine the graphs on slides 27 and 30 to have a

graphical representation of the General Equilibrium in a Small Open

Economy (with prices exogenous)

I

But first, let’s make this more formal through the firm’s profit

maximization problem.

I

In competition, the nominal wage paid to a factor in production of

good X equals its marginal revenue product such that where w is the

wage and r is the rental rate of capital

w = px mpl(K , L)

Christian Dippel (University of Toronto)

r = px mpk(K , L)

ECO364 - International Trade

Summer 2009

31 / 103

The Heckscher-Ohlin Model

General Equilibrium in a Small Open Economy

We can divide these two expressions such that

px mpl(K /L)

mpl(K /L)

w

=

=

r

px mpk(K /L)

mpk(K /L)

Because the marginal product of labor is increasing in and the marginal

product of capital is decreasing in K /L, we can rewrite the right hand side

into a single expression that is increasing in K /L.

w

= f (K /L)

r

Christian Dippel (University of Toronto)

,

∂ wr

= f 0 (K /L) > 0

∂(K /L)

ECO364 - International Trade

Summer 2009

32 / 103

The Heckscher-Ohlin Model

General Equilibrium in a Small Open Economy

Example: Suppose that computers are capital intensive and textiles are

labor intensive with Cobb-Douglas production functions.

QT = K 1/3 L2/3

QC = K 2/3 L1/3

Firms producing X maximize PX QX − wLX − rKX

First Order Conditions (FOC) give {KC , KT , LC , LT } as functions of

{w , r , pC , pT } :

(1)

(2)

1/3 −1/3

w = pT 23 KT LT

−2/3 2/3

LT

r = pT 13 KT

2/3 −2/3

(3)

w = pC 13 KC LC

(4)

r = pC 23 KC

−1/3 1/3

LC

But {w , r } are also unknown so we need 2 more equations given by the

endowments. (5) KT + KC = K (6) LT + LC = L

Christian Dippel (University of Toronto)

ECO364 - International Trade

Summer 2009

33 / 103

The Heckscher-Ohlin Model

Dividing (1)/(2) and (3)/(4) gives us:

General Equilibrium in a Small Open Economy

KT

w

w

1 KC

r = 2 LT

r = 2 LC

pT

KT −1/3 KC 2/3

( LC )

pC 2 = ( LT )

Setting (1)=(3) (or (2)=(4)) gives us:

Combining these expressions gives us a solution for w/r (as a function of

pT

1/3 which we can plug back in to solve for

prices):

pC = (w /r )

{KC , KT , LC , LT }

Christian Dippel (University of Toronto)

ECO364 - International Trade

Summer 2009

34 / 103

The Heckscher-Ohlin Model

I

General Equilibrium in a Small Open Economy

We can now combine these two graphs into one picture.

Christian Dippel (University of Toronto)

ECO364 - International Trade

Summer 2009

35 / 103

The Heckscher-Ohlin Model

I

For a given set of relative goods prices, we can now predict:

I

I

I

General Equilibrium in a Small Open Economy

Relative factor prices

Factor intensities

For a given set of relative factor prices, we can now predict

I

I

Relative goods prices.

Factor intensities

I

In a small open economy (where prices are exogenous) we predict

relative factor prices and factor intensities given output prices.

I

This can be represented in the following picture:

Christian Dippel (University of Toronto)

ECO364 - International Trade

Summer 2009

36 / 103

The Heckscher-Ohlin Model

Christian Dippel (University of Toronto)

General Equilibrium in a Small Open Economy

ECO364 - International Trade

Summer 2009

37 / 103

The Heckscher-Ohlin Model

I

The SS curve is the graphical representation of the

Stolper-Samuelson theorem:

I

I

Stolper Samuelson and Rybczynski Theorems

As the relative price of a good increases, the nominal wages of the

factor used relatively intensively in that good increase relative to the

nominal wages of the other factor.

Jones Magnification is an important corrollary that the real wages

of the factor used relatively intensively in that good increase and the

real wage to the other factor decreases.

Christian Dippel (University of Toronto)

ECO364 - International Trade

Summer 2009

38 / 103

The Heckscher-Ohlin Model

Stolper Samuelson and Rybczynski Theorems

I

Example 1: If pT rises relative to pC , then the relative return to

labor over capital rises, the real wages of workers increase and the

real return to capital falls.

I

Example 2: If pT falls relative to pC , then the relative return to

labor over capital falls, the real wages of workers falls and the real

return to capital rises.

I

Using “Jones’ Hat-Notation”, denote a change in x by x̂

I

Then it can be shown for Example 1, that: ŵ > p̂T > p̂C > r̂

Christian Dippel (University of Toronto)

ECO364 - International Trade

Summer 2009

39 / 103

The Heckscher-Ohlin Model

Stolper Samuelson and Rybczynski Theorems

Figure: The Price of Textiles Rises Relative to the Price of Computers

Christian Dippel (University of Toronto)

ECO364 - International Trade

Summer 2009

pT

pC

↑

40 / 103

The Heckscher-Ohlin Model

Stolper Samuelson and Rybczynski Theorems

Figure: The Price of Textiles Falls Relative to the Price of Computers

Christian Dippel (University of Toronto)

ECO364 - International Trade

Summer 2009

pT

pC

↓

41 / 103

The Heckscher-Ohlin Model

I

Stolper Samuelson and Rybczynski Theorems

If the price of textiles rises and the price of computers stays

unchanged, how do we know...

1. that the nominal wage of labor rises and falls for capital?

2. that the real wage of labor rises and falls for capital?

Christian Dippel (University of Toronto)

ECO364 - International Trade

Summer 2009

42 / 103

The Heckscher-Ohlin Model

Stolper Samuelson and Rybczynski Theorems

Figure: nominal wage changes follow from the Lerner Diagram

Christian Dippel (University of Toronto)

ECO364 - International Trade

Summer 2009

43 / 103

The Heckscher-Ohlin Model

Stolper Samuelson and Rybczynski Theorems

I

We now know that r falls and w rises.

I

But how do we know that the real wage of labor rises and falls for

capital?

I

w

pC

I

If consumers consume both goods, the price level that consumers face

will be a combination of the price of textiles and computers.

and

I

w

pT

are not real wages!

e.g p = 21 (pC + pT )

I

If pT rises and pC stays unchanged, the aggregate price level (p) that

consumers face must go up!

I

Because r falls,

r

p

Christian Dippel (University of Toronto)

must fall!

ECO364 - International Trade

Summer 2009

44 / 103

The Heckscher-Ohlin Model

Stolper Samuelson and Rybczynski Theorems

I

How do we know that the real wage of labor rises?

I

Label the cost share of labor in textile production as α and the cost

share of capital in textile production as (1 − α) (see Question 2c on

2nd HO Problem Set)

Recalling “Jones’ Hat-Notation” from previous slide and with zero

profits, we have:

I

I

p̂T = αŵ + (1 − α)r̂

I

Because r falls, w has to rise by more than pT

I

Therefore

w

pC

and

Christian Dippel (University of Toronto)

w

pT

must both rise and

ECO364 - International Trade

w

p

must rise!

Summer 2009

45 / 103

The Heckscher-Ohlin Model

I

Stolper Samuelson and Rybczynski Theorems

The results on real wages and return to capital are an extension to

the Stolper-Samuelson Theorem called Jones Magnification.

I

Jones Magnification holds very generally (i.e. without holding PC

constant) but that is harder to show.

I

Jones Magnification matters because it is real wages (i.e. purchasing

power) that determine welfare!

I

It can be shown more generally than here but the algebra gets a bit

involved.

Christian Dippel (University of Toronto)

ECO364 - International Trade

Summer 2009

46 / 103

The Heckscher-Ohlin Model

Stolper Samuelson and Rybczynski Theorems

I

We will now derive a very important result called the Rybczynski

Theorem.

I

To do this, we will use an Edgeworth Box...

I

First, note that LT + LC = L and KT + KC = K .

Christian Dippel (University of Toronto)

ECO364 - International Trade

Summer 2009

47 / 103

The Heckscher-Ohlin Model

Christian Dippel (University of Toronto)

Stolper Samuelson and Rybczynski Theorems

ECO364 - International Trade

Summer 2009

48 / 103

The Heckscher-Ohlin Model

Stolper Samuelson and Rybczynski Theorems

Figure: The Textile Sector is Relatively Large

Christian Dippel (University of Toronto)

ECO364 - International Trade

Summer 2009

49 / 103

The Heckscher-Ohlin Model

Stolper Samuelson and Rybczynski Theorems

Figure: The Computer Sector is Relatively Large

Christian Dippel (University of Toronto)

ECO364 - International Trade

Summer 2009

50 / 103

The Heckscher-Ohlin Model

I

Stolper Samuelson and Rybczynski Theorems

Remember from the “relative prices graph” that we know the ratio of

K to L in each sector.

Christian Dippel (University of Toronto)

ECO364 - International Trade

Summer 2009

51 / 103

The Heckscher-Ohlin Model

Stolper Samuelson and Rybczynski Theorems

I

For given factor and goods prices, the Lerner Diagram gives us the

ratio of K to L (slope of OEP) in each sector.

I

We can use this information in the Edgeworth Box.

Christian Dippel (University of Toronto)

ECO364 - International Trade

Summer 2009

52 / 103

The Heckscher-Ohlin Model

I

Stolper Samuelson and Rybczynski Theorems

Combinations of capital and labor in each sector must lie on the rays

below:

Christian Dippel (University of Toronto)

ECO364 - International Trade

Summer 2009

53 / 103

The Heckscher-Ohlin Model

Stolper Samuelson and Rybczynski Theorems

I

These curves only intersect at one location.

I

Therefore we know what inputs will be in each sector (and, therefore,

what output will be).

Christian Dippel (University of Toronto)

ECO364 - International Trade

Summer 2009

54 / 103

The Heckscher-Ohlin Model

I

I

Stolper Samuelson and Rybczynski Theorems

How do production patterns change if we increase one of the

endowments?

To do this, we simply expand the Edgeworth Box along the dimension

whose factor has increased in quantity

I

Suppose we increase the amount of labor in the economy.

Christian Dippel (University of Toronto)

ECO364 - International Trade

Summer 2009

55 / 103

The Heckscher-Ohlin Model

Christian Dippel (University of Toronto)

Stolper Samuelson and Rybczynski Theorems

ECO364 - International Trade

Summer 2009

56 / 103

The Heckscher-Ohlin Model

Stolper Samuelson and Rybczynski Theorems

I

Labor and capital employed in computers both fall.

I

Labor and capital employed in textiles both increase.

I

Production of computers falls and production of textiles increases.

I

Rybczynski Theorem: As endowments of one factor change, a

country will produce more of the goods that use that factor

intensively and less of those that don’t

I

A corollary is that Migration leads to industrial restructuring because

it changes relative factor abundance

Christian Dippel (University of Toronto)

ECO364 - International Trade

Summer 2009

57 / 103

The Heckscher-Ohlin Model

Stolper Samuelson and Rybczynski Theorems

Factor Price Insensitivity

I

Notice that the OEP’s did not change slope as we expanded the

Edgeworth Box. This means that w/r did not change and this

irresponsiveness of w/r with respect to changes in factor endowments

is referred to as Factor Price Insensitivity (FPI) .

I

When does it hold? Intuitively, w/r cannot change in the Lerner

diagram because goods prices are exogenously given to a SOE.

I

The only way w/r can change is if the country specializes in only one

good.

I

This implies that the condition for FPI is that both countries are

diversified (produce both goods).

Christian Dippel (University of Toronto)

ECO364 - International Trade

Summer 2009

58 / 103

The Heckscher-Ohlin Model

Stolper Samuelson and Rybczynski Theorems

Diversification vs. Specialization

I

The discussion of FPI is a good point to check your understanding of

production functions in the Ricardian and HO Model.

I

Why is there a tendency to fully specialize in the Ricardian Model but

not in the HO Model although both models have CRS production

function?

I

The reason is that the HO Model is a two-factor model and the

production function has declining marginal products in each factor

(despite being CRS - make sure you get the difference).

I

This implies that as one sector expands at the expense of the other,

the marginal product of the scarce factor will eventually tend to

infinity in the shrinking sector.

Christian Dippel (University of Toronto)

ECO364 - International Trade

Summer 2009

59 / 103

The Heckscher-Ohlin Model

Stolper Samuelson and Rybczynski Theorems

Recap

I

We have learnt how wages and factor intensities respond to price

changes

I

I

... and how factor intensities and industry structure (how much labor

employed in each sector) respond to factor endowments

I

I

This is Stolper Samuelson

This is Rybczynski

Now we learn about the patterns of specialization.

Christian Dippel (University of Toronto)

ECO364 - International Trade

Summer 2009

60 / 103

The Heckscher-Ohlin Model

I

Heckscher Ohlin

Unlike the Ricardian model, the PPF in the HO model is bowed out

to reflect imperfect substitutability across sectors...

Christian Dippel (University of Toronto)

ECO364 - International Trade

Summer 2009

61 / 103

The Heckscher-Ohlin Model

I

Heckscher Ohlin

Optimal output will be attained when the value of output is

maximized.

V = pC QC + pT QT

We can rewrite this as

QT =

V

pT

−

pc

pT

QT

We can also think of this as an isovalue line that keeps the value of

production constant while varying the composition of production. Utility

will be maximized when the value of production is maximized and this

curve is as far up and to the right as possible.

Do not confuse this isovalue line with the isovalue curve in the Lerner

diagram.

Christian Dippel (University of Toronto)

ECO364 - International Trade

Summer 2009

62 / 103

The Heckscher-Ohlin Model

I

Heckscher Ohlin

Value, and consequently utility, is higher as these curves shift up and

to the right

Christian Dippel (University of Toronto)

ECO364 - International Trade

Summer 2009

63 / 103

The Heckscher-Ohlin Model

Heckscher Ohlin

I

A key insight is that, when there is no trade (autarky), the

consumption bundle must lie on both the iso-value line and the PPF.

I

This is similar to the Ricardian model in which a consumption bundle

must lie on both the PPF and the budget constraint.

I

Of course, in autarky, the production point is actually determined by

tangency of PPF and indifference curve and the price ratio adjusts to

be equal to the slope of both.

I

In autarky, an economy can only consume what it produces.

I

But under trade, the iso-value line can be thought of as a budget

constraint in that it gives all the consumption bundle that a country

can afford.

Christian Dippel (University of Toronto)

ECO364 - International Trade

Summer 2009

64 / 103

The Heckscher-Ohlin Model

I

Heckscher Ohlin

As ppTC increases, the economy produces more computers relative to

textiles.

Christian Dippel (University of Toronto)

ECO364 - International Trade

Summer 2009

65 / 103

The Heckscher-Ohlin Model

I

Heckscher Ohlin

This also gives us a relative supply curve for the two goods

Christian Dippel (University of Toronto)

ECO364 - International Trade

Summer 2009

66 / 103

The Heckscher-Ohlin Model

I

Heckscher Ohlin

Combine with Relative Demand

Christian Dippel (University of Toronto)

ECO364 - International Trade

Summer 2009

67 / 103

The Heckscher-Ohlin Model

Heckscher Ohlin

I

The relative supply (RS) curve comes from the PPF and the iso-value

lines.

I

The relative demand (RD) curve comes from utility maximization as

in the Ricardian model.

I

Two countries in autarky:

I

Because preferences are identical and homothetic, the relative

demand curve is the same in both countries in autarky.

I

Using the Rybczynski theorem, we know that the relative supply curve

for the North is to the left of the relative supply curve for the South

in autarky. To see this:..

Christian Dippel (University of Toronto)

ECO364 - International Trade

Summer 2009

68 / 103

The Heckscher-Ohlin Model

I

Heckscher Ohlin

With free trade in goods, both pT and pC must equate across

countries. Therefore ppTC must equate across countries.

Christian Dippel (University of Toronto)

ECO364 - International Trade

Summer 2009

69 / 103

The Heckscher-Ohlin Model

Christian Dippel (University of Toronto)

Heckscher Ohlin

ECO364 - International Trade

Summer 2009

70 / 103

The Heckscher-Ohlin Model

I

Heckscher Ohlin

With free trade and perfect competition, relative prices equate across

countries. The relative price of a given good will rise in one country

and fall in the other.

Christian Dippel (University of Toronto)

ECO364 - International Trade

Summer 2009

71 / 103

The Heckscher-Ohlin Model

I

Heckscher Ohlin

For a given good, there will be excess relative supply in one country

and excess relative demand in the other country. This good will be

exported by the first country and imported by the other.

Christian Dippel (University of Toronto)

ECO364 - International Trade

Summer 2009

72 / 103

The Heckscher-Ohlin Model

Heckscher Ohlin

I

We can use the PPF graph to present the same information and to

illustrate the gains from trade.

I

The following equation presents a country’s balanced trade condition:

PC CC + PT CT = PC QC + PT QT

This can be rewritten as

CT − QT =

pc

pT

(QC − CC )

This is a budget constraint in that the value of goods consumed must be

no greater than the value of goods produced.

Christian Dippel (University of Toronto)

ECO364 - International Trade

Summer 2009

73 / 103

The Heckscher-Ohlin Model

Heckscher Ohlin

I

Looking at the South, recall that in Autarky, consumption equals

production.

I

In equilibrium in autarky, we see production and consumption occur

at the point where the indifference curve is tangent to the PPF.

Christian Dippel (University of Toronto)

ECO364 - International Trade

Summer 2009

74 / 103

The Heckscher-Ohlin Model

Christian Dippel (University of Toronto)

Heckscher Ohlin

ECO364 - International Trade

Summer 2009

75 / 103

The Heckscher-Ohlin Model

I

Heckscher Ohlin

However, with trade, countries are no longer constrained to QC = CC

and QT = CT . Now, they can trade at any point along their budget

constraint.

I pT

pC

rises ( ppTC falls) in the South.

Christian Dippel (University of Toronto)

pT

pC

falls ( ppTC rises) in the North.

ECO364 - International Trade

Summer 2009

76 / 103

The Heckscher-Ohlin Model

I

Heckscher Ohlin

For the South:

Christian Dippel (University of Toronto)

ECO364 - International Trade

Summer 2009

77 / 103

The Heckscher-Ohlin Model

I

Heckscher Ohlin

For the North:

Christian Dippel (University of Toronto)

ECO364 - International Trade

Summer 2009

78 / 103

The Heckscher-Ohlin Model

Heckscher Ohlin

I

In the above example, the price of computers relative to textiles rises

in the North and falls in the South.

I

More generally, the relative price of the good that intensively uses the

relatively abundant factor rises. The relative price of the good that

intensively uses the relatively scarce factor falls.

I

By the Stolper-Samuelson Theorem, the abundant factor wins and

the scarce factor loses.

“Society” gains in each country because consumers can attain higher

indifference curves

I

I

This can be easily seen on the last two slides

Christian Dippel (University of Toronto)

ECO364 - International Trade

Summer 2009

79 / 103

The Heckscher-Ohlin Model

I

Heckscher Ohlin

The Heckscher-Ohlin Theorem: Under all of the previously stated

assumptions, a country will export the good that relatively intensively

uses its relatively abundant good. The same country will import the

good that relatively intensively uses its relatively scarce factor.

Christian Dippel (University of Toronto)

ECO364 - International Trade

Summer 2009

80 / 103

The Heckscher-Ohlin Model

Factor Price Equalization

I

Stolper-Samuelson tells us what happens to relative factor prices in

each country.

I

Owners of each country’s relatively abundant factor win as its factor

wage rises.

I

Owners of each country’s relatively scarce factor lose as its relative

factor wage falls.

Christian Dippel (University of Toronto)

ECO364 - International Trade

Summer 2009

81 / 103

The Heckscher-Ohlin Model

Christian Dippel (University of Toronto)

Factor Price Equalization

ECO364 - International Trade

Summer 2009

82 / 103

The Heckscher-Ohlin Model

Christian Dippel (University of Toronto)

Factor Price Equalization

ECO364 - International Trade

Summer 2009

83 / 103

The Heckscher-Ohlin Model

Factor Price Equalization

I

How far does this factor price convergence go?

I

With Factor Price Equalization (FPE), goods price equalizing

across countries leads to factor prices equalizing across countries.

I

Relative factor prices converge across countries even though factors

are immobile across countries!

I

This is a striking result but when is it true?

I

The next slides show that FPE will happen as long as endowments are

not “too” different.

Christian Dippel (University of Toronto)

ECO364 - International Trade

Summer 2009

84 / 103

The Heckscher-Ohlin Model

I

Factor Price Equalization

Recall the Lerner Diagram

Christian Dippel (University of Toronto)

ECO364 - International Trade

Summer 2009

85 / 103

The Heckscher-Ohlin Model

I

Factor Price Equalization

... and the Edgeworth Box.

Christian Dippel (University of Toronto)

ECO364 - International Trade

Summer 2009

86 / 103

The Heckscher-Ohlin Model

I

Factor Price Equalization

Equilibrium Allocations can be found in two equivalent ways. Points

A and B are equivalent.

Christian Dippel (University of Toronto)

ECO364 - International Trade

Summer 2009

87 / 103

The Heckscher-Ohlin Model

Factor Price Equalization

The “Integrated Equilibrium Approach”

I

I

So far, we have considered how factors are divided across sectors in

one country.

Now, let’s engage in a thought experiment:

I

I

I

I

Suppose we combine 2 countries and drop all barriers between them

(we have already assumed free trade and ignore financial flows so the

only addition is free migration)

The two countries are now “like one” and there will be a unique

General Equilibrium set of goods and factor prices.

This can again be represented in an Edgeworth Box that looks exactly

like before.

The boundaries given by the OEP’s mark the “Cone of

Diversification”.

Christian Dippel (University of Toronto)

ECO364 - International Trade

Summer 2009

88 / 103

The Heckscher-Ohlin Model

Factor Price Equalization

Figure: the Cone of Diversification

Christian Dippel (University of Toronto)

ECO364 - International Trade

Summer 2009

89 / 103

The Heckscher-Ohlin Model

Factor Price Equalization

I

We can pick a factor allocation anywhere in the Edgeworth box to

slice the country into two (drawing national boundaries).

I

Claim: Any factor allocation inside the Cone of Diversification will

lead to FPE.

FPE is equivalent to saying the OEP’s in the two countries are the

same.

I

I

I

I

I

The goods prices have to be the same under free trade

Also, countries have the same technology.

Together, this implies the iso-value curves in each country’s Lerner

Diagram are the same.

The OEP’s can then only be the same under FPE (only then are the

iso-cost curves the same)

Christian Dippel (University of Toronto)

ECO364 - International Trade

Summer 2009

90 / 103

The Heckscher-Ohlin Model

I

Factor Price Equalization

Allocation α lies inside the Cone of Diversification and FPE is attained

Christian Dippel (University of Toronto)

ECO364 - International Trade

Summer 2009

91 / 103

The Heckscher-Ohlin Model

Factor Price Equalization

I

More intuitively, factor prices will be equalized if endowments are not

too different.

I

Endowments that are similar lie inside the Cone of Diversification

because it is “centered around the diagonal” in the Edgeworth Box.

I

Free Trade between Canada and the USA is likely to erase

wage-differences.

But Free Trade between Canada and China? The endowments are

likely too different.

I

I

I

Let’s say the last point α sliced the world into Canada and the US.

Instead, let’s slice the world into Switzerland and Bangladesh:

Christian Dippel (University of Toronto)

ECO364 - International Trade

Summer 2009

92 / 103

The Heckscher-Ohlin Model

I

Factor Price Equalization

The North runs out of labor and the South runs out of capital

Christian Dippel (University of Toronto)

ECO364 - International Trade

Summer 2009

93 / 103

The Heckscher-Ohlin Model

Volume of Trade

Volume of Trade

I

I

With identical preferences, all countries consume on the diagonal of

the global Edgeworth-Box (understand this!)

The factor content of trade is determined by the endowment point

and the factor prices.

I

I

I

I

To see this, note that Home is capital-abundant if its endowment lies

above the diagonal.

It exports capital-intensive goods and imports labor-intensive goods.

factor content of trade is the labor and capital embedded in these

good-flows.

Home exports good B and imports good A. Can read the imported

and exported labor and capital of the Edgeworth-Box.

Christian Dippel (University of Toronto)

ECO364 - International Trade

Summer 2009

94 / 103

The Heckscher-Ohlin Model

Christian Dippel (University of Toronto)

Volume of Trade

ECO364 - International Trade

Summer 2009

95 / 103

The Heckscher-Ohlin Model

Volume of Trade

The aggregate volume of trade is larger, the more different endowments

are.

Christian Dippel (University of Toronto)

ECO364 - International Trade

Summer 2009

96 / 103

The Heckscher-Ohlin Model

Size and Gains from Trade

Size and Gains from Trade

I

the integrated equilibrium graph suggests that the volume of trade is

larger if countries are more similar in size (as you get to the corners of

the box, the boundaries of the cone get closer to the diagonal)

I

Hoe does country-size relate to gains from trade?

I

Assertion: small countries gain more from the movement from

autarky to free trade than do large countries.

I

Recall that the gains from trade come from free trade prices being

different than autarky prices.

I

The more different free trade relative prices, the larger the gains from

trade.

Christian Dippel (University of Toronto)

ECO364 - International Trade

Summer 2009

97 / 103

The Heckscher-Ohlin Model

Size and Gains from Trade

I

In autarky, relative factor prices are determined by aggregate relative

factor endowments in each country.

I

In a free trade equilibrium, relative factor prices are determined by

world relative factor endowments.

I

The larger a country, the closer its relative endowments are to world

relative endowments.

I

Suppose we look at the two countries as Canada and China...

Christian Dippel (University of Toronto)

ECO364 - International Trade

Summer 2009

98 / 103

The Heckscher-Ohlin Model

I

Size and Gains from Trade

Let’s look at a couple of examples...

Table: Size and Equilibrium Factor Prices

Canada

China

World

I

Large Canada

K

L

K /L

200 100

2

5

20 0.25

205 120 1.71

Large China

K

L

K /L

20 10

2

50 200 0.25

70 210 0.33

(integrated) World equilibrium factor prices will more closely resemble

autarky factor prices in the large country than in the small country.

Christian Dippel (University of Toronto)

ECO364 - International Trade

Summer 2009

99 / 103

The Heckscher-Ohlin Model

Size and Gains from Trade

Figure: Size and Factor Prices: Large Canada

Christian Dippel (University of Toronto)

ECO364 - International Trade

Summer 2009

100 / 103

The Heckscher-Ohlin Model

Size and Gains from Trade

Figure: Size and Factor Prices: Large China

Christian Dippel (University of Toronto)

ECO364 - International Trade

Summer 2009

101 / 103

The Heckscher-Ohlin Model

Wrapping Up

Wrapping Up

I

Unlike the Ricardian model, there are winners and losers from trade

liberalization.

I

Owners of the scare factor lose because they become relatively less

scarce.

I

Owners of the abundant factor win because they become relatively

more scarce.

Winners win by more than the losers lose due to the gains from

specialization.

I

I

I

In order for “everyone” to gain from trade, we must see transfer

payments from the owners of the relatively abundant factor to the

owners of the relatively scarce factor.

Aggregate gains from trade come from the fact that consumers can

attain a higher indifference curve.

Christian Dippel (University of Toronto)

ECO364 - International Trade

Summer 2009

102 / 103

The Heckscher-Ohlin Model

Wrapping Up

I

Combining the Rybczynski and Heckscher-Ohlin theorems, a

country will export the good that relatively intensively uses its

relatively abundant factor and will import the other.

I

As a country moves from autarky to free trade, the relative price of

the good that relatively intensively uses its relatively abundant factor

increases.

I

As a country moves from autarky to free trade, the relative price of

the good that relatively intensively uses its relatively scarce factor

falls.

Christian Dippel (University of Toronto)

ECO364 - International Trade

Summer 2009

103 / 103

The Heckscher-Ohlin Model

Wrapping Up

I

As a country moves from autarky to free trade, we can use the

Stolper-Samuelson theorem to show that the nominal wages of a

country’s relatively abundant factor rise and the nominal wages of the

country’s relatively scarce factor falls.

I

Jones Magnification shows that the same is true for real wages.

I

This will lead to owners of the relatively scarce factor ”losing” and

owners of the relatively abundant factor ”winning.”

I

However, winners win by more than losers lose so trade can lead to

gains for everyone.

I

For everyone to gain from trade, there must therefore be transfer

payments from the winners to the losers.

I

Factors of production are immobile across countries but goods are

mobile. Trade in goods is enough to lead to factor price

convergence.

Christian Dippel (University of Toronto)

ECO364 - International Trade

Summer 2009

104 / 103