Financial Statement for the 1st Quarter 2001

advertisement

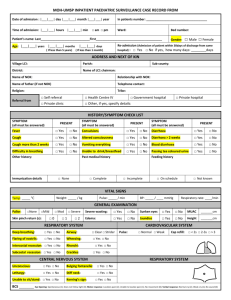

Rica Hotels Financial Statement for the 1st Quarter 2001 Comments on the Financial Statement for the 1st quarter 2001 NUMBER OF SOLD ROOM-NIGHTS 320 000 240 000 293 252 260 000 272 117 280 000 290 964 300 000 2000 2001 220 000 200 000 180 000 160 000 1999 OCCUPANCY RATE IN PERCENT % 70 65 60 60 58 57 58 55 55 1999 2000 The hotel market in Norway has shown clear signs of increased competition for hotel occupants in all market segments. This is due to a decrease in demand and the establishment of new hotels. In spite of this, Rica has maintained its own position in the market and formed new agreements with new, large customer groups. In Sweden the hotel market continued to show signs of minor growth in the 1st quarter of 2001, compared with the 1st quarter of 2000. The number of sold room-nights in the 1st quarter of 2001 was 293,252 compared to 290,964 sold room-nights in the 1st quarter of 2000. The average price per sold roomnight increased by 1% from NOK 720 to NOK 724 and hotel occupancy in the 1st quarter of 2001 was 56%, against 57% in the 1st quarter of 2000. Business Activity 45 ■ Rica hotels in Norway Market Development 56 50 40 Rica’s profits before taxes in the 1st quarter of 2001 were NOK 11 million, against NOK 10 million in the 1st quarter of 2000. The profit development for the 1st quarter has been good within all market segments, both in Norway and in Sweden, compared to the same period in 2000. 2001 ■ Rica hotels in Sweden The Rica Group’s business activities as of 03.31.2001 involved the operation of 50 hotels. Additionally, Rica is responsible for the operation of Rica Sjølyst Bankett og Konferansesenter, Nusfjord Rorbuanlegg and Nordkapphallen. Beyond this, Rica collaborates with 31 independent hotels under the concept "Rica Partner Hotel" which includes sales, marketing and purchasing. Operating revenues and income REVENUE PER SOLD ROOM-NIGHT NOK 700 706 720 750 698 699 800 804 850 805 900 650 600 550 500 1999 2000 2001 ■ Rica hotels in Norway ■ Rica hotels in Sweden (NOK) The operating revenues in the 1st quarter of 2001 were NOK 399 million against NOK 401 million for the 1st quarter of 2000 and the decrease is due to a corresponding decrease in sales of goods. Operating income II for the 1st quarter of 2001 was NOK 12 million, which is equivalent to the income for the same period of last year. In the 1st quarter of 2001, Rica has concluded a number of reorganization processes and cost cuts implemented in the 4th quarter of 2000 and the subsequent savings have thus far compensated to a certain extent for increases in other cost groups. Investments 2001, compared to NOK 2 million in the 1st quarter of 2000; the bulk of investments for 2001, NOK 20 million, are in connection with Rica Dyreparken Hotel. Financing and liquidity The Group’s long term debt was at NOK 362 million as of 03.31.01 against NOK 378 million for 03.31.00. Average annual interest on long term debt was 7.3%. NOK 112 million of the company loans have an annual fixed interest rate of 5.95% until 2008, while the remainder of the company loans have floating interest rates. Liquid assets as of 03.31.01 were at NOK 133 million against NOK 160 million as of 03.31.00. The Group also has drawing rights for NOK 100 million. Equity Capital The Group’s equity capital was NOK 446 million as of 03.31.01 against NOK 467 million as of 03.31.00. The booked equity/capital ratio as of 03.31.01 was at 38% compared to 39% as of 03.31.00. New and future projects Rica has not entered into any new contracts for new projects or acquired any new hotels in the 1st quarter of 2001. Rica Dyreparken Hotel, "Noah’s Ark", in Kristiansand opened on April 18th, in accordance with the project schedule and investment budget. Rica Forum Hotel in Stavanger which is still under construction will open in September 2001. In addition to this, the establishment of a new hotel in Copenhagen is in the planning stages, with a final decision on this project to be made in the 2nd quarter. Projected construction start is for the fall of 2001. Rica Hotel Copenhagen A/S, which shall both own and operate the hotel, is owned 50% by Eiendomsspar AS and 50% by Rica Hotels ASA. The total investment in the hotel project is estimated to be NOK 285 million. Profits in the 1st Quarter and Prospects for the 2nd Quarter The board is satisfied with the profit development for the 1st quarter and anticipates a profit result for the 2nd quarter which is better than that of the same period of last year. Investments have been made for approximately NOK 25 million in the 1st quarter of Billingstad, May 7, 2001 The Board of Rica Hotels ASA Financial Statement for 1st Quarter 2001 F i n a n c i a l S t a t e m e n t f o r t h e 1 st Q u a r t e r 2 0 0 1 2001 Income Statement 01.01. - 31.03. Operating revenues and operating expenses Lodging revenues Sale of goods Other operating revenues Total operating revenues Cost of goods Depreciation allowance Other operating costs Operating income I Gain on sales Refurbishing costs Operating income II Financial income Financial expenses Income before taxes Taxes Net income for the period Of which minority interest Balance Sheet 190 149 22 361 49 11 287 14 2 12 2 3 11 3 8 1 6 12 2 4 10 3 7 1 6 8 2 4 6 2 4 0 2001 2000 Definitions: 1. Net operating margin: 2. Gross operating margin: 3. Equity/Capital ratio: 4. Cash flow per share: Pr 31.03. 01.01 - 31.12 927 751 129 1 807 243 61 1 342 161 1 22 140 7 27 120 36 84 8 2000 Pr 31.12 952 308 1 260 903 258 1 161 953 342 1 295 446 32 68 362 363 1 271 467 28 82 378 305 1 260 408 22 78 399 254 1 161 441 32 79 343 400 1 295 Cash flow, operational activities Cash flow, investment activities Cash flow, financing activities Net cash flow for the period Cash on hand at beginning of period Cash on hand at end of period Capital strength Net operating margin Gross operating margin Equity/Capital ratio Key Figures per share Number of shares Nominal value Cash flow per share Earnings per share Equity per share Industry Figures Used Goods (percent) Personnel costs (percent) Occupancy rate (percent) RevPAR Room-nights sold Revenue per room sold 1999 Pr 31.03. NOK mill. 2000 966 305 1 271 01.01. - 31.03. Key Figures for the 1st Quarter 01.01. - 31.03. 209 167 25 401 52 12 319 18 2001 Cash Flow 01.01. - 31.03. 1999 212 162 25 399 49 11 325 14 Pr 31.03. Assets Fixed assets Current assets Total assets Equity and liabilities Equity Minority interest Provision for liabilities Long term debt Short term debt Total equity and liability 2000 2000 01.01. - 31.03. 1999 01.01. - 31.03. 2000 01.01 - 31.12 -79 -25 26 -78 211 133 -41 -3 0 -44 204 160 -63 -17 -2 -82 223 141 141 -62 -72 7 204 211 2001 2000 1999 01.01 - 31.12 2000 1 2 3 % % % 3,0 5,8 37,6 3,0 6,0 39,3 2,2 5,3 37,0 7,7 11,1 36,5 4 5 6 mill NOK NOK NOK NOK 24,0 1,0 0,8 0,3 18,6 24,0 1,0 0,8 0,3 19,5 24,0 1,0 0,6 0,2 17,0 24,0 1,0 5,8 3,5 18,4 % % % 30,2 41,1 56 408 293 252 724 31,3 40,3 57 410 290 964 720 33,1 39,9 58 406 272 117 698 32,4 38,6 61 428 1 310 324 707 7 8 9 NOK Operating income II / operating revenues Operating income II + depreciation/ operating revenues Booked equity + minority interest / total assets Profit + depreciation – minority / number of shares 5. 6. 7. 8. 9. Earnings per share: Equity per share: Used goods, percent: Personnel expenses, percent: RevPAR Earnings / number of shares Booked equity / number of shares Used goods / sale of goods Total personnel expenses / operating revenues Lodging revenue / available rooms Financial Statement for 1st Quarter 2001 F i n a n c i a l S t a t e m e n t f o r t h e 1 st Q u a r t e r 2 0 0 1 Business Segments for the 1 st Quarter 2001 FULL SERVICE HOTELS Operating revenues Operating income II Income before taxes 2001 2000 2001 2000 01.0131.03 01.0131.03 01.0131.03 01.0131.03 01.0131.03 01.0131.03 189 0 0 188 -2 -2 76 7 7 74 8 7 118 7 6 120 9 8 24 2 703 162 248 56 23 2 572 157 327 57 14 1 693 107 639 58 14 1 693 104 042 57 7 1 350 79 677 56 7 1 297 83 818 60 727 725 730 723 708 710 409 414 425 411 393 422 NOK Revenue per sold room Revenue per available room (RevPAR) NOK SEASONAL Operating revenues Operating income II Income before taxes OTHER 2000 2001 2000 2001 2000 01.0131.03 01.0131.03 01.0131.03 01.0131.03 01.0131.03 01.0131.03 1 -1 -1 1 -2 -3 15 -1 -1 18 -1 0 399 12 11 401 12 10 5 717 1 690 16 5 717 1 747 17 3 3 53 6 463 351 254 56 52 6 279 346 934 57 640 577 724 720 102 100 408 410 NOK Revenue per sold room Revenue per available room (RevPAR) NOK Operating revenues 2nd quarter 2001 broken down by business segment Income/loss before taxes 2nd quarter 2001 broken down by business segment -9 % 0% 4% 30 % 55 % 19 % GROUP 2001 NOK mill. NOK mill. NOK mill. Number of hotels /companies Number of rooms Occupant-nights Occupancy rate in percent % COURSE/CONFERENCE 2000 NOK mill. NOK mill. NOK mill. Number of hotels /companies Number of rooms Occupant-nights Occupancy rate in percent % ECONOMY 2001 47 % -9 % 0% 64 % ■ Full service ■ Economy ■ Course/conference ■ Seasonal ■ Other The 20 largest shareholders as of March 31, 2001 Name 1 2 3 4 5 6 7 8 9 10 Number of shares Share % Jan E. Rivelsrud Orkla ASA Hodne Holding AS Heliport Invest AS Skagenkaien Eiendom AS Pemanthel Holding AS Verdipapirfondet Avanse Spar Verdipapirfondet Skagen Vekst Norske Liv AS Eiendomsspar AS Rica Hotels ASA Slependveien 108 P.O. Box 3 N-1375 Billingstad 12 379 200 2 394 600 1 206 075 1 206 075 1 206 075 1 206 075 670 800 639 700 613 800 485 400 51,58 % 9,98 % 5,03 % 5,03 % 5,03 % 5,03 % 2,80 % 2,67 % 2,56 % 2,02 % Telephone: Telefax: e-mail: Company reg. no. : Name Number of shares Share % Vital forsikring ASA 400 000 1,67 % Hamang Papirfabrikk AS 250 000 1,04 % Prins Carl Bernadotte 240 000 1,00 % Tine Pensjonskasse 184 760 0,77 % Ole Jacob Wold 120 000 0,50 % Retiro AS 97 800 0,41 % Sykehjelps- og pensj.ordn. for leger v/Vital Forsikring 82 300 0,34 % 18 Citibank Switzerland Securities Dept. 70 000 0,29 % 19 Mustad Industrier AS 63 000 0,26 % 20 Strømmen Innredninger AS 56 300 0,23 % TOTAL 23 571 960 98,22 % 11 12 13 14 15 16 17 66 85 45 00 66 85 45 01 rica@rica.no NO 928 274 624 MVA Information about Rica is available at the following Internet links: http://www.RICA.no http://www.huginonline.no