Share Repurchases and Repayments of Nominal Value: The Swiss

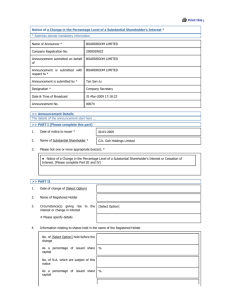

advertisement