Trends in foodservice

advertisement

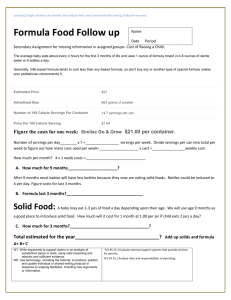

AUTOMOTIVE BEAUTY Examining the Foodservice Market and Capitalising on Key Trends COMMERCIAL TECHNOLOGY CONSUMER TECHNOLOGY ENTERTAINMENT Sean Ward Business Analyst UK Foodservice (CREST) FASHION FOOD & BEVERAGE FOODSERVICE HOME OFFICE SUPPLIES SOFTWARE SPORTS TOYS WIRELESS NPD Companies Follow us Today’s Agenda… What is CREST Total Out Of Home Performance Core Protein Trends by Category QS Fish and Chips Market Opportunities Final Thoughts ]2[ Global perspective… THE CURRENCY FOR FOODSERVICE INDUSTRY DECISIONS IN EUROPE AND ACROSS THE WORLD “Consumer Reports on Eating Share Trends” Paper Diary started in 2001 Online questionnaire as of April 2007 USA Canada Great Britain Germany France Spain Italy Russia Japan China Australia Mexico ]3[ Basic Methodology… Collection: Completes: Tracking: When: Projected: Brand: Online (since 2007) 5000-6000 per/Country per/Month Out of Home Meals & Snacks Yesterday’s behavior Total Country (GB, FR, DE, ES, IT) 2012 launch of CREST in Russia System-wide Performance Sales/Visits: Same-Store Sales Data: Consumer Perceived Sample: Discontinuous Outgo: Continuous 4 ]4[ Clients in Great Britain… ]5[ Looking at Traffic, Spend, and Sales on an annual basis, we can see the traffic is still in slight decline. Sales increases are driven by average spend Total Out of Home (OOH) UK Quarterly and Annual % Change Traffic Avg Ind Spend Sales YE Mar ‘11 Source: NPD CREST ® YE Mar ‘12 YE Mar ‘13 ] 6] 6[ [ Per Capita restaurant visits in 2013 held relatively steady at 178, while consumers 50-64 posted minimal gains for the same period Total Out of Home Per Capita Visits (Average Annual Visits per British Consumer) 7 Source: The NPD Group / CREST / UK National Statistics, National Population Projections ]7[ Total Out Of Home TOTAL OUT OF HOME Total Commercial QSR Pubs Full Service Café/Bistro Travel & Leisure Commercial Vending Total Non-Commercial Workplace (Canteen) College & University (Canteen) Workplace & College University(Vending) 8 ]8[ The Total OOH industry experienced negative Traffic growth, sourced to <18 and >65 at Lunch, Dinner and Snacking Occasions; No Deal/Promotion increased, driving up Price per item and driving down items per eater Total Out of Home Components of Spending YE Mar '13 vs ‘12 Total Out of Home Directional Traffic Change (000) SALES +0.5% £49.5 Billion AVERAGE SPEND +0.7% ₤4.49 Items Per Eater -1.2% 2.4 Price Per Item 1.7% £1.84 VISITS/TRAFFIC -0.2% 11.0 Billion < 18 Breakfast 18-24 Lunch 25-34 Dinner 35-49 Snack 50-64 > 65 Mon-Fri Sat-Sun Male Female On-Premises Off-Premises ABC1 C2DE Deal/Promotion No Deal/Promotion Adult Only Parties* Parties with Kids* Source: NPD CREST ® * = Meal Occasions (+) / (-) = Small Sample (Directional) | 9(++) or (--) YoY % <> 15% | NA = sample too small to report ]9[ QSR was the only industry bright spot with Modest Traffic gains; Pubs performance lost its spark from Q2 11 onwards Major Commercial Channels Traffic Trend (Quarterly & Annual) Quick Service 2% Pubs 0% 0% 0% -1% Full Service (Incl. Café/Bistro) -5% -2% -2% -1% -1% -1% Travel & Leisure -5% Q1 11 Source: NPD CREST ® -2% -2% -1% -1% Q2 11 Q3 11 Q4 11 Q1 12 0% 0% 0% 0% -1% -2% -3% 0% 1% 0% -1% Q2 12 Q3 12 Q4 12 Q1 13 YE Mar ‘11 YE Mar ‘12 10 or (--) YoY % <> 15% | NA = sample too small to report (+) / (-) = Small Sample (Directional) | (++) YE Mar ’13 ] 10 [ QSR had the highest percentage growth in Traffic compared to year ago – All channels except for T&L posted negative growth Total Out of Home (OOH) Traffic Change (000) and Trend by Channel YE Mar '13 vs. ‘12 % Traffic Share Category Visit Change % Traffic Change 50.9% QSR 0.6% 10.8% Travel & Leisure 0.0% 1.5% College/Uni Canteen -1.7% 2.5% Café/Bistro -1.5% 11.1% Pubs -0.4% 4.2% Vending -1.2% 10.6% FSR -1.3% 11.0% Workplace Canteen -2.3% Source: NPD CREST ® 11 or (--) YoY % <> 15% | NA = sample too small to report (+) / (-) = Small Sample (Directional) | (++) ] 11 [ Motorway Service stations had the highest percentage Traffic growth, followed by QS Sandwich and QS Burger % Traffic Share 8.3% 5.4% 13.4% 3.5% 4.5% 1.3% 4.2% 1.6% 0.2% 2.0% 2.3% 0.9% 3.0% 1.5% 0.7% 1.3% 2.6% 1.6% 2.4% 4.2% 4.8% Source: NPD CREST ® Total Out of Home (OOH) Traffic Change (000) and Trend by Category YE Mar '13 vs. ‘12 Category QS Burger QS Coffee Retail/Supermarket QS Sandwich QS Bakery Ice cream Shop Hotel In-Store Restaurant Motorway Service Stations QS Pizza/Italian FS Pizza/Italian Petrol Station QS Fish n Chips Bar/Club On-Board Catering Leisure/Entertainment Oth QS Chicken FS Ethnic QS Other FS Traditional QS Ethnic Visit Change (442) (862) (1,240) (1,974) (2,363) (3,861) (4,417) (4,715) (6,685) (13,287) 19,729 13,029 10,569 10,289 3,973 2,487 2,099 831 586 360 265 12 or (--) YoY % <> 15% | NA = sample too small to report (+) / (-) = Small Sample (Directional) | (++) % Traffic Change 2.2% 2.2% 0.7% 2.7% 0.8% 1.8% 0.5% 0.5% 3.2% 0.2% 0.1% -0.5% -0.3% -0.8% -2.6% -1.6% -1.3% -2.4% -1.7% -1.4% -2.4% ] 12 [ Among Major Brands, Subway now ranked third, even though it had the highest percentage Traffic growth – McDonalds still leading all Major Brands % Traffic Share 6.4% 1.8% 1.1% 3.2% 1.7% 1.7% 3.1% 0.8% 1.0% 1.1% 1.5% 1.3% 0.9% 0.7% 0.4% 0.8% 0.6% 2.3% 0.3% 0.9% 0.5% 0.6% 0.8% 0.5% 0.4% 1.8% Source: NPD CREST ® Total Out of Home (OOH) Traffic Change (000) and Trend by Brand YE Mar '13 vs. ‘12 Category Visit Change McDonald's Costa Coffee Subway Greggs/Bakers Oven Wetherspoon ASDA Tesco Pret A Manger M&S Off-Premises Starbucks Morrissons Burger King Caffé Nero Harvester Nandos Co-op Domino's Pizza Sainsbury Pizza Express Brewers Fayre Pizza Hut Full Servi Beefeater Boots Toby Carvery Pizza Hut Delivery KFC % Traffic Change -5,915 -13 -56 -534 -635 -875 9,184 7,967 6,943 4,625 4,424 3,432 2,842 2,525 1,816 1,684 1,636 1,617 1,479 1,434 930 598 428 416 201 17,554 13 or (--) YoY % <> 15% | NA = sample too small to report (+) / (-) = Small Sample (Directional) | (++) 2.5% 4.9% 7.3% 2.0% 2.5% 2.4% 1.0% 3.3% 2.4% 1.5% 1.1% 1.2% 1.6% 2.0% 3.1% 1.0% 0.9% 0.2% 1.1% 0.2% 0.0% -0.1% -0.6% -1.1% -2.2% -2.9% ] 13 [ Traffic trend shows that Brands outperformed Independents as consumers reverted back to familiar/safe options during this economic downturn Total Out of Home (OOH) Brands vs. Independents Traffic Trend YE Mar '13 vs. ‘12 3-Year CAGR -0.8% Total 2.5% Major Brands 2.1% Small Brands -3.8% Independents Source: NPD CREST ® 14 or (--) YoY % <> 15% | NA = sample too small to report (+) / (-) = Small Sample (Directional) | (++) ] 14 [ Protein Performance by Channel 15 ] 15 [ Total Protein Servings Distribution by Channel TOTAL OUT OF HOME YE Mar ’13 vs. ‘12 Total Protein Servings Non-Protein Food Servings 66.4% 11.5 Billion 33.6% 5.8 Billion At a topline level, Total protein performed well for the YE Mar ‘13 +53.3 Million Servings -168 Million Servings Total Protein include Meat, Poultry, and Seafood 16 40.7% Meat and Poultry Servings Distribution by Channel = Quick Service TOTAL OUT OF HOME YE Mar '13 vs. '12 = Full Service/Travel & Leisure 8.5% = Workplace & Education 50.7% Pubs = 18.5% (+0.6 ppts) FSR = 9.7% (-0.8 ppts) QSR = 50.7% (+1.2 ppts) More specifically, Protein gains sourced almost entirely to the Quick Service Restaurant Channel; still the industry bright spot as consumers continue to trade-down from Pubs and FSR Café/Bistro = 2.3% (= +0.1ppts) T&L = 10.2% (-0.6 ppts) Workplace = 7.1% (-0.3 ppts) Education 1.4% (+0.1 ppts) 17 Main Protein group performance Protein Servings TOTAL OUT OF HOME YE Mar 13 vs. ‘12 Share of Protein Servings YE Mar '13 Protein Servings (000) YE Mar ‘13 28.4% 1,650,071 Total Poultry 22.3% 1,295,394 Total Beef & Veal 1.6% 91,865 29.7% 1,725,368 Menu Importance Change YE Mar ‘13 Servings Change 0.0 -17,042 0.0 -6,537 Total Lamb 3,314 Total Pork Pork gains also sourced to a wide range of demo and occasions. There has been a focus on breakfast by major brands, as a result Total Pork is seeing servings increases 85,644 18 0.0 0.6 ] 18 [ Protein detail performance Share of Protein Servings YE Mar ‘13 5.9% 14.2% 8.9% 7.2% 6.3% 2.7% 1.0% 4.4% 0.6% 1.6% 1.7% 2.7% 1.1% 0.9% 3.8% 1.9% 0.6% 1.0% 2.3% 1.1% 1.1% 7.7% 0.3% 0.3% 0.6% 1.0% 1.7% 2.8% 1.0% 3.7% 4.5% 2.0% 3.2% Servings (000) Millions YE Mar ‘13 Protein Servings TOTAL OUT OF HOME YE Mar 13 vs. ‘12 Servings Change 344,227 825,927 516,047 417,625 364,046 155,416 55,572 253,443 36,592 91,971 100,935 154,053 65,789 50,808 222,693 111,771 33,595 59,478 131,474 61,188 64,818 448,138 19,444 16,586 33,775 55,273 98,520 163,916 55,504 217,229 259,694 118,648 184,837 * Low sample – Please use directionally Menu Importance Change YE Mar ‘13 As noted on previous slide, Pork performing well among breakfast items, while main opportunity appears to be development of lunch and dinner offerings, on the go offerings that appear to the 18-34 year old consumer, and items that maintain the everyday good value slot (via deals or everyday affordable pricing) 19 0.3 0.3 0.2 0.2 0.2 0.1 0.1 0.1 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 -0.1 -0.1 -0.1 0 0 -0.2 -0.2 ] 19 [ Fish Burgers and Fish Sandwiches share of Fish/Seafood servings has increased compared to last year Total Out of Home Fish/Seafood Servings Distribution Total Servings: 958,988,000 976,716,000 Seafood Sandwich 10% 11% Fish Sandwich 20% 20% Fish Burger 4% 5% Crabcake / Fishcake 18% 17% 37% 35% 10% 11% YE Mar 12 YE Mar 13 Total Seafood Fried Fish Non-Fried Fish Proprietary and confidential - for client use only Source: The NPD Group/ CREST ] 20 [ At a Total level Fish servings declined at a Total Out Of Home level Total Out of Home Fish - Servings Distribution 450.4 Mio 448.1 Mio 43% 43% Haddock 9% 9% Cod 14% 16% 30% 27% YE Mar 12 YE Mar 13 Other White Fish Salmon Mackerel Tuna Trout Proprietary and confidential - for client use only Source: The NPD Group/ CREST ] 21 [ Cod contributed to Total Fried Fish declines YE Mar 13 Vs. YA. Non- Fried Fish actually saw servings increases due to Salmon, Haddock and Cod Total Out of Home Servings Distribution Non-Fried Fish Fried Fish 352.6 Mio 343.7 Mio 97.9 Mio 104.4Mio Salmon (Smoked) 21% 18% Salmon (Grilled) 12% 13% Other White Fish Other Fish 49% 51% Mackerel Haddock 15% Cod 36% 17% 32% Haddock Cod Tuna Trout YE Mar 12 YE Mar 13 Proprietary and confidential - for client use only 24% 31% 9% 8% 10% 7% 11% 2% 12% 10% 11% 4% YE Mar 12 YE Mar 13 Source: The NPD Group/ CREST ] 22 [ Quick Service QUICK SERVICE RESTAURANTS (QSR) QS Burger QS Fish & Chips QS Chicken QS Sandwich QS Bakery QS Coffee QS Pizza/Italian QS Ethnic Retail/Supermarket Petrol QS Other ] 23 [ Beef and Pork posted the strongest gains at QSR this year Protein Servings QUICK SERVICE RESTAURANTS YE Mar 13 vs. ‘12 Share of Protein Servings YE Mar ‘13 Protein Servings (000) YE Mar ‘13 34.2% 1,009,349 Total Poultry 23.7% 699,956 Total Beef & Veal 0.5% 15,705 23.9% 705,652 Menu Importance Change YE Mar ‘13 Servings Change Total Lamb Total Pork 5,483 0.1 36,425 0.6 1,399 0.1 59,595 0.8 ] 24 [ Fried fish saw serving decreases within the QSR Market. Fish Burgers and Crab/Fish cakes were the main contributors to the increase. Seafood Servings QUICK SERVICE RESTAURANTS YE Mar 13 vs. ‘12 Total Servings Seafood Sandwich 429,620,900 451,245,800 12 12 26 25 6 1 5 8 1 6 47 44 2 3 YE Mar 12 YE Mar 13 Fish Sandwich Fish Burger Crabcake / Fishcake Total Seafood Fried Fish Non-Fried Fish Proprietary and confidential - for client use only 25 NPD Group/ CREST Source: The Most of the Fish eaten at QSR is reported as “Other White Fish” Fish Servings QUICK SERVICE RESTAURANTS YE Mar 13 vs. ‘12 Total Servings 203,686,700 200,060,400 64 67 Other/Unknown Fish Type Haddock 10 11 Cod Proprietary and confidential - for client use only 27 22 YE Mar 12 YE Mar 13 26 NPD Group/ CREST Source: The Pub Channel Pubs Branded Pubs Non-Branded Pubs ] 27 [ Extended early morning hours and aggressive deal/promotion activity helped to prop-up the Pub Channel this year ] 28 [ Pubs posted a slight correction in early 2011, but may be scratching their head regarding what to do next Pubs Components of Spending - % Change vs. Year Ago Traffic Spend Sales 1% 1% -1% -4% -1% YE Mar '10 -5% 0% YE Jun '10 1% 1% 2% -3% 1% 1% 0% 0% 0% -1% 0% 0% 0% 0% 0% 0% 0% Breakfast Family Food Focus Deals 0% YE Sep '10 1% YE Dec '10 YE Mar '11 Proprietary and confidential - for client use only YE Jun '11 YE Sep '11 YE Dec '11 YE Mar YE Dec '12 YE Jun 12 YE Sep 12 12 Source: The NPD Group/ CREST YE Mar 13 ] 29 [ Beef and Pork posted gains at Pubs in 2013 Share of Protein Servings YE Mar ‘13 23.5% 28.1% Protein Servings PUBS YE Mar 13 vs. ‘12 Protein Servings (000) YE Mar ‘13 253,259 302,485 2.5% 27,150 28.0% 301,467 Menu Importance Change YE Mar ‘13 Servings Change Total Poultry 11,401 Total Beef & Veal -1,262 Total Lamb -1,366 Total Pork 0.5 Beef and Lamb are the only proteins that have seen declines at Pub Pork almost on a par with Beef in terms of share of Pub Servings. Pork has seen an increase of over 26 million servings 26,690 -0.2 -0.2 1.3 ] 30 [ Seafood has increased share within pubs compared to year ago Seafood Servings Pubs YE Mar 13 vs. ‘12 Total Servings Seafood Sandwich Fish Sandwich Fish Burger 154,329,200 168,299,400 5 7 2 3 31 Crabcake / Fishcake 6 8 2 1 Mussels 0.8 Calamari 1.0 Scampi 13.8 Prawn 10.8 Prawn-Cocktail 4.5 Seafood-Other 4.7 30 Total Seafood 39 39 14 15 YE Mar 12 YE Mar 13 Fried Fish Non-Fried Fish Proprietary and confidential - for client use only 31 NPD Group/ CREST Source: The Mussels 1.1 Calamari 1.9 Scampi 12.9 Prawn 7.9 Prawn-Cocktail 3.6 Seafood-Other 5.7 Cod has increased in servings share, and drove fish servings within pubs Fish Servings Pubs YE Mar 13 vs. ‘12 Total Servings 82,034,430 90,247,340 19 18 Other White Fish Salmon 16 Mackerel 11 3 2 Haddock 19 21 Cod Tuna 43 45 1 0 1 YE Mar 12 YE Mar 13 Trout Proprietary and confidential - for client use only 32 NPD Group/ CREST Source: The Full Service (Including Café/Bistro) FULL SERVICE RESTAURANTS (FSR) FS Traditional FS Pizza/Italian FS Ethnic FS Other Café/Bistro (+) / (-) = Small Sample (Directional) / (++) / (--) YoY % <> 15% 33 ] 33 [ Not only do we see an overall servings decline among most proteins at FSR, but menu importance/incidence among top performers like beef also down; Only pork has seen servings growth Share of Protein Servings YE Mar ‘13 Protein Servings (000) YE Mar ‘13 Protein Servings FULL SERVICE RESTAURANTS (INCL. CAFÉ/BISTRO) YE Mar 13 vs. ‘12 Menu Importance Change YE Mar ‘13 Servings Change 22.4% 155,798 Total Poultry 17.1% 118,779 Total Beef & Veal 4.1% 28,160 Total Lamb 33.4% 232,174 -1.2 -19,512 -1.0 -15,145 -1,172 Total Pork -0.1 10,701 34 0.8 ] 34 [ Fish and Seafood sandwiches have slightly increased share at Full Service Restaurants Seafood Servings Full Service Restaurants YE Mar 13 vs. ‘12 Total Servings Seafood Sandwich Fish Sandwich 164,740,700 152,247,800 4 10 2 2 Fish Burger 37.4 Crabcake / Fishcake Total Seafood 5 11 1 3 Mussels 3.8 Calamari 4.0 Scampi 3.3 Prawn 14.8 Prawn-Cocktail 2.1 Seafood-Other 11.4 36.1 26 25 18 19 YE Mar 12 YE Mar 13 Fried Fish Non-Fried Fish Proprietary and confidential - for client use only 35 NPD Group/ CREST Source: The Mussels 3.3 Calamari 4.7 Scampi 3.7 Prawn 13.4 Prawn-Cocktail 2.9 Seafood-Other 10.9 QS Fish and Chips QS Fish and Chips (+) / (-) = Small Sample (Directional) / (++) / (--) YoY % <> 15% 36 ] 36 [ Fish & Chip shops posted consecutive rolling 52-week flat Visits, Spend, and Sales. Hasn’t been able to build on declines Mar 12 Fish & Chips Shop Category Components of Spending - % Change vs. Year Ago Traffic 1% 1% 3% 3% Spend 0% 0% 0% Sales 1% -2% -4% -3% -1% -2% -1% 0% -1% 0% 0% YE Mar YE Dec YE Jun 12 YE Sep 12 '12 12 YE Mar 13 -2% -3% -2% -1% 0% -1% -1% YE Mar '10 YE Jun '10 YE Sep '10 YE Dec '10 YE Mar '11 YE Jun '11 Proprietary and confidential - for client use only YE Sep '11 37 YE Dec '11 Source: The NPD Group/ CREST ] 37 [ What did consumers report when asked why they choose to eat outside the home FISH AND CHIP SHOPS = Family Time PUBS = Family & Friends Time Didn’t want to cook/Nothing home To satisfy hunger or thirst To Treat Myself/Others/Kids To eat as a family/Spend time Because Of Travel/Events/Holiday Socializing with friends To eat as a family/Spend time To Treat Myself/Others/Kids Dining as a couple To satisfy hunger or thirst QSR = Convenience FSR = “Lacks Definition” To satisfy hunger or thirst I was at work Didn’t want to cook/Nothing home To Treat Myself/Others/Kids Fitted In With A Shopping Trip Socializing with friends To Treat Myself/Others/Kids To satisfy hunger or thirst Fitted In With A Shopping Trip To eat as a family/Spend time 38 38 All dealing is down, but QS Fish & Chips and QS Ethnic are way below the industry average. Also the database is consumer perceived, often respondents don’t consider a long running deal as a deal Meal Deal/Promotion Traffic % by Category – YE Mar ‘13 vs. ‘12 YE Mar 12 50 49 47.6 48 46.6 YE Mar 13 50.9 44 42.4 29 23 21 20.3 15 18.2 25 24.3 19.4 Q Q i sh SF n C ps hi Q SC 25.8 18 16.1 10 9.4 6 5.9 r ge r u SB 25 23.9 h n ke ic Q S w nd a S h ic Q ry ke a SB Q SC e fe of Q Proprietary and confidential - for client use only S a/ zz Pi n li a a It Q 39 SE c ni th l/ ai t Re m er p Su t ke r a l tr o e P n io at t S FS d Tra l na o iti FS n lia a t I a/ zz i P FS Et ic hn Source: The NPD Group/ CREST ] 39 [ More of the same or just more? What’s the “best” way to drive Visits/Traffic growth… Frequency or Penetration? Loyalty Cards Multi-Daypart Loyalty Bounce-Back Receipt Kids/Family Promotions Take-Away/Dine-In Etc… 40 40 Other Market Trends 41 ] 41 [ Has Food mislabelling may have tainted one of Britain’s most treasured culinary institutions? IS better labelling the answer? Too many cases for it to be labelling mistake Successful Fish and Chip shop owner outlines type of Fish and when it was caught. 42 Blending clock time and consumer perceived daypart reveals a very complex consumer landscape with overlapping needs Visit Share Breakfast AM Snack Lunch Afternoon Snack Dinner Evening Snack 9% 8% 33% 16% 28% 5% ] 43 [ -5% Satisfy Hunger Take A Break MIDNIGHT 22:00-22:59 PM 21:00-21:59 PM Afternoon Snack 20:00-20:59 PM 19:00-19:59 PM 18:00-18:59 PM 17:00-17:59 PM 16:00-16:59 PM 15:00-15:59 PM AM Snack 14:00-14:59 PM 13:00-13:59 PM NOON 40% 11:00-11:59 AM 45% 10:00-10:59 AM 09:00-09:59 AM 08:00-08:59 AM 07:00-07:59 AM 06:00-06:59 AM 05:00-05:59 AM 04:00-04:59 AM 03:00-03:59 AM 02:00-02:59 AM 01:00-01:59 AM 00:00-00:59 AM As with the other core dayparts including Morning Meal, Lunch, and Dinner, consumers have different motivations for the various Snacking occasions throughout the day Evening Snack 35% 30% 25% 20% 15% 10% 5% 0% Treat & Socialize ] 44 [ Market opportunities… More “Ready to Eat” in Retail/Supermarket and Coffee Shops Seafood as an Ingredient (snacking, menu trade-out, etc.) Focus on driving parties with kids More Sandwiches and Wraps (Fish Finger Wraps/Dips) Consider family and sharing options Introduce two-for programs on higher priced items. Deal smart! Bundle with Dessert (over other items such as alcohol) More Deal/Promotions at Fish & Chip Shops QSR Sandwich variety targeted at Lunch Daypart. Go premium! More focus on Sandwiches Pubs and FSR Help drive FSR recovery with menu options that excite consumers Fish & Chip shops should innovate without compromising tradition Focus on Incidence/Menu Importance, not just Servings Focus on portions and portability Grow frequency now, and penetration later Keep it simple! ] 45 [ ] 46 [ Thank You Industries Automotive Beauty Entertainment Fashion Food / Foodservice Home Office Supplies Sports Technology Toys Video Games Wireless Countries Australia Austria Belgium Brazil Canada China France Germany Italy Japan Mexico Netherlands New Zealand Poland Portugal Russia Spain Sweden United Kingdom United States ] 47 [ Data Sharing Guidelines NPD actively supports use of CREST data in discussions and negotiations with your clients, as this is in with The NPD Group corporate objective of being the “currency” in markets where we operate. However, more-and-more CREST data is being given directly to non-subscribing chains, operators, distributors, media, and others. We encourage use of CREST data to facilitate discussions and negotiations with your clients (regardless of their status as a CREST subscriber). Please don’t leave CREST reports/presentations behind in electronic format with non-subscribing third parties. Do not “give” data directly to non-subscribers. If you’re unsure of what can and can’t be shared, consult with your client development representative. Non-Disclosure Clause -- Client shall not allow any Reports (including any Data) supplied to Client to be made available to any third party other than Client's officers, directors and employees. However, upon the prior written consent of NPD or as specifically described on the front of this Agreement, Client may provide Reports to Client’s advertising agency or marketing affiliates for use in Client's business. The obligations of Client under this Condition shall continue in effect for two years after Client received any Report (or Data therefrom) whether or not this Agreement is terminated during such period. Client shall procure that no Reports supplied by NPD and used by Client or its said advertising agency or its said marketing affiliates shall use the name of NPD without the prior written consent of NPD ]] 48 48 [[ CREST Measures and Basic Calculations Raw Sample (Transactions) Total number of completed surveys Sales: Estimate of total consumer expenditures for commercial foodservice meals and snacks, excluding any tip. Visits/Traffic: Total consumer-reported meals/snacks from commercial foodservice outlets. “Heads” through the door. Derived from reported meals/snacks by teens, adults, and kids under 13 reported by adults. Servings: The number of times a food or beverage was ordered at a commercial restaurant. Average Individual Spend: Average amount paid for one eater’s food and beverage. Does not include tip, but does include VAT Average Party Size: Average number of people in a party. This includes guests and kids. It is derived from the question: “Including yourself, please select the number of adults, teens and children in your party.” Average Price Per Item (**) Average Individual Spend divided by Items per Eater Average Items Per Eater / Order Size / Basket (*) Average number of different food items per person, per meal/snack. (*) Order size does not include same item multiples or refills. (**) CREST does not collect item price thus can’t size market value for specific product (e.g. burgers, cereal, etc.) Menu Importance / Incidence Simply stated, the % of orders (or visits) that include a specific food or beverage item, group of items, or category of items. A pure measure of item importance Index Reflects the relative importance of a specific variable (e.g. demo, occasion segment, etc.) Per Capita # of times the average GB consumer eats an out of home meal or snack in a given year. This can be looked at by any filter with matching population counts (e.g. age, income, gender, etc.) % Change vs. Same Period Year Ago YOY or PCYA the % change vs. same time period year ago (e.g. annual, quarter, month, etc.). Compound Rate of Change CAGR = Average annual % change over a period of two-years or more Penetration The percentage of the GB population who visit a specific brand, category, channel, or segment in a given 4-week period Frequency How often a typical consumer frequents a specific brand, category, channel, or segment of the industry in a 4-week period Contribution to Growth/Decline CTG and/or CTD = % of visit or servings growth/decline sourced to a specific variable (e.g. demo, occasion segment, etc.) ] 49 [ Ask your client development manager about NPDs complimentary monthly UK Highlights Online Format Share Discuss Feature Story Hyperlink Point of View Charts ] 50 [