A Q&A Guide to Insurance and Reinsurance Law in

advertisement

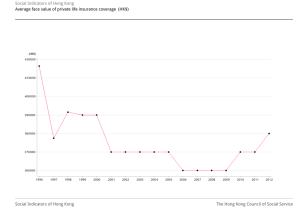

A Q&A GUIDE TO INSURANCE AND REINSURANCE LAW IN HONG KONG MARKET TRENDS AND REGULATORY FRAMEWORK 1 Please give a brief overview of the insurance and reinsurance markets in your jurisdiction, identifying market trends The information below is taken from the 2008 Annual Report of the Office of the Commissioner of Insurance (OCI) of the Hong Kong Government. Unless otherwise stated, statistics are as at 31 December 2007. Market data Low entry barriers mean the insurance market is crowded and competitive. There are 178 authorised insurers comprising: 112 general business insurers. 47 long-term business (life) insurers. 19 composite insurers (both general and long term). Pure reinsurers (insurers authorised to carry on only reinsurance business) form 14 of the general business insurers and five of the composite insurers. Most international insurers have operations in Hong Kong. Over 50% of insurers are incorporated locally, often as a local subsidiary of a large international insurer, with the rest coming from 23 different countries, but predominantly from the US (14), Bermuda (14) and the UK (13). Hong Kong has: 508 registered insurance brokers. 31,042 registered insurance agents. The major lines of business, using total premiums as the benchmark, are: General business: o Accident and health (26%) o General liability (24%) o Property damage (22%) o Motor vehicle (11%) Long-term business: o Individual life business (88%) o Retirement scheme management (9%) Premium income The insurance industry makes a major contribution to the economy. Gross annual premium income increased significantly during the 1990s and continued to do so until 2008 (before the economic crisis). Gross premium income for 2007 totalled HK$195 billion (about US$25.2 billion) (over 12% of GDP). Long-term business forms the largest sector of the insurance market. Gross premiums for long-term business in 2007 totalled HK$173 billion (just over 87% of 2007’s total premium income). Individual life insurance is the largest part of this business (88%). At the end of 2007, about 7.1 million individual life policies were in force, equivalent to more than one life policy per resident. General business only grew by 5.7% during 2007 (gross premiums totalling HK$24 billion (about US$3.1 billion)). Local assets maintained for general business for 2007 totalled over HK$79 billion (about US$10.2 billion). However, underwriting profit for general business was significantly down in 2008. Insurance penetration (measured as premiums as a percentage of GDP) stood at 10.7% for long-term business, but only 1.5% for general business. Market concentration The general business market remains fragmented. The top ten insurers have historically been responsible for only about 40% of market share by gross premium. The life insurance market has traditionally been far more concentrated. The top ten life insurance companies enjoy a market share by office premium of just over 74%, half of which is concentrated within the top four companies. The pure onshore reinsurance market is also very concentrated. In 2007, the top five reinsurers had an aggregate market share of over 82% in gross premiums for direct insurers. Major trends The major insurance market trends over the past few years include: The growth of wealth management and investment linked products. From 1990 onwards, an ageing population and increased prosperity led to a large increase in the sale of wealth management and retirement planning products, predominantly investment-linked insurance policies. By the end of 2007 investment-linked products accounted for more than half of life business by gross premium. Investment-linked business declined during 2008 with premiums falling by just under 40%, and figures for the first quarter of 2009 showed a fall of a further 51% (compared with the same period in 2008). This trend will probably continue as consumers switch from maximising returns to capital preservation. Creation of the Mandatory Provident Fund scheme (MPF). This compulsory retirement savings scheme was introduced at the end of 2000. Under the MPF, employers and employees must contribute a monthly minimum amount of salary (currently HK$1,000 each (about US$130)) to a privately operated retirement scheme established and administered under the MFP Scheme Ordinance. By the end of 2007 there were 70,295 existing retirement scheme contracts carrying net liabilities of HK$145.7 billion (about US$18.8 billion). Closer Economic Partnership Arrangement (CEPA). CEPA is the first free trade agreement between Hong Kong and Mainland China. Since it came into effect in 2004, locally incorporated insurers in Hong Kong who meet the access conditions can conduct insurance business in Mainland China. CEPA also allows Hong Kong residents with the necessary qualifications and who are appointed by mainland insurance institutions to carry on insurancerelated business in Mainland China. Since 2008, under CEPA Hong Kong insurance agencies can set up wholly owned enterprises in the mainland to provide insurance agency services to mainland insurance companies. 2 What is the regulatory framework for insurance/reinsurance activities? Hong Kong is a Special Administrative Region (SAR) of the People’s Republic of China. Hong Kong has an entirely separate legal system from Mainland China. Its constitutional framework is derived from the Basic Law under which Hong Kong exercises executive, legislative and independent judicial power. Under the “one country, two systems” principle, Hong Kong law has, since 1997, remained based on English common law supplemented by local legislation (largely based on English legislation) and will do so until at least 2047. Insurers and insurance intermediaries are regulated by various bodies and a mixture of statues, government regulation and self regulation. Insurance Companies Ordinance (ICO) The legal framework for the insurance industry is provided by the ICO and its subsidiary legislation including the: Insurance Companies (Determination of Long Term Liabilities) Regulation. Insurance Companies (Margin of Solvency) Regulation. Insurance Companies (General Business) (Valuation) Regulation. The ICO is derived from the English Insurance Companies Act 1974 (as amended in 1981 and then consolidated in the Insurance Companies Act 1982). The ICO recognises and regulates: Insurers. An insurer carries on insurance business in or from Hong Kong (other than Lloyd’s) (ICO). Insurance business is carried on if it either (section 2(3), ICO): o Maintains an office or agency in Hong Kong for that purpose o Holds itself out as carrying on insurance business in or from Hong Kong. Insurance agents. An insurance agent holds himself out to advise on or arrange insurance contracts in or from Hong Kong as an agent or sub-agent of one or more insurers. An appointed insurance agent is an insurance agent appointed by and registered with an insurer as an agent. Only an appointed insurance agent can hold himself out as an insurance agent. Insurance brokers. An insurance broker carries on the business of negotiating or arranging contracts of insurance in or from Hong Kong as the policyholder’s or potential policyholder’s agent, or advising on insurancerelated matters. An authorised insurance broker is an insurance broker who is either: Authorised by the Insurance Authority under section 69 A member of a body of insurance brokers approved by the Insurance Authority (see below) under section 70. The contract only requires some element of insurance for the person arranging it to require authorisation as a broker, and only an authorised insurance broker is permitted to hold itself out as an insurance broker. The ICO uses the collective term “insurance intermediaries” for insurance agents and insurance brokers. A person cannot act as both an appointed insurance agent and an authorised insurance broker (section 65(3), ICO). Insurance Authority (IA) The main regulatory body is the IA, established under the ICO. The Commissioner of Insurance is responsible for supervising and regulating the insurance industry. The IA authorises insurers, and monitors and scrutinises their financial strength and sustainability by reviewing their financial statements and business returns, ensuring compliance with the solvency standards and other ICO requirements, including requirements for: General insurers to maintain assets in Hong Kong. Long-term insurers to maintain the statutory solvency margin. Insurers to submit annual audited financial statements and business returns, and for long-term insurers to submit actuarial reports. Supervising insurance intermediaries. The IA can issue guidelines on the exercise of its functions (ICO). These are for the guidance of authorised insurers, insurance intermediaries and their auditors and actuaries. To date, the IA has issued 13 guidance notes (referred to with the prefix GN) (www.oci.gov.hk/press/index_03_01.html). The guidance notes are not legally binding, but importantly they indicate how the IA interprets and enforces ICO requirements. Breach of the guidelines is likely to lead to increased IA regulatory scrutiny. Hong Kong Federation of Insurers (HKFI) The HKFI (see box, Main insurance/reinsurance trade organisations) represents the insurance industry. Most authorised insurers are members (at the end of September 2009, it had 90 general business members and 44 life insurance members). It plays an important role in the self-regulation of the industry though various codes of practice, guidance notes and other self-regulatory measures including the: Code of Conduct for Insurers (Insurers’ Code). Code of Practice for the Administration of Insurance Agents (Agency Code). The Insurers Code sets out the standards with which HKFI members must comply when issuing consumer insurance contracts (private insurance contracts with Hong Kong resident individuals). The Agency Code (the HKFI will soon release the revised seventh edition) sets out the requirements for appointing, supervising and monitoring of insurance agents by their appointing insurer. CONTRACTS OF INSURANCE 3 What is a contract of insurance for the purposes of the law and regulation in your jurisdiction? There is no statutory definition of an insurance contract for the purposes of law or regulation in Hong Kong. As Hong Kong law is based on English common law, the defining principles of an insurance contract can be derived from the English Prudential Insurance Company v Commissioners of Inland Revenue [1904] 2KB 658. An insurance contract under Hong Kong law is therefore a contract where one party (the insurer) agrees, in return for consideration (the premium), to indemnify or provide a benefit to the other party (the insured) if an uncertain and adverse event occurs. As under English law: The usual contract law principles such as offer and acceptance, consideration and intention to create legal relations apply. The insured must have an insurable interest in the subject matter of the insurance policy at the time a claim is made. The insurance contract does not have to be in writing (except for marine insurance), although almost every insurance contract is in writing. 4 Are all contracts of insurance regulated in your jurisdiction? All insurance contracts are regulated. The insurance business classes relevant for ICO purposes are set out in the Ordinance, including a narrative for each class describing the features of a contract falling within that class. A contract within these classes and which is not otherwise an insurance contract (for example, because it is not an indemnity contract such as a life insurance policy) is deemed an insurance contract for ICO purposes (section 3(2), ICO). It is unlikely that any insurance contract would fall outside this comprehensive list. INSURERS AND REINSURERS 5 Are insurers and reinsurers regulated in the same way in your jurisdiction? The ICO does not distinguish between an insurer and a reinsurer (they both fall within the ICO definition of insurer) and are therefore regulated almost identically, except that: There is no requirement for a pure reinsurer to maintain assets in Hong Kong in compliance with section 25A of the ICO. An insurer is authorised to carry on either general business or long-term business, but not both (it is no longer possible for an insurer to obtain a composite licence, that is one licence permitting it to carry on both general business and long-term business), but a professional reinsurer can obtain a composite licence. Professional reinsurance companies enjoy a preferential tax treatment (see Question 27). Therefore, in this chapter “insurer” includes a reinsurer, and references to insurance include reinsurance unless otherwise stated. 6 Can insurers or reinsurers carry on non-insurance business? Please summarise any restrictions on their business activities. Insurers can carry on non-insurance business. However, the IA does not authorise applicants to carry on insurance business in or from Hong Kong unless it is satisfied that the carrying on of some other form of business is not contrary to existing or potential policyholders’ interests (section 8(3)(g), ICO). The authorisation conditions continue to apply to insurers after authorisation. 7 Are there any statutory limits or other restrictions on, or requirements relating to the transfer of risk by, insurance or reinsurance companies? There is no statutory limit or restriction on the transfer of risk but the following matters are relevant. To be authorised as an insurer, applicants (except captive insurers) must satisfy the IA that they would not engage in a fronting operation (under which the ceding company (the primary or fronting company) cedes the risk it has underwritten to its reinsurer with the ceding company retaining none or a small part of that risk for its own account) (Authorisation Guidelines). These conditions continue to apply to an insurer after authorisation. What constitutes a small part of that risk is not specified, but it would generally be difficult to persuade the IA to accept risk retention of less than 10% of a particular class of business. An insurer must either have adequate reinsurance arrangements for the risks of each class of business it insures, or justify to the IA why there are no arrangements for this purpose (section 8(3)(c), ICO). Further guidance on reinsurance arrangements with related companies is set out in GN12, but the IA only accepts this kind of reinsurance if those related companies have a sufficiently high credit rating. OPERATING RESTRICTIONS 8 Does the entity or person have to be authorised or licensed in your jurisdiction? If so, please outline the key steps involved in this process and the requirements that must be satisfied. Insurers A company wishing to carry on insurance business in or from Hong Kong must apply to the IA under section 7(1) of the ICO for authorisation to carry on the relevant classes of insurance business. The main requirements for authorisation are set out in the ICO (principally section 8(3)), including requirements covering: The applicant’s: o Place of incorporation (it must be a company) o Financial status o Reinsurance arrangements o Ability to comply with the ICO and the fitness of its directors and controllers. Finance, including that the applicant must both: o Have the minimum amount of paid up share capital o Maintain an excess of its assets over its liabilities of not less than the required solvency margin (to safeguard the risk its assets are insufficient to meet its liabilities in unpredictable events). Paid-up share capital. An insurer must generally have a minimum share capital of HK$10 million (about US$1.29 million). This is increased to HK$20 million (about US$2.58 million) for a composite insurer (both general and long-term business) and for an insurer carrying out statutory insurance business (mainly motor vehicle or employees’ compensation). The minimum capital requirement is, however, reduced to HK$2 million (about US$260,000) for a captive. The insurer maintaining a solvency margin more than the statutory amount for up to three years from authorisation. For a general business insurer the solvency margin is the greater of: o 20% of the relevant premium income up to HK$200 million (about US$25.8 million), plus 10% of the amount by which the relevant premium income exceeds HK$200 million o 20% of the relevant claims outstanding up to HK$200 million, plus 10% of the amount by which the relevant claims exceed HK$200 million. This is subject to a minimum of HK$10 million and increased to HK$20 million for insurers carrying on statutory business. For a long-term business insurer, the solvency margin is the greater of: o HK$2 million o The amount specified under the Insurance Companies (Margin of Solvency) Regulation 1995 (generally 4% of the mathematical reserves and 0.3% of the capital at risk). For a captive the solvency margin is the greater of: o HK$2 million o 5% of net premium income o 5% of net claims outstanding The applicant must also satisfy the IA that it will comply with the additional Authorisation Guidelines requirements, including: Maintaining an office as its place of business in Hong Kong with a professional management and staff establishment appropriate to the nature and scale of its operations based in that office. A locally based chief executive as its controller. Keeping and maintaining proper account books to enable audit and actuarial valuations. Sufficient financial resources to finance its operations set out in its threeyear business plan. Financial backing of its parent or controller, who must be reputable persons of good financial standing. A board of directors with sufficient knowledge and experience of the insurance business. In addition, a long-term business applicant must satisfy the IA: That it has sufficient actuarial expertise, including a qualified staff actuary to advise on relevant matters (and must submit a report and certificate from the qualified actuary on the applicant’s business plan confirming prudent and satisfactory arrangements regulating actuarial matters have been made). Where the applicant intends to carry on investment-linked business, that it has adequate accounting procedures to properly identify and value assets and liabilities, and provide timely reports to policyholders, and that it has sufficient investment management expertise to manage the invested funds. An overseas applicant must also satisfy the IA that it: Is incorporated in a country where there is a comprehensive company law and insurance law. Is an insurer under the effective supervision of an insurance authority in its home jurisdiction. Is a well-established insurer with international experience and of undoubted financial standing. Alternatively, it may establish a local subsidiary to carry on its business, thereby avoiding these additional requirements. Various documents must be filed with the application including: A business plan. A market feasibility report demonstrating the viability of that business plan. Particulars of all directors and controllers. Insurance agents An insurance agent must be appointed by and registered with an authorised insurer. The agent must also be registered with the IARB (Agency Code). An insurance agent may also appoint: Responsible officers (responsible for the conduct of their insurance agency business). Technical representatives (who undertake the agent’s day-today insurance agency business). Responsible officers and technical representatives must also be registered with the IARB. The registration requirements for insurance agents, responsible officers and technical representatives are set out in the Agency Code. These persons must be fit and proper and the Agency Code sets out the IARB’s grounds in deciding this. Agents must also comply with the other Agency Code requirements (Minimum Requirements for Agents) concerning age, residency or work visa and educational level, and have the minimum qualifications (clauses 52 to 65, Agency Code), including having passed all relevant papers of the Insurance Intermediaries Qualifying Examination (IIQE) unless exempt). In addition: The insurer must appoint its insurance agents under a written agency agreement meeting the minimum requirements of a model agency agreement adopted by the HKFI from time to time. The insurer must keep and maintain, and allow public inspection of, a register of appointed insurance agents, and a sub-register of their responsible officers and technical representatives. An insurance agent cannot act for more than four insurers, of which no more than two can be long-term insurers. A responsible officer or technical representative of an insurance agent cannot be a responsible officer or technical representative of another agent. Insurance brokers Most insurance brokers become authorised by joining one of the two authorised self-regulatory bodies (the CIB or PIBA). Therefore, the authorisation requirements and procedure depend on that body’s rules. However, using the CIB and its membership regulations as an example, the applicant must comply with the minimum requirements for the authorisation of an insurance broker specified by the IA (sections 69(2) and 70(2), ICO (Minimum Requirements for Brokers)) including the requirements on: Age. The broker or its chief executive must be over 21. Residency or work visa. The broker or its chief executive must be a Hong Kong permanent resident or a Hong Kong resident whose employment visa conditions do not restrict him from being engaged in insurance broking business. Qualifications and experience. The broker or its chief executive must have an acceptable insurance qualification and a minimum of two years’ experience in insurance in a management position and have passed the IIQE (unless exempted). Capital and net assets. The applicant must have a minimum net asset value and a minimum paid up share capital of HK$100,000 (about US$12,900). Professional indemnity insurance. A minimum limit of indemnity for any one claim and in any one insurance period of 12 months of not less than the greater of HK$3 million (about US$387,000) or an amount depending on its aggregate insurance brokerage income. Client accounts. Separate client accounts must be kept. Books and accounts. Proper books and accounts must be kept. The applicant must also satisfy the CIB it is fit and proper to be an insurance broker and that its chief executive and technical representatives are also fit and proper to hold those positions. 9 Please summarise the main exemptions or exclusions from authorisation or licensing that are available in your jurisdiction, if any. Insurers The restriction on carrying on an insurance business in or from Hong Kong without otherwise being authorised by the IA does not apply to: Lloyd’s names. An underwriters’ association with IA approval (although to date only one has been approved). The following are exempt from IA authorisation (section 51, ICO): Any body of persons, corporate or incorporate bound together by custom, religion, kinship, nationality or regional or local interest, not for the purpose of gain and whose gross premium income does not exceed HK$500,000 (about US$64,500). A person carrying on Hong Kong reinsurance business only, although this exemption does not apply to: o A body corporate incorporated in Hong Kong o A body corporate incorporated elsewhere which has a place of business in Hong Kong o Any other person or any partnership having a place of business in Hong Kong. A registered trade union carrying on insurance business for members’ provident fund or strike benefits. A registered co-operative society. The Hong Kong Export Credit Insurance Corporation. An authorised institution under the Banking Ordinance (limited to certain classes of business). The Credit Union League of Hong Kong. A recognised clearing house under the Securities and Futures (Clearing Houses) Ordinance to the extent it guarantees the settlement of securities transactions. The Chief Executive in Council can exempt an insurer from IA authorisation (section 53, ICO). Insurance agents Authorised insurers and Lloyd’s names are not required to be appointed as insurance agents, but this does not extend to any of their agents. Insurance brokers Authorised insurers and Lloyd’s names are not required to be authorised as insurance brokers. A person who holds himself out in Hong Kong as an insurance broker for reinsurance contracts only is not required to be authorised as an insurance broker. However, this exemption does not apply to: A body corporate incorporated in Hong Kong. A body corporate incorporated elsewhere which has a place of business in Hong Kong. A person represented here by an agent or any person or partnership having a place of business in Hong Kong. 10 Are there any restrictions on the ownership or control of insurancerelated entities in your jurisdiction (for example, age, nationality, qualification or other restrictions)? Insurers Hong Kong does not discriminate against foreign companies. There are no restrictions on or qualifications concerning ownership or control of an authorised insurer, except that the IA must be satisfied that all its directors and controllers are fit and proper to hold those positions (see GN4). There is no nationality requirement, but in determining if the applicant’s directors and controllers are fit and proper there are requirements concerning their qualifications and experience. For example, an insurer’s chief executive generally must hold recognised professional qualifications. An insurer must also appoint a locally based chief executive as controller. Insurance agents Restrictions include age, residency or unconditional employment visa and qualifications requirements for insurance agents who are individuals, and its responsible officers and technical representatives for corporate agents, but no requirements for an insurance agent’s owners or controllers (Minimum Requirements for Agents). Insurance brokers The position is similar to that for insurance agents. A broker and its chief executive and technical representatives must be fit and proper, and satisfy the Minimum Requirements for Brokers (see Question 8) including those for age, residency or unconditional employment visa and qualifications. 11 Do owners or controllers have to be pre-approved by or notified to the relevant authorities before taking, increasing or reducing their control or ownership of the entity? Insurers Before authorising the applicant as an insurer, the IA must be satisfied the applicant’s directors and the controllers are fit and proper to hold these positions (see GN4 for guidance and IA interpretation). A controller of an authorisation applicant includes not only its directors and chief executive but also any person that either (section 9, ICO): In accordance with whose directions or instructions the directors of the applicant or of a body corporate of which it is a subsidiary (or any of them) are accustomed to act. Who, alone or with any associate or through a nominee, is entitled to exercise or control the exercise of, 15% or more of the voting power at any general meeting of the applicant or a body corporate of which it is a subsidiary. Where there is a change in this type of owner controller for an insurer incorporated in Hong Kong, IA consent is required if the new owner controller (either alone, or with any associate, or through its nominee) is entitled to exercise, or control the exercise of, 15% or more of the voting power of that insurer at any general meeting of the insurer. Appointing a managing director or chief executive of an authorised insurer must involve prior notice to the IA. The IA may, within three months of notice, object to the proposed appointment because that person is not fit and proper to hold that position. Unless three months has expired without a notice of objection (or confirmation the IA has no objection) no such person may be appointed, appointment otherwise being an offence. Insurance intermediaries There are various restrictions set out in section 65 of the ICO on a person who is a proprietor or employee of, or partner in, an insurance agent or insurance broker being a proprietor, director or employee of, or partner in, another insurance agent or insurance broker. Insurance agents The IA may not consider a corporate insurance agent fit or proper to act, or to continue to act, as an insurance agent if any of its directors or controllers are not considered fit and proper to act as an insurance agent if they applied as an individual (except for requirements they are a Hong Kong permanent resident with the necessary qualifications or experience industry experience and have passed the IIQE). A controller under the Agency Code has the meaning defined in the ICO (section 9, ICO). Insurance brokers An insurance broker that is a limited company must satisfy the IA that executive, directors and controllers are fit and proper to hold that (section 9, ICO). The Minimum Requirements set out further guidance on IA applies this test. 12. Please summarise the key ongoing requirements authorised or licensed entity must comply with. 12 its chief position how the that the Please summarise the key ongoing requirements that the authorised or licensed entity must comply with Insurers The main ongoing regulatory requirements for authorised insurers are set out in Part III of the ICO and are summarised below. Auditor. An insurer must appoint a qualified auditor in the place where the insurer is incorporated and notify the IA of the identity of, and any change in, that auditor. Books of account and returns. The insurer must maintain proper and legible account books recording and explaining all the insurer’s transactions. The insurer must make all required returns to the IA of accounts, reports, statements and other information required under the ICO. Annual fee. An annual fee is payable to the IA, the amount depending on the class of business carried out by the insurer. Maintenance of assets in Hong Kong. General insurers (but not reinsurers or captives) are, unless exempted by the IA, required to maintain assets in Hong Kong of an amount and type determined under section 25A of the ICO. Further requirements for insurers carrying on long-term business. The insurer must: o Appoint a duly qualified actuary, who must comply with the standards specified in the Insurance Companies (Actuaries’ Standards) Regulation (or other standards accepted as comparable by the IA), and notify the IA of any change in that actuary o Notify the IA of the arrangements for the actuary to have direct access to the board of directors of the insurer to enable them to carry out their duties o Comply with both: Section 22 of the ICO for the continued separation of assets and liabilities attributable to that long-term business (or, if the long-term insurer is incorporated outside Hong Kong, and with prior IA authorisation, attributable only to that part of its long-term business carried out in Hong Kong Section 11 of the Solvency Regulations that not less than onesixth of the solvency margin is held in its long term business funds. The Insurers Code applies to all HKFI members when effecting insurance in Hong Kong for individual policyholders resident in Hong Kong and insured in their private capacity. The main ongoing requirements relate to: Using plain language in their documentation and ensuring sales materials and illustrations contain information which is accurate and easy to understand. Efficient and fair handling of claims. Managing, and handling complaints against, their agents. Managing employees. Avoiding misconduct. Efficient and fair handling of enquiries, complaints and disputes. The principal guidance notes containing ongoing obligations are: GN3: prevention of money laundering. GN8: use of the internet. GN10: corporate governance. Insurance agents There are various ongoing obligations for agents (sections 71 to 74 (for general agents) and sections 75 to 79 (for life agents), Agency Code). Agents must always conduct business in good faith and with integrity, and comply with the other Agency Code requirements relating to their dealings with, and information they must provide to existing and prospective policyholders. Insurance brokers Authorised insurance brokers must submit to the IA: Annual audited financial statements. An auditor’s report on those financial statements confirming the broker continues to satisfy the minimum requirements for capital and net assets, professional indemnity insurance, keeping of separate client accounts and the keeping of proper books and accounts. Such further evidence the IA may require to demonstrate the broker has continued to comply with the requirements in Question 8. Continuing professional development (CPD) requirements Insurance intermediaries and their chief executives, responsible officers and technical representatives must comply with the CPD programme requirements under the Insurance Intermediaries Quality Assurance Scheme (IIQAS). The current requirement is to complete at least ten CPD hours annually, generally obtained by attending accredited training courses. Failure to comply is likely to lead to disciplinary action including de-registration or de-authorisation. 13 Please outline the possible consequences of an entity failing to comply with applicable legal and regulatory requirements (including the disciplinary powers any relevant regulators have, as well possible customer remedies) Insurers It is an offence for an unauthorised person to carry on any class of insurance business in or from Hong Kong (section 6(3), ICO). The maximum penalty for this offence is a fine of HK$2 million (about US$258,000) and an additional daily fine of HK$2,000 (about US$258) for each day during which the offence continues and up to two years’ imprisonment. Where an insurance contract in relation to any class of insurance business (not being a reinsurance business) is entered into by an insurer who is not authorised to carry on that class of business, that contract is, at the option of the policyholder, either: Enforceable against the insurer by the policyholder. Void by reason of that contravention (in which case the policyholder may, before the expiration of that contract, recover from the insurer any consideration paid by it under the contract). A large number of ICO requirements include a provision that any insurer who fails to comply commits an offence and is liable to a fine (and sometimes a daily fine for each day the offence continues). The IA can intervene in an authorised insurer’s business in certain circumstances including if it considers it desirable for existing or potential policyholders’ protection against the risk the insurer will be unable to meet its liabilities to them, if (Part V, ICO): The insurer has either: o Failed to satisfy an ICO obligation o Provided misleading or inaccurate information to the IA The IA considers the insurer may be insolvent. This power includes the very wide right under section 35 of the ICO to require an insurer to take such action in relation to its affairs, business or property as the IA considers appropriate, to safeguard existing or potential policyholders’ interests. Insurance agents It is an offence for a person to hold themselves out as an insurance agent if they are not an appointed insurance agent. Penalties range from a fine of up to HK$1 million (about US$129,000) and up to two years’ imprisonment on indictment, and up to HK$100,000 (about US$12,900) and up to six months’ imprisonment on summary conviction (section 77(1), ICO). The Agency Code sets out the power of the IARB to: Handle complaints. Take disciplinary action against agents and their responsible officers and technical representatives. Require an insurer to take disciplinary action against its agents. Disciplinary action may include: Issuing a reprimand. Suspending or terminating the agent’s contract. Requiring the agent to take or refrain from taking such action as the IARB thinks fit. The IARB has also issued guidelines on how it will exercise its powers under the Agency Code including Guidelines on Misconduct and Guidelines on Handling of Premiums. The IA can require an insurer to de-register any of its insurance agents that fail to comply with the Agency Code. Insurance brokers It is an offence for a person to hold themselves out as an insurance broker if they are not an authorised insurance broker (section 77, ICO), carrying the same penalties as the comparable offence for an insurance agent (see above, Insurance agents). Each approved body of insurance brokers must have procedures to deal with breaches of proper conduct by its members. The IA can withdraw a broker’s authorisation if it fails to comply with the minimum authorisation requirements (see Question 8) or this withdrawal is justified in existing or potential policyholders’ or the public’s interests (section 75, ICO). The IA can petition to wind up a corporate broker or bankrupt an individual broker if it considers it in the public interest (section 76, ICO). Unauthorised brokers and non-appointed agents An insurer cannot enter an insurance contract through an insurance intermediary in Hong Kong or accept insurance business referred to it by an insurance intermediary in Hong Kong if that intermediary is not an appointed insurance agent or an authorised insurance broker. If an insurer does so, the contract is void at the option of the policyholder, and if the policyholder chooses to treat the contract as void, it is entitled to the return of its premium. ICO breaches There are various offences for insurers or insurance intermediaries who breach the provisions of Part X of the ICO (section 77, ICO) including: An insurer who effects an insurance contract through an insurance intermediary who is not an authorised insurance broker or appointed insurance agent commits an offence and is liable to a maximum fine of HK$1 million and up to two years’ imprisonment. An agent (or principal) who fails to comply with the Agency Code may be subject to criminal prosecution and a fine of up to HK$100,000. An authorised insurance broker who fails to keep client monies in separate accounts is liable on conviction on indictment to a maximum fine of up to HK$1 million and up to five years’ imprisonment. Personal liability A controller, director, manager or other officer of an insurer or insurance intermediary committing an offence under the ICO commits the same offence if it is committed with the consent or connivance of, or because of neglect by, that person (section 57, ICO). 14 Are there any restrictions on the persons to whom insurance/reinsurance services and contracts can be marketed or sold? Broadly speaking, there are no restrictions on the persons in Hong Kong to whom insurance/reinsurance services and contracts can be marketed or sold. However, the English law limitations on the contractual capacity of certain persons, such as minors and persons suffering from drunkenness or mental incapacity, apply. Section 64B of the ICO requires persons for whose use or benefit or on whose account a life insurance contract is entered into to have an insurable interest in the life assured at inception failing which the policy will void. To avoid problems with unscrupulous agents marketing to potential policyholders in Mainland China most life insurers require proof that the applicant was physically present in Hong Kong when a life policy was sold to them. Under the MIO, the assured under a marine insurance policy must also possess an insurable interest at inception. REINSURANCE 15 To what extent can/must a reinsurance company monitor the claims, settlements and underwriting of the cedant company? There is no implied duty or right implied into a reinsurance contract for the cedant to consult with or obtain the consent of the reinsurer before the cedant settles a claim by the insured. However, the reinsurance contract usually includes express claims co-operation and claims control clauses. A claims co-operation clause usually requires the insurer to notify the reinsurer of a claim under the underlying insurance, and to consult with and co-operate with the reinsurer in settling that claim. It may also require the insurer to obtain the reinsurer’s prior consent before settling the claim. A claims control clause goes further and gives the reinsurer the right to deal with and settle claims directly with the insured. The reinsurance contract often includes a “follow the settlements” clause obliging the reinsurer to follow any settlement reached by the insurer with the insured. Even if there is no express follow the settlement requirement, the Hong Kong Court of Appeal case of New Hampshire Insurance Co v Grand Union Insurance Co Ltd & Anor [1995] 2 HKC 1 held that the reinsurer must follow the settlements of the insurer. It is common for the reinsurance contract to give the reinsurer access rights to the settlement records of the cedant to check the settlement terms. A contractual term allowing the reinsurer reasonable access to the cedant’s settlement records and on reasonable notice is also implied. However, the reinsurer has no implied right of access to the insurer’s underwriting files or information, and it is unusual for the reinsurer to have this contractual right expressly. 16 What disclosure/notification obligations does the cedant company have to the reinsurance company? Since a reinsurance contract is simply an insurance contract between insurers, the cedant company has the same general disclosure and notification obligations that an insured has under an insurance contract. These obligations arise out of the duty of utmost good faith including that the cedant must: Disclose to the reinsurance company all facts of which it is aware, or deemed to be aware (and of which the reinsurer is not aware or deemed to be aware) which may affect the reinsurer’s decision to enter into the reinsurance contact, or the terms on which it is prepared to do so. Avoid making misrepresentations before entering into the insurance contract. The usual misrepresentation principles under English law apply. Avoid material non-disclosure. The onus is on the reinsurer to prove the undisclosed information was: o Material o Within the knowledge of the insurer; and o Was not communicated to the reinsurer Material matters for the cedant in relation to the underlying insurance contract are likely to be material to the reinsurer, particularly for facultative reinsurance that is generally considered to involve the insurance of the same subject matter as the underlying policy. The reinsurance policy may also impose disclosure and notification obligations on the cedant, by setting out express terms or by incorporating these terms from the underlying insurance contract. INSURANCE POLICIES 17 Please outline the main general form and content requirements for insurance policies in your jurisdiction, including a description of the most commonly found clauses. Generally there are no statutory requirements for the form and content of insurance policies. The principal exceptions are: Motor vehicle insurance. Employees’ compensation insurance. Marine insurance. Investment-linked insurance. Motor vehicle insurance The Motor Vehicle Insurance (Third Party Risks) Ordinance (MVIO) makes it unlawful for a person to use, or permit another person to use a motor vehicle on a road unless an insurance policy is in force insuring these persons for any liability they may incur in relation to the death of or bodily injury to any person caused by or arising out of the use of that motor vehicle on a road. Certain provisions of the MVIO dictate an insurer’s policy terms including that: Any condition precedent or condition subsequent to liability is of no effect. The insurer cannot avoid or restrict its liability by reference to various matters including the age or physical or mental condition of the driver or the vehicle’s condition (section 12(1), MVIO). Employees’ compensation insurance The Employees’ Compensation Ordinance (ECO) requires an employer in Hong Kong to maintain an insurance policy to cover its liabilities to pay compensation for injury by accident or for the death of employees arising out of or in the course of their employment. Sections 40A and 41(1) of the ECO require the insurer to include certain information in that policy, including the: Employer’s name. Insured’s name. Policy number. Date of policy’s issue. Dates of commencement and expiry of the period of insurance. Number of employees insured under the policy at the time of issue. Amount of the liability insured under the policy. Marine insurance The Marine Insurance Ordinance (MIO) requires that a contract of marine insurance must: Specify the assured’s name or of some person who effects the insurance on his behalf. Designate, with reasonable certainty, the subject matter insured. Investment-linked insurance policies Certain Class C investment-linked life insurance policies fall within the definition of a collective investment scheme under the Securities and Futures Ordinance (SFO). GN11 provides guidance on Class C products, and insurers issuing these products must seek authorisation from the Hong Kong Securities and Futures Commission (SFC) for the product’s marketing materials (section 105, SFO). The SFC has produced a checklist of provisions that must be included in these materials for them to be approved and to allow the product to be sold. Other relevant ordinances The following ordinances may also be relevant: The Misrepresentation Ordinance (a term purporting to exclude liability for misrepresentation is only valid if reasonable). The Unconscionable Contracts Ordinance (under which the court has a wide power to grant relief in relation to an unconscionable term in a consumer contract including holding this term or the entire contract unenforceable). An insurer cannot exclude or limit its liability for its appointed insurance agent’s actions in the dealings for the issue of an insurance contract and insurance business relating to that contract (section 68(2), ICO). HKFI Code of Conduct Under this code, HKFI members must draft policy documentation for consumer insurance contracts in plain and simple language. Common clauses A valid insurance contract must contain agreed terms including the: Subject matter of the policy. Obligation to indemnify (other than for life contracts). Duration of the risk. Premium amount. Sum insured. 18 Please identify any terms found in insurance policies in your jurisdiction that are implied by law or regulation (identifying the applicable laws or regulations and any mandatory provisions). The duty of utmost good faith applies to all insurance contracts. This duty is specifically incorporated into marine insurance contracts (section 17, MIO) and means the insured must disclose to the insurer all facts of which the insured is aware (and of which the insurer is not aware or deemed to be aware) which may affect the insurer’s decision to enter into the insurance contract or the terms on which it is prepared to do so. It also means the insured must: Not make misrepresentations before entering into the insurance contract (English legal misrepresentation principles apply). Avoid material non-disclosure. Breach of this duty allows the insurer to avoid the policy (provided it establishes inducement to enter into that policy by a material false statement). The insurer owes the same duty to the insured (although under the scope of that duty, it is harder to define what is material to the insured). Other terms implied into an insurance contract are: That the insured must have an insurable interest. The existence and identification of the subject matter of the insurance. The insurer’s subrogation rights. An insurer cannot exclude or limit its liability for the actions of its appointed insurance agent in the dealings for the issue of a contract of insurance and insurance business relating to that contract (section 68(2), ICO). 19 What customer protections are generally included in insurance policies to supplement relief available under general law? The OCI and the insurance industry have taken a series of measures to enhance consumer protection for long-term insurance policies. These measures include: A customer protection declaration form. A cooling-off period for long-term insurance policies. Illustration standards for long-term insurance policies. Customer protection declaration form (CPDF) The CPDF was introduced under the Code of Practice for Life Insurance Replacement issued by the insurance industry as a self-regulatory measure. Where an existing life policy is replaced (or where 50% or more of the guaranteed cash value of the existing policy is reduced), the CPDF must be completed to confirm the insurance intermediary has clearly explained to the policyholder the consequences and potential disadvantages and has been provided with the OCI’s pamphlet on the subject. Cooling-off period for long-term insurance policies Policyholders are given a cooling-off period in which to review, cancel and obtain a full refund or premium (less a market value adjustment where applicable) on their long-term insurance policy. The cooling-off period ends 21 days after the earlier of delivery to the policyholder or their representative of either: The policy. A notice informing the policy holder of the availability of the policy for collection and the expiry date of the cooling off period. Insurers must keep a copy of the acknowledgement of the receipt of the policy or the notice to confirm when the cooling off period ends. The new period is effective 1 February 2010. Illustration standards for long-term insurance policies To enhance the transparency of life policies and enable prospective policyholders to make informed decisions, insurers must provide prospective policyholders with a summary (in the required form), of: Insurance benefits. Investment returns. Surrender values. 20 Please identify examples of standard policies or terms produced by trade associations or relevant authorities, if any, and explain how these can be obtained. The HKFI has produced the following standard form insurance policies and terms: Building owners’ corporation third party liability insurance policy. Commercial vehicle insurance policy. Compulsory third party liability insurance clauses (local vessels). Employees’ compensation insurance policy. Premium adjustment and declaration of earnings form. Motorcycle insurance policy. Motor trade insurance policy. Private motorcar insurance policy. These can be downloaded from the HKFI website (www.hkfi.org.hk). 21 What must be established to trigger a claim under an insurance policy? The trigger for a claim depends on the policy’s notification provisions, but typically the insured must notify the insurer of one or more of the following: Any occurrence which may give rise to a claim against the insured. Any loss suffered by the insured. Any claim made against the insured. Any circumstances which may give rise to a loss suffered by the insured or to a claim made against the insured. For fidelity policies, reasonable suspicion of an employee’s fraud or dishonesty, irrespective of whether loss has been suffered. 22 Please identify brief circumstances in which third parties can claim under an insurance policy? An insured’s rights under an insurance policy can be transferred to and vest in a third party (section 2(1), Third Parties (Rights Against Insurers) Ordinance) when the insured satisfies all the following: It is insured against liabilities it may incur to the third party. It has become bankrupt (if an individual) or (if a company) has had a winding-up order made against it, or a resolution for a voluntary winding-up has been passed, or a receiver or manager has been appointed, or debenture-holders have taken possession of property subject to a floating charge. Before or after the bankruptcy or insolvency event in question, the insured has incurred a liability to the third party. Section 2(1) does not apply where a company is wound up voluntarily purely to reconstruct or amalgamate with another company. Generally, the rights that the third party acquires under this Ordinance are not superior to the insured’s rights. 23 Is there a time limit outside of which the insured/reinsured is barred from making a claim? Under a liability policy, the insured generally has six years (Limitation Ordinance) to issue proceedings against the insurer. Time starts to run from the date liability is established by a judgment, arbitration award or binding settlement. However, it is possible for the parties to agree to a shorter or longer limitation period, and the courts generally enforce this. 24 Can the original policyholder or other third party enforce the reinsurance contract against a reinsurer? There is no contractual relationship between the original policyholder and the reinsurer, so the policyholder does not acquire any contractual rights against the reinsurer and cannot bring a contractual claim against it directly. Hong Kong has no equivalent of the English Contracts (Rights of Third Parties) Act 1999. 25 What remedies are available for breach of an insurance policy? Generally, insurers are entitled to damages (on proof of loss) if an insurance policy is breached. However, if the insured has breached a condition precedent, a range of remedies may be available to the insurer, depending on the type of condition precedent. A condition may be a condition precedent to the: Validity of the policy (for example, a requirement to pay the premium), that is, the contract does not exist if the condition is not satisfied. Inception of risk (for example, recommendations from a survey to be implemented before coverage will attach), that is, the policy only offers protection once the condition has been satisfied. Insurer’s liability under the policy (for example, a requirement for the insured to notify the insurer of a loss or claim within a specified period of time), that is, the insurer does not incur liability for the loss or claim unless the condition is satisfied. A term in an insurance contract may be expressed as a warranty, that is, a term whereby the insured promises either that a given state of affairs existed before the commencement of the policy, or that it will continue to exist whilst the policy remains in force. A breach of warranty discharges the insurer from liability under the policy from the time of the breach. There is no requirement for the insurer to demonstrate that the warranty was material to the risk insured or the loss that may have been suffered. INSOLVENCY 26 Please outline the regulatory framework for dealing with distressed or insolvent insurance or reinsurance companies, or other persons or entities providing insurance or reinsurance related services. Except for ICO provisions relating to insolvent insurers (see below), there is no specialist regime for dealing with insolvent insurers or insurance intermediaries. The usual insolvency regime applies, which is similar to the English insolvency regime (although there are a number of differences such as the absence of any administration process for restructuring insolvent companies). Corporate insolvencies fall within the regulatory framework established by the Companies Ordinance supplemented by the Companies (Winding-Up) Rules. Some provisions of the Bankruptcy Ordinance also apply. Creditors have a number of options including: Appointing a receiver. Negotiating a restructuring. Applying to the court for the appointment of a provisional liquidator or for the court to sanction of a scheme of arrangement. Winding up the insolvent company. The Court of First Instance can wind up an insolvent insurer in accordance with the Companies Ordinance, subject to the following modifications (Part VI, ICO): The insurer may be wound up on the petition of ten or more policyholders. The winding-up petition may not be presented except with the leave of the court, and it cannot grant that leave unless it is satisfied that a prima facie case for winding up has been made out, and until security for costs for the amount the court thinks reasonable has been given. The insolvent insurer may not be wound up voluntarily unless the court orders otherwise, and it cannot make that order unless a copy of the application for that order is served on the IA (with the IA being entitled to be heard on that application and to call, examine and cross-examine witnesses and to support or oppose the making of the order as it sees fit). Where the petition is brought by anyone other than the IA, a copy of the petition must be served on the IA and it has the right to be heard on the petition and to call, examine and cross-examine witnesses and to support or oppose the making of the winding-up order as it sees fit. The IA can wind up an insurer in accordance with the Companies Ordinance (and may also apply for the appointment of provisional liquidator) if either the insurer: Is unable to pay its debt. Has failed to satisfy its obligations under the ICO (including specifically its obligation to keep and preserve and produce proper books of account). The IA can petition to wind up that insurer on just and equitable grounds, but only if it appears to the HKFI that it is expedient in the public interest for that insurer to be wound up (section 44, ICO and sections 117 and 327, Companies Ordinance). The other special provisions of the ICO relating to insolvent insurers are: Section 46. The liquidator of a long-term business must carry on that business with a view to it being transferred as a going concern to another insurer, and may appoint a special manager for this purpose (but may not issue any new policies). Section 47. Where an insurance business is transferred and the transferor or its creditors have claims against the transferee and the transferee is wound up, the court must wind up the transferor and may appoint the same liquidator over both. Section 48. Where an insurer is unable to pay its debts, the court may reduce the amount of the insurer’s contracts as it sees fit rather than making a winding-up order. The IA also has significant powers of intervention (see Question 13) and one of the grounds on which it can exercise those powers is if the authorised insurer is unable to pay its debts. A number of funds have also been established to assist persons attempting to recover from an insolvent insurer. Motor Insurers’ Bureau (MIB) The MIB (see box, Main insurance/reinsurance trade organisations) was formed to provide compensation to traffic accident victims where the driver at fault is uninsured or untraceable, or where the relevant insurer is insolvent. All insurers authorised by the IA to carry on statutory motor insurance business in Hong Kong must be MIB members. The MIB administers two funds, which are financed by levies on the premiums for policies for compulsory motor insurance business: The First Fund. This provides compensation to traffic accident victims who suffer bodily injury (or their dependants if they die), but who cannot obtain compensation because the driver at fault is uninsured or untraceable. When motor insurers could limit third party liability, the First Fund was extended to cover awards exceeding that limit. The Insolvency Fund. This compensates third parties making claims for bodily injury, death or property damage resulting from a traffic accident where the claim remains unsettled because the insurer is insolvent. Employees’ compensation assistance scheme This is a statutory scheme introduced by the Employees’ Compensation Assistance Ordinance and forms a fund administered by the Employees’ Compensation Assistance Fund Board. The fund is built up from levies collected through premiums paid by employers for compulsory employees’ compensation insurance. The fund protects those employers, where their insurer is insolvent, and their employees, if they cannot recover statutory compensation or common law damages from their employer awarded to them by a court or tribunal of competent jurisdiction in Hong Kong. TAX 27 Briefly describe the tax treatment for insurers, reinsurers, and persons or other entities providing insurance and reinsurance-related services in your jurisdiction. General principles Hong Kong adopts the territorial source principle when charging tax. Generally, only profits arising in or derived from Hong Kong are subject to Hong Kong profits tax. Case law has established an operations test to determine whether the profits are of Hong Kong source. If the operations giving rise to profits are in Hong Kong, then profits are of Hong Kong source. Normal business expenses are deductible in determining assessable profits. Profits tax is charged at the corporate tax rate (currently 16.5%) on assessable profits. Capital receipts and dividends from companies chargeable to Hong Kong tax are not subject to profits tax. Certain interest income derived by non-financial institutions can also be exempt. The Inland Revenue Ordinance (IRD) has two special provisions dealing with the taxation of insurance business: Section 23: life insurers. This deals with the determination of assessable profits of life insurance operations. It only deals with profits from the life insurance business. The profits from any other business the taxpayer undertakes will be assessed separately according to the general principles. It provides for two methods of assessment: o Calculating the assessable profits from life insurance business at 5% of the insurance premiums of that business. These premiums generally include all premiums received or receivable in Hong Kong from both residents and non-residents. o Electing to be taxed on the adjusted surplus method. This election is valid only if the insurer submits a certified true copy of the actuarial report to the Commissioner not later than two years after the end of the period for which it is made. Election is irrevocable and applies to the years elected and all subsequent years. The adjusted surplus is the amount by which the life insurance fund exceeds the estimated liability of the company on that fund at the end of the period for which the actuarial report is made (after taking into account the surplus or deficit of that fund brought forward from the previous period, and any adjustments made according to IRD rules). If the life insurance funds consist of policies of which the premiums are from life insurance business outside Hong Kong, the adjusted surplus is apportioned according to the ratio of aggregate premiums from life insurance business in Hong Kong to the total premiums from life insurance business both in Hong Kong and overseas during the period of the actuarial report. This adjusted surplus is deemed to be the assessable profits for the years of assessment for which the actuarial report is made. The adjusted surplus is then allocated to each year of assessment as assessable profits for that year. Section 23A: non-life insurers. The assessable profits of a non-life insurance company are calculated under section 23A and assessed according to the general principles. However, section 23A takes into account the changes in the reserve for unexpired risks that may arise from insurance policies. Any increase (or decrease) in the reserve in the year is deductible (or assessable). In determining the source of the non-life insurance policies, only polices which are made in Hong Kong or policies the proposals for which are made to a corporation in Hong Kong are included. If the insurer is a non-Hong Kong resident company with limited business transactions in Hong Kong, the Commissioner may determine the assessable profits in Hong Kong by reference to the proportion of the total profits of the corporation corresponding to the proportion which its premiums from insurance business in Hong Kong bear to its total premiums (or on any other equitable basis). Concession for qualified reinsurers A reinsurer who derives income from the reinsurance of non-life offshore risks as a professional reinsurer under section 23A can (irrevocably) elect to have its profits from that reinsurance business taxed at half the normal corporate tax rate. Insurance intermediaries Insurance brokers and insurance agents have their assessable profits from Hong Kong sourced operations determined and taxed in accordance with the general principles. DISPUTE RESOLUTION 28 Are there special procedures or venues for dealing with insurance or reinsurance complaints or disputes in your jurisdiction? There is no specialist insurance court or civil litigation procedure for resolving insurance disputes. The Hong Kong International Arbitration Centre has no specialist rules for these disputes, although it provides a list of arbitrators, some of whom have specialist insurance knowledge. Following an initiative launched by the Department of Justice to promote mediation as a dispute resolution method, the HKFI has signed a Mediation First Pledge to encourage its members to use mediation for dispute resolution before pursuing other methods such as litigation. The Hong Kong Mediation Council of the Hong Kong International Arbitration Centre regulates the New Insurance Mediation Pilot Scheme (NIMPS). The aim of NIMPS is to encourage insurance companies and injured workers to resolve personal injury disputes in the most amicable, economic and objective manner. However, as at the end of September 2009, only two cases have been resolved through this scheme. 29 Please give a brief overview of the main dispute resolution methods used to settle reinsurance claims The principal dispute resolution methods used to settle reinsurance claims are arbitration and litigation. However, with the introduction of the Civil Justice Reforms in April 2009, there is a greater focus on the early settlement of disputes, particularly through mediation. REFORM 30 Please summarise any proposals for reform of the law, regulation or rules in your jurisdiction relating to the provision of insurance or reinsurance services. Regulatory regime There have been a number of reform proposals of the regulatory regime over the past few years including: Establishing the IA as an independent regulatory body outside the civil service. Forming a super regulator amalgamating the functions of the SFC, the IA, the MPF Schemes Authority and the Hong Kong Monetary Authority (which regulates Hong Kong banks) similar to the Financial Services Authority in the UK or the Monetary Authority of Singapore. Following the recent economic crisis, the IA has held a series of meetings with general and life insurers to discuss possible regulatory regime changes. The HKFI is concerned that a super-regulator would wield excessive power, but supports a “twin-peaks” structure, with one regulator overseeing market conduct and another providing prudent supervision of the industry, as adopted in Australia. This model has been highly praised as the most effective regulatory regime during the recent economic crisis. Policyholders’ protection fund The HKFI supports the establishment of a policyholders’ protection fund (PPF) to provide a safety net for individual policyholders (but excluding compulsory business already covered by the MIB and the Employees’ Compensation Insurer Insolvency Bureau) by underwriting payments under their insurance policy if their insurer is insolvent. The fund (probably separate funds for general and life insurance) would be based on similar compensation schemes operating in the UK, Canada and Singapore and would be funded by a levy on premiums. The current proposal is for the PPF to provide compensation capped at a maximum compensation payment of HK$1 million (about US$129,000) for both: 100% of the first HK$100,000 (about US$12,900) of the benefits payable under the policy. 80% of the balance. The IA is conducting an actuarial study to establish the target fund size and optimal levy rate. It plans to finalise the details of the PPF by the end of 2010 and to introduce the draft legislation in 2011. Healthcare The current public healthcare system is state funded and heavily subsidised, and is becoming an increasing financial burden on the government. Many people take out private healthcare insurance (if affordable). The government is therefore carrying out a consultation exercise on reforming public healthcare financing. The HKFI supports a supplementary financing model made up of three elements: A progressive, measured increase in user fees for public healthcare designed to achieve cost sharing. Encouraging individuals to take out voluntary private insurance as an interim measure. In the long term, setting up a mandatory insurance scheme based on contributions from the Hong Kong working population. To promote using private healthcare services, the HKFI is also trying to persuade the government to introduce tax incentives such as tax rebates on medical expenses and private medical insurance premiums. Richard Bates Kennedys www.kennedys-law.com/rbates *The author would like to thank Rex Ho, Partner in Tax Services at PricewaterhouseCoopers Limited, Hong Kong for contributing the response to Question 27. This chapter was first published in the PLC Cross-border Insurance and Reinsurance Handbook 2010 and is reproduced with the permission of the publisher, Practical Law Company. For further information visit www.practicallaw.com/insurancehandbook MAIN INSURANCE/REINSURANCE TRADE ORGANISATIONS Hong Kong Federation of Insurers (HKFI) Main activities. The principal industry body undertaking a large degree of self regulation of that industry. W www.hkfi.org.hk Insurance Agents Registration Board (IARB) Main activities. The dual role of registering qualified insurance agents, responsible officers and technical representatives and handling complaints against them. W www.hkfi.org.hk Hong Kong Confederation of Insurance Brokers Main activities. An IA-approved body of insurance brokers implementing the self-regulation of insurance brokers in Hong Kong. W www.hkcib.org Professional Insurance Brokers Association Main activities. An IA-approved body of insurance brokers implementing the self-regulation of insurance brokers in Hong Kong. W www.piba.org.hk Motor Insurers’ Bureau (MIB) Main activities. Securing the satisfaction of claims in relation to liability for death or bodily injury arising from the use of motor vehicles required to be covered by the Motor Vehicles Insurance (Third Party Risks) Ordinance. W www.mibhk.com.hk