F.6 Capital transactions - South African Reserve Bank

advertisement

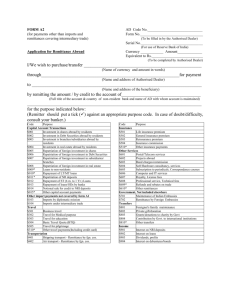

F.6 Capital transactions 6.1 Foreign investment by South African residents 6.1.1 Private individuals (natural persons) Authorised Dealers may allow private individuals (natural persons) who are taxpayers in good standing and over the age of 18 years, to invest up to a total amount of R10 million per calendar year, for investment purposes abroad, but, prior to the transfer of any funds, a duly electronically completed "(Tax Clearance Certificate in respect of foreign investments)", issued by the South African Revenue Service, must be presented to the bank. In addition the Financial Surveillance Department will consider applications by private individuals to invest in fixed property, e.g. holiday homes and farms in SADC member countries. Furthermore, applications by private individuals for investment purposes, including offshore properties outside of SADC, will also be considered. Income earned abroad and own foreign capital introduced into the Republic on or after 1997-07-01 by private individuals resident in South Africa may be transferred abroad, provided the Authorised Dealer concerned is satisfied that the income and/or capital had previously been converted to Rand, by viewing documentary evidence confirming the amounts involved. The sale proceeds of South African assets received from non-residents and export proceeds are, therefore, not eligible for retransfer abroad by private individuals resident in South Africa. Where a five percent levy was paid in terms of the Amnesty dispensation, the foreign capital repatriated to South Africa may also not be retransferred abroad. Furthermore, South African residents with foreign assets may not place such assets at the disposal of any third party normally resident in South Africa without the prior approval of the Financial Surveillance Department. Definitive guidelines in this regard will be available from an Authorised Dealer. In addition, private individuals may not utilise funds in terms of the foreign investment dispensation or any other authorised foreign assets to enter into a transaction or a series of transactions to directly or indirectly acquire shares or some other interests in a CMA company or a CMA asset. Similarly, such funds may not be reintroduced as a loan to a CMA resident. Funds so transferred abroad may not be used to facilitate, directly or indirectly (through any structure) any investment or scheme of arrangement whereby any asset or facility of any nature is acquired in the CMA. (this includes foreign funds/assets regularised by the Financial Surveillance Department as well as the Amnesty and the Exchange Control Voluntary Disclosure Programme). The creation of the so called “loop structures” by South African resident individuals into the CMA are contrary to the current exchange control policy in force. Such funds may, however, be used to invest in approved inward listed instruments on the bond and securities exchanges. South African residents may, furthermore, invest domestic funds in such listed instruments without restriction (See point 7.9, Section W). 6.1.2 South African Companies 6.1.2.1 Norms applied and factors considered In line with broader efforts to cut out red tape for small and medium sized businesses, the current application process for approval from the Financial Surveillance Department, before undertaking new foreign direct investment, has been removed for company transactions below R1 billion per applicant company per calendar year. Authorised Dealers shall henceforth adjudicate such applications and grant the necessary approval to companies that meet the (April ‘15) O1 minimum criteria requirements listed below. 6.1.2.2 Investments not exceeding R1 billion per applicant company per calendar year Mandated parastatals, as defined in Schedule 2 of the Public Finance Management Act, 1999 (Act No. 1 of 1999), private companies, public companies and listed companies wishing to make bona fide new outward foreign direct investments into companies, branches and offices outside the CMA where the total cost of such new investments does not exceed R1 billion per company per calendar year, may do so without prior approval of the Financial Surveillance Department. Authorised Dealers may now permit the transfer of additional working capital and/or funding to enable the South African company to increase their approved equity interest and/or voting rights in a specific foreign target entity. The transfer of such additional funding is subject to the provision that the Authorised Dealer may permit the transfer of funds for the aforementioned purposes, provided that the additional funding is authorised within the same calendar year in which the original investment was approved and will not result on the overall limit of R1 billion per applicant company per calendar year being exceeded. The following documents and information must be provided to an Authorised Dealer in order for them to consider the request: (1) The name and registration number, as well as the names and domicile of the shareholders, of the applicant company; (2) the applicant company’s latest available audited Financial Statements verifying, inter alia, the applicant’s nature of business; (3) details of how the investment will be funded, e.g. cash to be transferred and reflected as share capital or shareholders loans, guarantees to be issued, as well as forms NEP to be attested, if applicable; (4) an outline of the anticipated benefits of the foreign direct investment; and (5) the proposed structure through which the foreign target entity will be held, including details of existing or new foreign holding companies. The following criteria will be strictly applied by Authorised Dealers when considering these requests: (1) Parastatals may not use tax haven countries as a conduit for outward foreign direct investments elsewhere in the world. This moratorium is not applicable where the investment is made directly into a tax haven country; (2) at least 10 per cent of the foreign target entity’s voting rights must be obtained; (3) passive real estate investments are excluded from this dispensation; and (4) foreign currency denominated facilities may be extended by Authorised Dealers to South African companies for the financing of approved foreign direct investments. When applying to the Authorised Dealer, companies must indicate how the proposed foreign investment will be funded. Where Authorised Dealers are in doubt, such requests must be referred to the Financial Surveillance Department. (April ‘15) O2 The following conditions would be applicable to approved investments: (1) The audited Financial Statements of the foreign target entities and holding companies, as well as salient details of benefits, must be submitted to the Financial Surveillance Department on an annual basis; (2) the Financial Accounts of approved foreign branch operations and the Income and Expenditure Statements of approved foreign offices, as well as salient details of benefits, must be submitted to the Financial Surveillance Department on an annual basis; (3) in the event of the foreign investment being disposed of, the net sale proceeds must be repatriated to South Africa in terms of the provisions of Regulation 6, under advice to the Financial Surveillance Department; (4) expansion of the target entity’s business is permitted, provided that such expansion is without recourse to South Africa; (5) South African companies are permitted to acquire from 10 to 20 per cent equity and/or voting rights, whichever is the higher, in a foreign target entity, which may hold investments and/or make loans into any CMA country. This dispensation does not apply to foreign direct investments where the South African company holds an equity interest and/or voting rights in excess of 20 per cent; (6) South African owned Intellectual Property may not be transferred by way of a sale, assignment or cession and/or the waiver of rights in favour of non-residents in whatever form, directly or indirectly, without prior approval of the Financial Surveillance Department; (7) applicants may increase their approved equity interest and/or voting rights in the offshore target entity, subject to the provisions of paragraph (9) below. Applicants may not reduce or dilute their voting rights to below below 10 per cent, without prior approval of the Financial Surveillance Department; (8) any change in the nature of the target entity’s business must be reported to the Financial Surveillance Department; (9) requests to transfer any additional working capital to the foreign target entities and/or to increase an applicant’s approved equity interest and/or voting rights in an offshore target entity may be approved by Authorised Dealers provided that: (10) (i) The request to remit such additional funds are received an approved by the Authorised Dealer in the same calendar year in which the initial investment in the particular foreign target entity was sanctioned; (ii) The amount to be remitted will not result on the applicant exceeding the permissible limit of R1 billion per applicant per in the particular calendar year; and (iii) Full details of such additional funding as well as the purpose thereof must be forwarded to the Financial Surveillance Department. profits earned by foreign branches and offices must be repatriated to South Africa annually, since these entities have not been exempted from the provisions of Regulation 6; (April ‘15) O3 6.1.2.3 (11) in terms of the provisions of Regulation 6, parastatals and companies are obliged to receive their pro rata share of excess profits by way of a dividend on an annual basis and to repatriate same to South Africa. Dividends declared by offshore subsidiaries of South African companies after 2004-10-26 may be retained offshore and used for any purpose, without recourse to South Africa, except as provided for in paragraph (13) below. Such dividends repatriated to South Africa after 2004-10-26 may be retransferred abroad at any time and used for any purpose, provided that there is no recourse to South Africa, except as provided for in paragraph (13) below; (12) all dividends declared by the offshore operation(s), the amounts repatriated to South Africa or alternatively the dividend amounts retained abroad together with an indication of how such funds were utilised offshore should be reported to the Financial Surveillance Department on an annual basis; (13) dividend proceeds may be used to acquire from 10 to 20 per cent equity and/or voting rights, whichever is the higher, in a foreign target entity, which may hold investments and/or make loans into any CMA country. This dispensation does not apply to foreign direct investments where the South African company holds an equity interest and/or voting rights in excess of 20 per cent; (14) where guarantees from South Africa have been issued and such guarantees are implemented, full details of the circumstances giving rise thereto must immediately be reported to the Financial Surveillance Department; and (15) the original share certificates of the foreign target company (and holding company, where applicable) must be lodged with the Authorised Dealer approving the investment. In instances where the applicant company needs the foreign shares as collateral for foreign borrowings/debt abroad or for the disposal of the foreign investment, the share certificates may be released for that purpose. (16) South African must remain the place of effective management for the applicant company and under no circumstances may the applicants redomicile without the specific prior approval of Financial Surveillance Department. Investments exceeding R1 billion per applicant company per calendar year Foreign direct investments outside the CMA by mandated parastatals, as defined in Schedule 2 of the Public Finance Management Act, 1999 (Act No. 1 of 1999) and companies, where the total cost of such investments exceed R1 billion per investment, require prior approval from the Financial Surveillance Department. In terms of the current policy at least 10 per cent of the foreign target entity’s voting rights must be obtained. South African owned Intellectual Property may not be transferred by way of a sale, assignment or cession and/or the waiver of rights in favour of non-residents in whatever form, directly or indirectly, without the prior approval of the Financial Surveillance Department. Foreign currency denominated facilities may be extended by Authorised Dealers to South African companies for the financing of approved foreign direct investments. When applying to the Financial Surveillance Department, (April ‘15) O4 companies must indicate how the proposed foreign investment will be funded. Applications to the Financial Surveillance Department for making direct investments in excess of R1 billion abroad, should, inter alia, include the following: (1) The business plan of the applicant; (2) full details of the longer term monetary benefits (excluding dividend flows) to be derived by the Republic on a continuous basis, substantiated by cash flow forecasts. (3) a pro forma Balance Sheet of the offshore entity reflecting the financial position immediately prior to and after the investment from the Republic; (4) the percentage equity to be acquired in the foreign target company as well as the percentage voting rights to be acquired; (5) the names and domicile of the shareholders of the applicant company; (6) the proposed financial structure of the entity to be acquired or to be established, i.e. issued share capital, loan funds, guarantees to be issued from the Republic or credit facilities to be availed of abroad and the respective amounts involved; etc.; (7) the manner in which the funds required will be employed; and (8) where applicable, an estimate of the annual running expenses of the offshore entity. The following conditions/policy principles would inter alia be applicable to approved investments exceeding R1 billion: (1) Whilst there are no exchange control limits on new outward foreign direct investments by South African companies, the Financial Surveillance Department reserves the right to stagger capital outflows relating to very large foreign investments so as to manage any potential impact on the foreign exchange market. (2) On application, foreign finance may be raised on the strength of the applicant company’s South African balance sheet to finance foreign acquisitions. (3) Companies wishing to invest in countries outside the CMA may apply to the Financial Surveillance Department to engage in corporate asset or share swap transactions in order to fund such investments or to repay existing offshore debt. Similarly, requests for share placements and bond issues offshore by locally listed companies will also be considered. (4) Companies which have existing approved subsidiaries abroad are allowed to expand such activities without prior approval of the Financial Surveillance Department, provided that such expansion is financed by foreign borrowings, without recourse to South Africa, or by the employment of profits earned by that subsidiary, subject to the benefit to South Africa being demonstrated. The local parent company is required to place their proposed plans for the expansion of the investment on record with the Financial Surveillance Department at an early stage. The retention of any balance of the profits earned would, bearing in mind the provisions of Regulation 6, have to be negotiated with the Financial Surveillance Department at the time of normal annual report back. In addition, the Financial Surveillance Department also requires to be advised of all dividends declared by the offshore operation(s), the (April ‘15) O5 amounts repatriated to South Africa, or alternatively the dividends amounts retained abroad, together with an indication of how such funds were utilised offshore, on an annual basis. (5) Dividends repatriated from abroad by South African companies during the period 2003-02-26 to 2004-10-26 (dividend credits) automatically form part of domestic funds and may be allowed to be retransferred abroad for the financing of approved foreign direct investments or approved expansions, but may not be transferred abroad for any other purpose. Dividends declared by offshore subsidiaries of South African companies after 2004-10-26 (i.e. dividends declared out of normal trading income of a non-capital nature) may be retained offshore and used for any purpose, without any recourse to South Africa. Such dividends repatriated to South Africa after 2004-10-26 may be retransferred abroad at any time and used for any purpose, provided that there is no recourse to South Africa, except as provided for in paragraph (6) below. (6) 6.1.2.4 South African companies are permitted to acquire from 10 to 20 per cent equity and/or voting rights, whichever is the higher, in a foreign target entity, which may hold investments and/or make loans into any CMA country. Reporting requirement All companies establishing subsidiaries, branches, offices or joint ventures abroad are required to submit financial statements on these operations to the Financial Surveillance Department annually. In certain instances regular progress reports are also required. 6.1.2.5 Expansion of business abroad and remission of funds Where it is required to remit funds on a continuous basis from the RSA to finance running expenses or working capital requirements of offshore operations (i.e. branch operations or offices) that do not generate income at all or insufficient income, an annual application should be submitted to the Financial Surveillance Department supported by: A report on the operations of the past year; and an up-to-date financial statement of the foreign concern. South African companies are allowed, without prior approval of the Financial Surveillance Department, to expand their existing offshore business via the existing/newly established offshore entity, through the acquisition of further assets/equity interests offshore. The expansion must be financed without recourse to South Africa through foreign borrowings or by the employment of profits earned by their offshore company. No recourse to South Africa may occur to fund or guarantee such offshore expansion and all expansion plans including an enhanced monetary benefit must be placed on record with the Financial Surveillance Department at an early stage. Companies that wish to expand their existing South African operations with recourse to South Africa, i.e. by transferring cash or issuing guarantees from South Africa, have to submit a fresh fully motivated application to the Financial Surveillance Department. Such application must meet the same criteria requirements for foreign direct investment abroad as outlined in point 6.1.2.1 above. (October ‘11) O6 Purchase consideration of additional shares in existing offshore entities or the expansion of existing business ventures offshore. Where corporates wish to purchase additional shares in existing offshore entities or expand their existing business venture offshore, the Financial Surveillance Department will, on application, consider such requests. Transfer of equipment/machinery from the RSA into the foreign venture. Consideration will be given to requests for the export of equipment/machinery from South Africa and for the value thereof to be capitalised in the foreign venture. Factors that will be taken into account in considering such requests include the value of the equipment/machinery, the relationship of the value to the overall capitalisation required, whether the items are second-hand or new and whether they were imported or manufactured locally. As an alternative the applicants may wish to show the value as a shareholders loan, which on application is normally favourably considered. Foreign loans A loan with a foreign bank raised in the name of the foreign subsidiary, to finance current expenses of an offshore entity or day-to-day working capital, excluding trade financing to and from South Africa: 6.1.3 Repayments of the foreign loan may, with prior approval, be met from the foreign company's profits; and if guaranteed from South Africa and the guarantee is implemented, funds may only be remitted with prior approval from the Financial Surveillance Department. Loans by residents to non-residents Corporates Loans by South African corporates to non-residents are subject to the approval of the Financial Surveillance Department, which will usually only be given in exceptional circumstances if the loan is in lieu of dividends or if it is related to an approved foreign investment by a company. Individuals An individual may transfer loans within their overall discretionary limit of R1 000 000 per applicant during a calendar year to persons normally resident outside the Republic or to South African residents who are temporarily overseas, excluding those residents who are abroad on holiday or business travel. 6.1.4 Portfolio investments 6.1.4.1 Portfolio investments by residents The export of capital for portfolio investments, for instance in quoted stocks and shares, is prohibited, except as provided for in section 6.1.1. 6.1.4.2 Foreign portfolio investments by South African institutional investors As an interim step towards prudential regulation, retirement funds, long-term insurers, collective investment scheme management companies and investment managers are allowed to transfer funds from South Africa for investment abroad. The limit on foreign portfolio investment by institutional investors is applied to an institution’s total retail assets. The foreign exposure of retail assets may not (December ‘11) O7 exceed 25% in the case of retirement funds and underwritten policy business of long-term insurers. Collective investment scheme management companies, investment managers registered as institutional investors for exchange control purposes and the investment-linked business of long-term insurers are restricted to 35% of total retail assets under management. Institutional investors are allowed to invest an additional five per cent of their total retail assets by acquiring foreign currency denominated portfolio assets in Africa through foreign currency transfers from South Africa or by acquiring approved inward listed investments, excluding inward listed shares, based on foreign reference assets or issued by foreign entities, listed on the JSE Limited or the Bond Exchange of South Africa, respectively (See point 7.9, Section W for the definition of inward listed shares). A separate registered fund or collective investment scheme in South Africa sanctioned by the Financial Services Board, is preferred in instances where the institutional investor wishes to obtain direct African exposure by means of a pooling arrangement, e.g. an African fund set up specifically by a managing institution. It is, however, not a requirement that such a direct African exposure should always be undertaken through a separate fund (registered or unregistered). All institutional investors should ensure that their investments in African portfolio assets are in compliance with the Financial Services Board’s requirements and regulations. All direct or indirect transactions executed in terms of the five per cent African allowance, must be reported via the Reporting System. Institutional investors are permitted to invest in Rand denominated products issued abroad or foreign currency denominated instruments issued by local entities as part of their foreign portfolio investment allowances on condition that the requirements of the Financial Services Board are complied with, as is the case in respect of investments into any other product. It should be noted that compliance with the foreign exposure limits on foreign portfolio investment does not preclude an institution from also having to comply with any relevant prudential regulations as administered by the Financial Services Board. Foreign assets, for exchange control purposes, are defined as the sum of foreign- currency denominated assets and Rand-denominated foreign assets, acquired indirectly through investment with another domestic institution. To ensure the consistent classification of foreign exposure, institutions are required to report their assets on a “look-through” basis. Full details of this dispensation including the mechanics thereof, the procedures and the reporting requirements can be accessed from the Internet at the following address: http://www.reservebank.co.za. Follow the links: Home > Regulation and supervision > Financial surveillance and exchange controls > Guidelines > General > Guidelines – South African institutional investors. 6.1.4.3 Prudential limit on foreign diversification by Authorised Dealers Authorised Dealers are able to acquire direct and indirect foreign exposure up to a macro-prudential limit of 25% of their total liabilities, excluding shareholder’s equity. Furthermore, Authorised Dealers are allowed to invest an additional five per cent of their total liabilities, excluding total shareholder’s equity, for expansion into Africa. 6.1.4.4 South African Private Equity Funds Private equity funds that are members of the South African Venture Capital Association, mandated to invest into Africa, may apply to the Financial (April ‘13) O8 Surveillance Department for an annual approval to invest into Africa. The following information must accompany such applications: A copy of the local en-commandite partnership’s mandate to invest into Africa or in the case of a local fund running parallel with an offshore fund, a copy of the co-investment agreement between the local and foreign partnership; cash flow projections for a 36 month period indicating the amount of capital to be exited from South Africa for investment purposes into Africa; and confirmation that the local private equity fund will obtain a minimum of 10 per cent of the voting rights in the respective investment into Africa. In the context of a local fund running parallel with an offshore fund where the private equity fund is managed from South Africa, the minimum 10 per cent requirement may be measured on a fund-wide basis, after the conversion of investment rights into voting rights. Applications will also be considered where an unintended loop structure is created as a result of private equity funds investing into companies in the rest of Africa with a portion of their business in South Africa. Institutional investors must be aware that in terms of the look through principle, any offshore investment held indirectly via the local private equity fund must be marked off against the respective foreign portfolio investment allowances. The Financial Services Board Regulations governing the permissibility of these investments as part of their portfolios, must also be complied with. 6.1.4.5 International Headquarter Companies Subject to registration with the Financial Surveillance Department for reporting purposes, new established headquarter companies who meet the following shareholding and asset criteria may invest offshore without restriction: No shareholder in the headquarter company whether alone or together with any other company forming part of the same group of companies as a shareholder may hold less than 10 per cent of the shares and voting rights; no more than 20 per cent of the headquarter company shares may be directly or indirectly held by residents; and at the end of each financial year, at least 80 per cent of the assets of the holding company must consist of foreign assets. For the purposes of the above requirements, cash, cash equivalents and debt with a term of less than one year should not be taken into account. For the purposes of the above-mentioned requirements, cash, cash equivalents and debt with a term of less than one year should not be taken into account. Registration with the Financial Surveillance Department will remain valid, provided the above-mentioned requirements are adhered to for the duration of that year of assessment as well as all previous years of assessment. (April ‘13) O9 Reporting of the extent of the offshore investments will be required for statistical purposes which must, inter alia, include the source of funds, new or existing funds, destination, loan funds from local sources, etc. Headquarter companies will be treated, for exchange control purposes, as non-resident companies other than for their reporting obligations. Transactions by South African entities with headquarter companies will, therefore, be viewed as transactions with non-residents. Headquarter companies can freely borrow from abroad and such funds may be deployed locally or offshore. These transactions are regarded as occurring outside South Africa. Any lending by local banks to headquarter companies will form part of the banks’ macro prudential limits. 6.1.4.6 South African holding company for African and offshore operations Entities listed on the JSE Limited may establish one subsidiary (“HoldCo”) to hold African and offshore operations which will not be subject to any exchange control restrictions. HoldCo will, however,be subject to the following conditions: Registration with the Financial Surveillance Department; HoldCo must operate as a South African tax resident and be incorporated and effectively managed and controlled in South Africa; Authorised Dealers may authorise transfers from the parent company to the HoldCo up to Rand 2 billion per calendar year. Up to this amount, there will be no restriction on transfers in and out of the HoldCo, provided that such transfers are not undertaken to avoid tax. Additional amounts of up to 25 per cent of the listed company’s market capitalisation will be considered on application to the Financial Surveillance Department, provided there are demonstrated benefits to South Africa; HoldCo will be allowed to freely raise and deploy capital offshore,provided that these funds are without recourse to South Africa. Additional domestic capital and guarantees will be allowed to fund bona fide foreign direct investments in the same manner as the current foreign direct investment allowance; HoldCo will be allowed to operate as a cash management centre for South African entities. Cash pooling will be allowed without any restrictions and local income generated from cash management will be freely transferable; and HoldCo may choose its functional currency and operate a foreign currency account and a Rand denominated account for operational expenses. Unlisted entities may establish one subsidiary (“HoldCo”) to hold African and offshore operations, which will not be subject to any exchange control restrictions, subject to certain conditions. (February ‘14) O10 6.1.5 Share incentive schemes offered by foreign companies Private individuals are allowed to participate in offshore share incentive or share option schemes, provided that such participation is financed in terms of the foreign capital allowance dispensation (see point 6.1.1 above) and/or from the proceeds of authorised foreign assets. All applications falling outside the ambit of this dispensation must be referred to the Financial Surveillance Department with full details. Where an application is submitted to the Financial Surveillance Department and it is agreed to, the following guidelines will normally apply: Participation where the acquisition of shares will have a direct impact on the country’s foreign exchange reserves, i.e. employee must transfer funds abroad in order to purchase the shares: Requests of this nature must be dealt with in terms of in terms of the foreign capital allowance dispensation (see point 6.1.1 above). Should an employee who qualifies in terms of the incentive scheme wish to acquire shares in excess of the amount of R10 million, payment thereof may be effected provided such shares are immediately disposed of and the full sale proceeds thereof transferred to South Africa in terms of Regulation 6. Such transfer(s) may not be regarded as capital transferred from abroad as outlined in point 6.1.1 above. Participation where the acquisition of shares will not have any impact on the country’s foreign exchange reserves, i.e. shares are acquired by employees by means of a parent company or third party loan to be serviced from dividends earned abroad or the employee is awarded the share free of charged: All levels of employees of the company who qualify in terms of the rules of the share incentive scheme may acquire shares to any value and may retain such shares. The value of the shares acquired in this matter need not be deducted from the foreign capital allowance dispensation. Any income earned abroad in this regard may be retained abroad. 6.1.6 Trade finance Exporters require special authorisation from their bankers before granting credit in excess of six months. The Authorised Dealer may grant such authority provided that he is satisfied that the credit is necessary in the particular trade or that it is needed to protect an existing export market or to capture a new export market. Requests for granting credit in excess of twelve months need specific approval from the Financial Surveillance Department . 6.1.7 Borrowing abroad by residents 6.1.7.1 Control over borrowing abroad by residents Whilst permission is generally granted for residents to raise foreign loans, it is necessary for prior approval to be obtained, from Authorised Dealers or the Financial Surveillance Department, since the country will be placing itself in a position where the foreign creditor has a call on the country's foreign exchange reserves at the time of repayment. Authorised Dealers may approve applications by residents, to avail of inward foreign loans and foreign trade finance facilities from any non-resident, subject to the specific criteria applicable to inward foreign loans being adhered to and that such loans are recorded via the Loan Reporting System by the Authorised (July ‘10) O11 Dealers. Any other request which falls outside the applicable criteria, an application must be submitted to the Financial Surveillance Department, for consideration. The aforegoing applies not only to foreign loans introduced into the country but also to loan commitments as a result of the non-payment of imports or services rendered. 6.1.7.2 Purpose of control The objective of the control is not to restrict borrowing abroad but to ensure that the repayment and servicing of loans do not disrupt the balance of payments.The objective is also to ensure that the level of interest rates paid is reasonable in terms of prevailing international rates. In line with the general policy of not restricting transfers of genuine income, as opposed to capital transfers, the interest payable on foreign loans is freely transferable provided the underlying borrowing has been approved. The policy regarding borrowing abroad applies to both corporate entities and individuals. 6.1.7.3 Authority to Authorised Dealers Application requirements All applications to Authorised Dealers for inward foreign loans and foreign trade finance facilities must, inter alia, contain the following information: Full names of the local borrower; identity number or temporary resident permit number or registration number of the borrower; full names of the foreign lender; domicile of the foreign lender; relationship between the foreign lender and the borrower; denomination of the loan; currency and amount of principal sum; interest rate and margin; purpose of the loan; details of the type of security required, if any; tenor. In instances where a loan will be repaid at a fixed future date, the date on which the loan will be repaid must be provided and, where a loan will be repaid in instalments, the date of the first instalment should be provided as well as the interval of the instalments, e.g. monthly/quarterly instalments; copy of the loan agreement, if available/applicable; confirmation that there is no direct/indirect South African interest in the foreign lender; full details of early repayment options, as well as currency switch options, if any; (July ‘10) O12 in the case of trade finance facilities, written confirmation from the borrower to the effect that the relative import or export transaction is not being financed elsewhere; and details of any commitment fees, raising fees and/or any other administration fees payable by the borrower. Adjudication process The following criteria must be strictly applied by Authorised Dealers when adjudicating applications for inward foreign loans and foreign trade finance facilities: The tenor of each loan must be at least one month; the interest rate in respect of third party foreign denominated loans may not exceed the base lending rate plus 2% or, in the case of shareholders' loans, the base lending rate as determined by commercial banks in the country of denomination; the interest rate in respect of Rand denominated loans may not exceed the base rate, i.e. prime rate, plus 3% on third party loans or the base rate, in the case of shareholders' loans; the loan funds to be introduced may not represent or be sourced from a South African resident's foreign capital allowance, foreign earnings retained abroad, funds for which amnesty had been granted in terms of the Exchange Control Amnesty and Amendment of Taxation Laws Act, 2003 (Act No. 12 of 2003) and/or foreign inheritances; there may not be any direct/indirect South African interest whatsoever in the foreign lender; the loan funds may not be invested into sinking funds; and no upfront payment of commitment fees, raising fees and/or any other administration fees are payable by the borrower. Applications to be submitted to the Financial Surveillance Department Authorised Dealers must submit an application to the Financial Surveillance Department for consideration in the following instances: Regularisation of all unauthorised inward foreign loans and foreign trade finance facilities; loan draw downs, capital and interest payments, where the funds originate from or are deposited to Non-Resident Accounts. These transactions are not reportable on the Reporting System; loan draw downs, capital and interest payments in respect of foreign trade finance facilities for imports/exports where the transactions will not be reported under Category 107, 999 or 407 of the Reporting System. A quarterly schedule must be submitted detailing funds drawn against the facility as well as all repayments effected; any other instances where the Reporting System will not reflect changes to the original loan; any unauthorised increase/decrease of the principal amount of the foreign loan; (September ‘14) O13 capitalisation of interest; conversion of the loan to share capital; consolidation of loans; applications by affected persons, where the repayment of a shareholder’s loan will result in the local entity becoming “overborrowed” in terms of the local financial assistance ratio; all loans where commitment fees, raising fees and/or any other administrative fees are payable; early capital redemptions; issuance of redeemable preference shares to non-residents; bond issues; and all cases where the criteria which Authorised Dealers must apply when adjudicating applications cannot be met. Capital Repayments Authorised Dealers may also provide foreign exchange for the repayment of inward foreign loans and foreign trade finance facilities equal to the funds drawn down under a specific loan on the due date. Capital and interest payments must be reported separately on the Reporting System. Capital repayments must be strictly in accordance with the terms of the loan. Guarantees Authorised Dealers may issue guarantees in favour of non-resident lenders as and when required. Draw downs The principal sum of the loan must be introduced within a period of 12 months from the date that the loan was captured on the Loan Reporting System and may not exceed the authorised principal amount of the loan. Any extensions in this regard, must be advised to the Financial Surveillance Department. Retention of documentation Authorised Dealers must be able to substantiate all information submitted via the Loan Reporting System. For inspection purposes, documentary evidence must be retained for a period of five years after the full repayment of the loan. 6.1.7.4 Categories of loan finance The central question to be decided is when and on what conditions exemption should be granted from the general restriction on foreign borrowing. In the following sections the types of borrowing to be considered for exemption, the conditions attached and the required procedures will be discussed. Loan finance available from abroad usually falls within one of the following categories: Trade Finance, short-term working capital loans and long-term loans; loans from non-resident shareholders to affected persons; and loans from other non-residents. (July ‘10) O14 6.1.7.4.1 Trade finance, short-term working capital loans and long-term loans (a) Short-term trade finance Imports The Financial Surveillance Department is prepared to permit Authorised Dealers, on application, to extend short-term foreign trade finance facilities, relating to the importation of goods into the Republic, to residents subject to the following conditions: The facilities being extended by the local bank concerned are funded, in turn, from foreign currency placements attracted and/or lines of credit obtained from correspondent banks abroad for that specific purpose; the facilities relate to the payment for the importation of a specific consignment of goods. In this regard, the local bank concerned may bundle a number of payments together when extending a short-term foreign finance facility, but must ensure that payments for the underlying transactions have been made not more than six weeks prior to the date of draw down of the facility or that payments will be made within six weeks from the date of draw down of the facility. In all instances the draw down of the facility may only take place on or after date of shipment; except for advance payments where the draw down can be done prior to the goods being shipped. the Authorised Dealer extending these facilities ensures that the underlying payments comply fully with the relevant exchange control authorities and directives, including the viewing, endorsement of substantiating documentation and the reporting in terms of the Reporting System, on repayment of the facility. Where another Authorised Dealer has been instructed to effect some or all of the foreign currency payments (pay aways), the Authorised Dealer extending the trade finance facility would place the other Authorised Dealer in funds by crediting the latter's nostro account, thus ensuring that it is always possible to relate all facilities outstanding to specific import transactions; the overall finance period, including any initial supplier's credit taken, does not exceed 12 months from date of shipment of the underlying goods to the Republic; and no such facility may be drawn down unless the supplier has been paid or will be paid out of the said draw down and no other financial commitment exists in regard to the underlying importation, except where a batch of import payments are being bundled into one draw down under a short-term foreign finance facility. Exports The Financial Surveillance Department is prepared to permit Authorised Dealers, on application, to extend short-term foreign trade finance facilities relating to the export of goods from the Republic to residents, subject to the following conditions: The facilities being extended by the Authorised Dealer concerned are funded, in turn, from foreign currency placements attracted and/or lines of credit obtained from correspondent banks abroad for that specific purpose; (September ‘14) O15 the facilities relate to the pre- or post-shipment finance of the export of a specific consignment of goods; the Authorised Dealer extending these facilities ensures that at the time of draw down, the foreign currency amount of the drawing is converted into Rand and the relevant exchange control requirements and the observance of the 30 day rule, are complied with. The Reporting in terms of the Reporting System, must take place upon receipt of the export proceeds from abroad; the foreign currency draw down, under a short-term export finance facility, must be treated as the early accrual of the export proceeds, be converted to Rand and further administered as such; the foreign currency eventually received from the overseas importer is not converted to Rand, but is applied in repayment of the export finance facility; where another Authorised Dealer has been instructed to receive the proceeds, it would pass these on to the Authorised Dealer extending the trade finance facility by crediting the latter's nostro account, thus ensuring that it is always possible to relate all outstanding facilities to specific current export transactions; the overall finance period, including any initial credit granted by the exporter, does not exceed six months from date of shipment of the underlying goods from the Republic, unless a special dispensation has been granted, when the overall finance period including any initial credit granted by the exporter may not exceed 12 months from date of shipment of the underlying goods from the Republic. An export finance facility may be extended in the event of the overseas importer requiring an extension of the original credit period, provided that the overall finance periods set out above are not exceeded; the facility must be repaid with foreign currency. No facility may be drawn down where payment of the underlying export transaction has already been received; in the event of the overseas importer paying before the relative export finance facility has fallen due for repayment and effecting an early repayment thereof is not possible, the local exporter may either retain these foreign currency funds in a C.F.C. account to meet his export finance liability on due date or alternatively, convert such funds to Rand. Should the local exporter opt for the latter, the foreign finance facility must, from then on, be administered as a short-term working capital loan and be reported as such in subsequent monthly returns submitted to the Financial Surveillance Department; in the event the overseas importer does not effect payment or only makes partial payment, the balance outstanding must, from then on, be administered as a short-term working capital loan and be reported as such in subsequent monthly returns submitted to the Financial Surveillance Department, who must also be informed of the overseas importer's default; and (September ‘14) O16 Inform Financial Surveillance Department monthly of short-term foreign finance facilities relating to the exportation of goods and separately, such facilities relating to the export of goods from the Republic. The facilities enumerated above would not be included in the calculation of an affected person's local borrowing levels in terms of the provisions of Regulation 3(1)(f), provided that the facilities being extended by the local bank concerned are funded, in turn, from foreign currency placements attracted and/or lines of credit obtained from correspondent banks abroad, for that specific purpose. (b) Short-term working capital loans The Financial Surveillance Department is prepared to permit local Authorised Dealers, on application, to extend short-term foreign currency working capital loan facilities, specifically relating to the financing of current assets, other than those arising from the importation or the export of goods into or from the Republic, to residents on the following basis: That the facilities being extended by the Authorised Dealer concerned are funded, in turn, from foreign currency placements attracted and/or lines of credit obtained from correspondent banks abroad for that specific purpose; the facilities relate to the financing of the current assets, other than those arising from the importation or the export of goods into or from the Republic, of a resident; and Inform Exchange Control of short-term foreign finance facilities relating to the exportation of goods from the Republic and separately, such facilities relating to the export of goods from the Republic, on a monthly basis. The monthly return must be submitted in two parts, the one relating to resident borrowers (other than affected persons) and the other to affected persons. The facilities enumerated above would not be included in the calculation of an affected person's local borrowing levels in terms of the provisions of Regulation 3(1)(f), provided that the facilities being extended by the Authorised Dealer concerned are funded, in turn, from foreign currency placements attracted and/or lines of credit obtained from correspondent banks abroad for that specific purpose. (c) Long-term loans In the event of an Authorised Dealer wishing to interpose itself locally and assume the funding of a capital goods import by substituting either local funding or shorter-term foreign currency finance facilities and, in so doing, bars direct utilisation of new long-term lines of credit, which were available for that specific purpose (by e.g. negotiating any bills of exchange or promissory notes, transferring or providing any security or acknowledging any debt), prior approval of the Financial Surveillance Department must be obtained. Should, in similar circumstances, an Authorised Dealer wish to interpose itself through a subsidiary or branch office outside the Republic, it may do so, provided that such transactions are financed solely out of the offshore entity's own resources abroad. It follows that no funding may be provided (October '07) O17 from the CMA to the offshore entity, to assist either wholly or partially, with the financing of such a transaction. Furthermore, such financing must run for the full credit period originally agreed and the resident debtor may not repay such financing at an earlier date, without prior approval of the Financial Surveillance Department. Authorised Dealers must, similarly, obtain prior approval of the Financial Surveillance Department before entering into Export Credit Facility Agreements with correspondent banks abroad. Furthermore, prior approval of the Financial Surveillance Department must be obtained for all facilities subsequently availed of under such agreements where the overall finance period, including any initial supplier's credit, exceeds 12 months from date of shipment of the underlying goods to the Republic. The facilities mentioned above would not be included in the calculation of an affected person's local borrowing levels in terms of the provisions of Regulation 3(1)(f), provided that the facilities being extended by the Authorised Dealer concerned are funded, in turn, from foreign currency placements attracted and/or lines of credit obtained from correspondent banks abroad, for that specific purpose. 6.1.7.4.2 Loans from non-resident shareholders to affected persons South African companies subject to Regulation 3(1)(f) Special considerations regarding the acceptance and repayment of loans have to be taken into account when the non-resident interest in the South African company is 75% or greater and these are outlined hereunder. Given the restrictions on the extent to which South African companies, subject to the provisions of Regulation 3(1)(f), may use local borrowing and other financial assistance, the acceptance or the repayment of non-resident shareholders' loans may affect existing local borrowing authorities, as indicated in the table below: (October '07) O18 6.1.7.5 Type of Loan Transaction Effect on Local Borrowing Limit New loan from non-resident shareholders with no pro rata contribution from resident shareholders. Amount included in effective capital and local borrowing limit increased by applicable percentage of this amount. Repayment of above loan. Amount deducted from effective capital and local borrowing limit reduced by applicable percentage of this amount. New loan from non-resident shareholders with pro rata matching loan from resident share-holders. Both loans included in effective capital and local borrowing limit increased by applicable percentage of the total of the amounts of the loans. Repayment of the non-resident shareholders' loan only. Both non-resident and resident shareholders' loans deducted from effective capital and local borrowing limit reduced by the applicable percentage of the total of the amounts of the loans and resident shareholders loans now reclassified as local borrowing and must be accommodated under local borrowing limit. Fraudulent practices involving purported foreign loan facilities Any applications for foreign exchange to meet the purported cost of raising fees or administrative charges in connection with any proposed borrowing abroad by residents must be referred to the Financial Surveillance Department for approval with full details of the terms of the proposed loan together with the original documentary evidence submitted in support of the request. Furthermore, should Authorised Dealers be approached by prospective borrowers with the request to issue, on the borrower's behalf, stand-by letters of credit or other forms of guarantees, make promissory notes or avail of promissory notes or other forms of debt instruments made by the borrower, in favour of the lender, all such requests must be referred to the Financial Surveillance Department for approval with full details as enumerated above. (October '07) O19