METAspectrum 34.0

Enterprise Application Strategies, Application Delivery Strategies

22 July 2003

Author: Ruediger Spies

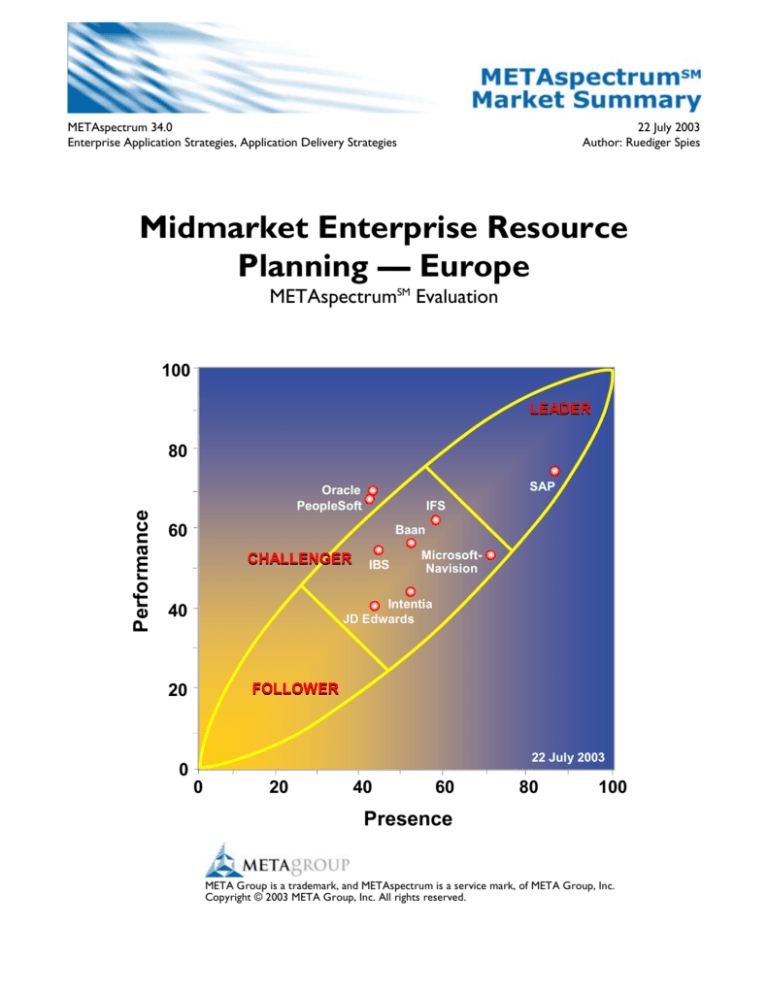

Midmarket Enterprise Resource

Planning — Europe

METAspectrumSM Evaluation

100

LEADER

Performance

80

SAP

Oracle

PeopleSoft

IFS

60

Baan

CHALLENGER

MicrosoftNavision

Intentia

JD Edwards

40

FOLLOWER

20

0

IBS

22 July 2003

0

20

40

60

80

100

Presence

META Group is a trademark, and METAspectrum is a service mark, of META Group, Inc.

Copyright © 2003 META Group, Inc. All rights reserved.

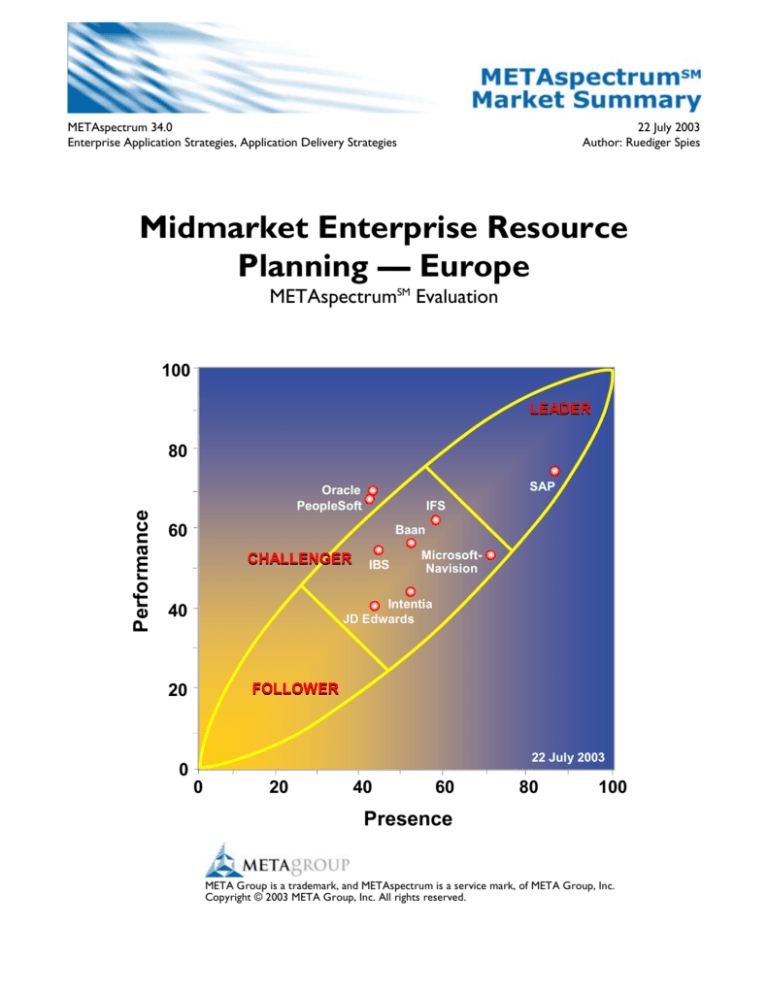

Market Overview

Market Definition

This METAspectrum investigates the midmarket enterprise resource planning (ERP) market in Europe. The larger territory —

EMEA (Europe, Middle East, and Africa) — is also reflected, but the key focus is on geographical Europe. ERP is defined as a

suite of enterprise business applications including, at a minimum, financials and human resources applications, plus at least one

of the following: manufacturing, supply chain management (SCM), or customer relationship management (CRM). ERP solutions

should be capable of satisfying at least 75% of the overall business requirements for target customers. ERP application

functionality is mission-critical, and solutions are therefore regarded as core IT investments. This is independent of the target

customer size, applying equally to large and midsized enterprises.

The focus of this METAspectrum is on enterprises with between 50 and 1,000 employees and annual revenues of less than 1B

euros. We refer to this space as the midmarket or the small and medium business (SMB) market. There are roughly 200,000

enterprises in this territory. For an ERP vendor to qualify for inclusion in this study, its license revenue in the last business year

must have exceeded 50M euros. License revenue better reflects the footprint in the market than total revenue including

services, because it treats direct and indirect selling companies equally.

Market Forecast

During 2003/04, reduced spending on new ERP projects by Global 2000 (G2000) firms will cause Tier 1 ERP vendors to focus

more on selling into the midmarket. Among Tier 1 vendors, some have packaged their existing ERP offerings to better

accommodate the needs of the midmarket, while others have developed offerings specifically for the midmarket. Tier 2 ERP

vendors, on the other hand, have largely served the extended midmarket as a matter of course and thus have not needed to

create special offerings.

The Tier 3 vendor landscape and part of Tier 2 continue to consolidate (e.g., Navision has been acquired by Microsoft, the

ownership of Baan has just changed), opening opportunities for vendors to win replacement business. Many midrange

customers have older ERP systems (or parts thereof), homegrown applications that must be replaced, or applications from

vendors that have gone out of business.

However, Tier 1 ERP vendors currently do not have an optimized offering (product plus service plus integration plus

midmarket pricing) for the midmarket. In 2004/05, we expect Tier 1 vendors to have finally optimized their offerings for the

SMB market, leaving less and less of the market to Tier 2 suppliers. The market will continue to consolidate until 2006/07, and

we expect overall growth to be flat over the next couple of years.

We also believe ERP vendors will have a much stronger chance of fulfilling the role of the enterprise backbone in the SMB

market than they do in the G2000 environment. Midrange companies tend to expect that their (relatively fewer) software

vendors will solve all their business application-related questions. The value of an integrated environment counts more in this

environment, since SMBs lack the resources to support costly application integration themselves. Due to the sheer number of

midmarket companies, the relatively modest revenue per deal, and local support requirements, we expect most ERP vendors

serving this market to develop a comprehensive partner strategy. Those without one will be relegated to niche status in this

market by 2005/06.

Key Findings

The midrange ERP market is fragmented, with one company dominating most discussions but certainly not all purchasing

decisions. Although that company — SAP — is still seen as the vendor of choice for G2000 enterprises, this perception is

slowly changing. The other vendors reflected in this METAspectrum (Baan, IBS, IFS, Intentia, JD Edwards, Microsoft Business

Solutions, Oracle, and PeopleSoft) are all challenging SAP to various degrees. In general, the market is balanced between the

need for presence and performance. Vendors must excel equally in both to be successful. Especially in light of the current tight

market, we consider financial stability a key criterion, because decisions regarding an ERP system often have consequences

extending out for 10 years.

Nevertheless, we do not expect a consolidation as severe as that of the database market (down to three main vendors),

because of the complexity of requirements in different vertical markets. However, we do expect a consolidation down to five

vendors that will address the complete market spectrum by 2005. Other vendors will survive to specialize in a limited number

of vertical industries. Tier 3 vendors will not be able to serve the complete European/EMEA territory with all its languages,

currencies, and legal requirements, and are therefore at a serious disadvantage. End users selecting a new ERP vendor should

seek a balance between the right level of functionality (i.e., avoiding overengineered solutions) and the appropriate pricing level.

208 Harbor Drive • Stamford, CT 06912 • (203) 973-6700 • Fax (203) 359-8066 • metagroup.com

Copyright © 2003 META Group, Inc. All rights reserved.

METAspectrum 34.0 Midmarket ERP — Europe

2

Market Overview

Leaders

Given SAP’s omnipresence in the European market, it is not surprising that its position is near the far right edge of the leaders

sector. The brand influence from G2000 deals is immense. However, SAP does not have a seamless offering in the midmarket

(SAP All-in-One and SAP Business One have different architectures); therefore, its ranking is derived from a mixture of its

offerings. From a functional perspective, we see Oracle’s offering for the midmarket as more or less equivalent to SAP’s

offering. However, Oracle’s presence in the market is far behind that of SAP, and we believe Oracle will try to become more

visible with its new partner strategy. Although PeopleSoft also ranks high in performance, its offering is not suited for the

lower end of the SMB market, nor does the vendor want to expend too much of its energy on small companies. PeopleSoft’s

marketing campaigns are, therefore, targeting the higher end of the midmarket.

Challengers

Similar to SAP in the leaders sector, Microsoft Business Solutions is near the right-hand edge of the METAspectrum shape due

to its presence in the market. The takeover of Navision by Microsoft improved Navision’s visibility and covered the dualarchitecture problem to a degree (ex-Navision, ex-Axapta, and also ex-Great Plains products). Baan, IBS, IFS, Intentia, and JDE

are well positioned in the challenger area. PeopleSoft, being a Tier 1 vendor, has focused much of its efforts on G2000

companies and thus must battle its unequal presence in different European markets. In this sense, PeopleSoft could also be

considered a follower in the broader sense of the midmarket, due to its limited focus on this constituency.

Followers

There are no vendors designated as followers in this market analysis. The main reason is that we selected an entry barrier for

this market analysis of 50M euros in license revenue in the Europe/EMEA territory. There are many more small ERP vendors

serving select territories, and the vendors examined here see fierce competition from these smaller/lower-presence vendors.

Bottom Line

The market for midrange ERP in Europe continues to be fragmented, leaving many choices for potential buyers.

Tier 1 ERP vendors have tried to compensate for declining revenue from G2000 companies by concentrating more

on the midmarket. This situation will drive consolidation, with the number of global general-purpose ERP midrange

vendors diminishing to five by 2005. However, a substantial number of global and local vendors will continue serving

the market. Given the multitude of options, mistakes can easily be made when selecting an ERP vendor. End users

must seek a sound functional fit (no oversized solutions), low maintenance fees, a good balance between

implementation cost and software license, and a financially stable partner.

Business Impact: Because of expected consolidation in the market and the long-term commitment inherent in

selecting an ERP system, buyers must look intensively at vendors’ financial condition. ERP vendors must be able to

continually invest in new technologies to support customers’ ongoing drive for better IT and business alignment.

Vendors should also have a proven track record of innovation in improving the value of the original ERP investment.

208 Harbor Drive • Stamford, CT 06912 • (203) 973-6700 • Fax (203) 359-8066 • metagroup.com

Copyright © 2003 META Group, Inc. All rights reserved.

METAspectrum 34.0 Midmarket ERP — Europe

3

Midmarket ERP — Europe Presence Evaluation

Our market presence evaluation includes a review of each vendor’s product and service attributes — representing vendors’

ability to deliver value to customers. The following seven criteria areas provide a summary of our presence analysis. For

complete details on how vendors fared with each criterion in our evaluation, visit metagroup.com.

Vision/Strategy

Channels/Partners

SAP

IFS

IBS

Intentia

JD Edwards

Microsoft-Navision

Baan

PeopleSoft

Oracle

Excellent

Good/Very Good

Good/Very Good

Good

Good

Good

Fair/Good

Fair/Good

Fair

SAP

Microsoft-Navision

Oracle

Baan

JD Edwards

IFS

PeopleSoft

Intentia

IBS

Excellent

Very Good

Good/Very Good

Fair

Fair

Fair

Poor/Fair

Poor

Poor

What We Evaluated

What We Evaluated

Messaging/Positioning — External visible communication

to the market about vision, views, expectations, priorities,

and values, including how these values are communicated.

Customer Life-Cycle Management — Level of industry

acceptance of messaging/positioning. Trustworthiness of

messages and customer confidence that the vendor will

keep its promises.

Innovation/Thought Leadership — Ability to generate

market-shifting ideas and incorporate those into the

product offering. Ability to articulate innovative ideas to

the market and position the company as having leadingedge domain expertise.

Business Impact of Channel — General assessment of

external sales and implementation capacities. The degree,

vitality, revenue, growth, reach, coverage, and profit of

active channels and partners. Includes relationships

between partners and vendor, ease of partnership, and

ability to manage channel conflicts.

Programs for Resellers — General support of the external

channel. Defined offerings, tools, requirements

management, programs, and incentives, as well as their

distinct value for partners, resellers, and ISVs.

Programs for SIs and Influencers — Defined offerings,

tools, requirements management, programs, and incentives,

as well as their distinct value for systems integrators (SIs)

and other influencers. Also, an understanding of all

parameters influencing the public’s opinion about a vendor

— and management of them.

Quality Assurance for Channel — Defined methods to

ensure the quality, consistency, and value delivered by

individual partners for the final benefit of the end customer.

Analyst Commentary

This criteria area received the highest weighting in the

presence category, because successful ERP vendors must

not only develop a compelling product offering, but also

articulate a sound vision for how the offering adds value.

Ideally, this vision statement demonstrates a deep

understanding of customer requirements. Regardless, it is a

clear indicator of whether a vendor rates customer or

company priorities higher. The longer the duration of the

vendor/customer relation, the more important it is for a

vendor to demonstrate a long-term commitment to the

customer. This normally translates to high marks in

customer life-cycle management, as vendors and customers

have to go through many upgrades and enhancements to

the original software. Intentia, JDE, and SAP got high marks

in this regard due to their deep commitment to delivering

customer value as reflected in their vision statement.

Innovation is another important subcriterion, due to the

longevity of a typical ERP system. Vendors must

continuously demonstrate that they can keep up with

competition and market developments, introducing new

functions based on modern technology for the benefit of

their customers.

Analyst Commentary

ERP vendors must develop and maintain partnerships to

ensure long-term survival and improve market penetration.

Reselling partners clearly enhance a vendor’s visibility and

market footprint. Microsoft Business Solutions scored well

here due to its strong commitment to partners. In addition,

SAP received good marks for its channel concept that has

gained traction. Even if its ecosystem of hardware partners,

systems integrators, partners with additional software, and

resellers is highly complex, SAP has developed a unique

model of how to manage all the relationships without

showing a disjointed face to its customers. Some vendors

have chosen to work without any partners or with a very

limited set to offer a one-stop shopping opportunity for

midmarket customers and ultimately to control the

implementation’s quality. However, we believe this is done

at the expense of market visibility and penetration. We are

convinced that this strategy will eventually drive vendors

opting for that approach into a niche position.

208 Harbor Drive • Stamford, CT 06912 • (203) 973-6700 • Fax (203) 359-8066 • metagroup.com

Copyright © 2003 META Group, Inc. All rights reserved.

METAspectrum 34.0 Midmarket ERP — Europe

4

Midmarket ERP — Europe Presence Evaluation

Awareness/Reputation

SAP

Microsoft-Navision

Oracle

PeopleSoft

JD Edwards

Baan

IFS

Intentia

IBS

Geographic Coverage

Good/Very Good

Good/Very Good

Good

Good

Good

Good

Good

Fair/Good

Fair/Good

SAP

IBS

Intentia

Microsoft-Navision

Baan

IFS

JD Edwards

Oracle

PeopleSoft

Very Good

Good/Very Good

Good/Very Good

Good/Very Good

Good

Good

Fair/Good

Fair

Fair

What We Evaluated

What We Evaluated

Mind Share — Action and effectiveness in terms of

publicity, sales, marketing, service, and development

activities that build positive perception in the market and

extend visibility above and beyond the organization’s size

and/or share.

Vendor Reputation — The measurable achievement of

visibility as demonstrated by direct and indirect activities

including publications, press engagement/coverage, and

analyst/key influencer visibility. Also, the market’s

perception of the vendor vis-à-vis customers and partners,

investors/analysts, and employees.

Importance of Business in Europe/EMEA — Weight of

vendor’s European business compared to overall company

business. Considers vendor’s focus on this region as well as

the percentage of its revenue coming from EMEA. Also

looks at the vendor’s ability to attract new business in this

region.

Split of Business in EMEA Countries — How equally

distributed the vendor’s business in Europe is, the level of

potential support in different countries, and resources

available — also with respect to partners (e.g.,

implementation).

Leverage — Ability to generate growth, profitability, and

new customers from non-headquarters regions.

Analyst Commentary

Awareness in the industry must not be confused with market

share. Mind share is often reflected in a vendor’s probability

of making a shortlist, because it also reflects the political

enforceability in a given enterprise. Although the vendors

evaluated in this research are typically adept at presenting

their respective cases in competitive sales situations, making

shortlists is a huge challenge for many. A vendor’s image of

being a trusted long-term fair partner plays a sizable role in

buying decisions. And reputation cannot be changed

overnight simply by adding more money to the marketing

budget. These are long-term influences that have been built

over time and are part of a company’s brand. Furthermore,

negative press can quickly damage the hard-won reputation

of a vendor. For the market analyzed here, SAP received

high marks due to its ability not to overuse its size and its

broad reputation as a fair market participant.

Analyst Commentary

Balanced distribution among the various European

countries is interpreted here as an indicator of good overall

acceptance, as a stable basis for future business, and as a

sign of the vendor’s ability to expand internationally. A

couple ERP vendors with good reputations in the American

market have not been included in this study, due to their

inability to generate enough revenue in foreign territories

(like Europe). On the other hand, we have included several

European ERP vendors that do most of their business in

Europe (e.g., IBS). Due to the characteristics of midrange

customers, it is often not critical to have a worldwide

presence. Consequently, we put much more weight on

European presence and the ability to serve customers

equally in all European countries.

208 Harbor Drive • Stamford, CT 06912 • (203) 973-6700 • Fax (203) 359-8066 • metagroup.com

Copyright © 2003 META Group, Inc. All rights reserved.

METAspectrum 34.0 Midmarket ERP — Europe

5

Midmarket ERP — Europe Presence Evaluation

Industry Focus

Investments

Intentia

IFS

Microsoft-Navision

SAP

PeopleSoft

Baan

IBS

Oracle

JD Edwards

Very Good/Excellent

Very Good

Very Good

Good/Very Good

Good/Very Good

Good

Good

Good

Good

SAP

Microsoft-Navision

Baan

IFS

PeopleSoft

Intentia

Oracle

IBS

JD Edwards

Excellent

Very Good/Excellent

Very Good

Very Good

Good/Very Good

Fair/Good

Fair

Fair

Fair

What We Evaluated

What We Evaluated

Vertical Coverage — Number of vertical markets

addressed, number of customers and/or percentage of

revenue in verticals, and available references in vertical

markets. Also, demonstrated market share strategy, depth

of product offering, and domain knowledge of personnel in

vertical markets.

Depth of Experience — Measured, demonstrable tools,

techniques, methods, certifications, primary research,

tailored approaches, or other analysis and delivery

attributes that highlight the relevant skills and expertise

brought to a particular market.

Research and Development — Ownership, investments,

or relationships tied to business areas that are horizontally

or vertically complementary to the core market business.

Access to specific, exclusive intellectual property. Spending

in R&D relative to the revenue.

Targeted Growth Areas — Planned and active investment

areas tied to business growth.

Acquisitions — Success in selecting, buying, and integrating

companies and technologies.

Analyst Commentary

A vendor’s domain expertise surrounding industry-specific

business processes has become critical for facilitating

application implementation and reducing upfront application

customization. Most midrange ERP vendors have selected

certain vertical industries on which to focus sales,

marketing, and development activities, whereas the Tier 1

vendors tend to argue that their packages are broad

enough to be tailored to any given industry. For this

criteria area, we looked at the breadth of industries

covered by the vendors as well as the depth of expertise

and packaging demonstrated for each offering. Due to the

backbone nature of ERP systems, the key to vendor

success is an ability to demonstrate vertical expertise

through investments in process experts that can align easily

with client business rules and processes. Leveraging

business partners with the required industry expertise is

another alternative used by vendors.

Analyst Commentary

Competitive differentiation through investments in leadingedge technologies, along with the percentage of revenue

invested back into research and development,

demonstrates a clear focus on product excellence. These

investments result in a steady stream of functional and

technological enhancements that enable competitive

leadership. Such enhancements are normally the result of

investments either directly in research and development

(this should be the primary force) or in new technologies

gained through the acquisition of smaller companies to

close functional gaps quickly. SAP’s investment level tends

to be high, even if the company does not always acquire a

complete company to gain access to new technology

(though TopTier and TopManage are exceptions). On the

other side are the acquisition levels of IBS and Oracle,

which for the ERP space are relatively lower.

208 Harbor Drive • Stamford, CT 06912 • (203) 973-6700 • Fax (203) 359-8066 • metagroup.com

Copyright © 2003 META Group, Inc. All rights reserved.

METAspectrum 34.0 Midmarket ERP — Europe

6

Midmarket ERP — Europe Presence Evaluation

Share

SAP

Microsoft-Navision

Oracle

PeopleSoft

JD Edwards

Baan

IFS

Intentia

IBS

Excellent

Very Good

Good

Good

Good

Good

Good

Good

Fair

What We Evaluated

Market Share — Share of market relative to competitors

in the target market. Only revenues for application

software are relevant. Additional service revenue is not

factored in here.

Analyst Commentary

In today’s uncertain market, share — encompassing mind,

market, and wallet share — has assumed a renewed

importance. Customers want to ensure that they can live

and work well with their vendors for a long time. ERP

backbone decisions are never tactical, and customers need

a certain level of assurance that their ERP vendors will

survive the next 10 years. We also see vertical coverage as

an influence on this criteria area. Vendors with the greatest

share have already established the ultimate testimony about

the acceptance of their application in many different vertical

markets. Market share will continue to be a proof point for

acceptance in the European market.

208 Harbor Drive • Stamford, CT 06912 • (203) 973-6700 • Fax (203) 359-8066 • metagroup.com

Copyright © 2003 META Group, Inc. All rights reserved.

METAspectrum 34.0 Midmarket ERP — Europe

7

Midmarket ERP — Europe Performance Evaluation

Our market performance evaluation includes a review of each vendor’s product and service attributes — representing

vendors’ ability to provide value to customers. The following seven criteria areas provide a summary of our performance

analysis. For complete details on how vendors fared with each criterion in our evaluation, visit metagroup.com.

Technology

PeopleSoft

Oracle

IFS

Intentia

SAP

IBS

Baan

JD Edwards

Microsoft-Navision

Good/Very Good

Good/Very Good

Good/Very Good

Good

Good

Good

Good

Fair/Good

Fair/Good

What We Evaluated

Architecture — Kind of architecture that is used (C/S, 3tier, 4-tier, pure Web, mixed), openness, standards used,

platform supported, open data model, DBMS supported,

extensibility by clients, proprietary/open development

language for extensions. Architecture consistency.

Core ERP Features/Functions — Optimization, planning,

and scheduling models supported. Link and integration to

factory-floor systems (where appropriate), flexibility in

methods used for optimization, and collaborative

execution. Service management and special vertical

extensions (e.g., for flow-oriented manufacturing).

Financials Features/Functions — General ledger,

accounts receivable, accounts payable, procurement

(purchase to pay process), asset management, expense

management, and support for new government regulations

(e.g., Basel II, Sarbanes-Oxley Act).

HR Features/Functions — Core HR functions, payroll

(multicountry), benefits, administration, hiring, performance

management, compensation, career development,

succession planning, and HR self-service functions.

Strategic Enterprise Planning and Management —

Integrated tools for enterprise planning, business planning,

enterprise performance management, and parallel

simulation of different scenarios.

Analytic Features/Functions — Integrated tools for

reporting, detailed query, DW functions, key performance

indicators, dashboards, balanced scorecards, accessibility by

external tools, OEMed analytics package, and business

consolidation.

SCM Features/Functions — General supply chain

planning, collaborative planning, collaborative sourcing, level

of support for supply execution, work management system,

logistics, service management, collaborative manufacturing,

support for TOC (theory of constraints), and supply chain

event management.

CRM Features/Functions — Integrated functions for

operational, analytical, and collaborative CRM, vertical

CRM offerings, and level of integration into ERP/SCM

system. Also, whether the CRM functionality is from an

external partner or is part of core vendor’s expertise.

Portal Framework — Whether a portal framework exists,

whether the suite is accessible via a portal, and whether an

external partner’s portal software is used. Also, ease of use

in a Web environment, network traffic requirements, and

efficiency in terms of using network resources.

EAI Features/Functions — Existence of a specific

integration framework as part of the ERP system, ease with

which functions can be accessed from the outside, and

support for modern integration standards (e.g., Web

services, XML, BPEL4WS).

Application Management Tools — Specific rules

declaration/management, application configuration,

application extensibility, visual modeling/workflow,

design/development environment, testing support, patching,

complexity, implementation time, upgradability, and tools

for upgrade support.

Analyst Commentary

Technology/functionality offered is by far the most

important selection criterion for customers and

consequently the most heavily weighted of the

performance criteria. It represents the heart of any

solution. Good product architecture is reflected in the

ability to seamlessly integrate newly acquired products and

to rapidly support emerging standards (e.g., XML, Web

services). Partnerships with other companies to fill

functional gaps have not been reflected in this study,

because they are open to any vendor and therefore result

in no real competitive advantage for a vendor. Core ERP

functions can be delivered by almost all vendors

investigated in this study, and are a prerequisite to play in

this league. However, points of differentiation exist in more

peripheral areas. Microsoft Business Solutions, for example,

lacks deeper analytical functions (not consistently available

among offerings and too report-oriented where present),

whereas SAP gets good marks for its All-in-One offering

with Business Warehouse (BW) but also lacks analytical

functionality in its Business One product.

208 Harbor Drive • Stamford, CT 06912 • (203) 973-6700 • Fax (203) 359-8066 • metagroup.com

Copyright © 2003 META Group, Inc. All rights reserved.

METAspectrum 34.0 Midmarket ERP — Europe

8

Midmarket ERP — Europe Performance Evaluation

Services

Pricing

SAP

Oracle

Baan

IFS

Intentia

PeopleSoft

IBS

JD Edwards

Microsoft-Navision

Very Good

Very Good

Very Good

Good/Very Good

Good/Very Good

Good/Very Good

Good/Very Good

Fair/Good

Fair/Good

IBS

Oracle

SAP

Baan

IFS

Microsoft-Navision

JD Edwards

PeopleSoft

Intentia

Very Good/Excellent

Good/Very Good

Good

Good

Good

Good

Fair/Good

Fair/Good

Fair

What We Evaluated

What We Evaluated

Business Process Methodology — Availability of

published implementation methodology, templates for

building add-on products, specific industry models, tools to

support change management, and integrated tools to

support the implementation project.

Implementation Services — Implementation services

offered and level of local vendor consultant capacity,

quality, skills, training, and certification. Sufficiency of

external resources in terms of availability and training.

Hosting Services — Vendor’s capabilities for hosting

services, internally or via established partnership with other

service providers. Also, availability of other usage models

(ASP, BPO, complete outsourcing).

Special Offerings for Midmarket — Special offerings the

vendor brings to the table for the midmarket (this

subcriterion very much targets Tier 1 vendors trying to

embrace the midrange market).

Pricing Strategies/Models — Type of general pricing

strategy (user-based, value-based, hardware performancebased), terms/conditions, and maintenance/support costs as

a percentage of revenue. Also, whether a pricing model is

publicly available and customers’ ability to see the

implications of usage changes.

Relative Costs — The relative cost of software, services,

and maintenance, taking into account existing discounts and

the vendor’s openness to negotiate.

Analyst Commentary

Weighted second in terms of performance (along with

vendor financials), services represent an important part of a

vendor’s offering. Quality of service can be controlled

much more easily when a direct sales model is employed

versus when the entire solution is sold via a partner

channel. In either case, special tools and control

mechanisms for quality assurance must be implemented.

The services criteria area in this evaluation covers the

entire scope of how vendor technology and functionality

are delivered to the customer. A factor receiving increasing

attention is the ability to deliver integrated implementation

methods, business process modeling tools, and easy-to-use

upgrade mechanisms. The more the industry recognizes the

importance of an “application center of excellence,” the

more post-implementation services will grow in

importance. Midrange enterprises are in favor of one-stop

shopping. Therefore, the willingness and ability of a vendor

to offer hosting services needs to be factored in as well.

Analyst Commentary

Because midmarket companies are highly price sensitive,

they need a clear calculation base for a new offering as well

as an idea of expected follow-on costs. Although most

vendors show flexibility in their pricing models (e.g., userbased, role-based, site license, engine-based, server-based),

most vendors try to hide the calculation base during the

price negotiations so that customers are not able to

perform any “what-if” calculations on their own. We

believe intensified price pressure and increasing customer

savvy in handling vendors — also in the midmarket — will

finally result in a more open pricing policy (by 2005/06).

Oracle deserves special mention because of its public price

model (on the Internet), though its maintenance and

upgrade fees are relatively high.

Another important metric is the cost of implementation

(i.e., the sum of hardware, software, and service costs) as a

ratio of software licenses. Our research indicates that IBS,

Intentia, PeopleSoft (with its midrange offering), and SAP

(with its Business One offering) have the lowest ratios.

However, this is sometimes offset in our ratings by

inflexible pricing models or the vendor’s inability to

communicate and ensure the value of a package

implementation.

208 Harbor Drive • Stamford, CT 06912 • (203) 973-6700 • Fax (203) 359-8066 • metagroup.com

Copyright © 2003 META Group, Inc. All rights reserved.

METAspectrum 34.0 Midmarket ERP — Europe

9

Midmarket ERP — Europe Performance Evaluation

Execution

Agility

SAP

Oracle

IBS

Baan

PeopleSoft

IFS

Microsoft-Navision

JD Edwards

Intentia

Very Good/Excellent

Very Good

Good/Very Good

Good

Good

Good

Good

Fair

Fair

IFS

SAP

PeopleSoft

Microsoft-Navision

Oracle

IBS

Baan

JD Edwards

Intentia

Good/Very Good

Good/Very Good

Good/Very Good

Good

Good

Good

Fair/Good

Fair

Fair

What We Evaluated

What We Evaluated

Execution Strategy — Vendor’s ability in terms of

effective management of new product introduction,

translation of vision into product/revenue, release

management, retention, reputation, and consistency of

actions and performance.

Customer Referenceability — Ability of vendor to

provide meaningful references for in-production (e.g.,

live), current-release customers, and ability to provide

high-transaction/interaction volume customer references.

Product Integration — Vendor’s ability to integrate

acquired products, new in-house developed products, and

partner/OEM products with adeptness, speed, and quality.

Reaction to Market Changes — Ability to respond,

change direction, be flexible, and achieve competitive

success as opportunities develop, competitors push for

change, customer needs evolve, and market dynamics

change.

Response to Customer Requirements — Vendor’s

willingness to accept customers as point of reference for

future direction of the company, speed in reacting to

customer requirements and building them into its

products, and listening skills with respect to client

requirements.

Analyst Commentary

The best-conceived business strategy amounts to nothing

without solid execution. Vendor track records are

important — for example, does the vendor keep

promised delivery dates, does it ship bug fixes rapidly

enough, and are individual customer problems taken

seriously? As the ERP market matures, customers show

less and less tolerance for delays and release management

issues. Product quality, meaningful customer references,

and solid financial performance are key measures for this

criteria area. We expect customers to continuously raise

the bar on their expectations of vendor execution.

Analyst Commentary

A vendor’s ability to react to (and anticipate) technology,

market, competitive, and geopolitical changes is key to

its long-term viability and success. Other measures of

agility include the ability to integrate newly acquired

products/functions quickly and seamlessly; the ability to

manage downward-oriented market conditions; and an

ability (and willingness) to react in a balanced way to

customer requirements. This latter capacity can

demonstrate the vendor’s ability to balance strategic

goals and customer requirements. Agility will continue to

be an important criteria area in the ERP midmarket,

because reactivity to change is a key requirement for

midmarket survival.

208 Harbor Drive • Stamford, CT 06912 • (203) 973-6700 • Fax (203) 359-8066 • metagroup.com

Copyright © 2003 META Group, Inc. All rights reserved.

METAspectrum 34.0 Midmarket ERP — Europe

10

Midmarket ERP — Europe Performance Evaluation

Personnel

Financials

SAP

PeopleSoft

Microsoft-Navision

JD Edwards

IFS

Oracle

Baan

IBS

Intentia

Excellent

Good/Very Good

Good

Good

Good

Fair/Good

Fair/Good

Fair/Good

Fair

SAP

Microsoft-Navision

Oracle

PeopleSoft

Baan

JD Edwards

IFS

Intentia

IBS

Excellent

Very Good

Good/Very Good

Good

Fair/Good

Fair/Good

Fair/Good

Fair

Fair

What We Evaluated

What We Evaluated

Attractiveness for Employees — Ability of vendor to

attract and keep talented personnel. Length of time

employees stay with vendor.

Technology and Domain Knowledge — Training,

certification, and knowledge about specific technologies,

verticals, services, processes, and methods that are

transferred into higher-value technologies and solutions,

with improved results for the customer.

Management Team — The market and financial

experience, charisma, consistency, leadership, and

knowledge of the vendor’s executive management.

Access to Capital — Sources of funding for growth,

operations, or investments, including whether the company

is public or needs to finance itself.

Viability — Viability of operational business model,

financial situation, sources of operational funding, balancesheet conditions, and long-term standalone viability.

Growth Rate — Comparative rate of business growth

versus overall market and key competitors, revenue

(trending) per employee, and future growth prospects.

Analyst Commentary

Although current market conditions enable vendors to

choose from among the best talent on the market, an

improving economy could soon change that. At that point,

the three core dimensions of vendor personnel will

become critical again: management, business process

expertise, and technical skill. Continuous investment in

training, a consistent management team and style, and the

attractiveness of a vendor to its employees will remain

important subcriteria. Vertical domain knowledge will

increase in importance through 2006/07. As soon as the

economy improves, we believe the management style

(rigid/open, centralized/decentralized) will more clearly

demonstrate where employees are willing to stay for

longer periods of time, better guaranteeing a consistent

interface to customers as well as follow-up on ideas and

company direction.

Analyst Commentary

This criteria area ranked second in terms of importance

within the performance category (along with services),

reflecting the nervousness buyers feel when a vendor gets

into financial trouble. The climate of consolidation in the

midrange ERP market — a ongoing trend for about 10

years — is accelerating, driving more buyers to look into

the details of a vendor’s financial wherewithal. A wellconceived product strategy, a great marketing campaign,

and a thorough implementation methodology are useless

if a vendor lacks financial solidity. The current IT

investment drought has made assess to capital and longterm viability more important than ever. Microsoft

Business Solutions and SAP have no problems assuring

their customer bases that they will be among the

survivors for the foreseeable future. The smaller, more

locally oriented players (e.g., Baan, IBS, IFS, Intentia) must

put more weight into convincing prospects about their

long-term ability to survive.

208 Harbor Drive • Stamford, CT 06912 • (203) 973-6700 • Fax (203) 359-8066 • metagroup.com

Copyright © 2003 META Group, Inc. All rights reserved.

METAspectrum 34.0 Midmarket ERP — Europe

11

SM

About METAspectrum

METAspectrumSM evaluations from META Group (Nasdaq: METG) provide IT

professionals with a view into critical market success factors and vendor positioning.

METAspectrum, in combination with META Group’s SPEX modules — which provide

detailed technical analysis of product features and capabilities — delivers comprehensive

evaluations of both technology markets and vendor product offerings. METAspectrum

evaluations are a standard component of a META Group retainer service subscription

and are updated periodically, depending on the characteristics of individual markets. To

view completed market evaluations, or learn more about the METAspectrum

methodology, visit metagroup.com/metaspectrum. For more information on META

Group’s SPEX offerings, visit metagroup.com/spex.

About META Group

META Group is a leading research and consulting firm, focusing on information

technology and business transformation strategies. Delivering objective, consistent, and

actionable guidance, META Group enables organizations to innovate more rapidly and

effectively. Our unique collaborative models help clients succeed by building speed,

agility, and value into their IT and business systems and processes. Connect with

metagroup.com for more details.