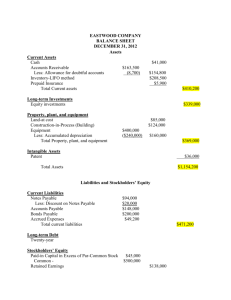

Current Liabilities & Contingencies Assignment Table

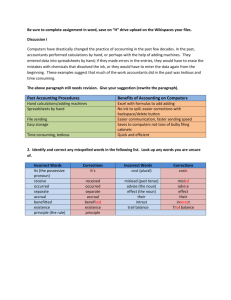

advertisement