3 Steps a Utility Should Take to Tap into a Small Commercial

advertisement

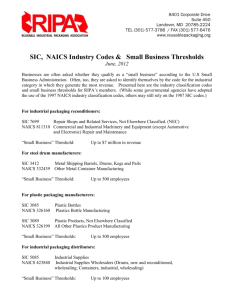

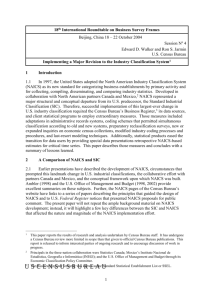

3 Steps a Utility Should Take to Tap into a Small Commercial Customer Tawn Graham December, 2013 1. Define Your Small Commercial Customers How does your utility define the Small Commercial Customer? With each of our utility partners, the answer has been a little different. Some use SIC Codes (Standard Industrial Classification) , NAICS Codes (North American Industry Classification System) , kWh’s, billing rate codes, monthly billing amount or a combination. Interestingly, the United States Small Business Association defines small businesses as: Having between 1 - 500 employees (in some business categories up to 1,000 employees) Plus having receipts of up to $35.5 million a year. In reality, this definition applies to about 99% of all business in the US. Try and compare a small business with 3 employees vs. one with 500 or even 1,000 employees. You can’t. Their needs, resources, what’s important to them, what they care about - even their goals and objectives are vastly different. But what is common among small businesses is that their time is limited. And one way to differentiate yourself is to treat their time as valuable - don’t waste it by talking about topics they don’t care about. It is important to talk to the small business only about his business type. And how do you do this? By segmenting customers into groups so you can talk to them about relevant issues and ideas – things that DirectKnowledge ©2013 Direct Options matter to them. We discuss segmentation in further detail later in this opinion paper. Impact your goals by simply serving this segment. Your goals may be Energy Efficiency, Customer Satisfaction, Education, or Revenue. Because this customer segment has been underserved by many utilities, there is a real opportunity to impact these goals. At a minimum, if you deliver useful, relevant information to the right customer, you can’t help but impact customer satisfaction. 2. Understand What the Small Commercial Customer Cares About In our research on small commercial customers, we found the most important consideration is payback. They want to know if they make an investment, how long it will be until they recoup that investment. For many of them anything longer than three years is too long. Note: 44% of all businesses fail by year three*. They look to you as an expert, so give them advice about immediate steps they can take now and what they may need to put off until later. As their expert resource, help them understand: • What steps can I take now to being more energy efficient? • If I make changes, what’s the cost now vs. the long-term savings? – Major/Small • Can you help me determine what changes I can afford to do now; what may need to wait until later? • Is there any help – i.e. financing, rebates? • What do I do if I don’t qualify for any specific rebate, yet I want to make changes (custom rebate) • Can you help me find someone I can trust to do the work? • If I rent/lease, what changes can I make? • What’s available for new construction? • What are my renewable/green energy options? DirectKnowledge ©2013 Direct Options Educate these customers about the products and services you provide coupled with what’s in it for them and make it easy for them. Do you provide financing and/or rebates? Can you refer them to a qualified contractor(s)? Tell them what’s available for new construction and even green energy options. Suffice it to say when we were developing our small commercial program, the small commercial customers we talked to directly revealed how interested and hungry they were for information. They self-educate via the internet. Undoubtedly, they are receptive to the information you provide (make it easy to find). We talked to small business customers who had estimates to change out their commercial lighting, but needed help to determine the breakeven timing. We talked to one small commercial customer who was experimenting with putting timers on his commercial refrigeration to save money. Again, these customers want energy education and can really benefit from the information you provide. 3. Understand How to Reach The Small Commercial Customer If you think you are reaching small businesses with bill inserts, you are wrong. Most service businesses outsource financial tasks/bookkeeping until revenue rises above $1 million – or it has 30+ employees**, after which time they hire someone full-time. People who receive your bills at a small business enterprise (and subsequently your bill stuffers) are not the decision-makers when it comes to energy efficiency or customer satisfaction – they simply write the check. Don’t bother with bill stuffers to reach this group. Don’t make your direct mail contacts look like a bill. You can try emailing your small commercial ebill contacts, but understand you probably aren’t reaching the majority of who you need to reach here either. However, an email is quick and painless to forward along in small business organizations, so it can’t hurt to employ this effort- just don’t make it you main effort. In order to increase the chances of your solicitations being delivered to the correct decision-maker, you will probably need to buy data. We discuss buying contact names later in this paper (see append data section). DirectKnowledge ©2013 Direct Options SEGMENTATION: Segmentation is how you divide separate groups of customers that share similar characteristics. When you properly segment your customers, you can tailor your products and services to meet their needs and you can further tailor your messaging. For example, if you are talking to the owner of a restaurant, he is concerned with information that pertains to refrigeration, commercial cooking and cleaning. If you are talking to the owner of a hair salon, he will be concerned with water heater efficiency. SIC/NAICS SEGMENTATION: One way to consider segmenting customers is by SIC/NAICS codes. A SIC code is a 4 digit numerical codes assigned by the government to a business to identify the primary activity of that establishment. The system arrays the economy into 11 divisions that are divided into 83 2-digit major groups that are further subdivided and then divided again. In 1997, a new code system was introduced to replace SIC. It is called North American Industrial Classification System - NAICS. It is similar to the SIC; however, there are 20 divisions that are divided and subdivided. In either case, you may want to roll-up some of the industry segments so as not to slice the customer groups too thin. By rolling-up segments, you take smaller groups of customers with similar characteristics (i.e. restaurants and hotels use similar things like commercial refrigeration, ovens, hot water etc.) and make a larger target group. The number of roll ups you will have depends on the total number of small commercial customers. You don’t want to have a large number of segments if you are only talking to a few hundred customers. Think of it in terms of a pie. When you slice a pie into 20 total pieces, the size of the slice will be thin. It may make more sense to take that same total pie and only slice it into 6 pieces. DirectKnowledge ©2013 Direct Options You may want to consider another way to segment or to add an additional level of segmentation that makes sense for you. Why? Because customers in a specific industry segment tend to act similarly as a group. Individual customer behavior can often cut across industry segments when viewed from a different metric. What could this additional level be? Revenue is one idea. Transportation /Wholesale Restaurant/ Retail/Lodging 15% 21% Services 8% Unknown 6% Manufacturing 16% Agriculture 34% An example of segmentation and how a more rural area might look when segmented by “rolled up“ SIC/NAICs segments. This roll-up is just an example. REVENUE TIERED SEGMENTATION: Revenue tiered segmentation is similar to the 80-20 rule that I’m sure you are familiar with. The 10-20-30-40 rule basically states that: 1. Top 10% of customers deliver 40% of revenue 2. The next 20% of customers deliver 30% of revenue 3. The next 30% of customers deliver 20% of revenue DirectKnowledge ©2013 Direct Options 4. The bottom 40% of customer deliver 10% of revenue 10-20-30-40 Rule Cummulative Basis 100% 90% Tier 4 80% % Revenue 70% Tier 3 60% 50% Tier 2 40% 30% 20% Tier 1 10% 0% 0% 10% 20% 30% 40% 50% 60% 70% 80% 90% 100% % Customers Essentially, this rule can help organizations focus efforts on their most productive customers and lessen their efforts on the bottom tiers of customers. This prioritization can help companies develop marketing campaigns and pricing strategies to extract maximum value from both high- and low-profit customers. A utility can use customer segmentation as the principal basis for allocating resources to product development, marketing, service and delivery programs. For example, you may want to provide customers with an on-site audit. By segmenting your customer base, you can easily determine which customers to offer this expensive marketing effort. The mid or lower-tiered customers could be offered an online audit only; whereas the high-tiered customer would be offered an on-site audit. Knowing this is valuable because this allows you to be selective in who you target and who you don’t. You may want to add yet another layer- for example, usage. By utilizing additional criteria – or layers you can better identify the customers that will a) be most likely to respond to your solicitation and b) benefit from a walk-through audit. It is really just based on your goals and objectives. DirectKnowledge ©2013 Direct Options APPEND DATA: Why would you purchase data and append it when you know billing information and SIC/NAICS? So you begin to formulate a more complete picture of your customers. When you apply purchased data information (which could include sq. footage, number of years in business, annual sales and even contact names and email addresses), your messages can be stronger and your responses can be higher. In a Special Report about small business customers, there is a disconnect about the products and services the utility is providing: only 35% are specific to their industry and business type, yet 87% of business customers rank utility products and services as “very important/somewhat important” to them***. That spells O-P-P-O-R-T-U-N-I-T-Y. A side note: you may not get great match rates with appended data, but at a minimum you are beginning to fill the data holes. Also note, purchased data goes bad at the rate of 36% each year. People change jobs, companies change and contact detail like email addresses, phone and mailing addresses also change. However, I am a firm believer the more information you collect about your customers the better off you are. USAGE: When you understand the role usage plays with your customer segments, you can also use it to further target your marketing. Like the picture in a puzzle, the more puzzle pieces you have, the more you understand the picture. The more information you have and apply, the more you can help your small commercial customers. Usage lets you understand how a particular customer or customer segment is using electricity. It lets you see how they use electricity historically. It gives you invaluable insights. You can see if this commercial customer is growing, shrinking or staying status quo. Let me refer back to the small commercial customer cited earlier – the one who is planning to switch out his commercial lighting. He is seriously considering making this investment. As his expert DirectKnowledge ©2013 Direct Options resource, you can help him determine when and if it’s the right move for his business. Using all his information and coupling it with usage, you can help him determine his payback timing and if it’s in the best interest of his company to do the entire project at one time or if he should do it in stages. In addition, you can help your customers identify low cost or no cost fixes to reduce energy waste (something as simple as caulking drafty office windows), you can suggest upgrades and improvements to their business and you can help them prioritize projects for the best ROI. You will make an important difference. Utilities are a small commercial customer’s most trusted source for information, so provide it to them. Imagine how satisfied these customers will be with you? At Direct Options, we saw a need for utilities to engage the small commercial customer in a meaningful way. That’s why we developed the DirectConnecttm Business Program. It’s an online survey portal that delivers customized reports (paper or electronic) to individual businesses. These customized reports provide small businesses pertinent suggestions, tips and information based on their business type plus any other information we know about that business. It’s loosely based on our residential product that has been used for over 7 years by clients in several markets in the Midwest and the South. One of our clients launched this program in May, 2013 and is currently seeing a program increase of over 120% in their key objective. We built this program so that it can help utilities effectively achieve their individual goals including Customer Satisfaction, Energy Efficiency, Revenue Generation and Education. In review: Online Log-in Portal and DirectKnowledge Customized Reports (Electronic/Paper) ©2013 Direct Options If you want assistance in reaching the small commercial customer call 513-7794416 or email tgraham@directoptions.com. I’m a DM executive who has been actively marketing since 1988. I’ve been privileged enough to managed marketing efforts on behalf of IOU’s across the US. Direct Options has been serving the Utility Industry for 20+ years: Your Customer. Engaged. *Statistic Brain.com Source: University of Tennessee Research Date Verified: 7.26.2012 **entrepreneur.com/article/219917# ***Special Report: Small and medium businesses: The untapped energy consumer. The New Energy Consumer Handbook DirectKnowledge ©2013 Direct Options