Discounts Are Piled On as Americans Buy Fewer Basics - WSJ.com

1 of 4

http://online.wsj.com/news/article_email/SB1000142405270230468810...

Dow Jones Reprints: This copy is for your personal, non-commercial use only. To order presentation-ready copies for distribution to your colleagues, clients or

customers, use the Order Reprints tool at the bottom of any article or visit www.djreprints.com

See a sample reprint in PDF format.

Order a reprint of this article now

BUSINESS

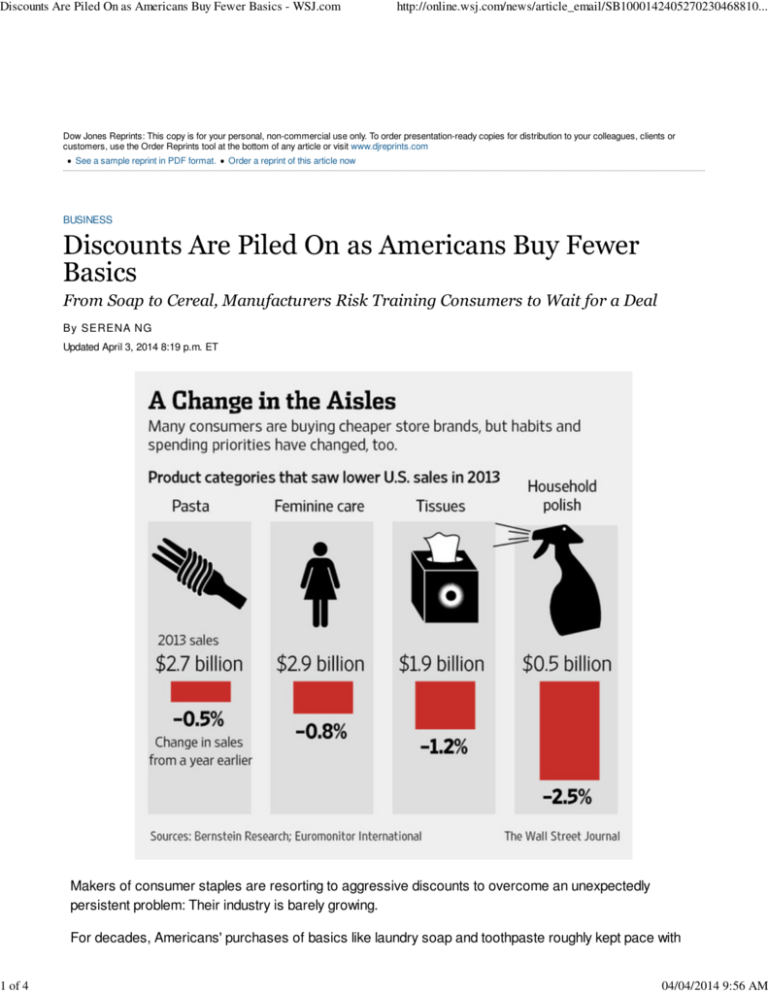

Discounts Are Piled On as Americans Buy Fewer

Basics

From Soap to Cereal, Manufacturers Risk Training Consumers to Wait for a Deal

By SERENA NG

Updated April 3, 2014 8:19 p.m. ET

Makers of consumer staples are resorting to aggressive discounts to overcome an unexpectedly

persistent problem: Their industry is barely growing.

For decades, Americans' purchases of basics like laundry soap and toothpaste roughly kept pace with

04/04/2014 9:56 AM

Discounts Are Piled On as Americans Buy Fewer Basics - WSJ.com

2 of 4

http://online.wsj.com/news/article_email/SB1000142405270230468810...

the rate of growth in the overall economy. But that rule of thumb no longer applies, which is bad news for

billion-dollar brands like Tide and Colgate.

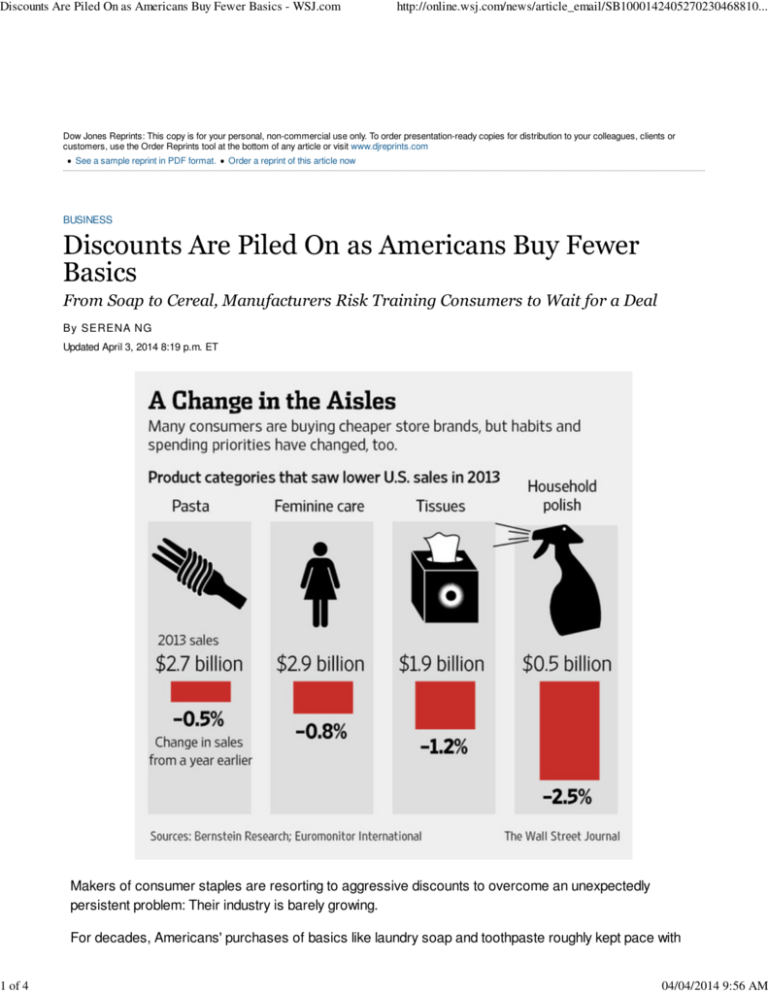

For the past three years running, unit sales of consumer products have been largely flat, according to

market research firm Nielsen.

Many segments are affected by changing preferences, habits and spending priorities. People are eating

less cereal and drinking less soda. Razorblade sales are down as many men shave less or grow beards.

Pre-measured laundry soap capsules and higher-efficiency machines require less detergent. And more

people are choosing freshly prepared food over packaged fare.

Procter & Gamble's Downy softener and Tide laundry detergent on display at a store in Pasadena,

Calif., earlier this year. Reuters

Procter & Gamble Co. , Georgia Pacific Corp., Henkel AG and other companies have responded with a

blitz of deals and coupons in conjunction with retailers. Indeed, over a third of packaged food and

household products are now sold with discounts, as retailers and manufacturers struggle to get people to

open their wallets. In some categories, such as soda, toilet paper and potato chips, more than 50% of

consumers' purchases include discounts, said Gary Stibel, chief executive of the New England

Consulting Group, a marketing consulting firm.

"When we see some of the promotional pricing out there, it's pretty clear someone has lost their mind,"

said Bill Schmitz, a Deutsche Bank analyst who follows companies that sell beverages, household and

beauty products.

At Target Corp. stores, shoppers recently could get a $5 gift card for purchases of five Febreze

air-freshener products, a discount of more than 30% for a $15 purchase of the P&G brand. This week,

the chain is giving a $10 gift card to customers who spend $30 on Angel Soft or Quilted Northern toilet

paper, made by Georgia Pacific.

Drugstore chains CVS and Rite Aid last month touted a buy-one, get-two offer for Purex laundry

detergent. Henkel, which makes Purex, also distributed coupons for $1.50 off purchases of two bottles.

04/04/2014 9:56 AM

Discounts Are Piled On as Americans Buy Fewer Basics - WSJ.com

3 of 4

http://online.wsj.com/news/article_email/SB1000142405270230468810...

By combining both offers, shoppers could pay a little more than $8 for six jugs of detergent, or $1.35 per

50 oz. bottle, according to Christie Hardcastle, who runs a website that tracks consumer deals.

At Walgreens, Colgate Optic White toothpaste was on sale for $3

last month, and shoppers could apply a $1.50 coupon to get it at

half that price, and also receive a $2 store coupon for their next

purchase.

Some manufacturers, like Church & Dwight Co. , bemoan the

trend, and worry that the discounts will train consumers to wait for

the sale price.

"Price wars don't help growth and are not good for the industry,"

said Jim Craigie, chief executive of Church & Dwight, which owns

the Arm & Hammer brands and produces other household

products. "They are the easiest things to start, and the hardest to

finish."

P&G and Henkel declined to comment, and Georgia Pacific had

no immediate comment. Colgate-Palmolive Co. didn't respond to

requests for comment.

Sales of many essentials have suffered in the wake of the

financial crisis. Consumers cut spending and shifted to cheaper

store brands. The average American spent $2,515 on packaged consumer goods last year, up just 0.6%

from 2012, according to Nielsen. The previous year, the increase was 2%, due largely to inflation.

More

Consumer Sluggishness Seems to Be

Growth Drag, for Now

Consumer Shift Seen Favoring Midprice

Watches

Americans now devote about 10.8% of their personal

expenditures to packaged consumer goods, down from

11.2% in 2000 and 13.7% in 1990, according to Ali Dibadj

of Bernstein Research who examined data from the U.S.

Bureau of Economic Analysis.

"It's still a tough time for the average American," said Church & Dwight's Mr. Craigie. "There's nothing

wrong with the industry. You just have an economy that's stagnant and people are having to trade down."

To be sure, not all categories in the roughly $770 billion-a-year industry are stagnant or shrinking. Sales

of things like pet food, energy drinks, and Greek yogurt are seeing growth.

Related

At the ECO:comics conference in Santa Barbara,

Calif. Walmart Chairman and Former CEO Michael T.

Discounts are in the standard tool kit for consumerproducts makers. Still, the current level of activity is

particularly high. All told, some 33.7% of consumer

packaged goods—from soda and razors to shampoo,

shaving cream and paper towels—were sold on promotion

in the 12 months through February 2014, according to data

from Nielsen. That's the highest level since the U.S.

recession ended in mid-2009. The numbers exclude

alcohol, tobacco, fruits and vegetables.

The problem for makers of household basics is that

04/04/2014 9:56 AM

Discounts Are Piled On as Americans Buy Fewer Basics - WSJ.com

4 of 4

Duke says customers should not have to choose

between products that are more cheaper and those

that are more sustainable.

http://online.wsj.com/news/article_email/SB1000142405270230468810...

consumers are devoting a shrinking share of their wallets

to packaged goods as other costs of living rise more

sharply, such as health care and education.

Prices of consumer goods last year rose by 1.1% on average, in part because retailers—wary of

moderating commodity prices—were reluctant to let manufacturers raise prices as much as in previous

years.

Shoppers are visiting stores less often, partly because of the Internet. Unemployment remains high,

meaning pennies are pinched. The U.S. population is aging, and research shows older people tend to

consume and spend less. Americans, meanwhile, have been feeling more strains on their wallet from last

year's expiration of the payroll tax break. And even some cash-strapped consumers would rather spend

money on their cellphone bills than shell out more money for everyday items.

Stacia Braun, a fourth-grade teacher from Shumway, Ill., recently forked out $30 for toothpaste, makeup,

candy and dozens of other everyday items that would have added up to $200 without various discounts

and coupons.

"I never pay full price for a lot of things," said the 39-year-old mother of three, who said she often finds

generous deals at a Walgreens store 13 miles from her home.

The discounts may give some brands a temporary boost, but they aren't reversing the industry's malaise

and they erode the value of sales that do happen. Sales of household products grew just 0.6% in 2013 in

dollar terms, below the 1.9% growth in U.S. GDP and well below last year's 4.2% growth in retail sales.

Dollar sales of laundry detergent and razors actually fell, according to Nielsen's data.

Packaged-goods makers typically try to raise prices by 2% to 3% each year, and more if raw-materials

costs have risen, said Krishnakumar Davey, a managing director at market research firm IRI.

Last year, however, 98 product categories out of 309 tracked by IRI recorded price decreases, up from

57 in 2012. Shoppers on average paid less for shaving lotions, fragrances, peanut butter, laundry

detergent, pasta and mayonnaise.

Price cuts and discounts can be used effectively to encourage consumers to try a new product, or buy

something on impulse, said Doug Bennett, who analyzes companies' promotional strategies at Nielsen.

Now, however, they may just be training shoppers to hold out for deals.

Write to Serena Ng at serena.ng@wsj.com

Copyright 2013 Dow Jones & Company, Inc. All Rights Reserved

This copy is for your personal, non-commercial use only. Distribution and use of this material are governed by our Subscriber Agreement and by copyright law. For

non-personal use or to order multiple copies, please contact Dow Jones Reprints at 1-800-843-0008 or visit

www.djreprints.com

04/04/2014 9:56 AM