View Syllabus

advertisement

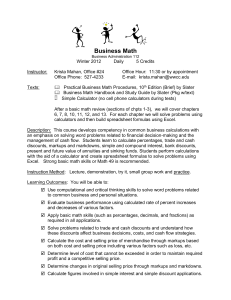

Business Math Business Administration 112 Instructor: Spring 2014 Krista Mahan, Office #21 Office Phone: 527-4233 Daily 5 Credits Office Hour: 12:30 or by appointment E-mail: krista.mahan@wwcc.edu Texts: Practical Business Math Procedures, 10th Edition (Brief) by Slater ISBN-13: 9780077362362 Business Math Handbook and Study Guide by Slater (Pkg w/text) Basic Calculator (no cell phone calculators during tests) After a basic math review (sections of chpts 1-3), we will cover chapters 6, 7, 8, 10, 11, 12, and 13. For each chapter we will solve problems using calculators and then build spreadsheet formulas using Excel. Description: This course develops competency in common business calculations with an emphasis on solving word problems related to financial decision-making and the management of cash flow. Students learn to calculate percentages, trade and cash discounts, markups and markdowns, simple and compound interest, bank discounts, present and future value of annuities and sinking funds. Students perform calculations with the aid of a calculator and create spreadsheet formulas to solve problems using Excel. Strong basic math skills or Math 49 is recommended. Instruction Method: Lecture, demonstration, try it, small group work and practice. Learning Outcomes: You will be able to: Use computational and critical thinking skills to solve word problems related to common business and personal situations. Evaluate business performance using calculated rate of percent increases and decreases of various factors. Apply basic math skills (such as percentages, decimals, and fractions) as required in all applications. Solve problems related to trade and cash discounts and understand how these discounts affect business decisions, costs, and cash flow strategies. Calculate the cost and selling price of merchandise through markups based on both cost and selling price including various factors such as loss, etc. Determine level of cost that cannot be exceeded in order to maintain required profit and a competitive selling price. Determine changes in original selling price through markups and markdowns. Calculate figures involved in simple interest and simple discount applications. Perform calculations dealing with the borrowing or lending of monies. Perform calculations required for establishment of annuities & sinking funds. Given scenarios, determine best financial course of action integrating skills from previous chapters. Apply math skills learned to develop spreadsheet formulas that will automatically calculate answers to problems calculated manually in class. Evaluation: 15% Homework Assignments. Homework assignments are given daily on course calendar and you will be given a chance to ask questions, correct, and learn from your mistakes. All homework for the chapter will be checked during the chapter’s testing period and will not be accepted past this day. Bring questions from homework to class the next day. Note: You have total control over earning 100% of these points. For Chapters 6-13, Homework consists of the following and is listed on your calendar: A-pages: most of which will be completed in class (gold outer edge in back of text) End of the chapter problems (Check figures for odd questions are in Appendix C. Summary Practice Test (text DVD has video showing how to solve these) Additional Practice Problems (Pretest practice packet is provided and assigned) Extra Practice if desired: (Some extra hand outs are provided and you may use your DVD provided with the text for additional practice quizzes.) I will check homework to see if you completed the following assignments: (1) A-pgs.; (2) End of Chapter; (3) Summary Practice; and (4) Additional Packets. If you have completed all four you earn 100%. Each assignment left undone lowers your chapter homework grade by 25%. Homework is meant to raise your grade, not lower it. If your homework grade is lower than your test score, your test score is used for both. 85% Chapter Tests . A Chapter/Unit test will be given approximately every 7 days and your scores will be averaged to determine this portion of your grade. Safety Net: At the end of the quarter I will drop out your lowest test score (10%) before your average is calculated. The final exam is comprehensive, however it is open book, open note. Missed Test Policy: There is a 10% percent deduction on any test taken after the scheduled testing time. It is your responsibility to schedule a time with me to make-up a missed test. 93% and above ...... A 90 – 92% ................ A87-89 ...................... B+ 83-86 ...................... B 80-82 ...................... B77-79 ...................... C+ 73-76 ...................... C 70-72 ...................... C67-69 ...................... D+ 60-66 ...................... D 59 and below F Chapter Test Values: Review: Chapter 6 Chapter 7 Chapter 8 Chapter 10 Chapter 11 Chapter 12 and 13 Final Test = Homework = Final Grade 5% 10% 10% 10% 10% 10% 20% 10% 85% + 15% 100% - see chart to left Suggestions for Success: 1. Attend class and participate. NO computer use or continual texting during class! 2. Be prepared for class by completing homework on time and ask questions. 3. Seek out help when needed. (Instructor, text DVD videos, math lab) 4. Focus on understanding the concept – don’t try to just memorize steps! 5. Practice, practice, practice!! Math is a skill – practice makes proficient.