February 20, 2015

AUSTRALIAN STRATEGY & ECONOMICS

Australia Macro+

Out of Sync, but are we Out of Time?

MORGAN STANLEY RESEARCH

Asia/Pacific

Morgan Stanley Australia Limited+

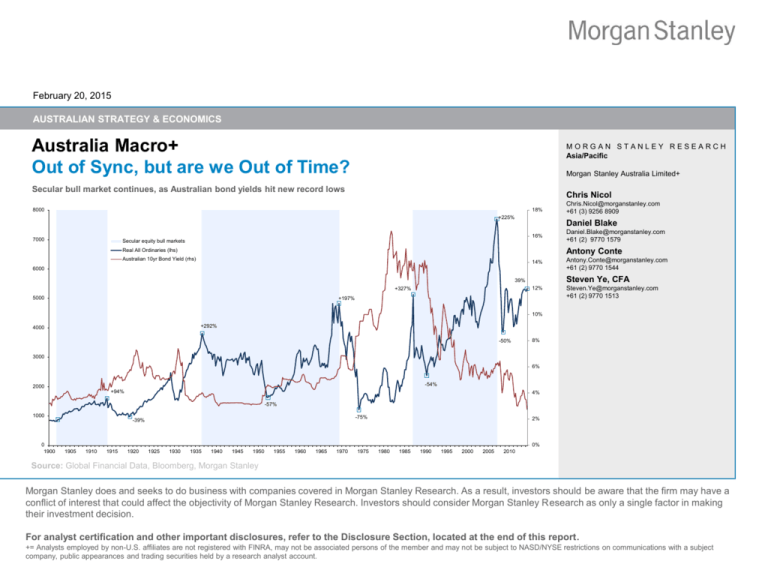

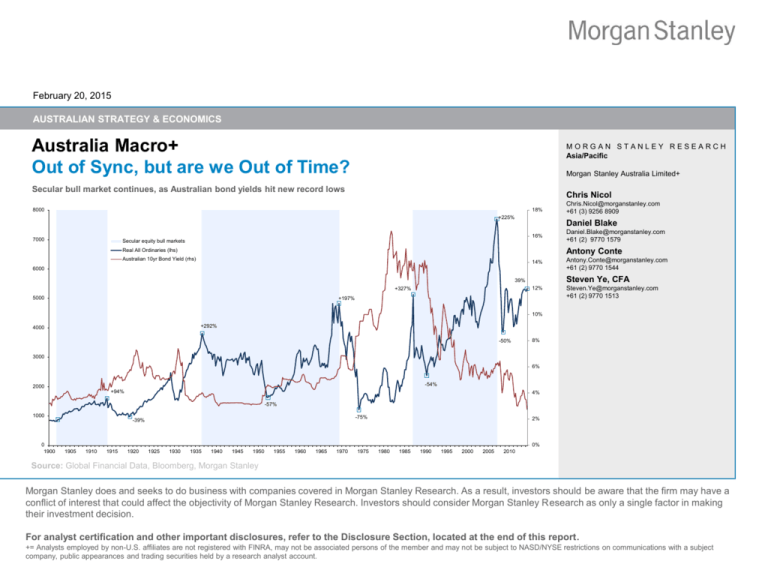

Secular bull market continues, as Australian bond yields hit new record lows

Chris Nicol

8000

18%

+225%

Daniel Blake

16%

7000

Chris.Nicol@morganstanley.com

+61 (3) 9256 8909

Secular equity bull markets

Daniel.Blake@morganstanley.com

+61 (2) 9770 1579

Antony Conte

Real All Ordinaries (lhs)

Australian 10yr Bond Yield (rhs)

14%

6000

Steven Ye, CFA

39%

12%

+327%

5000

Antony.Conte@morganstanley.com

+61 (2) 9770 1544

+197%

Steven.Ye@morganstanley.com

+61 (2) 9770 1513

10%

+292%

4000

-50%

8%

3000

6%

-54%

2000

+94%

4%

-57%

1000

0

1900

-75%

-39%

2%

0%

1905

1910

1915

1920

1925

1930

1935

1940

1945

1950

1955

1960

1965

1970

1975

1980

1985

1990

1995

2000

2005

2010

Source: Global Financial Data, Bloomberg, Morgan Stanley

Morgan Stanley does and seeks to do business with companies covered in Morgan Stanley Research. As a result, investors should be aware that the firm may have a

conflict of interest that could affect the objectivity of Morgan Stanley Research. Investors should consider Morgan Stanley Research as only a single factor in making

their investment decision.

For analyst certification and other important disclosures, refer to the Disclosure Section, located at the end of this report.

+= Analysts employed by non-U.S. affiliates are not registered with FINRA, may not be associated persons of the member and may not be subject to NASD/NYSE restrictions on communications with a subject

company, public appearances and trading securities held by a research analyst account.

MORGAN STANLEY RESEARCH

Australia Macro+: Out of Sync and Out of Time?

February 20, 2015

Table of Contents

1.

Global Strategy Outlook – Investing in the Long Cycle

3

2.

Global Macro Outlook – The Battle Against Lowflation

6

3.

Australian Growth Outlook – Lost in Transition

14

4.

Key Themes for 2015 – Out of Sync, but are we Out of Time?

23

5.

10 Surprises that Would Matter

33

6.

Private Wealth Manager – Model Portfolios & Asset Allocation

36

2

MORGAN STANLEY RESEARCH

Australia Macro+: Out of Sync and Out of Time?

February 20, 2015

Global Strategy Outlook - Investing in the Long Cycle

3

MORGAN STANLEY RESEARCH

Australia Macro+: Out of Sync and Out of Time?

February 20, 2015

Cross-Asset Strategy – “Melt Up” > “Melt Down”

4

MORGAN STANLEY RESEARCH

Australia Macro+: Out of Sync and Out of Time?

February 20, 2015

Cross-Asset Strategy – Detailed Markets Outlook

Source: Morgan Stanley Cross-Asset Strategy

5

MORGAN STANLEY RESEARCH

Australia Macro+: Out of Sync and Out of Time?

February 20, 2015

Global Macro Outlook – Battle Against Lowflation

6

MORGAN STANLEY RESEARCH

Australia Macro+: Out of Sync and Out of Time?

February 20, 2015

Global Macro Outlook – Set Up for Longest Expansion Post-1970

Global GDP growth – lower but longer: 3.5% in 2015, 3.9% in 2016

Unsynchronised growth outlook – MS’s cycle assessment

Headline inflation outlook slashed on lower oil prices

Core inflation pushing further away from CB targets near-term

Source: Morgan Stanley Research

7

MORGAN STANLEY RESEARCH

Australia Macro+: Out of Sync and Out of Time?

February 20, 2015

US Growth – Balanced and on Track

Source: Morgan Stanley Research

8

MORGAN STANLEY RESEARCH

Australia Macro+: Out of Sync and Out of Time?

February 20, 2015

Europe – Growth and Inflation Bottoming

Note: Estimates are by Morgan Stanley Research

9

MORGAN STANLEY RESEARCH

Australia Macro+: Out of Sync and Out of Time?

February 20, 2015

China – Expect More Easing

Source: Morgan Stanley Research

10

MORGAN STANLEY RESEARCH

Australia Macro+: Out of Sync and Out of Time?

February 20, 2015

China – Expect More Easing

Real growth slowdown – deeper than headlines suggest?

Property slowdown – offset by some infrastructure & better exports

Index

40

40

30

30

20

20

10

10

0

0

-10

-10

Li Keqiang Index

MS-CHEX

Real GDP YoY

-20

Jan-05 Jan-06 Jan-07 Jan-08 Jan-09 Jan-10 Jan-11 Jan-12 Jan-13 Jan-14

-20

Real funding costs remain elevated in China

Source: Morgan Stanley Research

China Forecast Summary

11

MORGAN STANLEY RESEARCH

Australia Macro+: Out of Sync and Out of Time?

February 20, 2015

Global QEquation – ECB+BoJ = Fed?

ECB & BoJ to inject similar liquidity to Fed’s QE3 program

Aggressive QQE2 program from BoJ – unprecedented in scale

G3 central bank balance sheets still growing relative to GDP

EUR expected to increase in role as cross-border funding currency

Source: BIS, Haver Analytics, Morgan Stanley Global Economics Team Estimates

12

MORGAN STANLEY RESEARCH

Australia Macro+: Out of Sync and Out of Time?

February 20, 2015

Oil markets backdrop

Global oil demand has been resilient, and should pick up

Growth in US liquids sees falling world demand on OPEC

Without OPEC cuts, price support relies on cash cost in US$40’s

Marginal breakeven cost (10% hurdle) on 2014-20 liquids additions

Source: IEA, Rystad Energy, Wood Mackenzie Estimates, Morgan Stanley Commodity Research

13

MORGAN STANLEY RESEARCH

Australia Macro+: Out of Sync and Out of Time?

February 20, 2015

Australian Growth Outlook: Lost in Transition

14

MORGAN STANLEY RESEARCH

Australia Macro+: Out of Sync and Out of Time?

February 20, 2015

Australia transitioning from resources boom – weak growth outlook for 2015

Delivering Australia an ‘income recession’ on our forecasts

Commodity price boom unwinding; gauging depth of correction

120

yoy % pt

Index

20%

f/cast

100

15%

80

10%

60

8%

% yoy

% yoy

8%

6%

6%

4%

4%

2%

2%

0%

0%

-2%

-2%

5%

40

0%

20

1990

-5%

1994

1998

2002

2006

2010

2014

-4%

1988

-4%

1991

1994

1997

GDP

Impact on real income

Terms of trade

MS forecast

2000

2003

Domestic Demand

2006

2009

2012

2015

Gross Domestic Income

RBA f/cast (Nov)

Policy strategy: Housing-Led, Infrastructure-Enabled Recovery

Near-recessionary outlook for domestic demand in 2015

% of GDP

7%

9%

% yoy

6%

6%

5%

4%

3%

3%

2%

0%

1%

0%

1980

1985

Residential

1990

Non-residential

1995

2000

Engineering - private

Source: ABS, RBA, Morgan Stanley Research

2005

2010

Engineering - for public

-3%

1986

1990

1994

1998

GDP growth

2002

2006

2010

2014

Domestic demand growth

15

MORGAN STANLEY RESEARCH

Australia Macro+: Out of Sync and Out of Time?

February 20, 2015

Housing market has taken up the baton - key driver of East Coast Recovery

RBA has taken cash rate to record lows, and real rates to zero

House price & activity lift-off from 2013, initially boosted confidence

90%

8%

National Clearance Rate

Index

Housing-Led

Recovery

7%

115

Budget, 13 May

80%

110

70%

105

60%

100

50%

95

40%

90

30%

Mar-2011 Sep-2011 Mar-2012 Sep-2012 Mar-2013 Sep-2013 Mar-2014 Sep-2014

85

6%

5%

4%

3%

2%

1%

0%

1993

1995

1997

1999

RBA target band

2001

2003

2005

Headline inflation

2007

2009

Underlying inflation

2011

2013

2015

Nominal cash rate

Lower for longer rates expected to support ‘long cycle’ in resi

Auction Clearance Rate (lhs)

Dwelling Prices (rhs)

Consumer sentiment (rhs)

Wealth effect crucial for consumers to tap into high savings

% yoy, nominal

'000s, trend

14%

'000s, trend

210

210

Long cycles

f/cast

12%

190

190

170

170

150

150

10%

8%

6%

4%

130

110

1985

130

110

1989

1993

1997

RBA trough cycle

2001

2005

RBA easing cycle

2009

2013

Building approvals

Source: ABS, RBA, RP Data, Rismark, Morgan Stanley Research Forecasts

2%

0%

1996

1998

2000

2002

Savings rate

2004

2006

Income growth

2008

2010

2012

2014

2016

Consumption growth

16

MORGAN STANLEY RESEARCH

Australia Macro+: Out of Sync and Out of Time?

February 20, 2015

But after a solid start to the year, four shocks: Commodity, Income, Housing & Fiscal

Commodity: Weaker ToT on supply shock and China rebalancing

US$/t

Income: Household income growth to slow even more in 2015

% yoy

US$/t

200

400

160

320

12%

10%

Mix boost

8%

120

240

6%

Mix drag

4%

80

160

2%

40

80

0

2000

0

2002

2004

2006

Iron Ore (lhs)

2008

2010

Thermal Coal (lhs)

2012

2014

-2%

1999

2001

Hours worked

Hard Coking Coal (rhs)

3m/3m ann.

2003

2005

2007

2009

2011

2013

2015

2016

Housing: Macro-prudential warnings impact price expectations

20%

0%

Index

200

Wage Inflation

Total Compensation of Employees

Fiscal: Alarmist Budget narrative has hit animal spirits

3

z-score

2

15%

180

1

10%

160

0

140

-1

5%

0%

-2

120

-5%

-3

100

-10%

-15%

2009

80

2010

2011

Australian median house prices (lhs)

2012

2013

2014

House price expectations index (rhs)

Source: ABS, RBA, RP Data, Rismark, Morgan Stanley Research Forecasts

-4

-5

2000

2002

2004

Consumer Sentiment

2006

2008

2010

Family Finances - Year Ahead

2012

2014

Business confidence

17

MORGAN STANLEY RESEARCH

Australia Macro+: Out of Sync and Out of Time?

February 20, 2015

RBA reacts to deeper slowdown and higher unemployment than expected

We see ~200k jobs (2% of employment) still at risk from capex cliff

Weak domestic demand outlook sees unemployment peak near 7%

8

% yoy

12%

6

10%

4

8%

2

6%

0

4%

-2

2%

* Leading by 6 months

-4

1979

0%

1983

1987

1991

1995

1999

2003

Domestic demand growth* (lhs)

2007

2011

2015

Unemployment rate (rhs)

RBA forecasts lowered in February’s Statement on Monetary Policy

No inflation pressure in the outlook, given soft labour market

5%

7%

4.0%

6%

4.5%

RBA GDP Forecasts

Real GDP Grow th

4%

f/cast

5%

3.75

5.0%

3%

4%

3%

6.0%

2%

6.5%

2%

3.25

2.3

2.8

2.75

2.50

2.1

2.25

1.5

1%

M S Forecasts

(Dotted)

7.0%

Source: ABS, Morgan Stanley Research

2Q17

4Q16

2Q16

4Q15

2Q15

0%

4Q14

Unemployment rate (rhs, inverted)

2016

2Q14

2014

4Q13

2012

2Q13

Non-Tradables Inflation

2010

4Q12

2008

2Q12

2006

4Q11

2004

2Q11

1%

2002

2.7

5.5%

3.50

18

MORGAN STANLEY RESEARCH

Australia Macro+: Out of Sync and Out of Time?

February 20, 2015

Labour market – underemployment rising after two years of weak jobs growth

Despite data-quality issues, clear trend of rising unemployment

20%

Participation back at 2006 levels; underemployment about 8%

trend

18%

66%

12%

65%

10%

64%

8%

63%

6%

62%

4%

61%

2%

16%

14%

12%

10%

8%

6%

1980

1985

1990

1995

Un/underemployment rate

2000

2005

2010

60%

1980

2015

Youth unemployment (15-24yo)

1990

Participation rate (lhs)

MS Employment Pulse pointing to continued weak jobs growth

z-score

1985

1995

2000

2005

Underemployment rate (rhs)

2010

0%

2015

Unemployment rate (rhs)

Broad-based lift in unemployment, with WA softening quickly

% yoy

7%

3

Unemployment rate, trend

4%

2

6%

3%

1

5%

0

2%

-1

4%

1%

-2

0%

-3

-4

2001

2003

2005

2007

2009

Morgan Stanley Employment Pulse (lhs, 6m lead)

Source: ABS, Morgan Stanley Research

2011

2013

-1%

2015

Employment growth (trend, rhs)

3%

2%

2004

2005

2006

2007

2008

NSW

2009

VIC

2010

2011

QLD

2012

2013

2014

2015

WA

19

MORGAN STANLEY RESEARCH

Australia Macro+: Out of Sync and Out of Time?

February 20, 2015

Crucial Stage for Government and Fiscal Policy – Time to Recalibrate

Fiscal policy needs to be re-calibrated to support growth

Net debt to track up towards 20% of GDP in our scenario

% of GDP

21

0.0

% of GDP

18

-0.2

-0.5

15

-0.6

-0.6

12

-1.0

-1.0

-1.0

9

-1.2

-1.5

6

-1.8

-2.0

3

-1.9

-2.0

0

-2.5

-2.5

-2.4

-3.0

2014-15

-3

-2.8

2015-16

2014-15 Budget (May 2014)

2016-17

2017-18

Mid-Year EFO (Dec 2014)

MS Estimate

Infrastructure agenda put at risk by recent State election outcomes

-6

1970-71 1975-76 1980-81 1985-86 1990-91 1995-96 2000-01 2005-06 2010-11 2015-16

Underlying cash balance

Net debt

Budget 2014-15 Projections

MS Projectionst

Key infra project (East-West Link) cancelled in VIC; QLD delays likely

A$bn, annualised

140

120

100

80

60

40

20

0

1985

1990

1995

2000

Engineering & non-res - private sector

2005

2010

2015

Engineering & non-res - for public sector

Source: ABS, Commonwealth Treasury, Lend Lease, Morgan Stanley Research Forecasts

20

MORGAN STANLEY RESEARCH

Australia Macro+: Out of Sync and Out of Time?

February 20, 2015

AUD a necessary relief valve – we forecast AUD/USD at 0.69 by end-2015

Japanese portfolio flows into AUD – signs of pause in Nov/Dec

8

Ongoing RBA focus on AUD deprecation as rebalancing tool

110

AUDbn, monthly

6

140

Index

Index

100

100

4

120

90

100

80

80

70

60

60

90

2

80

0

70

-2

-4

-6

2005

Equities

Other Bonds

Sovereign Bonds

AUDJPY (RHS)

2007

2009

2011

60

40

1980

50

2015

2013

Real AUD/USD still almost 1 s.d. above its post-float average

50

1985

1990

Terms of trade (lhs)

1995

2000

MS forecast

2005

2010

Real Australian TWI (rhs)

2015

MS forecast

Although note RBA has not intervened to weaken AUD since 1991

1.10

A$bn

60

1.00

50

0.90

40

2 std deviations

30

0.80

1 std deviation

20

0.70

post-float avg

10

0.60

0

0.50

0.40

1984

-10

1995

1990

1996

2002

2008

Source: ABS, Japan MoF, RBA, Morgan Stanley Research Forecasts

2014

1997

1999

2001

2003

Intervention

2005

2007

2009

2011

2013

RBA Net Reserves

21

MORGAN STANLEY RESEARCH

Australia Macro+: Out of Sync and Out of Time?

February 20, 2015

Morgan Stanley Australian Economic Forecasts

Quarterly

2Q15e

3Q15e

1Q14

2Q14

3Q14e

4Q14e

1Q15e

4Q15e

1Q16e

2Q16e

3Q16e

4Q16e

% qoq

% yoy

1.0

3.0

0.5

2.7

0.3

2.7

0.5

2.4

0.3

1.7

0.3

1.5

0.4

1.5

0.4

1.4

0.6

1.7

0.7

2.0

0.7

2.4

0.7

2.7

% qoq

% yoy

% qoq

% yoy

% qoq

% yoy

% qoq

% yoy

% qoq

% yoy

% qoq

% yoy

% qoq

% yoy

0.5

2.3

0.3

2.2

0.5

2.3

5.6

9.3

0.2

-3.6

-4.5

-6.8

0.2

-1.4

0.8

2.7

0.4

2.3

0.7

2.6

1.0

7.5

1.2

-1.8

-1.6

-6.3

0.7

-0.7

0.5

2.5

0.8

1.7

0.6

2.3

-0.9

6.8

-2.6

-5.6

-4.5

-3.6

-2.7

-2.8

0.4

2.2

0.4

2.0

0.4

2.2

3.0

8.9

-2.6

-3.9

1.2

-9.1

-0.6

-2.5

0.4

2.1

0.5

2.1

0.4

2.1

1.5

4.6

-3.3

-7.2

1.2

-3.7

-1.4

-4.0

0.5

1.8

0.6

2.3

0.5

2.0

1.5

5.1

-3.3

-11.3

1.1

-1.1

-1.3

-5.9

0.5

1.8

0.7

2.2

0.5

1.9

0.8

7.0

-2.6

-11.3

1.0

4.6

-1.1

-4.3

0.5

1.9

0.7

2.5

0.6

2.0

0.8

4.7

-2.3

-11.1

1.0

4.4

-0.9

-4.5

0.5

2.0

0.8

2.8

0.6

2.2

0.5

3.6

-1.0

-9.0

0.9

4.1

-0.3

-3.5

0.6

2.1

0.8

3.0

0.6

2.3

0.0

2.1

-0.9

-6.7

0.9

3.9

-0.3

-2.4

0.6

2.2

0.8

3.1

0.6

2.4

0.0

1.3

-0.1

-4.2

0.9

3.8

0.1

-1.3

0.7

2.4

0.8

3.2

0.7

2.6

0.0

0.5

0.6

-1.4

0.9

3.7

0.5

0.1

Gross national expenditure

% qoq

% yoy

-0.1

0.8

1.7

1.8

-0.4

1.3

0.0

1.1

0.0

1.2

0.0

-0.5

0.1

0.1

0.2

0.3

0.4

0.7

0.4

1.1

0.5

1.5

0.7

2.0

Net export contribution

qtr % pt

yr % pt

1.0

2.2

-0.8

1.1

0.8

1.6

0.5

1.5

0.4

0.9

0.3

1.9

0.2

1.4

0.2

1.1

0.2

0.9

0.3

0.9

0.2

0.9

0.1

0.8

Real GDP by expenditure

Real GDP growth

Household consumption

Government consumption

Total Consumption

Private dwelling investment

Private business investment

Public investment

Total Investment

Nominal growth, inflation, unemployment & policy rates

Nominal GDP growth

CPI (headline)

CPI (underlying)

qtr % pt

yr % pt

1.0

4.8

0.3

3.6

-0.1

2.7

0.6

1.8

0.4

1.3

0.7

1.7

1.1

2.9

1.2

3.5

1.6

4.7

1.4

5.4

1.2

5.5

1.3

5.7

% qoq

% yoy

% qoq

% yoy

0.6

2.9

0.5

2.7

0.5

3.0

0.7

2.8

0.5

2.3

0.4

2.5

0.2

1.7

0.7

2.2

-0.1

1.1

0.6

2.4

0.6

1.2

0.5

2.2

1.0

1.7

0.8

2.6

0.6

2.0

0.4

2.3

0.7

2.8

0.7

2.4

0.7

2.9

0.6

2.5

0.9

2.9

0.9

2.7

0.4

2.7

0.4

2.6

Unemployment rate

%, eop

5.8

6.0

6.1

6.1

6.3

6.5

6.7

6.8

6.8

6.7

6.7

6.7

RBA target rate

%, eop

2.50

2.50

2.50

2.50

2.00

1.75

1.75

1.75

1.75

2.00

2.25

2.50

Source: ABS, Morgan Stanley Research. E = Morgan Stanley Research Estimates

22

MORGAN STANLEY RESEARCH

Australia Macro+: Out of Sync and Out of Time?

February 20, 2015

Australian Equity Market Themes

23

MORGAN STANLEY RESEARCH

Australia Macro+: Out of Sync and Out of Time?

February 20, 2015

Summary of Morgan Stanley Global and Australian Macro+ Views

Global Macro Outlook – Lower but Longer; Battling Lowflation

Key Market Themes

We expect global GDP growth to average 3.5%Y in 2015 and 3.9%Y in

2016, revised down from 3.7%Y and 4.0%Y in September. The global

economy remains out-of-sync, and brittle in nature as Europe & Japan

struggle with sustainable growth and as large EM economies transition

their growth models slowly. The US should grow 2.9% in 2015, helped

by lower energy costs and supportive fiscal policy. We have lowered

growth estimates for China to 7.0%Y in 2015, reflecting weaker-thanexpected fixed asset investment, particularly in property development.

The dominant theme for central banks in 2015 is their battle against

“lowflation”, initiated by actions from BoJ, the ECB and the PBoC. We

continue to see the Fed hiking only after January 2016 against a

backdrop of low rates and ample liquidity. Please refer to our 2015

Global Macro Outlook: The Battle Against Lowflation for more detail.

Australian Macro Outlook – Shocks to the Economy a SpeedBump for the Transition

We are now bottom of consensus for Australian GDP growth in 2015.

Four shocks to the economy have caused us to be more cautious:

1) faster terms of trade deterioration than expected given the supply

shock and China’s accelerated rebalancing, 2) an alarmist Budget

narrative dampening consumer spirits, 3) a stronger housing recovery

in 2014 forcing a mixed policy outlook for 2015, and 4) a household

income shock given job losses and negative mix effect from the

resources transition. This all paints a negative picture and puts

domestic demand close to recessionary levels in 2015. See Asia

Insight: Lost in Transition? for more detail

We remain cautious on banks as we expect APRA to follow the FSI’s

recommendations on higher capital requirements, which will impact

ROEs. We recommend a portfolio rotation toward non-bank financials,

FX earners, dividend growers and structural growers. Please see our

Asia Insight: It's Not Easy Being Different for more detail.

Negative Earnings Momentum: We are concerned that the downgrade

cycle will broaden from resources to industrials through 1H15 results, and

that FY15 market earnings could finish in negative territory (currently 3%).

Rate Cut Playbook: We advise ‘minding the gap’ for cyclical earnings

between slowing growth momentum and a behind-the-curve RBA response.

Assessing Risk-Reward in Resources: Supply is driving commodity

markets, with metals like copper, zinc and alumina best placed. Bulks are

now abundant, with cost curves low and flat. Oil has near-term risk, but

should also be one of the earliest to recover given rapid decline rates.

The Role of Yield: Our Global Chief Economist notes a ‘triple glut’ of

savings, oil and liquidity is driving bond yields to record low levels. We see

support for Australian bond-proxy and blue-chip yield, particularly where it

can be paired with a defensive earnings stream or growth.

M&A Triggers: With the AUD below 80c, we look for M&A activity when

the value of market incumbency and asset footprint falls below what the

market is willing to pay for the near-term earnings outlook.

Key Portfolio Tilts

Underweight Banks on FSI: We moved underweight the sector in

September 2014, with concerns centering on: 1) the FSI leading to more

onerous capital requirements, which will depress sustainable ROEs,

2) any business credit recovery will be ROE-mix negative, 3) the upgrade

cycle has come to an end, and 4) sector valuations remain elevated.

Too Early on Resources: We are also modestly underweight materials

and energy, with a preference for large caps that can benefit from scale and

cost-curve advantages through the final phase of the commodity cycle.

Buying Global Earners and Yield: With our 0.69 end-2015 AUD/USD

forecast and a ‘lower for longer’ cash rate and yield outlook, we remain

overweight these themes within our Model Portfolio.

24

MORGAN STANLEY RESEARCH

Australia Macro+: Out of Sync and Out of Time?

February 20, 2015

Theme 1 - Negative earnings momentum

Dec 2014 saw largest 1M earnings downgrade since GFC

Industrial-ex-Financial valuations not set up for downgrades

x

1.5

23

1.0

21

0.5

19

0.0

17

-0.5

15

-1.0

13

-1.5

11

-2.0

9

-2.5

7

ASX 200 12MF EPS 1M Revision

-3.0

5

2003

-3.5

10

11

12

13

2004

2005

14

2006

2007

Resources

2008

2009

2010

Industrials x Financials

2011

2012

2013

2014

Banks

Historically, weak earnings momentum justifies lower market

multiples

3M Earnings revisions also trending down

10%

8000

5%

7000

10

20

18

5

16

6000

0%

0

14

5000

-5%

12

-5

4000

-10%

3000

-15%

2000

-20%

ASX 200 3M EPS Revisions

-25%

2001

1000

ASX 200 Index

10

-10

8

PE Lower when EPS

momentum is significantly

negative

-15

-20

6

ASX 200 3M EPS Rev (lhs)

4

ASX 200 12MF PE (rhs)

2

0

2002

2003

2004

2005

2006

2007

2008

2009

2010

2011

2012

Source: IBES, Datastream, Bloomberg, Morgan Stanley Research

2013

2014

-25

Dec-01

0

Dec-03

Dec-05

Dec-07

Dec-09

Dec-11

Dec-13

25

MORGAN STANLEY RESEARCH

Australia Macro+: Out of Sync and Out of Time?

February 20, 2015

Long-term Valuations by Macro Sector

Price to Earnings – ASX 200 – Last 15.3x

Price to Earnings – ASX 200 Resources – Last 14.7x

12 mth fw d

12 mth fw d

25

20

23

18

21

19

16

17

15

14

13

12

11

9

10

7

5

8

94 95 96 97 98 99 00 01 02 03 04 05 06 07 08 09 10 11 12 13 14

94 95 96 97 98 99 00 01 02 03 04 05 06 07 08 09 10 11 12 13 14

PE

av g

PE

+/-1 std

Price to Earnings – ASX 200 Industrials ex Financials – Last 17.8x

av g

+/-1 std

Price to Earnings – ASX 200 Financials (GICS) – Last 14.0x

12 mth fw d

12 mth fw d

22

16

20

15

14

18

13

16

12

14

11

12

10

10

9

8

8

02

04

05

06

PE

07

09

av g

Source: RIMES, IBES, Morgan Stanley Research

10

+/-1 std

11

12

14

02 03 03 04 04 05 05 06 06 07 07 08 08 09 09 10 10 11 11 12 12 13 13 14 14

PE

av g

+/-1 std

26

MORGAN STANLEY RESEARCH

Australia Macro+: Out of Sync and Out of Time?

February 20, 2015

Consensus EPS Growth Forecasts – FY15 forecasts lower again….now at 1.5%

Annual EPS Grow th (%)

FY14-17 consensus EPS growth forecasts

FY2014

FY2015

FY2016

FY2017

5.6

1.5

5.4

10.8

EPSg (%)

S&P/ASX 200

14%

Sector

12%

FY17 = +10.8%

10%

8%

6%

FY14 = +5.6%

FY16 = +5.4%

4%

2%

FY15 = +1.5%

0%

Jan-12 May-12 Sep-12 Jan-13 May-13 Sep-13 Jan-14 May-14 Sep-14 Jan-15

2014

2015

2016

2017

Historical consensus annual EPS growth trends

Energy

-4.7

22.2

-23.7

33.3

Materials

15.0

-26.1

6.9

22.6

Industrials

-13.7

22.0

16.9

10.5

Discretionary

3.0

9.2

10.8

8.2

Staples

0.0

1.1

8.6

6.6

Health Care

9.0

14.5

9.0

11.5

Financials

6.2

8.1

5.5

6.5

Info Tech

5.1

9.6

9.9

11.3

Telcos

3.9

7.0

7.3

8.0

Industry Group

Energy

-4.7

22.2

-23.7

33.3

Materials

15.0

-26.1

6.9

22.6

Capital Goods

-9.7

-13.6

7.2

3.7

Commercial Services & Supplies

-2.4

-3.8

9.9

10.3

-27.9

85.1

25.5

12.1

0.5

2.6

8.6

8.0

-17.7

15.0

11.8

7.8

Transportation

Automobiles & Components

%

Consumer Durables & Apparel

30%

20%

10%

0%

2005

Consumer Services

11.8

12.9

12.4

9.6

2006

Media

-8.1

9.1

9.0

5.4

2007

Retailing

-3.7

1.3

8.7

7.4

2008

Food & Staples Retailing

2.9

2.4

8.0

6.1

2009

Food Beverage & Tobacco

-18.0

-8.8

13.2

10.6

2010

Health Care Equipment & Services

6.4

17.2

7.3

9.5

Pharmaceuticals & Biotechnology

11.4

12.1

10.7

13.4

2011

2012

2013

-10%

2014

2015

-20%

2016

2017

-30%

03

04

05

06

07

08

09

10

Source: RIMES, IBES, Morgan Stanley Research

11

12

13

14

Banks

3.8

9.3

4.1

6.7

23.0

13.0

8.5

7.4

Insurance

8.2

4.1

10.2

7.2

Real Estate

12.3

1.1

7.2

4.5

5.1

9.6

9.9

11.3

Diversified Financials

Softw are & Services

Technology Hardw are & Equipment

-65.4

-27.7

84.9

50.0

Telcos

3.9

7.0

7.3

8.0

Utilities

-6.6

4.4

8.5

6.3

27

MORGAN STANLEY RESEARCH

Australia Macro+: Out of Sync and Out of Time?

February 20, 2015

Theme 2- Is the Rate Cut Playbook Different This Time?

Futures market pricing 43bp of RBA cuts over 2015

Rate Cut Cycles: Banks and Builders historical beneficiaries, but

Retail less than often assumed

2.75%

300

Rate Cut Cycle

Bank Relative Index

250

Retail

2.50%

Construction Materials

200

2.25%

150

100

2.00%

50

1.75%

Index

Index

2014

2013

2012

2011

2010

2009

2008

2007

2006

2005

2004

2003

2002

160

120

145

110

130

100

115

90

100

80

85

70

2000

2001

Bank Impairment Charges / Total Loans at Historical Lows

Consumer Sentiment Weakens into Christmas

130

2000

As of 3 Feb 2015 (post-cut)

1999

0

Feb-2016

1998

RBA Futures Pricing: 2 December 2014

Nov-2015

1997

Aug-2015

1996

May-2015

1995

Feb-2015

70

2002

2004

2006

WBC-MI Consumer Sentiment (lhs)

2008

2010

2012

2014

Time to buy major HH items (rhs)

Source: Datastream, Westpac-MI, Bloomberg Morgan Stanley Research

28

MORGAN STANLEY RESEARCH

Australia Macro+: Out of Sync and Out of Time?

February 20, 2015

Theme 3 - Assessing Risk/Reward in Resources

Oil: Incentive pricing for the estimated 30mb/d of gross additions

needed over 2014-20

Crude Oil: Sharp correction from stable price regime

US$/bbl

160

140

120

100

80

60

40

20

0

2000

2002

2004

2006

2008

2010

2012

2014

2016

Tapis Crude Oil

Chinese growth remains in 2012-2014 downtrend

Bulks and Base Metals trading well below 1H15 forecasts

35

MS 1H15 Forecasts vs Spot

30

25

%

20

15

10

5

0

-5

-10

Source: Bloomberg, Morgan Stanley Research

29

MORGAN STANLEY RESEARCH

Australia Macro+: Out of Sync and Out of Time?

February 20, 2015

Theme 4 - The Role of Yield – Low Rates Forecast

M1KE (Months to 1st Rate Hike)

Equity dividend yield now historically inexpensive compared to

bond yields

21

8%

19

6%

17

4.4%

15

4%

2.5%

13

2%

11

0%

9

-2%

7

*ASX 200 vs 10 Yr Aus Gov Yield

-4%

2000

2002

2004

2006

2008

Earnings Yield* gap

2010

2012

2014

Mar-14

May-14

M1KE

Dividend yield gap

Jul-14

Sep-14

Nov-14

Jan-15

Natural Trend from Jan 14

Strong relative performance of yield-linked sectors against falling

Australian 10-year bond yields

Australian yield remains attractive globally

5.5%

5.0%

5

Jan-14

5.5%

4.8%

5.0%

4.7%

4.5%

4.5%

4.1%

4.0%

4.0%

3.9%

4.0%

3.7%

3.5%

3.5%

3.0%

3.0%

3.0%

2.5%

2.7%

2.1%

2.2%

2.0%

2.0%

2.5%

2.0%

1.9%

1.5%

1.5%

ASX 200

S&P 500

FTSE 100

Current

Hang Seng

TOPIX

MSCI AC

World

12MF Dividend Yield (10Yr Average)

Source: IBES, Datastream, Bloomberg, Morgan Stanley Research

30

MORGAN STANLEY RESEARCH

Australia Macro+: Out of Sync and Out of Time?

February 20, 2015

The Role of Yield – The Yield Spectrum

Source: IBES, Thomson Reuters Bloomberg, Morgan Stanley Research

31

MORGAN STANLEY RESEARCH

Australia Macro+: Out of Sync and Out of Time?

February 20, 2015

Theme 5 - M&A Triggers – Additives to a Low-Growth Diet

M&A cycle improving but not yet at peak

Global M&A Cycle in Sync

25,000

3,000

20,000

$USbn

$USbn

300

2,500

250

2,000

200

1,500

150

1,000

100

15,000

10,000

500

5,000

50

0

0

1996

1996

1998

2000

2002

2004

2006

2008

2010

2012

1998

2000

2002

2004

2006

2008

2010

2012

2014

2014

US Announced Transaction Values (ann)

Rest of World

Australia (rhs)

M&A Values as Proportion of Market Cap

30%

Proportional M&A Transaction Values seeing

strong growth and now back at trend levels

25%

20%

15%

10%

5%

*Announced M&A transactions per annum. Indices used for Mkt Cap are ASX All Ords and

S&P 500

0%

1996

1997

1998

1999

2000

2001

2002

2003

2004

2005

2006

2007

Australian M&A as % of Mkt Cap

Source: Dealogic, Bloomberg, ABS, Morgan Stanley Research

2008

2009

2010

2011

2012

2013

2014

US

32

MORGAN STANLEY RESEARCH

Australia Macro+: Out of Sync and Out of Time?

February 20, 2015

10 Surprises that Would Matter – 4 Highlights

33

MORGAN STANLEY RESEARCH

Australia Macro+: Out of Sync and Out of Time?

February 20, 2015

#1: Industrial Earnings Finish FY15 Negative

ASX 200 FY15e EPSg falling sharply, but Resources the major drag

Key Industrial Sector Growth Expectations: Consumer sectors

have come down, but Health Care and Financials remain elevated

Source: Bloomberg, Morgan Stanley Research

#2: Staples outperform REITs?

Structural earnings pressure in CCL and WOW weigh on consumer

staples performance

Rate rebound scenario along with higher food inflation could see

Staples outperform REITs.

34

MORGAN STANLEY RESEARCH

Australia Macro+: Out of Sync and Out of Time?

February 20, 2015

#4 : Fiscal Austerity Abandoned

#3: RBA cuts by more than 50bps

Futures now pricing 50bp in RBA rate cuts, but ‘behind the curve’

response might necessitate more

Electoral cycle should see more stimulatory Budget

2.75%

2.50%

2.25%

2.00%

1.75%

Feb-2015

May-2015

Aug-2015

RBA Futures Pricing: 2 December 2014

Nov-2015

Feb-2016

As of 3 Feb 2015 (post-cut)

Housing market sentiment has come back to more sustainable

levels, but watching for further slowing

90%

National Clearance Rate

Index

Housing-Led

Recovery

Government has retained profile of fiscal austerity, despite

additional shocks to the outlook

% of GDP

115

0.0

110

-0.5

Budget, 13 May

-0.2

80%

-0.6

70%

105

-0.6

-1.0

-1.0

-1.0

-1.2

-1.5

60%

100

50%

95

40%

90

-2.0

-1.8

-1.9

-2.5

-2.5

-2.4

-3.0

2014-15

30%

Mar-2011 Sep-2011 Mar-2012 Sep-2012 Mar-2013 Sep-2013 Mar-2014 Sep-2014

Auction Clearance Rate (lhs)

Dwelling Prices (rhs)

-2.0

-2.8

2015-16

2016-17

2017-18

85

2014-15 Budget (May 2014)

Mid-Year EFO (Dec 2014)

MS Estimate

Consumer sentiment (rhs)

Source: ABS, Datastream, Bloomberg, ABC, Morgan Stanley Research

35

MORGAN STANLEY RESEARCH

Australia Macro+: Out of Sync and Out of Time?

February 20, 2015

MSWM Portfolio and Asset Allocation

36

MORGAN STANLEY RESEARCH

Australia Macro+: Out of Sync and Out of Time?

February 20, 2015

MSWM TAA Strategy – Equities over Cash and Government Bonds

International Equity Country ETF Model Portfolio

MSWM Tactical Asset Allocation Strategy

MSWM TAA - Balanced Investor

Equities

Australian Equities

Global Equities

Listed Property

Fixed Income

Gov t. Bonds

Credit

Cash

Alternatives

Commodities

Hedge Funds

Source: Morgan Stanley Research, MSWM Research

TAA Tilt

Retail Soph.

+5%

+4%

+10%

+8%

0%

0%

Code

Name

Weight

*Bmark

Tilt

VTS

Vanguard US Total Market Shares

51.0%

54.5%

-3.5%

IEU

iShares S&P Europe 350

26.0%

24.7%

1.3%

IJP

iShares MSCI Japan

10.0%

7.9%

2.1%

IEM

iShares MSCI Emerging Markets

11.5%

10.4%

1.1%

1.5%

2.5%

-1.0%

AGF

-10%

-8%

-3%

-1%

-2%

-4%

n.a.

-1%

n.a.

+2%

AMP Capital China Growth Fund

1

*MSCI All Country World Index ex Canada, Australia, NZ, Singapore and Hong Kong.

Benchmark weight adjusted. 1. Including the 2.6% exposure to China H-shares within IEM, in

total we have a 4.1% allocation to China. This represents a 1.75% overweight relative to the

MSCI AC World Index

37

MORGAN STANLEY RESEARCH

Australia Macro+: Out of Sync and Out of Time?

February 20, 2015

MSWM’s Asset Allocation for a Balanced Investor

MSWM Strategic Asset Allocation

MSWM Tactical Asset Allocation

Cash, 6%

Cash, 8%

Australian

Equities, 26%

Fixed Income

- Credit, 16%

Retail

Balanced

SAA

Fixed Income Credit, 13%

Fixed Income Bonds, 10%

Australian

Equities, 31%

Retail

Balanced

TAA

Property, 5%

Fixed Income Bonds, 20%

International

Equities, 25%

Property, 5%

Source: \MSWM Research

International

Equities, 35%

38

MORGAN STANLEY RESEARCH

Australia Macro+: Out of Sync and Out of Time?

February 20, 2015

MSWM Equity Model Portfolios

For more detail, please talk to your Morgan Stanley adviser

Value Portfolio

Growth Portfolio

SRI-Ethical

Portfolio

• Suited to more

conservative

investors, with

preference for

dividends

• Suited to investors

who prefer to invest

in “undervalued”

stocks

• Provides more

balanced mixture of

yield and capital

returns

• Suited to investors

who can tolerate

higher risk

• Performs well under

more bullish growth

conditions

• Suited to investors

who want a socially

responsible

portfolio with above

average dividend

yield

Gross Yield (est: 6.3%)

Gross Yield (est): 5.7%

Gross Yield (est): 5.7%

Gross Yield (est): 6.3%

Income Portfolio

39

39

MORGAN STANLEY RESEARCH

Australia Macro+: Out of Sync and Out of Time?

February 20, 2015

Australian Equities: Finding Earnings at a Reasonable Price

ANN – Strong Sales and Margin Growth Driving EPS

Good earnings momentum trading at reasonable

multiples:

•Ansell:

MSe 10% EPS growth in F16; beneficiary of

lower input costs; improved demand in Developed

Markets; exposure to Emerging Markets growth;

synergies from BSSI acquisition.

•Oil

Search: rising earnings profile despite lower oil

prices led mainly by production growth; Well placed to

adapt to lower oil prices – break even EBIT ~ $40/bbl;

PNG LNG a relatively cost project with potential for

additional trains.

•Perpetual:

MSe 17% EPS growth in F16; interest

rate cuts to support flows; launch of Global Share

Fund; TRU acquisition; Valuation reasonable relative

to history and peers.

Source: Company presentation.

PPT - Strong Net Flows Aids FUM Growth

40

Source: Company data, Morgan Stanley Research

40

MORGAN STANLEY RESEARCH

Australia Macro+: Out of Sync and Out of Time?

February 20, 2015

Australian Equities: The Role of Yield

Low interest rates, record low bond yields, supports

defensive yields or yield with a story:

Singtel: Optus Mobile Revenue Showing Recovery

•Duet:

regulated assets with largely predictable revenues;

above industry-average yield; SKI holds a synthetic 14.1%

interest.

•SingTel:

Emerging Asian consumer and demand for

mobile data; Optus turnaround; dividends supported by

steady cash flow from Singapore business.

•AMP:

play on Australian superannuation growth; interest

rate cuts to support flows; strategic position in Chinese

pension market; exercising strong cost disciplines.

Note: Company Data, Morgan Stanley Research

•Lend

Lease: improved visibility of earnings; $36bn

development pipeline, including in urban re-generation;

Government policy to drive future growth in infrastructure

spending.

•Exchange

Duet: Yield Gap to 10yr Bond Yield Relatively High (ppts)

Traded Funds

Source: Company Data, Morgan Stanley Research. y-axis is difference between

distribution yield and 10yr bond yield (ppts)

41

41

MORGAN STANLEY RESEARCH

Australia Macro+: Out of Sync and Out of Time?

February 20, 2015

Australian Equities: Assessing Risk/Reward in Resources

In Materials – positioned in lower cost, larger cap

miners. In Energy – weighing up growth and balance

sheets:

BHP: Further Reduction in Unit Costs Expected in F15

•BHP:

diversified asset base; low cost producer; levers

to pull; relative value.

•RIO:

low cost producer; capex and opex reductions to

support cash flow; returning capital; gearing just 21%

post buyback; relative value.

•Origin:

integrated energy company; discount to DCF;

our oil price forecasts still see EPS and DPS doubling by

F17, driven mainly by APLNG.

•Oil

Search: rising earnings profile despite lower oil

prices led mainly by production growth; Well placed to

adapt to lower oil prices – break even EBIT ~ US$40/bbl;

PNG LNG a relatively cost project with potential for

additional trains.

Note: Company presentation, Morgan Stanley Research

OilSearch: Unit Cash, Non-Cash & Exploration Costs

Source: Morgan Stanley Research

42

42

MORGAN STANLEY RESEARCH

Australia Macro+: Out of Sync and Out of Time?

February 20, 2015

Australian Equities: Global Leaders

Exposure to recovering global growth or weaker AUD:

Industrial Companies with > 30% of Sales Outside

Aus/NZ

•Global

•

Ansell

•

Recall: regulation driving physical document

storage growth; margin expansion opportunities;

acquisitions.

•

Brambles: cost reduction opportunities; tailwinds

from stronger USD; exposure to more defensive

FMCG sectors.

•

Goodman Group: work-in progress across Asia,

US, Europe, UK.

•

James Hardie: exposure to US housing recovery.

•US

•Europe

•

Macquarie Atlas – Key asset is French toll road

APRR. Has significantly lowered debt and interest

costs.

•Asia/EM

•

SingTel

Source: Datastream, Worldscope, Company reports. * based on MS numbers. Stocks43

highlighted are in MSWM Model Portfolios

43

MORGAN STANLEY RESEARCH

Australia Macro+: Out of Sync and Out of Time?

February 20, 2015

Stocks Mentioned: Comparison Table

Source: Modelware, Morgan Stanley Research, MSWM Research. Intraday prices 20 Feb 2015 used. *S$4.65 price target converted to $A at 0.944 exchange rate.

44

MORGAN STANLEY RESEARCH

Australia Macro+: Out of Sync and Out of Time?

February 20, 2015

Behind It All: The Global Presence of Morgan Stanley

Our global network of analysts cover over 3,300 stocks across the world, bringing the

investment debate to you, regardless of geography

North America

Europe

Asia Pacific

1,047 Stocks

91% of S&P 500 market cap

756 Stocks

83% of MSCI EU market cap

990 Stocks

89% of MSCI Asia market cap

Japan

334 Stocks

81% of TOPIX

Latin America

211 Stocks

75% of MSCI LA market cap

This material is not a solicitation of any offer to buy or sell any security or other financial instrument or to participate in any trading strategy. This communication is not a research report.

Copyright © by Morgan Stanley 2015, all rights reserved.

45

MORGAN STANLEY RESEARCH

Australia Macro+: Out of Sync and Out of Time?

February 20, 2015

Research in Asia – 1,324 Stocks

Korea

China / HK

93 Stocks

351 Stocks

India

Japan

130 Stocks

334 Stocks

Singapore

Taiwan

32 Stocks

92 Stocks

Indonesia

53 Stocks

Australia / NZ

178 Stocks

Malaysia/Thailand/Philippines

61 Stocks

This material is not a solicitation of any offer to buy or sell any security or other financial instrument or to participate in any trading strategy. This communication is not a research report.

Copyright © by Morgan Stanley 2015, all rights reserved.

46

MORGAN STANLEY RESEARCH

Australia Macro+: Out of Sync and Out of Time?

February 19, 2015

Morgan Stanley ModelWare is a proprietary analytic framework that helps clients uncover value, adjusting for distortions

and ambiguities created by local accounting regulations. For example, ModelWare EPS adjusts for one-time events, capitalizes

operating leases (where their use is significant), and converts inventory from LIFO costing to a FIFO basis. ModelWare also

emphasizes the separation of operating performance of a company from its financing for a more complete view of how a company

generates earnings.

Disclosure Section

The information and opinions in Morgan Stanley Research were prepared or are disseminated by Morgan Stanley Asia Limited (which accepts the responsibility for its contents) and/or

Morgan Stanley Asia (Singapore) Pte. (Registration number 199206298Z) and/or Morgan Stanley Asia (Singapore) Securities Pte Ltd (Registration number 200008434H), regulated by the

Monetary Authority of Singapore (which accepts legal responsibility for its contents and should be contacted with respect to any matters arising from, or in connection with, Morgan Stanley

Research), and/or Morgan Stanley Taiwan Limited and/or Morgan Stanley & Co International plc, Seoul Branch, and/or Morgan Stanley Australia Limited (A.B.N. 67 003 734 576, holder

of Australian financial services license No. 233742, which accepts responsibility for its contents), and/or Morgan Stanley Wealth Management Australia Pty Ltd (A.B.N. 19 009 145 555,

holder of Australian financial services license No. 240813, which accepts responsibility for its contents), and/or Morgan Stanley India Company Private Limited, and/or PT Morgan Stanley

Asia Indonesia and their affiliates (collectively, "Morgan Stanley").

For important disclosures, stock price charts and equity rating histories regarding companies that are the subject of this report, please see the Morgan Stanley Research Disclosure

Website at www.morganstanley.com/researchdisclosures, or contact your investment representative or Morgan Stanley Research at 1585 Broadway, (Attention: Research Management),

New York, NY, 10036 USA.

For valuation methodology and risks associated with any price targets referenced in this research report, please contact the Client Support Team as follows: US/Canada +1 800 303-2495;

Hong Kong +852 2848-5999; Latin America +1 718 754-5444 (U.S.); London +44 (0)20-7425-8169; Singapore +65 6834-6860; Sydney +61 (0)2-9770-1505; Tokyo +81 (0)3-6836-9000.

Alternatively you may contact your investment representative or Morgan Stanley Research at 1585 Broadway, (Attention: Research Management), New York, NY 10036 USA.

Analyst Certification

The following analysts hereby certify that their views about the companies and their securities discussed in this report are accurately expressed and that they have not received and will

not receive direct or indirect compensation in exchange for expressing specific recommendations or views in this report: Chris Nicol.

Unless otherwise stated, the individuals listed on the cover page of this report are research analysts.

Global Research Conflict Management Policy

Morgan Stanley Research has been published in accordance with our conflict management policy, which is available at www.morganstanley.com/institutional/research/conflictpolicies.

Important US Regulatory Disclosures on Subject Companies

The following analyst or strategist (or a household member) owns securities (or related derivatives) in a company that he or she covers or recommends in Morgan Stanley Research:

Antony Conte - Nat Aust Bank(common or preferred stock), Telstra Corporation(common or preferred stock), Westpac Banking(common or preferred stock).

As of December 31, 2014, Morgan Stanley beneficially owned 1% or more of a class of common equity securities of the following companies covered in Morgan Stanley Research:

BlueScope Steel, Dexus, Goodman Group, Lend Lease Corporation.

Within the last 12 months, Morgan Stanley managed or co-managed a public offering (or 144A offering) of securities of AMP Ltd, Commonwealth Bk Aust, Macquarie Group Limited, MMA

Offshore, Westpac Banking.

Within the last 12 months, Morgan Stanley has received compensation for investment banking services from AMP Ltd, Commonwealth Bk Aust, Lend Lease Corporation, MMA Offshore,

Nat Aust Bank, Oil Search Ltd., Westpac Banking.

In the next 3 months, Morgan Stanley expects to receive or intends to seek compensation for investment banking services from AMP Ltd, BHP Billiton Limited, BlueScope Steel, Brambles

Ltd., Commonwealth Bk Aust, CSL Ltd, Dexus, Domino's Pizza Enterprises Limited, DUET Group, DuluxGroup, Goodman Group, InvoCare Ltd, JB Hi-Fi, Lend Lease Corporation,

Macquarie Group Limited, MMA Offshore, Nat Aust Bank, Navitas Limited, Oil Search Ltd., Origin Energy Ltd., Rio Tinto Ltd, Telstra Corporation, Wesfarmers, Westpac Banking,

Programmed Maintenance Services Limited, Transpacific Industries Group Ltd.

47

MORGAN STANLEY RESEARCH

Australia Macro+: Out of Sync and Out of Time?

February 19, 2015

Disclosure section (cont.)

Within the last 12 months, Morgan Stanley has received compensation for products and services other than investment banking services from AMP Ltd, BHP Billiton Limited,

Commonwealth Bk Aust, DUET Group, IOOF Holdings, Lend Lease Corporation, Macquarie Group Limited, Nat Aust Bank, Rio Tinto Ltd, Westpac Banking.

Within the last 12 months, Morgan Stanley has provided or is providing investment banking services to, or has an investment banking client relationship with, the following company: AMP

Ltd, BHP Billiton Limited, BlueScope Steel, Brambles Ltd., Commonwealth Bk Aust, CSL Ltd, Dexus, Domino's Pizza Enterprises Limited, DUET Group, DuluxGroup, Goodman Group,

InvoCare Ltd, JB Hi-Fi, Lend Lease Corporation, Macquarie Group Limited, MMA Offshore, Nat Aust Bank, Navitas Limited, Oil Search Ltd., Origin Energy Ltd., Rio Tinto Ltd, Telstra

Corporation, Wesfarmers, Westpac Banking, Programmed Maintenance Services Limited, Transpacific Industries Group Ltd.

Within the last 12 months, Morgan Stanley has either provided or is providing non-investment banking, securities-related services to and/or in the past has entered into an agreement to

provide services or has a client relationship with the following company: AMP Ltd, BHP Billiton Limited, Commonwealth Bk Aust, Domino's Pizza Enterprises Limited, DUET Group, IOOF

Holdings, Lend Lease Corporation, Macquarie Group Limited, Nat Aust Bank, Rio Tinto Ltd, Telstra Corporation, Westpac Banking.

Morgan Stanley & Co. LLC makes a market in the securities of BHP Billiton Limited, Westpac Banking.

The equity research analysts or strategists principally responsible for the preparation of Morgan Stanley Research have received compensation based upon various factors, including

quality of research, investor client feedback, stock picking, competitive factors, firm revenues and overall investment banking revenues.

Morgan Stanley and its affiliates do business that relates to companies/instruments covered in Morgan Stanley Research, including market making, providing liquidity and specialized

trading, risk arbitrage and other proprietary trading, fund management, commercial banking, extension of credit, investment services and investment banking. Morgan Stanley sells to and

buys from customers the securities/instruments of companies covered in Morgan Stanley Research on a principal basis. Morgan Stanley may have a position in the debt of the Company

or instruments discussed in this report.

Certain disclosures listed above are also for compliance with applicable regulations in non-US jurisdictions.

48

MORGAN STANLEY RESEARCH

Australia Macro+: Out of Sync and Out of Time?

February 19, 2015

Disclosure section (cont.)

STOCK RATINGS

Morgan Stanley uses a relative rating system using terms such as Overweight, Equal-weight, Not-Rated or Underweight (see definitions below). Morgan Stanley does not assign ratings of

Buy, Hold or Sell to the stocks we cover. Overweight, Equal-weight, Not-Rated and Underweight are not the equivalent of buy, hold and sell. Investors should carefully read the definitions

of all ratings used in Morgan Stanley Research. In addition, since Morgan Stanley Research contains more complete information concerning the analyst's views, investors should carefully

read Morgan Stanley Research, in its entirety, and not infer the contents from the rating alone. In any case, ratings (or research) should not be used or relied upon as investment advice.

An investor's decision to buy or sell a stock should depend on individual circumstances (such as the investor's existing holdings) and other considerations.

Global Stock Ratings Distribution

(as of January 31, 2015)

For disclosure purposes only (in accordance with NASD and NYSE requirements), we include the category headings of Buy, Hold, and Sell alongside our ratings of Overweight, Equalweight, Not-Rated and Underweight. Morgan Stanley does not assign ratings of Buy, Hold or Sell to the stocks we cover. Overweight, Equal-weight, Not-Rated and Underweight are not

the equivalent of buy, hold, and sell but represent recommended relative weightings (see definitions below). To satisfy regulatory requirements, we correspond Overweight, our most

positive stock rating, with a buy recommendation; we correspond Equal-weight and Not-Rated to hold and Underweight to sell recommendations, respectively.

Coverage Universe

Investment Banking Clients (IBC)

Count

% of

Total

Count

Overweight/Buy

1173

35%

320

41%

27%

Equal-weight/Hold

1446

43%

361

46%

25%

Stock Rating Category

% of % of Rating

Total IBC

Category

Not-Rated/Hold

107

3%

14

2%

13%

Underweight/Sell

603

18%

92

12%

15%

Total

3,329

787

Data include common stock and ADRs currently assigned ratings. Investment Banking Clients are companies from whom Morgan Stanley received investment banking compensation in

the last 12 months.

Analyst Stock Ratings

Overweight (O). The stock's total return is expected to exceed the average total return of the analyst's industry (or industry team's) coverage universe, on a risk-adjusted basis, over the

next 12-18 months.

Equal-weight (E). The stock's total return is expected to be in line with the average total return of the analyst's industry (or industry team's) coverage universe, on a risk-adjusted basis,

over the next 12-18 months.

Not-Rated (NR). Currently the analyst does not have adequate conviction about the stock's total return relative to the average total return of the analyst's industry (or industry team's)

coverage universe, on a risk-adjusted basis, over the next 12-18 months.

Underweight (U). The stock's total return is expected to be below the average total return of the analyst's industry (or industry team's) coverage universe, on a risk-adjusted basis, over the

next 12-18 months.

Unless otherwise specified, the time frame for price targets included in Morgan Stanley Research is 12 to 18 months.

Analyst Industry Views

Attractive (A): The analyst expects the performance of his or her industry coverage universe over the next 12-18 months to be attractive vs. the relevant broad market benchmark, as

indicated below.

In-Line (I): The analyst expects the performance of his or her industry coverage universe over the next 12-18 months to be in line with the relevant broad market benchmark, as indicated

below.

Cautious (C): The analyst views the performance of his or her industry coverage universe over the next 12-18 months with caution vs. the relevant broad market benchmark, as indicated

below.

Benchmarks for each region are as follows: North America - S&P 500; Latin America - relevant MSCI country index or MSCI Latin America Index; Europe - MSCI Europe; Japan - TOPIX;

Asia - relevant MSCI country index or MSCI sub-regional index or MSCI AC Asia Pacific ex Japan Index.

49

MORGAN STANLEY RESEARCH

Australia Macro+: Out of Sync and Out of Time?

February 19, 2015

Disclosure section (cont.)

Important Disclosures for Morgan Stanley Smith Barney LLC Customers

Important disclosures regarding the relationship between the companies that are the subject of Morgan Stanley Research and Morgan Stanley Smith Barney LLC or Morgan Stanley or

any of their affiliates, are available on the Morgan Stanley Wealth Management disclosure website at www.morganstanley.com/online/researchdisclosures. For Morgan Stanley specific

disclosures, you may refer to www.morganstanley.com/researchdisclosures.

Each Morgan Stanley Equity Research report is reviewed and approved on behalf of Morgan Stanley Smith Barney LLC. This review and approval is conducted by the same person who

reviews the Equity Research report on behalf of Morgan Stanley. This could create a conflict of interest.

Other Important Disclosures

Morgan Stanley & Co. International PLC and its affiliates have a significant financial interest in the debt securities of BHP Billiton Limited, Commonwealth Bk Aust, Lend Lease

Corporation, Macquarie Group Limited, Nat Aust Bank, Origin Energy Ltd., Rio Tinto Ltd, Tabcorp Holdings, Telstra Corporation, Wesfarmers, Westpac Banking.

Morgan Stanley is not acting as a municipal advisor and the opinions or views contained herein are not intended to be, and do not constitute, advice within the meaning of Section 975 of

the Dodd-Frank Wall Street Reform and Consumer Protection Act.

Morgan Stanley produces an equity research product called a "Tactical Idea." Views contained in a "Tactical Idea" on a particular stock may be contrary to the recommendations or views

expressed in research on the same stock. This may be the result of differing time horizons, methodologies, market events, or other factors. For all research available on a particular stock,

please contact your sales representative or go to Matrix at http://www.morganstanley.com/matrix.

Morgan Stanley Research is provided to our clients through our proprietary research portal on Matrix and also distributed electronically by Morgan Stanley to clients. Certain, but not all,

Morgan Stanley Research products are also made available to clients through third-party vendors or redistributed to clients through alternate electronic means as a convenience. For

access to all available Morgan Stanley Research, please contact your sales representative or go to Matrix at http://www.morganstanley.com/matrix.

Any access and/or use of Morgan Stanley Research is subject to Morgan Stanley's Terms of Use (http://www.morganstanley.com/terms.html). By accessing and/or using Morgan Stanley

Research, you are indicating that you have read and agree to be bound by our Terms of Use (http://www.morganstanley.com/terms.html). In addition you consent to Morgan Stanley

processing your personal data and using cookies in accordance with our Privacy Policy and our Global Cookies Policy (http://www.morganstanley.com/privacy_pledge.html), including for

the purposes of setting your preferences and to collect readership data so that we can deliver better and more personalized service and products to you. To find out more information

about how Morgan Stanley processes personal data, how we use cookies and how to reject cookies see our Privacy Policy and our Global Cookies Policy

(http://www.morganstanley.com/privacy_pledge.html).

If you do not agree to our Terms of Use and/or if you do not wish to provide your consent to Morgan Stanley processing your personal data or using cookies please do not access our

research.

Morgan Stanley Research does not provide individually tailored investment advice. Morgan Stanley Research has been prepared without regard to the circumstances and objectives of

those who receive it. Morgan Stanley recommends that investors independently evaluate particular investments and strategies, and encourages investors to seek the advice of a financial

adviser. The appropriateness of an investment or strategy will depend on an investor's circumstances and objectives. The securities, instruments, or strategies discussed in Morgan

Stanley Research may not be suitable for all investors, and certain investors may not be eligible to purchase or participate in some or all of them. Morgan Stanley Research is not an offer

to buy or sell or the solicitation of an offer to buy or sell any security/instrument or to participate in any particular trading strategy. The value of and income from your investments may vary

because of changes in interest rates, foreign exchange rates, default rates, prepayment rates, securities/instruments prices, market indexes, operational or financial conditions of

companies or other factors. There may be time limitations on the exercise of options or other rights in securities/instruments transactions. Past performance is not necessarily a guide to

future performance. Estimates of future performance are based on assumptions that may not be realized. If provided, and unless otherwise stated, the closing price on the cover page is

that of the primary exchange for the subject company's securities/instruments.

The fixed income research analysts, strategists or economists principally responsible for the preparation of Morgan Stanley Research have received compensation based upon various

factors, including quality, accuracy and value of research, firm profitability or revenues (which include fixed income trading and capital markets profitability or revenues), client feedback

and competitive factors. Fixed Income Research analysts', strategists' or economists' compensation is not linked to investment banking or capital markets transactions performed by

Morgan Stanley or the profitability or revenues of particular trading desks.

The "Important US Regulatory Disclosures on Subject Companies" section in Morgan Stanley Research lists all companies mentioned where Morgan Stanley owns 1% or more of a class

of common equity securities of the companies. For all other companies mentioned in Morgan Stanley Research, Morgan Stanley may have an investment of less than 1% in

securities/instruments or derivatives of securities/instruments of companies and may trade them in ways different from those discussed in Morgan Stanley Research. Employees of

Morgan Stanley not involved in the preparation of Morgan Stanley Research may have investments in securities/instruments or derivatives of securities/instruments of companies

mentioned and may trade them in ways different from those discussed in Morgan Stanley Research. Derivatives may be issued by Morgan Stanley or associated persons.

50

MORGAN STANLEY RESEARCH

Australia Macro+: Out of Sync and Out of Time?

February 19, 2015

Disclosure section (cont.)

With the exception of information regarding Morgan Stanley, Morgan Stanley Research is based on public information. Morgan Stanley makes every effort to use reliable, comprehensive

information, but we make no representation that it is accurate or complete. We have no obligation to tell you when opinions or information in Morgan Stanley Research change apart from

when we intend to discontinue equity research coverage of a subject company. Facts and views presented in Morgan Stanley Research have not been reviewed by, and may not reflect

information known to, professionals in other Morgan Stanley business areas, including investment banking personnel.

Morgan Stanley Research personnel may participate in company events such as site visits and are generally prohibited from accepting payment by the company of associated expenses

unless pre-approved by authorized members of Research management.

Morgan Stanley may make investment decisions or take proprietary positions that are inconsistent with the recommendations or views in this report.

To our readers in Taiwan: Information on securities/instruments that trade in Taiwan is distributed by Morgan Stanley Taiwan Limited ("MSTL"). Such information is for your reference only.

The reader should independently evaluate the investment risks and is solely responsible for their investment decisions. Morgan Stanley Research may not be distributed to the public media

or quoted or used by the public media without the express written consent of Morgan Stanley. Information on securities/instruments that do not trade in Taiwan is for informational purposes

only and is not to be construed as a recommendation or a solicitation to trade in such securities/instruments. MSTL may not execute transactions for clients in these securities/instruments.

To our readers in Hong Kong: Information is distributed in Hong Kong by and on behalf of, and is attributable to, Morgan Stanley Asia Limited as part of its regulated activities in Hong Kong.

If you have any queries concerning Morgan Stanley Research, please contact our Hong Kong sales representatives.

Certain information in Morgan Stanley Research was sourced by employees of the Shanghai Representative Office of Morgan Stanley Asia Limited for the use of Morgan Stanley Asia

Limited.

Morgan Stanley is not incorporated under PRC law and the research in relation to this report is conducted outside the PRC. Morgan Stanley Research does not constitute an offer to sell or

the solicitation of an offer to buy any securities in the PRC. PRC investors shall have the relevant qualifications to invest in such securities and shall be responsible for obtaining all relevant

approvals, licenses, verifications and/or registrations from the relevant governmental authorities themselves.

Morgan Stanley Research is disseminated in Brazil by Morgan Stanley C.T.V.M. S.A.; in Japan by Morgan Stanley MUFG Securities Co., Ltd. and, for Commodities related research reports

only, Morgan Stanley Capital Group Japan Co., Ltd; in Hong Kong by Morgan Stanley Asia Limited (which accepts responsibility for its contents) and by Bank Morgan Stanley AG, Hong

Kong Branch; in Singapore by Morgan Stanley Asia (Singapore) Pte. (Registration number 199206298Z) and/or Morgan Stanley Asia (Singapore) Securities Pte Ltd (Registration number

200008434H), regulated by the Monetary Authority of Singapore (which accepts legal responsibility for its contents and should be contacted with respect to any matters arising from, or in

connection with, Morgan Stanley Research) and by Bank Morgan Stanley AG, Singapore Branch (Registration number T11FC0207F); in Australia to "wholesale clients" within the meaning

of the Australian Corporations Act by Morgan Stanley Australia Limited A.B.N. 67 003 734 576, holder of Australian financial services license No. 233742, which accepts responsibility for its

contents; in Australia to "wholesale clients" and "retail clients" within the meaning of the Australian Corporations Act by Morgan Stanley Wealth Management Australia Pty Ltd (A.B.N. 19

009 145 555, holder of Australian financial services license No. 240813, which accepts responsibility for its contents; in Korea by Morgan Stanley & Co International plc, Seoul Branch; in

India by Morgan Stanley India Company Private Limited; in Indonesia by PT Morgan Stanley Asia Indonesia; in Canada by Morgan Stanley Canada Limited, which has approved of and

takes responsibility for its contents in Canada; in Germany by Morgan Stanley Bank AG, Frankfurt am Main and Morgan Stanley Private Wealth Management Limited, Niederlassung

Deutschland, regulated by Bundesanstalt fuer Finanzdienstleistungsaufsicht (BaFin); in Spain by Morgan Stanley, S.V., S.A., a Morgan Stanley group company, which is supervised by the

Spanish Securities Markets Commission (CNMV) and states that Morgan Stanley Research has been written and distributed in accordance with the rules of conduct applicable to financial

research as established under Spanish regulations; in the US by Morgan Stanley & Co. LLC, which accepts responsibility for its contents. Morgan Stanley & Co. International plc, authorized

by the Prudential Regulatory Authority and regulated by the Financial Conduct Authority and the Prudential Regulatory Authority, disseminates in the UK research that it has prepared, and

approves solely for the purposes of section 21 of the Financial Services and Markets Act 2000, research which has been prepared by any of its affiliates. Morgan Stanley Private Wealth

Management Limited, authorized and regulated by the Financial Conduct Authority, also disseminates Morgan Stanley Research in the UK. Private UK investors should obtain the advice of

their Morgan Stanley & Co. International plc or Morgan Stanley Private Wealth Management representative about the investments concerned. RMB Morgan Stanley (Proprietary) Limited is

a member of the JSE Limited and regulated by the Financial Services Board in South Africa. RMB Morgan Stanley (Proprietary) Limited is a joint venture owned equally by Morgan Stanley

International Holdings Inc. and RMB Investment Advisory (Proprietary) Limited, which is wholly owned by FirstRand Limited.

The information in Morgan Stanley Research is being communicated by Morgan Stanley & Co. International plc (DIFC Branch), regulated by the Dubai Financial Services Authority (the

DFSA), and is directed at Professional Clients only, as defined by the DFSA. The financial products or financial services to which this research relates will only be made available to a

customer who we are satisfied meets the regulatory criteria to be a Professional Client.

The information in Morgan Stanley Research is being communicated by Morgan Stanley & Co. International plc (QFC Branch), regulated by the Qatar Financial Centre Regulatory Authority

(the QFCRA), and is directed at business customers and market counterparties only and is not intended for Retail Customers as defined by the QFCRA.

51

MORGAN STANLEY RESEARCH