Accounting for Short Sale

advertisement

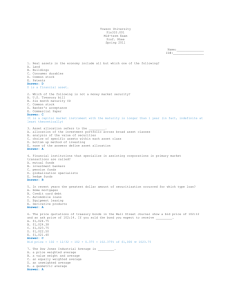

Hedge Fund Accounting Student Manual Copyright © 2011 BNY Mellon Alternative Investment Servicing All material contained herein is confidential and proprietary. Do not reproduce or distribute to any third party without written consent from BNY Mellon. Data as of 07/01/2010 Short Sales A Short Sale is when a Fund sells a security which it does not actually own. How does that work? The Fund borrows the security, which it perceives to be over-priced, from a broker and sells it immediately on the market. Eg. Fyffes shares are currently trading at €18.50. Based on his experience, the Fund Manager knows that this price can’t be maintained. He approaches a broker and borrows 1,000 shares and immediately sells them out on the market. The proceeds of this sale are €18,500. As anticipated the price falls to €14.25. At this stage the Fund Manager buys 1,000 shares which will cost him €14,250. he immediately pays back the broker Therefore cost Sales proceeds Gain 14,250 18,500 4,250 Short sales can occur on numerous instruments, including stocks, bonds, debentures, warrants and commodity futures. The focus of this chapter will be in relation to equity short sales. With equities, the Fund will not only be required to return the security to the broker; it will also have to repay any dividend income that was earned on the security during the short sale. This will be dealt with at a later point. Jargon Uptick Exchange rules permit short sales only after an “uptick” which means they an only be executed when the last recorded change in the stock price is positive. Long buying Short Selling Cover when you buy back the underlying security, you are said to have covered your position. When the Fund purchases the security, it must immediately return it to the broker from whom the security was originally borrowed Against the box A situation where the Fund holds a security of identical property, but does not intend to deliver such property to cover the short sale - the Fund is permitted to deliver a security of identical property that it holds to cover the short sale. Rebate Fee Interest earned on the cash (short sale proceeds) held in the segregated accounts The rebate fee may be equivalent to all or some portion of this interest. Repaid to the fund by the broker/custodian Sale proceeds The proceeds of the short sale must be held by the broker, so that the Fund cannot invest the proceeds to generate income for the Fund. Obligations to the Broker Lending the Security for the Short Sale Any income earned by the investment sold short must be returned to the broker. If the broker requires that the shares of the security be returned, the Fund must do so, by purchasing the shares on the open market at whatever the prevailing price is, which may even result in a realised loss for the Fund. Strategy The Fund intends to sell high and repurchase low. Short sale Traditional The diagram below compares the strategy of short selling to the traditional long strategy. Margin Requirements Initial Margin Generally 50% (as per SEC requirement) of the total trade value has to be deposited with the custodian. The initial margin has to be at least to the value of $2,000 – so if 50% of your trade is less than this then you must deposit $2k. (exchange rulings) Once the short sale is covered, i.e once you buy the underlying stock and return it to the broker you lent it off,all margin moneys are returned to the Fund. The margin is simply a “good-faith” deposit, provided as protection to the broker, in the event that the Fund defaults on its obligation to return the security. Maintaining the margin Each contract entered into will also incorporate a maintenance requirement. As the market value of the security increases, the Fund may be required to deposit additional funds. This is so that the margin money does not fall below the maintenance requirement – and the fund will receive a “margin call”. Example of the Margin Requirement A Fund has executed a short sale on 1,000 MSFT shares at a price of $102 per share, giving sales proceeds of $102,000. It has deposited 50% of the market value in a segregated account with its custodian $51,000. The Maintenance Requirement on this account has been set at 30% To calculate the MSFT price at which the Fund receives a “Margin Call”, follow the working:The total equity in the segreagated account is currently $153,000, from which the cost of purchasing the 1,000 shares must be deducted (refer to as 1,000 X). Therefore, $153,000 – 1,000 X / 1,000 X = 0.30 $153,000 – 1,000 X = 300 X $153,000 = 1,300 X $117.69 = X Therefore, if the price of MSFT were to rise above $117.69, the Fund would receive a margin call and would be required to deposit additional funds to re-establish the 30% margin requirement. The following diagram summarises the cash flows involved in a short sale transaction: The diagram shows all of the cash-flows from the Fund to the broker and the custodian (represented by ). When the short sale is covered, and all obligations have been fulfilled by the Fund, the diagram shows the cash flows that the Fund receives back (represented by ). It is the responsibility of the Fund Advisor to instruct the custodian to close the short position, return the margin deposit and deliver the security. Dividends The Fund must pass on any dividends that have gone ex during the period that the short sale is open. These dividends will be recorded as an expense payable on the books of the Fund, and not as an income receivable. As we do not own the equities, we cannot claim any income earned on them. For example, the Fund has executed a short sale on 200 IBM shares. Notification is received that an IBM dividend is going ex today, with a dividend rate of 2.5 per share. The accounting entry required will be as follows, and will be recorded on ex-date: DR CR Dividend Expense Dividend Expense Payable (C) (L) 500 500 The dividend income will be paid to the broker who leant the Fund the 200 shares of IBM, on the date when the contract is covered. Accounting Treatments for Short Sales Example The “Global Equity Fund” enters a short sale of AOL shares, with the following details: Security: Sedol: Shares: Price: Principal: AOL 00184A105 1,000 $58.00 $58,000.00 SEC Fee: Commission: Total Receivable: $32.00 $100.00 $57,868.00 Broker: JP Morgan Opening entries DR Investment sold unsettled CR Investment at Cost (A) (A) 57,868 57,868 (A) (A) 28,934 28,934 Initial margin entries (50% of value) DR Margin Receivable CR Cash Appreciation/ Depreciation The security sold short will then be valued daily and unrealised appreciation or depreciation is recorded. If the price of AOL rises to $63.00, the following entry will be made: Cost to cover contract Sale proceeds Therefore loss DR 1,000 * $63 = = = $63,000 $57.868 $ 5,132 Unrealised Price Gain/Loss Shorts (C) CR Unrealised Price Gain/ Loss Shorts (A) 5,132 5,132 If the price of AOL falls to $50.00, the following entry will be made: Cost to cover contract Sale proceeds Therefore gain DR 1,000 * $50 = = = 7,868+5,132 To show right position $50,000 $57.868 $ 7,868 Unrealised Price Gain/Loss Shorts (A) CR Unrealised Price Gain/ Loss Shorts (C) 13,000 13,000 If a dividend goes ex on AOL with a rate of 4.50, the following entry will be made on exdate: DR Dividend Expense CR Dividend Expense Payable (C) (L) 4,500 4,500 Closing out the position If the Fund were then to close out the position, by purchasing 1,000 shares of AOL at a price of $56.00 pre share, the following entries would be needed: Cost to cover contract Sale proceeds Therefore gain DR 1,000 * $56 = = = Investment at Cost CR Investments Purchased Unsettled CR Realised Capital Gain Shorts $56,000 $57.868 $ 1,868 (A) (L) (C) 57,868 56,000 1,868 The unrealised entries must also be backed out, as the gain is realised. Let us assume that the prior price was $50.00 DR Unrealised Price Gain/Loss Shorts (C) CR Unrealised Price Gain/ Loss Shorts (A) 7,868 7,868 Settlement date entries When the moneys are moved, the following entries will be needed to clear the transaction from the books of the Fund, leaving only the realised capital gain: DR DR DR CR CR Cash Dividend Expense Payable Investment Purchased Unsettled Investment Sold Unsettled Margin Receivable (A) (L) (L) (A) (A) 26,302 4,500 56,000 57,868 28,934 Explanation of entries a. the balance of all the cashflows explained below. We would only see this amount coming in from the broker/ custodian. b. Dividend that went ex during the period is now being paid out to the true owner of the equities c. Today we are paying for the securities that we purchased to cover our position d. Today we are receiving in the proceeds of the short sale e. Today, as we have not defaulted on our contract, we receive back into the fund the initial margin that we paid out at the beginning of the contract.