On the Horizon

April 10, 2012

Current practice issue

Jumpstart Our Business Startups Act

GASB issues two new standards

OCC releases guidance on troubled debt restructurings

Current practice issue

Accounting for tenant allowances

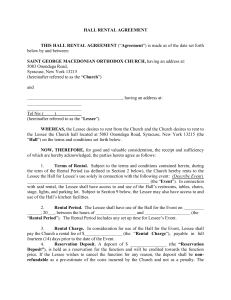

Questions often arise as to how a lessee should account for proceeds

derived from incentives or allowances that are frequently offered by lessors

in many leasing contracts. The correct accounting for these amounts

depends on how the lessee uses the proceeds.

If a cash allowance is used to pay moving costs, for example, the allowance

is accounted for as an incentive, recorded as a deferred credit, and included

in the determination of straight-line rental expense. If the allowance relates

to lessee construction of leasehold improvements, however, it may not

qualify as an incentive and would require additional analysis.

In all situations, the first consideration is whether the lessee will own the

leasehold improvements. If so, the allowance would be accounted for as an

incentive, and the lessee would record the improvements and related

depreciation over the shorter of either their useful life or the lease term.

© 2011 Grant Thornton LLP. All rights reserved. This Grant Thornton LLP On the Horizon provides information and comments on current accounting issues and developments. It is not a

comprehensive analysis of the subject matter covered and is not intended to provide accounting or other conclusions with respect to the matters addressed in this issue. All relevant facts and

circumstances, including the pertinent authoritative literature, need to be considered to arrive at accounting that complies with matters addressed in this publication. For additional information on

topics covered in this publication, contact a Grant Thornton client-service partner.

On the Horizon April 10, 2012

If it will not own the leasehold improvements, then the lessee would need to

evaluate whether it is involved with the construction of the leasehold

improvements. The lessee’s involvement could take many forms, but the two

most common forms are to be (1) primarily obligated under the construction

contract, or (2) responsible for cost overruns. The test to determine whether the

lessee is involved in construction is complicated and often leads to a conclusion

that the lessee is involved and is the deemed owner of the improvements during

the construction period. If the lessee is not involved in construction, the activity

is usually managed and financed by the lessor, and there is no accounting

impact on the lessee’s books.

If it is involved in the construction of the leasehold improvements, then the

lessee would account for the leasehold improvements as owned assets during

the construction period. When the assets are placed into service, the lessee

would analyze whether the assets can be derecognized using the accounting

rules for a sale-and-leaseback arrangement. If the transaction qualifies for saleand-leaseback accounting, it would then be evaluated to determine whether it

should be accounted for as an operating lease or a capital lease in the usual way.

But if the transaction fails to qualify for sale-and-leaseback accounting, the

improvements would remain on the lessee’s books, and the transaction would

be accounted for as a financing.

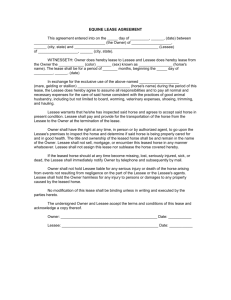

Real estate lease

Construction

allowance?

Yes

Yes

Lessee owns

improvements?

Record allowance as an

incentive and amortize

over the lease term

No

No

Lessee involvement

in construction?

Record allowance as a

cost reimbursement

The following flowchart summarizes this decision-making process.

Yes

Sale-and-leaseback

accounting

2

On the Horizon April 10, 2012

Jumpstart Our Business Startups Act

JOBS Act signed into law

On April 5, President Obama signed the Jumpstart Our Business Startups

(JOBS) Act into law. The JOBS Act is intended to foster job creation and

economic growth by assisting smaller companies in accessing the capital

markets.

The JOBS Act creates a new category of issuers called “emerging growth

companies” (EGCs). An EGC is generally an issuer with annual gross revenues

of less than $1 billion during its most recently completed fiscal year. However,

an issuer cannot qualify as an EGC if its first sale of equity securities pursuant

to an effective registration statement occurred on or before December 8, 2011.

An EGC is afforded certain reduced regulatory and disclosure requirements for

up to a maximum of five years following its equity initial public offering (IPO).

Certain of those accommodations are available only in connection with an IPO

registration statement, and others extend to other registration statements or to

periodic or other reports. Certain of the accommodations available to an EGC

include

Providing only two years of audited financial statements in its equity IPO

registration statement

Excluding selected financial data for any period prior to the earliest audited

period included in its equity IPO registration statement

Complying with any new or revised accounting standards when they

become effective for companies that are not issuers

Scaling executive compensation disclosures to the level provided by smaller

reporting companies

Submitting draft equity IPO registration statements for confidential review

by the SEC staff prior to public filing

Providing temporary exemption from

Section 404(b) of the Sarbanes Oxley-Act, which requires auditor

attestation regarding a company’s internal control over financial

reporting

Any future PCAOB rules, if adopted, requiring mandatory audit

firm rotation or supplements to the auditor’s report

Certain current and future executive compensation–related

disclosures

An issuer continues to maintain its EGC status until the earliest of (1) the

last day of the fiscal year in which it had total annual gross revenues of $1

billion or more, (2) the last day of the fiscal year following the fifth

anniversary of its equity IPO, (3) the date on which it has, during the

previous three-year period, issued more than $1 billion in non-convertible

debt or, (4) the date on which it becomes a “large accelerated filer.”

Other provisions of the JOBS Act that are not limited to EGCs include

increasing the Regulation A offering threshold from $5 million to $50

million and raising the Securities Exchange Act of 1934 Section 12(g)

registration threshold from 500 to 2,000 shareholders with certain nonaccredited investor limitations for issuers that are not banks and bank

holding companies.

CorpFin sets procedure for confidential submission of draft

registration statements for EGCs

The staff of the SEC’s Division of Corporation Finance (CorpFin)

announced that until a system for electronic submission of confidential

filings of EGCs is in place, the confidential filings should be submitted

either in text-searchable PDF format on a CD/DVD or in paper form. This

requirement applies whether the issuer is a domestic company or foreign

private issuer. CorpFin will then contact the issuer to confirm receipt and to

3

On the Horizon April 10, 2012

notify it of the review office to which the registration statement was assigned.

GASB issues two new standards

The Governmental Accounting Standards Board (GASB) recently published the

following two accounting standards:

Statement 65, Items Previously Reported as Assets and Liabilities, which clarifies

the presentation of deferred outflows of resources and deferred inflows of

resources

Statement 66, Technical Corrections – 2012 – an amendment of GASB Statements

No. 10 and No. 62, which eliminates inconsistencies in previously issued

standards

OCC releases guidance on troubled debt restructurings

The Office of the Comptroller of the Currency (OCC) recently released

OCC 2012-10, “Troubled Debt Restructurings,” to address numerous

queries received from bankers and examiners on the accounting and

reporting for troubled debt restructurings (TDRs), especially for loan

renewals and extensions of substandard commercial loans.

OCC 2012-10 reviews the authoritative guidance on identifying a TDR,

including the changes codified in Accounting Standards Update 2011-02, A

Creditor’s Determination of Whether a Restructuring is a Troubled Debt Restructuring.

It also discusses how to account for the loan after it has been identified as a

TDR.

Both of these Statements are effective for reporting periods beginning after

December 15, 2012. In both cases, early adoption is permitted.

4