2014 Annual Report - Alliant Credit Union

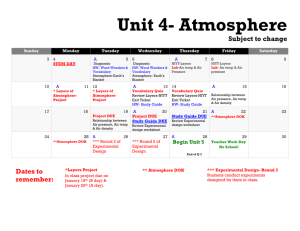

advertisement

2014 Annual Report Growth at a Glance $96.2 Million in Assets 499 New Members 10.72% Net Worth 89.57% Loans:Savings CHAIRMAN’S REPORT Your Credit Union has had another successful year of serving members with great products and services. As of January 1st, we were happy to welcome our newest members from the former Three I Credit Union. With this merge we have added a full-service branch to accommodate our Southern Iowa members in the Burlington, Iowa area. In addition, former Three I members will now have many more services available to them to meet their financial needs. In 2014, members used our loan and savings products at a record Jack Schumacher pace. As we move into 2015, I hope you will continue to spread the Board Chairman word to your family and co-workers that Alliant Credit Union and Health Services Credit Union are great credit unions to be members of. I would like you to know that your board of directors works diligently to protect and serve your financial needs. I express my sincere thanks to you for continuing to make us your trusted financial home. We hope to exceed your expectations now and well into the future. PRESIDENT/CEO’S REPORT Alliant Credit Union (ACU) experienced another very positive year in 2014 and continues to build for the future. ACU ended the year with consolidated assets over $96 million. Our lending programs were a great benefit to the members as shown by our 89.57% loans to shares ratio. Net worth rose to 10.72% and we ended the year with a Return on Assets of 0.69%. 2014 was very positive and the ratio’s confirm your credit union is headed in the right direction. The future is indeed bright at ACU. Our staff and volunteer Board of Directors continually look for new products and services that will benefit membership. One such example of this commitment to you was the introduction of our student consolidation loan program. Alliant Credit Union is in the forefront by offering our Unified Student Consolidation Loan with our partner Aspire (formerly named Iowa Student Loan). This is a wonderful program for former college students to consolidate their loans into one easy, affordable payment. If you know of a family member or co-worker who could benefit by this program, have them contact the credit union. In the Fall, we were pleased to announce the merger of Three I Credit Union in Burlington, Iowa to Alliant Credit Union. On January Mike Moroney 1st of this year, we successfully completed the merge. Not only does President/CEO this give us greater economies of scale, but it also gives our Southern Iowa members easier access to the credit union. We welcome Vince Copeland and Diane Lee to ACU’s Board from the former Three I Board. I would be remiss if I did not acknowledge the staff at Alliant Credit Union. Having just gone through a merge over the holiday season, I was very pleased to see how they stepped up to the challenge. I was very proud to see them in action working to ensure a successful merge. Weekends and holidays were no match for this dedicated crew. I conclude my report thanking you for your ownership in Alliant Credit Union. I am confident that our future is bright by the membership we serve. Not only are you using your credit union for your financial needs, but you are spreading the word about the great things your credit union can do to help your co-workers and families. Together, we can accomplish great things. BALANCE SHEETS As of December 31, Assets 2014 2013 2012 Consumer Loans ............................. $ 31,431,128 $ 31,154,412 $ 29,722,781 Mortgage Loans .............................. 43,908,136 39,309,875 35,172,655 Allowance for Loan Loss ................. (376,526) (383,789) (352,952) Cash in Bank ................................... 1,414,369 1,422,218 1,645,100 Investments - Held to Maturity........ 10,703,326 16,670,551 19,820,575 Accrued Interest .............................. 283,20 236,781 190,375 Fixed Assets (Less Depreciation) .... 2,416,333 2,507,472 2,406,799 CUSO Investments.......................... 839,370 858,124 875,384 NCUSIF ........................................... 842,450 838,982 822,225 Other Assets.................................... 4,360,551 2,328,187 858,073 Total Assets ............................................ $95,822,337 $94,942,813 $91,161,015 Liabilities and Members’ Equity Member Savings ............................. $ Other Liabilities & Accrued Expense Statutory Reserve............................ Undivided Earnings ......................... 83,776,636 $ 85,134,638 $ 81,937,479 1,776,476 199,435 219,913 4,156,137 3,956,137 3,656,137 6,113,088 5,652,603 5,347,486 Total Liabilities & Equity ....................... $ 95,822,337 Number of Members ............................ 9,429 $ 94,942,813 $ 91,161,015 9,560 9,343 STATEMENTS OF INCOME As of December 31, Income & Expense 2014 Interest Income Interest from Loans ......................... $ 3,270,976 Interest from Investments ............... 122,114 2013 2012 $ 3,293,697 $ 3,322,106 170,050 209,730 Total Interest Income .................... 3,393,090 3,463,747 3,531,836 Less Interest and Dividend Expense .. 513,608 602,766 777,188 Less Provision for Loan Loss.............. Net Interest Income After Provision for Loan Loss ................ 246,705 230,633 266,800 2,632,777 2,630,348 2,487,848 Non-Interest Income ........................... 1,137,985 1,059,286 1,348,921 Less Operating Expenses ................... Less NCUSIF Premium/Stabilization Expense .............................................. 3,110,278 3,017,397 2,823,578 - 67,119 78,111 Net Income..................................... 660,484 605,118 935,080 Transfer to Reserves ........................... - - - Transfer to Undivided Earnings........... $ 660,484 $ 605,118 $ 935,080 GROWTH As of December 31, Amount of Description Increase Assets $ 879,524 Total Savings ($1,358,002) Total Loans $4,874,977 Total for Percent of 2014 Growth $95,822,337 0.93% $83,776,636 -1.60% $75,339,264 6.92% Total for 2013 $94,942,813 $85,134,638 $70,464,287 Millions 100 90 80 70 60 50 0 2010 TOTAL LOANS 2011 2012 TOTAL SAVINGS 2013 2014 TOTAL ASSETS Annual Meeting Minutes The 81st annual membership meeting was held at The Diamond Jo Casino, Dubuque, Iowa, on Saturday, March 29, 2014. There were 143 members and guests in attendance, with one board member, Jim Hodgson not present. Jack Schumacher, Chairman, called the meeting to order at 5:41 p.m., welcoming everyone to the annual meeting on behalf of the board and staff. Jack announced the winners of the Credit Union’s essay scholarship contest and thanked Carla Decker, Denice Habel, Bruce Main, Beth McMullen, and Lynn Vogt for grading the essays. Each winner listed below will receive a $500 scholarship. 5PJOVSHZ1VOUZVU 2YPZ[LU:H]HY` A drawing was held for three additional $500 scholarships and awarded to: (UKYL^)YVVRZ (\Z[PU3L^PZ 3PII`:JOUVVY The drawing for door prizes was held and listed below are the winners: )HYI:JOHPISL 2H[OSLLU@HUUH +VU)YHUKLS 7LNN`2LUULK` 9VK*OYPZ[ )L[[`;OPSS 1VL2VJO Jack introduced the current board of directors and members-at-large: Ed Barud, Jeff ,KK`:HUK`,]LU)LJR`1LURPUZ1VL2\ILZOLZRP2H[O`4PSSLY4PRL4VYVUL`1HJR Schumacher, Vince Schuster, Shelley Spicer and Board Emeritus Jean Hoeger. Board member Jim Hodgson was excused. 1HJRYLJVNUPaLK[OL5VTPUH[PVU*VTTP[[LLHUKPU[YVK\JLK;LYY`2V\IH;LYY`[OHURLK everyone for attending and reviewed the ballot for candidates that will be elected to the board for a term of three years. Terry introduced the nominees: Michelle Arenson, Jeff ,KK`4PJOLSSL:OLSS`-P[aNLYHSK4PRL4VYVUL`2H[O`4PSSLYHUK.HY`:OHYW4LTILYZ were asked to vote for four candidates listed on the ballot. The votes are to be tallied and will be announced later in the meeting. 7YLZPKLU[4PRL4VYVUL`WYLZLU[LK[OLÄUHUJPHSYLWVY[OPNOSPNO[PUN[OH[(*< assets are $94.9 million, loan growth of 8.58% and a net worth ratio of 10.12%. We welcomed 582 new members to the credit union. Mr. Moroney thanked the staff for another great year. Mike Moroney also thanked Ed Barud for his service to ACU. Ed is retiring from the board after 36 years. Ed joined the credit union in 1966. Ed thanked the board and the credit union for 36 pleasurable years. Jack referred members to the annual report. Loren Heber motioned to approve the minutes from the 2013 annual meeting. This was seconded by Char Eddy. All in favor, motion carried. 4HY[`+LJRLYTV[PVULK[VHWWYV]L[OLÄUHUJPHSZ[H[LTLU[Z;OPZ^HZZLJVUKLK by Roger Vogt. All in favor, motion carried. 1HJRYLJVNUPaLK[OL5VTPUH[PVU*VTTP[[LL2H[O`9VILY[Z3`UU>HLSJOSPHUK;LYY` 2V\IHHUKHZRLK[OL,SLJ[PVU*VTTP[[LL[VZ[HUK!*OHPY1LHU5HJO[THUJVTTP[[LL members Chuck Nachtman, Steve & Janell Stoffell. The election committee collected and tallied the votes. The following were elected to the board: 1LMM,KK` 4PRL4VYVUL` 4PJOLSSL:OLSS`-P[aNLYHSK 2H[O`4PSSLY The meeting adjourned at 6:01 p.m. Respectfully submitted, Becky Jenkins, Secretary CREDIT COMMITTEE REPORT ([`LHY»ZLUK+LJLTILY[OLSVHUVMÄJLYZHUKJYLKP[JVTTP[[LLWYVJLZZLK 1,977 loans for $35,177,288. This includes 174 mortgage loans, including advances, for $16,323,882. @V\YJYLKP[\UPVUJHUTLL[HSSVM`V\YÄUHUJPHSULLKZ=PZP[V\Y^LIZP[LVYJHSSHU`VMV\Y VMÄJLZMVYSVHUHWWSPJH[PVUZYH[LZHUK[LYTZ>OLU`V\KVI\ZPULZZ^P[O`V\YJYLKP[\UPVU you are doing business with an organization in which you have a vested interest. The credit committee would like to commend the staff for their dedication and service to the membership. @V\YJYLKP[\UPVUSVVRZMVY^HYK[VZLY]PUN`V\PU Sandy Even, Chair Joseph Kubesheski Shelly Spicer Shelley Fitzgerald AUDIT COMMITTEE REPORT 0UV\YVWPUPVU[OLÄUHUJPHSZ[H[LTLU[ZHJJ\YH[LS`YLÅLJ[[OLÄUHUJPHSJVUKP[PVUVM Alliant Credit Union as of December 31, 2014, and were in accordance with generally accepted accounting principles. 0[PZV\YVWPUPVU[OH[[OLJYLKP[\UPVUPZVWLYH[LKPUHULMÄJPLU[HUKWYVMLZZPVUHSTHUULY HZ[OLJYLKP[\UPVUJVU[PU\LZZ[YVUNÄUHUJPHSWLYMVYTHUJL Jim Hodgson, Chair Kathy Miller Jeff Eddy ACU wishes to thank the board of directors for their ongoing support, dedication, and contributions. Vince Copeland Jeff Eddy Sandy Even Shelly Fitzgerald James Hodgson Becky Jenkins Joe Kubesheski Diane Lee Kathy Miller Mike Moroney Jack Schumacher Vince Schuster Shelly Spicer www.alliantcu.com