CCH brings you...

CHAPTER 1: Introduction to Attestation Engagements

From the

Attestation Guide, 2009

Visit CCHGroup.com/AASolutions for an overview of our complete set of Accounting and Auditing solutions.

To learn more about this book, or to make a purchase, visit CCHGroup.com

Vist CCHGroup.com/Books to browse the CCH online bookstore.

©2010 CCH. All Rights Reserved.

CHAPTER 1

INTRODUCTION TO ATTESTATION

ENGAGEMENTS

CONTENTS

Introduction

Assurance Services

1.02

1.03

Assurance Services over Historical Financial Statements

Audits

Reviews

Compilations

Assurance Services over Information Other

Than Historical Financial Statements

Attestation Engagements

Other Assurance Services

Nonassurance Services

1.03

1.04

1.04

1.04

1.05

1.05

1.06

1.08

Consulting Services

Exhibit 1-1: Consulting Services Terminology and

Standards

1.12

Tax Services

Valuation Services

1.13

1.14

Personal Financial Planning Services

Attestation Engagements

Exhibit 1-2: Attestation Engagement Standards

Objective of Attestation Engagements

Elements of Attestation Engagements

1.09

1.15

1.16

1.17

1.19

1.20

Three-Party Relationship

Subject Matter Information

Suitable Criteria

Level of Assurance

1.21

1.22

1.23

1.25

Sufficient Appropriate Evidence

Written Report

Exhibit 1-3: Elements of an Example

Attestation Engagement

1.27

1.28

1.01

1.30

1.02 Introduction to Attestation Engagements

Distinguishing Attestation Engagements

from Other Engagements

Nature of the Subject Matter Information

Primary Beneficiaries of the Service

Ethics and Quality Control Considerations in Attestation

Engagements

Ethics Considerations

Quality Control Considerations

1.31

1.31

1.32

1.33

1.33

1.35

INTRODUCTION

Certified public accountants provide a variety of services that can be

categorized, in broad terms, as either (1) assurance services or

(2) nonassurance services. While certain standard-setting bodies

classify CPA services somewhat differently between these two

broad categories, the services provided by CPAs generally can be

classified as follows:

1.

Assurance services

• Over historical financial statements:

— Audits

— Reviews

— Compilations

•

2.

Over other financial and nonfinancial information:

— Attestation engagements

— Other assurance services

Nonassurance services

• Consulting services

• Tax services

• Valuation services

•

Personal financial planning

OBSERVATION: While the AICPA, PCAOB, and the GAO

define agreed-upon procedures and compilation engagements as an “assurance” service, in its International Framework for Assurance Engagements, the IFAC excludes these

two types of services from its definition of “assurance”

engagements. The IFAC framework defines agreed-upon

procedures engagements and compilations of financial or

Introduction to Attestation Engagements

1.03

other information as “related services” covered by their International Standards for Related Services.

NOTE: For the purposes of this book, agreed-upon procedures engagements and compilation engagements are classified as a form of assurance services.

This guide is narrowly focused on providing the practitioner

with interpretive guidance dealing with attestation engagements,

which for the purposes of this book will be considered a type of

assurance service. This guidance will assist the practitioner in identifying potential attestation engagements, determining the applicable standards for such engagements, and planning, performing,

and reporting on such engagements.

ASSURANCE SERVICES

The AICPA defines “assurance services” as follows:

Assurance services are independent professional services that improve the quality of information, or its context, for decision makers.

The IFAC defines an “assurance engagement” as follows:

Assurance engagement means an engagement in which a

practitioner expresses a conclusion designed to enhance

the degree of confidence of the intended users other than

the responsible party about the outcome of the evaluation

or measurement of a subject matter against criteria.

Using either of these definitions, “assurance services or engagements” can be described as services that enhance the quality, context,

or usefulness of information for the benefit of intended users or decision

makers. These services can involve financial or nonfinancial information. The information may be internal or external to the user and

might involve discrete data or entire systems.

Assurance Services over Historical Financial Statements

The most commonly known assurance services provided by certified

public accountants have been assurance over historical financial

statements in the form of (1) audits, (2) reviews, or (3) compilations.

1.04 Introduction to Attestation Engagements

Audits

Audits of historical financial statements are designed to provide

financial statement users with a high-level of assurance over the fair

presentation of the audited financial statements. In an audit, the

practitioner performs tests of financial statement assertions to form

an opinion (positive assurance) on the financial statements taken as

a whole. The objective of an audit is to provide a reasonable basis

for expressing an opinion as to whether the financial statements are

fairly presented in accordance with generally accepted accounting

principles (or an other comprehensive basis of accounting).

Reviews

In a review service over historical financial statements, the practitioner performs inquiries and analytical procedures on the financial

statement data to provide him with a reasonable basis for expressing limited assurance on the financial statements. The objective in a

review is to provide a reasonable basis for stating that there are no

material modifications that should be made to the financial statements in order for them to be in conformity with generally accepted

accountingprinciples(oranothercomprehensivebasisofaccounting).

Compilations

In a compilation service related to financial statements, the practitioner presents in the form of financial statements information that

is the representation of management, without undertaking to

express any assurance on the financial statements.

OBSERVATION: As previously noted, while the IFAC international standards do not classify compilations as an “assurance service,” the AICPA and PCAOB do consider it an

assurance service. Within the context of the AICPA definition

of an assurance service, compilations are viewed as services

that improve the quality of information, or its context, for

decision makers. Therefore, although compilations reports

express no form of explicit assurance over the financial information compiled, there exists implied improvement in the

quality of management’s information through the practitioner’s correction of any obvious misstatements in the compilation process.

Introduction to Attestation Engagements

1.05

PRACTICE POINTER: In terms of the AICPA professional

standards, compilations of historical financial information are

considered an assurance service subject to their Standards

for Accounting and Review Services (SSARs). However,

compilations of prospective financial statements are considered an assurance service subject to the Statements on

Standards for Attestation Engagements (SSAEs). This is the

only type of compilation considered an attestation engagement subject to attestation standards.

Assurance Services over Information Other than Historical

Financial Statements

While traditionally, assurance services provided by practitioners

have been concentrated on providing audits, reviews, or compilations of historical financial statements, today’s business environment is marked by increased competition and the need for quicker

and better information for decisions. In addition, the complexity of

systems and the anonymity of the Internet present barriers to

growth. Businesses and their customers need independent assurance that the information that decisions are based on is reliable. By

virtue of their training, experience, and reputation for integrity,

professional accountants are the logical choice to provide this assurance. Attestation engagements and other assurances service engagements are designed to meet this dynamic need for assurance.

Attestation Engagements

In a broad sense, an attestation engagement is one in which a practitioner, by virtue of issuing a report, provides some level of assurance on information that is the responsibility of another party. The

term attest and its variants, such as attesting and attestation, are used

in a number of state accountancy laws and in regulations issued by

state boards of accountancy under such laws for different purposes

and with different meanings from those intended by the various

professional standards applicable to attestation engagements. In

fact, the traditional financial statement audit is an attest service in

that a practitioner (auditor), by virtue of issuing a report (audit

opinion), provides reasonable assurance (a high-level of positive

assurance) on the subject matter or information (financial statements) that is the responsibility of another party (management) for

the use and benefit of other parties (financial statement users).

However, for practical purposes the “attestation” term has evolved

in the accounting profession to be commonly used to mean an

1.06 Introduction to Attestation Engagements

engagement or service that provides assurance on information other

than historical financial statements.

OBSERVATION: For example, an attestation engagement

would be appropriate to meet requirements contained within

a debt agreement for the debt-issuing entity to obtain an

independent verification of compliance with specific debt

covenant requirements that must be met before new debt

can be incurred. In this example, a practitioner (independent

accountant), by virtue of issuing a report (attestation engagement report), provides assurance (conclusion on compliance) on the subject matter or information (debt covenant

requirements related to new debt issuance) that is the

responsibility of another party (entity management) for the

use and benefit of other parties (current and prospective

investors in the entity’s debt).

An expanded overview of attestation engagements is provided

later in this chapter and such engagements are the subject of the

remaining chapters of this book.

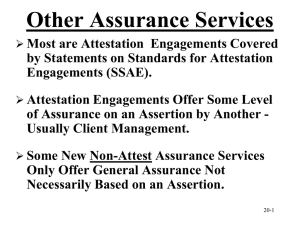

Other Assurance Services

The AICPA Special Committee on Assurance Services was created in

1994 to explore the expansion of assurance services into new areas

beyond the traditional assurances services over historical financial

statements and traditional attest engagements. The AICPA’s movement into developing additional assurance services began with the

1993 Audit/Assurance Conference. The conference had been concerned with the decline in the demand for audits and other attest

services, and the users of assurance services had expressed dissatisfaction with their scope and utility. It analyzed why the audit and

assurance function had come to this juncture and developed a broad

plan for shaping the future of assurance to enhance its value.

The AICPA authorized the Special Committee on Assurance Services to investigate the issues and what could be done to reposition

CPAs for the future. The Committee’s report, The Report of the Special Committee on Assurance Services, was issued in 1997. The report

called for the development of additional services to serve the needs

of clients. The Committee research identified a number of new service opportunities and the AICPA has actively developed the following assurance services:

1.

SysTrust Services As more organizations become dependent

on information technology to run their businesses, produce

Introduction to Attestation Engagements

1.07

products and services, and communicate with customers and

business partners, it is critical that their systems be secure,

available when needed, and consistently able to produce

accurate information. An unreliable system can trigger a

chain of business events that negatively affect a company and

its customers, suppliers, and business partners. SysTrust

responds to this business need by providing suitable criteria

and a process that enables a CPA to provide assurance that a

system is, in fact, reliable.

2.

3.

4.

5.

WebTrust Services During a WebTrust engagement, the practitioner “audits” a company’s online business practices to

verify compliance matters such as privacy, security, availability, confidentiality, consumer redress for complaints, and

business practices. WebTrust provides suitable criteria for

practitioners as well as a licensing process that enables CPAs

to provide assurance on Web sites.

ElderCare Services The Committee defines ElderCare Services as a service designed to provide assurance to family

members that care goals are achieved for elderly family

members no longer able to be totally independent. The service relies on the expertise of other professionals, with the

CPA serving as the coordinator and assurer of quality of services based on criteria and goals set by the client. The purpose of the service is to provide assurance in a professional,

independent, and objective manner to third parties (children,

family members, or other concerned parties) that the needs of

the elderly person to whom they are attached are being met.

ElderCare Services can involve three kinds of services: direct

services, assurance services, and consulting services. Direct

services entail the more traditional aspects of accounting and

financial services. Assurance services involve the measuring

and reporting on prescribed goals against stated criteria.

Consulting services include planning and evaluation of client needs.

Performance View Services This service enables CPAs to use

the skills they have traditionally used to handle the financial

portion of a client’s business to address the nonfinancial

aspects as well. This service identifies critical success factors

that lead to measures that can be tracked over time. These

measures are then used to assess progress in achieving specific targets linked to an entity’s vision and performance.

Risk Advisory Services The CPA profession has taken a leading role in the field of risk, and firms increasingly include risk

1.08 Introduction to Attestation Engagements

management in the wide range of services they provide to

their clients. Risk Advisory Services provide the CPA with:

a. A common language and framework for understanding

and communicating risk management issues; and

b. A series of practice guides describing tools, techniques,

and training that support the risk management process.

The performance of these types of assurance services may or may

not be subject to the attestation standards, depending on how an

engagement is developed and performed. The attestation standards

apply whenever a CPA is engaged to issue or does issue an examination, review, or agreed-upon procedures report on subject matter

(or an assertion about the subject matter) that is the responsibility

of another party. This definition is engagement-oriented and, therefore, the CPA must take care to define the nature of the services to

be provided and whether they are intended to provide assurance.

NONASSURANCE SERVICES

Typically, nonassurance services provided by CPAs can be categorized into one of the following:

•

•

Consulting services

Tax services

•

•

Valuation services

Personal financial planning

A common characteristic of these nonassurance services is that

the professional accountant’s services are designed to provide technical skills, education, observations, experiences, and knowledge to

subject matter for the direct use and benefit of the client. The services considered necessary are generally determined by agreement

between the client and the practitioner, and the outcome of the work

is not designed to provide any level of assurance to parties outside

the client or responsible party.

OBSERVATION: For example, an engagement to assist the

client’s management in evaluating the effectiveness of the

design and operation of its internal controls over financial

reporting and to make recommendations for improvements in

those controls, would be considered a “nonassurance consulting service” because the engagement is designed to provide technical skills and knowledge (the practitioner’s

Introduction to Attestation Engagements

1.09

expertise) to subject matter (the design and operation of controls) for the direct use and benefit of the client (management).

Examples of professional services typically provided by practitioners that would not be considered an attestation engagement

include:

•

Management consulting engagements whereby the practitioner provides advice or recommendations to a client;

• Engagements to advocate a client’s position (e.g., tax matters

being reviewed by the Internal Revenue Service);

•

•

•

•

•

Tax engagements involving the preparation of tax returns or

providing tax advice;

Compilations or reviews of financial statements;

Engagements in which the practitioner’s role is solely to assist

the client (e.g., acting as the company’s accountant in preparing information other than financial statements);

Engagements to testify as an expert witness in accounting,

auditing, taxation, or other matters; and

Engagements to provide an expert opinion on certain points

of principle, such as the application of tax laws or accounting

standards, given certain stipulated facts provided by another

party as long as the expert opinion does not express a conclusion about the reliability of the facts provided by another

party.

Consulting Services

Consulting services possess fundamental differences from the

engagements to provide assurance over assertions or subject matter

of other responsible parties. In an assurance service (including attestation engagements), the practitioner expresses a conclusion about

the subject matter or the reliability of a written assertion that is the

responsibility of another party. In a consulting service, the practitioner develops the findings, conclusions, and recommendations

based on the objectives of the engagement for the direct use and

benefit of the client. The nature and scope of work is determined

solely by the agreement between the practitioner and the client.

Generally, the work is performed only for the use and benefit of the

client rather than outside parties. The practitioner does not attest to

someone else’s assertion but is the one who develops the final presentation.

1.10 Introduction to Attestation Engagements

In a consulting engagement, the practitioner’s role is to assist the client or, on some occasions, to testify as an expert witness in accounting, auditing, taxation, or other matters, given certain stipulated

facts.

OBSERVATION: Attest Services Related to Consulting Service Engagements

When a practitioner provides an attest service as part of a

consulting service engagement, the attestation standards

apply only to the attest service. Statements on Standards for

Consulting Services apply to the balance of the consulting

service engagement. When the practitioner determines that

an attest service is to be provided as part of a consulting service engagement, the practitioner should:

•

Inform the client of the relevant differences between

the two types of services.

•

Obtain the client’s acknowledgment that the attest

service is to be performed in accordance with the

appropriate professional requirements.

•

Issue separate reports on the attest engagement and

the consulting service engagement. If the report on the

attestation engagement is submitted in the same

document with the report on the consulting service

engagement, it should be clearly identified and segregated from the consulting service engagement.

In terms of the AICPA professional standards, consulting engagements are performed in accordance with Statements on Standards for

Consulting Services (SSCS), and include consultations, advisory services, implementation services, transaction services, staff and other

support services, and product services. An analytical approach and

process is applied in a consulting service and typically involves some

combination of activities relating to determination of client objectives, fact-finding, definition of the problems or opportunities, evaluation of alternatives, formulation of proposed action, results

communication, implementation, and follow-up. Examples of consulting services include:

1.

Consultations, in which the practitioner’s function is to provide counsel in a short time frame, based mostly, if not

entirely, on existing personal knowledge about the client, the

circumstances, the technical matters involved, client representations, and the mutual intent of the parties. Examples of

Introduction to Attestation Engagements

1.11

consultations are reviewing and commenting on a clientprepared business plan and suggesting computer software

for further client investigation.

2.

Advisory services, in which the practitioner’s function is to

develop findings, conclusions, and recommendations for client consideration and decision making. Examples of advisory services are an operational review and improvement

study, analysis of an accounting system, assistance with strategic planning, and definition of requirements for an information system.

3.

Implementation services, in which the practitioner’s function is

to put an action plan into effect. Client personnel and

resources may be pooled with the practitioner’s to accomplish the implementation objectives. The practitioner is

responsible to the client for the conduct and management of

engagement activities. Examples of implementation services

are providing computer system installation and support,

executing steps to improve productivity, and assisting with

the merger of organizations.

Transaction services, in which the practitioner’s function is to

provide services related to a specific client transaction, generally with a third party. Examples of transaction services are

insolvency services, valuation services, preparation of information for obtaining financing, analysis of a potential merger

or acquisition, and litigation services.

4.

5.

6.

Staff and other support services, in which the practitioner’s

function is to provide appropriate staff and possibly other

support to perform tasks specified by the client. The staff provided will be directed by the client as circumstances require.

Examples of staff and other support services are data processing facilities management, computer programming,

bankruptcy trusteeship, and controllership activities.

Product services, in which the practitioner’s function is to provide the client with a product and associated professional

services in support of the installation, use, or maintenance of

the product. Examples of product services are the sale and

delivery of packaged training programs, the sale and implementation of computer software, and the sale and installation of systems development methodologies.

1.12 Introduction to Attestation Engagements

Consulting services do not include:

•

Any of the services described in the AICPA Statements on

Auditing Standards (SAS), Statements on Standards for

Accounting and Review Services (SSARS), or Statements on

Standards for Attestation Standards (SSAE);

•

Engagements specifically to perform tax return preparation,

tax planning/advice, tax representation, personal financial

planning or bookkeeping services;

• Situations involving the preparation of written reports or the

provision of oral advice on the application of accounting

principles to specified transactions or events, either completed or proposed, and the reporting thereof; and

•

Recommendations and comments prepared during the same

engagement as a direct result of observations made while performing the excluded services.

The performance of consulting services for an audit or attest client does not, in and of itself, impair independence of the practitioner. However, members and their firms performing attest

services for a client should comply with applicable independence

standards, rules and regulations issued by AICPA, the state boards

of accountancy, state CPA societies, and other regulatory agencies.

PRACTICE POINTER: Consulting services may be referred

to by different names by the various standard-setting bodies

or organizations. Exhibit 1-1 below provides a summary of

the terminology and professional standards used for consulting services by each standard-setting organization.

EXHIBIT 1-1

CONSULTING SERVICES TERMINOLOGY AND STANDARDS

Organization

Terminology

Applicable Standards

AICPA

Consulting Services

AICPA Statements on Standards

for Consulting Services

PCAOB

Consulting Services

PCAOB Statements on Standards

for Consulting Services

GAO

Non-Audit Services

No Standards Established

Introduction to Attestation Engagements

Organization

Terminology

1.13

Applicable Standards

IFAC

Consulting and

Advisory Services

No Standards Established

IIA

Consulting Services

IIA Attribute and Performance

Standards for Consulting Services

Tax Services

The accounting profession has long been recognized for its services

in the area of taxation. Professional accountants provide a wide

range of tax services, including tax return preparation and compliance, tax planning and research, and technical advice on tax-related

matters.

The AICPA’s Tax Executive Committee has established Statements on Standards for Tax Services (SSTS) that sets forth the ethical tax practice standards for practitioners. Practitioners should

fulfill their responsibilities as professionals by instituting and complying with these standards against which their professional performance can be measured. Compliance with professional standards of

tax practice also confirms the public’s awareness of the professionalism that is associated with professional accountants.

The SSTS ethical standards provide for an appropriate range of

behavior that recognizes the need for interpretations to meet a

broad range of personal and professional situations. The SSTSs have

their origin in the Statements on Responsibilities in Tax Practice

(SRTPs), which provided a body of advisory opinions on good tax

practice. Various interested parties including the courts, Internal

Revenue Service, state accountancy boards, and other professional

organizations had recognized and relied on the SRTPs as the appropriate criteria for defining the requirements of professional conduct

in a professional accountant’s tax practice. Therefore, the SRTPs, in

and of themselves, had become de facto enforceable standards of

professional practice, because state disciplinary organizations and

malpractice cases in effect regularly held CPAs accountable for failure to follow the SRTPs when their professional practice conduct

failed to meet the prescribed guidelines of conduct. Now the SSTSs

have become the ethical tax practice standards for practitioners and

have become a part of the AICPA Code of Professional Conduct.

1.14 Introduction to Attestation Engagements

Valuation Services

Over the years, an increasing number of professional accountants

have begun providing professional valuation services to meet a

growing demand for such services. These services include valuations of businesses, business ownership interests, securities, or

intangible assets that could be performed for a wide variety of purposes including the following:

1.

Transactions or potential transactions, such as acquisitions,

mergers, leveraged buyouts, initial public offerings,

employee stock ownership plans and other share based

plans, partner and shareholder buy-ins or buyouts, and stock

redemptions.

2.

Litigation or pending litigation relating to matters such as marital dissolution, bankruptcy, contractual disputes, owner disputes, dissenting shareholder and minority ownership

oppression cases, and employment and intellectual property

disputes.

3. Compliance-oriented engagements, including (a) financial

reporting and (b) tax matters such as corporate reorganizations; S corporation conversions; income, estate, and gift tax

compliance; purchase price allocations; and charitable contributions.

4.

Planning oriented engagements for income tax, estate tax, gift

tax, mergers and acquisitions, and personal financial planning.

The AICPA Consulting Services Executive Committee is a body

designated by AICPA Council to promulgate technical standards

and has developed Statement on Valuation Services (SSVS) No.1,

“Valuation of a Business, Business Ownership Interest, Security, or

Intangible Asset,” to improve the consistency and quality of practice among AICPA members performing business valuations.

AICPA members performing such services are referred to as valuation analysts, within the standards and are required to follow the

standard when they perform engagements to estimate value that

culminate in the expression of a conclusion of value or a calculated

value. The term “engagement to estimate value” refers to an

engagement or any part of an engagement (e.g., a tax, litigation, or

acquisition-related engagement) that involves estimating the value

of a subject interest. In the process of estimating value as part of an

engagement, the valuation analyst applies valuation approaches

Introduction to Attestation Engagements

1.15

and valuation methods, as described in this Statement, and uses

professional judgment. The use of professional judgment is an

essential component of estimating value.

There are generally two types of valuation services engagements

as follows:

1.

Valuation engagement—A valuation analyst performs a valuation engagement when (1) the engagement calls for the valuation analyst to estimate the value of a subject interest, and

(2) the valuation analyst estimates the value and is free to

apply the valuation approaches and methods he or she

deems appropriate in the circumstances. The valuation analyst expresses the results of the valuation as a conclusion of

value; the conclusion may be either a single amount or a

range.

2.

Calculation engagement—A valuation analyst performs a calculation engagement when (1) the valuation analyst and the

client agree on the valuation approaches and methods the

valuation analyst will use and the extent of procedures the

valuation analyst will perform in the process of calculating

the value of a subject interest (these procedures will be more

limited than those of a valuation engagement), and (2) the

valuation analyst calculates the value in compliance with the

agreement. The valuation analyst expresses the results of

these procedures as a calculated value. The calculated value

is expressed as a range or as a single amount. A calculation

engagement does not include all of the procedures required

for a valuation engagement.

Personal Financial Planning Services

Personal financial planning engagements are only those that

involve developing strategies and making recommendations to

assist a client in defining and achieving personal financial goals.

Personal financial planning engagements generally involve all of

the following tasks:

1.

Defining the engagement objectives;

2.

Planning the specific procedures appropriate to the engagement;

Developing a basis for recommendations;

Communicating recommendations to the client;

3.

4.

1.16 Introduction to Attestation Engagements

5.

Identifying the tasks for taking action on planning decisions

and making recommendations to assist a client in defining

and achieving personal financial goals.

In addition, personal financial planning services could include:

1.

2.

Assisting the client to take action on planning decisions.

Monitoring the client’s progress in achieving goals.

3.

Updating recommendations and helping the client revise

planning decisions.

Personal financial planning does not include services that are limited to:

1.

Compiling personal financial statements.

2.

3.

Projecting future taxes.

Tax compliance, including, but not limited to, preparation of

tax returns.

4.

Tax advice or consultations.

The AICPA has established the Personal Financial Planning Executive Committee to establish engagement responsibilities for professional accountants providing personal financial planning services in

the form of Statements on Responsibilities in Personal Financial Planning Practice (SRPFPs). The SRPFPs are published for the guidance of

AICPA members and do not constitute enforceable standards under

Rule 202 of the AICPA Code of Professional Conduct.

ATTESTATION ENGAGEMENTS

Attestation engagements provide assurance in the form of a report

on financial or nonfinancial information other than historical financial statements, that is the responsibility of another party, for the use

or benefit of third-party users. For the purposes of this book, “attestation engagements” is defined as those engagements covered by

the professional standards identified in Exhibit 1-2 below.

Introduction to Attestation Engagements

1.17

EXHIBIT 1-2

ATTESTATION ENGAGEMENT STANDARDS

Organization

Applicable Attestation Engagement Standards

AICPA

Statements on Attestation Standards (SSAE)

PCAOB

Interim Standards for Attestation Engagements

GAO

Standards for Attestation Engagements (Contained in

Government Auditing Standards)

IFAC

International Standards on Assurance Engagements

(Section 3000—Assurance Engagements Other Than

Audits or Reviews of Historical Financial Information)

IFAC

International Standards on Related Services (Section

4400—Engagements to Perform Agreed-Upon

Procedures Regarding Financial Information)

IIA

IIA Attribute and Performance Standards for Assurance

Services (other than assurance services over historical

financial statements)

Chapter 2, “Overview of Attestation Engagement Standards,”

provides a thorough discussion of these attestation standards of the

various standard-setting bodies or organizations.

Chapter 3, “Accepting, Planning, and Performing an Attestation

Engagement,” and Chapter 4, “Concluding and Reporting on an

Attestation Engagement,” provide general guidance on conducting

and reporting on an attestation engagement.

Attestation engagements for which specific attestation standards

have been developed by the AICPA are addressed in the following

chapters of this book:

•

Chapter 5, “Agreed-Upon Procedures Attestation Engagements” (AT 201)—An agreed-upon procedures engagement is

one in which a practitioner is engaged to issue a report of

findings based on specific procedures agreed to by the users

and the practitioner.

•

Chapter 6, “Financial Forecasts and Projections Attestation

Engagements” (AT 301)—A forecast presents an entity’s

expected financial position, results of operations, and cash

1.18 Introduction to Attestation Engagements

flows based on the client’s assumptions about conditions that

are expected to exist and the course of action that it is

expected to be taken. In contrast, a projection is based on one

or more hypothetical assumptions and, in that sense,

attempts to answer “what if” questions.

• Chapter 7, “Pro Forma Financial Statements Attestation

Engagements” (AT 401)—The objective of pro forma financial

information is to show what the significant effects on historical financial information might have been had a consummated or proposed transaction (or event) occurred at an

earlier date.

• Chapter 8, “Integrated Internal Control Attestation Engagements” (AT 501)—An integrated internal control attestation

engagement involves the examination of the effectiveness of

an entity’s internal control over financial reporting that is

integrated with the audit of the entity’s financial statements.

The engagements involve examination level assurance only.

Engagements to provide limited assurance (review) on internal control are explicitly prohibited by AICPA attestation

standards.

OBSERVATION: Probably the most recognized attestation engagement regarding internal control is the attestation

engagement requirements established through Section 404

of the Sarbanes-Oxley Act (SOX). In accordance with Section 404 of SOX, the Securities and Exchange Commission

(SEC) issued rules requiring that each annual report of a publicly held company contain an internal control report that (1)

states that it is the responsibility of management to establish

and maintain an adequate internal control structure and procedures for financial reporting, and (2) contains an assessment, as of the end of the most recent fiscal year, of the

effectiveness of the internal control structure and procedures of the public company. In addition, Section 404 of SOX

requires the public companies’ external auditors to attest to,

and report on, the internal control assessment made by the

management of the public company in accordance with the

standards for attestation engagements adopted by the

PCAOB. Chapter 2, “Overview of Attestation Engagements

Standards,” discusses the differences between the internal

control attestation engagement requirements of the PCAOB

pursuant to Section 404 of SOX and the AICPA attestation

standards applicable to internal control over financial reporting pursuant to AT 501.

•

Chapter 9, “Compliance Attestation Engagements” (AT

601)—Compliance attestation engagements include those

Introduction to Attestation Engagements

1.19

related to either (1) examination of or applying agreed-upon

procedures to an entity’s compliance with requirements of

specified laws, regulations, rules, contracts, or grants, or (2)

agreed-upon procedures pertaining to only the effectiveness

of an entity’s internal control over compliance with specified

requirements (an examination-level service on this subject

would be covered by AT 101).

• Chapter 10, “Management’s Discussion and Analysis Attestation Engagements” (AT 701)—Public companies are required

by the SEC to include a Management’s Discussion and Analysis (MD&A) in their annual reports and other documents. The

provisions of AT 701 are applicable when practitioners are

engaged to report on the MD&A prepared using the rules and

regulations adopted by the SEC.

Objective of Attestation Engagements

The key to understanding the basics of attestation engagements is

to understand the objective and basic elements of such engagements. The objective of an attestation engagement is for the practitioner to enhance the degree of confidence of the intended users, other

than the responsible party, in certain subject matter information (financial or nonfinancial information other than historical financial statements) by gathering sufficient appropriate evidence on the subject

matter information, evaluating or measuring the subject matter evidence against suitable criteria and providing some level of assurance

in the form of a written report on the subject matter information.

OBSERVATION: Attestation engagements are constructively similar to assurance engagements over historical financial statements. Consider the following examples:

Assurance Engagement over Historical Financial Statements

In the case of an audit of historical financial statements, a

professional accountant (the practitioner) enhances the

degree of confidence of the intended users (the financial

statement users), other than the responsible party (management of the auditee), in the financial statements (the subject

matter information) by gathering audit evidence (sufficient

appropriate evidence), evaluating the audit evidence against

applicable generally accepted accounting principles (suitable criteria) and providing an opinion (positive or reasonable

assurance) in the form of an independent auditor’s report

(written report).

1.20 Introduction to Attestation Engagements

Attestation Engagement over Internal Control Effectiveness

In the case of an attestation engagement over the effectiveness of an entity’s internal control over financial reporting, a

professional accountant (the practitioner) enhances the

degree of confidence of the intended users (the control

report users), other than the responsible party (management

of the entity), in the design and operation of internal controls

over financial reporting (the subject matter information) by

gathering evidence of control design and operation (sufficient appropriate evidence), evaluating the evidence against

an appropriate internal control framework such as the Integrated Framework of the Committee of Sponsoring Organizations of the Treadway Commission (COSO) (the suitable

criteria) and providing an examination-level conclusion (positive or reasonable assurance) in the form of an independent

accountant’s report on internal control (written report).

While assurance engagements over historical financial statements and attestation engagements over financial and nonfinancial

information are constructively similar, they are differentiated by the

subject matter (historical financial statements versus other financial

information and nonfinancial information) and by differing professional standards (audit, accounting and review standards versus

attestation standards).

Elements of Attestation Engagements

All attestation engagements possess certain basic elements that

must be present for the engagement to meet professional standards.

These elements include:

•

Three-Party Relationship

•

•

Subject Matter Information

Suitable Criteria

•

•

•

Level of Assurance

Sufficient Appropriate Evidence

Written Report

The information provided below is an introductory overview of

the elements of an attestation engagement. For more specific guidance on planning, performing, and reporting on examination-level

and review level attestation engagements, see Chapter 3, “Accepting,

Planning, and Performing an Attestation Engagement,” and Chapter 4, “Concluding and Reporting on an Attestation Engagement.”

Introduction to Attestation Engagements

1.21

Three-Party Relationship

Attestation engagements, like other assurance engagements,

involve three separate parties:

1.

Responsible party The responsible party is the person(s)

responsible for the subject matter in a direct reporting

engagement or assertion over the subject matter of the

engagement in an assertion-based engagement. For example,

management of an entity that is responsible for the design

and operation of the internal control processes (subject matter information) is considered the responsible party in an

attestation engagement over the effectiveness of internal controls.

2.

Intended users The intended users are persons or parties for

whom the practitioner is providing the attestation engagement report. The responsible party can be one of the intended

users of the report but not the only user. If they were the only

user, the engagement would only involve a two-party relationship. An example of an intended user that is not the

responsible party is a trustee financial institution that is a

user of a compliance attestation engagement report related to

an entity’s compliance with specified debt covenants.

Practitioner The practitioner is the professional accountant

possessing the necessary skills and knowledge of the subject

matter and criteria to perform an attestation engagement and

provide the desired level of assurance over the subject matter information for the benefit of the intended users.

3.

OBSERVATION: The responsible party and intended users

may be from different entities or within the same entity. For

example, in the intended users’ example above, management of the debt-issuing entity is the responsible party, while

one of the intended users was a trustee financial institution

representing debt holders (different entity from the responsible party). However, in another example, an entity’s board

(the intended users) may engage a practitioner to perform an

attestation engagement over subject matter information that

is the immediate responsibility of the entity’s management

(the responsible party) although the board has ultimate

responsibility.

1.22 Introduction to Attestation Engagements

Subject Matter Information

“Subject matter information” is the financial or nonfinancial information for which the practitioner gathers sufficient appropriate evidence to be evaluated or measured against suitable criteria as a

reasonable basis for expressing a conclusion or reporting findings in

the attestation engagement report. Attestation engagement subject

matter information can take many forms, including:

•

Financial events, performance or condition information, such as

specific transactions or events, account balances, or financial

position or results;

•

Nonfinancial performance or condition information, such as entity

performance in terms of effectiveness, efficiency, or program

results;

• System and process information, such as an entity’s internal controls or information technology systems;

•

Behavioral information, such as compliance with laws, regulations or contract provisions; and

• Physical characteristics information, such as facility capacity or

commodity supply information.

To be capable of evaluation or measurement in an attestation

engagement, subject matter information should be both:

•

Identifiable and capable of consistent evaluation or measurement against suitable criteria; and

•

Be reasonably subjected to procedures for gathering sufficient appropriate evidence to provide the desired level of

assurance.

OBSERVATION: A potential engagement to provide reasonable assurance over an assertion by management of a

company that its product lasts longer than any other similar

or competitive product on the market may not be capable of

consistent evaluation or measurement against suitable criteria or be reasonably subjected to procedures to gathering

sufficient appropriate evidence to support a reasonable

assurance conclusion. Therefore, the assertion about the

subject matter information may not be appropriate for an

attestation engagement.

Introduction to Attestation Engagements

1.23

Attestation engagements can be classified based on how the subject matter information is initially evaluated or measured against

suitable criteria in of two ways:

1.

2.

Assertion-Based Attestation Engagements In assertion-based

engagements, the evaluation or measurement of the subject

matter information is initially performed by the responsible

party, and the subject matter information is in the form of an

assertion by the responsible party. For example, the management of an entity (the responsible party) has evaluated its

compliance with the provisions of debt covenants prescribed

by a long-term debt agreement and asserts that it has complied, in all material respects, with such requirements.

Direct-Reporting Attestation Engagements In direct-reporting

engagements, the practitioner directly performs the evaluation or measurement of the subject matter information without any assertion by the responsible party, or obtains

representation from the responsible party that it has performed the evaluation or measurement but the information is

not available to the intended users. For example, when management of an entity (the responsible party) has not evaluated its compliance with the provisions of debt covenants

prescribed by a long-term debt agreement and therefore

makes no assertion as to compliance, the practitioner may

directly evaluate and measure compliance and report the

results to the intended users.

Subject matter information can often fail to be properly expressed

in accordance with the applicable provisions of the criteria, and

therefore may be materially misstated or misrepresented. For

example, an entity’s assertion that its internal control over financial

reporting meets the criteria established by COSO may not be fairly

stated, in all material respects, and the attestation engagement

report would communicate the assertion misrepresentation.

Suitable Criteria

Attestation engagement criteria serve as the benchmarks used in the

evaluation or measurement of the subject matter information. Criteria can be in the form of formal requirements or guidelines, such

as generally accepted accounting principles as promulgated by a

standard-setting body or organization or compliance requirements

1.24 Introduction to Attestation Engagements

contained in laws, regulations, or contracts, or more informal, such

as an internally-developed performance budget or code of conduct.

Suitable criteria must be available for there to be a sufficient and

generally accepted frame of reference for the evaluation or measurement of the subject matter information. Without an acceptable frame

of reference, the practitioner’s conclusions could be more open to

individual interpretation and misunderstanding among interest

parties to the engagement.

OBSERVATION: Suitable criteria must be considered within

the context of the attestation engagement circumstances.

The same subject matter information could be evaluated or

measured against different criteria. For example, in an

internet-based marketing effort performance measurement

attestation engagement, one responsible party might select

the number of web site hits as suitable criteria, while another

responsible party might select the actual amount of internetgenerated sales as the most suitable criteria. As long as the

criteria possess the characteristics noted below, the criteria

for evaluating similar subject matter information can differ in

relation to specific engagement circumstances.

The IFAC Framework for Assurance Engagements indicates that

suitable criteria should possess the following characteristics:

•

Relevance—should actually contribute to conclusions that are

of benefit to the intended users;

• Completeness—should not omit relevant factors that could

affect the practitioner’s conclusions;

• Reliability—should allow for reasonably consistent evaluation

or measurement in similar circumstances by different practitioners;

•

Neutrality—should contribute to practitioner conclusions that

are free from bias; and

•

Understandability—should contribute to practitioner conclusions that are clear, comprehensive, and not subject to significantly different interpretations.

In addition, suitable criteria should be “available” to the

intended users of the attestation engagement report in an effort to

allow the users to understand how the subject matter information

has been evaluated or measured. Criteria can be made available

through public assess (such as GAAP Codifications and the COSO

framework), inclusion in a clear manner in the presentation of the

subject matter information (benchmark measurements included in

Introduction to Attestation Engagements

1.25

the body of a performance report), inclusion in a clear manner in the

attestation engagement report (repeating a statutory reference and

wording in the body of the practitioner’s report on compliance

attestation), or by general understanding (measurements of weight

or time).

Level of Assurance

“Level of assurance” is a result of the extent of work performed over

the subject matter information and the extent of the conclusions that

can be reached based on the results of the work. Although the attestation standards vary depending on the nature of the subject matter

information, in general, the standards provide three different levels

of assurance:

1.

High Level of Assurance (examination level) An examination

level attestation engagement is analogous to a financial statement audit. When engaged to perform an examination-level

attestation engagement, the practitioner’s objective is to

reduce assurance risk to an acceptably low level as a basis to

express an opinion (a high level of assurance) as to whether

the subject matter or assertion about the subject matter is in

conformity with given criteria. In other words, the practitioner provides a positive or reasonable assurance conclusion in an

examination.

2. Moderate Level of Assurance (review level) A review level

attestation engagement is analogous to a review of historical

financial statements. When engaged to perform a reviewlevel attestation engagement, the practitioner’s objective is to

reduce assurance risk to a level that is acceptable in the circumstance of the engagement, but a higher acceptable risk

than reasonable assurance (a moderate level of assurance). In

the report, the accountant states a conclusion about whether

any information came to his or her attention to indicate that

the subject matter or assertion about the subject matter is not

in conformity with given criteria. This conclusion is referred

to as negative, limited, or moderate assurance.

3. No Assurance (agreed-upon procedures or compilation level)

Although agreed-upon procedures and compilation engagement services are defined as “no assurance” level engagements, some level of user benefit is obtained by having the

professional accountant perform certain procedures over the

subject matter.

1.26 Introduction to Attestation Engagements

a.

Agreed-Upon Procedures In an agreed-upon procedures

engagement, the practitioner issues a report of findings

based on specific procedures performed on the subject

matter. In an agreed-upon procedures engagement, the

practitioner’s report is limited to reporting the findings

of the procedures performed without drawing any

conclusion.

b. Compilation A compilation involves the practitioner

using accounting expertise to collect, classify and summarize financial information. Compilations of historic

financial statements are the most common compilations

and are addressed by other professional standards. In

terms of attestation engagements, compilations are limited to compilations of prospective information that is

defined in AICPA attestation standards as a professional

service that involves assembling the prospective financial statements based on the responsible party’s assumptions, performing the required compilation procedures,

and issuing a compilation report. Compilation of prospective financial statements is the only type of compilation covered by the AICPA attestation standards.

OBSERVATION: While the AICPA, PCAOB, and the GAO

identify three levels of assurance by defining agreed-upon

procedure and compilation engagements as an “assurance”

service, in its International Framework for Assurance

Engagements, the IFAC excludes these two types of services from its definition of “assurance” engagements. As a

result, the IFAC framework recognizes only two types of

assurance for attestation engagements: (1) reasonable

assurance engagements and (2) limited assurance engagements.

The level of assurance to be provided in an attestation engagement is a matter that involves certain considerations between the

practitioner and the party engaging the practitioner. These considerations include:

•

Type of Subject Matter of the Engagement Various professional

standards, as discussed in Chapter 2, provide certain limitations on the level of assurance that may be provided over certain subject matter in an attestation engagement. For

example, the AICPA attestation standards provide for only an

Introduction to Attestation Engagements

1.27

examination-level assurance (high level of assurance) attestation engagement over internal control over financial reporting and prohibits a review-level (moderate level of assurance)

engagement over prospective financial statements.

• Quality of the Subject Matter Information For high level of

assurance or moderate level of assurance conclusions to be

expressed, sufficient appropriate evidence must exist to provide the practitioner a reasonable basis for expressing a conclusion in the attestation engagement report. If it is likely that

such evidence will not be available, an agreed-upon procedures attestation engagement (no assurance) may be more

appropriate.

• Level of Confidence Desired The needs of the intended users of

the attestation engagement report as to the desired level of

confidence in the subject matter or assertion over the subject

matter should be considered when determining the type of

attestation engagement to perform. For example, the higher

the level of confidence needed by the intended users of the

report, the more the consideration should be given to performing an examination level attestation engagement.

Sufficient Appropriate Evidence

In an attestation engagement, the practitioner must apply professional skepticism to obtain sufficient appropriate evidence about

whether the subject matter information is fairly presented. In doing

so, the practitioner should consider issues of materiality, attestation

engagement risk, and the sufficiency and appropriateness of evidence.

Sufficiency involves considerations of the quantity of evidence, while

appropriateness considers the quality of the evidence in terms of relevance and reliability.

The quantity and quality of evidence is dependent upon the level

of assurance required and the risk of the subject matter information

being materially misstated or misrepresented. For example, the

higher the level of assurance required and the higher the risk of misstatement or misrepresentation, the higher the quantity and/or

quality of evidence that is required.

OBSERVATION: Sufficiency (quantity) and appropriateness

(quality) of attestation engagement evidence are interrelated

in that lower quantity of higher quality evidence may be

sufficient to manage engagement risk, while lower quality of

evidence may require more quantity to manage the risk.

1.28 Introduction to Attestation Engagements

Materiality consideration in an attestation engagement involves

the practitioner understanding and assessing the factors that might

influence the decisions of the intended users of the engagement

report. Both quantitative and qualitative factors should be considered when assessing the needs of the intended users. For example,

a finding of noncompliance in a debt covenant compliance attestation engagement may have resulted from a quantitatively immaterial amount of transactions, but the fact that the covenant has not

been met may result in potential debt default conditions that are

considered qualitatively material to the intended users.

Attestation engagement risk is the risk that the practitioner

expresses an inappropriate conclusion or reports inaccurate findings when the subject matter information contains material misstatements or misrepresentations. The higher the level of assurance

(i.e., reasonable assurance in an examination engagement) that is

required in the engagement, the more the practitioner must obtain

sufficient appropriate evidence through the nature, timing, and

extent of engagement procedures.

The topics of materiality and attestation engagement risk are discussed in more detail in Chapter 3, “Accepting, Planning, and Performing an Attestation Engagement.”

Written Report

In an attestation engagement, the practitioner provides a written

report containing a conclusion or some form of assurance obtained

over the subject matter information or related assertion in relation

to the suitable criteria; or, in the case of an agreed-upon procedures

engagement, reports the findings resulting from the procedures performed.

Reporting on attestation engagements varies depending on

whether the engagement is an assertion-based or direct-reporting

engagement and on the level of assurance provided as defined

above.

•

Assertion-based attestation engagements—In the report on an

examination level engagement, the practitioner may express

a conclusion either in terms of:

— The responsible party’s assertion (“in our opinion, the

responsible party’s assertion that the entity has complied

with the requirements of state law section XYZ is fairly

stated, in all material respects”); or

Introduction to Attestation Engagements

1.29

— The subject matter and criteria directly (“in our opinion,

the responsible party complied, in all material respects, with

the requirements of state law section XYZ”).

•

Direct-reporting engagements—The report expresses a conclusion only on the subject matter and criteria directly (“in our

opinion, the responsible party complied, in all material

respects, with the requirements of state law section XYZ”).

There is no responsible party assertion to report on.

In terms of level of assurance, the wording of practitioner’s attestation engagement report will vary depending on whether the

engagement was designed to provide a high level of assurance, a

moderate level of assurance, or no assurance.

•

High level of assurance—The practitioner’s conclusion is

expressed in a positive opinion (“in our opinion, the responsible party complied, in all material respects, with the requirements of state law section XYZ”);

• Moderate level of assurance—The practitioner’s conclusion is

expressed in a negative form (“based on our work, nothing

came to our attention that causes us to believe the responsible

party did not comply, in all material respects, with the

requirements of state law section XYZ”);

• No assurance—The practitioner provides no conclusion or

form of assurance on the subject matter information or the

responsible party’s assertion as to the subject matter information. Most commonly applicable to agreed-upon procedures

engagements, the report is limited to describing the procedures performed, their purpose, and the factual findings

identified as a result of the procedures performed. The

intended users are to assess for themselves the procedures

and findings and draw their own conclusions.

OBSERVATION: Similar to reports on audits of historical

financial statements, the practitioner should not express

an unqualified opinion or positive assurance conclusion

(high level of assurance) when certain circumstances exist,

including:

•

There is a material limitation on the scope of the practitioner’s work (which would result in a qualified conclusion or disclaimer depending on the materiality and

pervasiveness of the scope limitation).

1.30 Introduction to Attestation Engagements

•

In an assertion-based engagement, the responsible

party’s assertion is not fairly stated in all material

respects (which would result in a qualified or adverse

conclusion depending on the materiality and pervasiveness of the departure from the criteria).

•

In a direct-reporting engagement, the subject matter

information is materially misstated or misrepresented,

or does not conform to the criteria (which would result

in a qualified or adverse conclusion depending on the

materiality and pervasiveness of the departure from

the criteria).

Exhibit 1-3 provides an illustration of the required elements of an

example attestation engagement. The example assumes that the

practitioner has been engaged to provide reasonable assurance over

the assertion of management of a government entity that it has complied with a contractual grant agreement to train and graduate a

specified number of disadvantaged citizens in specific jobs for the

benefit of the granting agency as the intended users of the report.

EXHIBIT 1-3

ELEMENTS OF AN EXAMPLE

ATTESTATION ENGAGEMENT

Element

Three-Party

Relationship

Description

Responsible Party: Management of the Grantee

Government

Intended Users: The Grantor Agency and

Management and the Board of the Grantee

Government

Attestor: The Practitioner

Subject Matter

Information

Assertion-based engagement: the subject matter

information is the assertion by management of the

grantee government that they have met the

compliance requirement in the contractual

agreement in regards to training and graduating

the specific number of disadvantaged citizens.

Suitable Criteria

The specific provision of the contractual

agreement that specifies the number of trainees

and graduates, what constitutes training and

graduation, and defines the criteria for an

individual to be classified a disadvantaged citizen.

Introduction to Attestation Engagements

Element

Level of Assurance

1.31

Description

Examination-level (high-level of assurance) that will

result in the expression of a positive conclusion as

to compliance.

Sufficient Appropriate The engagement evidence will need to be of high

Evidence

enough quantity and quality to support the

expression of a positive opinion or conclusion and

acceptable to reduce the risk of an inappropriate

conclusion on compliance to an acceptably low

level.

Written Report

Assertion-based engagement expressing

reasonable assurance: the practitioner will report in

the form of a positive conclusion as to the fair

statement of management’s assertion (e.g., “in our

opinion, management’s assertion that grantee

government complied with the section XYZ of the

contract between the government and grantee

agency during the [period] ended [date] is fairly

stated, in all material respects”).

Distinguishing Attestation Engagements from Other

Engagements

Quite often, a practitioner will be faced with responding to a request

from a client or potential client for a type of service that may not be

limited to a specific set of professional standards. Frequently, a practitioner will face a dilemma in choosing between performing an

engagement under the attestation standards and another set of professional standards, such as the audit, accounting or review services, or consulting standards. Generally, the key factors to consider

when deciding the most appropriate type of engagement are:

•

•

The nature of the subject matter information; and

The primary beneficiaries of the service.

Nature of the Subject Matter Information

When the practitioner is asked to deliver services related to providing some level of assurance over subject matter information other

than historical financial statements, then the service is a candidate

1.32 Introduction to Attestation Engagements

for an attestation engagement. Audits, reviews, and compilations of

historical financial statements are governed by specific standards

related to those type services and are not considered attestation

engagements as defined in this book. Attestation engagements are

best suited for engagements where assurance is needed over subject

matter information that involves elements of financial statements

less than complete statements (such as accounts payable or inventory balances) or nonfinancial information (such as performance

statistics, compliance requirements, or internal control systems or

processes).

Primary Beneficiaries of the Service

When the direct primary beneficiary and intended user of the

desired service is limited to the client or responsible party, rather

than other third-party beneficiaries, then the service is not a candidate for an attestation engagement. In attestation engagements, the

primary beneficiaries of the assurance service are not limited to the

client or party responsible for the subject matter information. The

intended users of an attestation engagement report must include

parties other than the responsible party.

If the requested service primarily involves evaluating information in an effort to provide advice or recommendations to the client

or responsible party rather than reporting on the results of the work

for the benefit of third parties, then the required service is likely

more appropriately performed as a consulting service and not an

attestation engagement.

OBSERVATION: One of the most common dilemmas

encountered by practitioners in determining the type of

engagement to perform to meet the needs of unique or nontraditional service requests is the determination of whether a

potential engagement is best performed as an attestation

engagement or consulting service. One of the key considerations in responding to this dilemma is the determination of

the number of parties to the engagement or direct beneficiaries of the service.

In a consulting engagement (such as evaluating system

processes and providing recommendations for the benefit of

management for the improvement of those processes), the

parties are generally limited to two: (1) the practitioner providing the advice, and (2) the party seeking and receiving the

advice—the engagement client.

In an attestation engagement (e.g., one that provides a

reasonable assurance conclusion on an entity’s compliance

with debt covenants in order to issue new debt), the parties

Introduction to Attestation Engagements

1.33

generally include three groups: (1) the party responsible for

the subject matter—the debt-issuing entity’s management,

(2) the intended users of the report—debt holders and potential investors in the new debt, and (3) the practitioner providing the assurance.

Ethics and Quality Control Considerations in Attestation

Engagements

In addition to the professional standards applicable to the performance of attestation engagements, practitioners providing attest

services are also subject to ethics and quality control considerations

and standards that are applicable to their other assurance engagements. For example, in its International Framework for Assurance

Engagements, the IFAC states that practitioners who perform assurance engagements (including all attest services) are also governed

by the IFAC Code of Ethics for Professional Accountants, and International Standards on Quality Control.

Ethics Considerations

The IFAC Code of Ethics establishes fundamental ethics principles

that deal with integrity, objectivity, professional competence and

due care, confidentiality, and professional behavior. An essential

component of ethics in the conduct of attestation engagements is the

principle of independence. A practitioner who performs an attest

service must be independent of the party responsible for the subject

matter of the attest engagement. The IFAC Code of Ethics provides

a conceptual framework approach to independence that considers

threats to independence and safeguards to address those threats.

In addition to the IFAC Code of Ethics, the AICPA Code of Professional Conduct (the AICPA Code) provides guidance for the CPA

to conduct his professional practice, including the conduct of attestation engagements. A member CPA must observe all of the rules

and interpretations in the AICPA Code. The AICPA Code consists of

two sections: (1) the Principles and (2) the Rules. The Principles provide the framework for the Rules, which govern the performance of

professional services by CPAs. The Council of the AICPA is authorized to designate bodies to promulgate technical standards under

the Rules. A member who performs auditing, review, compilation,

management consulting, tax, or other professional services, including attestation engagements, shall comply with standards promulgated by bodies designated by Council. The AICPA Council has

1.34 Introduction to Attestation Engagements

designated the Accounting and Review Services Committee

(ARSC), the Auditing Standards Board (ASB), and the Consulting

Services Executive Committee (CSEC), jointly, to establish professional standards for attestation engagements.

Rule 201 of the AICPA Code is concerned with general standards, including guidance on organizational structure that the CPA

must observe in the performance of all professional services, including attestation engagements. These general standards deal with the

following:

•

Professional Competence. Undertake only those professional

services that the member or the member’s firm can reasonably expect to be completed with professional competence.

•

Due Professional Care. Exercise due professional care in the

performance of professional services.

• Planning and Supervision. Adequately plan and supervise the

performance of professional services.

• Sufficient Relevant Data. Obtain sufficient relevant data to

afford a reasonable basis for conclusions or recommendations

in relation to any professional services performed.

Rule 202 of the AICPA Code addresses compliance with standards that the CPA must observe in the performance of all professional services, including attestation engagements. Statements on

Standards for Attestation Engagements (SSAE) and SSAE Interpretations have been issued under the authority established by Rule

202. Practitioners should have sufficient knowledge of the SSAEs to

identify those that are applicable to his attestation engagement, and

he should be prepared to justify departures from the SSAEs and

related interpretations.

AICPA Ethics Rulings consist of formal rulings made by the

AICPA’s professional ethics division’s executive committee after

exposure to state societies, state boards, practice units, and other

interested parties. Ethics Rulings summarize the application of

Rules of Conduct and Interpretations to particular sets of factual circumstances. CPAs who depart from such ethics rulings in similar

circumstances will be requested to justify such departures.

In addition to the IFAC and AICPA, the PCAOB and GAO have