Are lotteries substitutes to each other?

advertisement

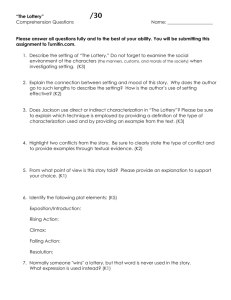

Are lotteries substitutes to each other? Yuan Jia∗† Faculty of Business Administration, University of Macau, Taipa, Macau. Email: jiayuan@umac.mo As lottery becomes a more and more important source for government tax revenue, one opinion argues that governments should strategically manage different lotteries and coordinate the prices of different lotteries. Although, in the literature, many studies have examined single lottery price elasticity, little has been done to understand the relationship between different lotteries. We examine the substitution effect between two almost identical national lotteries in Canada: Lotto 6/49 and Super 7 (Now called Lotto Max). By exploiting a social experiment, we employ a Regression Discontinuity method to estimate the elasticity of the lotteries. We find that the estimation about the single lottery price elasticity of demand is consistent with the literature; however, we find surprisingly low cross elasticity between these two, almost identical, Canadian lotteries. If the nominal ticket price of one lottery doubles, the demand for the other lottery does not change significantly. This puzzlingly low substitution effect between the two, almost identical, Canadian lotteries provides a benchmark for future theoretical studies. ∗ Correspondence Author. Email: jiayuan@umac.mo I would like to thank the seminar participants at the Canadian Economics Association 2011 Annual Conference. All errors are my own. † Ⅰ. Introduction In the past several decades, many countries have legalized the lottery business and as a result, the lottery industry has become more and more influential. For instance, according to 2005 Canada Statistics, the average spending on lottery in Canada was $154 in 2005. In the U.S., the lottery industry was generating $50 billion in sales in 2006, roughly $160 per capita, and around 1 percent of government revenue (See Yu and Xu, 2008). In China, government-run lottery agencies sold over $25 billion in 2010, with a 25 percent annual growth rate. In reality, there are usually several similar lotteries sold at the same time. For instance, in Canada, there are two very similar and popular lotteries: Lotto 6/49 and Super 7 (Now called Lotto Max)1; In the U.S., in many states, MegaMillion and SuperBall are sold at the same time. As lottery is generating more and more tax revenue, one opinion argues that governments should coordinate the prices among different lotteries to generate the biggest revenue for "Good Causes". In the past, most of the economics literature focuses on the price elasticity of demand for a single lottery. The paper list includes Forrest, Gulley, and Simmons (2001), Gulley and Scott (1993), Scoggins (1995), and so on. But little work has been done to understand the relationship between different lotteries. This paper tries to understand the substitution effect between two almost identical lotteries in Canada, Lotto 6/49 and Super 7, and estimates the cross-elasticity of these two 1 Super 7 was replaced by a new game, Lotto Max in September 2009. Without causing confusion, in the rest of the paper, we will use Super 7 to denote this lottery. lotteries. Studying the lottery substitution effect is important. If gamblers are managing a portfolio of lotteries, and if the lotteries act as substitutes for each other, we should observe that lottery gamblers will constantly change their lottery portfolio as the effective prices of different lotteries fluctuate. Therefore, managing and coordinating the prices among different lotteries will potentially increase a government's revenue. However, anecdotal stories tell us that lottery ticket buyers rarely switch back and forth among different lotteries. Most of the time, people purchase a lottery ticket out of habit, showing loyalty to a particular lottery game. Of course, we need rigorous method to examine this issue. The difficulty in estimating the cross elasticity of two lotteries is the identification. We take a different approach by exploiting the lottery price change in Lotto 6/49 in 1996. We employ a regression discontinuity method to identify the demand response of Super 7 to the price change of Lotto 6/49 and calculate the cross elasticity. The result is surprising. Even though these two lotteries, which are almost identical, seem like they should act as substitutes for one another, their cross elasticity is almost zero. This paper also contributes to another body of literature that studies the addictive consumption. One important and interesting feature about lottery is its addictive gambling nature. Actually, Sabine M. Grusser and Morsen (2007) and Guryan and Kearney (2011) provide empirical evidence for the addictiveness of lottery gambling. In the literature, studies on addictive behavior from an economic perspective can trace back to Becker and Murphy (1988). There is a long line of empirical studies on the estimation of the elasticity of addictive consumption such as cigarettes, alcohol and drugs. This paper explores this issue from a different angle: it does not only study the elasticity of single lottery consumption in Canada, but it also explores the relationship between different addictive lottery consumptions. This paper’s findings suggest that, lottery consumption is not only sticky in the sense of lottery gambling addiction itself, but it is also sticky in the sense that lottery consumers are really stuck to one type of lottery game even though there may be similar and cheaper alternative lottery games. This complements current lottery addiction findings. This paper is organized as follows. Section 2 introduces the two Canadian lotteries and briefly reviews the literature. Section 3 introduces the dataset. Section 4 sets up the Regression Discontinuity model to estimate the elasticity of lotteries. Section 5 shows the estimation results. Section 6 concludes. Ⅱ. Backgrounds and Literature Background In Canada, there are two popular national lotteries. Lotto 6/49 is one of them. In this lottery, six numbers are drawn from a set of 49. The jackpot is the ticket matching all six numbers and it wins a prize of at least $3 000 000. There is also a bonus number. If a player's ticket matches five numbers and the bonus number, he or she wins the "second prize," which is usually between $100 000 and $500 000. If more than one player win the top or second prize, the winners will split the prize. Lesser prizes are also awarded if one matches at least three numbers, or two numbers plus the bonus number. If the top prize is not won, the money will roll over to the next draw. Before June 2, 2004, the ticket price for Lotto 6/49 was $1 and after that, it increased to $2. This is the policy change which we will exploit in this paper. In section 3, there will be a detailed discussion of this policy change. Lotto Super 7 is the other popular national lottery game in Canada. It was launched on 10 June 1994, and its last draw was on 18 September 2009. In July 2009, the authority announced that Lotto super 7 would be replaced by a new game, Lotto Max. This research does not deal with Lotto Max. Therefore, we keep using Super 7 throughout the paper. In Lotto Super 7, players picked seven numbers from 1 through 47. Tickets for Super 7 were sold in all of the following lottery jurisdictions: British Columbia Lottery Corporation, Western Canada Lottery Corporation, Ontario Lottery and Gaming, Loto-Qubec, and the Atlantic Lottery Corporation. The ticket price for Super 7 was $2. From a pure mathematics perspective, there is no essential difference between Lotto 6/49 and Super 7. other. These two lotteries should act as substitutes for each If lottery players are rational consumers, they should calculate the cost-benefit of these two lotteries and then choose the more favorable one. Therefore, lottery consumers should be sensitive to ticket prices. For each draw, they should purchase the cheaper ticket. If this were the case, we could expect a high substitution rate between these two almost identical lotteries. Of course, the above argument is based on the assumption that the transaction cost of switching between these two lotteries is low. There is no way to directly prove that this switching cost is low. However, Figure 1 helps demonstrate that lotteries consumers are fully aware of the two options they have. Figure 1 is obtained from the "Ontario Lottery and Gaming Corporation Summary Report to the Ombudsman, September 2008" and shows a Lotto 6/49 ticket. On the top of the ticket, a player's lottery numbers for the Lotto 6/49 are displayed. On the bottom of the ticket, it shows information about the other popular lottery: Super 7. The Lotto 6/49 ticket reminds customers that they have an alternative lottery to play. Based on Figure 1, it is reasonable to assume that people are clear about the two lottery options they face when they make their lottery purchase. It is also reasonable to assume that lottery consumers can easily obtain Super 7 thickets. Otherwise, this inclusion of information about Super 7 is a waste of resources for Lotto 6/49. Intuition tells us that these two almost identical lotteries should act as substitute for each other. The following section will review the related literature and examine this substitution effect using these two popular lotteries. Figure 1: Lottery ticket of lotto 6/49 Literature Both economists and government are interested in lottery price elasticity because it is valuable to know whether the current price setup generates optimal tax revenue for "Good Causes". For a detailed discussion about the optimal lottery design for tax purposes, readers can refer to Walker and Young (2001) and Maeda (2008). Most of the literature focuses on the estimation of lottery price elasticity of a single lottery. This line of research includes Forrest, Gulley, and Simmons (2001), Gulley and Scott (1993), and Scoggins (1995). All of these papers are based on an aggregate time series to estimate the price elasticity of lottery demand. Forrest, Gulley, and Simmons (2001) use the size of a lottery rollover and its square as instruments to estimate the elasticity of demand for lottery tickets in the U.K.. Almost all other related papers follow this approach to estimate lottery price elasticity in different economies. Meanwhile, in the literature, there is no clear conclusion on the substitution properties of the lotteries demand. Forrest, Gulley, and Simmons (2010) analyze the potential substitution of lottery play and bookmaker betting and find strong evidence for the substitution effect. But their findings show the substitution effect between lottery and another type of gambling. Lin and Lai (2006) and Forrest, Gulley, and Simmons (2004) have studied the substitutions of different lotteries. Both of these studies use simple OLS regressions and aggregate lottery demand time series to examine the substitution effect of the lotteries. Both of them find no strong substitution effect. However, both of the papers suffer from a lack of control for unobserved heterogeneities. This lack of identification has plagued their conclusions based on the insignificant estimation results. For instance, a common shock may affect both the lottery price and lottery purchase. Without controlling for these unobserved heterogeneities, the estimation for the cross-elasticity will be biased. For cross elasticity, the challenge of identification is greater compared to the estimation of price elasticity for a single lottery. One has to make the effort to isolate the demand response of one lottery to the price variation of the other lottery. By exploiting a social experiment, we employ a Regression Discontinuity method to estimate the elasticity of the lotteries. Ⅲ. Data Before we introduce the data, it is worthwhile to point out that the price of a lottery ticket is not just the nominal lottery ticket price. Gulley and Scott (1993) point out that other parameters, such as the prize pool, and the number of tickets sold in each draw, may also affect the true value of the ticket. Gulley and Scott (1993) calculate the expected ex post lottery ticket price. This effective price of a ticket is obtained from the following equation. Later on, Scoggins (1995) and Forrest, Gulley, and Simmons (2001) all follow this formula to calculate this benchmark effective price. 1 P = 1 − ( (R + jQ(1 − + EVs In the above formula, P is the effective price of a lottery ticket; Q is the sale number of tickets in that draw; R is the rollover value from the preceding draw; j is the proportion of the revenue allocated to the jackpot fund; p is the probability of any ticket winning the jackpot; and EVs is the expected value of smaller prizes.2 Data is obtained from the Canadian lottery website directly. In each draw, we 2 One thing worth emphasizing here, as pointed out by Forrest, Gulley, and Simmons (2001), is that this benchmark effective price is only an ex post price at the end of each draw. When an individual lottery consumer purchases a lottery ticket, the actual price may also be affected by other factors. We employ a regression discontinuity approach, so as long as we assume that this benchmark effective price captures the trend of the lottery price, the estimation results here will not be affected. Therefore, we also follow the literature, including Gulley and Scott (1993) and Forrest, Gulley, and Simmons (2001), and use this effective price to measure the lottery price. obtain the winning prize at each level and the corresponding numbers of winners, rollover money, the time of the draw, and the total tickets sold. Table 1 and table 2 report the simple statistics of the lotteries before and after the policy change for the two lotteries, Lotto 649 and Super 7, respectively. Table 1 shows that before June 2, 2004, the nominal price of each Lotto 6/49 ticket was $1. After June 2, 2004, this ticket price jumped to $2. This policy change has important impact on the effective price and sales of Lotto 6/49. Before June 2, 2004, the mean value of effective price of Lotto 6/49 was around 47 cents, and the mean value of total tickets sold was 13.3 million. After the nominal lottery ticket price was doubled, the mean value of the effective price increased to 126 cents, and mean number of tickets sold dropped to 9.38 million. We observe a significant change of effective price and its corresponding sale drop. Table 1: Simple statistics: lotto 6/49 Sale (In 1,000,000) Nominal Ticket Price Effective Price Obs Sale (In 1,000,000) Nominal Ticket Price Effective Price Obs Before June 2, 2004 Min Max 10.6 22.9 1 1 0.136 1 After June 2, 2004 Min Max 8.03 49.7 2 2 0.136 4.9 Mean 13.3 1 0.466 147 Std. Dev. 2.6 0 0.163 Mean 9.38 2 1.26 165 Std. Dev. 4.48 0 0.542 Figure 2 plots the trend of the effective price and ticket sales of Lotto 6/49 before and after June 2, 2004. From the graph, we can see that the effective price of Lotto 6/49 after June 2, 2004, moved significantly upward, and that the tickets sold after June 2, 2004, dropped significantly. We also record the statistics and plot the trend of effective price and lottery ticket sales for the lottery Super 7 as a comparison. Table 2 records the same statistics as we do in table 1. From table 2, we can see that the effective price of Super 7 did not change much, but the sale of Super 7 changed significantly. This may be attributed to the extreme values of sales of Super 7 tickets before June 2, 2004. The maximum sale number before June 2, 2004 was 78 million, which pulled up the mean value. If we ignore this extreme value, there is no significant change of the trends. Actually, figure 3 confirms this idea. Figure 3 plots the trend of the lottery ticket price and sales of Super 7 ticket. From the graph, we can see that there was no structural change in either the effective lottery price or lottery ticket sales. In fact, if we look at the bottom value of both trends before and after June 2, 2004, the bottom points show an almost continuous line, which suggests the continuity of the trends on June 2, 2004. Figure 2: The trend of price and sale of lotto 6/49 Finally, table 3 records the detailed policy change on June 2, 2004. The most drastic change is the price change of a Lotto 6/49 ticket from $1 to $2. Meanwhile, there were also changes on the distribution of the fund pool and prize level setup. As discussed in the beginning of section 3, the effective price captures all of these changes. We do observe a significant effective price change in Lotto 6/49 as in table 1. However, the more important fact is that there was no structural change in the Super 7, and we do observe there is not much change in the effective price of Super 7. These facts establish the foundation for the regression discontinuity approach in the following section. Table 2: Simple statistics: super 7 Sale (In 1,000,000) Nominal Ticket Price Effective Price Obs Sale (In 1,000,000) Nominal Ticket Price Effective Price Obs Before June 2, 2004 Min Max 10.6 78 1 1 0.407 1.188 After June 2, 2004 Min Max 43.3 11.2 1 1 0.54 1.16 Figure 3: The trend of price and sale of super 7 Mean 27.6 1 0.708 48 Std. Dev. 18.1 0 0.1483 Mean 19.4 1 0.753 56 Std. Dev. 8.06 0 0.128 Ⅳ. Model We aim to estimate how the sale of Super 7 tickets responded to the change in price of Lotto 6/49 tickets. Let QS,t denote the sale of Super 7 tickets at time t; PS,t is the corresponding ticket price. Let QL,t denote the sale of Lotto 6/49 ticket at time t and PL,t be the price of those tickets. We follow the literature, Forrest, Gulley, and Simmons (2001), and set up the lottery sale function of Super 7 tickets as the following: , = (, , , , Here, Xt is the covariate vector including the sale trend over time, the rollover money from the last period, the dummy variable indicating whether the lottery draw happens on Wednesday or Saturday, and so on. We assume the function takes a linear form as the literature does. Therefore, the regression function is simplified into the following standard setup: , = α ∗ , + ∗ , + ∗ + Here, captures all the influence of unobserved factors. Let t be the time when the major structural change takes place and causes the price jump. Assumption 1: PS,t, Xt and ! are all continues function at !̅. Assumption 1 is the continuity assumption in the regression discontinuity design. As we cannot control for all the unobserved influences on the lottery sale, we assume that, at least, these variables are continues at #.̅ Although we make this continuity assumption here for the proof of claim 1, we will check the smoothness of the above covariates in section 5.1. It turns out that the continuity condition is satisfied. Claim 1: Given assumption 1, the following equation identifies the β: The proof of claim 1 is straight forward following the RDD idea. The estimation of the β takes the following procedure. We first consider local linear regression for PL,t and QS,t on both sides of the discontinuity point. That is, we solve the following four standard minimization problems for local linear regression estimation: Table 3: Rule change of lotto 6/49 Ticket Price Take-out Rate Prize categories Share of Pool Fund Jackpot 2nd prize 3rd prize 4nd prize 5nd prize 6nd prize Source: Yu and Xu (2008). Before June 2, 2004 $1 55% 5 After June 2, 2004 $2 53% 6 50% 16% 12% 23% $10 N/A 80.50% 5.75% 4.75% 9% $10 $5 Then the estimator for the price elasticity of lottery demand will be This estimation procedure is very similar to the estimation for the fuzzy regression discontinuity design although it is sharp regression discontinuity design here. The denominator here is capturing the change of quantity instead of probability change in the fuzzy RDD setup. For the details, readers can refer to Imbens and Lemieux (2007). It is possible that the average consumers of Lotto 6/49 responded to the price change by purchasing more tickets before the policy change date. This self-selection leaves a higher estimation of the price elasticity of demand for Lotto 6/49. However, for the estimation of cross-elasticity between Super 7 and Lotto 6/49, the impact of strategic behaviors of Super 7 lottery buyers is secondary. Actually, we pay more attention to the examination of the impacts brought by the covariates of Super 7, such as the amount of the first prize, or the total prize given out in each draw. The examination is left to section 5.1. Ⅴ. Results Table 4 records the RDD estimation results. First, on the top half of the table, we conduct RDD on the trend of effective prices and the ticket sales of both Lotto 6/49 and Super 7. We calculate the impact of policy change in both the absolute value and relative value. Table 4 shows that the effective ticket price of Lotto 6/49 increases by around 67 cents, or 88 percent. Meanwhile, the effective price of Super 7 ticket did not have significant changes, which is also consistent with figure 3. These results clearly show that the policy change of the Lotto 6/49 had significant impact on the effective price of itself, and the lottery price of Super 7 can be regarded as continuous at June 2, 2004. Table 4 also shows the impact of the price change on ticket sales for both Lotto 6/49 and Super 7. We first normalize the number of Lotto 6/49 tickets sold on June 2, 2004 and the number of Super 7 sold on June 4, 2004 as one. The number of tickets sold for Lotto 6/49 dropped by around 2.4 million, which represented a 22 percent drop. These values are both significant. Meanwhile, the number of tickets sold for Super 7 increased by around 1.9 million, which represented an insignificant 9 percent increase. The drop in Lotto 6/49 ticket sales reflects the response of lottery players to the price increase. However, this number is a lower bound estimation of the drop. Lotto 6/49 players might have purchased more Lotto 6/49 tickets in advance of June 2 because they were aware of the coming price hike. This self-selecting behavior makes the estimation of sale drop of Lotto 6/49 biased downward. However, as discussed above, this self-selection in the Lotto 6/49 did not directly impact Super 7, which is the focus of this paper. Table 4 shows that the effective price of a Super 7 ticket did not display significant discontinuity like the price of a Lotto 6/49 ticket did. The change for a Super 7 ticket was around 5 cents, which was not significant. Meanwhile, as the Lotto 6/49 was undergoing a significant change in ticket price, it is not unlikely to expect a high number of Lotto 6/49 players to switch to playing Super 7. While we do observe a positive increase in sales for Super 7, the number is not significant. To examine the cross-elasticity, we need to do further calculations. The results are in the lower part of the table. Table 4: RDD estimation results Change of Effective Price Change Effective Price (Log) Ticket Sale Change Ticket Sale Change (Log) βLotto649 βSL-cross-elasticity Lotto 649 Super 7 0.674***(0.078) 0.0455(0.052) 0.886***(0.182) -0.044(0.078) -2,348,074**(837,360) 1,996,585(1,377,463) -0.22**(0.070) 0.089(0.040) Price Elasticity of Lottery -0.25*(0.11) 0.10(0.24) Standard errors in parentheses * p < 0:05, ** p < 0:01, *** p < 0:001 The lower part of table 4 records the estimation results of price elasticity of Lotto 6/49, βLotto649, and the cross-elasticity of Super 7 with respect to the price change of Lotto 6/49, βSL. The estimation results show that the price elasticity of Lotto 6/49 is around 0.3. One thing worth noting is that this number is only lower bound estimation because of the possible self-selecting behaviors of Lotto 6/49 players. In the literature, Forrest, Gulley, and Simmons (2001) found that the price elasticity of lotteries in the United Kingdom was around 0.6. Therefore, the estimation here is consistent with the literature. Table 4 also shows the cross elasticity of Super 7 with respect to the price change of Lotto 6/49. βSL is around 0.1, which is also not significant. This surprisingly low cross elasticity contrasts to our intuition about these two almost identical lotteries. This result has an important immediate implication. The opinion about coordinating the prices of different lotteries is not valid because of the low substitution effect. Lottery players, in this case, Lotto 6/49 and Super 7, seem to stick to a particular lottery and are not sensitive to price changes within their chosen game. Examining the possible impact of other covariates In this section, we check the robustness of the above estimation. We examine the possible impacts of other important factors, which may also possibly display discontinuity, at time #.̅ Two factors we consider for Super 7 are the size of the fund pool and the size of each first prize payout. Lottery players are possibly sensitive to the idea of a "Big Prize" or an increased "fund pool". For example, if there is an unusually large fund pool, this may create additional advertising and attract a discontinuous number of lottery players. Figure 4: The trend of other important covariates of super 7 Figure 4 plots the trends of fund pool and first prize payout for Super 7. These are the most important factors which may potentially violate the continuity assumption. From the figure, we can conclude that there is no structural change or unusual sudden change for both the fund pool and the first prize payout. All these suggest that the continuity condition for Super 7 at time #̅ is valid. The changes are not significant and unusual. Therefore, combining the robustness check here, and the RDD estimation results in the previous section, we find a surprising fact: these two almost identical lotteries have a very low substitution effect. VI. Conclusion Understanding the relationship between different lotteries is important in two senses. First, from a government's tax revenue perspective, optimal lottery design requires the coordination of different lotteries. Second, from an economic perspective, studying the relationship between different lotteries reveal the information about consumers' preference over risks and skewness in the gambling games, which can be further used to test current expected utility theory or prospect theory. Our intuition tells us that these two almost identical lotteries, Lotto 6/49 and Super 7, should act as substitutes for each other. This paper tries to examine this issue using a clean estimation: regression discontinuity approach. The RDD estimation results show, first, that the estimation about the single lottery price elasticity of demand is consistent with the literature. However, the cross elasticity between these two almost identical lotteries is surprisingly low. If the nominal ticket price of one lottery doubles, the demand for the other lottery does not change significantly. This result is both interesting and puzzling. Our conjecture is that these two lotteries may be potentially very different. Lotto 6/49 and Super 7 have very different price patterns. Lotto 6/49 has a more stable payout than Super 7, yet Super 7 has a clear trend: its jackpot builds up for a couple of rounds, then pays out big at once, and then starts building again. The two lotteries do have some differentiation. We conjecture that regular lotto players buy Lotto 6/49, while more risk-loving, prospecting players would buy Super 7, especially when the jackpot is high. This consumer heterogeneity in risk preferences could explain why no significant substitution occurred after the policy change in Lotto 6/49. This conjecture needs further investigation, especially more detailed data. This paper only has an aggregate level time series. The aggregation itself hides important information. Detailed examination about lottery buyers' preference and the relationship between different lotteries with individual level data will be left to future work. References Becker, G., and K. M. Murphy (1988) A theory of rational addiction, Journal of Political Economy, 4, 675-700. Forrest, D., D. Gulley, and R. Simmons (2001) Elasticity of demand for UK national lottery tickets, National Tax Journal, 4, 853-63. Forrest, D., D. Gulley, and R. Simmons (2004) Substitution between games in the UK national lottery, Applied Economics Letters, 36, 645-51. Forrest, D., D. Gulley, and R. Simmons (2010) The relationship between betting and lottery play, Economic Inquiry, 1, 26-38. Gulley, O. D., and F. A. Scott (1993) The demand for wagering on state-operated lottery games, National Tax Journal, 45, 13-22. Guryan, J., and M. S. Kearney (2011) Is lottery gambling addictive, American Economic Journal: Policy, Forthcoming. Imbens, G., and T. Lemieux (2007) Regression discontinuity designs: a guide to practice, NBER WORKING PAPER SERIES, No. 13039. Lin, C.-T., and C.-H. Lai (2006) Substitute effects between lotto and big Lotto in Taiwan, Applied Economics Letters, 13, 655-58. Maeda, A. (2008) Optimal lottery design for public financing, The Economic Journal, 118, 1698-1718. Sabine M. Grusser, Babett Plontzke, U. A., and C. P. Morsen (2007) The addictive potential of lottery gambling, Journal of Gambling Issues, 19. Scoggins, J. F. (1995) The lotto and expected net revenue, National Tax Journal, 61-70. Walker, I., and J. Young (2001) An economist's guide to lottery design, Economic Journal, 111, 700-22. Yu, K., and X. Xu (2008) Welfare effect of a price change: the case of lotto 6/49, Working Paper.