Cocoa Prices Heat Up as Developing World Develops a Sweet Tooth -...

1 of 2

http://online.wsj.com/news/articles/SB1000142405270230470380457...

Dow Jones Reprints: This copy is for your personal, non-commercial use only. To order presentation-ready copies for distribution to your colleagues, clients or customers, use the Order Reprints tool at the bottom of any

article or visit www.djreprints.com

See a sample reprint in PDF format.

Order a reprint of this article now

MORE

ALL

MEDALS »

NOR

NED

USA

RUS

GER

CAN

SWE

SUI

+

OLYMPICS

AUT

COMMODITIES

World's Sweet Tooth Heats Up Cocoa

Growing Demand From Emerging Markets Is Pushing Up Prices for Key Ingredient in Chocolate

B y ALE XANDR A WEXLE R

Updated Feb. 13, 2014 7:06 p.m. ET

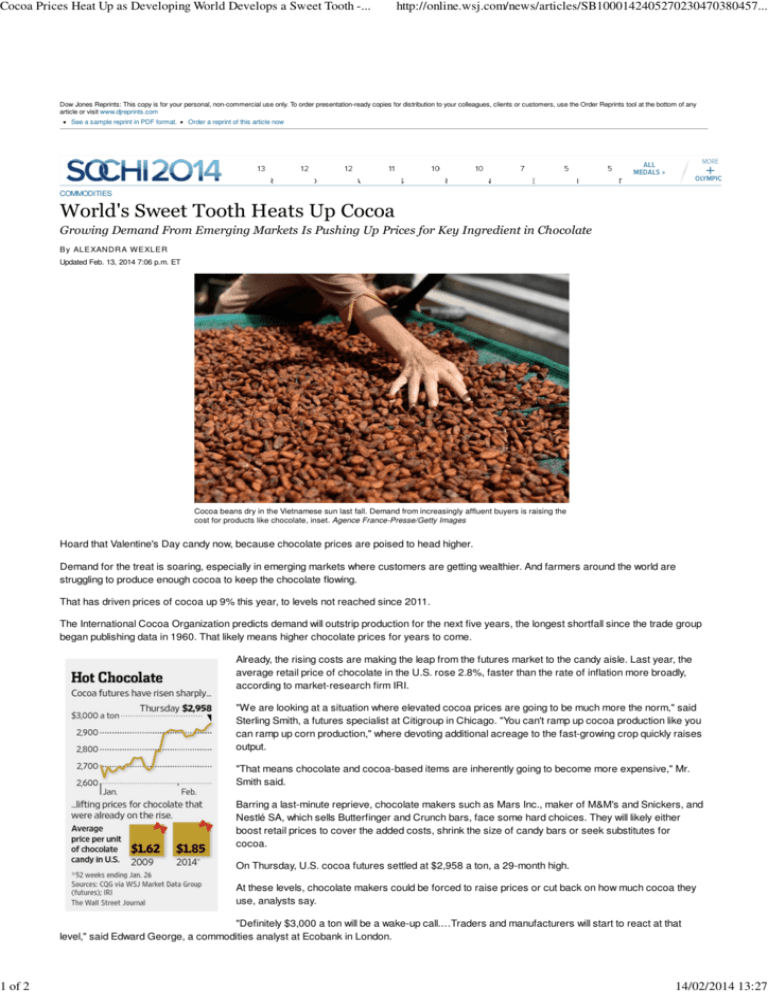

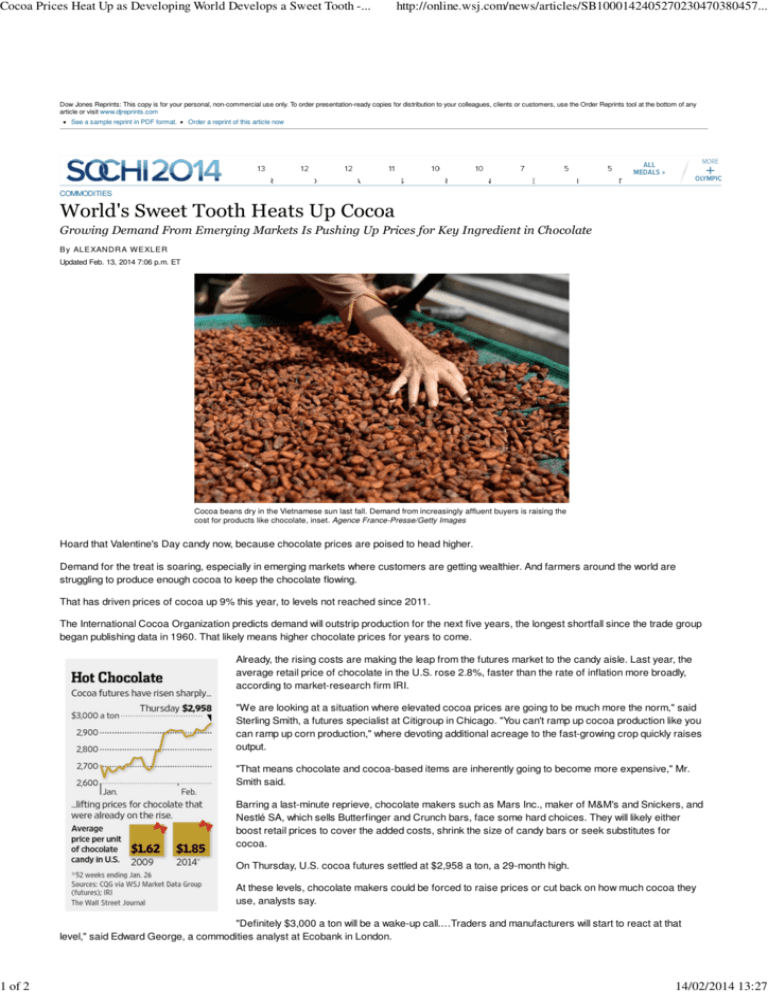

Cocoa beans dry in the Vietnamese sun last fall. Demand from increasingly affluent buyers is raising the

cost for products like chocolate, inset. Agence France-Presse/Getty Images

Hoard that Valentine's Day candy now, because chocolate prices are poised to head higher.

Demand for the treat is soaring, especially in emerging markets where customers are getting wealthier. And farmers around the world are

struggling to produce enough cocoa to keep the chocolate flowing.

That has driven prices of cocoa up 9% this year, to levels not reached since 2011.

The International Cocoa Organization predicts demand will outstrip production for the next five years, the longest shortfall since the trade group

began publishing data in 1960. That likely means higher chocolate prices for years to come.

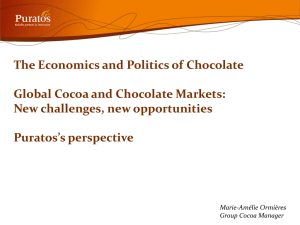

Already, the rising costs are making the leap from the futures market to the candy aisle. Last year, the

average retail price of chocolate in the U.S. rose 2.8%, faster than the rate of inflation more broadly,

according to market-research firm IRI.

"We are looking at a situation where elevated cocoa prices are going to be much more the norm," said

Sterling Smith, a futures specialist at Citigroup in Chicago. "You can't ramp up cocoa production like you

can ramp up corn production," where devoting additional acreage to the fast-growing crop quickly raises

output.

"That means chocolate and cocoa-based items are inherently going to become more expensive," Mr.

Smith said.

Barring a last-minute reprieve, chocolate makers such as Mars Inc., maker of M&M's and Snickers, and

Nestlé SA, which sells Butterfinger and Crunch bars, face some hard choices. They will likely either

boost retail prices to cover the added costs, shrink the size of candy bars or seek substitutes for

cocoa.

On Thursday, U.S. cocoa futures settled at $2,958 a ton, a 29-month high.

At these levels, chocolate makers could be forced to raise prices or cut back on how much cocoa they

use, analysts say.

"Definitely $3,000 a ton will be a wake-up call.…Traders and manufacturers will start to react at that

level," said Edward George, a commodities analyst at Ecobank in London.

14/02/2014 13:27

Cocoa Prices Heat Up as Developing World Develops a Sweet Tooth -...

2 of 2

http://online.wsj.com/news/articles/SB1000142405270230470380457...

Mars, Nestlé and Mondelēz International Inc., which owns Cadbury, declined to comment on how they might adjust to higher cocoa prices.

As he was spending $60 on chocolate in La Maison du Chocolat in Midtown New York on Thursday, investment manager Jim Carey said he

buys chocolate for special occasions and wouldn't necessarily stop if prices went higher.

"Probably what I would do is keep buying it, but I wouldn't buy as many pieces, or trade down to smaller boxes," Mr. Carey, who is 67 years old,

said. He said he also might visit a less expensive retailer if prices rise.

Terence Huang, 28, a student at New York University, who was shopping at Rockefeller Center the day before Valentine's Day for Godiva

chocolates to give his friends, says he may not be so generous if prices keep rising.

"If [the price] is very high, I will not buy it," Mr. Huang said.

Many cocoa traders and analysts say they are preparing for years of high prices.

Demand is surging world-wide, particularly in developing countries. Last year, the world consumed more than four million tons of cocoa beans

for the first time, a 32% increase in a decade.

Growth is particularly strong in emerging markets. In China, cocoa demand is expected to rise 5% annually through at least 2018, according to

market-research firm Euromonitor International.

"Emerging markets are getting to an income level where they can start affording chocolate, and that pushes up demand," said Matt Hudak,

consumer analyst at Euromonitor.

Growers can't keep up. Cocoa is grown by millions of independent farmers tilling small plots of land, mostly in poor countries in West Africa.

Aging trees are producing fewer beans, and some farmers are switching to more profitable crops like palm oil and rubber.

And planting trees won't help immediately. Cocoa trees take about 10 years to reach their peak.

Chocolate makers such as Mars and Nestlé have poured millions of dollars into developing new varieties of cocoa trees. They have hired

agronomists to teach advanced techniques to small farmers across West Africa.

"The sad truth is, it has made no difference," said Barry Parkin, global head of commodity procurement at Mars.

Higher prices could help, by potentially persuading farmers to invest more in their cocoa farms.

Olam International Ltd. , one of the biggest cocoa traders, estimates futures prices need be around $3,000 a ton this year just to keep

production steady and must rise to $3,500 a ton to entice farmers to expand production.

Candy companies have other options before raising prices.

Cocoa products make up 31% of an average 100-gram milk chocolate bar, according to commodity analysts at Mintec Ltd. The Hershey Co. in

2006 began using substitutes for cocoa butter in a few products, a company representative said. Cocoa butter gives chocolate its rich, creamy

texture.

The move forced the company to relabel those products as "made with chocolate" or "chocolate candy" instead of "milk chocolate," since the

products no longer met Food and Drug Administration guidelines for milk chocolate, which has to contain at least 10% cocoa.

Hershey is beginning to switch some products, including Krackel and Mr. Goodbar miniature bars, back to solid milk chocolate, the

representative said.

In 2011, when cocoa prices spiked, Michael Szyliowicz, co-founder of Mont Blanc Gourmet, had trouble finding the cocoa powder he needs to

make beverage mixes and syrups for companies including Krispy Kreme Doughnuts Inc.

He told his customers: "You can either stick with what you've got and we're passing along the price increase, or if you want to choose a

different taste profile, we can change suppliers."

He said most agreed to pay higher prices.

—Annie Gasparro contributed to this article.

Write to Alexandra Wexler at alexandra.wexler@wsj.com

Copyright 2013 Dow Jones & Company, Inc. All Rights Reserved

This copy is for your personal, non-commercial use only. Distribution and use of this material are governed by our Subscriber Agreement and by copyright law. For non-personal use or to order multiple copies, please

contact Dow Jones Reprints at 1-800-843-0008 or visit

www.djreprints.com

14/02/2014 13:27