Shared Capitalism at Work

advertisement

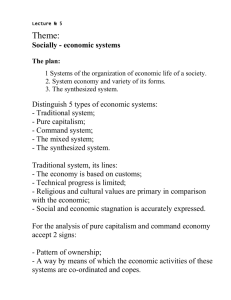

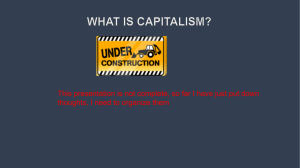

Does Shared Capitalism Help the Best Firms Do Even Better? Douglas Kruse, Rutgers University and NBER Joseph Blasi, Rutgers University and NBER Richard Freeman, Harvard University and NBER May 2011 Prepared for British Academy Seminar, ―The Economics of Share Ownership and Gainsharing: Findings and Policy Implications,‖ Centre for Economic Performance, London School of Economics, May 26, 2011. This research was made possible with the gracious cooperation of Amy Lyman and the Great Place to Work® Institute. It was supported by an Officer Grant from the Sloan Foundation, and by the Foundation for Enterprise Development who funded the Beyster Faculty Fellowships for Kruse and Blasi. Abstract We analyze the effects of employee ownership, profit and gain sharing, and broad-based stock options (―shared capitalism‖) on employee attitudes, turnover, and performance among applicants to the ―100 Best Companies to Work For in America‖ competition. The dataset includes company surveys filled out by 780 firms for 1312 firm-year observations over 2005 to 2007, matched to representative employee surveys within each company totaling over 300,000 surveys in the three years. One finding is that company-reported shared capitalism is linked to employee-reported empowerment measures (participation in decisions, information sharing, high-trust supervision), and several measures of positive workplace culture. A second key finding is that shared capitalism has favorable effects on voluntary turnover and employee intent to stay, but only when combined with employee empowerment and positive workplace culture. We find some similar patterns when examining return on equity and Tobin’s Q among the public companies in the sample. The analysis provides a stringent test of the relationship between shared capitalism and workplace performance, given that outcomes will be compressed in this select sample of firms with the ―best‖ workplaces. Introduction About half of all private-sector workers have their pay or wealth tied to company or workplace performance through employee ownership, profit sharing, gain sharing, or broadbased stock options (Kruse, Freeman, and Blasi, 2010). We refer to these collectively as ―shared capitalism‖ plans. Over 100 studies indicate that these plans are linked to better average workplace performance (see reviews in Kaarsemaker, 2007, Freeman, 2007, Freeman et al., 2011). There is, however, considerable dispersion in the outcomes, with some plans linked to very positive workplace outcomes and in other cases linked to null or negative outcomes. In the past few years researchers have begun to uncover the individual- and firm-level factors that moderate the effects of shared capitalism on employee attitudes, behavior, and performance. These factors include complementary ―high-performance‖ workplace policies such as participation in decisions, training, and job security that researchers have found to work well together in improving workplace outcomes (e.g., Ichniowski et al., 1997; Appelbaum et al., 2000; Kruse, Freeman, and Blasi, 2010). While many studies have looked at outcomes under shared capitalism, there are very few that have the data necessary to explore the mechanisms underlying its operation. Our recent intensive studies had a large sample of over 41,000 employees but were based on only 14 firms. We addressed the question of generalizability by replicating the findings in national employee surveys (the 2002 and 2006 General Social Surveys), but the question remains of whether the findings will extend to a larger firm-based sample. In this paper we have a sample of 780 firms with up to 3 years of data on each firm, including company reports on policies combined with representative employee surveys within each company, totaling over 300,000 surveys. Unlike most firm-based studies that have data on just one or two types of shared capitalism, this one has company-reported data on four key forms of shared capitalism. The sample is unique in that all of the firms applied to the Great Place to Work® Institute to be under consideration for inclusion on the list of the ―100 Best Companies to Work for in America‖ published each year by Fortune magazine. The Institute compiles the management surveys and administers the random employee surveys that go into this process of selection. As such it is clearly not a representative sample of all firms, but is heavily skewed toward firms that consider themselves candidates for the ―best companies‖ designation, so are likely to have the best workplace policies and practices for attracting, motivating, and retaining employees. As will be seen, about half of these firms have some form of shared capitalism plan for employees. Our empirical task is to see whether even in this select group of firms: a) shared capitalism is linked to better attitudes and outcomes, and b) the effects of shared capitalism are moderated by high-performance policies. If we created a distribution of all firms along a scale of workplace quality, these firms would be concentrated in the ―upper tail,‖ and the variation in outcomes among them will be more compressed than if we had a representative sample of all firms. As an analogy, the variation in outcomes among professional basketball players will be more compressed than it would be among a representative sample of the population, because these players have already demonstrated their skill in one way or another. The greater compression makes it more difficult to tease out differences among the subjects and the factors responsible for those differences. Therefore our exploration of this sample can be seen as a stringent test of the effects of shared capitalism, since the select nature of the sample creates a bias against finding significant differences. While it is a select sample, it represents a noteworthy share of American workplaces 2 since these companies employ about 6 million workers or about 5% of the private-sector workforce. In the next section we summarize the theory and prior literature, followed by a description of our model and the data. In the results section we first find that shared capitalism is positively linked to measures of employee empowerment and workplace culture, and then find that these measures moderate the effects of shared capitalism on voluntary turnover and employee intent such that shared capitalism has favorable effects only when combined with empowerment and positive workplace culture. We conclude with a discussion of limitations and next steps for research. Theory and Prior Literature Establishing a closer link between compensation and performance is one solution to the principal-agent problem of the employment relationship. The perception that compensation plans based on workplace performance can help improve performance is widespread. In public opinion polls, two-thirds to four-fifths of Americans believe that workers in employee-owned firms ―work harder‖ and ―pay more attention to the quality of their work‖ than do other workers, and four-fifths say that ―Employee stockholders are more likely than outside stockholders to vote their shares in the best, long-term interest of the company‖ (summarized in Kruse and Blasi, 1999). One of the key challenges facing all group incentives is the free rider or 1/N problem: in a group incentive plan with N workers, individual incentives become diluted because each individual receives on average only 1/N of the reward from his or her extra effort. It is possible, however, for workers to establish a cooperative solution to the free rider problem by establishing 3 and enforcing work norms for high effort, with the results that all workers could be better off (Axelrod, 1984; Fudenberg and Maskin, 1986). What it takes to establish and maintain such an agreement, however, is not obvious. Laboratory experiments show that cooperation is more common than would be predicted by simple models of self-interest, and is more likely when participants can begin to form a group identity by talking with each other before making their choices (Dawes and Thaler, 1988; Kahneman and Thaler, 1991). The empathy with co-workers that may be built through communication can help develop and enforce worker norms that support higher performance (Kandel and Lazear, 1992; Lazear, 1992). These considerations make it clear that a shared capitalism plan cannot simply be installed and expected to improve performance. ―To get the productivity-enhancing effects, something more may be needed—something akin to developing a corporate culture that emphasizes company spirit, promotes group cooperation, encourages social enforcement mechanisms, and so forth‖ (Weitzman and Kruse, 1990: 100). As argued by Rousseau and Shperling (2003), employee ownership may alter the psychological contract between the employee and the organization, but only if combined with some of the perquisites of ownership: Bundling equity and profit sharing with financial information and participation in decision making can enhance worker contributions to the firm by creating employment relationships based on congruent psychological contracts. Such a bundle can form the basis of trust and aligned interests between workers and employer (2003: 564-565). Most studies point toward a positive relationship between shared capitalism and workplace performance. There have been over 100 studies on organizational performance under shared capitalism policies, including not just comparisons among firms but also pre/post studies following firms before and after the adoption of shared capitalism plans.1 For reviews of the employee ownership literature see Blasi 1988; Doucouliagos, 1995, Kruse and Blasi, 1997, Kruse, 2002, Kaarsemaker, 2006a,b, and Freeman, 2007. For a review of the broad-based stock option literature see Blasi et al., 2003. For reviews of the profit sharing and gainsharing literatures see Weitzman 1 4 Two reviews of the employee ownership literature concluded that ―Two thirds of 129 studies on employee ownership and its consequences found favourable effects relating to employee ownership, while one tenth found negative effects‖ (Kaarsemaker, 2006), and ―research on ESOPs [Employee Stock Ownership Plans] and employee ownership is overwhelmingly positive and largely credible‖ (Freeman, 2007). Formal meta-analyses analyzing the combined results of studies have found strong evidence of a positive association between shared capitalism and performance (Doucialiagos, 1995; Kruse and Blasi, 1997; Weitzman and Kruse, 1990). A number of the studies address firm-level selection effects by using panel data with fixed effects to control for fixed unobservables, or by using other corrections to control for unobservables that may not be fixed. Selection effects have also been addressed by random assignment: one field study implemented random assignment of profit sharing at 3 of 21 establishments within a firm, finding that the performance of those establishments improved relative to the control group (Peterson and Luthans, 2006); also, laboratory evidence using a true experiment found higher productivity among subjects organized into employee-owned ―firms‖ (Frohlich et al., 1998). Our study using an employee survey before and after the introduction of a profit sharing plan also lends support to these findings (Freeman, Kruse, and Blasi 2010: 31). In addition, two studies cast doubt on worker self-selection as a serious problem, finding that average worker quality did not change as compensation was changed from individual to group incentives, while average worker performance improved under the group incentives (Weiss, 1987; Hansen, 1997).2 While the studies overall have found better workplace performance on average for firms with shared capitalism plans, there is dispersion in results both within and across studies. This dispersion—with shared capitalism apparently improving performance in and Kruse, 1990, Bullock and Tubbs, 1990, Kruse, 1993, OECD, 1995, Doucialiagos, 1995, Welbourne and Mejia, 1995. For a listing of all studies see the appendix to Freeman, Blasi, and Kruse (2011). 2 For further discussion of selection bias in studying shared capitalism, see Kruse, Freeman, and Blasi (2010: 29-33). 5 some firms but sometimes not in others—indicates that there are likely to be important pre-conditions or enabling factors for shared capitalism to have a positive effect, in line with the idea that “something more” is needed to create a cooperative solution to the free rider problem. In our 2010 book we analyzed two nationally representative surveys and over 41,000 employee surveys in shared capitalism companies, finding that these plans have the most positive effects on performance-related attitudes and behaviors when they are combined with high-trust supervision (trusting employees to work well without close supervision), base wages at or above market, and high-performance policies (job security, training, and employee involvement in decisions). Without these policies these plans can have no or negative effects, indicating that the dispersion in results across the 100+ studies may be explained in part by the types of policies that do or do not accompany shared capitalism. Other recent studies finding evidence of complementarities between shared capitalism and workplace policies include Jones et al. (2010) and Pendleton and Robinson (2010).3 Another key theoretical challenge to shared capitalism programs is employee risk aversion. Employees may react negatively toward the pay variability in shared capitalism programs (Rousseau and Shperling, 2003), and may require a compensating differential in pay, benefits, or work conditions. The pay variability may, for example, be offset in part or whole by greater employment security that can accompany shared capitalism (as Weitzman, 1984, argued with respect to profit sharing). There is little evidence of a paybased compensating differential. While employee ownership has occasionally been adopted as part of wage or benefit concessions in a few high profile cases, this appears to Pendleton and Robinson find that employee ownership appears to interact with formal employee involvement programs in affecting performance only when a minority of employees participate in employee ownership, while it has a direct unmoderated effect on performance when a majority of employees participate. The authors note that this latter result may reflect the importance of an informal ownership culture for performance when most employees are owners. 3 6 happen in only 4% of adoptions ((U.S. General Accounting Office, 1986; Blasi and Kruse, 1991: 325-328). More broadly, there is no evidence of generally lower fixed pay or benefits in exchange for employee ownership and profit sharing. Both cross-sectional and longitudinal studies have found ESOPs to be associated with higher or similar levels of pay relative to nonESOP firms or pre-ESOP pay (Kim and Ouimet, 2009; Kardas, Scharf, and Keogh 1998; Scharf and Mackin 2000), while other forms of employee ownership are associated with higher average compensation levels (Blasi et al., 1996), pension assets (Kroumova, 2000), wage growth (Renaud et al., 2004), and overall worker wealth (Buchele et al., 2010). Likewise, firms with profit-sharing or broad-based stock options generally have higher average compensation than otherwise-comparable firms (Carstensen et al., 1995; Estrin and Wilson 1989; Handel and Gittleman 2004; Hart and Hubler, 1991; Hubler, 1993; Sesil et al., 2007), and profit-sharing workers have faster wage growth than other workers (Azfar and Danninger, 2001). Another challenge related to risk is whether the level of objective risk in worker portfolios exceeds the prudent amount. Benartzi and Thaler (2001) found that when given a choice in a company 401(k), workers over-invest in company stock. Among the 41,000 employee surveys in a recent sample of companies with a range of employee ownership formats, the median amount of a worker’s portfolio in company stock was 5 percent and the mean was 5 percent, while 16 percent had more than twice the mean. Working with Harry Markowitz who received the Nobel Prize in Economics in portfolio theory, it was determined that around 10 to 15 percent of a worker’s portfolio in company stock constituted a manageable level of risk. But, in an analysis inspired by Kahneman’s work, we found that workers with high economic insecurity or subjective risk did not respond well to shared capitalism (Blasi, Kruse, and Markowitz 2010: 121, 125, 110-120.) To address this issue, the study found that companies can 7 use ESOPs where the workers do not purchase the shares but are granted them or stock options. Different formats of employee ownership can be combined with cash profit sharing and gain sharing in order to offset the shared capitalism risk (Kruse, Freeman, and Blasi 2010). These results on pay levels and risk, combined with the performance literature summarized above, indicate that shared capitalism generally appears to be part of a “gift exchange” (Akerlof, 1983) in which the plans can be structured so that they do not introduce excessive risk into the workers’ basic pay package but instead draw on feelings of reciprocity that help establish norms for greater effort and cooperation (Kruse, Blasi, and Freeman: 377-382). The prior literature therefore points to average positive effects of shared capitalism plans on performance, but with substantial dispersion in results and insufficient exploration of the mechanisms and conditions under which they can have an effect. Here we contribute evidence on this question from a new data source that combines management-reported and employeereported survey data drawn from companies that tend to have the best workplace policies. Data and Method Data source The data come from surveys collected by the Great Place to Work® Institute, to which we were given access under a special arrangement with the Institute. There are two types of survey data: 1) a ―Culture Audit‖ with detailed information on company policies, filled out by a company representative, and 2) an employee survey filled out by 200-300 representative employees in each company, measuring employee attitudes and perceptions of the company. The randomized surveys were administered by the Institute. The Culture Audit was developed 8 as a result of intensive field work with corporations over the last fifteen years by the Institute. It contains information on the availability of shared capitalism plans, the company’s other work practices, and performance measures. About 400 companies supply culture audit and employee survey data each year as part of an application to be one of the ―100 Best Companies to Work For in America.‖ The dataset contains all applicants including those who won this particular competition and those who did not win the competition. We were provided access to the dataset under a strict confidentiality agreement which allowed us to analyze the data on an Institute server, but not download or copy the data. We have data on 780 companies over a 3-year span, collected in 2005-2007, with a total of 1312 company-year observations. The companies that submitted surveys for one year only were 480, for two years were 168, and for three years were 182. We were able to match to public company performance information for 375 or 48% of the 780 corporations (the remainder are privately-held). While this collection of public companies was not randomly selected, the group of companies studied do meaningfully represent the companies traded on the U.S. public market, namely the NYSE and the NASDAQ. For example, based on Standard & Poors Compustat, our public company sample constitutes 10% of the total sales, 10% of the total employment, and 20% of the market value of all publicly traded corporations in 2007. The total number of employee surveys over the three years was 305,339 or an average of 232 surveys per companyyear. While firms can be tracked by year, individual employees cannot be tracked by year. Model and measures We examine the relationship between company-level and individual-level measures using multilevel techniques, based on the model presented in Figure 1. Shared capitalism is measured at the company level using management responses on the culture audit, and employee 9 empowerment and workplace culture are measured at the individual level using employee survey responses. We examine the relationship of empowerment and culture to a) individual-level intent to stay, and b) company-level performance outcomes, testing both the potential mediating and moderating effects of empowerment and culture on the relationship of shared capitalism to these outcomes. One advantage of our data is that by using both employee and manager surveys, we are able to avoid the problem of common method bias for many of our estimated relationships (in which relationships may be inflated by spurious covariance due to the common method used in collecting the data). Our shared capitalism measures come from the manager-reported data, while the measures of empowerment, culture, and intent to stay come from the employee survey, and the public company performance data come from Standard and Poor’s Compustat. We also have manager-reported data on actual company voluntary turnover separate from the employee survey measure of individual intent to stay, allowing us to compare both outcome variables on this key measure. Descriptive data are provided in Tables 1 to 3. Regarding overall prevalence of shared capitalism, Table 1 shows that close to one-sixth (17.6%) of firms report ESOPs, just under half (44.5%) report granting stock options in the previous year, and close to one-fifth report cash profit/gainsharing plans (18.1%) and deferred profit sharing plans (22.3%). More detail on the plans is provided in Table 2. In the average ESOP company, the ESOP owns one-sixth (17%) of the company, with 9% of the ESOPs owning a majority of the company. Twelve companies were 100% owned by their ESOPs. In the companies with stock options, the average percent of employees granted stock options was 20.6%, while 16.4% of the companies were broad-based in that they granted stock options to more than half of their employees and 8.7% of the companies 10 granted stock options to between 25% and 50% of workers. The average profit/gain sharing plan provided an employee 7.2% of annual pay as a profit/gain share, and the average deferred profit sharing plan provided a contribution equaling 6.5% of employee pay. Table 2 also introduces the shared capitalism index that we use as a convenient thermometer of the intensity of shared capitalism within a company. The shared capitalism index is a summated rating with one point each for 1) an Employee Stock Ownership Plan (ESOP), 2) an ESOP owning 50% or more of the company, 3) a stock option plan covering 25% or more of employees, 4) a stock option plan covering 50% or more employees, 5) a cash profit/gainsharing plan, 6) a cash profit/ gainsharing paying more than the median percent of pay, 7) a deferred profit sharing plan, and 8) a deferred profit sharing with a contribution above the median percent of pay. As seen in Table 2, the average score is .835, with 52% of firm-years having a score of zero (i.e., no shared capitalism) and 6% having scores of 3 or more (with a maximum of 5). Along with using this index as a measure of the intensity of shared capitalism, we also break out the individual shared capitalism variables in many of the specifications. Table 3 provides descriptive statistics on the other variables used in this study. We focus on three workplace practices that both theory and prior research suggest are complementary to shared capitalism: high-trust supervision, high participation in decisions, and high information sharing. We examine these separately as dependent variables, but given the high correlation among them we analyze their effects by combining them into a measure of employee empowerment (alpha=.890). For workplace culture we use six measures: perceived ―family‖ or ―team‖ feeling, perceived employee cooperation, perceived employee willingness to ―give extra‖, feeling that one receives a fair share of company profits, the Great Place to Work Trust 11 Index©, and the perception that ―this is a great place to work.‖ The Trust Index© is used by the Institute as a summary measure of employee perceptions of the company; it includes all items from the employee survey, grouped into five dimensions and then averaged across the dimensions.4 While many of these items tap employee perceptions of company culture, in the regressions we keep the presentation manageable by using the Trust Index© as our summary measure of company culture. Table 3 also presents descriptive statistics for our individual-level measure of intent to stay, and our company-level performance measures of voluntary and involuntary turnover, worker compensation claims, and return on equity (ROE) and Tobin’s Q for the public companies. The ―adjusted‖ ROE and Tobin’s Q figures represent the residuals for the Great Place to Work® applicants from a robust regression of ROE or Tobin’s Q on forty industry dummies, separately by year, for the entire Standard and Poor’s Compustat dataset. The resulting value therefore represents the company’s performance after subtracting the average performance for all public companies in the company’s industry in that year. The mean value of .081 for adjusted ROE indicates that the applicants had an average ROE that was 8.1 percentage points higher than the industry-year average, consistent with the idea that these are betterperforming firms in general. Regression specifications Cross-sectional comparisons among companies may be tainted by unobservable firmspecific factors (e.g., management quality, market placement). The fact that many of the firms applied in more than one year allows us to account for firm-specific factors using random-effects The five dimensions are labeled camaraderie (10 items, alpha=.94), credibility (13 items, alpha=.96), fairness (12 items, alpha=.93), pride (8 items, alpha=.93), and respect (13 items, alpha=.94). The Trust Index© that averages these five dimensions has an alpha of .970. We exclude the “intent to stay” item since we examine the relationship between the Trust Index© and intent to stay in Table 7. 4 12 specifications. While it would be ideal to use fixed effects, there was very little within-firm variation in the shared capitalism measures over the three years of our data, so we rely on random effects specifications that exploit both within-firm and between-firm variation (though we hope to use fixed effects as further years of data become available). There are three stages of analysis. First we examine the overall relationship of shared capitalism to the other outcomes using the following equations: (1) Y1ijt= a + b1*SCjt + b2*X1ijt + b3*X2jt + b4*Rj + eijt (2) Y2ijt= a + b1*SCjt + b2*X1ijt + b3*X2jt + b4*Rj + eijt (3) Y3jt= a + b1*SCjt + b2*X2jt + b3*Rj + ejt where Y1ijt = perception of empowerment and culture for individual i, firm j, year t Y2ijt = intent to stay for individual i, firm j, year t Y3jt = firm performance measure for firm j, year t SCjt = shared capitalism measure(s) for firm j, year t X1ijt = employee-level controls for individual i, firm j, year t X2jt = company-level controls for firm j, year t Rj = firm-level random effect for firm j eijt = error term for individual i, firm j, year t ejt = error term for firm j, year t The X1 controls include individual-level employee demographic information (gender dummy, full-time dummy, 6 dummies for race/ethnicity, 5 dummies for age category, 7 dummies for occupation, 6 dummies for tenure category) and the X2 controls include company-level characteristics (defined benefit pension plan dummy, natural logarithm of total employment, unionized percent of workforce, whether publicly-held, age of company, dummies for services and manufacturing, and natural logarithms of average hourly pay for largest hourly-paid group and average salary for largest salaried group). 13 In the second stage of analysis we examine how empowerment and culture may mediate the effects of shared capitalism by inserting the Y1 term into equations 2 and 3 above, and estimating with and without the shared capitalism term: (4) Y2ijt= a + b1*Y1ijt + b2*SCjt + b3*Xjt + b4*Rj + eijt (5) Y3jt= a + b1* Y 1 jt + b2*SCjt + b3*Xjt + b4*Rj + eijt where Y 1 = mean of Y1 variable across individuals in firm j, year t Other variables as defined above The mediation analysis is conducted using the method of Baron and Kenny (1986) by examining a) whether the shared capitalism measures predict outcomes in equations 2 and 3, b) whether the empowerment and culture measures predict outcomes in equations 4 and 5, both before and after shared capitalism is included, and c) whether the magnitudes of the shared capitalism coefficients are decreased from equations 2 and 3 to equations 4 and 5. Finally in the third stage of analysis we examine the potential moderating effects of empowerment and culture by using interactions with shared capitalism. (6) Y2ijt= a + b1*Y1ijt + b2*SCjt + b3*(Y1ijt*SCjt) + b4*Xjt + b5*Rj + eijt (7) Y3jt= a + b1* Y 1 jt + b2*SCjt + b3*( Y 1 jt*SCjt) + b4*Xjt + b5*Rj + ejt The b3 coefficients will indicate whether empowerment and culture appear to moderate the effects of shared capitalism. As noted earlier, this is a select sample drawn from among companies that think they have a chance to be on the list of the 100 best companies to work for. As such, they are likely to have both formal and informal policies that help create a good work experience for employees. Companies that lack recognized formal policies (e.g., shared capitalism plans, work-life 14 programs) may make up for this with informal policies that establish a distinct and positive culture (e.g., a firm without shared capitalism plans may have a variety of nonfinancial incentives that successfully engage employees). Both the formal and informal policies will lead to a compression of outcomes relative to what we would observe across a representative sample of U.S. companies. This compression is likely to lead to a downward bias in both the magnitudes and statistical significance of within-sample differences, so that any significant differences we do observe are more likely to represent true differences. Results Shared capitalism is positively related to the workplace practice and culture variables, as shown in Table 4. The regressions show that employees in companies with greater amounts of shared capitalism are more likely to report high-trust supervision, participation in decisions, information sharing, and more favorable outcomes on all of the culture measures. When the shared capitalism index is replaced first by the dummy variables decomposing the index, and then by the continuous shared capitalism variables, the ESOP variables appear most consistently as positive predictors of good outcomes. Furthermore the coefficients on ―ESOP 50%+ of co.‖ are always larger than the coefficients on ―ESOP 1-49% of co.,‖ indicating that outcomes are better in majority-owned ESOP companies than in minority-owned ESOP companies. Shared capitalism is also a positive predictor of an employee’s intent to stay with the company, as shown in the last column of Table 4. Consistent with this, company-reported voluntary turnover is also lower in firms with greater amounts of shared capitalism, as shown in column 1 of Table 5. The other company-reported performance outcomes are not as consistently related to shared capitalism. Involuntary turnover is not significantly tied to the shared 15 capitalism index, but is lower among firms with cash profit/gainsharing and deferred profit sharing plans (column 2), as predicted by Weitzman (1984). Workers compensation claims are significantly lower in ESOP companies, but the extent of claims is not related to the percent of company owned by the ESOP (column 3). Within the publicly-held companies, the shared capitalism index is a weak positive predictor of ROE, but there are no strong predictors of ROE or Tobin’s Q among the shared capitalism variables without including measures of company culture (columns 4 and 5). Given the strong relationship of shared capitalism to voluntary turnover and intent to stay, we focus on these two outcome variables in Tables 6 and 7 in order to disentangle the routes through which shared capitalism may have an effect. These tables examine both the mediating and moderating effects of empowerment and culture. The empowerment measure is a very strong predictor of voluntary turnover, both before and after controlling for the shared capitalism index (Table 6, columns 2 and 3). When controlling for empowerment, the coefficient on the shared capitalism index is reduced only slightly (column 3), indicating that empowerment is only partially mediating the effects of shared capitalism. The story is made richer, however, when considering the interactions in columns 4 and 5. The significant positive coefficient on the shared capitalism variable indicates that shared capitalism has an unfavorable effect on voluntary turnover when empowerment is at a low level, and the significant negative coefficient on the interaction term indicates that shared capitalism has a favorable effect at higher levels of empowerment. The significant negative interaction is found when specifying both as a continuous index (column 4) and as a dummy variable indicating an index score above the upper quartile (column 5). We find the same pattern of results when examining the interaction of shared capitalism with the Trust Index© (columns 6 to 16 9), although the interaction is statistically significant only with the continuous Trust Index© (column 8). These results are illustrated in Figure 2, based on regression 4 in Table 6.5 ―Low‖ empowerment is here defined as the empowerment score for the firm at the 10th percentile, while ―high‖ empowerment is the score at the 90th percentile. In a firm without any shared capitalism, voluntary turnover is predicted to drop slightly from 15.3% to 14.4% as a firm moves from low to high empowerment. In a firm with high shared capitalism (the maximum observed score of 5 on the index), voluntary turnover is predicted to drop dramatically from 17.6% to 6.3% as a firm moves from low to high empowerment. It is noteworthy that the effects of shared capitalism appear to be unfavorable with low employee empowerment, as predicted turnover is larger with high shared capitalism (17.6%) than without shared capitalism (15.3%). This is consistent with the results in Kruse, Freeman, and Blasi (2010), where we found positive effects of shared capitalism on employee behavior and attitudes only when shared capitalism was combined with high-trust supervision and high-performance practices. Our interpretation is that employees may react badly to shared capitalism when they are over-supervised and not given the tools to improve performance (―we want you to be inspired by the shared rewards, but we’re still going to keep a close eye on you‖); in this case the shared capitalism may be seen primarily as shifting financial risk onto employees. An important finding is that these results from company-reported data are consistent with employee reports on intent to stay, as seen in Table 7. The positive interaction coefficients in columns 4 and 8 indicate that intent to stay increases when shared capitalism is combined with high levels of the empowerment and trust. The coefficient on the base shared capitalism variable 5 A very similar figure is created when the results of regression 8 are used, replacing empowerment with the Trust Index© (not shown but available). 17 is negative when the interactions are included, indicating lower intent to stay when shared capitalism is implemented in companies where empowerment and the Trust Index© are low. One difference from the pattern in Table 6 is that the shared capitalism coefficient is no longer significant when controlling for empowerment or the Trust Index© (columns 3 and 7), which would indicate either that these variables fully mediate the effects of shared capitalism or that shared capitalism is a proxy for them in column 1. The interaction results from both Tables 6 and 7, however, point toward a richer story of moderation rather than mediation in analyzing the effects of shared capitalism. Do we find such patterns in other performance-related outcomes? Involuntary turnover reflects decisions by the company and is not under control of the employee, so we do not investigate how employee attitudes may mediate of moderate the effects of shared capitalism on involuntary turnover. As found in Table 5, shared capitalism is not a predictor of workers compensation claims, and in further tests we do not find that it interacts with empowerment or culture in predicting workers compensation claims. We do find some positive interactions in predicting ROE and Tobin’s Q in the public companies, as shown in Tables 8 and 9. In Table 8, the shared capitalism index has a positive effect on Tobin’s Q only for firms in the top quarter of employee empowerment (column 5), although the interactions with the continuous empowerment measure and the Trust Index© are not statistically significant (columns 4, 8, 9). In Table 9, the shared capitalism index has a positive effect on ROE only for firms in the top quarter of the Trust Index© (column 9), although the interactions with the continuous Trust Index© and the empowerment measures are not statistically significant (columns 4, 5, 8). Apart from the question of shared capitalism’s effects, it is noteworthy that the Trust Index© is a 18 positive predictor of both Tobin’s Q and ROE, and empowerment is a significant predictor of ROE, both with and without controlling for shared capitalism (columns 2, 3, 6, and 7). We also explored a productivity measure for the public companies based on sales per employee, using a standard Cobb-Douglas production function.6 While it would be better to use value-added per employee, the Compustat dataset has necessary information for value-added for only 20% of the companies, or 75 of the applicants, which is not a sufficient sample for meaningful analysis. The sales per employee measure was not related to any of the shared capitalism, empowerment, or trust measures (not reported here but available). We have concerns about the quality of the productivity measure, since we would expect it to be related to voluntary turnover and other performance measures. The lack of significant relationships may also indicate that the effects of shared capitalism, empowerment, and the culture measures are swamped by the influence of other factors inside and outside the company (e.g., type of technology, industry shocks). Nonetheless the findings provide an important caution in interpreting the other favorable results on the effects of shared capitalism. Conclusion Our key findings are: 1) shared capitalism predicts greater employee empowerment (high-trust supervision, participation in decisions, and information sharing) and a variety of positive perceptions of company culture, and 2) shared capitalism has a favorable effect on voluntary turnover and employee intent to stay only when combined with employee empowerment and a positive culture. These results are consistent with the findings from our To obtain industry-specific parameters, a Cobb-Douglas specification was run separately by industry for each of 40 industries over the 2000-2009 period for all Compustat companies, then the residuals for each year for the applicants were used to form the dependent variable in specifications similar to those in Tables 8 and 9. 6 19 intensive analysis of two national random datasets from the General Social Survey and 41,000 employees in 14 companies with shared capitalism plans. The results are strengthened by two features of our data. First, unlike most studies in this area, we can match management and employee responses, helping avoid common method bias. The fact that the voluntary turnover results are highly consistent with the results for employeereported intent to stay, and that one is based on management-reported data while the other is based on employee-reported data, provides strong cross-validation that increases our confidence in the findings. A second strength derives from the fact that this is a select sample of companies who think they have a chance of being on the list of the 100 best companies to work for. As described earlier, the outcomes within this sample will be more compressed than among a representative sample of U.S. companies, making it more difficult to find significant differences. Indeed, we would not have been surprised to find few significant differences among these companies with the ―best‖ workplaces, just as the top basketball players may be roughly equivalent. This makes it all the more noteworthy that we found positive effects of shared capitalism when combined with empowerment and a positive culture. There are of course a number of limitations. First, while we found consistent evidence in how shared capitalism appears to affect voluntary turnover and employee intent to stay, with some supportive findings in analyzing ROE and Tobin’s Q, we did not find these patterns in analyzing workers compensation claims and the productivity measure. This may reflect difficulty in sorting out the variety of influences on workers compensation claims and productivity, whereas voluntary turnover is fully under control of employees. We think it also reflects the poor data on productivity available in Compustat. A second limitation is the select sample: while this provides a stringent test, it would clearly be valuable to have such high- 20 quality company-reported and employee-reported data from a fully representative sample of U.S. companies. The select sample raises questions of generalizability, though the positive results are consistent with the general findings of favorable outcomes for firms with shared capitalism. The question of selection would be more acute if we had only those companies that made it onto the 100 best list; the fact that we have both those that did and did not make it onto the list gives us greater variation to exploit. A third limitation is that there may be unobservable companyspecific factors that help account for our results. We have two or three years of observations on many of the companies, allowing us to do random-effects specifications that help account for unobservable factors in analyzing both within-firm and between-firm variation. We do not, however, have sufficient within-company variation in shared capitalism over time to reliably use company fixed effects, which would fully remove the effects of any fixed unobservable factors at the company level. The addition of further years of data may provide us such variation. The ―100 Best Companies to Work for In America‖ annual listing has itself become a part of American business culture. Companies vie for the designation and talk about being on the list. This study indicates that shared capitalism plays an important role among those who apply for the designation. In addition, shared capitalism has a meaningful relationship to the Trust Index©—an important measure of ―a good place to work‖—and to voluntary turnover and some financial measures of performance. These results, using a large sample of banner U.S. corporations and thousands of randomly administered worker surveys, both confirm and help explain the overall findings from prior studies. The results strongly point to the value of further research on how shared capitalism interacts with other workplace policies, particularly policies that give workers the means to make a difference in the workplace and help engender a climate of cooperation. 21 22 Bibliography Akerlof, George. 1982. "Labor Contracts as Partial Gift Exchange," Quarterly Journal of Economics, Vol. 97, pp. 543-569. Appelbaum, Eileen, Thomas Bailey, Peter Berg, and Arne Kalleberg. 2000. Manufacturing Advantage. Ithaca: Cornell University Press. Axelrod, Robert M. 1984. The Evolution of Cooperation. New York: Basic Books. Azfar, Omar, and Stephan Danninger. 2001. ―Profit Sharing, Employment Stability, and Wage Growth,‖ Industrial and Labor Relations Review, 54(3), pp. 619-630. Baron, Reuben M., and David A. Kenny. 1986. ―The Moderator-Mediator Variable Distinction in Social Psychological Research.‖ Journal of Personality and Social Psychology, Vol. 51, No. 6, pp. 1173-82. Benartzi, S. and R. Thaler. 2001. Naïve Diversification Strategies in Defined Contribution Plans,‖ American Economic Review Vol. 91, No. 1, pp. 79-98. Berger, Johannes, Claus Herbertz, and Dirk Sliwka, 2011. ―Incentives and Cooperation in Firms: Field Evidence,‖ IZA DP No. 5618, Institute for the Study of Labor, April 2011. Blasi, Joseph R. 1988. Employee Ownership: Revolution or Ripoff? New York: HarperCollins, Ballinger Books. Blasi, Joseph, and Douglas Kruse. 1991. The New Owners The Mass Emergence of Employee Ownership in Public Companies and What it Means to American Business. New York: HarperCollins. Blasi Joseph, Michael Conte, and Douglas Kruse. 1996. ―Employee Stock Ownership and Performance Among Public Companies,‖ Industrial and Labor Relations Review, Volume 50, Number 1, 60-79. 23 Blasi, Joseph, Douglas Kruse, and Aaron Bernstein. 2003. In the Company of Owners: The Truth About Stock Options (And Why Every Employee Should Have Them). New York: Basic Books. Blasi, Joseph, Douglas Kruse, and Harry Markowitz. 2010. ―Risk and Lack of Diversification under Employee Ownership,‖ in Douglas Kruse, Richard Freeman, and Joseph Blasi, eds. Shared Capitalism at Work: Employee Ownership, Profit Sharing, Gainsharing, and Broad-based Stock Options. Chicago: University of Chicago Press. Buchele, Robert, Douglas Kruse, Loren Rodgers, and Adria Scharf. 2010. ―Show Me the Money: Does Shared Capitalism Share the Wealth?‖ in Douglas Kruse, Richard Freeman, and Joseph Blasi, eds. Shared Capitalism at Work: Employee Ownership, Profit Sharing, Gainsharing, and Broad-based Stock Options. Chicago: University of Chicago Press. Bullock, R.J. and Mark E. Tubbs. 1990. "A Case Meta-Analysis of Gainsharing Plans as Organization Development Interventions," Journal of Applied Behavioral Science, 26, 3, pp. 383-404. Cappelli, Peter, and David Neumark. 2001. ―Do 'High-Performance' Work Practices Improve Establishment-Level Outcomes?‖ Industrial and Labor Relations Review, July 2001, v. 54, iss. 4, pp. 737-75. Carstensen, Vivian, Knut Gerlach, and Olaf Hübler. 1995. ―Profit sharing in German firms,‖ in Friedrich Buttler, Wolfgang Franz, Ronald Schettkat, and David Soskice (eds.), Institutional frameworks and labor market performance: Comparative views on the U.S. and German economies. London and New York: Routledge, 168-207. Dawes, Robyn M., and Richard H. Thaler. 1988. ―Anomalies: Cooperation,‖ Journal of Economic Perspectives, Summer 1988, v. 2, iss. 3, pp. 187-97 24 Doucouliagos, C. 1995. ―Worker participation and productivity in labor-managed and participatory capitalist firms: a meta-analysis,‖ Industrial and Labor Relations Review, 49(1), 58-77. Estrin, Saul, and Nicholas Wilson. 1989. "Profit Sharing, the Marginal Cost of Labour and Employment Variability," Draft, Dept. of Economics, London School of Economics (May). Freeman, Richard B., Joseph R. Blasi, and Douglas L. Kruse. 2011. ―Inclusive Capitalism for the American Workforce: Reaping the Rewards of Economic Growth through Broad-based Employee Ownership and Profit Sharing,‖ Center for American Progress, Washington, D.C., March. Freeman, Richard B., Douglas L. Kruse, and Joseph Blasi, 2011. ―Worker Responses to Shirking under Shared Capitalism,‖ ,‖ in Douglas Kruse, Richard Freeman, and Joseph Blasi, eds. Shared Capitalism at Work: Employee Ownership, Profit Sharing, Gainsharing, and Broad-based Stock Options. Chicago: University of Chicago Press. Freeman, Steven F. 2007. ―Effects of ESOP Adoption and Employee Ownership: Thirty years of Research and Experience,‖ Working Paper #07-01, Organizational Dynamics Programs, University of Pennsylvania. Frohlich, N., J. Godard, J. A. Oppenheimer, and F. A. Starke. 1998. Employee versus conventionally- owned and controlled firms: An experimental analysis. Managerial and Decision Economics 19 (4/ 5): 311– 26. Fudenberg, Drew, and Eric Maskin. 1986. "The Folk Theorem in Repeated Games with Discounting or with Incomplete Information." Econometrica, Vol. 54, No. 3 (May), pp. 533-54. 25 Handel, Michael, and Maury Gittleman. 2004. "Is There A Wage Payoff to Innovative Practices?" Industrial Relations, Vol. 43 (1), pp. 67-97. Hansen, D. G. 1997. ―Worker performance and group incentives: A case study,‖ Industrial and Labor Relations Review 51 (1): 37– 49. Hart, R.A., and Olaf Hubler. 1991. ―Are Profit Shares and Wages Substitute or Complementary Forms of Compensation?‖ Kyklos 44, pp. 221-231. Hubler, Olaf. 1993. ―Productivity, Earnings, and Profit Sharing: An Econometric Analysis of Alternative Models,‖ Empirical Economics, 18, pp. 357-380. Ichniowski ,Casey, Kathryn Shaw, and Giovanna Prennushi. 1997. ―The Effects of Human Resource Management Practices on Productivity: a Study of Steel Finishing Lines,‖ American Economic Review, Volume 87. Number 23, 291-313. Jones, Derek C.; Kalmi, Panu; Kauhanen, Antti. 2010. ―Teams, Incentive Pay, and Productive Efficiency: Evidence from a Food-Processing Plant,‖ Industrial and Labor Relations Review, July 2010, v. 63, iss. 4, pp. 606-626. Jones, D., T. Kato, and J. Pliskin. 1997. Profit sharing and gainsharing: A review of theory, incidence, and effects. In Handbook of human resources, ed. D. Lewin, D. Mitchell, and M. Zaidi. Greenwich, CT: JAI Press. Kaarsemaker, Eric C.A. 2006. ―Employee ownership and its consequences: Synthesis-generated evidence for the effects of employee ownership and gaps in the research literature.‖ York, UK: University of York. Kahneman, Daniel, Jack L. Knetsch, and Richard Thaler. 1991. ―Anomalies: The Endowment Effect, Loss Aversion, and Status Quo Bias,‖ Journal of Economic Perspectives, Volume 5, Issue 1, Winter 1991, 193-206 26 Kandel, Eugene, and Edward P. Lazear. 1992. "Peer Pressure and Partnerships," Journal of Political Economy, Vol. 100, No. 4 (August), pp. 801-17. Kardas, Peter; Adria L. Scharf; and Jim Keogh. 1998. ―Wealth and Income Consequences of ESOPs and Employee Ownership: A Comparative Study from Washington State," Journal of Employee Ownership Law and Finance. Vol. 10, No. 4, Fall. Kaufman, Roger T. 1998. ―The Effects of Gain Sharing on the Basic Wage: The Case of IMPROSHARE ,‖ Labour, Autumn 1998, v. 12, iss. 3, pp. 595-610. Kim, E. Han and Paige Ouimet. 2011 ―Employee Stock Ownership Plans: Employee Compensation and Firm Value,‖ working paper, Ross School of Business, University of Michigan. Kroumova, M. 2000. ―Investment in employer stock through 401(k) plans: Is there reason for concern?‖ PhD dissertation. New Brunswick, NJ: Rutgers University. Kruse, Douglas. 1993. Profit Sharing: Does It Make A Difference? Kalamazoo, MI: W.E. Upjohn Institute for Employment Research. Kruse, Douglas, and Joseph Blasi. 1997. "Employee Ownership, Employee Attitudes, and Firm Performance: A Review of the Evidence." In David Lewin, Daniel J.B. Mitchell, and Mahmood A. Zaidi, eds., Human Resources Management Handbook, Part 1. Greenwich, CT.: JAI Press. Kruse, Douglas, and Joseph Blasi. 1999. ―Public Opinion Polls on Employee Ownership and Profit Sharing,‖ Journal of Employee Ownership Law and Finance, Vol. 11, No. 3, Summer 1999, pp. 3-25. 27 Kruse, Douglas, Richard Freeman, and Joseph Blasi (Eds). 2010. Shared Capitalism at Work: Employee Stock Ownership, Profit and Gain Sharing, and Broad-based Stock Options. Chicago: University of Chicago Press. Lazear, Edward P. 1992. ―Compensation, Productivity and the New Economics of Personnel,‖ in Lewin, David, Olivia Mitchell, and Peter Sherer, eds., Research frontiers in industrial relations and human resources. Madison, WI: Indistrial Relations Research Association, pp. 341-80 Organization for Economic Cooperation and Development (OECD). 1995. ―Profit sharing in OECD countries,‖ OECD Employment Outlook, pp. 139– 69. Pendleton, Andrew; Robinson, Andrew. 2010. ―Employee Stock Ownership, Involvement, and Productivity: An Interaction-Based Approach,‖ Industrial and Labor Relations Review, October 2010, v. 64, iss. 1, pp. 3-29. Poutsma, Erik, Panu Kalmi, and Andrew Pendleton. 2006. ―The Relationship between Financial Participation and Other Forms of Employee Participation: New Survey Evidence from Europe,‖ Economic and Industrial Democracy, November, vol. 27, no. 4, pp. 637-67. Peterson, Suzanne J., and Fred Luthans. 2006. ―The Impact of Financial and Nonfinancial Incentives on Business-Unit Outcomes Over Time,‖ Journal of Applied Psychology, Vol. 91, No. 1, 156–165 Renaud, S., S. St- Onge, and M. Magnan. 2004. ―The impact of stock purchase plan participation on workers’ individual cash compensation,‖ Industrial Relations 43(1): 120– 47. Scharf, Adria, and Christopher Mackin. 2000. "Census of Massachusetts Companies with Employee Stock Ownership Plans (ESOPs)." Boston: Commonwealth Corporation. 28 Sesil, James, Maya Kroumova, Douglas Kruse, and Joseph Blasi. 2007. ―Broad-based Employee Stock Options in the United States: Company Performance and Characteristics,‖ Management Revue, Vol. 18, No. 2, 2007, pp. 5-22. U.S. Bureau of Labor Statistics. 2007. National Compensation Survey: Employee Benefits in Private Industry in the United States, 2005, Bulletin 2589. Washington, D.C.: U.S. Bureau of Labor Statistics, May. U.S. Bureau of Labor Statistics. 2010. National Compensation Survey: Employee Benefits in the United States, March 2010, Bulletin 2752. Washington, D.C.: U.S. Bureau of Labor Statistics, September. United States General Accounting Office. 1987. Employee Stock Ownership Plans. Washington, D.C.: U.S. General Accounting Office, Report GAO/PEMD-88-1. END Weiss, Andrew. 1987. "Incentives and Worker Behavior," in Haig Nalbantian, ed., Incentives, Cooperation, and Risk Sharing (Totowa, N.J.: Rowman and Littlefield, 1987), pp. 137-150. Weitzman Martin. 1984. The Share Economy. Cambridge, MA: Harvard University Press. Weitzman, Martin L, and Douglas Kruse. 1990. ―Profit Sharing and Productivity,‖ in Alan Blinder, ed., Paying For Productivity: A Look at the Evidence. Washington, D.C.: Brookings Institution. Welbourne, T. M., and L. R. G. Mejia. 1995. Gainsharing: A critical review and a future research agenda. Journal of Management 21 (3): 559– 610. 29 Individual level Company level Figure 1: Overall model Shared capitalism Employee ownership Cash profit/gain sharing Deferred profit sharing Stock options Employee Empowerment and Culture 1. Supervision 2. Participation in decisions 3. Information 4. Perceptions of culture Company outcomes 1. 2. 3. 4. 5. Voluntary turnover Involuntary turnover Workers comp claims Tobin’s Q ROE Intent to stay Figure 2: Shared Capitalism, Empowerment, and Voluntary Turnover 20.0% 18.0% 16.0% 14.0% 12.0% 10.0% 8.0% 6.0% 4.0% 2.0% 0.0% 17.6% 15.3% 14.4% No shared capitalism 6.3% High shared capitalism Low employee empowerment High employee empowerment Table 1: Prevalence of shared capitalism plans All years 17.6% 2006 17.3% 2007 18.2% 2008 17.3% Stock options granted in past year 44.5% 52.2% 40.2% 40.5% Cash profit/gainsharing plan 18.1% 20.1% 19.3% 14.4% Deferred profit sharing plan 22.3% 22.5% 23.0% 21.5% 1312 463 444 405 ESOP n 32 Table 2: Characteristics of shared capitalism plans Combining all company-years If have ESOP, % of co. owned by ESOP: Mean (Std. dev.) Median <50% of co. 50%+ of co. n If granted stock options, % of employees granted: Mean (Std. dev.) Median <25% of employees 25-49% of employees 50%+ of employees n If have cash profit/gainsharing plan, bonus as avg. % of pay: Mean (Std. dev.) Median n If have deferred profit-sharing plan, contribution as avg. % of pay: Mean (Std. dev.) Median n Shared capitalism index Mean (Std. dev.) Distribution 0 1 2 3 4 5 n 33 17.4% (26.9) 5.9% 90.9% 9.1% 154 20.6% (29.1) 6.5% 74.9% 8.7% 16.4% 538 7.2% (10.5) 4.7% 201 6.5% (8.7) 3.9% 212 0.835 (1.05) 52.3% 20.9% 20.4% 4.0% 2.0% 0.4% 1089 Table 3: Descriptive Statistics Var. name Shared capitalism index Employee empowerment High-trust supervision Participation in decisions Info sharing Culture Family Cooperation Give extra Fair share Trust Index© Great place Intent to stay Company performance Voluntary turnover Variable definition/survey statement^ One point each for: any esop, esop>50% of co., stock options to >25% of employees, stock options to >50% of employees, any cash profit/gainsharing, cash profit/gainsharing>5% of pay, any deferred profit sharing, deferred profit sharing>4% of pay Management trusts people to do a good job without watching over their shoulders. Management involves people in decisions that affect their jobs or work environment. Management keeps me informed about important issues and changes. There is a "family" or "team" feeling here. You can count on people to cooperate. People here are willing to give extra to get the job done. I feel I receive a fair share of the profits made by this organization. Great Places to Work Trust Index© Taking everything into account, I would say this is a great place to work. I want to work here for a long time. Voluntary separations (excluding retirements) of full-time employees as proportion of full-time employment (company-reported) Workers comp claims Workers comp claims per 100 FTE (company-reported) ROE Return on equity (from S&P Compustat) ROE adjusted Return on equity relative to year-industry mean (upper and lower 1% trimmed) Tobin's Q Tobin's Q (from S&P Compustat) Tobin's Q adjusted Tobin's Q relative to year-industry mean (upper and lower 1% trimmed) ^ All employee survey items scored on 1-5 scale (1="almost always untrue", 5="almost always true") Survey statements are protected by copyright by Great Place to Work® Institute 34 Sample Mean (S.d.) size 0.835 (1.05) 1089 Mean (s.d.) n 4.246 (0.96) 303928 3.821 (1.09) 302608 4.026 (1.02) 303855 4.215 4.116 4.200 3.671 (0.99) (0.88) (0.88) (1.21) 303517 303232 303503 299067 4.180 4.351 (0.72) (0.95) 305339 304160 4.266 (1.04) 302863 0.139 (0.12) 1258 4.774 (5.45) 1035 0.156 0.081 (0.18) (0.15) 415 406 1.965 0.737 (1.64) (1.31) 360 351 Table 4: Predicting Workplace Practices, Culture, and Intent to Stay under Shared Capitalism Workplace practices Dep. var.: High-trust supervision Part. in decisions Info sharing (1) (2) (3) Shared capitalism index 0.019 (3.07) *** 0.012 (2.12) ** 0.015 (2.09) ** n Wald chi-sq. (38) Elements of index Stock options 1-25% Stock options 25-49% Stock options 50%+ ESOP 1-49% of co. ESOP 50%+ of co. Def. PS <4% of pay Def. PS 4%+ of pay Cash PS/GS <5% of pay Cash PS/GS 5%+ of pay 241564 3863.5 n Wald chi-sq. (45) Continuous variables Any stock options % of ees. given options ESOP % of co. owned by ESOP Deferred PS plan Def. PS as % of pay Cash PS/GS plan Cash PS/GS as % of pay 241564 3888.7 -0.005 0.029 0.015 0.076 0.149 0.050 0.082 -0.013 -0.011 -0.005 0.000 0.066 0.001 0.048 0.266 -0.007 -0.001 240507 7299.8 (0.27) (1.03) (0.55) (3.36) (2.74) (2.08) (3.49) (0.71) (0.53) *** *** ** *** -0.015 0.038 0.011 0.066 0.128 0.035 0.081 -0.006 -0.011 241499 6390.4 (0.67) (1.04) (0.30) (2.31) ** (1.82) * (1.15) (2.72) *** (0.27) (0.41) 240507 7311.9 (0.28) (0.87) (2.71) *** (1.70) * (2.14) ** (1.41) (0.41) (0.95) -0.019 0.001 0.060 0.001 0.038 0.322 -0.009 0.000 -0.022 0.016 -0.021 0.071 0.109 0.042 0.061 -0.005 0.002 (1.04) (0.47) (0.61) (2.69) *** (1.69) * (1.51) (2.24) ** (0.23) (0.08) 241499 6402.2 (0.80) (1.39) (1.93) * (1.10) (1.33) (1.32) (0.44) (0.10) -0.024 0.000 0.066 0.001 0.033 0.294 -0.006 0.000 Family (4) 0.015 Culture Cooperation (5) (2.07) ** 0.012 (2.12) ** 241227 6675.6 240999 5136.1 -0.026 0.012 -0.020 0.066 0.139 0.034 0.053 -0.007 0.006 (1.28) (0.38) (0.61) (2.56) ** (2.22) ** (1.23) (1.97) ** (0.34) (0.26) 241227 6686.5 (1.11) (0.69) (2.31) ** (0.83) (1.27) (1.32) (0.31) (0.38) -0.029 0.000 0.058 0.001 0.026 0.268 -0.001 0.000 0.000 0.030 0.017 0.038 0.114 0.041 0.064 -0.016 -0.018 (0.01) (1.14) (0.63) (1.83) (2.23) (1.82) (2.95) (0.92) (0.91) * ** * *** 240999 5153.8 (1.40) (1.06) (2.09) ** (1.35) (1.02) (1.23) (0.07) (0.17) -0.003 0.000 0.032 0.001 0.029 0.371 -0.017 0.000 (0.18) (1.36) (1.42) (1.62) (1.39) (2.11) ** (1.11) (0.07) n 241564 240507 241499 241227 240999 Wald chi-sq. (45) 3890.8 7312.2 6404.4 6690.1 5158.8 * p<.10 ** p<.05 *** p<.01 Each column has three regressions: 1)with the shared capitalism index, 2) breaking out the elements of the shared capitalism index, and 3) using the continuous variables underlying the shared capitalism index. All regressions are run using a random-effects maximum likelihood multilevel model, with random effects both at the company-year level and the company level. Companylevel control variables include defined benefit pension, ln(total employment), ln(avg. hourly pay), ln(avg. salaried pay), company age, whether publicly-held, manufacturing, services, and percent of employees who are unionized. Individual-level control variables include gender, race/ethnicity (7 dummies), age (5 dummies), tenure (7 dummies), and occupation (7 dummies). Regressions were run using Stata's xtmixed command. 35 Table 4 (cont.) Culture Dep. var.: Give extra Fair share Trust Index© (6) (7) (8) Shared capitalism index 0.020 (3.33) *** 0.073 (6.29) *** 0.069 (2.34) ** n Wald chi-sq. (38) Elements of index Stock options 1-25% Stock options 25-49% Stock options 50%+ ESOP 1-49% of co. ESOP 50%+ of co. Def. PS <4% of pay Def. PS 4%+ of pay Cash PS/GS <5% of pay Cash PS/GS 5%+ of pay 241241 7054.4 n Wald chi-sq. (45) Continuous variables Any stock options % of ees. given options ESOP % of co. owned by ESOP Deferred PS plan Def. PS as % of pay Cash PS/GS plan Cash PS/GS as % of pay 241241 7077.7 -0.003 0.048 0.069 0.041 0.097 0.045 0.075 -0.024 -0.013 -0.008 0.001 0.036 0.001 0.031 0.447 -0.024 0.000 237488 8825.5 (0.17) (1.83) (2.56) (1.90) (1.88) (1.93) (3.30) (1.35) (0.62) * ** * * * *** 0.022 0.074 0.083 0.160 0.305 0.078 0.237 0.007 0.100 242587 9910.2 (0.66) (1.48) (1.59) (3.83) (3.02) (1.72) (5.42) (0.22) (2.56) *** *** * *** ** 237488 8843.6 (0.49) (3.58) *** (1.57) (1.31) (1.45) (2.49) ** (1.54) (0.53) 0.019 0.001 0.134 0.002 0.110 0.773 0.029 0.002 -0.024 0.158 0.037 0.264 0.584 0.166 0.317 -0.101 -0.029 241751 4860 (0.29) (1.23) (0.28) (2.50) ** (2.29) ** (1.46) (2.87) *** (1.17) (0.29) 242587 9928 (0.57) (1.70) (2.99) (2.04) (2.59) (2.18) (0.96) (1.26) * *** ** *** ** -0.032 0.002 0.230 0.004 0.166 1.186 -0.073 -0.001 Intent to stay Great place (9) 0.022 (3.03) *** -0.007 0.050 0.001 0.067 0.159 0.025 0.085 -0.022 0.025 -0.007 0.000 0.056 0.001 0.023 0.495 -0.004 0.000 (1.73) * 240715 7958.6 (0.32) (1.58) (0.04) (2.56) ** (2.53) ** (0.88) (3.10) *** (1.04) (1.01) 241751 4877.5 (0.39) (1.16) (2.03) ** (1.42) (1.56) (1.33) (0.95) (0.15) (10) 0.012 0.006 0.043 -0.017 0.056 0.175 0.009 0.063 -0.026 0.005 (0.28) (1.37) (0.52) (2.22) ** (2.86) *** (0.33) (2.35) ** (1.21) (0.19) 240715 7978.4 (0.34) (0.99) (1.99) ** (1.67) * (0.88) (2.25) ** (0.22) (0.07) 0.006 0.000 0.043 0.001 0.021 0.233 -0.012 0.000 (0.30) (0.17) (1.56) (2.11) ** (0.81) (1.09) (0.64) (0.27) n 241241 237488 242587 241751 240715 Wald chi-sq. (45) 7087.3 8840.4 9927.7 4874.2 7973.4 * p<.10 ** p<.05 *** p<.01 Each column has three regressions: 1)with the shared capitalism index, 2) breaking out the elements of the shared capitalism index, and 3) using the continuous variables underlying the shared capitalism index. All regressions are run using a random-effects maximum likelihood multilevel model, with random effects both at the company-year level and the company level. Companylevel control variables include defined benefit pension, ln(total employment), ln(avg. hourly pay), ln(avg. salaried pay), company age, whether publicly-held, manufacturing, services, and percent of employees who are unionized. Individual-level control variables include gender, race/ethnicity (7 dummies), age (5 dummies), tenure (7 dummies), and occupation (7 dummies). Regressions were run using Stata's xtmixed command. 36 Table 5: Predicting Firm-level Outcomes with Shared Capitalism Dep. var.: Voluntary turnover, Involuntary full-time workers turnover (1) (2) Shared capitalism index -0.008 (0.004) ** -0.004 (0.002) R-squared n Elements of index Stock options 1-25% Stock options 25-49% Stock options 50%+ ESOP 1-49% of co. ESOP 50%+ of co. Def. PS <4% of pay Def. PS 4%+ of pay Cash PS/GS <5% of pay Cash PS/GS 5%+ of pay R-squared n Continuous variables Any stock options % of ees. given options ESOP % of co. owned by ESOP Deferred PS plan Def. PS as % of pay Cash PS/GS plan Cash PS/GS as % of pay 0.34 1011 0.004 -0.025 -0.012 -0.015 0.036 0.029 -0.018 -0.013 -0.023 0.317 968 (0.011) (0.018) (0.018) (0.012) (0.034) (0.013) ** (0.013) (0.011) (0.013) * 0.353 1011 0.003 0.000 -0.020 0.001 0.019 -0.225 -0.015 0.000 Workers' comp. claims (3) 0.036 (0.17) 0.014 0.008 0.026 0.000 0.018 0.008 -0.018 -0.012 -0.017 0.105 848 (0.007) (0.011) (0.011) (0.008) (0.021) (0.008) (0.008) (0.007) (0.008) ** ** ** * ** 0.335 968 (0.011) (0.000) (0.014) (0.000) (0.012) (0.109) ** (0.010) (0.001) 0.013 0.000 -0.001 0.000 -0.002 -0.065 -0.013 0.000 -0.774 -0.686 -0.270 -1.937 -1.543 -0.341 0.793 0.871 0.057 -0.761 0.001 -2.038 0.007 0.543 -4.300 0.724 -0.032 (4) 0.0149 (0.008) * 0.107 406 (1.15) (0.60) (0.24) (2.60) * (0.78) (0.42) (1.07) (1.24) (0.08) 0.123 848 (0.007) * (0.000) (0.009) (0.000) (0.008) (0.066) (0.006) ** (0.000) Return on equity -0.013 -0.007 -0.017 0.0253 na -0.001 0.0553 0.055 0.0379 -0.016 0.0003 0.0293 -5E-04 0.0035 0.4801 0.0496 -7E-04 (5) 0.0114 (0.064) 0.202 351 (0.023) (0.034) (0.034) (0.024) (0.030) (0.033) (0.035) (0.029) 0.109 406 (1.12) (0.07) (2.47) * (0.33) (0.76) (0.70) (1.21) (0.96) Tobin's Q 0.055 0.054 0.113 -0.04 na -0.29 -0.04 -0.05 0.112 (0.209) (0.297) * (0.289) (0.197) (0.254) (0.267) (0.277) (0.253) 0.232 351 (0.024) (0.000) (0.028) (0.003) (0.037) (0.605) (0.034) (0.003) 0.0774 0.0005 -0.056 0.002 -0.547 7.747 0.0447 -0.001 (0.213) (0.003) (0.232) (0.020) (0.304) * (4.878) (0.271) (0.024) R-squared 0.343 0.329 0.123 0.11 0.217 n 1011 968 848 406 351 * p<.10 ** p<.05 *** p<.01 (s.e. in parentheses) All regressions use random effects with correction for autogression. Control variables include defined benefit pension, ln(total employment), ln(avg. hourly pay), ln(avg. salaried pay), company age, whether publicly-held, manufacturing, services, and percent of employees who are female, black, Hispanic, asian, other race, age 26-34, age 35-44, age 45-54, age 55+, and unionized. 37 Table 6: Interacting shared capitalism with practices and culture in predicting voluntary turnover Dep. var.: Voluntary turnover rate among full-time workers (company level) (1) (2) (3) (4) (5) Shared capitalism index -0.008 ** -0.007 * 0.1374 ** -0.0033 (0.004) (0.004) (0.056) (0.004) Employee empowerment -0.0454 *** -0.044 *** -0.016 (0.048) ** (0.015) (0.016) (0.020) (0.020) * shared capitalism index -0.036 *** (0.014) High level of employee 0.014 empowerment (dummy) (0.010) * shared capitalism index -0.013 ** (0.006) Trust Index© * shared capitalism index High trust dummy * shared capitalism index (6) (7) (8) (9) -0.007 * 0.154 ** -0.005 (0.004) (0.065) (0.004) -0.056 *** -0.054 *** -0.023 -0.042 (0.017) (0.019) (0.023) (0.024) -0.039 ** (0.016) -0.005 (0.004) -0.008 (0.006) n 1011 1168 1011 1011 1011 1168 1011 1011 1011 R-squared 0.348 0.346 0.348 0.353 0.35 0.349 0.351 0.355 0.353 * p<.10 ** p<.05 *** p<.01 (s.e. in parentheses) All regressions use random effects with correction for autogression. Control variables include defined benefit pension, ln(total employment), ln(avg. hourly pay), ln(avg. salaried pay), company age, whether publicly-held, manufacturing, services, and percent of employees who are female, black, Hispanic, asian, other race, age 26-34, age 35-44, age 45-54, age 55+, and unionized. 38 Table 7: Interacting shared capitalism with practices and culture in predicting intent to stay Dep. var.: Intent to stay at company (individual level) (1) (2) Shared capitalism index 0.012 * (0.007) Employee empowerment 0.7347 *** (0.002) * shared capitalism index High level of employee empowerment (dummy) * shared capitalism index (3) (4) (5) 0.0006 -0.03 *** -0.002 (0.004) (0.008) -0.004 0.7365 *** 0.73 *** 0.8138 *** (0.002) (0.002) -0.003 0.0076 *** (0.002) -0.206 *** -0.006 0.0064 ** -0.003 Trust Index© (6) (7) -0.003 (0.003) (8) (9) -0.047 *** -0.006 * (0.008) (0.003) 1.114 *** 1.115 *** 1.106 *** 1.18 *** (0.002) (0.002) (0.003) -0.002 0.011 *** (0.002) -0.202 *** (0.005) 0.0108 *** (0.003) * shared capitalism index High trust dummy * shared capitalism index n 240715 278667 240550 240550 240550 278852 240714 240714 240714 Wald chi-sq. 7958.6 191767 166966 166998 169943 391595 340643 340722 346887 * p<.10 ** p<.05 *** p<.01 (s.e. in parentheses) All regressions are run using a random-effects maximum likelihood multilevel model, with random effects both at the company-year level and the company level. Company-level control variables include defined benefit pension, ln(total employment), ln(avg. hourly pay), ln(avg. salaried pay), company age, whether publicly-held, manufacturing, services, and percent of employees who are unionized. Individual-level control variables include gender, race/ethnicity (7 dummies), age (5 dummies), tenure (7 dummies), and occupation (7 dummies). 39 Table 8: Interacting shared capitalism with practices and culture in predicting Tobin's Q Shared capitalism index Employee empowerment * shared capitalism index (1) 0.011 (0.064) (2) 0.462 * (0.282) (3) 0.003 (0.064) 0.546 (0.335) (4) -0.638 (1.007) 0.369 (0.435) 0.162 (0.253) High level of employee empowerment (dummy) * shared capitalism index (5) -0.0573 (0.067) 0.827 ** (0.385) (6) (7) -0.002 (0.064) (8) -0.582 (1.143) (9) -0.024 (0.069) 0.7292 (0.490) 0.1406 (0.277) 0.648 (0.460) (0.647) (0.220) *** 0.350 *** (0.117) Trust Index© 0.834 *** 0.8819 ** (0.327) (0.395) * shared capitalism index High trust dummy 0.0591 (0.227) 0.0834 (0.124) * shared capitalism index n 351 452 351 351 351 452 351 351 351 Wald chi-sq. 0.202 0.194 0.212 0.216 0.236 0.202 0.223 0.225 0.226 * p<.10 ** p<.05 *** p<.01 (s.e. in parentheses) All regressions use random effects with correction for autogression. Control variables include defined benefit pension, ln(total employment), ln(avg. hourly pay), ln(avg. salaried pay), company age, whether publicly-held, manufacturing, services, and percent of employees who are female, black, Hispanic, asian, other race, age 26-34, age 35-44, age 45-54, age 55+, and unionized. 40 Table 9: Interacting shared capitalism and culture in predicting return on equity Shared capitalism index Employee empowerment * shared capitalism index (1) 0.015 * (0.008) (2) 0.088 ** (0.037) (3) (4) 0.014 * -0.151 (0.008) (0.126) 0.116 *** 0.071 (0.041) (0.053) 0.042 (0.032) High level of employee empowerment (dummy) * shared capitalism index (5) 0.0104 (0.008) 0.101 ** (0.048) (6) (7) 0.013 * (0.008) (8) -0.217 (0.143) (9) 0.0066 (0.008) -0.012 (0.027) 0.022 (0.015) Trust Index© 0.1426 *** 0.166 *** 0.1067 * (0.043) (0.047) (0.060) 0.0557 (0.035) * shared capitalism index High trust dummy 0.1573 *** (0.056) -0.03 (0.026) 0.0339 ** (0.015) * shared capitalism index n 406 512 406 406 406 512 406 406 406 Wald chi-sq. 0.107 0.088 0.137 0.135 0.14 0.101 0.152 0.150 0.16 * p<.10 ** p<.05 *** p<.01 (s.e. in parentheses) All regressions use random effects with correction for autogression. Control variables include defined benefit pension, ln(total employment), ln(avg. hourly pay), ln(avg. salaried pay), company age, whether publicly-held, manufacturing, services, and percent of employees who are female, black, Hispanic, asian, other race, age 26-34, age 35-44, age 45-54, age 55+, and unionized. 41